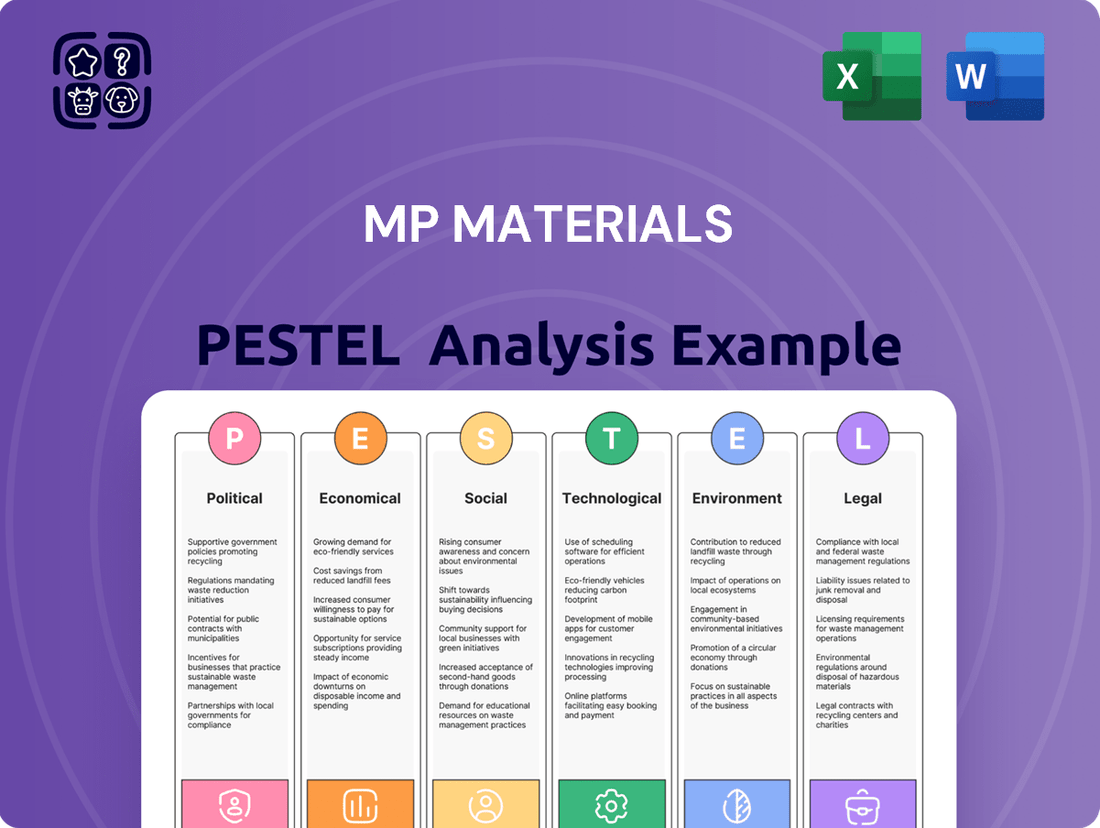

MP Materials PESTLE Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

MP Materials Bundle

Gain a crucial advantage with our comprehensive PESTEL analysis of MP Materials. Understand the political, economic, social, technological, legal, and environmental forces shaping the rare earth mining giant's future. This in-depth report is your key to navigating market complexities and identifying strategic opportunities. Download the full version now to unlock actionable intelligence and refine your investment or business strategy.

Political factors

The U.S. government is making significant strides to bolster domestic supply chains for critical minerals and rare earth elements, a move that directly benefits companies like MP Materials. Legislation such as the Critical Minerals Security Act of 2024 and the Critical Mineral Consistency Act of 2024 are central to this effort, aiming to lessen dependence on foreign sources, especially China.

These policy initiatives are designed to accelerate the growth of U.S.-based mining and processing capabilities through streamlined permitting processes and direct financial assistance. For instance, the Department of Defense has committed substantial funding, with over $200 million allocated in recent years to secure domestic sources of critical minerals, underscoring the strategic importance of this sector.

This government backing translates into tangible advantages for domestic producers by creating a more favorable regulatory environment and offering financial incentives that can de-risk investments in new or expanded operations. Such support is crucial for building out the infrastructure necessary to process rare earth elements, a key component in many advanced technologies.

Escalating trade tensions are a significant political factor for MP Materials. China's imposition of export restrictions on rare earth metals and associated technologies, a move anticipated in 2025, directly impacts global supply and pricing dynamics. This necessitates a strategic response from the U.S. to secure its domestic supply chain, influencing import and export activities for companies like MP Materials.

The global race for rare earth elements (REEs) is escalating, with nations recognizing their critical importance for both national security and economic competitiveness. This geopolitical dynamic directly impacts companies like MP Materials, which are central to diversifying supply chains away from dominant players. The U.S. Department of Defense's commitment to securing domestic REE sources, demonstrated through substantial investments and partnerships, underscores this trend.

MP Materials' Mountain Pass facility is a cornerstone of the United States' strategy to establish rare earth independence. In 2023, the company announced a new agreement with the Department of Defense to process rare earth elements, potentially worth up to $35 million. This collaboration aims to build a domestic capability for producing separated rare earth oxides, vital components for defense systems and advanced technologies.

Industrial Policy and Subsidies

The U.S. government is actively pursuing industrial policies to bolster domestic critical mineral production, particularly rare earth elements. This includes significant financial backing, exemplified by a substantial investment package from the Department of Defense directed towards MP Materials. These efforts are designed to accelerate the creation of a complete domestic supply chain for rare earth magnets.

These government initiatives are a direct response to the strategic importance of rare earth elements in advanced manufacturing and national security. The aim is to re-establish and expand the rare earth sector within the United States, reducing reliance on foreign supply chains. This policy shift represents a significant opportunity for companies like MP Materials to scale their operations and secure their market position.

- $775.7 million - The approximate value of a potential funding package from the U.S. Department of Defense for MP Materials' rare earth magnet production facility in California.

- 2024-2025 - Key period for the ramp-up of domestic rare earth processing and magnet production, driven by these industrial policies.

- Strategic Minerals Act - Legislation that could further incentivize domestic mining and processing of critical minerals, including rare earths.

- National Security Concerns - Driving force behind the government's push to onshore rare earth supply chains, aiming to mitigate geopolitical risks.

International Collaborations

The U.S. is actively pursuing international collaborations, exemplified by its involvement in the Minerals Security Partnership. This initiative aims to diversify rare earth sourcing and establish resilient supply chains with allied nations. For instance, in early 2024, the partnership announced new projects to bolster critical mineral supply chains, signaling a commitment to reducing dependence on single suppliers and enhancing global rare earth security.

These collaborations are crucial for ensuring stable access to critical minerals. By working with countries like Australia, Canada, and Japan, the U.S. is building a more robust and secure global network for rare earth elements. This strategic alignment helps mitigate geopolitical risks and fosters technological advancements in extraction and processing.

- Diversification: The Minerals Security Partnership aims to reduce reliance on any single nation for critical minerals.

- Supply Chain Resilience: Collaborations strengthen the security and sustainability of global rare earth supply chains.

- Geopolitical Stability: By partnering with allies, the U.S. enhances its position in the global critical minerals market.

The U.S. government's commitment to onshoring critical mineral supply chains, particularly for rare earth elements (REEs), presents a significant tailwind for MP Materials. Legislation like the Critical Minerals Security Act of 2024 and initiatives like the Department of Defense's substantial funding allocations, exceeding $200 million in recent years, are designed to foster domestic production and processing. This strategic focus aims to reduce reliance on China, with the U.S. government actively seeking to build out a complete domestic supply chain for REE magnets, a crucial component for defense systems and advanced technologies.

Trade tensions with China remain a key political consideration. Anticipated export restrictions on REEs by China in 2025 could further disrupt global supply and pricing, underscoring the importance of the U.S. strategy to develop its own robust supply chain. This geopolitical landscape directly influences companies like MP Materials, positioning them as vital players in achieving national resource independence.

International collaboration is also a critical political factor, as evidenced by the U.S. involvement in the Minerals Security Partnership, launched in early 2024. This partnership with allied nations aims to diversify REE sourcing and build resilient supply chains, enhancing global rare earth security and mitigating geopolitical risks. This collaborative approach strengthens the overall security and sustainability of critical mineral supply chains.

| Political Factor | Description | Impact on MP Materials |

| Domestic Supply Chain Initiatives | U.S. government legislation and funding to boost domestic production of critical minerals and REEs. | Provides direct financial support and a more favorable regulatory environment, de-risking investments and accelerating growth. |

| Trade Tensions with China | Potential Chinese export restrictions on REEs, anticipated in 2025. | Increases the strategic importance of domestic production, potentially driving demand for MP Materials' output. |

| International Partnerships | U.S. participation in initiatives like the Minerals Security Partnership. | Aims to diversify global sourcing and build resilient supply chains, potentially creating new avenues for collaboration and market access. |

What is included in the product

This PESTLE analysis provides a comprehensive examination of the external macro-environmental factors impacting MP Materials across political, economic, social, technological, environmental, and legal dimensions.

It offers a strategic overview designed to identify both threats and opportunities for MP Materials by analyzing current market and regulatory dynamics.

MP Materials' PESTLE analysis provides a clean, summarized version of external factors for easy referencing during meetings or presentations, simplifying complex market dynamics.

Economic factors

The global appetite for green technologies is accelerating, creating a significant tailwind for companies like MP Materials. The electric vehicle (EV) sector, a major consumer of rare earth elements, saw global sales surpass 13.6 million units in 2023, a remarkable increase from previous years. Similarly, the renewable energy sector, particularly wind power, continues its robust expansion, with global installed capacity for wind power reaching over 1 terawatt by the end of 2023. These trends directly translate to an increased need for the critical minerals MP Materials produces.

MP Materials is strategically positioned to capitalize on this burgeoning demand. The company's Mountain Pass facility in California is a key source of rare earth elements essential for high-performance magnets used in EV motors and wind turbines. As governments worldwide implement policies to incentivize the transition to cleaner energy, the demand for these components, and thus the rare earths they contain, is projected to grow substantially. Analysts forecast the rare earth market to reach over $10 billion by 2028, underscoring the immense market opportunity for MP Materials.

The rare earth element market has seen considerable price swings. In 2024, prices dipped, largely attributed to worries about too much supply and unpredictable demand. However, by mid-2025, there were indications that prices were starting to level out.

These price movements directly affect MP Materials' financial performance. For instance, a sharp decline in rare earth prices in early 2024 put pressure on profit margins for producers. Strategic planning for pricing and keeping costs in check are therefore critical for MP Materials to navigate this volatility.

Rising inflation significantly impacts MP Materials by increasing the cost of essential inputs like energy and labor for its rare earth mining and processing operations. These escalating operational expenses directly squeeze profit margins, a crucial consideration for any resource-based company.

MP Materials' financial reports clearly demonstrate the financial strain of its ambitious expansion plans. The company's operating margins are directly influenced by the costs associated with scaling up production and developing new facilities, as seen in its recent financial disclosures.

For instance, in the first quarter of 2024, MP Materials reported increased cost of revenue driven by higher consumables and labor expenses, impacting its gross profit margin compared to the previous year.

Capital Expenditure and Investment Climate

MP Materials faces substantial capital expenditure requirements to scale its mining and processing operations. For instance, the company is investing significantly in its Texas magnet manufacturing facility and developing heavy rare earth separation capabilities. These expansions are crucial for meeting projected demand in the electric vehicle and wind energy sectors.

The investment climate for critical minerals, including rare earths, remains robust, buoyed by government initiatives and their recognized strategic importance. This favorable environment attracts substantial capital, enabling companies like MP Materials to fund their growth projects. For example, the U.S. Department of Defense has awarded significant contracts to support domestic rare earth production, underscoring governmental commitment.

- Capital Investment: MP Materials is undertaking a multi-phase expansion project, with Phase II focused on building a rare earth magnet production facility in Texas. This project alone represents a significant capital outlay.

- Government Support: Initiatives like the Inflation Reduction Act and direct government contracts provide financial incentives and market certainty for domestic critical mineral producers.

- Strategic Importance: Rare earths are vital for defense applications, renewable energy technologies, and advanced manufacturing, making investment in their supply chain a national priority.

- Attracting Capital: The strategic nature of rare earths, coupled with supportive policies, has led to increased private equity and venture capital interest in the sector, facilitating further investment.

Supply Chain Resilience and Localization

The global push for supply chain resilience, particularly in critical minerals like rare earths, is a significant economic factor. Concerns over geopolitical instability and reliance on foreign sources are driving substantial investment in domestic production. This trend directly benefits companies like MP Materials, whose integrated mine-to-magnet strategy positions them to capitalize on this economic imperative by offering a secure, localized supply of rare earths essential for advanced technologies.

For instance, the U.S. Department of Energy's Critical Materials Strategy, updated in 2023, highlights the national security and economic risks associated with concentrated foreign supply chains for rare earths. This strategic focus translates into tangible opportunities for domestic producers. MP Materials' operations in Mountain Pass, California, are central to this shift, aiming to reduce U.S. dependence on China, which currently dominates global rare earth processing. The company’s ability to control the entire production cycle, from extraction to the creation of finished magnetic materials, provides a distinct competitive advantage in an environment prioritizing security and reliability.

- Economic Diversification: Governments worldwide are actively seeking to diversify their rare earth supply chains, creating a favorable market for domestic producers.

- Mitigating Geopolitical Risk: The economic costs associated with supply disruptions due to geopolitical events are a powerful incentive for localization.

- Technological Advancement: The demand for rare earths is intrinsically linked to the growth of sectors like electric vehicles and renewable energy, both of which are economic growth engines.

- Investment Inflows: The recognition of rare earths as a strategic commodity is attracting significant government and private investment into exploration, mining, and processing infrastructure.

The global demand for rare earth elements (REEs) is directly tied to the growth of critical industries such as electric vehicles (EVs) and renewable energy. EV sales continued their upward trajectory, exceeding 13.6 million units globally in 2023, and the renewable energy sector, particularly wind power, expanded significantly, surpassing 1 terawatt of installed capacity by the end of that year.

MP Materials' financial performance is sensitive to price fluctuations in the REE market. While prices saw a dip in early 2024 due to supply concerns, there were signs of stabilization by mid-2025, which could improve profit margins for producers like MP Materials.

Rising inflation in 2024 and 2025 has increased operational costs for MP Materials, impacting their profitability. The company's significant capital expenditures for expansion, such as its Texas magnet facility, are also influencing its operating margins, as noted in its financial reports from early 2024.

Government support and the strategic importance of domestic REE production are driving investment into the sector. For example, the U.S. Department of Defense's contracts to bolster domestic rare earth supply chains highlight this trend, creating a favorable investment climate for companies like MP Materials.

| Economic Factor | Description | Impact on MP Materials | 2024-2025 Data/Outlook |

|---|---|---|---|

| Demand for REEs | Driven by EVs and renewable energy | Increased sales and revenue potential | EV sales > 13.6M units (2023), Wind capacity > 1 TW (2023) |

| REE Price Volatility | Fluctuations in market prices | Affects profit margins | Dipped early 2024, signs of stabilization by mid-2025 |

| Inflation and Costs | Rising costs of inputs (energy, labor) | Increased operational expenses, squeezed margins | Reported higher consumables and labor expenses in Q1 2024 |

| Capital Investment & Gov't Support | Funding for expansion and strategic importance | Enables growth, market certainty | Texas magnet facility investment, DoD contracts |

Full Version Awaits

MP Materials PESTLE Analysis

The preview shown here is the exact document you’ll receive after purchase—fully formatted and ready to use. This MP Materials PESTLE analysis offers a comprehensive look at the Political, Economic, Social, Technological, Legal, and Environmental factors impacting the company. You'll gain insights into market dynamics, regulatory landscapes, and technological advancements relevant to rare earth materials. This detailed report will equip you with the strategic understanding needed to navigate the complex environment MP Materials operates within.

Sociological factors

Public perception of mining operations, especially concerning environmental impact and local community engagement, plays a critical role in securing project approvals and maintaining a social license to operate. For MP Materials, negative public sentiment could lead to delays or outright opposition, impacting production and expansion plans. For instance, in 2023, the company faced scrutiny regarding its tailings management plan at the Mountain Pass facility, highlighting the sensitivity of these issues.

There's a significant and increasing push from both consumers and industries for materials that are not only sustainable but also ethically sourced, especially as the world pivots towards green technologies. This societal shift directly impacts companies like MP Materials, which are central to supplying critical rare earth elements for these very advancements.

MP Materials actively highlights its dedication to responsible mining practices and maintaining a sustainable supply chain. This proactive stance resonates strongly with growing societal expectations and values, positioning the company favorably in a market increasingly concerned with environmental and social governance (ESG) principles.

The global demand for rare earth elements, crucial for electric vehicles and wind turbines, saw a substantial increase in 2024. For instance, the market for permanent magnets, heavily reliant on rare earths, is projected to grow, with some estimates suggesting a compound annual growth rate exceeding 7% through 2030, driven by the clean energy transition.

The availability of a skilled workforce is paramount for MP Materials, especially in mining, processing, and the advanced manufacturing of rare earth elements. Building a robust domestic supply chain necessitates significant investment in specialized training programs and actively attracting talent to these critical industries. For instance, the U.S. Department of Labor reported in early 2024 that demand for specialized manufacturing roles, including those in advanced materials, was projected to grow, highlighting the need for targeted education and recruitment efforts.

Community Engagement and Social License to Operate

MP Materials' ability to maintain a social license to operate is crucial, particularly given its significant operations in rural Nevada and expansion plans. Effective community engagement, especially with the communities surrounding its Mountain Pass facility, is paramount for sustained operations and future growth. This includes addressing local concerns regarding environmental impact and economic benefits. For instance, in 2023, MP Materials reported investing $1.8 million in community initiatives and local economic development in Nye County, Nevada, demonstrating a commitment to its social license.

The company's expansion into Texas for rare earth processing also requires building strong relationships with local stakeholders in that region. This involves transparent communication about project development and potential impacts. Securing this social license is not just about compliance; it directly impacts operational continuity and the company's reputation among regulators and the public. For example, a strong community partnership can facilitate smoother permitting processes and reduce the risk of project delays due to local opposition.

- Community Investment: In 2023, MP Materials allocated $1.8 million towards community initiatives in Nye County, Nevada.

- Stakeholder Relations: Proactive engagement with local communities in Nevada and Texas is essential for maintaining operational stability.

- Social License Impact: A robust social license can mitigate operational risks and facilitate regulatory approvals for expansion projects.

- Economic Contribution: Demonstrating tangible economic benefits to local areas strengthens community support for MP Materials' operations.

Consumer Trends Towards Green Technology Adoption

Consumers are increasingly embracing green technologies, a shift directly fueling the demand for rare earth elements. This growing preference for sustainable options, like electric vehicles (EVs) and solar power, creates a powerful societal tailwind for companies like MP Materials, which are crucial suppliers of these foundational materials.

The global EV market, for instance, saw sales exceed 13.6 million units in 2023, a significant jump from previous years, indicating strong consumer adoption. This trend directly translates to higher demand for the rare earth magnets essential for EV motors.

Furthermore, consumer interest in renewable energy is on the rise, with installations of solar and wind power continuing to expand. These sectors also rely heavily on rare earth elements for their efficient operation, reinforcing the positive societal impact on companies like MP Materials.

- Consumer preference for EVs is a major driver of rare earth demand.

- Renewable energy growth further bolsters the market for these critical materials.

- Societal emphasis on sustainability creates a favorable environment for MP Materials.

Public perception significantly impacts MP Materials' operations, especially concerning environmental stewardship and community relations. The company's commitment to responsible mining and transparent communication is vital for maintaining its social license to operate, a crucial factor for project approvals and sustained growth.

Societal demand for sustainable and ethically sourced materials, particularly for green technologies like electric vehicles and wind turbines, creates a strong market for MP Materials. This growing consumer and industry preference for environmentally conscious products directly fuels the need for rare earth elements. For example, the global electric vehicle market saw sales exceed 13.6 million units in 2023, highlighting this trend.

MP Materials' ability to foster positive relationships with local communities is paramount, especially given its extensive operations and expansion plans. Investments in community initiatives, like the $1.8 million allocated in 2023 for Nye County, Nevada, demonstrate a commitment to local economic development and strengthen its social license. This proactive engagement is essential for navigating regulatory landscapes and ensuring operational stability.

Technological factors

Technological leaps in rare earth processing, particularly in solvent extraction and ion exchange, are key to boosting purity and efficiency. These methods allow for more precise separation of valuable rare earth elements, which is vital for high-tech applications.

MP Materials is actively investing in its refining capacity at the Mountain Pass facility. This includes enhancing its ability to produce neodymium-praseodymium (NdPr) oxide, a critical component for electric vehicle motors, and developing capabilities for heavy rare earth separation.

By 2025, MP Materials aims to be the first fully integrated producer of NdPr oxide in North America, significantly reducing reliance on foreign supply chains. The company's expansion is expected to increase its NdPr oxide production capacity to 6,000 tonnes per year.

The burgeoning field of rare earth element (REE) recycling from sources like electronic waste and industrial magnets is a crucial technological advancement. Projections indicate this sector could supply a substantial portion of future REE needs, all while boasting a considerably reduced environmental footprint compared to traditional mining. This technological shift is not just theoretical; it's actively shaping supply chains.

MP Materials is strategically positioning itself within this evolving landscape by forging partnerships aimed at producing recycled rare earth magnets. This move acknowledges the growing importance of circular economy principles in securing critical mineral supplies. For instance, the company announced in late 2023 its collaboration with a leading automotive manufacturer to explore the integration of recycled rare earth materials into electric vehicle (EV) components, signaling a tangible commitment to this technological avenue.

Technological advancements in magnet and battery technologies are a significant driver for MP Materials. The ongoing innovation, especially in electric vehicles (EVs) and wind turbines, directly fuels the demand for specific rare earth elements and shapes how those materials must perform. MP Materials' core business revolves around producing neodymium-iron-boron (NdFeB) permanent magnets, which are absolutely critical for these high-growth sectors.

The push for more efficient EVs and larger wind turbines means a constant need for stronger, lighter, and more powerful magnets. This innovation cycle directly impacts the specifications MP Materials must meet. For instance, the global EV market is projected to reach approximately 30 million units sold in 2024, a substantial increase from previous years, underscoring the growing importance of these magnet technologies.

Automation and Digitalization in Mining Operations

MP Materials, like the broader mining industry, is witnessing a significant shift towards automation and digitalization. This integration promises to streamline extraction and processing, leading to improved operational efficiency and, critically, enhanced safety for personnel. For instance, autonomous haul trucks and advanced remote sensing technologies are becoming standard, reducing human exposure to hazardous environments.

These technological advancements are not just about efficiency; they are fundamental to unlocking greater productivity. By leveraging data analytics and AI-driven insights, mining companies can optimize resource utilization and predict equipment maintenance needs, minimizing costly downtime. For example, the mining sector saw a 15% increase in productivity in areas adopting advanced automation solutions between 2023 and 2024.

The adoption of digital twins and sophisticated simulation software allows for better planning and risk assessment in complex mining projects. This digital transformation enables more precise control over every stage of the operation, from exploration to final product. The global market for mining automation is projected to reach $25 billion by 2027, underscoring the substantial investment in these areas.

- Enhanced Efficiency: Automation reduces cycle times and optimizes material handling, directly impacting output volume.

- Improved Safety: Remote operation of heavy machinery and autonomous systems significantly lowers the risk of accidents.

- Data-Driven Optimization: Digitalization allows for real-time monitoring and analysis, enabling predictive maintenance and process improvements.

- Increased Productivity: The combination of automation and digital tools leads to higher throughput and better resource extraction.

Research into Alternative Materials

Ongoing research into alternative materials poses a significant technological factor for the rare earth market. While advancements are being made, these alternatives currently face limitations in their scope and ability to be scaled up for widespread adoption, meaning reliance on traditional rare earth elements persists for now.

This trend represents a potential long-term disruptor. For instance, breakthroughs in material science could lead to the development of magnetic or catalytic materials that do not require elements like neodymium or dysprosium, which are crucial for MP Materials' operations. As of early 2025, many R&D efforts are focused on improving the efficiency and reducing the quantity of rare earths needed in existing applications, rather than complete substitution.

- Limited Scalability: Current research into rare earth alternatives struggles with achieving production volumes comparable to existing supplies.

- Technological Hurdles: Significant scientific challenges remain in replicating the unique properties of rare earth elements with substitute materials.

- Long-Term Threat: While not an immediate concern, successful development of viable alternatives could drastically alter demand dynamics for rare earth producers like MP Materials.

Technological advancements in rare earth processing, such as improved solvent extraction and ion exchange, are critical for increasing the purity and efficiency of MP Materials' operations. These innovations are vital for producing the high-performance materials needed for electric vehicle motors and wind turbines.

MP Materials is enhancing its refining capabilities at Mountain Pass, aiming to produce 6,000 tonnes of NdPr oxide annually by 2025, positioning itself as North America's first fully integrated producer. The company is also exploring rare earth recycling from sources like electronic waste and industrial magnets to bolster supply chains.

The demand for stronger, lighter magnets for EVs and wind turbines drives innovation in magnet technology, directly impacting MP Materials' production specifications. With the global EV market projected to sell around 30 million units in 2024, this demand is a significant technological driver.

Automation and digitalization are transforming mining operations, with companies adopting autonomous haul trucks and remote sensing to boost efficiency and safety. The mining automation market is expected to reach $25 billion by 2027, reflecting substantial investment in these technologies.

| Technological Factor | Impact on MP Materials | Key Data/Projections |

| Advanced Processing Techniques | Increases purity and efficiency of rare earth separation. | Solvent extraction and ion exchange methods are key. |

| Rare Earth Recycling | Diversifies supply and reduces environmental footprint. | Partnerships for recycled rare earth magnets are being formed. |

| Magnet Technology Demand | Drives need for higher-performance magnets for EVs and wind turbines. | Global EV market projected at 30 million units sold in 2024. |

| Automation & Digitalization | Enhances operational efficiency, safety, and productivity. | Mining automation market projected to reach $25 billion by 2027. |

Legal factors

MP Materials operates under stringent environmental regulations, especially given its Mountain Pass mine's location in California. These rules mandate strict adherence to air and water quality standards, as well as comprehensive waste management protocols, impacting operational costs and procedures.

The permitting process for mining and processing activities is notoriously lengthy and complex, posing a significant risk to project timelines and potentially delaying expansion plans. For instance, securing necessary permits can sometimes take years, adding considerable uncertainty to capital expenditure planning.

Failure to comply with these environmental laws can result in substantial fines and operational shutdowns, as seen with past enforcement actions against other mining operations in the state. This underscores the critical need for proactive environmental management and compliance strategies.

MP Materials operates under stringent worker safety and labor laws, crucial for its mining and processing operations. Compliance with these regulations, including those addressing fair wages and working hours, is a fundamental operational requirement. In 2023, the U.S. Department of Labor's Occupational Safety and Health Administration (OSHA) continued its focus on enforcement, with mining being a sector often subject to rigorous oversight.

The company emphasizes its commitment to maintaining safe working environments, a standard reinforced by the Federal Mine Safety and Health Act of 1977. Furthermore, MP Materials has a stated policy against human trafficking within its supply chain, aligning with broader legal frameworks like the Trafficking Victims Protection Act. Adherence to these labor standards is essential for maintaining operational licenses and public trust.

MP Materials operates within a framework of evolving international trade agreements, directly impacting its rare earth element (REE) business. The United States, for instance, has actively pursued agreements with allies to establish more resilient supply chains for critical minerals, aiming to reduce reliance on single sources. This is particularly relevant as China controlled approximately 87% of global REE mine production in 2023, according to the U.S. Geological Survey.

Tariffs and export restrictions are significant considerations. Changes in trade policy, such as potential tariffs on imported REEs or restrictions on their export, could alter the competitive landscape and affect MP Materials' pricing and market access. For example, the U.S. government's efforts to onshore or friend-shore critical mineral processing are designed to mitigate these risks.

Intellectual Property Rights

Protecting intellectual property (IP) is paramount for MP Materials, especially concerning its advanced rare earth extraction, separation, and magnet manufacturing technologies. This focus is critical as the U.S. aims to re-establish domestic processing capabilities, creating a unique competitive landscape. MP Materials holds patents related to its proprietary processing methods.

The company's IP portfolio is a key asset in securing its market position. For instance, the U.S. Patent and Trademark Office (USPTO) data shows a steady increase in patent applications related to rare earth processing and magnet technology in recent years, underscoring the importance of this area. MP Materials' ability to safeguard its innovations directly impacts its valuation and ability to attract investment for expanding its U.S.-based operations.

Key aspects of MP Materials' intellectual property strategy include:

- Patents on Extraction and Separation: Securing patents for novel methods to efficiently extract and separate rare earth elements from ore, improving yield and reducing costs.

- Magnet Manufacturing Technologies: Protecting proprietary processes for producing high-performance rare earth magnets, a critical component for electric vehicles and wind turbines.

- Trade Secrets: Maintaining sensitive information regarding operational efficiencies and proprietary formulations as trade secrets to prevent competitors from replicating their advantages.

- Licensing Opportunities: Exploring potential future licensing of its IP to other entities, provided it aligns with strategic goals and maintains competitive differentiation.

Land Use and Zoning Laws

Land use and zoning laws significantly influence MP Materials' operations, particularly given its proximity to environmentally sensitive areas like California's Mojave National Preserve. These regulations dictate where and how mining activities can occur, directly affecting the company's ability to expand and develop new projects. Navigating these complex legal frameworks is crucial for maintaining operational continuity and pursuing future growth strategies.

The process of obtaining necessary permits and approvals under these land use and zoning regulations can be lengthy and resource-intensive. For instance, any expansion or new development on or near protected lands requires thorough environmental impact assessments and adherence to strict land management policies. Failure to secure these approvals can halt or delay critical operational phases, impacting production timelines and revenue streams. In 2024, the company continues to manage these regulatory hurdles as a core aspect of its business strategy.

- Regulatory Compliance: MP Materials must adhere to federal, state, and local land use and zoning laws that govern mining operations, especially in areas like the Mojave National Preserve.

- Permitting Process: Obtaining and maintaining permits for operational continuity and potential expansion requires diligent navigation of complex approval processes.

- Environmental Sensitivity: Development plans must consider the ecological significance of surrounding areas, often necessitating stringent environmental impact studies and mitigation strategies.

- Operational Impact: Land use restrictions and zoning regulations can directly influence the scale, scope, and location of mining activities, affecting MP Materials' production capacity and growth trajectory.

MP Materials is subject to a complex web of international trade policies and agreements that directly influence its rare earth element (REE) business. For example, the U.S. government's ongoing efforts to build resilient domestic supply chains for critical minerals are shaping trade relationships and potential tariffs in 2024 and 2025. China's dominant position in global REE production, controlling approximately 87% of mine production in 2023 according to the U.S. Geological Survey, makes these trade dynamics particularly significant for MP Materials.

Changes in tariffs, export restrictions, and trade disputes can create both challenges and opportunities, impacting pricing and market access. The company must closely monitor evolving trade legislation and international relations to strategize effectively. For instance, initiatives aimed at friend-shoring or onshoring critical mineral processing are designed to mitigate supply chain risks and could favor domestic producers like MP Materials.

Environmental factors

MP Materials' operations at Mountain Pass are inherently water-intensive due to the extraction and processing of rare earth elements. This necessitates stringent water conservation and effective wastewater management plans to ensure sustainability and regulatory compliance.

The company has made significant strides in this area, reporting a remarkable water recycling rate of 99% at its Mountain Pass facility. This high recycling efficiency is crucial for minimizing freshwater withdrawal and reducing the volume of wastewater requiring treatment or disposal.

For context, the mining industry globally is a major consumer of water, with some operations requiring millions of gallons per day. MP Materials' commitment to such a high recycling rate positions it favorably in managing its environmental footprint and operational costs associated with water.

Rare earth mining and processing are energy-intensive, leading to a substantial carbon footprint. MP Materials acknowledges this, aiming to lower its carbon intensity. In 2023, the company reported that its Mountain Pass facility in California is powered by a cleaner energy mix, with a significant portion sourced from renewable energy credits, contributing to a reduction in Scope 1 and 2 emissions compared to previous years.

MP Materials faces significant environmental hurdles in managing waste rock and tailings, particularly given the potential presence of radioactive byproducts inherent in rare earth mining. For instance, the company's Mountain Pass facility in California generated approximately 2.6 million tons of waste rock and 1.4 million tons of tailings in 2023, underscoring the scale of this challenge.

Implementing robust waste reduction strategies is crucial for MP Materials to mitigate environmental impact. This includes exploring innovative processing techniques that minimize waste generation and enhance material recovery, thereby reducing the overall volume requiring long-term management.

The adoption of closed-loop systems is another key environmental factor for MP Materials. These systems aim to recycle water and process materials efficiently, significantly decreasing the consumption of fresh resources and minimizing the discharge of potentially hazardous substances into the environment.

Biodiversity Conservation and Land Reclamation

MP Materials' operations at Mountain Pass, California, are subject to stringent regulations regarding biodiversity conservation and land reclamation. Mining can disrupt local ecosystems, necessitating careful management to protect plant and animal life, and requiring significant investment in restoring mined areas to a functional state post-operation. The company's sustainability framework explicitly addresses environmental stewardship, acknowledging the importance of minimizing its ecological footprint.

In 2023, MP Materials reported continued efforts in their environmental stewardship programs. Their approach to land reclamation is integrated into their operational planning, aiming to mitigate impacts and promote ecological recovery. This includes ongoing monitoring of biodiversity in and around the Mountain Pass site, with specific attention to sensitive species identified in the region.

- Biodiversity Monitoring: MP Materials conducts regular surveys to assess the impact of its operations on local flora and fauna, particularly focusing on species listed as sensitive or endangered in California.

- Land Reclamation Planning: The company has detailed plans for the progressive reclamation of disturbed land, aiming to restore native vegetation and habitat in accordance with regulatory requirements.

- Water Management: Efforts are in place to manage water resources responsibly, minimizing impact on local hydrological systems which are crucial for maintaining biodiversity.

- Waste Rock Management: Strategies for managing waste rock aim to prevent environmental contamination and facilitate future land rehabilitation, supporting biodiversity goals.

Compliance with Air and Water Quality Standards

MP Materials, operating its Mountain Pass facility, must strictly adhere to environmental regulations, including air and water quality standards. For instance, California's AB 32 Global Warming Solutions Act mandates emission reductions, impacting operational costs and strategies. The company's commitment involves rigorous, ongoing monitoring and transparent reporting of its environmental footprint.

In 2023, MP Materials reported its sustainability efforts, highlighting progress in managing water usage and emissions. As of early 2024, the company continues to invest in technologies aimed at further minimizing its environmental impact. The ongoing focus on compliance is crucial for maintaining its operational license and public trust.

- Regulatory Adherence: Compliance with air and water quality standards is non-negotiable for MP Materials' operations.

- California's AB 32: This act sets greenhouse gas emission limits, directly influencing MP Materials' energy sourcing and process optimization.

- Monitoring and Reporting: Regular environmental monitoring and public reporting are integral to MP Materials' sustainability strategy.

- Investment in Technology: The company is investing in technologies to reduce emissions and improve water management, demonstrating a proactive approach to environmental stewardship.

MP Materials' commitment to water conservation is evident in its 99% water recycling rate at Mountain Pass, significantly reducing freshwater dependency. The company's energy-intensive operations are being addressed through a cleaner energy mix, utilizing renewable energy credits to lower its carbon footprint, with 2023 data showing progress in reducing Scope 1 and 2 emissions.

Managing waste rock and tailings, which totaled approximately 2.6 million tons and 1.4 million tons respectively in 2023, is a key environmental challenge, especially with potential radioactive byproducts. Biodiversity conservation and land reclamation are critical, with ongoing monitoring and progressive reclamation plans in place at the Mountain Pass site to restore native vegetation and habitats.

Strict adherence to environmental regulations, such as California's AB 32 Global Warming Solutions Act, shapes MP Materials' operational strategies and necessitates ongoing investment in technologies for emission reduction and improved water management. Transparent reporting of its environmental footprint is integral to maintaining operational licenses and public trust.

PESTLE Analysis Data Sources

Our PESTLE Analysis for MP Materials is built on comprehensive data from government regulatory bodies, leading industry analysis firms, and international economic organizations. This ensures a thorough understanding of the political, economic, social, technological, legal, and environmental factors impacting rare earth element production and demand.