News Corp SWOT Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

News Corp Bundle

News Corp, a global media and information services giant, possesses significant strengths in its diversified portfolio of news, digital real estate, and book publishing. However, it also faces considerable threats from the evolving digital landscape and shifting advertising revenues. Understanding these dynamics is crucial for anyone looking to navigate this complex industry.

Want to truly grasp News Corp's strategic position, its vulnerabilities, and the opportunities that lie ahead? Purchase the complete SWOT analysis to unlock a professionally written, fully editable report designed to empower your strategic planning, investor pitches, and in-depth research.

Strengths

News Corp boasts a robust diversified portfolio, spanning digital real estate services, subscription video, news media, and book publishing. This wide array of businesses significantly reduces its dependence on any single market or product. For instance, in the fiscal year ending June 30, 2024, its digital real estate segment, including Realtor.com, demonstrated continued growth, contributing substantially to overall revenue alongside its established media assets.

The company's global reach, with a strong presence in the United States, Australia, and the United Kingdom, offers a significant advantage. This international footprint allows News Corp to tap into diverse economic cycles and consumer behaviors. In 2024, its Australian operations, particularly The Herald and Weekly Times, remained a key revenue driver, while its US-based Dow Jones continued to show resilience in its professional information services.

News Corp's Digital Real Estate Services segment, encompassing REA Group and Realtor.com, is a powerhouse for the company. This segment has been consistently showing impressive growth, driving both revenue and EBITDA.

The strength here lies in its ability to capitalize on thriving residential property markets and smart, forward-thinking strategic alliances. This positions News Corp advantageously in the ever-changing digital property space.

For the fiscal year 2024, News Corp reported that its Digital Real Estate Services segment experienced a revenue increase of 10%. This growth was largely fueled by the strong performance of REA Group in Australia and Realtor.com in the United States.

This segment's double-digit revenue increases and robust profitability are crucial indicators of its significance to News Corp's overall financial stability and future prospects.

Dow Jones, a cornerstone of News Corp, demonstrates remarkable resilience and growth, especially within its professional information division. This segment is experiencing robust expansion, particularly in specialized sectors such as Risk & Compliance and Dow Jones Energy. These areas are proving highly lucrative due to lucrative content licensing agreements and a substantial increase in digital subscriptions, which now exceed 6 million users.

The success of Dow Jones' B2B offerings represents a significant achievement, bolstering segment profitability and diminishing dependence on less predictable advertising revenue. This strategic shift toward high-margin, subscription-based professional services is a key strength, solidifying its market position and contributing significantly to News Corp's overall financial health.

Successful Digital Transformation and Increased Digital Revenue

News Corp has demonstrated considerable success in its digital transformation, with digital revenues now representing the dominant portion of its overall income. This strategic evolution is underpinned by substantial investments in digital platforms, advanced technology, and artificial intelligence, all aimed at refining user experiences and optimizing content distribution.

The company's emphasis on digital subscriptions and continuous online innovation has been pivotal in aligning with evolving consumer behaviors and positioning for sustained future growth. For instance, during the first quarter of fiscal year 2024, News Corp reported that digital advertising revenue at its Dow Jones segment grew by 11%, highlighting the ongoing momentum in this area.

- Digital Revenue Dominance: Digital revenues now constitute the majority of News Corp's total revenue, signifying a successful business model shift.

- Investment in Technology: Significant capital has been allocated to digital platforms, technology infrastructure, and AI integration to enhance user engagement.

- Subscription Growth: The focus on digital subscriptions has proven effective in adapting to market changes and securing a stable revenue stream.

- AI Integration: The incorporation of AI is enhancing content delivery and user experience, a key component of their digital strategy.

Strong Financial Health and Capital Management

News Corp exhibits strong financial health, marked by consistent revenue growth and increasing net income, with EBITDA also showing positive trends. This financial robustness is underscored by investment-grade credit ratings and multiple years of record profitability. For instance, the company reported a significant increase in revenue for the fiscal year ending June 30, 2024, reaching approximately $10.36 billion, a notable jump from the previous year.

The company's strategic financial management is further evidenced by its recent capital allocation initiatives. The successful sale of its stake in Foxtel significantly bolstered its balance sheet, providing substantial liquidity. This financial strengthening has directly enabled proactive capital management, exemplified by the announcement of a new $1 billion stock repurchase program, signaling confidence in future performance and a commitment to shareholder value.

Key financial highlights include:

- Consistent Revenue Growth: Demonstrated by figures like the reported $10.36 billion in revenue for FY24.

- Record Profitability: Achieved multiple consecutive years of strong earnings.

- Investment-Grade Credit Ratings: Reflecting sound financial stability and responsible debt management.

- Strengthened Balance Sheet: Enhanced by strategic asset divestitures, such as the Foxtel sale.

- Active Capital Management: Including a $1 billion stock repurchase program, underscoring financial flexibility.

News Corp's diversified business model, encompassing digital real estate, news media, and book publishing, significantly mitigates risk. Its digital real estate segment, notably Realtor.com and REA Group, demonstrated robust growth in fiscal year 2024, contributing substantially to overall revenue and EBITDA, with a 10% revenue increase reported for the segment.

The company's global presence across the US, UK, and Australia provides access to varied economic conditions. In 2024, Dow Jones' professional information services, particularly in Risk & Compliance and Energy, showed resilience and expansion, supported by over 6 million digital subscribers.

A key strength is News Corp's successful digital transformation, with digital revenues now forming the majority of its income. This shift is fueled by ongoing investments in technology and AI, enhancing user experience and content delivery, as evidenced by an 11% growth in Dow Jones' digital advertising revenue in Q1 FY24.

News Corp's financial health is robust, with FY24 revenue reaching approximately $10.36 billion. The company benefits from investment-grade credit ratings and a strengthened balance sheet, partly due to strategic asset sales like its Foxtel stake, enabling initiatives such as a $1 billion stock repurchase program.

What is included in the product

Provides a clear SWOT framework for analyzing News Corp’s business strategy, highlighting its diverse media portfolio and digital transformation challenges.

Identifies key vulnerabilities and opportunities in News Corp's media landscape, enabling targeted risk mitigation and strategic growth initiatives.

Weaknesses

News Corp's traditional news media segment, encompassing print publications, continues to grapple with shrinking revenues. This decline is primarily driven by falling circulation numbers and a significant drop in print advertising. For instance, in the fiscal year 2023, News Corp reported a revenue decline in its News Media segment, reflecting these persistent industry trends.

The shift in advertising budgets towards digital platforms, coupled with changes in how consumers access information, has severely impacted print advertising effectiveness. This dynamic forces News Corp to constantly seek ways to optimize costs within this segment.

These ongoing revenue pressures necessitate aggressive cost management and a relentless pursuit of operational efficiencies to mitigate the financial impact. The company must therefore continue to innovate and adapt its strategies to navigate these challenging market conditions.

News Corp's news media segment, while diversified, still leans heavily on advertising income, leaving it exposed to economic shifts. For instance, in the fiscal year ending June 30, 2023, advertising revenue across its news media businesses, including publications like The Wall Street Journal and The Sun, experienced a decline. This vulnerability is amplified by a softening tech sector and evolving digital advertising spending habits, which directly impact the company's top line and financial predictability.

News Corp's Digital Real Estate Services segment, a significant contributor, is heavily influenced by the health of the property markets, especially in Australia and the US. For instance, in the fiscal year 2023, the segment reported revenue of $1.26 billion, demonstrating its substantial impact, yet this performance is inherently linked to market dynamics.

Changes in mortgage rates, the number of property transactions, and the general state of housing markets can directly affect this division's earnings. A slowdown in these areas, like the observed cooling in some US housing markets during 2023, can lead to reduced activity on its key platforms, impacting revenue generation.

Regulatory Scrutiny and Reputation Risks

News Corp has a history of navigating legal and regulatory challenges, especially concerning its newspaper divisions. For instance, in the UK, the company has faced ongoing investigations and fines related to phone hacking scandals, impacting its public image and incurring substantial legal expenses. These past issues highlight the persistent risk of regulatory scrutiny.

The company must continually invest in robust compliance measures and ethical journalism practices to mitigate these risks. In 2024, ongoing adjustments to digital media regulations worldwide, including those pertaining to content moderation and data privacy, present a dynamic landscape requiring constant adaptation. Failure to do so could result in further fines or operational limitations.

Reputational damage from past or future regulatory missteps can significantly erode trust with advertisers and audiences. For example, reports in late 2023 and early 2024 continued to scrutinize the business practices of some of its subsidiaries, underscoring the sensitivity of its media operations to public perception. This scrutiny can affect subscription numbers and advertising revenue.

- Ongoing Investigations: News Corp remains subject to potential investigations into past journalistic practices, particularly in its legacy newspaper operations.

- Compliance Costs: Adhering to diverse and evolving media regulations across its global footprint incurs significant ongoing compliance and legal expenses.

- Reputational Impact: Past regulatory issues have demonstrably affected News Corp's reputation, posing a continued threat to brand trust and market standing.

- Digital Media Scrutiny: The evolving regulatory environment for digital platforms and online content presents new compliance challenges and potential reputational risks.

Competition in Digital and Subscription Markets

News Corp contends with significant competition across its digital and subscription-based operations, a persistent challenge in the media landscape. This includes rivalry from established media giants, agile digital-native companies, and specialized online platforms in areas like real estate. For instance, in the digital news sector, competitors like The New York Times and The Wall Street Journal, both with strong digital presences, vie for subscriber attention. The company's digital advertising revenue also faces pressure from tech behemoths such as Google and Meta.

The subscription markets, particularly for news and content, are saturated. News Corp must continually invest in content quality and user experience to retain and attract subscribers amidst numerous alternatives. This dynamic is evident in the book publishing segment, where it competes with a vast array of independent and major publishers, both traditional and digital. The company's R.E.A. Group, a leader in online real estate portals, also faces competition from other property listing sites globally.

Maintaining market share necessitates ongoing innovation and substantial investment. News Corp’s ability to adapt its digital strategies and content offerings is crucial for its success. For fiscal year 2024, the company reported a total revenue of $9.86 billion, highlighting the scale of its operations and the competitive pressures it navigates. Its digital revenue, a key growth area, must constantly evolve to counter new entrants and changing consumer habits.

- Digital Subscriptions: News Corp faces intense competition for digital subscribers from both legacy media organizations and digital-native news outlets, requiring continuous investment in content and platform development.

- Online Real Estate: The company's R.E.A. Group operates in a competitive online real estate market, facing rivals that offer similar listing and advertising services.

- Book Publishing: In the book industry, News Corp's HarperCollins competes with a wide range of publishers, including major conglomerates and smaller independent houses, both in print and digital formats.

- Advertising Revenue: Digital advertising revenue is pressured by large technology platforms that dominate online ad spending, impacting News Corp's ability to capture a larger share of this market.

News Corp's reliance on traditional print media, despite diversification, continues to be a significant weakness. Declining print circulation and advertising revenues, as seen in fiscal year 2023 reports, necessitate ongoing cost-cutting measures. This segment's revenue pressures demand constant innovation to offset the impact of changing consumer habits and digital advertising shifts.

Preview Before You Purchase

News Corp SWOT Analysis

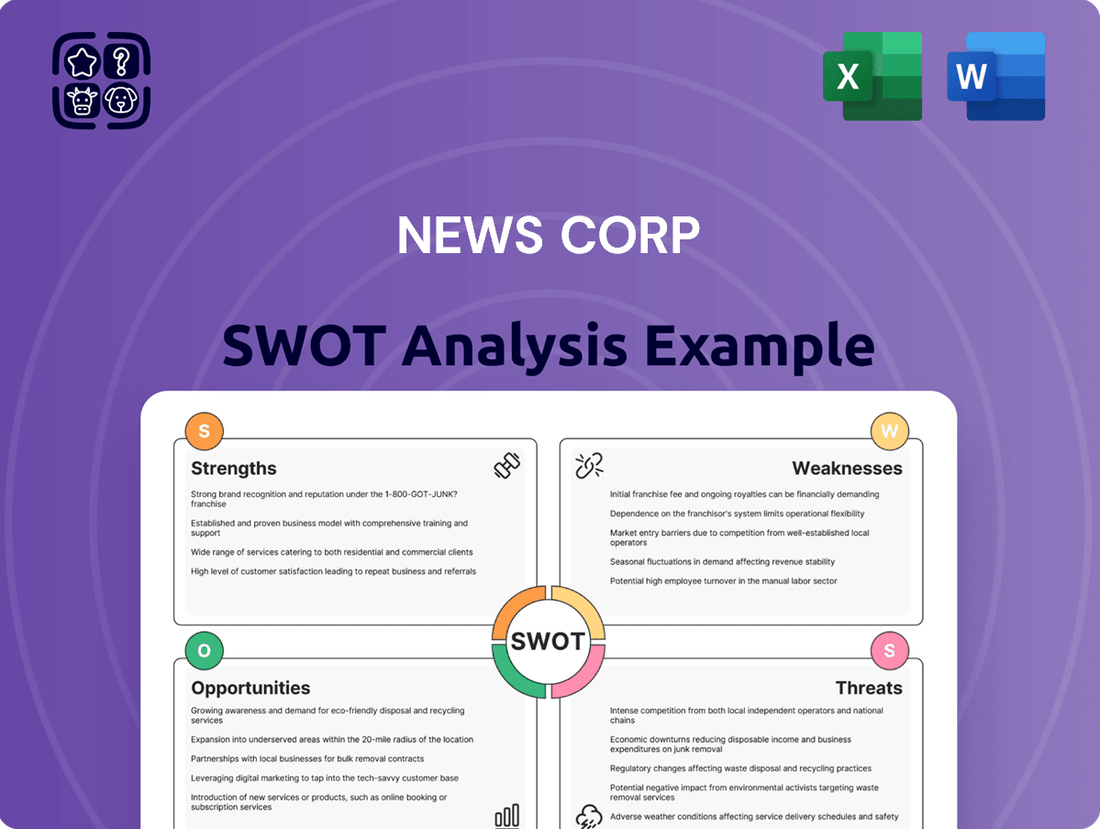

This preview reflects the real document you'll receive—professional, structured, and ready to use. It offers a glimpse into the comprehensive analysis of News Corp's Strengths, Weaknesses, Opportunities, and Threats. You're viewing an actual excerpt from the complete document.

Opportunities

News Corp can capitalize on the burgeoning digital real estate market by expanding its services on platforms like REA Group and Realtor.com. These platforms already boast strong user bases, providing a solid foundation for growth. For instance, in the fiscal year 2023, REA Group reported a revenue of A$1.3 billion, showcasing the significant commercial viability of these digital real estate assets.

Further enhancements in data analytics and user experience are key opportunities. By offering more sophisticated tools for buyers, sellers, and agents, News Corp can increase engagement and transaction volumes. This includes integrating AI-driven property valuations and personalized search filters to better serve users, thereby driving deeper platform utility.

Exploring new geographical markets and specialized property segments presents another avenue for expansion. This could involve targeting emerging economies with growing online property search habits or focusing on niche markets like commercial real estate or luxury properties. Such diversification can broaden revenue streams and reduce reliance on existing markets.

Strategic partnerships and acquisitions within the proptech sector offer a path to accelerate innovation and market penetration. Collaborating with or acquiring companies that offer cutting-edge solutions in areas like virtual tours, property management software, or blockchain-based transactions can bolster News Corp's competitive edge. This proactive approach ensures they remain at the forefront of digital real estate evolution.

News Corp's strategic alliance with OpenAI, solidified by a multi-year global partnership, unlocks substantial avenues for content monetization. This collaboration allows News Corp to license its extensive archive of news articles and data for AI model training, generating new revenue streams. The company can also leverage AI to create more engaging content and tailor user experiences across its diverse media platforms.

Furthermore, AI integration offers significant opportunities to optimize advertising performance. By utilizing AI-driven analytics, News Corp can deliver more targeted and effective advertising campaigns, thereby increasing value for advertisers and boosting ad revenue. This technological advancement is crucial for staying competitive in the evolving digital media landscape.

Dow Jones' professional information business is a significant growth engine for News Corp, with strong performance in Risk & Compliance and Dow Jones Energy. This segment is well-positioned to capture increasing demand for specialized data in a complex world.

Continued investment in B2B offerings and tailored data solutions will be key to unlocking further revenue expansion. For instance, Dow Jones' Factiva service, a leading source of business news and research, saw continued user engagement in early 2024, underscoring the value proposition of authoritative information.

The profitability of this segment is already substantial, providing a solid foundation for future growth initiatives. News Corp's focus on these high-margin areas like professional information is a strategic advantage in the current market landscape.

Strategic Acquisitions and Divestitures for Portfolio Optimization

News Corp has a clear opportunity to sharpen its focus by strategically acquiring businesses in fast-growing digital sectors, complementing its existing strengths. This approach allows for targeted expansion into areas with higher revenue potential and better integration with its digital-first strategy. For instance, the company can build upon its digital real estate services or expand its digital news subscriptions further.

Simultaneously, divesting non-core or underperforming assets is crucial for portfolio optimization. The sale of its stake in Foxtel in 2020, for example, allowed News Corp to reduce debt and redeploy capital towards more promising ventures. This strategic streamlining enables the company to concentrate resources on segments that offer superior growth prospects and greater alignment with its overarching digital transformation goals.

- Acquire in high-growth digital segments like AI-powered content creation tools or advanced data analytics platforms.

- Divest underperforming traditional media assets to free up capital and management attention.

- Streamline operations by integrating acquired digital businesses into existing platforms for greater synergy.

- Focus capital allocation on digital subscriptions and advertising technologies to drive future revenue growth.

Increasing Digital Subscriptions Across News and Book Publishing

News Corp has a significant opportunity to boost its digital-only subscriptions for its various news mastheads. This growth is particularly promising in the book publishing sector, with a strong emphasis on digital book sales, including the rapidly expanding audiobook market. By concentrating on delivering high-quality, premium content and tailoring user experiences, News Corp can attract and retain more subscribers, creating a stable stream of recurring revenue that helps counterbalance the ongoing decline in traditional print media revenue.

The company is already seeing success in this area. For instance, in the first quarter of fiscal year 2024, News Corp reported a 5% increase in total segment revenues to $2.53 billion. Digital advertising revenue across its news media segment grew by 12% year-over-year, highlighting the effectiveness of their digital strategy. The company’s strategy includes leveraging partnerships, such as their collaboration with Spotify for audiobook distribution, which directly taps into the growing demand for digital audio content.

- Growing Digital Subscriber Base: News Corp can capitalize on the shift towards digital consumption by offering compelling digital-only subscription packages for its news brands.

- Audiobook Market Expansion: The increasing popularity of audiobooks presents a prime opportunity for News Corp to expand digital book sales through its HarperCollins division, potentially through strategic platform partnerships.

- Premium Content Monetization: Investing in and highlighting premium, exclusive content can justify subscription costs and drive higher conversion rates, as seen with the strong performance of digital subscriptions.

- Personalized User Experiences: Tailoring content delivery and user interfaces to individual preferences can significantly enhance subscriber loyalty and reduce churn rates in the competitive digital media landscape.

News Corp can leverage its existing digital real estate platforms, such as REA Group and Realtor.com, to further penetrate the growing online property market. Enhancing these platforms with advanced data analytics and AI-driven tools can improve user engagement and transaction volumes. The company also has the opportunity to expand into new geographical regions and niche property markets, diversifying its revenue streams and strengthening its global presence.

Threats

News Corp faces a significant threat from evolving consumer habits, with a clear move away from traditional print and linear TV towards digital and on-demand content. This shift directly impacts its legacy media businesses, requiring continuous investment in digital transformation to remain relevant.

Failure to adapt quickly enough could result in further erosion of audience numbers and advertising revenue for its established platforms. For instance, while digital subscriptions are growing, they often come with lower per-user revenue compared to print advertising in the past. In 2023, digital advertising revenue across the industry continued to grow, but the transition from print advertising revenue has been a persistent challenge for many legacy media companies.

News Corp faces a significant threat from digital-native platforms that are rapidly capturing audience attention and advertising revenue. Competitors like Google and Meta continue to dominate digital advertising, with Google's ad revenue alone reaching an estimated $237.9 billion in 2023, a figure News Corp's publishing segment, for instance, cannot directly match.

These agile digital players often operate with lower overheads and can quickly adapt to changing consumer behaviors, posing a constant challenge to News Corp's established market position. The increasing reliance on social media for news consumption further fragments the audience, making it harder for traditional publishers to maintain direct relationships and monetize their content effectively.

In the streaming and content creation space, new entrants and established tech giants are also investing heavily, creating a crowded landscape that competes directly with News Corp's entertainment and content divisions. For example, Disney's direct-to-consumer revenue for fiscal year 2023 was approximately $23.7 billion, highlighting the scale of investment and competition in this sector.

Global economic uncertainties, including persistent inflation and the specter of potential downturns, pose a significant threat to News Corp. These factors directly impact advertising markets, a crucial revenue stream for its news media segment. For instance, during the 2023 fiscal year, advertising revenue across News Corp's news media segment, which includes titles like The Wall Street Journal and The Sun, experienced a decline, reflecting broader market softness.

A weakened economic climate typically compels businesses to tighten their belts, leading to reduced marketing and advertising budgets. This contraction in advertiser spending directly translates to lower revenues for News Corp, potentially affecting its overall financial performance and profitability. The company's reliance on advertising, particularly in its print and digital news operations, makes it vulnerable to these cyclical economic shifts.

Regulatory and Legal Challenges, Including AI Content Licensing

News Corp faces significant regulatory headwinds in its diverse media operations. Potential legal challenges loom over content licensing agreements and copyright protections, especially as the company navigates the complex terrain of digital distribution and intellectual property. For instance, ongoing debates surrounding fair use of journalistic content by AI models could lead to new legal precedents and operational adjustments for News Corp.

The rise of artificial intelligence introduces novel threats, particularly concerning the licensing of AI-generated content and the use of existing journalistic material. News Corp must carefully manage its intellectual property rights in this rapidly evolving landscape, as unauthorized use or inadequate licensing of its vast content library by AI platforms could result in substantial financial and reputational damage.

- Regulatory Scrutiny: News Corp operates in sectors subject to stringent regulations regarding media ownership, content standards, and data privacy.

- AI Content Licensing Risks: The use of AI to generate or repurpose content poses risks related to copyright infringement and fair compensation for original journalistic work.

- Competition Law: As a major player, News Corp is also subject to antitrust and competition laws, which could impact its market strategies and potential acquisitions.

Technological Disruptions and Cybersecurity Risks

News Corp faces significant threats from rapid technological advancements, particularly the increasing integration of Artificial Intelligence (AI). AI's ability to generate content and personalize delivery could fundamentally alter traditional media models, potentially diminishing the value of News Corp's established content libraries if not adapted. For instance, AI-powered news aggregation and summarization services could bypass traditional news outlets, impacting subscription and advertising revenues.

Cybersecurity risks are also a major concern for a company like News Corp, which handles vast amounts of sensitive data. A successful cyberattack could result in severe consequences, including the compromise of subscriber information, disruption of digital platforms, and significant financial penalties. The media industry, in general, has seen a rise in targeted attacks, with reported data breaches affecting major players regularly.

Consider these specific threats:

- AI-driven content creation: The potential for AI to generate high-quality, low-cost content could devalue News Corp's premium journalism and intellectual property.

- Shifting audience consumption: As audiences increasingly rely on personalized algorithms and short-form digital content, News Corp's traditional long-form journalism and print products may see declining engagement.

- Cybersecurity vulnerabilities: Major media companies are prime targets for ransomware and data theft, which could lead to substantial financial losses and reputational damage. In 2023, the media sector experienced a notable increase in cybersecurity incidents impacting sensitive customer data.

- Evolving digital advertising landscape: Changes in data privacy regulations and the rise of ad-blocking technologies pose ongoing challenges to News Corp's digital advertising revenue streams.

News Corp faces intense competition from digital-native platforms like Google and Meta, which dominate digital advertising. For instance, Google's ad revenue reached an estimated $237.9 billion in 2023, dwarfing News Corp's publishing segment's capabilities in this area.

The company is also vulnerable to global economic downturns, impacting its crucial advertising revenue streams. Advertising revenue across News Corp's news media segment declined in fiscal year 2023, reflecting broader market softness and reduced corporate spending.

Rapid technological advancements, particularly AI, present a threat by potentially devaluing premium journalism and intellectual property through AI-driven content creation. Cybersecurity risks also loom large, with the media sector experiencing a notable increase in incidents in 2023, potentially leading to significant financial and reputational damage.

SWOT Analysis Data Sources

This SWOT analysis for News Corp is built upon a foundation of robust data, including their official financial filings, comprehensive market research reports, and expert analyses of the media and publishing landscape. We also incorporate insights from industry publications and reputable news sources to ensure a well-rounded and accurate assessment.