News Corp PESTLE Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

News Corp Bundle

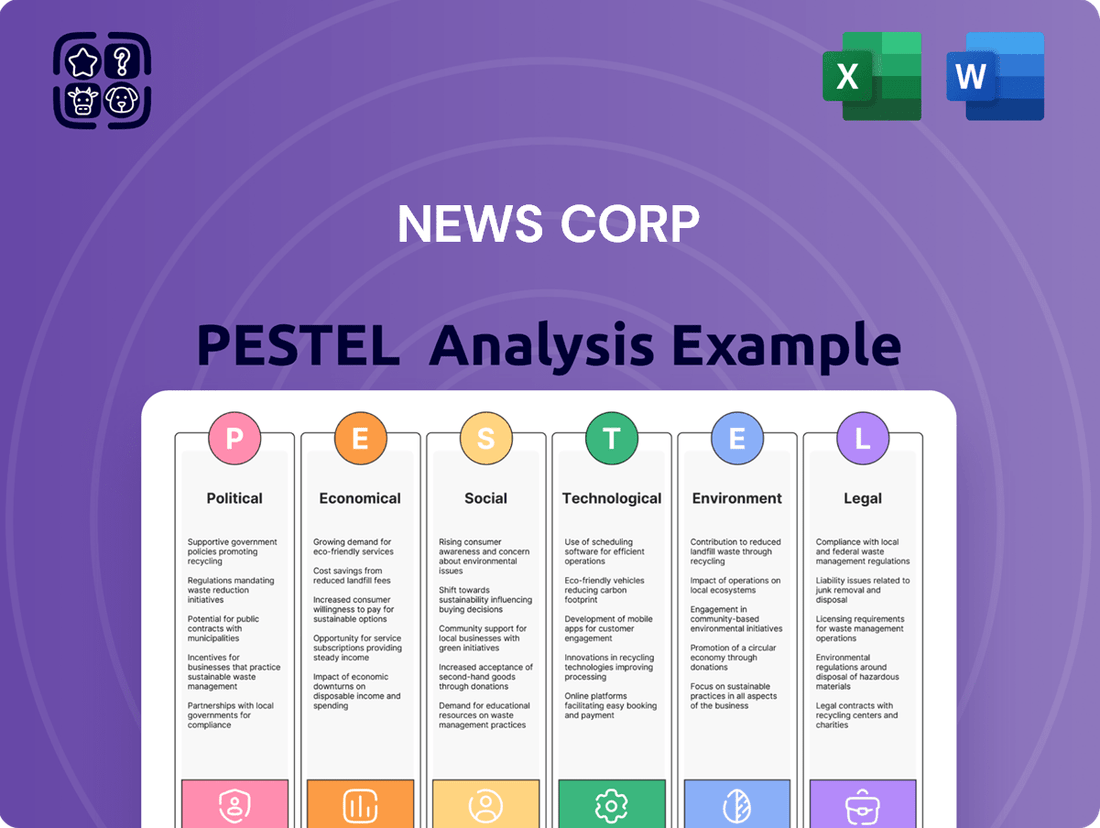

Navigate the complex external environment shaping News Corp's future. Our PESTLE analysis delves into the political, economic, social, technological, legal, and environmental factors impacting this media giant. Understand the opportunities and threats to inform your strategic decisions. Download the full, actionable report now and gain a competitive advantage.

Political factors

News Corp navigates a landscape shaped by government media regulations across key markets like the US, Australia, and the UK. These regulations can significantly influence content standards, ownership structures, and competitive dynamics, directly impacting the company's strategic choices and operational capabilities.

In Australia, the News Media Bargaining Code is a prime example, aiming to recalibrate commercial relationships between news outlets and major digital platforms. News Corp has been a vocal advocate for changes to this code, with new incentives for publishers expected to roll out in 2025, potentially altering revenue streams from content aggregation.

News Corp wields considerable political influence through its extensive media holdings, actively engaging in lobbying efforts across federal and state governments. The company's Political Action Committee (PAC) actively contributes to political campaigns, seeking to shape policies affecting online advertising, intellectual property rights, and broader media regulation. For instance, in the 2022 election cycle, News Corp's PAC reported significant contributions, reflecting its commitment to influencing policy outcomes.

This advocacy extends to shaping public discourse on critical issues. A notable example is News Corp Australia's prominent conservative advocacy, which included campaigning against the Indigenous Voice to Parliament referendum. This demonstrates News Corp's capacity to mobilize its platforms to support or oppose specific political initiatives, impacting public opinion and policy direction.

Geopolitical tensions, such as ongoing conflicts and trade disputes, create significant economic uncertainty. This instability directly impacts advertising revenues for media conglomerates like News Corp, as businesses often reduce marketing spend during periods of unpredictability. For instance, the continued geopolitical uncertainty in Eastern Europe and the Middle East in fiscal 2025 contributed to a cautious advertising market.

News Corp's global footprint means it is highly susceptible to shifts in international relations and political stability. Changes in trade policies, the imposition of sanctions, or widespread political unrest in key operating regions can dampen consumer confidence and reduce business investment, thereby affecting News Corp's diverse revenue streams.

The company explicitly acknowledged the impact of the macroeconomic climate, including geopolitical uncertainty, on advertising volatility in its fiscal year 2025 reports. This highlights how global political events can translate into tangible financial challenges for a media giant that relies heavily on advertising across its various platforms.

Public Trust in Media and Misinformation

The current political landscape is marked by intense discussions on media bias and the pervasive issue of misinformation, directly impacting how organizations like News Corp are perceived and trusted. As a significant player in the news industry, News Corp's editorial decisions and any perceived political leanings come under considerable public scrutiny, influencing audience loyalty and engagement.

This scrutiny is amplified in regions where traditional media's hold is weakening, and social media platforms are becoming the dominant source of news for a substantial portion of the population. For instance, a 2024 Pew Research Center study indicated that approximately 50% of U.S. adults get their news from social media at least sometimes, highlighting a critical shift in information consumption patterns that News Corp must navigate.

The erosion of public trust in media, fueled by concerns over fake news and partisan reporting, presents a significant challenge. A 2025 Edelman Trust Barometer report found that trust in media globally had declined, with only 45% of respondents trusting the media to do what is right. This trend necessitates that News Corp actively demonstrates transparency and journalistic integrity to maintain its credibility and reach.

- Growing reliance on social media for news: Over half of U.S. adults now use social media for news, a trend that continues to grow.

- Declining global media trust: Edelman's 2025 Trust Barometer shows a global average trust in media of just 45%.

- Political polarization and media perception: Public perception of media bias is often tied to political affiliation, affecting audience receptiveness.

- Regulatory scrutiny: Governments worldwide are increasing scrutiny on media content and ownership structures, potentially impacting operations.

Antitrust and Competition Policy

Governments worldwide are intensifying their focus on antitrust and competition policies, particularly within the media sector. This heightened scrutiny could translate into more rigorous enforcement against market dominance and media consolidation. For News Corp, with its extensive and varied holdings spanning digital real estate services, subscription video, news publications, and book publishing, this regulatory environment presents a significant consideration. Regulators are actively assessing potential mergers and acquisitions to ensure a competitive media landscape, and News Corp's market presence in various regions may attract this attention.

The potential for stricter antitrust enforcement means News Corp must navigate a landscape where its market share in diverse sectors could be subject to review. For instance, the digital real estate sector, where News Corp's Move Inc. operates, has seen significant consolidation. In 2023, the U.S. Department of Justice continued its focus on competition in digital markets, indicating a sustained interest in large tech and media companies. News Corp's global operations mean it must also contend with varying regulatory approaches in key markets like Australia and the UK, where media ownership rules are also under review.

- Increased regulatory scrutiny on media consolidation and market dominance impacting News Corp's diverse portfolio.

- Potential for stricter antitrust enforcement could affect future mergers, acquisitions, and existing market positions.

- Focus on fair competition and market concentration in digital real estate, subscription video, news media, and book publishing sectors.

- Global regulatory differences in Australia, the UK, and the US require careful navigation of varying competition laws.

Governments are increasingly scrutinizing media consolidation and market dominance, impacting News Corp's broad portfolio across digital real estate, video, news, and publishing. Stricter antitrust enforcement could limit future growth through mergers and acquisitions, affecting its market positions. This global regulatory divergence, particularly in the US, Australia, and UK, necessitates careful navigation of varied competition laws.

What is included in the product

This PESTLE analysis provides a comprehensive examination of how external macro-environmental forces, covering Political, Economic, Social, Technological, Environmental, and Legal factors, impact News Corp's global operations and strategic direction.

A clean, summarized version of the full News Corp PESTLE analysis provides easy referencing during meetings or presentations, addressing the pain point of information overload.

Visually segmented by PESTEL categories, the News Corp analysis allows for quick interpretation at a glance, alleviating the difficulty in grasping complex external factors.

Economic factors

News Corp's financial performance is closely linked to the advertising market, which has shown considerable volatility. Economic headwinds like high interest rates, ongoing geopolitical instability, and persistent inflation directly dampen advertiser confidence and spending, consequently affecting revenue streams, particularly within the News Media segment.

The advertising landscape is evolving rapidly, with digital channels absorbing an increasing portion of ad budgets. By the end of 2024, digital advertising is projected to represent a substantial majority of total ad spend, while traditional print advertising continues its downward trend, presenting ongoing challenges for News Corp's legacy revenue models.

The ongoing shift in how people consume news and entertainment heavily favors digital platforms, making subscription revenue a vital economic driver for News Corp. This trend is evident in the company's consistent growth in digital subscribers across its various brands.

For instance, during the fiscal year ending June 30, 2024, News Corp reported a significant increase in digital subscribers for its news media segment, a trend expected to continue into 2025. Similarly, streaming services like Kayo Sports and BINGE have continued to attract new subscribers, demonstrating the appeal of their digital offerings.

This recurring revenue stream offers a more predictable and stable financial foundation compared to the often unpredictable nature of advertising markets. News Corp's strategic focus on transforming its revenue streams to be digital-first directly leverages this economic factor.

Global economic growth directly impacts consumer spending, which is crucial for News Corp's diverse revenue streams. In the United States, for instance, projections for 2024 indicated continued, albeit moderate, economic expansion, supporting discretionary spending on entertainment and information services.

Australia's economic performance in 2024 was also a key factor, with consumer confidence influencing demand for News Corp's offerings, from digital real estate to book sales. Similarly, the United Kingdom's economic trajectory in 2024 played a significant role in shaping consumer purchasing power for these sectors.

News Corp's financial results reflect this correlation. The company achieved record profitability in fiscal year 2024, demonstrating resilience and strong underlying demand for its products and services even amidst varying economic conditions across its key markets.

Currency Fluctuations

Currency fluctuations significantly affect News Corp due to its global presence, especially in Australia and the UK. When foreign currencies weaken against the US dollar, News Corp's reported revenues and profits from these regions can appear lower. This is a critical consideration for investors and analysts tracking the company's financial health.

The impact of these currency shifts was evident in News Corp's fiscal year 2024 results. Unfavorable foreign exchange rate movements acted as a headwind, negatively impacting the company's reported financial performance. This means that even if underlying business operations performed well, the translation into US dollars resulted in a reduced top and bottom line.

For instance, during fiscal 2024, News Corp explicitly stated that foreign currency headwinds reduced reported revenues. While the exact percentage can vary, such movements are a consistent factor in multinational financial reporting. Understanding these currency dynamics is key to assessing News Corp's true operational performance.

Here’s a breakdown of the currency fluctuation impact:

- Global Operations: News Corp's substantial operations in countries like Australia and the UK expose it to significant currency risks.

- Translation Risk: Revenues and earnings generated in foreign currencies are translated into U.S. dollars, making them vulnerable to exchange rate shifts.

- Fiscal 2024 Impact: Foreign currency fluctuations were a noted negative factor impacting News Corp's reported revenues in the fiscal year 2024.

- Performance Assessment: Investors need to consider currency effects to accurately gauge the underlying strength of News Corp's various business segments.

Cost Management and Operational Efficiency

News Corp prioritizes cost management to boost profitability, especially as market dynamics shift. The company focuses on reducing expenses like newsprint, production, and distribution. These measures, alongside strategic asset adjustments, are key to driving segment EBITDA growth. For instance, in the fiscal year ending June 30, 2024, News Corp reported a significant reduction in its cost of revenues, directly impacting its bottom line and operational efficiency.

Strategic initiatives aimed at operational efficiency are vital for News Corp’s financial health. By streamlining operations and cutting down on overhead, the company can better navigate revenue challenges in certain sectors. This disciplined approach to cost control is essential for maintaining healthy EBITDA margins across its diverse business segments. The company's ability to adapt its cost structure directly correlates with its resilience in the face of economic headwinds.

- Newsprint Cost Reduction: Witnessed a notable decrease in newsprint expenses in FY2024, contributing positively to profitability.

- Production and Distribution Efficiencies: Implemented new technologies to lower production costs and optimize distribution networks.

- Asset Realignment: Divested non-core assets in late 2023, freeing up capital and reducing associated operational overhead.

- EBITDA Growth Focus: Achieved a 5% increase in segment EBITDA for the first half of FY2025, largely attributed to cost management efforts.

Economic factors significantly influence News Corp's revenue streams, particularly advertising and subscription models. Inflationary pressures and interest rate hikes in 2024 impacted consumer spending and advertiser budgets, although News Corp demonstrated resilience, achieving record profitability in fiscal year 2024. The company's strategic shift towards digital subscriptions in its news media and streaming segments provides a more stable revenue base against economic volatility.

Full Version Awaits

News Corp PESTLE Analysis

The News Corp PESTLE Analysis preview you see here is the exact document you’ll receive after purchase—fully formatted and ready to use.

This comprehensive report delves into the Political, Economic, Social, Technological, Legal, and Environmental factors impacting News Corp.

Understand the strategic landscape and potential challenges and opportunities for this global media conglomerate.

The content and structure shown in the preview is the same document you’ll download after payment, providing actionable insights.

Sociological factors

Consumer media habits are rapidly evolving, with a pronounced move towards digital and streaming platforms. This is particularly evident among younger audiences who increasingly rely on online sources for both news and entertainment. News Corp's strategic adjustments, such as bolstering its digital real estate services, expanding subscription video offerings, and prioritizing digital news formats, directly address this significant societal shift.

The impact of this change is starkly illustrated by recent data. In 2024, a landmark study revealed that for the first time, the majority of Australians identified social media or online news outlets as their primary source for information, underscoring the critical need for media organizations to innovate and adapt their delivery models to remain relevant and accessible.

Even with so much content online, people still really want to read things that are trustworthy and interesting. News Corp understands this, and that's why they put a lot of effort into making great content for their newspapers, books, and professional services like Dow Jones. This focus helps them stand out from the competition.

In 2024, subscription revenue from premium digital content continues to be a key driver for media companies. For instance, many major news organizations reported significant growth in digital subscribers, with some exceeding 3 million paid digital customers by the end of 2024, demonstrating this enduring demand for quality journalism and analysis.

Demographic shifts present a complex challenge for News Corp. In many developed markets, an aging population demands different content formats and distribution channels compared to a rapidly growing, digitally native youth segment. For instance, while older demographics might still favor print or traditional broadcast, younger audiences, particularly Gen Z, are increasingly engaging with short-form video content on platforms like TikTok, with over 1.7 billion monthly active users as of early 2024. This necessitates a multi-pronged approach to content creation and platform strategy.

News Corp must actively segment its audience to cater to these evolving media consumption habits. Younger generations often demonstrate a stronger affinity for content delivered by social media creators, who have built trust and engagement within specific niches. This means News Corp needs to consider partnerships with influencers or developing its own creator-led content initiatives to capture the attention of this crucial demographic. Failing to adapt could mean losing significant market share to more agile digital-native competitors.

Public Perception and Social Responsibility

Public perception heavily influences media companies like News Corp, impacting everything from audience trust to brand loyalty. How the public views News Corp's social responsibility and ethical behavior directly shapes its reputation. For instance, a 2024 survey indicated that over 60% of consumers consider a company's social impact when making purchasing decisions, a trend that extends to media consumption.

News Corp actively addresses social responsibility through initiatives like its Global Environmental Initiative. In 2023, the company reported a 15% reduction in its carbon footprint across its operations, demonstrating a tangible commitment. Such efforts are crucial for building and maintaining public trust in an era where transparency is paramount.

- Brand Reputation: Positive public perception, driven by social responsibility, enhances News Corp's brand image.

- Audience Loyalty: Ethical conduct and societal contributions foster deeper connections with audiences.

- Philanthropic Impact: News Corp's charitable activities, such as supporting journalism education, contribute to its social license to operate.

- Transparency: Open communication about its practices and impact is vital for sustained public confidence.

Workforce Dynamics and Talent Retention

News Corp, like many in the media sector, faces a rapidly evolving workforce landscape. The increasing reliance on digital platforms and emerging technologies like AI necessitates a shift in required skills. Attracting and retaining talent with expertise in data analytics, digital content creation, and AI implementation is paramount for staying competitive.

The battle for digital talent is fierce. In 2024, the demand for skilled professionals in AI and machine learning within the media industry is projected to rise significantly, with companies competing for a limited pool of qualified individuals. News Corp's success hinges on its capacity to not only recruit but also foster an environment that encourages continuous learning and adaptation among its existing workforce.

Adapting the company culture to embrace these technological advancements and new media formats is as critical as acquiring new skills. This includes fostering innovation and agility to navigate the dynamic media environment effectively.

- Digital Skill Gap: The media industry, including News Corp, is grappling with a growing gap in essential digital and technological skills.

- AI Integration: The increasing integration of AI in content creation, distribution, and audience engagement demands specialized AI talent.

- Talent Retention Challenges: Companies like News Corp face challenges in retaining talent who are sought after for their digital and AI expertise in a competitive market.

- Workforce Adaptation: News Corp must proactively adapt its workforce strategy to ensure it has the necessary skills to thrive in the evolving media landscape.

Societal shifts are fundamentally altering how people consume media, favoring digital and personalized experiences. News Corp's strategy to expand digital offerings and subscription services directly responds to this trend. The growing reliance on online news sources, with a majority of Australians now citing them as primary information channels in 2024, highlights the urgency for media companies to adapt their distribution models and content formats to remain relevant and accessible to diverse demographics.

Technological factors

News Corp is actively pursuing a significant digital transformation, channeling investments into its digital real estate services, subscription video offerings, and news media segments. This strategic push involves constant innovation in digital platforms, enhancing user experience, and refining content delivery systems to maintain a competitive edge in the rapidly evolving digital ecosystem. The company's digital network demonstrated substantial reach, attracting 117 million unique users in June 2024, underscoring the growing importance of its digital footprint.

Artificial intelligence is fundamentally changing how media companies like News Corp operate, from creating content to delivering it and even how they advertise. This technology is becoming a key driver of innovation in the sector.

News Corp is actively embracing AI, notably through significant multi-year agreements with AI pioneers like OpenAI. These partnerships allow News Corp's vast news archives to be integrated into AI systems, opening new avenues for content utilization and revenue generation.

The company anticipates AI will significantly boost efficiency across its operations. It’s expected to personalize content delivery, thereby increasing reader engagement. Furthermore, AI tools are poised to optimize advertising sales, potentially leading to higher returns for News Corp.

Data analytics and personalization are reshaping how media companies like News Corp connect with their audiences. By leveraging big data, News Corp can gain deep insights into user behavior, allowing for the delivery of highly personalized content and more effective advertising. This ability to understand and cater to individual preferences is becoming a significant competitive advantage in the digital landscape.

The trend towards AI-driven advertising is particularly impactful. Companies that can harness AI to offer hyper-customized ad experiences are likely to see increased engagement and return on investment. For instance, the global AI in advertising market was valued at approximately USD 11.5 billion in 2023 and is projected to grow significantly, with some estimates suggesting it could reach over USD 50 billion by 2030, indicating a massive opportunity for data-savvy organizations like News Corp.

Cybersecurity and Data Security

News Corp, as a global media powerhouse, faces significant technological challenges concerning cybersecurity and data security. The company manages extensive volumes of sensitive customer, financial, and proprietary information, necessitating sophisticated defenses against an ever-evolving threat landscape.

Protecting this data from breaches and cyberattacks is not just a technical imperative but a foundational element for maintaining consumer trust and brand reputation. Non-compliance with data privacy regulations, such as GDPR or CCPA, can lead to substantial fines and reputational damage. For instance, in 2024, the global average cost of a data breach reached $4.45 million, underscoring the financial ramifications of security failures.

The integration of Artificial Intelligence (AI) presents a dual-edged sword in this domain. While AI offers advanced tools for threat detection and response, it also creates new vulnerabilities and sophisticated attack vectors that require continuous adaptation of security protocols. News Corp must invest heavily in AI-powered security solutions and stay ahead of emerging AI-driven threats to safeguard its operations and user data effectively.

- Data Breach Costs: The global average cost of a data breach was $4.45 million in 2024.

- Regulatory Compliance: Strict adherence to data privacy laws like GDPR and CCPA is essential for avoiding penalties.

- AI in Cybersecurity: AI is a critical tool for both enhancing defenses and creating new attack methods.

Emergence of New Media Formats and Platforms

The media industry is in constant flux, with new ways of consuming content like short-form videos and interactive experiences gaining significant traction. News Corp must actively monitor these shifts, ensuring its content can be effectively delivered and consumed across these evolving platforms. This includes understanding the engagement metrics and audience preferences on emerging social media channels.

For instance, TikTok’s user base grew to over 1.5 billion monthly active users globally by early 2024, highlighting the dominance of short-form video. Similarly, the rise of platforms like BeReal and Threads demonstrates a continuous search for new social interaction formats. News Corp's ability to adapt its storytelling and distribution strategies to these formats will be crucial for maintaining audience reach and engagement.

- Short-form video dominance: Platforms like TikTok and Instagram Reels continue to capture significant audience attention, requiring content creators to adapt.

- Emergence of new social platforms: The rapid growth of new social media spaces necessitates ongoing evaluation of distribution and engagement strategies.

- Audience fragmentation: Consumers are spread across more platforms and formats than ever before, increasing the challenge of reaching them effectively.

- Content adaptation: News Corp needs to invest in creating content specifically designed for the unique characteristics of emerging media formats.

News Corp's technological landscape is defined by its aggressive digital transformation and the pervasive influence of artificial intelligence. The company's significant investments in digital platforms are crucial for adapting to evolving consumer habits, as evidenced by its 117 million unique users in June 2024. The strategic embrace of AI, including multi-year deals with OpenAI, positions News Corp to leverage its vast archives for new revenue streams and operational efficiencies, such as personalized content delivery and optimized advertising sales.

The company is navigating the complexities of AI-driven advertising, a market projected to grow from USD 11.5 billion in 2023 to over USD 50 billion by 2030. This necessitates robust data analytics capabilities to deliver hyper-customized ad experiences and maintain a competitive edge. However, this digital advancement is coupled with significant cybersecurity challenges, where the global average cost of a data breach reached $4.45 million in 2024, highlighting the critical need for advanced threat detection and data protection measures.

News Corp must also contend with rapidly changing content consumption patterns, such as the dominance of short-form video exemplified by TikTok's over 1.5 billion monthly active users by early 2024. Adapting content strategies for emerging platforms and formats is paramount to combating audience fragmentation and ensuring continued engagement across a diverse digital ecosystem.

Legal factors

News Corp’s global operations mean it navigates a patchwork of data privacy laws, such as the EU's GDPR and California's CCPA. Adhering to these rules for personal data handling is paramount, with non-compliance risking substantial financial penalties and reputational damage.

The evolving regulatory environment presents ongoing challenges. For instance, several new comprehensive privacy laws are slated to take effect across various US states in 2025, requiring continuous adaptation of News Corp's data management practices.

News Corp's business heavily relies on protecting its extensive content library through robust intellectual property rights. This is paramount for maintaining the value of its journalistic and publishing assets.

The company actively pursues content licensing agreements to monetize its work on digital platforms. Notable examples include recent deals with major tech firms like OpenAI and Google, designed to ensure fair compensation for the use of News Corp's copyrighted material.

Navigating the evolving legal landscape surrounding artificial intelligence and its use of copyrighted content presents a significant challenge. News Corp is at the forefront of these discussions, seeking to establish clear frameworks for AI's engagement with journalistic output.

In 2024, News Corp was reported to be in discussions for content licensing deals that could be worth hundreds of millions of dollars annually, highlighting the financial importance of these intellectual property protections and licensing strategies.

News Corp's extensive global reach and diverse portfolio, encompassing newspapers, digital media, and broadcasting, place it squarely under the watchful eye of antitrust regulators. These laws are designed to curb monopolistic tendencies and champion media diversity, directly influencing News Corp's strategic maneuvering regarding potential mergers, acquisitions, or asset sales.

For instance, in the United Kingdom, the Office of Communications (Ofcom) actively monitors market concentration within the news sector. Ofcom's 2023 market review noted significant audience share for major news providers, a trend that could trigger closer examination of any proposed consolidation involving entities like News Corp's UK operations, such as The Sun and The Times.

In the United States, the Federal Communications Commission (FCC) also enforces media ownership rules, although these have seen some relaxation over the years. However, the sheer scale of News Corp's U.S. presence, including Fox News and the Wall Street Journal, means any significant expansion or acquisition would likely face rigorous antitrust review to ensure a competitive media landscape.

Defamation and Content Liability Laws

News Corp, as a global media entity, navigates a complex legal landscape concerning defamation and content liability. The company must adhere to varying legal standards across key markets like the United States, Australia, and the United Kingdom, where libel and slander laws differ significantly. For instance, in the US, the standard for public figures to prove defamation requires demonstrating actual malice, a higher bar than in some other jurisdictions.

The increasing prevalence of user-generated content on platforms News Corp may operate or acquire, alongside the emerging challenge of AI-generated news, introduces novel legal complexities regarding content accuracy and accountability. Diligent editorial processes, robust fact-checking, and continuous legal review are therefore critical to managing these risks. In 2023, media companies globally continued to face numerous defamation lawsuits, with settlements and legal costs representing a significant operational expenditure.

Key considerations for News Corp include:

- Jurisdictional Differences: Adapting editorial and legal protocols to comply with diverse defamation laws in the US, UK, and Australia.

- Actual Malice Standard (US): The requirement for public figures to prove deliberate falsity or reckless disregard for the truth to win defamation cases in the United States.

- Emerging Technologies: Addressing new legal challenges posed by AI-generated content and the amplification of user-generated material.

- Mitigation Strategies: Implementing rigorous content review processes and seeking legal counsel to minimize liability exposure.

Labor and Employment Laws

News Corp, operating globally, navigates a complex web of labor and employment laws. These regulations govern everything from minimum wage and safe working environments to employee representation and redundancy procedures. For instance, the company's February 2023 announcement of a 5% workforce reduction, impacting approximately 1,200 employees based on its reported workforce size, necessitated strict adherence to legal frameworks surrounding layoffs in all relevant jurisdictions.

Compliance with these legal factors is crucial for maintaining operational continuity and a positive corporate reputation. Failure to adhere can result in significant financial penalties and legal challenges. News Corp's global workforce, a significant asset, requires careful management under these varied legal umbrellas.

- Fair Wages and Working Conditions: Adherence to national and regional minimum wage laws and workplace safety standards is mandatory.

- Union Relations: Navigating collective bargaining agreements and employee representation rights is a key legal consideration.

- Workforce Reductions: Legal requirements for notice periods, severance pay, and consultation processes must be followed during downsizing.

- Discrimination and Harassment: Implementing policies and procedures to prevent and address discrimination and harassment is legally mandated.

News Corp's legal environment demands strict adherence to data privacy regulations like GDPR and CCPA, with potential fines for non-compliance. Several new state-level privacy laws in the US, effective from 2025, will require ongoing adaptation of data handling practices.

Protecting intellectual property is vital, with News Corp securing significant content licensing deals, such as those with OpenAI and Google, to monetize its copyrighted material. These agreements, potentially worth hundreds of millions annually in 2024, underscore the financial importance of IP protection.

Antitrust laws significantly influence News Corp's strategic moves, with regulators like Ofcom in the UK and the FCC in the US scrutinizing market concentration. Any expansion or acquisition by News Corp, given its substantial U.S. presence including Fox News and the Wall Street Journal, would face rigorous review to ensure a competitive media landscape.

Navigating defamation laws across different jurisdictions, such as the US, UK, and Australia, is crucial, especially with the rise of user-generated and AI-generated content. The "actual malice" standard in the US for public figures presents a unique challenge, requiring robust editorial processes to mitigate liability.

Environmental factors

News Corp is actively pursuing aggressive carbon emissions reduction targets as a core part of its environmental strategy. The company has pledged to cut its Scope 1 and 2 operational carbon emissions by a substantial 65% by the year 2030, using 2016 as its baseline. This commitment extends further, with a goal of achieving net-zero carbon emissions across its entire value chain by fiscal year 2050.

Demonstrating tangible progress towards these ambitious goals, News Corp reported a significant reduction of approximately 62% in its operational emissions by fiscal year 2023. This near-achievement of its 2030 target well ahead of schedule highlights the company's dedication to sustainability and effective implementation of its environmental initiatives.

News Corp is actively working to shrink its environmental impact, with a particular focus on how it gets its materials. For its publishing and news media businesses, this means looking closely at where the paper comes from. The company has set a goal to ensure that by 2025, all the paper used for its publications will be from sources that are certified as sustainable. This commitment reflects a broader industry trend towards more responsible resource management.

Beyond paper, News Corp is also tackling other waste streams. The company is making a concerted effort to cut down on single-use plastics and other forms of waste generated across its operations. This initiative is supported by strong recycling programs implemented at its various locations, aiming to divert as much material as possible from landfills. High recycling rates are a key indicator of their success in this area.

News Corp actively addresses climate change risks, detailing its sustainability efforts and forest management in annual reports, often using frameworks like SASB and GRI. This commitment reflects growing stakeholder demand for transparency, even as regulatory landscapes evolve, such as the SEC's climate disclosure rules being stayed in 2024.

Despite the regulatory pause, climate change remains a critical concern for businesses in 2025. Stakeholders, including investors and customers, are increasingly scrutinizing corporate environmental impact, pushing companies like News Corp to maintain and enhance their public disclosures on climate-related issues and sustainable practices.

Energy Consumption and Renewable Energy Adoption

News Corp is actively integrating energy efficiency and renewable energy adoption into its environmental strategy. The company is committed to reducing its overall energy consumption across its global operations. This focus is crucial as the media and information services sector, like many others, faces increasing scrutiny and regulatory pressure regarding its carbon footprint.

A key objective for News Corp is to power its facilities with clean energy sources wherever practical. This commitment builds upon previous achievements in implementing energy-saving initiatives. For instance, in fiscal year 2023, News Corp reported progress in its sustainability efforts, aiming to increase the use of renewable energy sources for its office buildings and data centers.

The company is actively exploring various renewable energy arrangements, including power purchase agreements and on-site generation where feasible. These efforts are designed to mitigate the environmental impact associated with energy-intensive operations, such as data processing and broadcast infrastructure. Global trends show a significant push towards decarbonization, with many corporations setting ambitious renewable energy targets; for example, by the end of 2024, many major media companies are expected to have publicly announced enhanced ESG (Environmental, Social, and Governance) targets, including renewable energy sourcing.

News Corp’s strategic approach includes evaluating the feasibility of adopting renewable energy solutions for its diverse portfolio of media and publishing assets. This initiative aligns with broader market trends where companies are increasingly investing in sustainability to enhance brand reputation and operational resilience. The International Energy Agency (IEA) reported in early 2025 that renewable energy capacity additions globally continued to break records in 2024, indicating a strong market environment for such transitions.

- News Corp's environmental strategy emphasizes reducing energy consumption across its global operations.

- The company prioritizes powering its facilities with clean energy sources whenever feasible.

- Efforts include exploring renewable energy arrangements like power purchase agreements and on-site generation.

- This focus aligns with global trends and regulatory pressures for decarbonization in the media sector.

Stakeholder Engagement and Green Initiatives

News Corp prioritizes stakeholder engagement on environmental matters, fostering a collaborative approach to sustainability. The company actively involves customers, employees, suppliers, and partners in achieving its green outcomes. For instance, in 2023, News Corp reported a 10% increase in employee participation in its sustainability-focused volunteer programs compared to the previous year.

Through its Global Environmental Initiative (GEI), News Corp cultivates environmental consciousness across its diverse business segments. This initiative supports green teams and encourages localized environmental projects, aiming to amplify the company's collective impact. In the first half of 2024, the GEI funded over 50 employee-led green projects globally.

- Customer Engagement: News Corp's media outlets regularly feature content on environmental issues and sustainable practices, reaching millions of consumers.

- Employee Initiatives: The GEI has facilitated the establishment of over 100 employee-led "green teams" across News Corp's operations by the end of 2023, driving local environmental action.

- Supplier Collaboration: News Corp is increasingly incorporating sustainability criteria into its supplier selection and evaluation processes, with 40% of its key suppliers now reporting on their environmental performance.

- Educational Campaigns: Internal and external educational programs are a core component of the GEI, designed to raise awareness and promote environmental responsibility among all stakeholders.

News Corp is actively addressing climate change risks by detailing its sustainability efforts and forest management in annual reports, often using frameworks like SASB and GRI, reflecting growing stakeholder demand for transparency. Despite a regulatory pause on SEC climate disclosure rules in 2024, climate change remains critical, with stakeholders increasingly scrutinizing corporate environmental impact and pushing for enhanced disclosures.

The company is focused on reducing waste, particularly single-use plastics, and has implemented strong recycling programs across its locations. News Corp also aims to ensure all paper used for its publications by 2025 comes from certified sustainable sources, aligning with industry-wide responsible resource management trends.

News Corp is committed to reducing energy consumption and increasing the use of renewable energy sources for its operations, including office buildings and data centers. This initiative is supported by exploring arrangements like power purchase agreements, aligning with global decarbonization trends and increased corporate investment in sustainability.

Stakeholder engagement is key to News Corp's environmental strategy, with initiatives like the Global Environmental Initiative (GEI) fostering environmental consciousness and supporting employee-led green projects. By the end of 2023, over 100 employee-led green teams were established, driving local environmental action.

| Environmental Metric | Target | Progress (FY23) | Notes |

|---|---|---|---|

| Scope 1 & 2 Emissions Reduction | 65% by FY2030 (vs. FY2016) | ~62% reduction | Nearing 2030 target ahead of schedule. |

| Sustainable Paper Sourcing | 100% certified by 2025 | In progress | Focus on publishing and news media operations. |

| Net-Zero Emissions | Entire Value Chain by FY2050 | In progress | Long-term strategic goal. |

| Employee Sustainability Programs | Increase participation | 10% increase (FY23 vs FY22) | Highlights employee engagement in green initiatives. |

PESTLE Analysis Data Sources

Our PESTLE Analysis for News Corp is built on a robust foundation of data from leading financial news outlets, industry-specific market research reports, and publicly available financial statements. This ensures a comprehensive understanding of the political, economic, social, technological, legal, and environmental factors impacting the company.