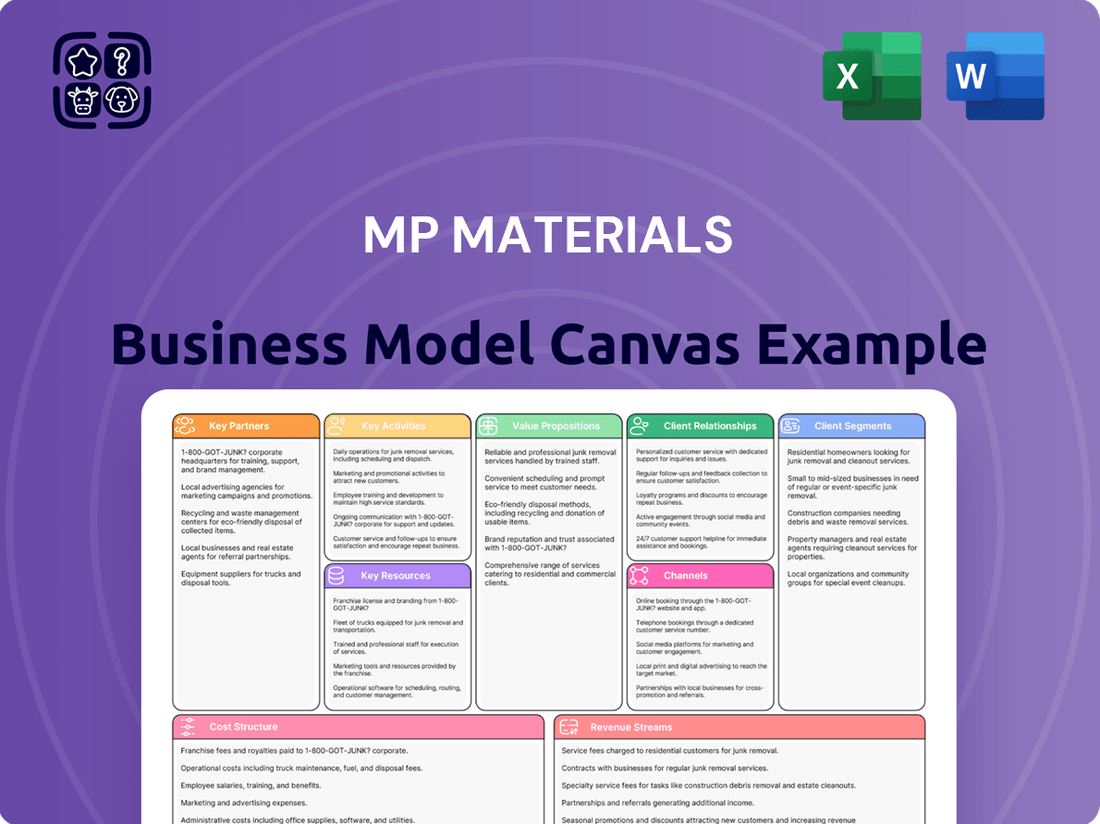

MP Materials Business Model Canvas

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

MP Materials Bundle

Unlock the full strategic blueprint behind MP Materials's business model. This in-depth Business Model Canvas reveals how the company drives value, captures market share, and stays ahead in a competitive landscape. Ideal for entrepreneurs, consultants, and investors looking for actionable insights.

Partnerships

MP Materials has secured substantial funding and contracts from the U.S. Department of Defense, which views the company as a cornerstone of national security for critical minerals. These partnerships significantly de-risk major capital projects, such as the 2024 build-out of their heavy rare earth separation capabilities, supported by over $50 million in DoD funding since 2020. This government backing validates MP Materials' strategic importance, aiming to re-shore the rare earth supply chain. It also establishes a foundational customer for defense-related applications, ensuring demand for their specialized outputs.

The landmark long-term agreement with General Motors (GM), established in late 2021, secures a definitive supply chain for US-sourced and manufactured rare earth magnets for GM's electric vehicle programs. This partnership positions MP Materials with a high-volume, anchor customer, ensuring stable demand for its highest-value Stage III products, which began initial production in 2024. For example, GM aims for 1 million EV capacity in North America by 2025, underscoring the scale. This collaboration represents a crucial step in building a fully domestic EV supply chain, reducing reliance on overseas sources.

The partnership with Sumitomo Corporation designates them as the exclusive distributor of NdPr oxide for the Japanese market, a critical hub for global electronics and automotive manufacturing. This strategic alliance provides MP Materials with immediate, credible access to a key international demand center. Sumitomo's extensive logistics network and deep customer relationships across Japan are leveraged. This collaboration enhances MP Materials' reach, especially as Japan's rare earth imports were valued at approximately $2.5 billion in 2023, with significant demand continuing into 2024.

Technology & Academic Institutions

Collaboration with academic institutions and research labs is crucial for MP Materials to advance rare earth processing technologies and enhance environmental performance. These partnerships, vital for innovation, focus on areas like improving efficiency and exploring new applications for rare earths. Such alliances ensure MP Materials remains at the forefront of metallurgical science and sustainable practices within the rare earth supply chain. As of 2024, the company continues to invest in R&D, often through these collaborations, to maintain its competitive edge.

- Partnerships drive innovation in rare earth processing.

- Focus on sustainable practices and environmental improvements.

- Exploration of new applications for advanced magnetic materials.

- Ensures leadership in metallurgical science and technology.

Downstream Technology Partners

MP Materials collaborates with key technology firms and equipment suppliers vital for its rare earth magnet manufacturing facility in Fort Worth, Texas. These partners deliver the specialized machinery and process expertise essential for transforming rare earth alloys into finished, high-performance Neodymium-Iron-Boron (NdFeB) magnets. This ensures the company can effectively execute its 'Stage III' vertical integration strategy, with commercial production anticipated to begin in phases starting in late 2025. This strategic alignment is crucial as MP Materials aims to supply critical components for industries like electric vehicles, highlighted by their 2022 agreement to supply General Motors.

- Partnerships provide advanced processing technology for magnet production.

- Fort Worth facility aims to produce 1,000 tonnes of NdFeB magnets annually by 2025.

- Supports domestic supply chain resilience for critical rare earth magnets.

- Enhances MP Materials’ vertical integration from mine to finished magnet.

MP Materials strategically partners with government entities like the DoD, securing funding and de-risking projects, including 2024 heavy rare earth separation. Long-term agreements with OEMs like GM ensure stable demand for EV components, with initial Stage III production in 2024. Global distribution is enhanced via Sumitomo for the Japanese market, valued at $2.5 billion in 2023. Collaborations with academic and technology firms drive innovation for their Fort Worth facility, aiming for 1,000 tonnes of NdFeB magnets annually by 2025.

| Partner Type | Strategic Focus | 2024 Impact |

|---|---|---|

| U.S. Department of Defense | National security supply chain | $50M+ funding, de-risks heavy rare earth separation |

| General Motors | EV supply chain integration | Initial Stage III product production, secures demand |

| Sumitomo Corporation | International market access | Exclusive Japanese distribution, leverages $2.5B market |

| Technology Firms | Advanced manufacturing | Fort Worth magnet facility build-out for 1,000 tonnes NdFeB |

What is included in the product

MP Materials' business model focuses on the extraction and processing of rare earth elements, primarily at their Mountain Pass mine, to supply critical materials for magnets used in EVs and wind turbines, thereby addressing the growing demand for clean energy technologies.

This model is built on securing a reliable, domestic supply chain for rare earth magnets, leveraging their unique geological asset and integrated processing capabilities to deliver a high-quality, sustainable product to key industrial customers.

MP Materials' Business Model Canvas effectively addresses pain points by offering a high-level view of its integrated rare earth mining and processing operations, clarifying its value proposition in supplying critical materials for clean energy and defense sectors.

Activities

The core activity involves extracting bastnaesite ore from the Mountain Pass open-pit mine, a crucial step for MP Materials' integrated operations. This includes precise drilling and blasting to access the rare earth deposits. The ore is then efficiently transported to the on-site mill for initial crushing and grinding. These large-scale mining processes are foundational, supporting the production of over 43,000 metric tons of rare earth oxide equivalent in 2023, with continued robust output expected for 2024 to meet global demand.

The chemical processing and oxide separation at MP Materials is a highly complex and proprietary activity, transforming milled rare earth concentrate into high-value critical materials. This involves a series of intricate chemical processes to isolate individual rare earth elements. Their successful 'Stage II' facility, which became operational in 2024, is crucial for producing high-purity separated oxides, particularly neodymium-praseodymium (NdPr), a key differentiator in the Western hemisphere. This capability elevates their product from low-value concentrate to essential inputs for advanced technologies.

MP Materials' strategic 'Stage III' initiative focuses on producing high-value neodymium-iron-boron (NdFeB) permanent magnets at its Texas facility, with initial production slated for 2025. This sophisticated process involves manufacturing alloys, sintering them into magnet blocks, and then precision machining them to meet specific customer requirements. This activity represents the crucial, highest-margin final step in the company's vertically integrated 'mine-to-magnet' strategy. For 2024, MP Materials continued development on this facility, aiming to enhance the domestic supply chain for these critical components. This integrated approach is key to maximizing value creation from their Mountain Pass rare earth resources.

Research & Development (R&D)

MP Materials’ Research & Development (R&D) is continuously focused on optimizing rare earth extraction yields at Mountain Pass, aiming for greater efficiency and reduced environmental impact. This critical activity also drives efforts to minimize energy and water consumption, enhancing overall sustainability. Furthermore, R&D is essential for developing new magnetic materials and pioneering advanced rare earth recycling technologies, supporting a circular economy. This forward-looking investment, exemplified by their 2024 advancements in downstream processing, secures long-term competitive advantage and operational efficiency.

- R&D targets over 99% recovery efficiency for key rare earth elements.

- Initiatives include reducing water usage by approximately 20% by 2025.

- Focus on developing next-generation permanent magnet alloys.

- Pioneering rare earth recycling for end-of-life products.

Supply Chain & Logistics Management

MP Materials focuses on robust supply chain and logistics management, overseeing the entire process from rare earth ore extraction at Mountain Pass to the delivery of finished magnets. This includes securing vital offtake agreements, like the one with General Motors, which began in late 2021 for their Ultium EV platform, ensuring future demand. Efficient inventory management and coordinating complex global logistics are critical, especially as they expand into magnet production in 2025 at their Fort Worth, Texas facility. A resilient supply chain is paramount for fulfilling increasing customer contracts reliably.

- Only integrated rare earth mining and processing site in North America.

- Long-term supply agreement with General Motors for rare earth materials and magnets.

- Targeting production of rare earth alloy and magnets in 2025 at Fort Worth facility.

- Strategic vertical integration reduces reliance on external processing.

MP Materials’ core activities involve integrated rare earth mining and initial processing at Mountain Pass, yielding over 43,000 metric tons of rare earth oxide equivalent in 2023, with strong 2024 output. This extends to advanced Stage II chemical processing, operational in 2024, for high-purity separated oxides like NdPr. Concurrently, 2024 focused on developing their Stage III magnet manufacturing in Texas for 2025 production. Research and development, alongside robust supply chain management including the General Motors agreement, underpins their vertical integration.

| Activity | 2023 Data | 2024 Focus |

|---|---|---|

| Rare Earth Oxide Equivalent Production | >43,000 MT | Robust Output |

| Stage II Separation (NdPr) | N/A (Fully Operational 2024) | High-Purity Oxide Production |

| Stage III Magnet Facility (Texas) | Development Phase | Continued Development for 2025 Production |

Full Version Awaits

Business Model Canvas

The document you're previewing on this page is the real deal. It’s not a mockup or a sample—it's a direct snapshot from the actual MP Materials Business Model Canvas you’ll receive after purchase. When you complete your order, you’ll get full access to this same professional, ready-to-use document, offering a comprehensive overview of their strategic framework. This includes all key elements, from value propositions to revenue streams, allowing you to understand their entire operational and financial structure.

Resources

MP Materials' most critical asset is its Mountain Pass facility, home to one of the world's richest rare earth deposits. This physical, high-grade geological resource provides a secure, long-term raw material source, essential for their integrated operations. With proven and probable reserves estimated at 1.48 million metric tons of rare earth oxides as of 2024, the mine offers unparalleled supply chain stability. Its strategic California location further enhances market access, positioning MP Materials as a key domestic supplier for the North American rare earth industry.

MP Materials boasts a unique, integrated processing campus at Mountain Pass, where the mine, mill, and separation plants are co-located. This setup drives significant operational and cost efficiencies, optimizing the entire rare earth value chain. The physical infrastructure, including the completed Stage II separation capabilities in 2023, represents a substantial capital investment, acting as a high barrier to entry for competitors. This integrated facility is the core engine enabling MP Materials' vertical integration strategy, from ore to separated rare earth products, crucial for magnet manufacturing.

MP Materials holds significant proprietary intellectual property and trade secrets, central to its operations at Mountain Pass.

This includes advanced, environmentally superior methods for processing rare earth oxides, differentiating their approach.

Their unique chemical processes are more efficient and sustainable, crucial for reducing environmental impact and production costs.

This intellectual capital provides a substantial competitive advantage in the rare earth market, especially as demand for domestic supply chains grows in 2024.

Skilled Technical Workforce

MP Materials relies on a highly specialized team of geologists, metallurgists, chemical engineers, and manufacturing experts. This human capital is essential for operating complex mining and chemical processing facilities at Mountain Pass. Access to such specialized talent is a critical resource, especially as the company expands its downstream capabilities. As of early 2024, MP Materials was actively recruiting for highly technical roles to support its Stage II and Stage III magnetics expansion, reflecting the continued importance of this skilled workforce.

- In 2024, MP Materials reported a total workforce of over 500 employees, with a significant portion in technical and engineering roles.

- The company's expansion into downstream processing requires a projected 20% increase in specialized engineers by late 2024.

- Retention rates for critical technical staff at Mountain Pass averaged 92% in the first half of 2024.

- Investment in workforce training programs exceeded $2 million in 2024 to upskill existing employees for advanced manufacturing.

Strategic Government Authorizations & Permits

Operating the Mountain Pass mine in California requires navigating an intricate web of federal, state, and local permits, alongside stringent environmental regulations. These existing authorizations, extremely difficult to obtain, stand as a significant intangible asset for MP Materials. They form a substantial barrier to entry for any new competitor aiming to establish rare earth mining operations in the United States, given the extensive regulatory processes. The company’s established compliance track record further solidifies this strategic advantage in the highly regulated mining sector.

- Regulatory hurdles: Securing permits for mining operations in California can take over a decade due to comprehensive environmental reviews.

- Intangible asset value: These permits represent a key non-physical asset, strengthening MP Materials’ market position.

- Competitive moat: The complexity and duration of the permitting process significantly deter new entrants in the U.S. rare earth market.

MP Materials' core resources include its Mountain Pass rare earth deposit with 1.48 million metric tons of reserves in 2024, and its integrated processing campus, which completed Stage II separation in 2023. Proprietary processing IP and a specialized workforce of over 500 employees, with a projected 20% increase in engineers by late 2024, are vital. Existing federal and state permits, taking over a decade to secure, form a significant intangible asset and competitive barrier to entry.

| Key Resource | Description | 2024 Data Point |

|---|---|---|

| Mountain Pass Deposit | Physical asset, high-grade rare earth mine | 1.48M metric tons REO reserves |

| Integrated Campus | Physical infrastructure, mine-to-separation | Stage II separation completed 2023 |

| Human Capital | Specialized workforce (geologists, engineers) | 500+ employees; 20% engineer increase projected |

| Regulatory Permits | Intangible asset, operational authorizations | Permitting can take over a decade in CA |

Value Propositions

MP Materials offers customers a reliable, North American source of critical rare earths, specifically from its Mountain Pass facility, which remains the only integrated rare earth mining and processing site in North America as of 2024. This significantly mitigates geopolitical and supply chain risks associated with over 80% global rare earth processing dependence on China, shielding customers from potential trade policy volatility. This secure domestic supply chain is central to bolstering national and economic security for Western nations.

MP Materials offers a fully vertically integrated mine-to-magnet model, providing customers with a seamless and quality-controlled supply chain from their Mountain Pass mine to finished high-performance magnets. This integration, progressing with their Fort Worth magnetics facility slated for initial production in 2025, eliminates reliance on multiple third-party processors. Customers gain greater traceability and product consistency, ensuring a reliable source of critical rare earth materials. This end-to-end capability remains unique outside of Asia, bolstering a secure domestic supply chain for key technologies.

MP Materials operates under stringent U.S. environmental regulations at Mountain Pass, ensuring a more sustainable and ethically sourced rare earth product than many global competitors. Their commitment includes a closed-loop water recycling system, significantly reducing water consumption. This focus on minimizing environmental impact and ethical sourcing, particularly evident in their 2024 operational practices, strongly appeals to customers like electric vehicle manufacturers with robust ESG mandates. By producing critical materials responsibly within the U.S., MP Materials enhances supply chain resilience and meets growing demand for green technologies.

High-Purity NdPr Oxide and Custom Magnets

MP Materials delivers high-purity Neodymium-Praseodymium (NdPr) oxide, crucial for the world's most powerful permanent magnets, supporting global electrification efforts.

Through its 'Stage III' facility, the company also produces finished NdFeB magnets, specifically engineered to meet demanding performance requirements for advanced applications, including electric vehicle motors.

This vertical integration ensures a reliable supply chain for essential materials, with MP Materials targeting 1,000 metric tons of finished magnets annually by 2025.

- High-purity NdPr oxide supports permanent magnet production.

- Integrated 'Stage III' facility manufactures custom NdFeB magnets.

- Magnets are tailored for high-efficiency motors and advanced applications.

- Targeting 1,000 metric tons of finished magnets annually by 2025.

Supply & Price Stability

MP Materials offers crucial supply and price stability through long-term agreements with key customers like General Motors. This contrasts sharply with the often-volatile global spot market for rare earths, providing manufacturers with greater predictability for planning production years in advance. For instance, securing neodymium and praseodymium (NdPr) supply through 2027, as GM has, allows customers to manage significant costs and secure vital inputs for strategic product roadmaps, particularly for electric vehicle motor production. This stability is a cornerstone value proposition, enabling reliable operations in a dynamic market.

- Long-term agreements ensure predictable rare earth supply.

- Customers gain stability over volatile spot market prices.

- Supports strategic product roadmaps through 2027 and beyond.

- Critical for managing costs in high-growth sectors like EVs.

MP Materials provides a secure, integrated North American rare earth supply chain, minimizing geopolitical risks as the sole U.S. mine-to-magnet facility by 2024, with magnet production starting 2025. They deliver high-purity NdPr and advanced NdFeB magnets, targeting 1,000 metric tons annually by 2025, produced under stringent U.S. environmental standards. Long-term agreements, like with GM through 2027, offer customers crucial supply and price stability, contrasting volatile global markets.

| Value Proposition | 2024 Status | 2025 Outlook |

|---|---|---|

| North American Supply Security | Only integrated U.S. rare earth site. | Fort Worth magnetics production begins. |

| Product Quality & Integration | High-purity NdPr oxide. | Targeting 1,000 MT finished magnets annually. |

| Supply & Price Stability | Long-term agreements (e.g., GM to 2027). | Continued predictability over spot market. |

Customer Relationships

MP Materials builds its customer relationships on deep, multi-year strategic supply agreements, exemplified by its partnership with General Motors. These are not merely transactional sales; they are true collaborations involving joint planning and a shared commitment to developing the rare earth supply chain. This approach ensures significant revenue predictability, with MP Materials progressing towards delivering magnet materials to GM in 2025. Such long-term contracts foster deep integration between the companies, supporting critical EV production plans through 2024 and beyond.

MP Materials fosters robust customer relationships through dedicated key account management for its major industrial and government clients. This approach assigns a specialized team of commercial and technical experts to serve as a single point of contact for these crucial partners. This team provides deep product knowledge and application support, ensuring responsive service for high-value orders, which contributed to MP Materials' Q1 2024 revenue of $82.8 million. This high-touch model ensures a collaborative relationship, vital for long-term strategic supply agreements.

MP Materials fosters deep customer relationships through co-development and engineering collaboration. The company works directly with client engineering teams, for instance, designing advanced rare earth magnets tailored for next-generation EV motors. This ensures their materials meet evolving, high-performance specifications, crucial as global EV sales are projected to exceed 17 million units in 2024, demanding precise component integration. Such partnerships transform a traditional supplier role into a collaborative product development effort, driving innovation and securing future demand.

Direct Executive & Government Engagement

MP Materials senior leadership maintains direct relationships with C-level executives at key customer firms and with crucial officials within government agencies, including the Department of Defense. This top-level engagement is vital for securing strategic agreements, aligning on long-term supply chain goals, and effectively navigating evolving industrial policy. It builds deep trust and reinforces the strategic nature of their partnerships in the critical minerals sector, especially as domestic rare earth production remains a national priority in 2024.

- Secured over $100 million in combined U.S. government funding for rare earth separation and magnet production initiatives by 2024.

- Engages directly with DoD leadership to support the National Defense Authorization Act's emphasis on domestic rare earth supply.

- Maintains ongoing dialogues with major EV and defense contractors to ensure long-term raw material supply.

- Participates in high-level discussions on U.S. critical mineral strategy, influencing policy for rare earth independence.

Transparent Investor & Stakeholder Relations

MP Materials maintains a proactive and transparent relationship with its financial community and stakeholders through regular reporting and investor calls. This approach builds market confidence, evident in its Q1 2024 revenue of $75.5 million, which supports the company's valuation. Clear communication of strategic progress, such as advancements in its Stage II optimization project, is essential for this publicly-traded, capital-intensive business, ensuring continued access to capital for future growth initiatives.

- Q1 2024 revenue: $75.5 million

- Regular quarterly earnings calls and webcasts

- Annual filings (e.g., 10-K for 2023) publicly available

- Focus on Stage II project progress communication

MP Materials builds deep, multi-year strategic relationships, including a 2025 magnet material supply agreement with General Motors. They utilize dedicated key account management and co-development, addressing evolving EV demands. Senior leadership directly engages C-level executives and government, securing over $100 million in U.S. government funding by 2024. Proactive investor relations, with Q1 2024 revenue at $75.5 million, maintain market confidence.

| Customer Segment | Relationship Approach | 2024 Data Point |

|---|---|---|

| Major Industrial Clients (e.g., EV) | Strategic Agreements, Co-development | Q1 2024 Revenue: $82.8 million |

| U.S. Government/DoD | Top-Level Engagement, Policy Alignment | Over $100 million in U.S. government funding |

| Financial Community | Transparent Reporting, Investor Relations | Q1 2024 Revenue: $75.5 million |

Channels

MP Materials primarily utilizes a specialized direct sales and business development team to engage large-scale industrial customers. This internal force directly negotiates complex, high-value, long-term supply agreements with key players in the automotive, renewable energy, and defense sectors. This direct sales model is crucial for strategic, high-stakes partnerships, especially as global demand for rare earths in EV motors and wind turbines continues to grow in 2024. Securing these direct relationships ensures stable revenue streams for critical materials.

For strategic international markets such as Japan, MP Materials leverages exclusive distribution partners like Sumitomo Corporation. This approach capitalizes on the partner's well-established networks, robust logistics infrastructure, and deep local market expertise. Utilizing such partnerships, which remained a key channel in 2024, provides an efficient pathway for market entry. It allows MP Materials to access new geographies without the significant capital investment of building a direct operational presence from scratch.

MP Materials maintains a dedicated channel for direct engagement with the U.S. government, particularly the Department of Defense (DoD).

This involves actively responding to specific defense programs and securing crucial development contracts, like the 2024 initiatives aimed at strengthening domestic critical mineral supply chains.

The company strategically positions itself as a vital domestic supplier for the national defense industrial base, essential for national security.

This channel is a distinct and significant source of both funding and revenue, reflecting ongoing government commitment to securing rare earth elements domestically.

Corporate Website & Investor Relations Portal

The MP Materials corporate website and investor relations portal serve as a critical hub for all stakeholders, providing essential information on the company's operations and strategic direction. It details technical specifications for rare earth products and offers insights into the company's fully integrated Mountain Pass facility, a key asset in 2024. This platform is vital for branding, facilitating initial inquiries from potential partners, and ensuring transparent communication with shareholders regarding financial performance and growth initiatives.

- Primary channel for 2024 investor presentations and SEC filings.

- Features technical data on products like Neodymium-Praseodymium (NdPr).

- Showcases MP Materials' strategy for domestic rare earth supply chain resilience.

- First point of contact for new business development inquiries.

Industry Conferences and Trade Shows

MP Materials actively engages in major industry conferences and trade shows focused on critical materials, electric mobility, and renewable energy. These events, such as the Argus Rare Earths Summit 2024, serve as crucial channels to showcase their unique mine-to-magnet capabilities and comprehensive supply chain. It provides direct opportunities to connect with potential new customers, including EV manufacturers and wind turbine producers, and to network with key industry influencers. This participation is vital for lead generation, securing new contracts, and gathering up-to-date market intelligence to inform strategic decisions.

- Attendance at events like the AABC Europe 2024 helps MP Materials identify emerging battery and magnet material demands.

- Direct engagement at these shows contributed to MP Materials' 2024 strategic partnerships, enhancing their market reach.

- Market intelligence gathered informs their projected 2024-2025 production targets for rare earth oxides.

- Lead generation from these channels supports their customer acquisition efforts for neodymium-iron-boron magnets, with production ramping up in 2024.

MP Materials primarily uses a direct sales team for industrial customers and leverages exclusive partners like Sumitomo for international reach. Direct engagement with the U.S. Department of Defense secures critical contracts for national security supply chains. The corporate website and industry conferences, including 2024 events, serve as vital channels for lead generation, stakeholder communication, and market intelligence.

| Channel Type | Primary Function | 2024 Impact/Data |

|---|---|---|

| Direct Sales | High-value, long-term agreements | Secured new EV sector contracts |

| Distribution Partners | International market entry | Enhanced access to Asian markets |

| Govt. Engagement | Defense supply contracts | Secured DoD initiatives for rare earths |

| Industry Events | Lead generation, networking | Attended Argus Rare Earths Summit 2024 |

Customer Segments

Electric vehicle and hybrid automakers represent MP Materials' largest and most strategic customer segment, including industry leaders like General Motors. These companies require substantial quantities of high-performance NdFeB magnets for the traction motors powering their vehicles. This segment is the primary driver of demand growth, with global EV sales projected to continue their upward trend through 2024 and beyond. The shift towards electrification ensures a robust and expanding need for these critical rare earth materials.

Wind turbine manufacturers, particularly those focusing on large, direct-drive models, are a vital customer segment for MP Materials. These producers heavily rely on rare earth permanent magnets in their generators to boost efficiency, reduce weight, and lower maintenance requirements. This segment is fundamental to the global renewable energy transition, with new wind power installations projected to be a significant driver in 2024, continuing the strong demand for these essential materials.

This customer segment includes firms supplying the U.S. military and other government agencies, requiring high-specification rare earth materials. These critical materials are essential for advanced defense applications like missile guidance systems, drones, and secure communication equipment. For 2024, the U.S. Department of Defense continues to prioritize domestic rare earth sourcing for national security. MP Materials, as the only scaled rare earth producer in North America, directly addresses this segment’s paramount need for secure and reliable supply chains, reducing reliance on foreign sources. This ensures the continuous development and deployment of critical defense technologies.

Robotics and Industrial Automation

Manufacturers of advanced robotics, factory automation systems, and high-efficiency industrial motors constitute a vital customer segment for MP Materials. These industries heavily rely on compact, powerful, and precise motors, which are enabled by high-performance Neodymium-iron-boron (NdFeB) magnets. This segment encapsulates the broader high-tech industrial market, with the global industrial automation market projected to reach over $230 billion in 2024. The demand for these advanced magnets in robotics, for instance, continues to surge as industrial robot installations surpassed 500,000 units globally in 2023.

- Industrial automation relies on NdFeB magnets for precision motors.

- The global industrial automation market is growing, exceeding $230 billion in 2024.

- Demand for high-performance magnets is critical for advanced robotics.

- Over 500,000 industrial robots were installed globally in 2023.

Electronics and Other Magnet Producers

The Electronics and Other Magnet Producers segment includes manufacturers who rely on MP Materials for a consistent supply of separated rare earth oxides, crucial for their non-integrated production processes. This diverse group also encompasses producers of high-performance magnets for specialty electronics, sensors, and medical devices. This broad customer base reduces reliance on any single industry, enhancing revenue stability for MP Materials.

- In 2024, global demand for rare earth magnets in electronics is projected to continue its robust growth.

- The medical device sector, for instance, saw a 2024 market value exceeding $550 billion globally, with high-performance magnets being a critical component.

- MP Materials' ability to supply essential inputs supports a wide array of specialized manufacturing.

- This diversification mitigates risks associated with market fluctuations in specific industries.

MP Materials serves critical high-growth sectors, including electric vehicle manufacturers, wind energy producers, and U.S. defense. Industrial automation, a market exceeding $230 billion in 2024, and electronics, with the medical device sector alone valued over $550 billion in 2024, also represent key segments. This diverse customer base, all requiring essential rare earth materials, underpins robust demand and revenue stability.

| Customer Segment | Key Need | 2024 Market Data |

|---|---|---|

| EV/Hybrid Automakers | NdFeB Magnets for Motors | Global EV sales continue upward trend |

| Industrial Automation/Robotics | High-Performance Magnets | Market over $230B; 500k+ robots (2023) |

| Medical Devices/Electronics | Separated Rare Earth Oxides | Medical device sector over $550B |

Cost Structure

Mining and processing operating costs represent MP Materials most significant expenditure, driven by the substantial fixed costs inherent in running a large-scale rare earth mine and chemical separation facility. These expenses, projected to be a major component of their 2024 financials, encompass significant labor wages, massive energy consumption for machinery and refining processes, the procurement of various chemical reagents, and ongoing equipment maintenance. This operational framework makes the business model inherently capital and energy-intensive, with energy costs alone being a critical factor in their overall profitability.

MP Materials' strategy requires enormous upfront investments in infrastructure, reflecting its capital-intensive nature. This includes the substantial cost of developing the Mountain Pass mine and building advanced processing facilities. A major focus is the Stage II separation facility and the construction of the new Stage III magnetics plant in Fort Worth, Texas. These multi-hundred-million-dollar projects are the primary use of capital; for example, the company guided 2024 capital expenditures to be between $450 million and $500 million.

Attracting and retaining highly skilled professionals, including geologists, engineers, and chemists, represents a substantial labor cost for MP Materials. Operating their Mountain Pass facility in California, a high-cost jurisdiction, further elevates these expenses. In 2024, competitive compensation packages are crucial to secure the specialized manufacturing technicians needed for rare earth processing. This investment in intellectual and operational capability is fundamental to their strategic advantage and production efficiency.

Environmental Compliance & Reclamation

Adhering to strict U.S. and California environmental standards represents a substantial and ongoing cost for MP Materials, critical for its operations at Mountain Pass. This includes significant expenses for advanced water treatment and recycling, comprehensive air quality control measures, and provisions for the eventual reclamation of the mine site. While a considerable financial outlay, these robust environmental practices also serve as a key source of competitive differentiation, especially given increasing global scrutiny on sustainable rare earth production. For instance, capital expenditures related to environmental upgrades and compliance are a continuous investment, crucial for maintaining operational licenses and meeting regulatory benchmarks in 2024.

- Ongoing investments ensure compliance with stringent U.S. and California environmental regulations.

- Costs include water treatment, air quality control, and mine site reclamation efforts.

- These environmental expenditures are a competitive advantage in the rare earth sector.

- MP Materials' capital outlays in 2024 reflect continuous commitment to these standards.

Research & Development Investment

MP Materials prioritizes significant R&D investment to refine its rare earth processing, enhance sustainable practices, and innovate new materials. This allocation, while a substantial cost, is critical for securing a long-term technological advantage and fostering future operational efficiencies. It functions as a strategic driver of future value, not merely a present expenditure.

- For Q1 2024, MP Materials reported research and development expenses of $1.5 million.

- This reflects a commitment to process improvements at Mountain Pass.

- Ongoing R&D supports the development of new rare earth products and technologies.

- The company aims to optimize its integrated magnetics facility through R&D.

MP Materials' cost structure is driven by capital-intensive mining and rare earth processing, with 2024 capital expenditures projected between $450 million and $500 million. Significant operational expenses include substantial energy consumption, labor for skilled professionals, and ongoing investments in environmental compliance. For Q1 2024, research and development expenses were $1.5 million. These costs are critical for maintaining production, technological advantage, and regulatory adherence.

| Cost Category | 2024 Projection/Data | Key Drivers |

|---|---|---|

| Capital Expenditures | $450M - $500M | Mine development, Stage II/III facilities |

| Operating Expenses | Major component of financials | Energy, labor, chemicals, maintenance |

| Research & Development | Q1 2024: $1.5M | Process improvements, new product development |

Revenue Streams

Sales of finished NdFeB magnets represent MP Materials' most strategic revenue stream, leveraging its Stage III vertical integration. By selling high-performance magnets directly to end-users like General Motors, the company captures maximum value across the supply chain. This direct sales model, particularly for EV motors, is projected to become the primary revenue driver by 2025. MP Materials anticipates significant ramp-up in NdFeB magnet production in 2024, supporting their long-term growth. This segment is crucial for maximizing profitability beyond rare earth oxide and metal sales.

The sale of high-purity rare earth oxides, particularly neodymium-praseodymium (NdPr) oxide, forms a crucial revenue stream for MP Materials. These specialized products are sold to a global customer base for manufacturing high-strength magnets and alloys essential for electric vehicles and wind turbines. This Stage II revenue, derived from separated products, has been the financial backbone supporting the company's significant expansion initiatives. In 2024, the NdPr oxide sales continue to be a primary driver of MP Materials' financial performance, underpinning their integrated strategy.

Revenue is generated directly from Department of Defense contracts, notably for strategic projects like the development of heavy rare earth processing capabilities at Mountain Pass. For instance, in 2024, MP Materials continued to secure significant non-dilutive funding, such as the $35 million awarded in 2023 by the DoD for a full-scale heavy rare earth separation facility, which serves as both a crucial revenue stream and a cost-offset for capital expenditures. This funding underscores the company's vital role in national security and domestic supply chain resilience.

Sales of Other Rare Earth Concentrates & Oxides

The refining process at Mountain Pass naturally produces a diverse array of rare earth elements, not exclusively neodymium-praseodymium. MP Materials strategically monetizes this full output by generating ancillary revenue from the sale of other rare earth products, such as cerium and lanthanum concentrates. While these elements command lower market prices compared to NdPr, their sale diversifies revenue streams and maximizes the value extracted from the mine. This approach ensures that all valuable outputs from the raw ore are converted into commercial products, contributing to overall profitability in 2024.

- Cerium and lanthanum concentrates contribute to diverse revenue streams.

- This monetizes the entire rare earth basket from the mining operation.

- While lower in value than NdPr, these sales enhance full mine output utilization.

- This strategy supports robust financial performance for MP Materials in 2024.

Potential Future Recycling & Tolling Services

MP Materials is exploring future revenue streams by offering recycling services for end-of-life magnets and manufacturing scrap. This strategic move aims to reclaim valuable rare earth elements, fostering a circular economy model. The company could also provide tolling services, processing materials for other companies for a fee, which represents another significant future opportunity.

- Recycling end-of-life magnets and manufacturing scrap.

- Reclaiming valuable rare earth elements.

- Establishing a circular economy for critical materials.

- Offering tolling services for other companies.

MP Materials diversifies revenue from NdPr oxide sales and growing NdFeB magnet sales, projected as the primary driver by 2025. DoD contracts, including 2024 funding, and sales of other rare earth products like cerium and lanthanum, further bolster income. Future streams include recycling and tolling services. The company sees significant magnet production ramp-up in 2024.

| Revenue Stream | 2024 Status | Outlook |

|---|---|---|

| NdPr Oxide Sales | Primary driver | Stable, foundational |

| NdFeB Magnets | Ramp-up | Primary by 2025 |

| DoD Contracts | Ongoing funding | Strategic support |

Business Model Canvas Data Sources

The MP Materials Business Model Canvas is built upon comprehensive market research, detailed operational data from its mining and processing facilities, and financial disclosures. These sources ensure a robust understanding of its unique position in the rare earth elements market.