News Corp Porter's Five Forces Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

News Corp Bundle

News Corp navigates a dynamic media landscape, facing intense competition and evolving customer expectations.

The threat of new entrants is moderate, while the bargaining power of buyers, particularly advertisers, exerts significant pressure.

Suppliers, though diverse, hold some sway, especially in content acquisition and technology platforms.

The threat of substitutes, from digital streaming to independent content creators, is a constant challenge to traditional media models.

The full Porter's Five Forces Analysis reveals the real forces shaping News Corp’s industry—from supplier influence to threat of new entrants. Gain actionable insights to drive smarter decision-making.

Suppliers Bargaining Power

News Corp's reliance on content providers like freelance journalists and news agencies means that if a few dominant players exist, they can wield considerable power. This concentration allows them to potentially dictate terms, impacting News Corp's cost of content acquisition.

The company's dependence on technology infrastructure, particularly cloud services, further amplifies supplier bargaining power. For instance, Amazon Web Services (AWS) supports a significant portion of News Corp's operations, giving AWS considerable leverage in pricing and service agreements.

Similarly, specialized broadcasting equipment suppliers can hold sway, especially if their technology is proprietary and essential for News Corp's media delivery. A lack of readily available substitutes for these critical technological components empowers these suppliers.

This concentration among key content and technology providers creates a scenario where News Corp may face increased costs and reduced flexibility, directly impacting its profitability and operational efficiency.

News Corp's bargaining power with suppliers is influenced by the uniqueness of the content it sources. When News Corp licenses highly differentiated or exclusive content, such as from specific authors at HarperCollins or specialized data providers for Dow Jones, these suppliers gain leverage. This leverage allows them to negotiate higher fees, directly impacting News Corp's costs.

For instance, exclusive rights to premium financial data from a provider like Dow Jones can be critical for maintaining competitive advantages in financial news. If this data is not readily available from other sources, the supplier's bargaining power increases significantly, as News Corp faces limited alternatives without compromising its service quality or market position.

The ability to easily switch suppliers is curtailed when content is unique. This lack of substitutability strengthens the supplier's position, enabling them to demand more favorable terms. In 2024, the demand for exclusive, high-quality content across all media platforms continued to rise, potentially increasing the bargaining power of key content creators and data providers for News Corp.

News Corp faces considerable bargaining power from suppliers due to high switching costs, particularly concerning its core technology infrastructure and large-scale content partnerships. For example, transitioning its vast digital platforms from a major cloud service provider to a new one would entail substantial financial outlays and potential operational delays, reinforcing the leverage of incumbent providers.

The complexity and expense associated with migrating extensive digital assets, such as subscriber databases and content management systems, from one provider to another significantly limit News Corp's flexibility. This technological dependency means that established providers can command higher prices or more favorable terms, as the cost and risk of changing are prohibitive.

Importance of Supplier's Input to News Corp's Business

The bargaining power of suppliers for News Corp is significantly influenced by the essential nature of the inputs they provide. For its traditional print media operations, paper is a fundamental requirement, and disruptions in its supply or significant price increases can directly impact profitability. Similarly, its digital divisions, like Dow Jones for financial news and Realtor.com or REA Group for digital real estate services, rely on specialized data feeds and technology platforms. Without these critical components, News Corp's ability to produce and distribute its core products and services would be severely compromised, granting these suppliers considerable leverage.

For instance, Dow Jones's reliance on real-time financial data feeds from exchanges and specialized data providers means that any interruption or unfavorable pricing from these sources can directly affect its competitive edge and operational costs. In 2023, the global pulp and paper market experienced volatility, with prices fluctuating based on demand and supply chain dynamics, directly impacting News Corp's printing costs.

- Essential Inputs: Paper for print media and specialized data feeds for Dow Jones and digital real estate platforms are non-negotiable for News Corp's operations.

- Operational Dependence: Without these inputs, News Corp's core business functions would be significantly hindered, increasing supplier leverage.

- Data Feed Criticality: Dow Jones's need for real-time financial data makes its data providers powerful allies or potential bottlenecks.

- Market Volatility Impact: Fluctuations in commodity prices, like paper, directly affect News Corp's cost structure and supplier negotiations.

Threat of Forward Integration by Suppliers

The threat of forward integration by suppliers presents a significant challenge to companies like News Corp. This occurs when suppliers, who currently provide content or technology, decide to bypass intermediaries and distribute their offerings directly to the end consumer. For instance, a successful independent content creator might establish their own platform, cutting out the need for a traditional media distributor.

While less of a concern for companies supplying essential infrastructure, this trend is becoming more pronounced in the content sector. The rise of digital platforms and self-publishing tools empowers creators to reach audiences directly. For example, many popular podcasters or online course creators now manage their own distribution and monetization, bypassing established media houses. This direct-to-consumer model reduces the reliance on traditional media companies and can erode their market share and revenue streams.

This strategic shift by suppliers can fundamentally alter the competitive landscape. It means that News Corp not only competes with other media giants but also with the very entities that supply it with content and technology. This dynamic can lead to increased pressure on pricing and a reduced ability to control the distribution channels.

Consider the growing creator economy, where platforms like Substack and Patreon in 2024 allow writers and artists to build direct relationships with their subscribers. This model bypasses traditional publishing and distribution channels, demonstrating a clear instance of forward integration.

- Direct Distribution: Content creators may launch their own platforms, directly reaching consumers and bypassing traditional media companies.

- Creator Economy Growth: Platforms like Substack and Patreon facilitate direct consumer engagement for creators, a trend gaining momentum in 2024.

- Reduced Reliance: This direct model lessens the dependence of creators on established media houses for distribution and monetization.

- Market Share Erosion: Forward integration by suppliers can lead to a loss of market share and revenue for companies like News Corp.

News Corp faces significant supplier bargaining power stemming from the essential nature of inputs like paper for its print operations and specialized data feeds for its digital divisions, such as Dow Jones. Disruptions or price hikes in these areas directly impact profitability, granting these suppliers leverage.

The company's dependence on cloud service providers like AWS, coupled with high switching costs for its extensive digital platforms, further empowers these technology suppliers. Migrating vast data assets is financially prohibitive, allowing incumbent providers to dictate terms.

Moreover, the increasing trend of content creators launching their own direct-to-consumer platforms, facilitated by services like Substack in 2024, represents a form of supplier forward integration. This bypasses traditional media distributors, potentially eroding News Corp's market share and revenue.

| Supplier Type | Key Inputs/Services | Impact on News Corp | 2024 Trend/Data Point |

|---|---|---|---|

| Content Creators/Agencies | Exclusive/Differentiated Content | Higher acquisition costs, reduced flexibility | Increased demand for exclusive content |

| Technology Infrastructure | Cloud Services (e.g., AWS) | Pricing leverage, high switching costs | Continued reliance on major cloud providers |

| Data Providers | Financial Data (Dow Jones) | Critical for competitive edge, supplier leverage | Volatility in financial data market |

| Raw Materials | Paper for Print | Direct impact on printing costs | Fluctuations in pulp and paper prices |

What is included in the product

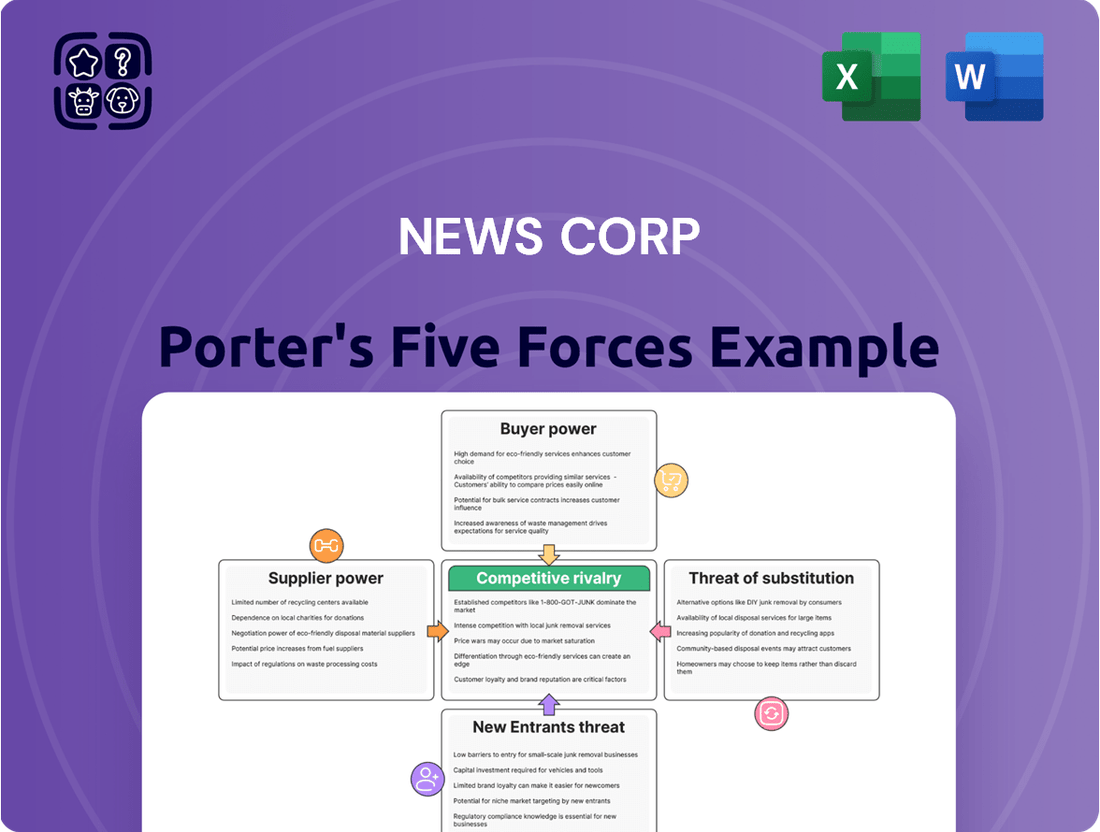

This analysis reveals the intensity of competition, the bargaining power of buyers and suppliers, the threat of new entrants and substitutes, all specifically applied to News Corp's media and publishing operations.

Effortlessly identify and quantify competitive pressures across News Corp's media landscape, enabling targeted strategies to mitigate threats and capitalize on opportunities.

Customers Bargaining Power

News Corp faces significant price sensitivity from both its individual consumers and its advertising clients. For instance, the average monthly cost of a digital news subscription can be a deciding factor for many consumers, especially with numerous free online news sources available.

The company's advertising revenue, particularly from its news media segment, has been directly impacted by this price sensitivity. In fiscal year 2023, News Corp reported a notable decline in advertising revenues, underscoring how businesses are scrutinizing their ad spend and demanding more value for their investment.

This trend is further amplified by the ongoing shift of advertising budgets towards digital platforms that offer more targeted reach and measurable results, often at a lower perceived cost than traditional print advertising.

The abundance of readily accessible, often free, digital content creates a constant pressure on News Corp to justify its subscription prices and demonstrate tangible value to both readers and advertisers.

Customers today have an abundance of readily available alternatives for news, entertainment, and even real estate information. Think about it: beyond traditional media, there are countless digital platforms, streaming services like Netflix and Disney+, and social media channels like TikTok and X, all vying for attention. In 2024, the digital media landscape is incredibly fragmented, meaning consumers can easily find content elsewhere if they feel a particular source is too expensive or not offering what they want.

This wide array of choices directly translates to increased bargaining power for customers. If News Corp's offerings, for example, are perceived as overpriced or lacking in quality compared to competitors, users can simply shift their engagement. This ease of switching is a significant factor; reports from early 2024 indicate that consumer price sensitivity remains high across many entertainment and information sectors, further empowering them to demand better value.

For most consumers, the cost of switching between news providers, streaming platforms, or real estate listings is minimal, often requiring only a few clicks or a new subscription. This ease of transition gives customers significant leverage, allowing them to easily explore alternatives and demand better value or content. For instance, the digital nature of media consumption means that subscription cancellations and new sign-ups are typically instantaneous.

Consolidation of Advertising Buyers

The consolidation of advertising buyers significantly amplifies their bargaining power against media companies like News Corp. Large advertising agencies and major corporations, controlling substantial portions of advertising budgets, can negotiate for lower rates due to their sheer volume of spend. This is particularly relevant as digital advertising continues to grow, offering buyers more platform choices and leverage.

In 2023, global digital ad spending reached approximately $600 billion, a figure that allows major buyers to dictate terms. This concentration means that a few key clients can represent a significant portion of a media outlet's revenue, giving them considerable sway over pricing and placement. Consequently, News Corp, like its competitors, faces pressure to offer competitive rates to retain these large advertisers.

- Consolidated Buyers: A few large advertising agencies and corporations control a significant share of ad spend, increasing their negotiation leverage.

- Digital Shift: The ongoing migration of ad budgets to digital platforms provides buyers with more options and power to demand lower rates.

- Volume Discounts: Large advertisers can command volume discounts, directly impacting News Corp's advertising revenue per impression.

- 2023 Data: Global digital ad spending exceeding $600 billion in 2023 underscores the financial clout of major advertising buyers.

Impact of User-Generated Content and Social Media

The rise of user-generated content and social media has dramatically shifted the landscape for news organizations like News Corp. Consumers now have immediate access to vast amounts of information, often for free, directly through platforms like X (formerly Twitter), Facebook, and TikTok. This accessibility acts as a powerful substitute for traditional paid news sources, diminishing the perceived value of subscriptions for many users.

This increased access to alternative information channels significantly bolsters customer bargaining power. Consumers can easily compare news sources and are less compelled to pay for content when similar information is readily available elsewhere. For instance, a significant portion of news consumption in 2024 occurs through social media feeds, which often aggregate content from various outlets without direct payment from the end-user.

- Information Accessibility: Social media platforms offer consumers free and instant access to news, bypassing traditional paywalls.

- Substitute Effect: User-generated content and shared news function as viable alternatives to subscribing to paid news services.

- Perceived Value Reduction: The abundance of free information lowers the perceived value of paid news subscriptions.

- Increased Bargaining Power: Consumers can leverage these alternatives to negotiate better terms or simply opt for free content, thereby increasing their power over news providers.

Customers' ability to influence News Corp's pricing and terms is substantial due to the widespread availability of alternative information and entertainment sources. With minimal switching costs, consumers can easily opt for free or lower-priced options, forcing News Corp to demonstrate superior value to retain their business.

In 2024, the digital media landscape is characterized by an overwhelming abundance of content, from streaming services to social media platforms, all competing for consumer attention and wallet share. This competitive environment significantly empowers consumers, as they can readily shift their engagement if News Corp's offerings are perceived as too expensive or less appealing.

The bargaining power of advertisers is also a critical factor, particularly with the continued growth of digital advertising, which offers buyers greater choice and transparency. Large advertisers can leverage their significant spend to negotiate favorable rates, directly impacting News Corp's revenue streams and forcing a focus on delivering measurable results.

| Factor | Impact on News Corp | Supporting Data/Trend |

|---|---|---|

| Availability of Substitutes | Weakens pricing power; increases churn risk. | Consumers increasingly rely on free social media news aggregation. |

| Price Sensitivity | Forces competitive pricing and value demonstration. | High consumer price sensitivity noted across entertainment sectors in early 2024. |

| Low Switching Costs | Enables easy migration to competitor offerings. | Digital subscriptions and content access are typically instantaneous to change. |

| Advertiser Consolidation | Amplifies negotiation leverage for large ad buyers. | Global digital ad spending exceeded $600 billion in 2023, concentrating power. |

Same Document Delivered

News Corp Porter's Five Forces Analysis

This preview showcases the complete News Corp Porter's Five Forces analysis, offering a detailed examination of industry competition, buyer and supplier power, and the threat of new entrants and substitutes. The document you see here is precisely the same professionally formatted and ready-to-use analysis you will receive instantly upon purchase. You are looking at the actual, fully developed report, ensuring no discrepancies or placeholder content. This comprehensive analysis is your deliverable, providing immediate access to valuable strategic insights without any further customization or setup required.

Rivalry Among Competitors

News Corp operates in intensely competitive landscapes, encountering a multitude of rivals across its diverse business segments. This includes established global media conglomerates, agile digital-native news organizations, as evidenced by the existence of over 25 major online news sources, and a growing number of streaming platforms, with approximately 12 primary streaming competitors vying for audience attention.

Furthermore, the company faces significant competition within its digital real estate services sector, where numerous specialized platforms and local players actively compete for market share. This broad spectrum of competitors, ranging from legacy media giants to emerging digital disruptors, intensifies the rivalry and necessitates continuous innovation and strategic adaptation.

The digital media and advertising landscape is fiercely competitive, with tech giants like Google and Meta dominating a substantial portion of digital ad spending. This trend significantly impacts traditional news media, including News Corp's operations, as advertising revenue continues to shift online.

News Corp's news media segment, in particular, grapples with the persistent challenge of declining advertising revenues, a common issue across the entire industry. For instance, in the fiscal year 2023, News Corp's News Media segment saw its revenues decrease, reflecting the ongoing pressures from digital competition.

Competitive rivalry within the media industry, particularly for News Corp, is intensely fueled by the constant demand for superior content quality and groundbreaking innovation. Companies are locked in a battle to capture audience attention through authoritative reporting and engaging storytelling. This means a relentless pursuit of accuracy and depth in every piece of content published.

Innovation is no longer optional; it's a necessity for survival and growth. News Corp recognizes this, actively investing in new digital formats and enhancing user experiences across its platforms. This includes exploring novel ways to deliver news and entertainment, making content more accessible and interactive for a diverse readership.

A significant driver of this competitive edge is the strategic integration of artificial intelligence. News Corp is pouring resources into AI for content creation and personalization. This allows them to tailor content to individual user preferences, thereby increasing engagement and loyalty. For instance, by mid-2024, many major news outlets are leveraging AI to summarize articles, suggest related content, and even draft initial reports, aiming to improve efficiency and output.

This focus on AI-driven personalization is crucial for maintaining market share. In a landscape where user attention is a scarce commodity, the ability to deliver relevant, high-quality content precisely when and how users want it is paramount. News Corp's commitment to these areas underscores the fierce competition to be a leader in the evolving media ecosystem.

Strategic Partnerships and Acquisitions

Competitive rivalry in the media and information services sector is intensifying as companies actively pursue strategic partnerships and acquisitions. These moves aim to expand market reach, diversify product and service portfolios, and solidify competitive standing.

News Corp exemplifies this trend, notably through its multi-year global partnership with OpenAI. This collaboration is designed to integrate AI capabilities across its news operations, enhancing content creation and distribution. Furthermore, News Corp continues to invest strategically in its key growth areas, such as Dow Jones and its Digital Real Estate Services segment, to bolster its market position and drive future revenue streams.

- Strategic Alliances: Competitors are forming alliances to share resources, technology, and market access, a strategy News Corp employs with OpenAI.

- Mergers & Acquisitions: The industry sees ongoing consolidation, with companies acquiring rivals or complementary businesses to gain scale and new capabilities.

- Investment in Core Assets: News Corp's continued investment in Dow Jones and Digital Real Estate Services highlights a focus on strengthening its foundational businesses amidst competitive pressures.

- AI Integration: Partnerships focused on artificial intelligence are becoming crucial for enhancing operational efficiency and developing innovative offerings in the competitive landscape.

Geographic and Segment Overlap

News Corp encounters intense rivalry, particularly where its operations overlap geographically and across different business segments. In the digital real estate sector, for example, the company contends with a multitude of local portals and established international platforms, each vying for user attention and advertiser spend.

This competitive pressure is also evident in its news media businesses. In the United States, Australia, and the United Kingdom, News Corp's newspapers and digital news sites face competition from a wide array of national broadcasters, regional publications, and increasingly, digital-native news organizations. For instance, in Australia, News Corp Australia competes directly with Nine Entertainment Co. and Seven West Media, both of which have significant digital footprints and broadcast assets.

- Digital Real Estate Competition: News Corp's digital real estate segment, including brands like Realtor.com, faces competition from Zillow Group and CoStar Group (which acquired Homes.com in 2024).

- News Media Rivalry: In the US, The Wall Street Journal competes with Bloomberg and The New York Times, while The Sun in the UK rivals the Daily Mail and The Guardian.

- Australian Market Dynamics: News Corp Australia's dominance is challenged by Nine Entertainment's digital news sites and its ownership of real estate portal Domain.

News Corp faces intense competition across all its business segments, from established media giants to agile digital disruptors. This rivalry is particularly fierce in digital real estate, where players like Zillow and CoStar Group (which acquired Homes.com in 2024) actively compete for market share. In news media, The Wall Street Journal contends with Bloomberg and The New York Times, while Australian operations face challenges from Nine Entertainment Co. and Seven West Media, highlighting the broad competitive pressures. The company's strategic investments in AI, such as its partnership with OpenAI, are a direct response to this need to innovate and maintain relevance in a rapidly evolving media landscape.

| Competitor | News Corp Segment | Key Competitive Factor |

|---|---|---|

| Zillow Group | Digital Real Estate Services | Online real estate listings, data, and tools |

| CoStar Group (Homes.com) | Digital Real Estate Services | Real estate data and marketplaces |

| Bloomberg | News Media (Dow Jones) | Financial news and data services |

| The New York Times | News Media | General news and investigative journalism |

| Nine Entertainment Co. | News Media (Australia) | Diversified media assets including news and real estate portals |

SSubstitutes Threaten

The proliferation of free online news and social media presents a substantial threat of substitutes for News Corp's traditional media. Platforms like X (formerly Twitter) and aggregated news sites offer immediate access to information, often at no direct cost to the consumer. This accessibility directly competes with paid subscriptions for newspapers and magazines.

In 2024, the digital advertising market, which heavily supports free online content, continued to grow, with global spending projected to reach over $700 billion. This massive investment in free content makes it harder for paid news models to retain subscribers. Consumers increasingly expect news to be readily available without a paywall, diminishing the perceived value of traditional paid news products.

News Corp's own digital strategy, while robust, also highlights this competitive landscape. The company's digital advertising revenue, though significant, must contend with the sheer volume of free content vying for audience attention and advertising dollars. This dynamic puts pressure on News Corp to continually innovate and demonstrate the unique value proposition of its premium content to justify subscription fees.

For News Corp's subscription video services and book publishing, the threat of substitutes is significant. Competitors like Netflix, Disney+, and Hulu directly vie for consumer entertainment budgets and viewing time. In 2023, the global video streaming market reached an estimated $90 billion, highlighting the intense competition for eyeballs.

Beyond traditional streaming, user-generated content platforms such as YouTube and TikTok capture substantial audience engagement, offering a vast and often free alternative. Similarly, the booming video game industry, which saw global revenues projected to exceed $180 billion in 2024, presents another powerful substitute for leisure time and discretionary spending.

The threat of substitutes in book publishing is significantly amplified by the growth of self-publishing platforms. Authors can now directly reach readers through services like Amazon Kindle Direct Publishing (KDP), bypassing traditional gatekeepers such as News Corp's HarperCollins. This offers consumers a vast and often more affordable selection of content, directly challenging the established publishing model.

In 2023, KDP alone saw over 2.7 million titles published, highlighting the sheer volume of content available outside traditional channels. This surge in self-published works, from e-books to audiobooks, provides a direct substitute for titles that would typically be managed and distributed by major publishing houses, potentially impacting their market share and revenue streams.

Digital Real Estate Alternatives and DIY Services

While News Corp's digital real estate platforms like Realtor.com and REA Group hold significant market share, the threat of substitutes is a growing concern. Direct-to-consumer (DTC) platforms and private listing services allow sellers and renters to bypass traditional portals, reducing reliance on News Corp's offerings.

The increasing accessibility of property data and the rise of DIY tools empower individuals to manage their own property transactions. This trend directly challenges the value proposition of comprehensive real estate portals.

- Direct-to-Consumer Platforms: Services like Zillow's FSBO (For Sale By Owner) and rentals section enable direct listing and management, bypassing traditional agent-driven models.

- Private Listings: Word-of-mouth, social media groups, and local bulletin boards continue to facilitate private property sales and rentals, offering a low-cost alternative.

- Online Aggregators: While some are competitors, others aggregate listings from various sources, potentially offering a broader, albeit less curated, view than a single portal.

- DIY Tools: The availability of online contract generators and pricing tools empowers individuals to handle aspects of real estate transactions independently.

AI-Generated Content and Automated Information Services

AI-generated content and automated information services represent a significant emerging threat. These technologies can deliver tailored information at remarkable speed, potentially undermining the value proposition of traditional journalistic content and specialized information providers. News Corp’s strategic investments in AI acknowledge this disruptive potential, as these tools could offer a cheaper, more immediate alternative for consumers seeking news and data.

The increasing sophistication of AI in content creation means that articles, summaries, and even basic market analysis can be produced with minimal human intervention. This poses a direct challenge to News Corp's core offerings, particularly in areas where speed and volume are paramount. By 2024, numerous companies are already leveraging AI for content generation, with some studies indicating that over 30% of content marketing teams are utilizing AI tools for writing assistance.

- AI-driven content platforms can offer hyper-personalized news feeds, directly competing with curated content from News Corp.

- Automated financial news services can provide real-time market updates, potentially replacing the need for some subscription-based data services offered by News Corp's subsidiaries.

- The cost-effectiveness of AI-generated content could pressure pricing models for traditional media and information services.

- News Corp's own AI initiatives, while defensive, also underscore the technological capabilities that could be deployed by competitors or new entrants.

The threat of substitutes for News Corp is substantial, with free online platforms and user-generated content directly competing for audience attention and advertising revenue. These alternatives offer immediate access to information and entertainment, often without a cost to the consumer, forcing News Corp to continually demonstrate the unique value of its premium offerings.

In the digital news space, social media and aggregators provide readily available information, challenging the economics of paid subscriptions. For entertainment, streaming services and video games represent significant substitutes for News Corp's media and publishing businesses. The real estate sector also sees direct-to-consumer platforms and DIY tools emerge as alternatives to traditional portals.

Emerging AI-generated content and automated information services pose a growing challenge by offering fast, tailored information, potentially impacting News Corp's core journalistic and data provision services. This technological shift necessitates ongoing innovation to maintain relevance and justify pricing models in a competitive landscape.

Entrants Threaten

Entering traditional media sectors like large-scale newspaper publishing or extensive broadcasting requires significant capital investment in infrastructure, printing presses, distribution networks, and content production. For instance, establishing a new national newspaper in 2024 could easily demand hundreds of millions of dollars for state-of-the-art printing facilities and a nationwide distribution system. This creates a substantial barrier to entry for new players, limiting the threat of new entrants in these established media domains.

News Corp's formidable brand recognition, exemplified by titles such as The Wall Street Journal and The Times, presents a significant barrier to new entrants. These established brands have cultivated deep consumer trust over many years, a crucial asset in the information and publishing sectors. For instance, The Wall Street Journal boasts a circulation of over 3 million across its print and digital platforms as of early 2024, a testament to its enduring appeal and credibility. This level of established trust is not easily replicated, requiring substantial time and financial investment for any newcomer to achieve.

The threat of new entrants in certain News Corp segments, especially broadcasting and specific information services, is significantly dampened by stringent regulatory hurdles and demanding licensing requirements. These complex legal and administrative processes act as substantial barriers, making it difficult and costly for newcomers to establish a foothold.

Network Effects in Digital Real Estate and Professional Information

The threat of new entrants for News Corp's digital real estate and professional information segments is significantly mitigated by powerful network effects. Platforms like Realtor.com, for instance, become more valuable as more users list and search for properties, creating a virtuous cycle that is difficult for newcomers to break into. Similarly, Dow Jones' professional information services gain strength from the sheer volume and quality of data accumulated over time, which attracts more subscribers and, in turn, leads to richer insights.

Replicating the comprehensive listing databases and established user communities that News Corp platforms have cultivated presents a substantial barrier. For example, Realtor.com boasted millions of property listings in 2024, a scale that new entrants would find incredibly challenging and costly to match. This deep reservoir of data and engaged audience provides a distinct competitive advantage, making it harder for nascent platforms to gain traction and offer comparable value.

- Network Effects: Platforms like Realtor.com and Dow Jones' professional services inherently become more valuable as user numbers and data grow, creating a self-reinforcing cycle.

- Barrier to Entry: New entrants face significant hurdles in replicating the extensive property listings, vast user bases, and proprietary data held by News Corp's established digital platforms.

- Data Accumulation: Dow Jones' professional information services benefit from decades of data aggregation, providing unparalleled depth and breadth that is difficult for newcomers to match quickly.

- User Engagement: The established user communities on these platforms drive repeat engagement and contribute to the ongoing value proposition, a critical mass that new entrants must build from scratch.

Lower Barriers to Entry in Digital-Only Content

The digital realm significantly lowers the cost of entry for new players compared to traditional media. Niche online news sites, independent content creators, and even specialized digital real estate tech startups can launch with minimal capital investment. This accessibility allows for rapid proliferation of new ventures, directly challenging established entities like News Corp.

This dynamic necessitates continuous innovation from News Corp to maintain its competitive edge. Smaller, more agile digital-first competitors can quickly adapt to market shifts and emerging trends. For instance, the rise of subscription-based newsletters and independent journalism platforms demonstrates how quickly new digital models can gain traction, often bypassing the legacy infrastructure costs of traditional publishers.

- Digital Platforms Lower Entry Costs: Traditional media often requires substantial investment in printing presses, distribution networks, and physical infrastructure. In contrast, digital-only content creation can begin with a website, social media presence, and minimal equipment, making it far more accessible.

- Rise of Niche Content Providers: The internet allows for the easy dissemination of highly specialized information. This has led to a surge in niche online news sites and independent creators focusing on specific industries or topics, directly competing for audience attention and advertising revenue.

- Agility of Digital Competitors: New digital entrants are typically unburdened by legacy systems or established workflows. This allows them to pivot quickly, experiment with new monetization models, and respond rapidly to changing consumer preferences, posing a continuous threat to larger, more established companies.

- Impact on Advertising Revenue: As more content is consumed digitally, advertising budgets increasingly shift towards online platforms. This intensifies competition for digital ad spend, with new entrants often offering more targeted or cost-effective solutions, impacting News Corp's traditional advertising streams.

While traditional media sectors like large-scale publishing and broadcasting present high capital barriers, the digital landscape offers a significantly lower cost of entry. New, agile digital-first competitors can rapidly emerge with minimal investment, challenging established players like News Corp by quickly adapting to market shifts and consumer preferences.

The proliferation of niche online news sites and independent content creators, often leveraging digital platforms for minimal startup costs, directly competes for audience attention and advertising revenue. This dynamic, exemplified by the rise of subscription newsletters, necessitates continuous innovation from News Corp to maintain its competitive edge against these nimble entrants.

Porter's Five Forces Analysis Data Sources

Our Porter's Five Forces analysis for News Corp is built upon comprehensive data from financial reports, industry-specific market research, and competitive intelligence platforms.

We leverage insights from company investor relations, regulatory filings, and leading financial news outlets to accurately assess the competitive landscape for News Corp.