MP Materials Marketing Mix

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

MP Materials Bundle

MP Materials' marketing success hinges on a robust 4Ps strategy, from its critical rare earth element products to its sophisticated pricing and distribution networks.

Discover how their product differentiation and market positioning create a competitive edge in a vital global industry.

Uncover the nuances of their pricing architecture and how it reflects both market value and strategic advantage.

Explore their carefully chosen distribution channels that ensure accessibility and reliability for their essential materials.

Gain insight into their promotional tactics that build awareness and reinforce their leadership in the rare earth sector.

Go beyond the basics—get access to an in-depth, ready-made Marketing Mix Analysis covering Product, Price, Place, and Promotion strategies for MP Materials.

Save hours of research and analysis. This pre-written Marketing Mix report provides actionable insights, examples, and structured thinking—perfect for reports, benchmarking, or business planning.

Product

MP Materials' core product offering centers on rare earth materials, extracted and processed at its Mountain Pass facility. The initial output includes rare earth concentrate, which the company then refines into higher-value separated oxides. Notably, Neodymium-Praseodymium (NdPr) oxide, crucial for high-strength permanent magnets, saw production reach 1,529 metric tons in Q1 2024. Additionally, their product portfolio encompasses lanthanum carbonate, cerium chloride, and a heavy rare earth concentrate (SEG+), supporting diverse industrial demands as of 2024.

MP Materials is vertically integrating into high-performance NdFeB permanent magnets, a crucial downstream product.

Their Fort Worth, Texas 'Independence' facility commenced commercial NdPr metal production and trial automotive-grade sintered magnet production in 2024.

This facility is projected to produce approximately 1,000 metric tons of finished magnets annually.

These magnets are essential for key partners like General Motors, supporting electric vehicle initiatives.

While MP Materials' Mountain Pass deposit primarily yields light rare earth elements, the company is strategically expanding its capabilities into heavy rare earth separation.

It produces a heavy rare earth concentrate, known as SEG+, which includes critical elements like dysprosium (Dy) and terbium (Tb), essential for high-performance, high-temperature magnets.

Furthering this expansion, the Department of Defense (DoD) awarded MP Materials a $35 million grant in late 2023 to accelerate the construction of a heavy rare earth separation plant in California, aiming for 2025 operational readiness.

Strategic National Asset

MP Materials positions its products as a strategic national asset, vital for decreasing U.S. reliance on foreign, particularly Chinese, rare earth supply chains. These outputs are crucial for technologies like electric vehicles and advanced defense systems, supporting critical infrastructure. This strategic importance is reinforced by a significant public-private partnership with the U.S. Department of Defense, securing domestic production. This ensures a resilient domestic supply for national security and economic priorities through 2025.

- DoD partnership: $35 million funding for heavy rare earth separation.

- Supports domestic EV and defense manufacturing through 2025.

- Reduces reliance on 85% of global rare earth processing from China.

Sustainable and Traceable Materials

MP Materials prioritizes the sustainable and traceable production of its rare earth materials at the integrated Mountain Pass facility, ensuring responsible mining, processing, and tailings management. This vertical integration provides customers with trusted provenance and unmatched visibility into a supply chain often lacking transparency. For instance, the facility boasts a water recycling rate exceeding 95%, aligning with California's stringent environmental regulations for operations through 2025.

- Mountain Pass is the only fully integrated rare earth production site in North America.

- The facility recycles over 95% of its process water, minimizing environmental impact.

- MP Materials aims for a net-zero carbon footprint by 2040, enhancing product sustainability.

- The company produced 10,030 metric tons of rare earth oxides in Q1 2024, emphasizing responsible sourcing.

MP Materials offers a comprehensive product portfolio, encompassing rare earth concentrates and separated oxides like Neodymium-Praseodymium (NdPr), crucial for high-strength magnets. The company is vertically integrating into NdFeB permanent magnets, with its Fort Worth facility commencing production in 2024. This expansion, alongside a new heavy rare earth separation plant by 2025, positions MP Materials as a critical domestic supplier for electric vehicle and defense sectors. Their Q1 2024 rare earth oxide production reached 10,030 metric tons.

| Product Category | Key Output | 2024/2025 Status |

|---|---|---|

| Rare Earth Oxides | Neodymium-Praseodymium (NdPr) | 1,529 metric tons produced Q1 2024 |

| Finished Magnets | NdFeB Permanent Magnets | Fort Worth facility commenced production 2024; 1,000 metric tons/year projected |

| Heavy Rare Earths | Dysprosium (Dy), Terbium (Tb) | Separation plant operational by 2025 (DoD grant) |

What is included in the product

This analysis offers a comprehensive 4Ps marketing mix breakdown for MP Materials, examining their product strategy for rare earth magnets, pricing considerations in a volatile market, place-based distribution, and promotional efforts to build brand awareness.

It provides actionable insights into MP Materials' marketing positioning, ideal for stakeholders needing to understand their competitive strategy and market approach.

Simplifies complex marketing strategies by clearly outlining MP Materials' 4Ps, alleviating the pain of understanding their market approach.

Provides a clear, actionable framework for MP Materials' marketing efforts, addressing the challenge of translating strategy into tangible market impact.

Place

MP Materials' Mountain Pass facility in San Bernardino County, California, serves as the sole integrated rare earth mining and processing site in North America. This unique location handles the entire value chain, from ore extraction through separation and refining, all on one contiguous site. This integration, a key strategic advantage, significantly reduces logistical costs and enhances operational efficiency, contributing to its competitive position in the global rare earth supply chain. For Q1 2024, the facility reported 11,547 metric tons of rare earth oxide production, underscoring its substantial output capacity. The site's strategic importance is further highlighted by its role in bolstering domestic critical mineral independence through 2025.

MP Materials strategically expanded its physical footprint to Fort Worth, Texas, with the Independence magnetics facility. This plant, operational in 2025, represents the crucial downstream component of their supply chain. It converts refined rare earth oxides from Mountain Pass into metals and finished NdFeB magnets. This facility is central to their U.S.-based mine-to-magnet supply chain strategy, aiming to produce approximately 1,000 tons of magnets annually by 2025. This move enhances domestic rare earth magnet production for industries like electric vehicles.

MP Materials engages in direct sales, primarily serving business-to-business (B2B) customers in high-tech sectors and government entities. Key clients include automotive giants like General Motors, for whom MP Materials supplies rare earth materials crucial for electric vehicle (EV) motors. The company also directly supports the U.S. Department of Defense, providing strategic rare earth products for critical defense applications, a partnership solidified by a recent agreement. This positions the U.S. government as a significant anchor customer, ensuring demand for their domestically produced rare earths.

Diversified Global and Domestic Distribution

MP Materials is strategically diversifying its distribution channels. Historically, a significant volume of its rare earth concentrate was sent to China for processing. However, in April 2025, the company ceased these shipments due to evolving tariff landscapes, pivoting instead to develop a robust domestic and allied supply chain. Their refined rare earth materials are now distributed to key markets including Japan, South Korea, and the United States, enhancing supply chain resilience.

- By Q2 2025, MP Materials aims for full domestic processing of its rare earth concentrate.

- The company's Stage II processing facility is expected to be fully operational by mid-2025.

- MP Materials holds rights to over 85% of North America's rare earth reserves.

- Projected 2025 revenue from refined products is a key focus for growth.

Strategic International Partnerships

MP Materials is strategically expanding its global footprint by forging international partnerships to diversify and secure critical rare earth supply chains. In May 2025, the company cemented a significant collaboration by signing a memorandum of understanding with the Saudi Arabian Mining Company (Ma'aden). This partnership aims to jointly explore the development of a vertically integrated rare earth supply chain within Saudi Arabia, leveraging the region's emerging potential.

This move is crucial for enhancing global rare earth security and positions MP Materials for sustained growth beyond its Mountain Pass operations.

- The Ma'aden MOU in May 2025 highlights MP Materials' commitment to global diversification, targeting new supply chain development.

- MP Materials' Q1 2025 revenue reached approximately $65 million, with strategic partnerships poised to boost future international contributions.

- Global rare earth demand is projected to grow by 6-8% annually through 2030, necessitating such international collaborations.

- This partnership could significantly reduce reliance on single-source rare earth processing, enhancing supply chain resilience.

MP Materials leverages its integrated Mountain Pass facility, producing 11,547 metric tons of rare earth oxide in Q1 2024, and its Fort Worth plant, targeting 1,000 tons of magnets annually by 2025, to establish a robust domestic supply chain. Distribution channels diversified significantly in April 2025, shifting from China to key markets like Japan, South Korea, and the U.S. By Q2 2025, the company aims for full domestic processing. Further global expansion includes a May 2025 MOU with Ma'aden to explore a vertically integrated rare earth supply chain in Saudi Arabia.

| Location/Channel | Key Function | 2024/2025 Data |

|---|---|---|

| Mountain Pass, CA | Integrated mining & processing | 11,547 metric tons REO (Q1 2024) |

| Fort Worth, TX | NdFeB magnet production | 1,000 tons magnets annually (by 2025) |

| Global Distribution | Refined RE products | China shipments ceased April 2025; new markets: Japan, South Korea, U.S. |

| Saudi Arabia (Ma'aden) | International supply chain development | MOU signed May 2025 |

Preview the Actual Deliverable

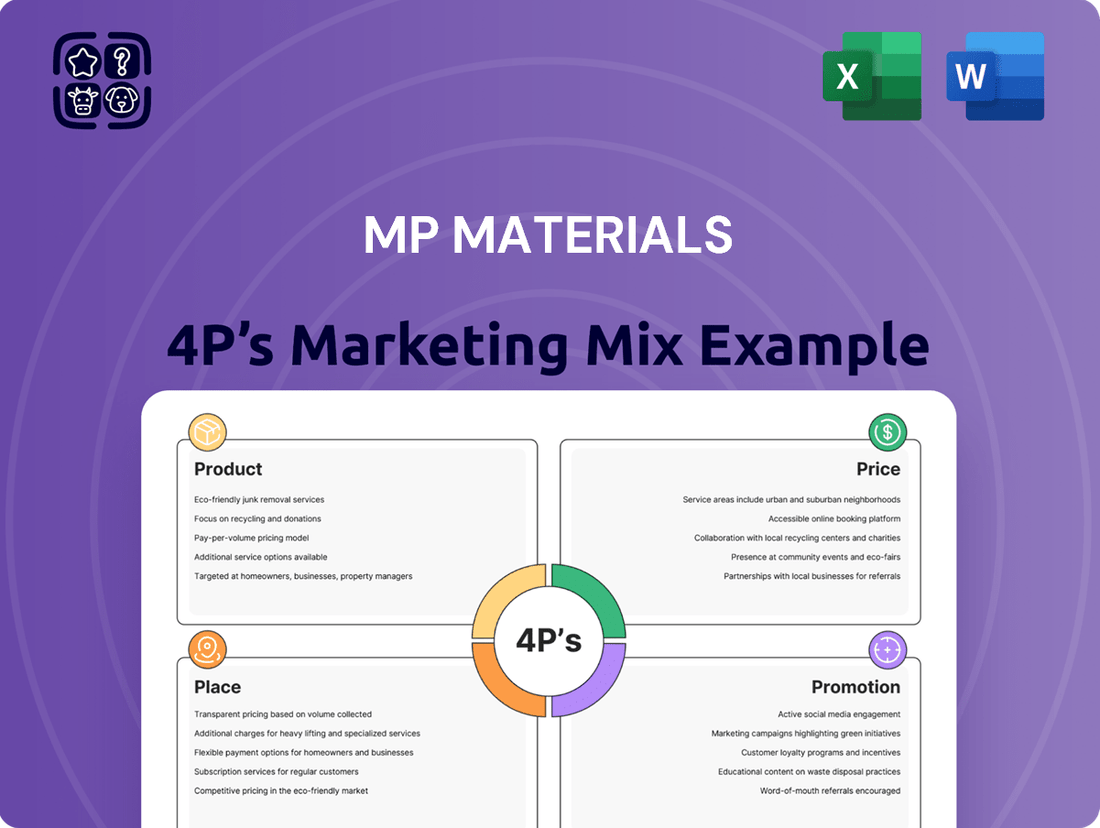

MP Materials 4P's Marketing Mix Analysis

The preview shown here is the actual document you’ll receive instantly after purchase—no surprises. This comprehensive analysis delves into MP Materials' Product, Price, Place, and Promotion strategies. You'll gain clear insights into their rare earth element offerings, competitive pricing models, strategic distribution channels, and targeted marketing efforts. This is the same ready-made Marketing Mix document you'll download immediately after checkout, providing you with all the essential details for informed decision-making.

Promotion

The core of MP Materials promotional strategy centers on its strategic public-private partnership with the U.S. Department of Defense. This collaboration is consistently emphasized in company communications, positioning MP Materials as a critical national champion for U.S. economic and national security. For instance, the Department of Defense awarded MP Materials $35 million in 2023 to establish a full-scale heavy rare earth separation facility, highlighting this validation. This partnership not only provides significant funding but also immense credibility, enhancing the company's market standing and investor confidence heading into 2025.

As a publicly traded entity on the NYSE, MP Materials maintains robust investor relations. The company consistently engages the financial community through quarterly earnings calls, such as the Q1 2024 call, and detailed investor presentations available on its website. These channels communicate strategic progress, including Stage II optimization and the anticipated 2025 production from its Stage III magnetics facility. This ensures transparency on financial performance, like the reported $75.6 million revenue in Q1 2024, to investors, analysts, and media.

MP Materials heavily promotes its mission to restore the full rare earth supply chain to the United States. This narrative of American industrial independence strongly resonates with policymakers, investors, and customers concerned about geopolitical supply chain risks, especially given 2024 global dynamics. The company consistently positions itself as America's only fully integrated rare earth producer, with operations at Mountain Pass, California, and planned downstream processing in Fort Worth, Texas by 2025. This emphasis leverages national security and economic resilience for market differentiation.

CEO and Executive Leadership as Public Figures

MP Materials leverages its Founder, Chairman, and CEO, James Litinsky, as a key promotional asset. His vocal advocacy for domestic rare earth supply chain independence and the company's strategic vision is frequently highlighted in press releases and media coverage. This leadership visibility serves as a powerful tool to build brand trust and communicate the company's critical role in the US industrial base. For instance, MP Materials remains the only scaled producer of separated rare earth oxides in North America as of mid-2025.

- Litinsky's public statements often align with national security and economic independence narratives.

- His media appearances reinforce MP Materials' position as a critical domestic supplier.

- This executive visibility enhances stakeholder confidence and market perception.

Digital Presence and Media Engagement

MP Materials maintains a robust digital presence, utilizing its professional corporate website and engaging actively on platforms like LinkedIn, YouTube, and X to connect with diverse stakeholders. The company strategically leverages media relations to publicize significant developments, such as its ongoing Department of Defense partnerships which secured over $100 million in funding by early 2024 for domestic rare earth processing. This engagement ensures broad coverage in major financial and industry news outlets, reinforcing its market position and investor confidence.

- By Q1 2025, MP Materials aims to significantly increase its social media engagement metrics, targeting a 15% rise in LinkedIn followers.

- The company's website traffic is projected to grow by 20% in 2024-2025 due to enhanced content and SEO.

- Media mentions related to its Fort Worth facility and Stage II processing are expected to surge by 25% by year-end 2024.

- MP Materials' media strategy highlights its role in the U.S. rare earth supply chain, a critical national security priority.

MP Materials' promotion centers on its vital U.S. Department of Defense partnerships, securing over $100 million by early 2024, and robust investor relations, evident in Q1 2024 revenue of $75.6 million. The company emphasizes its role in restoring the domestic rare earth supply chain, leveraging CEO James Litinsky's advocacy. Digital engagement and media relations amplify its position as America's sole fully integrated rare earth producer, with Stage III production anticipated by 2025.

| Promotional Channel | Key Metric (2024/2025) | Impact |

|---|---|---|

| DoD Partnerships | >$100M Funding (Early 2024) | Enhanced Credibility & Funding |

| Investor Relations | $75.6M Q1 2024 Revenue | Transparency & Investor Confidence |

| Digital Presence | 20% Website Traffic Growth (2024-2025) | Broader Stakeholder Engagement |

Price

The price for MP Materials' core products, such as NdPr oxide, is largely determined by the global commodities market for rare earth elements. Prices can be volatile, significantly influenced by global supply and demand dynamics, particularly production levels in China. In 2024, the company's revenue was impacted by a softer pricing environment for rare earth products. For instance, NdPr oxide prices saw a notable decline compared to prior years, reflecting broader market trends.

MP Materials can command higher prices by integrating into downstream manufacturing of NdFeB magnets, moving beyond raw and semi-processed materials. This vertical integration allows them to capture substantial value, as finished magnets fetch significantly higher prices than rare earth oxides. While rare earth oxides might sell for thousands per ton, finished NdFeB magnets can exceed $70,000 per ton as of 2024, leading to much higher margins. This strategic shift maximizes revenue potential and strengthens market positioning.

MP Materials mitigates commodity price volatility through strategic long-term fixed and offtake agreements. A significant 10-year agreement with the Department of Defense establishes a robust price floor of $110 per kilogram for its NdPr products. This arrangement guarantees predictable revenue streams and crucially protects against market downturns, especially vital given that market prices for NdPr have recently been under $60/kg in early 2024. These agreements provide essential pricing stability and financial predictability into 2025 and beyond.

Guaranteed Purchase Agreements

MP Materials significantly de-risks its operations through guaranteed purchase agreements, a key element within its pricing strategy. For instance, its 10-year offtake agreement with the U.S. Department of Defense ensures 100% of magnets from the new '10X Facility' are purchased, securing revenue streams. This critical partnership, formalized in early 2024, mitigates the substantial capital investment for the facility, which is projected to boost domestic rare earth magnet production. Such agreements stabilize the customer base for their highest-value products, fostering predictable financial performance.

- 10-year offtake agreement with the DoD guarantees 100% magnet purchase from the 10X Facility.

- This arrangement, active since early 2024, significantly de-risks capital investment in the new plant.

- Ensures a stable customer base for MP Materials' high-value permanent magnets.

Strategic Government Investment and Loans

Strategic government investment significantly bolsters MP Materials' capital structure, enhancing its pricing power. The Department of Defense is investing $400 million in convertible preferred stock and providing a $150 million loan for expansion. This crucial government backing, alongside $1 billion in commercial financing, strengthens the company's financial position. Such robust financial support enables the execution of its long-term strategy, minimizing vulnerability to short-term price fluctuations.

- DoD investment: $400 million in convertible preferred stock.

- DoD loan: $150 million for expansion.

- Commercial financing: Over $1 billion secured.

MP Materials navigates volatile rare earth commodity prices through strategic vertical integration into higher-value NdFeB magnets, which fetched over $70,000 per ton in 2024. Long-term fixed-price and offtake agreements, like the 10-year DoD deal establishing a $110/kg NdPr floor against early 2024 market prices below $60/kg, stabilize revenue. This includes a 100% purchase guarantee for magnets from the 10X Facility, active since early 2024. Significant government and commercial financing bolster their capital structure, enhancing pricing power and de-risking operations.

| Pricing Strategy Element | Key Data/Impact (2024/2025) | Benefit |

|---|---|---|

| NdPr Oxide Price Volatility | Market prices under $60/kg (early 2024) | Mitigated by agreements |

| DoD NdPr Floor Price | $110/kg for 10 years | Guaranteed revenue stream |

| NdFeB Magnet Value | Over $70,000/ton | Higher margins, value capture |

| 10X Facility Magnet Offtake | 100% purchased by DoD | De-risks investment, stable customer |

| Government/Commercial Funding | $550M DoD; $1B+ commercial | Strengthens financial position, pricing power |

4P's Marketing Mix Analysis Data Sources

Our MP Materials 4P's analysis is grounded in a comprehensive review of public company filings, investor relations materials, and industry-specific market research. We meticulously examine their product development, pricing strategies, distribution networks, and promotional activities to provide a data-driven overview.