News Corp Boston Consulting Group Matrix

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

News Corp Bundle

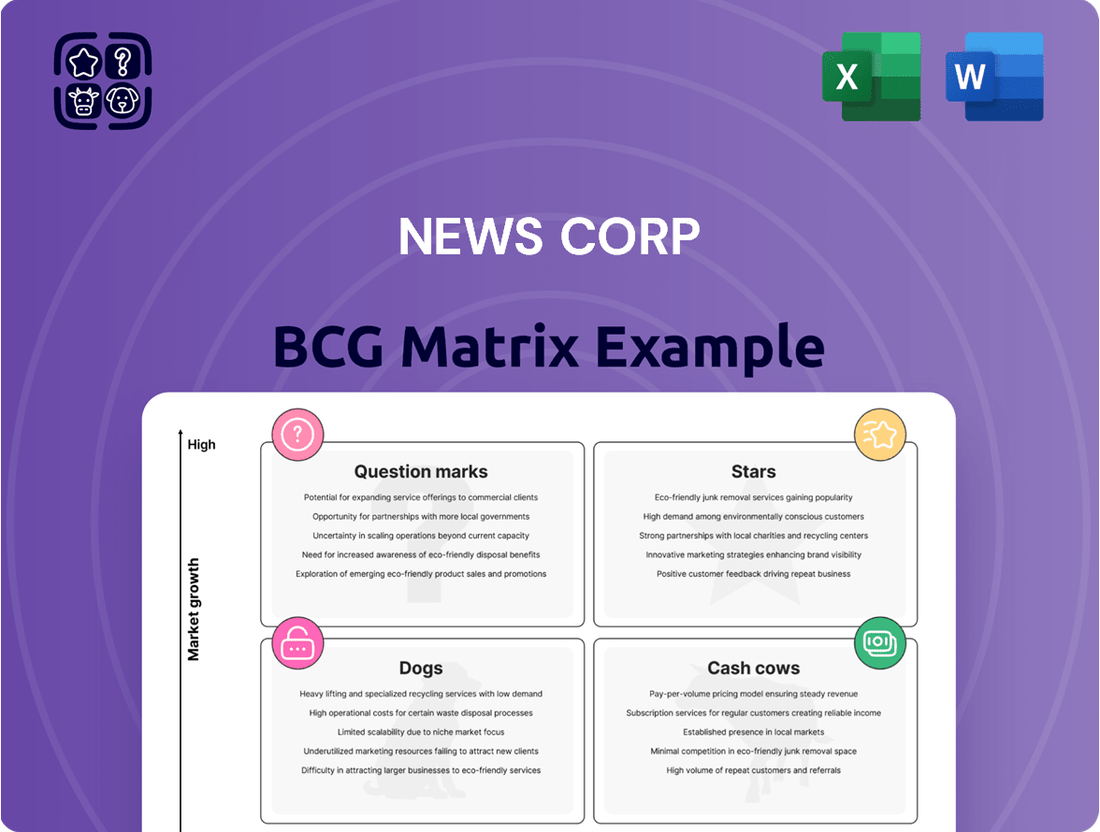

Curious about News Corp's strategic positioning? This preview offers a glimpse into their product portfolio's potential, hinting at the critical balance between market growth and share. Understanding where their ventures fall – be it high-growth Stars, stable Cash Cows, underperforming Dogs, or promising Question Marks – is vital for any investor or strategist.

Don't miss out on the complete picture. Purchase the full News Corp BCG Matrix for a detailed quadrant breakdown, revealing the true health and future prospects of each business segment. Gain actionable insights to navigate the dynamic media landscape and make informed decisions.

Stars

REA Group, especially its Australian residential operations, is a clear Star in News Corp's portfolio. Its dominant market share and consistent revenue expansion highlight this. For instance, in the nine months concluding March 31, 2025, the company saw an impressive 18% jump in revenue year-over-year.

This upward trajectory continued into the third quarter of fiscal 2025, where revenue grew by 12%. Such growth is fueled by a rising number of property listings, significant yield increases, and price adjustments within the Australian digital real estate landscape.

The Dow Jones Professional Information Business, including segments like Risk & Compliance and Dow Jones Energy, stands as a significant Star within News Corp's BCG Matrix. This business-to-business offering is a powerhouse, showcasing robust revenue growth; Risk & Compliance saw an 11% increase, while Dow Jones Energy grew by 10% in the first half of fiscal 2025.

Its strong performance is a testament to its dominant market position and the increasing demand for specialized professional information. High renewal rates further underscore the value and stickiness of these services, solidifying their contribution to Dow Jones' overall profitability and News Corp's diversified revenue streams.

The Wall Street Journal's digital-only subscriptions represent a significant growth engine within the mature News Corp portfolio, fitting the profile of a star in the BCG matrix. As of March 31, 2025, digital-only subscriptions across Dow Jones' consumer products, including the Journal, surpassed 5.5 million, marking a robust 9% increase.

This impressive growth trajectory is fueled by strategic initiatives such as converting subscribers to higher-priced tiers and ongoing investment in digital product enhancements. Such efforts are clearly resonating with consumers, allowing The Wall Street Journal to effectively capture market share in the increasingly competitive digital news sector.

News Corp's Content Licensing Deals with AI Platforms

News Corp's strategic multi-year global partnership with OpenAI solidifies its position as a Star in the burgeoning AI and content licensing arena. This collaboration capitalizes on News Corp's substantial portfolio of high-quality intellectual property, paving the way for lucrative, high-margin revenue streams within a rapidly expanding technological sector. The company is actively integrating AI-powered insights across its journalism and financial services divisions, demonstrating a forward-looking investment in sustained future growth.

This venture is particularly significant given the increasing demand for licensed content by AI developers. For instance, in 2024, the market for digital content licensing is projected to experience robust growth, driven by the insatiable appetite of AI models for training data. News Corp's foresight in securing these agreements positions it to benefit significantly from this trend.

- News Corp's partnership with OpenAI is a key driver of its Star status in the AI content licensing market.

- The deal leverages News Corp's extensive intellectual property to create new, high-margin revenue streams.

- Integration of AI-driven insights into journalism and financial services signals a strategic commitment to future growth.

- The global nature of the partnership broadens its revenue potential and market influence in the evolving AI landscape.

HarperCollins' Digital Audiobooks

HarperCollins' digital audiobooks are a star in News Corp's BCG Matrix, showcasing impressive growth within the book publishing segment. This category saw a significant 18% increase in sales during fiscal year 2024, demonstrating its strong market momentum. Furthermore, the quarter ending December 31, 2024, recorded a robust 13% growth, fueled by strategic collaborations with platforms such as Spotify.

The digital audiobook sector is outperforming other book formats, a trend solidified by its revenue now surpassing that of e-books. This indicates HarperCollins' successful positioning in a rapidly expanding and lucrative market. Key drivers for this success include:

- Significant Sales Growth: 18% increase in fiscal 2024 and 13% in the December 2024 quarter.

- Platform Partnerships: Collaborations with major players like Spotify are boosting accessibility and sales.

- Market Dominance: Audiobook revenue now exceeds e-book revenue, highlighting a shift in consumer preference.

- High-Growth Potential: The segment is expanding faster than other book formats, signaling a strong future outlook.

The Dow Jones Professional Information Business, encompassing Risk & Compliance and Dow Jones Energy, is a standout Star. Its strong revenue growth, with Risk & Compliance up 11% and Energy up 10% in the first half of fiscal 2025, demonstrates its market leadership and the increasing demand for specialized data.

The Wall Street Journal's digital-only subscriptions are also a Star, having surpassed 5.5 million by March 31, 2025, a 9% increase. This growth is driven by strategic efforts to move subscribers to premium tiers and enhance digital offerings, solidifying its position in the competitive digital news landscape.

News Corp's collaboration with OpenAI positions it as a Star in AI and content licensing. This strategic partnership leverages News Corp's vast intellectual property to generate high-margin revenue, with AI developers' demand for training data creating significant growth opportunities in 2024 and beyond.

HarperCollins' digital audiobooks are a clear Star, with sales up 18% in fiscal 2024 and 13% in the December 2024 quarter. This segment's revenue now exceeds that of e-books, reflecting successful platform partnerships and a strong consumer shift towards audio content.

| Segment | BCG Category | Key Performance Indicators (as of latest available data) |

|---|---|---|

| REA Group (Australia) | Star | 18% revenue growth (9 months to March 31, 2025); 12% revenue growth (Q3 FY25) |

| Dow Jones Professional Information Business | Star | Risk & Compliance: 11% revenue growth (H1 FY25); Dow Jones Energy: 10% revenue growth (H1 FY25) |

| The Wall Street Journal (Digital Subscriptions) | Star | 5.5+ million digital-only subs (March 31, 2025); 9% growth in digital-only subs |

| News Corp - OpenAI Partnership | Star | Leveraging IP for high-margin revenue; significant growth in AI content licensing market |

| HarperCollins (Digital Audiobooks) | Star | 18% sales growth (FY24); 13% sales growth (Q3 FY25); revenue now exceeds e-books |

What is included in the product

This BCG Matrix overview offers tailored analysis for News Corp's diverse media and publishing portfolio.

The News Corp BCG Matrix offers a clear, one-page overview, instantly relieving the pain of deciphering complex portfolio performance.

Cash Cows

The Wall Street Journal's core operations, built on a loyal subscriber base and established advertising revenue, represent a significant Cash Cow for News Corp. This legacy business maintains a dominant position in the business news sector, generating dependable and substantial cash flow.

While the digital landscape is evolving, the Journal's high market share in business news means it doesn't demand massive new investments for growth. For instance, in the fiscal year ending June 30, 2023, News Corp reported total segment revenue of $9.36 billion, with the Dow Jones segment, which includes The Wall Street Journal, contributing $1.87 billion. This segment consistently demonstrates strong profitability.

The publication's ability to command premium subscription prices and attract high-value advertisers underscores its status as a stable and highly profitable asset within News Corp's portfolio. Its enduring brand recognition fuels consistent demand for its in-depth financial reporting and analysis.

HarperCollins' traditional print and e-book publishing segment operates as a robust Cash Cow within News Corp's portfolio. This segment consistently commands a significant market share in the established book publishing industry, translating into consistent and substantial profit generation and cash flow.

Fiscal year 2024 saw a healthy 6% increase in sales for HarperCollins, underscoring its enduring appeal. Even more impressively, EBITDA experienced a remarkable surge of 61% during the same period, highlighting the segment's potent ability to convert revenue into strong financial returns.

News Corp Australia's established digital news mastheads, including titles like The Australian and Herald Sun, clearly fit into the Cash Cow quadrant of the BCG Matrix. These platforms command a substantial presence within the Australian digital news sector.

As of March 31, 2025, these digital mastheads reported a significant milestone with closing digital subscribers totaling 1,148,000. This strong subscriber base underscores their market dominance and the consistent demand for their content.

Despite broader challenges impacting the news media industry, these digital assets consistently generate stable, recurring revenue streams. Their established brand recognition and loyal readership contribute significantly to News Corp's overall profitability.

Barron's (within Dow Jones)

Barron's, a key component of Dow Jones under News Corp, operates as a classic Cash Cow. Its established reputation and deep focus on investment news and analysis have secured a high market share within its specific segment. This allows Barron's to consistently generate robust revenue and profits with minimal need for significant reinvestment, capitalizing on its mature market standing and loyal, affluent subscriber base.

The publication benefits from a predictable revenue stream driven by its dedicated readership, which values its in-depth market insights. In 2024, Barron's continues to be a reliable profit generator for News Corp, underscoring its role as a mature, high-performing asset. Its established brand loyalty and niche market dominance are key factors in its sustained financial success.

- High Market Share: Dominates the niche of in-depth investment news and analysis.

- Stable Revenue Generation: Consistent profits are derived from a loyal, high-value subscriber base.

- Low Investment Requirement: Mature market position means growth capital needs are minimal.

- Profitability: Continues to be a significant and reliable profit center for Dow Jones.

Dow Jones' Existing Data and Information Licensing

Dow Jones' existing data and information licensing represents a significant cash cow for News Corp. These licensing agreements tap into the company's vast archive of historical news and financial data, generating stable, recurring revenue. The high market share of this proprietary information allows for high-margin income with minimal need for further investment.

This steady income stream is a crucial contributor to News Corp's overall cash flow. For instance, in fiscal year 2023, Dow Jones' digital subscription revenue, which includes licensing, continued to show robust growth. The established nature of these licenses means they require little incremental capital expenditure, further boosting their cash-generating capabilities.

- Recurring Revenue: Licensing agreements provide predictable and consistent income.

- High Margins: The proprietary nature of the data allows for strong profitability.

- Low Investment: Minimal new capital is needed to maintain these revenue streams.

- Market Share: Dow Jones holds a dominant position in professional information licensing.

The Wall Street Journal's established brand and loyal readership solidify its position as a News Corp Cash Cow. It generates substantial, consistent cash flow from subscriptions and advertising with minimal need for growth investment.

HarperCollins' traditional publishing arm also operates as a strong Cash Cow. Fiscal year 2024 saw a 6% sales increase and a remarkable 61% EBITDA surge, demonstrating its potent profit generation capabilities.

News Corp Australia's digital mastheads, like The Australian, are also Cash Cows, boasting 1,148,000 digital subscribers as of March 31, 2025. These platforms provide stable, recurring revenue streams supported by strong brand recognition and readership.

Barron's, a Dow Jones publication, is a prime example of a Cash Cow. Its niche dominance in investment news and analysis ensures consistent, high-margin revenue from a loyal subscriber base with low capital expenditure needs.

Dow Jones' data and information licensing is another significant Cash Cow. These agreements leverage a vast data archive for stable, high-margin, recurring revenue with minimal ongoing investment, contributing significantly to News Corp's overall cash flow.

What You See Is What You Get

News Corp BCG Matrix

The News Corp BCG Matrix preview you are viewing is the definitive, final version you will receive upon purchase. This means the comprehensive analysis, strategic insights, and professional formatting are identical to the document you will download, ensuring no surprises and immediate usability.

Dogs

Realtor.com, managed by Move Inc. under News Corp's Digital Real Estate Services umbrella, is currently positioned as a Dog in the BCG Matrix. This classification stems from its struggling performance metrics, including a 17% drop in lead volumes during Q3 FY25 and an 8% year-over-year decrease in average monthly unique users.

The platform's revenue has also experienced a downturn, directly linked to unfavorable macroeconomic conditions and a sluggish U.S. housing market. This challenging environment makes Realtor.com a cash trap, demanding significant resources for limited positive outcomes.

The print advertising revenue within News Corp's News Media segment is clearly positioned as a Dog in the BCG matrix. This segment saw an 8% year-over-year decline in Q3 FY25, underscoring its struggles.

Further illustrating this downturn, advertising revenues in the broader News Media division experienced a 2% drop between October and December 2024. This performance aligns with the typical characteristics of a Dog: low market share and low growth, a trend driven by the declining demand for print advertising across the industry.

The Sun's global online audience has seen a dramatic decrease, falling from 143 million monthly unique users in December 2023 to just 70 million in December 2024. This more than 50% drop signals a significantly reduced market share in terms of online reach. The primary driver for this decline is believed to be shifts in platform algorithms, impacting the discoverability of its free online content.

This steep decline places The Sun's online presence in a precarious position within the News Corp portfolio. Its current low reach and challenging growth prospects for its digital content suggest it might be categorized as a 'Dog' in the BCG Matrix. This means the business unit requires careful consideration for potential restructuring or even divestment if turnaround strategies do not yield positive results in the near future.

News Corp Australia's Print Publications

News Corp Australia's print publications, such as The Herald Sun and The Courier-Mail, are categorized as Dogs within the BCG Matrix. These assets are situated in a mature market characterized by declining print circulation and advertising revenues, a trend that has persisted for years. For instance, in the fiscal year 2023, News Corp reported a 7% decrease in revenue for its News Media segment, largely attributable to print advertising declines.

These publications continue to demand substantial investment for their upkeep, even as their market share and profitability shrink. Despite ongoing efforts to streamline operations and manage costs, the long-term outlook for significant growth remains bleak. The company's strategy often involves focusing on cost efficiencies and potentially exploring divestment options for these legacy assets.

- Print Circulation Decline: Many Australian newspapers have seen double-digit percentage drops in average daily circulation over the past decade.

- Advertising Revenue Erosion: Digital platforms have siphoned away print advertising spend, leading to significant revenue challenges for the print sector.

- High Maintenance Costs: Printing, distribution, and legacy operational costs continue to be substantial for these publications.

- Mature Market Saturation: The market for print media in Australia is considered saturated and contracting, limiting growth potential.

Factiva's Ongoing Customer Dispute

Factiva, a part of News Corp’s Dow Jones business, is facing a significant customer dispute. This issue has already caused a 200 basis point reduction in Factiva's revenue. This situation places Factiva in the 'underperforming dog' quadrant of the BCG matrix, characterized by low market growth and low market share.

The revenue impact highlights a specific problem within an otherwise robust segment of Dow Jones. Resolving this customer dispute is critical to stop further financial erosion and to improve Factiva's contribution to News Corp's overall performance.

- Revenue Impact: A 200 basis point adverse effect on Factiva's revenues.

- BCG Quadrant: Positioned as a 'dog' due to low growth and low market share.

- Strategic Concern: Represents a drag on performance within a strong business segment.

- Resolution Priority: Urgent need to address the customer dispute to mitigate further negative impacts.

Several News Corp business units currently reside in the 'Dog' category of the BCG Matrix, indicating low market share and low growth prospects. These include Realtor.com, print advertising within the News Media segment, The Sun's online presence, News Corp Australia's print publications, and Factiva. These segments often face declining revenues and require careful management or restructuring.

Realtor.com, for example, experienced a 17% drop in lead volumes in Q3 FY25 and an 8% year-over-year decrease in average monthly unique users, directly impacted by a weak housing market. Similarly, News Corp Australia's print publications contend with declining circulation and advertising revenue, with print advertising revenue in the broader News Media division dropping 2% between October and December 2024.

The Sun's online audience plummeted by over 50% from December 2023 to December 2024, falling from 143 million to 70 million monthly unique users, attributed to algorithm changes. Factiva is also flagged as an underperforming dog due to a customer dispute that reduced its revenue by 200 basis points.

| Business Unit | BCG Category | Key Performance Indicators | Challenges |

| Realtor.com | Dog | -17% lead volume (Q3 FY25) -8% YoY avg. monthly unique users |

Macroeconomic conditions, sluggish housing market |

| News Media (Print Advertising) | Dog | -2% ad revenue (Oct-Dec 2024) | Declining demand for print ads, industry-wide trend |

| The Sun (Online) | Dog | -50%+ drop in monthly unique users (Dec 2023 vs. Dec 2024) | Algorithm changes impacting discoverability |

| News Corp Australia (Print) | Dog | -7% segment revenue decline (FY23) | Declining print circulation and advertising, high maintenance costs |

| Factiva | Dog | -200 basis points revenue reduction | Customer dispute, low market growth and share |

Question Marks

REA India, a key player within News Corp's Digital Real Estate Services segment, currently fits the profile of a Question Mark in the BCG matrix. Its recent performance highlights this dynamic.

The company experienced robust revenue growth, surging by 46% in the first half of fiscal year 2025. This impressive top-line expansion signifies its operation within a high-growth market, a crucial characteristic for Question Marks.

However, this promising growth unfolds against a backdrop of intense competition. The increasing number of market participants is indeed exerting downward pressure on yields, suggesting REA India's current market share, while growing, is still relatively small in this expanding landscape.

Significant strategic investment will be essential for REA India to capture a larger share of this burgeoning market. Such investment is critical to transform its current Question Mark status into that of a Star, a position indicating market leadership.

The Sun's Sun Club subscription offering positions it as a Question Mark within the News Corp BCG Matrix. This new venture aims to tap into the burgeoning digital subscription market, a strategic pivot to counter the persistent decline in traditional advertising revenue.

As a nascent product, Sun Club currently holds a low market share, reflecting its recent introduction. However, its potential for growth is significant, contingent on widespread consumer adoption of its premium online content.

The success of Sun Club hinges on substantial investments in marketing and content development. These efforts are crucial for building brand awareness and persuading users to commit to a paid subscription model in a competitive digital landscape.

Dow Jones' recent acquisitions, including Dragonfly and Oxford Analytica, are strategically positioned within the News Corp BCG Matrix's Question Mark quadrant. These moves signify a deliberate expansion into specialized, high-potential markets within the professional information sector, signaling a focus on future growth engines.

These acquisitions, while promising significant growth potential, represent relatively nascent ventures for Dow Jones. Their current market share and revenue contribution are likely modest, necessitating continued investment and strategic development to solidify their positions and achieve scalability.

For instance, Dragonfly, a threat intelligence platform, and Oxford Analytica, a geopolitical and economic analysis firm, are examples of Dow Jones investing in niche, data-rich segments. These areas are characterized by high growth but require substantial resources to build market dominance and demonstrate a clear path to profitability.

News Corp's Broader AI Integration Initiatives

News Corp is actively exploring artificial intelligence beyond simple content licensing, aiming to embed AI across its journalism, financial services, and education sectors. These strategic pushes are targeting areas with significant growth potential, where AI can drive new applications and operational efficiencies. For instance, in journalism, AI is being tested for tasks like automated reporting and content summarization, potentially freeing up journalists for more in-depth investigative work. The financial services arm, including Dow Jones, is leveraging AI for market analysis and personalized client insights, aiming to enhance product offerings and customer engagement.

These broader AI integration initiatives represent News Corp's "question marks" in the BCG matrix, signifying high growth potential but currently uncertain market positions. The company is investing heavily in research and development for these nascent AI products and services. For example, Dow Jones reported a 10% increase in digital revenue in its fiscal 2024 first quarter, partly attributed to new AI-driven tools for subscribers, indicating early traction in this high-potential area. However, significant investment is still required to refine these offerings and capture substantial market share.

- Journalism: AI-powered content generation and summarization tools are under development to augment reporting capabilities.

- Financial Services: Dow Jones is implementing AI for enhanced market data analysis and personalized client solutions.

- Education: Exploring AI applications to personalize learning experiences and improve educational content delivery.

- Investment: Significant R&D funding is allocated to these AI initiatives, reflecting their strategic importance and the need to establish market leadership.

Realtor.com's Strategic Partnerships for New Services

Realtor.com is actively pursuing strategic partnerships, notably with Zillow, to expand into seller services, new homes, and rentals. These collaborations are designed to unlock new avenues for growth, particularly as the core lead generation business faces headwinds in the current U.S. housing market.

These ventures into adjacent service areas represent a strategic pivot to capture market share in what are perceived as high-growth segments. However, the financial impact of these partnerships on Realtor.com's overall performance is still in its nascent stages, necessitating ongoing investment to achieve substantial market penetration.

- Partnership Focus: Expanding beyond traditional lead generation into seller services, new homes, and rentals.

- Market Context: Addressing challenges in the core lead generation business within a fluctuating U.S. housing market.

- Growth Potential: Targeting high-growth opportunities in adjacent real estate service sectors.

- Investment Required: Current performance contribution is developing, requiring further investment for significant market share gains.

REA India's substantial 46% revenue growth in the first half of fiscal year 2025 confirms its status as a Question Mark. This rapid expansion in a high-growth market is tempered by intense competition, which pressures yields and indicates a currently small market share despite growth.

The Sun's Sun Club is also a Question Mark, a new digital subscription venture designed to offset declining ad revenue. It has a low market share but significant growth potential, heavily reliant on consumer adoption and substantial investment in marketing and content.

Dow Jones' acquisitions of Dragonfly and Oxford Analytica place them in the Question Mark quadrant, representing strategic entries into niche, high-growth professional information markets. While these ventures show promise, they require continued investment to build market dominance and achieve profitability.

News Corp's broader AI integration across journalism, financial services, and education are Question Marks, characterized by high growth potential and uncertain market positions. Dow Jones' fiscal 2024 first quarter saw a 10% digital revenue increase, partly due to AI tools, demonstrating early traction but still requiring significant investment for market share capture.

Realtor.com's strategic partnerships, including with Zillow, aim to tap into high-growth seller services, new homes, and rentals to counter headwinds in its core lead generation business. These ventures are nascent, requiring ongoing investment for substantial market penetration.

| Business Unit | BCG Category | Key Indicators | Strategic Imperative |

|---|---|---|---|

| REA India | Question Mark | 46% H1 FY25 revenue growth, high market growth, intense competition, low market share | Invest to gain market leadership |

| The Sun (Sun Club) | Question Mark | New digital subscription, low market share, high growth potential, requires marketing investment | Build brand awareness and user adoption |

| Dow Jones (Acquisitions) | Question Mark | Entry into niche data markets, promising growth, modest current contribution, requires investment | Achieve scalability and market dominance |

| News Corp AI Initiatives | Question Mark | High growth potential, uncertain market position, R&D investment, early traction (e.g., Dow Jones digital revenue) | Refine offerings and capture market share |

| Realtor.com Partnerships | Question Mark | Expansion into adjacent services, nascent financial impact, requires ongoing investment | Achieve significant market penetration |

BCG Matrix Data Sources

Our News Corp BCG Matrix is built on a foundation of verified market intelligence, integrating financial disclosures, industry growth forecasts, and proprietary market analytics.