News Corp Marketing Mix

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

News Corp Bundle

News Corp's marketing prowess hinges on a masterful orchestration of its 4Ps. Explore how their diverse product portfolio, from news and publishing to digital ventures, resonates with varied audiences. Understand the strategic pricing models employed across their extensive media empire.

Discover the intricate distribution channels News Corp leverages to reach global markets, ensuring their content is accessible wherever readers are. Delve into their sophisticated promotional strategies, analyzing how they build brand loyalty and drive engagement.

This 4Ps analysis offers a comprehensive blueprint of News Corp's marketing success, providing actionable insights for your own business. Save valuable time and gain a competitive edge with this expertly crafted, ready-to-use report.

Unlock the full potential of marketing strategy with our in-depth analysis of News Corp's Product, Price, Place, and Promotion. This editable document is perfect for students, professionals, and anyone seeking to understand market leadership.

Product

News Corp boasts a remarkably diverse content portfolio, a key aspect of its marketing mix. This spans across its prestigious news mastheads, including The Wall Street Journal, The Times, and The Australian, offering a rich blend of news, in-depth analysis, and opinion. These publications reach a broad audience through both traditional print and accessible digital platforms.

The company's reach extends significantly through its book publishing arm, HarperCollins. This segment further diversifies News Corp's offerings by providing a wide spectrum of genres and formats to a global readership. For instance, in fiscal year 2023, HarperCollins reported total revenues of $1.7 billion, demonstrating the significant financial contribution of this diverse content segment.

News Corp's digital real estate services, centered on REA Group and Realtor.com, represent a significant growth engine. These platforms are vital for agents, buyers, and sellers, offering property listings, data insights, and marketing tools.

In fiscal year 2023, News Corp reported that its Digital Real Estate segment generated $1.3 billion in revenue, a notable increase driven by strong performance in both Australia and the US markets.

The strategic importance of these digital assets is underscored by their role in capturing high-growth opportunities within the real estate sector, providing essential services that connect millions of users with property opportunities.

These services are not just about listings; they offer sophisticated data analytics and advertising solutions, making them indispensable for industry professionals and contributing substantially to News Corp's overall revenue diversification.

News Corp's subscription video services, notably Foxtel, Kayo Sports, and BINGE in Australia, are pivotal to its content strategy, offering a robust mix of sports, entertainment, and news. These platforms have seen significant subscriber growth, with Kayo Sports alone reaching over 1.3 million subscribers by the end of 2024, showcasing strong market penetration in the competitive Australian streaming landscape.

While Foxtel was divested to DAZN in April 2025, News Corp's retention of a minority equity stake underscores its ongoing commitment to the lucrative global sports streaming sector. This strategic move allows News Corp to benefit from the future growth of these services while focusing its resources on other key initiatives.

Professional Information and Data Services

News Corp's Professional Information and Data Services, primarily through its Dow Jones segment, offer critical financial data, news, and analytical tools to business professionals. This includes specialized services like Risk & Compliance and Dow Jones Energy, catering to specific industry needs.

This B2B focus creates a robust value proposition, underpinned by significant recurring revenue streams. For instance, in fiscal year 2023, Dow Jones reported revenue of $1.6 billion, representing a substantial portion of News Corp's overall performance. This recurring model is a key driver of News Corp's profitability and stability.

The segment’s strength lies in its ability to provide indispensable resources for decision-making. Its offerings are vital for professionals in fields such as finance, legal, and energy, ensuring they have access to timely and accurate information for strategic planning and operational execution.

- Dow Jones Revenue (FY23): $1.6 billion

- Key Segments: Dow Jones, Risk & Compliance, Dow Jones Energy

- Business Model: Business-to-Business (B2B) with strong recurring revenue

- Profitability Impact: Significant contributor to News Corp's overall financial results

Innovation in Digital Formats and AI

News Corp is actively innovating its product strategy by embracing new digital formats and artificial intelligence. This includes developing engaging content streams like vertical video feeds and improving mobile news applications to better serve its audience on the go.

The company is leveraging AI to personalize content delivery, making news more relevant to individual users, and to create advanced advertising solutions such as Intent Connect, which targets consumers based on their expressed interests. This AI integration is key to enhancing user experience and driving engagement across News Corp's extensive portfolio.

Further diversifying its digital product offerings, News Corp completed the acquisition of Vapormedia in June 2025. This strategic move expands the company's reach into the rapidly growing fantasy sports market, demonstrating a commitment to broadening its digital footprint and capturing new revenue streams.

- Vertical Video Feeds: Enhanced mobile content consumption.

- AI for Personalization: Tailored news experiences for users.

- AI for Advertising: Advanced targeting with solutions like Intent Connect.

- Vapormedia Acquisition (June 2025): Entry into the fantasy sports sector.

News Corp's product strategy is centered on a diverse and evolving content ecosystem, ranging from established news brands to digital real estate and professional information services. The company is actively integrating artificial intelligence to personalize user experiences and enhance advertising capabilities. Recent strategic acquisitions, like Vapormedia in June 2025, signal an expansion into new, high-growth digital markets such as fantasy sports.

| Product Area | Key Offerings | 2023 Revenue (USD Billions) | Key Development (2024-2025) |

|---|---|---|---|

| News & Publishing | The Wall Street Journal, The Times, The Australian | N/A (part of segment reporting) | Continued focus on digital subscriptions and content innovation. |

| Book Publishing | HarperCollins | 1.7 | Global reach across diverse genres. |

| Digital Real Estate | REA Group, Realtor.com | 1.3 | Strong growth in Australia and US; enhanced data analytics. |

| Subscription Video | Kayo Sports, BINGE (Australia) | N/A (part of segment reporting) | Kayo Sports reached over 1.3 million subscribers by end of 2024; Foxtel divested April 2025, News Corp retains minority stake. |

| Professional Information & Data | Dow Jones (Risk & Compliance, Dow Jones Energy) | 1.6 | Focus on B2B services with recurring revenue streams. |

| Digital Innovation | AI personalization, Intent Connect advertising, Vertical Video | N/A (integrated across segments) | Acquired Vapormedia in June 2025, entering fantasy sports market. |

What is included in the product

This analysis offers a comprehensive breakdown of News Corp's Product, Price, Place, and Promotion strategies, grounding the insights in actual brand practices and competitive context.

It's ideal for professionals seeking a deep dive into News Corp's marketing positioning, providing actionable examples and strategic implications for benchmarking or planning.

Simplifies the complex News Corp 4Ps analysis into actionable insights, alleviating the pain of information overload for strategic decision-making.

Place

News Corp leverages an extensive network of digital platforms, encompassing websites like The Wall Street Journal and The Sun, dedicated mobile applications, and smart TV integrations. This multi-channel approach ensures their content reaches audiences across diverse devices and environments, reflecting a significant shift in media consumption. In the fiscal year 2023, digital advertising revenue for News Corp's Dow Jones segment, which includes The Wall Street Journal, saw a substantial increase, demonstrating the growing importance of these platforms.

While News Corp's core operations are concentrated in the United States, Australia, and the United Kingdom, its digital platforms and syndicated content ensure a significant global reach. This international presence allows News Corp to access a wider array of advertising markets and subscription bases, diversifying its revenue streams beyond its primary geographic strongholds.

In the fiscal year 2023, News Corp reported that its digital advertising revenue constituted a substantial portion of its overall income, underscoring the importance of its global digital footprint. The company's brands, such as The Wall Street Journal and The Times, have established international editions and online presences, enabling them to serve audiences worldwide and capture global advertising spend.

Despite the undeniable surge in digital media consumption, News Corp strategically leverages its enduring print and broadcast networks. These legacy platforms, including prominent newspapers and popular radio stations like talkSPORT and Virgin Radio UK, continue to connect with substantial audiences, thereby reinforcing the company's broader media presence. For instance, in the fiscal year ending June 30, 2023, News Corp's News Media segment, which encompasses its print operations, generated approximately $2.0 billion in revenue, demonstrating the sustained financial relevance of these traditional channels. These channels are not merely historical relics but active contributors that complement and amplify digital strategies, ensuring a multi-faceted reach in the evolving media landscape.

Strategic Partnerships and Licensing

News Corp actively pursues strategic partnerships to amplify its market presence and revenue streams. A prime example is its collaboration with OpenAI, involving content licensing agreements that grant access to News Corp’s vast journalistic archives for AI model training. This move is designed to unlock new monetization avenues for its intellectual property and ensure its content remains relevant in the evolving digital landscape.

The company also strategically partners for distribution and advertising. Its alliance with Tubi, for instance, bolsters its video content segment by leveraging Tubi's advertising sales capabilities to reach a broader audience. These partnerships are crucial for News Corp’s 'Place' strategy, ensuring its diverse content portfolio is accessible and monetized effectively across various platforms.

- Content Licensing: Agreements with AI firms like OpenAI expand digital reach and create new revenue streams for News Corp's journalism.

- Advertising Partnerships: Collaborations like the one with Tubi enhance video content monetization and audience engagement.

- Distribution Expansion: These alliances ensure News Corp's content is available on a wider array of digital platforms, increasing its overall market 'Place'.

Direct-to-Consumer and B2B Channels

News Corp effectively leverages a dual-channel strategy, reaching both individual readers and professional clients. Its direct-to-consumer (DTC) efforts are heavily focused on digital subscriptions for its renowned news publications and video content, fostering a direct relationship with its audience.

Complementing this, News Corp maintains robust business-to-business (B2B) channels, particularly through its professional information services. This segment caters to the specific needs of businesses and institutions requiring in-depth data and analytics.

This blended approach allows for broad market penetration and diversified revenue streams. For instance, in fiscal year 2023, the company reported significant digital subscriber growth across its news media portfolio, demonstrating the strength of its DTC model.

- Digital Subscriptions: News Corp's DTC strategy prioritizes digital subscriptions for its news and video offerings, aiming for direct reader engagement.

- Professional Information Services: The company's B2B segment focuses on delivering specialized data and analytics to business clients.

- Market Penetration: This dual-channel approach enables News Corp to reach a wider audience and serve diverse market needs.

- Revenue Diversification: The combination of DTC and B2B channels contributes to a more resilient and diversified revenue base.

News Corp's 'Place' in the marketing mix is defined by its extensive multi-channel distribution strategy, encompassing both its vast digital ecosystem and its established print and broadcast networks. This ensures content accessibility across various devices and environments, catering to a diverse audience. The company's global reach is amplified by its digital platforms and syndicated content, allowing it to tap into international advertising markets and subscription bases.

| Segment | FY23 Revenue (Approx.) | Key Distribution Channels |

|---|---|---|

| News Media | $2.0 billion | Print newspapers, websites (e.g., WSJ, The Sun), mobile apps |

| Dow Jones | (Digital advertising significant contributor) | The Wall Street Journal (print & digital), Barron's, MarketWatch |

| Book Publishing | (Not specified separately in FY23 for this analysis) | Physical books, e-books, audiobooks |

| Digital Real Estate Services | (Not specified separately in FY23 for this analysis) | Websites (e.g., Realtor.com), mobile applications |

Preview the Actual Deliverable

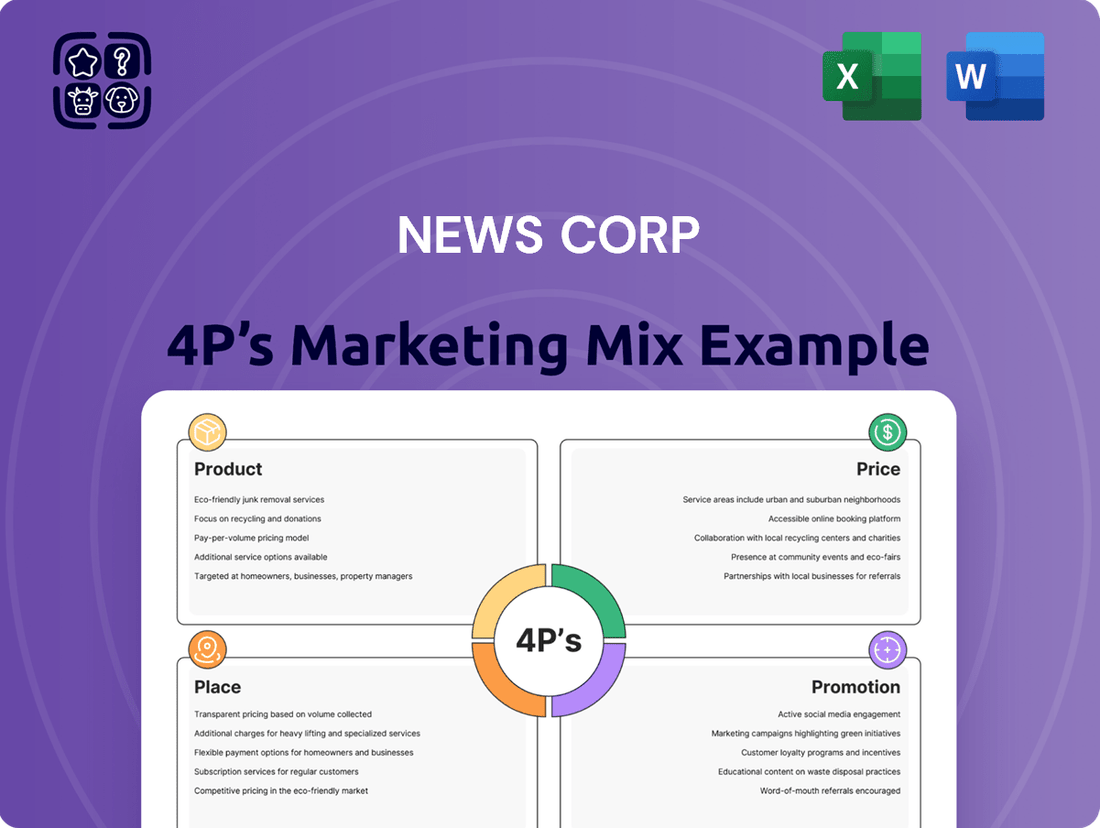

News Corp 4P's Marketing Mix Analysis

The preview shown here is the actual document you’ll receive instantly after purchase—no surprises. This comprehensive analysis of News Corp's 4Ps (Product, Price, Place, Promotion) is fully prepared and ready for your immediate use. You'll gain valuable insights into News Corp's strategic marketing decisions without any delay or alteration. Trust that what you see is exactly what you'll get, empowering you with actionable information.

Promotion

News Corp’s promotion strategy heavily leans on integrated digital marketing campaigns. They utilize their proprietary audience intelligence platform, Intent Connect, to drive data-led advertising. This allows for highly precise targeting and personalization across their extensive digital network, ensuring messages resonate with specific consumer segments.

In 2024, News Corp continued to refine its digital advertising capabilities. For instance, its Dow Jones division, a key component, saw continued investment in digital subscriptions and advertising solutions, aiming to capture a larger share of the growing digital ad spend. This focus on data-driven outreach is crucial for maximizing campaign effectiveness and ROI.

News Corp leverages its extensive portfolio by cross-promoting across its media properties. This strategy, evident in their 4P's marketing mix, allows them to amplify reach for brands like The Wall Street Journal and Fox News. For instance, content from their digital news sites is frequently featured on their radio and video platforms, creating a powerful internal synergy.

This cross-media approach significantly boosts brand awareness among News Corp's massive audience. In the first quarter of fiscal year 2025, News Corp reported total revenues of $2.52 billion, a testament to the effectiveness of such integrated marketing efforts. The company's ability to channel audiences between its various assets is a key driver of engagement and monetization.

News Corp leverages the immense brand reputation and inherent authority of its flagship publications, including The Wall Street Journal and HarperCollins, to bolster its marketing mix. This established trust is a significant asset, directly influencing consumer perception and loyalty.

The company's commitment to high-quality journalism and authoritative content across its diverse portfolio is a key differentiator. This focus not only attracts new audiences but also cultivates a deeply loyal customer base, as evidenced by The Wall Street Journal's paid digital subscriptions reaching over 3.8 million in the first quarter of fiscal year 2024.

Content Marketing and Thought Leadership

News Corp leverages content marketing and thought leadership to solidify its position in the market. By offering valuable insights, especially through its Dow Jones arm and events like D_Coded, the company aims to attract and retain professional clients and advertisers. This strategy helps build credibility and reinforces News Corp as a go-to source for industry information.

This approach is crucial for attracting high-value B2B clients and advertisers who seek authoritative content. For example, Dow Jones's various publications and data services provide essential market intelligence, directly contributing to its thought leadership status. In fiscal year 2023, Dow Jones revenue reached $1.7 billion, demonstrating the commercial success of its content-driven strategies.

News Corp's commitment to thought leadership is evident in its investment in premium content creation and distribution channels. Events such as D_Coded, which brings together industry leaders, serve as platforms to showcase expertise and foster valuable connections. These initiatives not only enhance brand perception but also drive engagement with key stakeholders, supporting the broader marketing objectives.

The effectiveness of this strategy can be seen in the continued demand for Dow Jones's professional information services. These services, underpinned by robust content marketing, cater to a discerning audience that values accuracy and depth. This focus on quality content positions News Corp favorably in a competitive media landscape.

- Dow Jones revenue in FY23: $1.7 billion.

- Key thought leadership platforms: Dow Jones publications and D_Coded events.

- Objective: Attract professional clients and advertisers through valuable insights.

- Strategic benefit: Enhances brand credibility and industry leadership.

Subscription-Focused Initiatives

News Corp's subscription-focused initiatives are primarily aimed at increasing its digital subscriber base. A key example is The Sun Club, which provides access to premium journalism and special deals designed to attract and retain readers.

The company actively runs campaigns to convert casual readers into paying subscribers. These efforts emphasize the unique value and exclusive content that differentiate its digital offerings from free alternatives.

By focusing on subscription growth, News Corp is adapting to evolving media consumption habits. This strategy is crucial for generating recurring revenue and ensuring long-term financial stability in the digital age.

- Digital Subscription Growth: News Corp's strategy prioritizes expanding its digital subscriber numbers.

- 'The Sun Club' Example: This initiative offers premium content and exclusive benefits to foster loyalty.

- Conversion Campaigns: Efforts are in place to turn casual readers into dedicated paying subscribers by showcasing content value.

News Corp's promotional efforts are deeply integrated, leveraging digital channels and cross-platform synergies. Their data-driven approach, exemplified by the Intent Connect platform, ensures targeted and personalized advertising across their vast media holdings, including key assets like The Wall Street Journal.

This integrated promotion strategy is vital for driving engagement and revenue. For instance, in the first quarter of fiscal year 2025, News Corp achieved total revenues of $2.52 billion, reflecting the success of campaigns that amplify reach across their diverse properties, from digital news to video and radio.

The company also emphasizes thought leadership, particularly through Dow Jones, to attract B2B clients and advertisers. Dow Jones's revenue reached $1.7 billion in fiscal year 2023, underscoring the commercial impact of high-quality content and platforms like the D_Coded events.

News Corp's focus on subscription growth, as seen with The Sun Club, further solidifies its promotional strategy by converting readers into loyal customers through exclusive content and benefits.

Price

News Corp leverages tiered digital subscription models across its portfolio, including The Wall Street Journal and The Times, to cater to diverse reader needs and maximize digital revenue streams. These tiers typically offer varying levels of content access, from breaking news to in-depth analysis and premium features, encouraging customer loyalty and predictable income. For instance, The Wall Street Journal's digital subscriptions have seen consistent growth, contributing significantly to the company's overall digital revenue, which stood at approximately $731 million for the six months ending December 31, 2023.

News Corp's advertising revenue, a crucial element of its marketing mix, is strategically priced. Rates are determined by factors such as audience reach, user engagement levels, and the demonstrated effectiveness of targeted advertising campaigns. The company leverages advanced data capabilities, like its Intent Connect platform, to offer highly precise targeting, thereby commanding premium pricing.

Digital advertising forms a substantial and growing segment of News Corp's overall advertising income. For instance, in the fiscal year 2024, digital advertising revenue represented a significant portion of the segment's total, reflecting the ongoing shift in media consumption and advertising spend towards online platforms.

HarperCollins, a key News Corp subsidiary, actively utilizes dynamic pricing for its book titles, adapting costs based on format and market demand. This strategy acknowledges that physical books, e-books, and audiobooks are priced differently to capture various consumer segments. For instance, in 2024, the audiobook market continued its robust expansion, with projections indicating further growth, which directly influences pricing models and licensing agreements with platforms.

The company's approach to licensing also plays a crucial role in its pricing architecture. By strategically licensing content for different markets and platforms, HarperCollins can optimize revenue streams. This is particularly evident in the burgeoning digital audiobook sector, where innovative licensing deals can unlock new revenue opportunities and shape the overall pricing strategy for audio content, reflecting its increasing market share and consumer preference.

Bundling and Package Deals

News Corp is actively exploring bundling strategies to increase the appeal of its diverse content portfolio. By combining news subscriptions with other digital services, such as streaming or premium analytics, the company aims to boost perceived value and drive wider customer adoption. This approach is particularly relevant in the 2024-2025 period as digital content consumption continues to evolve.

These bundled packages can offer significant advantages, making it more attractive for consumers to engage with multiple News Corp brands. For instance, a subscriber might gain access to The Wall Street Journal, Dow Jones MarketWatch, and even select offerings from HarperCollins through a single, tiered subscription. Such integration fosters customer loyalty and can lead to higher average revenue per user.

Partnerships are a key component of this bundling strategy. News Corp may collaborate with other technology or media companies to provide integrated access across different platforms. This could involve offering bundled deals that include not only News Corp's own digital assets but also complementary services from third parties, thereby expanding the value proposition for consumers.

The effectiveness of these bundles is being closely monitored through key performance indicators:

- Increased Subscriber Acquisition: Bundles are designed to attract new customers who might be hesitant to subscribe to individual services.

- Enhanced Customer Retention: Offering a wider array of integrated services can reduce churn by providing greater value and convenience.

- Cross-Promotion Opportunities: Bundles allow for effective cross-promotion of different News Corp brands and services to a captive audience.

- Data Synergy: Combining user data from various bundled services can provide deeper insights for personalized content delivery and future product development.

Strategic Monetization of Intellectual Property

News Corp is actively exploring new avenues to generate revenue from its vast intellectual property holdings. This includes forging strategic licensing deals with prominent technology companies, such as OpenAI. These agreements are designed to unlock value from its content in ways that extend beyond traditional print and digital subscriptions.

The company is focusing on monetizing its journalistic archives and creative works. This strategic shift aims to create significant new revenue streams by leveraging the inherent value of its content in emerging digital ecosystems. For instance, News Corp’s licensing agreements are expected to contribute positively to its financial performance in the 2024-2025 fiscal year, reflecting a growing trend in media companies capitalizing on their data assets.

- Licensing agreements with major tech platforms represent a new revenue stream.

- OpenAI is a key partner in these intellectual property monetization efforts.

- This strategy leverages content value beyond traditional consumption models.

- Expectations are for these deals to bolster financial results in the 2024-2025 period.

News Corp's pricing strategy is multifaceted, balancing subscription tiers for its news publications with dynamic pricing for books and strategic licensing for its intellectual property. The company utilizes tiered digital subscriptions for titles like The Wall Street Journal, with digital revenue reaching approximately $731 million for the six months ending December 31, 2023. Advertising is priced based on reach and engagement, with digital advertising forming a significant portion of the segment's income in fiscal year 2024.

| Product/Service | Pricing Strategy | Key Data Point (2023/2024) |

|---|---|---|

| Digital News Subscriptions | Tiered Subscriptions | WSJ digital revenue: ~$731M (H1 FY24) |

| Advertising | Value-based (Reach, Engagement, Targeting) | Digital advertising significant portion of segment income (FY24) |

| Books (HarperCollins) | Dynamic Pricing (Format, Demand) | Audiobook market growth influencing pricing |

| Intellectual Property | Strategic Licensing | Agreements with tech companies (e.g., OpenAI) expected to boost FY25 results |

4P's Marketing Mix Analysis Data Sources

Our 4P analysis for News Corp is grounded in a deep dive into their diverse portfolio, utilizing public financial reports, investor relations materials, and newsroom data to understand their product offerings and pricing strategies. We also leverage industry analysis and competitive intelligence to map their distribution channels and promotional activities.