MP Materials Porter's Five Forces Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

MP Materials Bundle

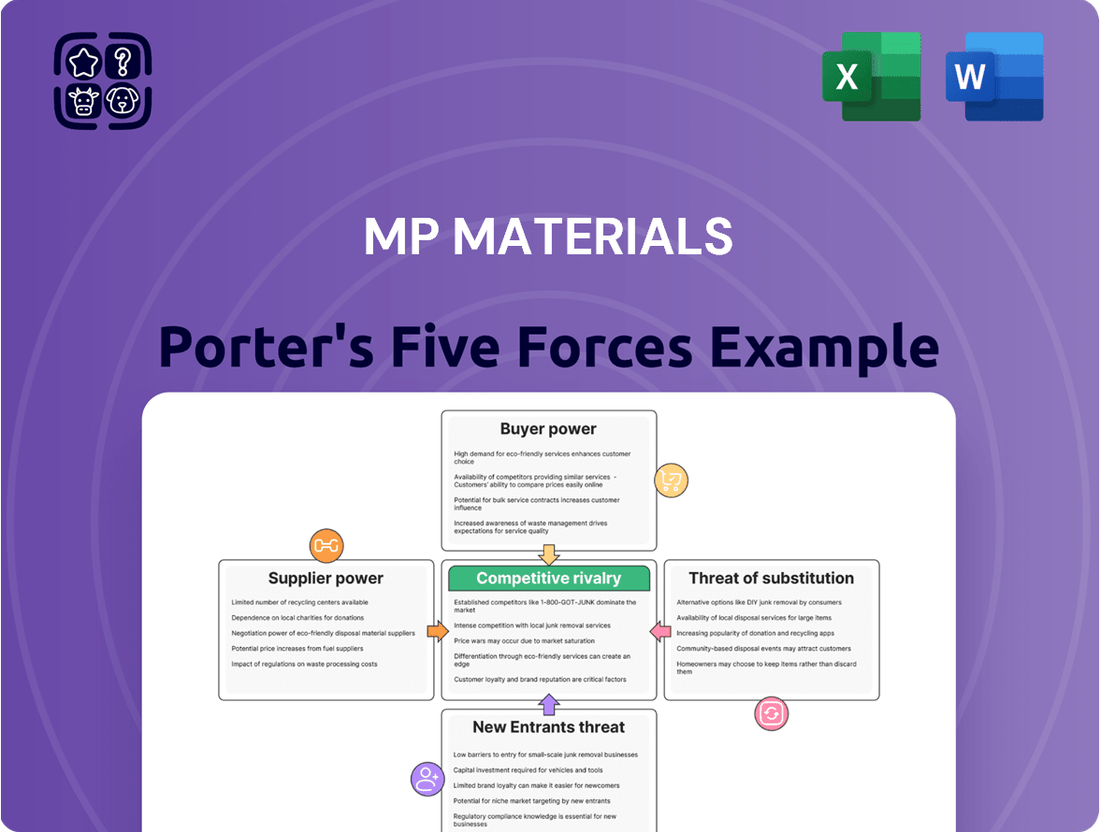

MP Materials operates in a fascinating competitive landscape, shaped by the powerful forces of Porter's Five Forces. Understanding these dynamics is crucial for grasping the company's strategic positioning and future potential.

The threat of new entrants to the rare earth mining sector is moderate, given the significant capital investment and regulatory hurdles. However, buyers of rare earth materials, particularly in the defense and technology sectors, wield considerable bargaining power due to the critical nature of these inputs.

Supplier power is relatively low for MP Materials, as they control a significant portion of North American rare earth reserves. The threat of substitutes is also minimal, as rare earth elements are unique in their properties and difficult to replace in many high-tech applications.

The intensity of rivalry within the rare earth market is a key factor, with geopolitical influences and existing players creating a complex competitive environment. This snapshot only scratches the surface.

Unlock the full Porter's Five Forces Analysis to explore MP Materials’s competitive dynamics, market pressures, and strategic advantages in detail.

Suppliers Bargaining Power

MP Materials, operating as North America's only integrated rare earth mining and processing facility, finds itself dependent on a select group of specialized suppliers for essential equipment, advanced chemicals, and energy. The niche nature of rare earth extraction and processing means many of these inputs are not standard commodities, giving these suppliers significant leverage due to the scarcity of viable alternatives.

This limited supplier base can translate into increased costs and less favorable contract terms for MP Materials, especially concerning proprietary technologies or specific chemical compounds crucial for their operations. For instance, in 2023, MP Materials reported that its cost of materials and supplies represented a significant portion of its operating expenses, highlighting the impact of supplier pricing on its bottom line.

Geopolitical shifts significantly impact the rare earth supply chain, with China's substantial control over processing and export policies being a key factor. Even as MP Materials strives for U.S. supply chain self-sufficiency, reliance on global suppliers for specific components or raw materials remains a possibility. For instance, in 2023, China accounted for approximately 70% of global rare earth mine production and over 85% of rare earth processing.

These upstream dependencies mean that any trade restrictions or tariffs enacted by other nations on these essential inputs could directly escalate MP Materials' operational expenses and introduce considerable instability. This external leverage effectively amplifies the bargaining power of these global suppliers on a broader, macroeconomic scale, influencing MP Materials' strategic sourcing decisions.

MP Materials faces significant supplier bargaining power due to high switching costs associated with specialized mining and processing equipment. For instance, securing custom-built machinery for rare earth element extraction and separation often involves lengthy lead times and bespoke engineering, making a pivot to a new vendor a complex and expensive undertaking. The financial implications of re-tooling or re-calibrating such specialized machinery can easily run into millions of dollars, alongside the operational disruption of learning new systems and ensuring consistent output quality.

Labor and Expertise Scarcity

The rare earth industry, particularly in advanced processing stages, demands a highly specialized workforce. This scarcity of skilled labor, including engineers, metallurgists, and technicians with niche expertise, translates directly into increased bargaining power for these human capital suppliers. MP Materials, like others in the sector, faces the challenge of securing and retaining this talent.

A tight labor market for these specialized roles means that companies must offer competitive compensation and attractive working conditions to attract qualified individuals. Failure to do so can lead to operational disruptions, project delays, and increased costs as the company struggles to fill critical positions. For instance, the global demand for skilled professionals in advanced materials processing is projected to grow significantly, intensifying competition for talent.

- Talent Shortage Impact: The limited availability of specialized rare earth processing expertise can inflate labor costs and create bottlenecks in production.

- Strategic Importance: Retaining a skilled workforce is paramount for maintaining operational efficiency and achieving technological advancement in rare earth separation and refinement.

- Investment in People: MP Materials' investment in training and development programs is crucial to mitigate the risks associated with a scarce talent pool.

- Competitive Landscape: Companies across various high-tech industries are vying for a similar pool of skilled engineers, further amplifying the bargaining power of these professionals.

Regulatory and Environmental Compliance Demands

The bargaining power of suppliers, particularly those providing environmental consulting, waste management, and regulatory compliance services, is significant for MP Materials. These specialized services are indispensable given the rigorous environmental standards in the U.S. rare earth sector. For instance, the Environmental Protection Agency (EPA) continuously updates regulations impacting mining operations, requiring ongoing expert oversight.

MP Materials' operational continuity and public image are directly tied to its ability to meet these exacting environmental mandates. Any disruption or cost escalation from these critical service providers can directly affect the company's bottom line and its social license to operate. In 2024, companies in the mining sector faced increasing scrutiny and potential fines for non-compliance, underscoring the leverage held by compliant service providers.

- Stringent U.S. Environmental Regulations: The Environmental Protection Agency (EPA) and state-level bodies impose strict rules on mining and processing, increasing reliance on specialized compliance expertise.

- Operational Necessity: Reliable waste management and environmental consulting are not optional but are fundamental requirements for MP Materials to maintain its operating permits.

- Reputational Risk: Failures in environmental compliance, even if stemming from a supplier, can lead to significant reputational damage and loss of investor confidence.

- Increased Demand for Specialized Services: The growing focus on sustainable mining practices in 2024 has likely driven up demand and, consequently, the pricing power of qualified environmental service providers in the rare earth industry.

MP Materials experiences substantial bargaining power from its suppliers, primarily due to the highly specialized nature of the rare earth industry. This includes critical inputs like proprietary processing chemicals and custom-built mining equipment, where alternatives are scarce and switching costs are exceptionally high. For instance, in 2024, the company's reliance on a limited number of suppliers for essential reagents meant that price increases from these suppliers directly impacted MP Materials' cost of goods sold.

What is included in the product

This analysis reveals the competitive intensity and profitability potential for MP Materials by examining the power of buyers and suppliers, the threat of new entrants and substitutes, and the existing rivalry within the rare earth materials market.

Unlock actionable insights from MP Materials' Porter's Five Forces analysis, streamlining strategic planning and mitigating competitive threats.

Customers Bargaining Power

MP Materials serves major global manufacturers in critical industries like electric vehicles and renewable energy. These clients depend on a steady supply of high-quality rare earth materials. Despite their concentration, MP Materials' role as the sole integrated North American producer gives it significant leverage, particularly for those aiming to reduce reliance on Chinese sources.

Customers in advanced technology sectors, particularly those reliant on rare earths, are increasingly demanding supply chain security and sustainability. This heightened awareness means they are less likely to solely focus on price, shifting their priorities towards reliable and ethically sourced materials. For instance, companies like Apple are actively seeking partnerships to secure sustainable supply chains, as seen in their collaboration with MP Materials on recycled rare earth magnets.

For manufacturers reliant on rare earth elements, the process of switching suppliers is far from simple. It often involves extensive qualification procedures, potential product redesigns, and significant adjustments to existing production lines. These complexities translate into substantial switching costs, effectively diminishing the bargaining power of customers.

When a company like MP Materials establishes itself as a dependable supplier, particularly for crucial materials such as Neodymium-Praseodymium (NdPr) magnets used in electric vehicles and wind turbines, customers become hesitant to seek alternatives. This customer stickiness, driven by the high cost of changing suppliers, strengthens MP Materials' market position by reducing the frequency of customer churn and fostering long-term relationships.

Price Sensitivity vs. Strategic Value

Customers for rare earth elements, like those produced by MP Materials, often exhibit price sensitivity. However, the critical nature of these materials for high-performance applications, such as in defense systems and advanced electronics, frequently diminishes the impact of small price variations, especially when considering the geopolitical instability of other supply chains. For instance, the demand for neodymium-iron-boron magnets, a key product derived from rare earths, is projected to grow significantly, driven by electric vehicles and wind turbines, underscoring their strategic importance.

MP Materials' unique position as a domestic producer of rare earths offers a distinct advantage. The company can leverage its secure and reliable supply chain to command a premium, effectively buffering against direct price negotiations. This is particularly relevant for sectors where supply chain resilience is paramount, such as the U.S. defense industry, which relies heavily on consistent access to these critical minerals.

- Strategic Importance Over Price: While price is a factor, the essential role of rare earths in advanced technologies often makes supply security more critical than minor cost differences.

- Geopolitical Risk Mitigation: Customers are increasingly factoring in the geopolitical risks associated with sourcing rare earths from potentially unstable regions, valuing domestic supply.

- MP Materials' Value Proposition: MP Materials' ability to provide a stable, North American-based supply chain offers a significant value-add that can offset direct price pressures.

- Market Demand Trends: The escalating demand for rare earths in sectors like renewable energy and defense highlights their strategic value, giving suppliers like MP Materials greater pricing leverage.

Downward Integration by Customers (Limited)

The threat of customers integrating backward into rare earth production is extremely low for companies like MP Materials. This is primarily due to the colossal capital investment, specialized technical knowledge, and significant regulatory complexities inherent in mining and processing rare earth elements. For instance, establishing a new rare earth mine and processing facility can easily cost billions of dollars and take over a decade to become operational, a barrier most end-users cannot overcome.

While some major manufacturers might consider direct investment or strategic alliances to guarantee their supply chains, they are highly unlikely to engage in direct competition by becoming primary producers themselves. This limited capacity for backward integration significantly curtails a potent avenue of customer bargaining power that is more prevalent in other industrial sectors.

- High Capital Requirements: Establishing rare earth mining and processing operations demands billions in upfront investment.

- Technical Expertise: The complex extraction and separation processes require highly specialized scientific and engineering skills.

- Regulatory Hurdles: Obtaining permits and adhering to environmental regulations for mining and chemical processing is a lengthy and arduous process.

- Limited Consumer Integration: End-users in sectors like automotive or electronics are unlikely to replicate the full rare earth production cycle.

The bargaining power of customers for MP Materials is generally low due to the critical nature of rare earths and the high switching costs involved. Customers prioritize supply chain security and reliability, especially given geopolitical risks, making them less sensitive to price alone. The significant complexities and costs associated with qualifying new rare earth suppliers further limit customer leverage.

MP Materials' unique position as the sole integrated North American producer of rare earths, particularly Neodymium-Praseodymium (NdPr) for EVs and wind turbines, grants it considerable pricing power. For example, in 2024, the demand for NdPr is projected to outpace supply, further strengthening MP Materials' negotiating stance. The company's ability to offer a secure, domestic supply chain is a key differentiator that customers value, often above minor price concessions.

| Factor | Impact on Customer Bargaining Power | MP Materials' Position |

|---|---|---|

| Switching Costs | High | Customers face significant technical and qualification hurdles to change suppliers. |

| Supply Chain Security | High Priority | MP Materials offers a reliable, domestic source, reducing geopolitical risk for customers. |

| Product Differentiation | Low Availability of Alternatives | MP Materials is a primary producer of critical rare earth elements in North America. |

| Price Sensitivity | Moderate (for strategic materials) | Essential rare earths for advanced applications often temper extreme price sensitivity. |

Same Document Delivered

MP Materials Porter's Five Forces Analysis

This preview showcases the complete MP Materials Porter's Five Forces Analysis, offering a thorough examination of competitive forces within the rare earth elements market. You're viewing the actual, professionally formatted document that will be delivered instantly upon purchase. This detailed analysis covers the bargaining power of buyers and suppliers, the threat of new entrants and substitutes, and the intensity of rivalry among existing competitors. Rest assured, what you see here is precisely the comprehensive report you will receive, ready for immediate use.

Rivalry Among Competitors

The rare earth market is undeniably dominated by Chinese producers, who leverage substantial government backing, mature infrastructure, and significant economies of scale. Giants like China Northern Rare Earth Group and China Minmetals Rare Earth Co., Ltd. hold considerable sway globally, intensifying competitive rivalry, especially concerning pricing and output volumes.

MP Materials faces direct competition from these formidable Chinese entities, a challenge that becomes even more pronounced as MP Materials progresses into downstream processing. For instance, in 2023, China's rare earth output reached approximately 230,000 metric tons, a figure underscoring their dominant position and the competitive pressure MP Materials must navigate.

Outside of China, the landscape of fully integrated rare earth mining and processing companies is quite sparse. This limited number of non-Chinese players means that any significant competitor holds considerable sway in the global market. MP Materials stands as the sole integrated rare earth producer in North America, giving it a unique position within its home market.

Lynas Rare Earths, an Australian company, emerges as a prominent global competitor. They operate a significant processing facility in Malaysia and have strategic plans to establish a separation facility in the United States. This expansion directly challenges the existing market dynamics by actively building out non-Chinese rare earth supply chains.

The presence of Lynas, with its ambitious expansion into the U.S., creates a direct competitive environment for MP Materials. Both companies are vying for market share in a sector crucial for advanced technologies and national security, aiming to diversify supply away from a single dominant source.

Competitive rivalry in the rare earth sector, including for MP Materials, is significantly shaped by government support and strategic initiatives. The U.S. government has actively invested in domestic critical mineral production, with the Department of Defense, for instance, providing substantial funding to MP Materials. This support, aimed at bolstering supply chain security and reducing foreign dependence, directly enhances MP Materials' competitive position.

These government interventions aren't unique to MP Materials. Other nations are also implementing similar strategies to secure their rare earth supplies, recognizing their strategic importance. For example, the European Union has its Critical Raw Materials Act, and countries like Australia are also bolstering their domestic mining and processing capabilities. This global trend of government backing influences the intensity of competition by potentially subsidizing domestic players.

In 2024, the U.S. Department of Defense announced a $125 million contract with MP Materials to establish a commercial rare earth magnetic production facility. This substantial investment highlights the government's commitment to onshore capabilities and provides MP Materials with a significant competitive edge against rivals who may not receive similar levels of direct financial backing.

Technological Advancements and Processing Capabilities

Competitive rivalry is intensified by rapid technological advancements in rare earth processing. Innovations in extraction, separation, and refining can significantly lower production costs and boost efficiency, directly impacting market competitiveness. MP Materials is leveraging this by developing its own magnet production capabilities, aiming for vertical integration to secure a distinct advantage in the market.

Rival firms and potential new entrants are actively investing in cutting-edge technologies. This includes exploring novel methods for extracting heavy rare earths, improving separation techniques, and developing advanced recycling processes for rare earth materials. For instance, in 2024, several companies announced significant R&D funding for next-generation rare earth processing, aiming to disrupt existing supply chains.

- Technological leaps in processing can reduce operational costs and enhance the recovery rates of critical rare earth elements.

- MP Materials' vertical integration, including its planned magnet manufacturing, aims to capture more value across the supply chain.

- Competitors are focusing on R&D for more efficient extraction, separation, and recycling of rare earths, as evidenced by increased venture capital funding in this sector in 2023-2024.

- The drive for innovation creates a dynamic competitive landscape where companies that adopt and develop superior processing technologies are likely to gain a significant market share.

Market Dynamics and Price Volatility

The rare earth market is notoriously volatile, with prices swinging based on supply and demand, geopolitical tensions, and stockpiling efforts. In 2024, a notable downturn in prices put pressure on producers' bottom lines, consequently heightening competitive pressures.

MP Materials' success hinges on its capacity to weather these market storms and sustain profitability, particularly as it scales up its separated rare earth product sales. This ability to manage price fluctuations is a key determinant of its competitive standing.

- Price Volatility Impact: The rare earth market saw significant price drops in 2024, affecting producer profitability.

- Geopolitical Influence: Global events and supply-demand imbalances are major drivers of price fluctuations in the sector.

- MP Materials' Challenge: Navigating these market dynamics and maintaining profitability is crucial for MP Materials, especially with increased product sales.

Competitive rivalry in the rare earth sector is intense, largely driven by China's dominant market share and the strategic efforts of other nations to build independent supply chains. MP Materials, as North America's sole integrated producer, faces direct competition from global players like Lynas Rare Earths, which is actively expanding its U.S. presence.

Government support plays a crucial role, with significant U.S. investment, such as a $125 million contract in 2024 for MP Materials' magnet production, bolstering domestic capabilities and influencing competitive dynamics. Technological innovation is another key driver, with companies investing heavily in advanced processing to reduce costs and improve efficiency.

The rare earth market's inherent price volatility, exemplified by price downturns in 2024, further heightens competitive pressures as producers strive for profitability amid fluctuating global demand and geopolitical factors.

| Competitor | Key Operations/Strategy | 2023/2024 Relevant Data Point |

|---|---|---|

| China Northern Rare Earth Group | Dominant global producer, extensive infrastructure, economies of scale | China's rare earth output ~230,000 metric tons in 2023 |

| Lynas Rare Earths | Integrated producer, processing facility in Malaysia, U.S. separation facility plans | Expanding U.S. presence to build non-Chinese supply chains |

| MP Materials | Sole integrated North American producer, vertical integration into magnet production | $125 million U.S. DoD contract in 2024 for magnet facility |

SSubstitutes Threaten

For many high-performance applications, like those in electric vehicle motors and advanced wind turbines, rare earth permanent magnets, particularly Neodymium-Iron-Boron (NdFeB), have no direct substitutes offering similar magnetic strength and efficiency. This technical limitation means the threat of direct substitution for MP Materials' core products remains low in these critical sectors, even as research into alternatives continues.

The development of rare earth-free magnet technologies represents a growing threat of substitution. While currently no direct, high-performance replacements exist for neodymium-iron-boron (NdFeB) magnets, significant R&D is underway. Projects are exploring advanced ferrites, iron-nitride compounds, and manganese-aluminum-carbon alloys as potential alternatives.

This push is driven by the inherent price volatility and supply chain risks associated with rare earth elements. Companies are actively seeking to diversify their material inputs to mitigate these concerns. For instance, advancements in ferrite magnet technology are showing promise in applications where peak performance isn't critical, potentially eroding market share in certain segments.

If these emerging technologies can achieve comparable magnetic strength and efficiency at a competitive cost and can be produced at scale, they could significantly impact the demand for rare earth magnets. For example, the global market for permanent magnets, largely dominated by NdFeB, was valued at over $20 billion in 2023 and is projected to grow, making any successful substitution a considerable threat.

Advancements in recycling rare earth elements from electronics and electric vehicle motors are gaining momentum, driven by a global push for sustainability and resource security. These efforts are not direct replacements for newly mined materials but can significantly curb the demand for primary rare earth elements by offering an alternative supply source. MP Materials is actively participating in this trend through its own investments in recycling technologies, recognizing its potential impact.

Design and Engineering Innovations

Advances in motor design and engineering present a significant threat of substitution for MP Materials. Innovations could lead to reduced reliance on specific rare earth elements or the development of alternative materials altogether.

For instance, Toyota has been actively researching and developing cerium-based magnets, aiming to lessen their dependence on heavy rare earths like neodymium and dysprosium, which are crucial components in many high-performance motors. This pursuit of alternative magnetic materials directly challenges the demand for MP Materials' core products.

- Reduced Rare Earth Content: Engineering advancements may allow for motors that require a smaller quantity of rare earth elements to achieve comparable performance levels.

- Alternative Element Use: Innovations could enable the use of less critical or more abundant elements in magnetic applications, bypassing the need for traditionally sourced rare earths.

- Cerium Magnet Research: Toyota's efforts with cerium magnets illustrate a direct pathway to substitution, potentially impacting the market share for neodymium and praseodymium magnets.

- Lower Overall Demand: Successful implementation of these design and engineering innovations could collectively decrease the overall market demand for the specific rare earth elements that MP Materials extracts and processes.

Cost-Performance Trade-offs of Alternatives

The threat of substitutes for MP Materials' rare earth products is generally considered low in the near term, primarily due to significant cost-performance trade-offs. Current alternatives often fall short in delivering the same level of performance, requiring compromises such as larger component sizes, reduced efficiency, or a narrower operating temperature range compared to rare earth magnets. For industries where high performance and miniaturization are critical, like electric vehicles and advanced electronics, the advantages of rare earth elements typically outweigh these drawbacks.

This dynamic makes widespread substitution unlikely unless substantial technological advancements emerge. For instance, while some non-rare earth magnet technologies are being developed, they often struggle to match the magnetic strength density of neodymium-iron-boron (NdFeB) magnets, which are crucial for high-efficiency motors. The automotive industry's push for lighter and more powerful EV motors, a key market for MP Materials, relies heavily on the superior properties of rare earth magnets. In 2023, the global electric vehicle market continued its rapid expansion, with sales exceeding 13 million units, underscoring the sustained demand for high-performance components that rare earths enable.

- Performance Gaps: Non-rare earth alternatives frequently exhibit lower magnetic strength, requiring larger or heavier motor designs.

- Efficiency Concerns: Substitutes can lead to reduced energy efficiency in applications like electric motors and wind turbines, increasing operational costs.

- Miniaturization Limitations: Many alternatives cannot achieve the same power density as rare earth magnets, hindering the development of smaller, more compact devices.

- Technological Hurdles: Significant R&D is still needed to bridge the performance gap, making immediate, large-scale substitution improbable for critical applications.

The threat of substitutes for MP Materials' rare earth products is currently moderate. While no direct substitutes offer the same magnetic strength and efficiency for critical applications like EV motors, ongoing research into rare earth-free magnets, such as advanced ferrites and iron-nitride compounds, poses a future risk. These alternatives are driven by concerns over rare earth price volatility and supply chain security.

Advancements in motor design also present a threat, potentially reducing the need for rare earth elements or enabling the use of alternative materials. Toyota's work on cerium magnets exemplifies this trend, aiming to decrease reliance on neodymium and dysprosium. If these emerging technologies achieve comparable performance at a competitive cost, they could significantly impact demand for MP Materials' core products, particularly as the global EV market continues its rapid expansion, exceeding 13 million units sold in 2023.

Entrants Threaten

The rare earth mining and processing sector is characterized by extremely high capital intensity. Establishing new operations, from initial exploration to the construction of sophisticated separation and refining facilities, can demand investments running into billions of dollars. For instance, bringing a new rare earth mine and processing plant online in the United States can take anywhere from 10 to 29 years.

The threat of new entrants into the rare earth processing sector is significantly diminished by the sheer complexity of the technical expertise required. Rare earth extraction and separation involve intricate chemical processes, often necessitating over a thousand solvent extraction steps, a field where China has cultivated a dominant, multi-decade lead. New players must overcome the substantial hurdle of acquiring or developing this highly specialized knowledge and the proprietary technologies associated with it.

Furthermore, achieving the necessary economic scale to compete effectively presents another major challenge for potential entrants. The capital investment and operational experience needed to build and run a successful rare earth processing facility are immense. For instance, the Mountain Pass facility, MP Materials' flagship operation, represents a significant investment in re-establishing domestic rare earth processing capabilities, illustrating the substantial resources required to enter this market.

Stringent environmental and regulatory hurdles present a formidable barrier to entry in the rare earth sector. Mining and processing these critical minerals are inherently linked to significant environmental risks, leading to rigorous regulations, especially in North America. For instance, securing the required permits and licenses for smelting and refining operations is a protracted and intricate undertaking, often spanning 7 to 10 years. These substantial costs and inherent risks associated with environmental compliance effectively discourage many potential new market participants.

Access to High-Quality Deposits

The threat of new entrants into the rare earth mining sector is significantly mitigated by the challenge of accessing high-quality deposits. Economically viable and high-grade rare earth deposits outside of China are exceptionally scarce. This scarcity acts as a substantial barrier, making it difficult for new companies to establish a competitive foothold.

MP Materials, for instance, benefits immensely from its ownership of the Mountain Pass mine, recognized as one of the richest rare earth deposits worldwide. This proprietary access to a premier resource gives MP Materials a distinct advantage. Any new entrant would face the daunting task of securing comparable deposits, a feat that is both rare and demands extensive, costly exploration efforts.

- Limited Global Rare Earth Deposits: The world possesses a finite number of economically viable rare earth deposits, with a significant concentration of high-grade resources outside of China being particularly scarce.

- Mountain Pass Advantage: MP Materials' ownership of the Mountain Pass mine provides a critical competitive edge due to its high concentration of rare earth elements, estimated to contain approximately 1.5 million tonnes of rare earth oxides (REO).

- High Entry Costs: New entrants would require substantial capital investment for exploration, permitting, and mine development to access and extract rare earths from any discovered deposits, further deterring potential competitors.

- Geological Rarity: The geological conditions required to form economically exploitable rare earth deposits are uncommon, meaning that finding new, high-grade sites is an inherently low-probability undertaking.

Government Support for Incumbents and Strategic Initiatives

Government support for incumbents like MP Materials significantly raises the barrier to entry for new players. For instance, the U.S. Department of Defense has committed substantial resources, including over $100 million in funding and long-term offtake agreements, to bolster domestic rare earth production capabilities. This strategic backing, aimed at securing critical mineral supply chains, creates a less competitive environment for emerging companies lacking similar governmental backing and financial stability.

- Government Funding: Direct investments and loans from entities like the Department of Defense provide incumbents with significant capital advantages.

- Offtake Agreements: Long-term commitments from government agencies guarantee demand for incumbent products, reducing market risk.

- Strategic Partnerships: Government support often fosters collaborations that further solidify the position of established players.

- Competitive Disadvantage: New entrants without similar support face a steeper uphill battle to secure financing and market access.

The threat of new entrants into the rare earth mining and processing sector remains low. The immense capital required for exploration, permitting, and establishing sophisticated processing facilities, often in the billions of dollars, acts as a primary deterrent. Furthermore, the scarcity of high-grade, economically viable rare earth deposits outside of established mining regions like China presents a significant hurdle for any potential new competitor seeking to enter the market.

Technical expertise and proprietary processing knowledge, honed over decades, particularly by Chinese firms, create another substantial barrier. Environmental and regulatory compliance also adds significant time and cost, with permit acquisition alone potentially taking 7 to 10 years. Finally, government support for existing players, such as MP Materials, through funding and offtake agreements, further solidifies their competitive position and discourages new entrants.

| Barrier to Entry | Description | Impact on New Entrants |

|---|---|---|

| Capital Intensity | Billions of dollars needed for exploration, mine development, and processing facilities. | Extremely High |

| Technical Expertise | Complex chemical separation processes require specialized knowledge and proprietary technology. | Very High |

| Deposit Scarcity | Economically viable, high-grade rare earth deposits outside of China are rare. | High |

| Environmental & Regulatory Hurdles | Lengthy (7-10 years) and costly permitting processes. | High |

| Government Support for Incumbents | Funding and offtake agreements for established players like MP Materials. | High |

Porter's Five Forces Analysis Data Sources

Our Porter's Five Forces analysis for MP Materials is built upon a foundation of publicly available financial disclosures, including SEC filings and annual reports, alongside industry-specific market research and trade publications to capture competitive dynamics.