MP Materials SWOT Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

MP Materials Bundle

MP Materials, a key player in rare earth element production, boasts significant strengths in its Mountain Pass mine, the only integrated rare earth mining and processing facility in North America. This unique position offers a substantial competitive advantage. However, the company also faces considerable threats from global competition and fluctuating commodity prices.

The opportunities for MP Materials are vast, particularly with the growing demand for rare earths in electric vehicles and renewable energy technologies. Yet, these opportunities are tempered by the need for significant capital investment and the complexities of navigating regulatory environments.

Understanding the full scope of MP Materials' strategic position requires a deeper dive. Discover the complete picture behind the company’s market position with our full SWOT analysis. This in-depth report reveals actionable insights, financial context, and strategic takeaways—ideal for entrepreneurs, analysts, and investors.

Strengths

MP Materials stands as North America's sole integrated rare earth mining and processing operation, a critical strategic advantage for U.S. national security and domestic supply chain resilience. The Mountain Pass mine, producing approximately 15% of the world's rare earth content by 2024, ensures a secure, domestic source vital for electric vehicles, renewable energy, and defense sectors. This unique position is bolstered by the company's ongoing vertical integration strategy, particularly with its Stage II and Stage III processing capabilities expected to further enhance domestic production by mid-2025.

MP Materials is strategically advancing vertical integration, building a complete mine-to-magnet supply chain within the United States. The company commenced commercial production of separated light rare earth oxides at Mountain Pass in Q1 2024, a significant step in its Stage II development. Furthermore, construction of their Fort Worth, Texas magnet manufacturing facility is underway, with initial production targeting 2025. This integration aims to capture more value, enhance domestic supply security, and reduce reliance on foreign processing, particularly from China.

The Mountain Pass ore body is a premier global source, notably rich in neodymium and praseodymium (NdPr), crucial for high-performance permanent magnets. These magnets are vital for rapidly expanding sectors like electric vehicles, wind turbines, and defense applications. This high-grade deposit ensures MP Materials' long-term supply advantage. Global NdPr demand is projected to grow significantly through 2025 due to electrification trends, reinforcing the strategic importance of this resource.

Strong Government and Commercial Support

MP Materials benefits from substantial U.S. government backing, including direct grants from the Department of Defense. A landmark multi-billion dollar partnership, announced in July 2025, further solidified this support, involving a significant DoD equity investment and guaranteed price floors for its products. This ensures long-term offtake agreements, bolstering revenue stability. The company also maintains crucial commercial partnerships, notably a supply agreement with General Motors for magnets used in electric vehicles.

- July 2025: Multi-billion dollar DoD partnership announced.

- DoD equity investment and guaranteed price floors are key components.

- Strategic supply agreement with General Motors for EV magnets.

Commitment to Sustainable and Responsible Operations

MP Materials demonstrates a strong commitment to sustainable operations, integrating significant water recycling and aiming to minimize emissions at its Mountain Pass facility. This focus on environmentally responsible practices, including their Green Financing Framework established in 2023, positions them favorably. The company is actively working to lower its environmental impact across the entire product lifecycle.

This dedication to sustainability provides a competitive edge, as customer and investor prioritization of ESG factors continues to rise significantly in 2024 and 2025.

- Achieved a water recycling rate exceeding 95% at Mountain Pass in 2023.

- Targeting a further reduction in Scope 1 and 2 emissions by 2025.

- Secured over $500 million in green financing by early 2024 to support sustainable initiatives.

- ESG ratings have seen an upward trend, enhancing investor confidence.

MP Materials uniquely controls North America's sole integrated rare earth supply, leveraging its high-grade NdPr resource at Mountain Pass, which supplies approximately 15% of global rare earth content by 2024. Strategic vertical integration, with magnet production starting in 2025, enhances domestic value capture. Substantial U.S. government support, including a multi-billion dollar DoD partnership announced in July 2025, provides significant financial and demand stability. The company's strong commitment to sustainability, evidenced by 95% water recycling in 2023 and over $500 million in green financing by early 2024, boosts its competitive edge.

| Metric | 2024 | 2025 (Projected) |

|---|---|---|

| Global Rare Earth Content Share | ~15% | Expected Growth |

| NdPr Demand Growth | Significant | Significant |

| DoD Partnership Value | Multi-Billion |

What is included in the product

Analyzes MP Materials’s competitive position through key internal and external factors, highlighting its dominant market share in rare earth mining against geopolitical risks and opportunities in downstream processing.

Offers a clear roadmap to address MP Materials' supply chain vulnerabilities and competitive threats.

Weaknesses

MP Materials has historically faced significant revenue concentration, with a substantial portion dependent on its commercial relationship with China's Shenghe Resources. This reliance, accounting for a majority of its sales volumes in fiscal year 2024, highlighted a considerable customer concentration risk. Although the company announced in April 2025 it would cease shipments to China, any past disruption to this key relationship could have adversely affected financial performance. Full scaling of its domestic downstream operations, projected to ramp up in late 2025, is crucial to mitigate this historical vulnerability.

MP Materials faces significant financial exposure to the highly volatile prices of rare earth elements. These prices are directly influenced by global supply and demand dynamics, geopolitical factors, and the actions of major producers, especially China. This volatility can lead to substantial fluctuations in revenue and profitability, as evidenced by NdPr oxide prices decreasing over 30% from early 2024 to mid-2024. Such price instability makes consistent financial forecasting and operational planning challenging for the company into 2025.

MP Materials' vertical integration into downstream rare earth processing and magnet manufacturing demands substantial ongoing capital investment. For example, projected capital expenditures for 2024 are between $550 million and $650 million, a significant outlay. Scaling these new operations to commercial levels carries inherent execution risks, as evidenced by a negative free cash flow of $115.8 million in Q1 2024. This transition involves high costs and a steep learning curve, which are currently pressuring profit margins and cash flow, impacting profitability which saw Q1 2024 net income at only $1.5 million.

Limited History in Downstream Manufacturing

While MP Materials excels in rare earth mining and concentration, its operational history in complex downstream processes like separating individual rare earth oxides remains limited. The company is actively developing its Stage II separation capabilities at Mountain Pass, with commercial production anticipated in late 2024 or early 2025. Successfully competing with established global players, particularly in China which dominates over 85% of rare earth separation, presents a significant hurdle. This lack of extensive experience in higher-value magnet manufacturing segments means MP Materials must rapidly scale sophisticated technology and expertise.

- Mountain Pass Stage II separation expected commercial production in late 2024/early 2025.

- China controls over 85% of global rare earth separation capacity as of 2024.

- MP Materials is still building out its Stage III magnetics capabilities.

Resource Deficiencies in Heavy Rare Earths

MP Materials faces a weakness in resource deficiencies for heavy rare earths, as its Mountain Pass mine predominantly provides light rare earth elements. The facility lacks significant deposits of crucial heavy rare earths such as dysprosium and terbium. These elements are essential for enhancing the thermal performance of high-strength magnets used in demanding applications, including advanced EV motors. This necessitates MP Materials to secure these critical materials from external suppliers, impacting supply chain control and potentially increasing input costs for their planned magnet production in 2025.

- Mountain Pass mine yields mainly light rare earth elements.

- Critical heavy rare earths like dysprosium and terbium are scarce in its deposits.

- These heavy elements are vital for high-temperature EV magnets.

- External sourcing for heavy rare earths is required, impacting future magnet production plans.

MP Materials faces significant geopolitical and regulatory risks, stemming from the critical nature of rare earth elements to national security and clean energy transitions. Government policies, trade disputes, and international relations, particularly concerning China, directly impact supply chains and market access. For instance, potential import tariffs or export controls, as seen in 2024 discussions, could disrupt operations and profitability, making long-term planning challenging.

| Risk Factor | Impact on MP Materials | 2024/2025 Context |

|---|---|---|

| Geopolitical Tensions | Supply chain disruptions, market access restrictions | Potential for new tariffs or trade barriers in 2024-2025 |

| Regulatory Changes | Increased compliance costs, operational delays | Evolving environmental and mining regulations globally |

| Trade Policy Shifts | Revenue volatility, strategic uncertainty | Ongoing US-China trade relations influencing REE markets |

Full Version Awaits

MP Materials SWOT Analysis

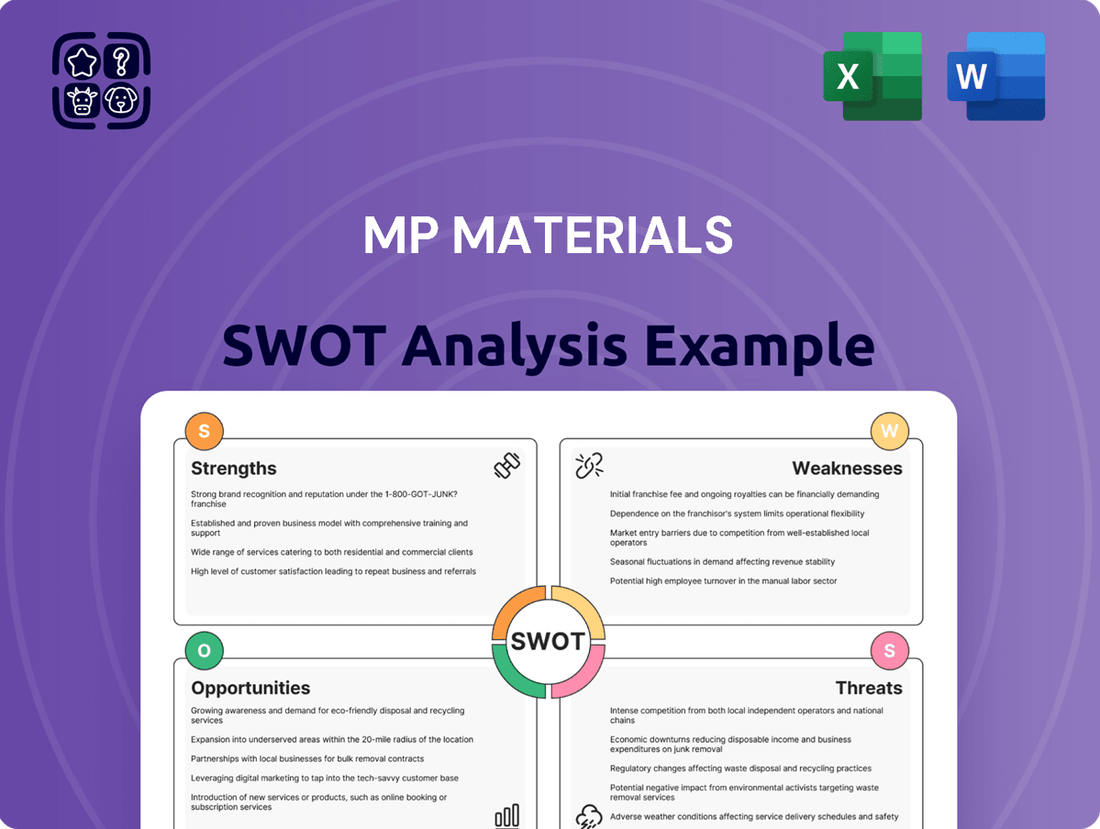

The preview below is taken directly from the full SWOT report you'll get. Purchase unlocks the entire in-depth version. This analysis meticulously details MP Materials' Strengths, such as its dominant position in rare earth element production, and Weaknesses, including its reliance on specific markets. It also highlights Opportunities like the growing demand for EVs and Threats such as geopolitical instability impacting supply chains. This comprehensive overview is essential for understanding the company's strategic landscape.

Opportunities

The global transition to electric vehicles and clean energy sources like wind turbines is driving a massive increase in demand for high-performance rare earth magnets. Global EV sales are projected to exceed 17 million units in 2024, further accelerating in 2025. This provides MP Materials, as a key domestic supplier, a substantial and expanding market opportunity. Rare earth magnet demand, crucial for these technologies, is forecast to grow significantly, ensuring long-term secular growth for the company's products.

Geopolitical tensions are driving strong U.S. government support to onshore critical mineral supply chains, aiming to reduce reliance on China. Policies like the Inflation Reduction Act of 2022 provide substantial incentives, including over $1 billion in direct investments and loan guarantees for domestic rare earth projects. For MP Materials, this translates to a highly favorable operating environment, exemplified by the Department of Defense's 2024 award of up to $50 million for heavy rare earth separation capacity. These initiatives significantly reduce investment risk and bolster domestic production capabilities.

MP Materials is strategically expanding downstream into NdFeB permanent magnet production, enabling it to capture significantly more value from its rare earth resources. The new Fort Worth, Texas magnetics facility anticipates first deliveries by late 2025, targeting critical sectors like automotive and defense. This pivot from a commodity producer to a manufacturer of high-value, mission-critical components represents a primary growth driver. This move significantly enhances profit margins beyond current rare earth oxide sales.

International Partnerships and Global Market Diversification

MP Materials has a strong opportunity to expand globally, leveraging its expertise to diversify its geographic presence. For instance, the company recently announced an agreement with a Saudi Arabian firm to explore the joint development of a rare earth supply chain within that country. These strategic international partnerships are crucial for opening new markets and further solidifying MP Materials' position as a global leader in the rare earth sector outside of China. Such moves enhance supply chain resilience and market reach by 2025.

- Diversifying geographic footprint reduces reliance on single markets.

- Strategic partnerships, like the Saudi Arabian agreement, open new supply chain avenues.

- Global expansion enhances MP Materials' competitive standing.

- These initiatives contribute to a more robust and resilient rare earth supply chain by 2025.

Potential for Rare Earth Recycling

Developing capabilities for recycling rare earth magnets from end-of-life products presents a significant long-term opportunity for MP Materials. This urban mining approach can establish a circular economy, offering a supplementary source of critical materials like Neodymium and Praseodymium, crucial for electric vehicles and wind turbines. MP Materials is actively exploring these recycling avenues, which could enhance its sustainability profile and supply chain resilience by 2025 and beyond. This strategic move aligns with global pushes for resource efficiency and reduced reliance on new mining.

- Projected global rare earth magnet recycling market valued at over $200 million by 2025.

- Potential to recover 5-10% of global rare earth demand from end-of-life products by 2030.

- MP Materials aims to integrate recycling into its Mountain Pass operations, creating a closed-loop system.

- Recycling reduces environmental impact by up to 90% compared to primary extraction.

Surging demand from over 17 million EV sales in 2024 and robust U.S. government support, including 2024 DoD awards, significantly expand MP Materials' market. The company’s strategic move into NdFeB magnet production by late 2025 and global partnerships like the Saudi Arabian agreement enhance value capture and resilience. Furthermore, the rare earth magnet recycling market, projected at over $200 million by 2025, offers substantial future growth.

| Opportunity | 2024/2025 Metric | Impact |

|---|---|---|

| EV/Clean Energy Demand | Global EV sales: 17M+ (2024) | Increased rare earth magnet demand |

| U.S. Gov. Support | DoD Award: Up to $50M (2024) | Reduced investment risk, bolstered domestic supply |

| Downstream Expansion | Fort Worth facility first deliveries: Late 2025 | Higher profit margins from magnet production |

| Recycling | Market value: Over $200M (2025) | New revenue stream, enhanced sustainability |

Threats

Intense competition from Chinese rare earth producers poses a significant threat to MP Materials. China dominates the global market, accounting for approximately 70% of rare earth mine production in 2023, benefiting from substantial economies of scale and strong government backing. This allows Chinese firms to maintain lower production costs, creating a challenging pricing environment for MP Materials. Competing effectively on a global scale requires MP Materials to overcome these entrenched cost advantages and expand its downstream processing capabilities by 2025.

Geopolitical tensions, especially between the U.S. and China, pose a significant threat due to rare earths' strategic importance. China's historic market dominance, controlling roughly 70% of global rare earth mining and 90% of processing as of early 2024, enables it to implement export controls. Such actions, like those seen in the past, can disrupt global supply chains and cause price volatility for critical materials. While these dynamics can incentivize domestic production for companies like MP Materials, they also introduce substantial market uncertainty and investment risk.

A prolonged period of low rare earth prices significantly impacts MP Materials' profitability and cash flow. For instance, NdPr oxide prices, crucial for MP Materials, saw a substantial decline of over 50% from early 2022 peaks through late 2023, although they stabilized somewhat into mid-2024. Such depressed prices, often driven by oversupply, particularly from Chinese producers, squeeze profit margins and undermine the economic viability of capital-intensive expansion projects. This financial pressure could potentially delay the company's critical growth initiatives and vertical integration plans, including their Stage 2 and Stage 3 development at Mountain Pass.

Discovery of New Large-Scale Deposits

The discovery and development of new, large-scale rare earth deposits globally pose a significant threat to MP Materials, potentially increasing supply and depressing prices. Several projects, including those in North America like Energy Fuels' Wyoming assets or Appia Rare Earths & Uranium Corp.'s Alces Lake in Canada, are progressing towards potential production by 2026-2028, introducing new competition. Such an oversupply scenario would significantly impact MP Materials' revenue per kilogram, directly affecting profitability. For instance, a 10% market oversupply could lead to a substantial drop in Neodymium-Praseodymium (NdPr) oxide prices, which were around $65-75/kg in early 2024, directly eroding profit margins.

- Global rare earth production is projected to increase, with new projects outside China targeting commercialization by 2026-2028.

- Potential oversupply could depress NdPr oxide prices, impacting MP Materials' dominant market share at Mountain Pass.

- Major deposits in North America, like those in Wyoming or Texas, could add significant new supply streams within the next 3-5 years.

- Increased competition from new entrants would challenge MP Materials' pricing power and market position.

Technological Disruption

Technological disruption poses a long-term threat as advancements could yield high-performance magnets requiring fewer rare earths or utilizing alternative materials. Research into 'thrifted' or rare-earth-free magnets is actively pursued, especially within the automotive and technology sectors. For instance, in 2024, significant R&D investments continue to focus on reducing reliance on neodymium and praseodymium. A major breakthrough in these areas could substantially reduce future demand for MP Materials core rare earth products.

- By 2025, several automotive OEMs are exploring rare-earth-free motor designs.

- Global R&D spending on advanced materials for magnet alternatives is projected to increase.

- New magnet technologies could shift market dynamics by the late 2020s.

- The Department of Energy continues funding projects for rare earth element substitutes.

MP Materials faces significant regulatory and environmental compliance risks, particularly at its Mountain Pass facility. Stringent environmental regulations, including water management and waste disposal, are projected to intensify by 2025, potentially increasing operational costs and permitting delays. Non-compliance or new requirements could lead to costly operational restrictions and impact expansion plans. This introduces financial uncertainty and execution risk for their Stage 2 and Stage 3 processing initiatives.

| Risk Factor | Outlook (2024-2025) | Potential Impact |

|---|---|---|

| Environmental Regulations (California) | Increasing scrutiny; stricter compliance | Higher operational costs; permitting delays (e.g., NEPA for expansion) |

| Water Management (Mojave Desert) | Drought conditions persist; usage restrictions possible | Operational limitations; increased water acquisition costs |

| Waste Disposal (Tailings) | Enhanced oversight; potential for new standards | Higher disposal costs; long-term liability |

SWOT Analysis Data Sources

This analysis is built on a foundation of verified financial filings, comprehensive market intelligence reports, and expert commentary from industry leaders to ensure a robust and accurate assessment of MP Materials.