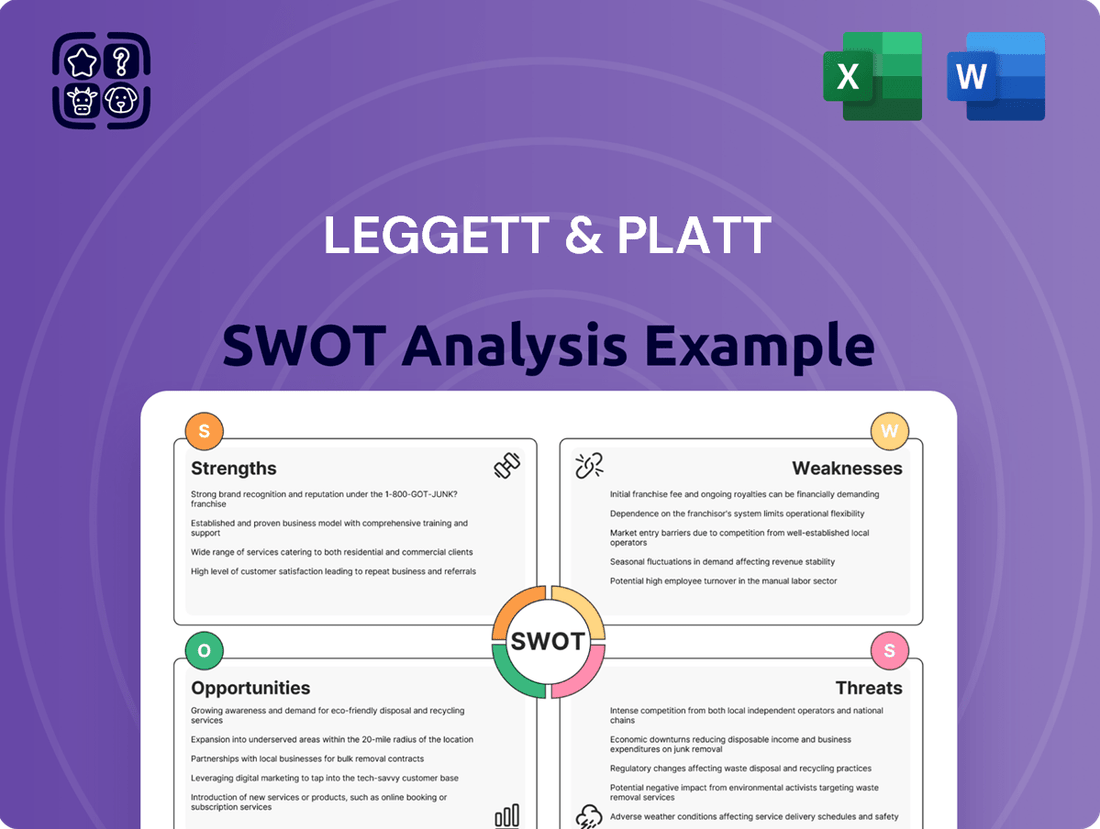

Leggett & Platt SWOT Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Leggett & Platt Bundle

Leggett & Platt's SWOT analysis reveals a company with a diversified product portfolio and a strong market presence, but also highlights potential challenges related to economic sensitivity and supply chain disruptions. Understanding these internal capabilities and external pressures is crucial for any investor or strategist looking to capitalize on their opportunities or mitigate their risks.

Want the full story behind Leggett & Platt's strengths, risks, and growth drivers? Purchase the complete SWOT analysis to gain access to a professionally written, fully editable report designed to support planning, pitches, and research.

Strengths

Leggett & Platt boasts a strong advantage with its highly diversified product portfolio, encompassing everything from bedding components to automotive seating systems and specialty chemicals. This breadth of offerings allows the company to serve a wide array of industries, effectively cushioning the impact of any single market's volatility. For instance, in 2023, their Bedding segment continued to be a significant contributor, while their Automotive segment showed resilience, demonstrating the strength of their varied market penetration.

Leggett & Platt holds strong competitive positions as a leading supplier across many of its operating segments. This leadership is built on a foundation of quality products and reliable customer service, fostering deep, long-standing relationships with a diverse global clientele.

The company's reach extends to manufacturers, retailers, and consumers in approximately 100 countries, underscoring its broad market penetration and established presence. For instance, in 2023, Leggett & Platt reported that its products were used in roughly 100 countries, highlighting its extensive international customer base.

Leggett & Platt's commitment to operational efficiency is a significant strength, underscored by its ongoing restructuring program launched in 2024 and extending through 2025. This initiative focuses on consolidating facilities and streamlining manufacturing, a move designed to sharpen the company's competitive edge.

These strategic maneuvers are already demonstrating tangible financial benefits, with reported realized EBIT gains. The company anticipates these efficiency improvements will continue to positively impact profitability and overall operational effectiveness.

Further reinforcing this strength, Leggett & Platt projects substantial annualized EBIT benefits stemming directly from these comprehensive restructuring efforts. This proactive approach signals a clear dedication to optimizing its operational footprint and driving enhanced financial performance.

Solid Operating Cash Flow and Balance Sheet Focus

Leggett & Platt consistently generates robust operating cash flow, a key strength that fuels its day-to-day operations and allows for strategic reinvestment. For instance, in the first quarter of 2024, the company reported operating cash flow of $227 million, demonstrating its ongoing ability to convert sales into cash.

The company's management is keenly focused on strengthening its balance sheet. This includes a concerted effort to reduce outstanding debt and maintain ample liquidity, providing a buffer against economic downturns. As of March 31, 2024, Leggett & Platt had $413 million in cash and cash equivalents, underscoring its liquidity position.

This dual emphasis on strong cash generation and balance sheet health creates significant financial resilience. It positions Leggett & Platt to navigate market volatility and pursue growth opportunities without undue financial strain.

- Consistent Operating Cash Flow: Demonstrated by $227 million in Q1 2024.

- Balance Sheet Prioritization: Focus on debt reduction and liquidity.

- Strong Liquidity: Holding $413 million in cash and equivalents at the end of Q1 2024.

- Financial Resilience: Ability to withstand market uncertainties due to financial discipline.

Sustainability Commitment and Innovation

Leggett & Platt's dedication to sustainability is a significant strength, clearly outlined in their 2024 Sustainability Report. This commitment spans environmental, social, and governance (ESG) areas, demonstrating a forward-thinking approach to business operations.

The company is actively developing innovative products with sustainability in mind, alongside improvements in ethical sourcing and environmental care. This focus not only enhances their brand image but also appeals to a growing segment of environmentally aware consumers.

These sustainability efforts are crucial for long-term business resilience. For instance, in 2023, Leggett & Platt reported a 14% reduction in Scope 1 and 2 greenhouse gas emissions intensity compared to their 2020 baseline, showcasing tangible progress.

Furthermore, their investment in sustainable materials and processes positions them favorably in a market increasingly prioritizing eco-friendly options. This strategic direction can lead to greater customer loyalty and a stronger competitive edge.

Leggett & Platt's diverse product mix acts as a significant strength, enabling it to serve multiple industries and mitigate risks associated with any single market's performance. This diversification is evident in its continued strong showing across segments like bedding and automotive, as reported in 2023.

The company solidifies its market standing by holding leading positions in many of its operational areas, built on a reputation for quality and dependable customer service. This has cultivated robust, long-term relationships with a global customer base.

Leggett & Platt's operational efficiency is a key advantage, bolstered by its 2024-2025 restructuring initiative focused on consolidating facilities and streamlining manufacturing. This strategy is projected to yield substantial annualized EBIT benefits.

The company demonstrates financial strength through consistent operating cash flow, as highlighted by $227 million generated in Q1 2024, and a proactive approach to strengthening its balance sheet by reducing debt and maintaining liquidity, evidenced by $413 million in cash and equivalents as of March 31, 2024.

What is included in the product

Delivers a strategic overview of Leggett & Platt’s internal and external business factors, highlighting their market position and potential for growth.

Identifies strategic vulnerabilities and opportunities for proactive risk mitigation.

Weaknesses

Leggett & Platt has grappled with a notable downturn in sales and volume across its essential business areas. This weakness is particularly pronounced in residential markets like bedding and furniture, as well as in the automotive and hydraulic cylinders sectors.

Throughout 2024 and into the first quarter of 2025, the company experienced a sales decline of 7% compared to the same period in the prior year. This persistent decrease is largely attributable to ongoing weak demand across these key segments.

Leggett & Platt's current restructuring efforts, while aimed at boosting efficiency and profitability, have unfortunately resulted in a noticeable impact on sales. The company anticipates an incremental sales attrition of approximately $45 million for the year 2025 due to these changes.

This reduction in sales, and the potential loss of market share it represents, presents a significant concern for Leggett & Platt's long-term growth prospects. While the restructuring might offer short-term benefits in terms of Earnings Before Interest and Taxes (EBIT), the ongoing sales attrition highlights a direct trade-off between immediate cost-saving measures and maintaining a strong market presence.

Leggett & Platt's financial structure is burdened by significant debt, standing at $1.9 billion as of March 31, 2025. This includes a notable amount of commercial paper, indicating a reliance on short-term borrowing. The company's net debt to trailing 12-month adjusted EBITDA ratio of 3.77x highlights a substantial leverage position.

This high level of debt presents a critical challenge for the company's financial management. Elevated leverage can constrain Leggett & Platt's ability to pursue new growth opportunities or respond to unexpected economic downturns. Furthermore, it increases the company's vulnerability to rising interest rates, potentially impacting profitability and cash flow.

Exposure to Cyclical Industries and Demand Volatility

Leggett & Platt's reliance on industries such as residential furniture and automotive exposes it significantly to economic downturns. When consumers cut back on big-ticket items like furniture or new cars due to economic uncertainty or higher interest rates, Leggett & Platt feels the impact directly through reduced demand. This sensitivity to the broader economic cycle creates inherent volatility in its sales performance.

This demand volatility presents a persistent challenge for forecasting and managing inventory and production levels. For instance, Leggett & Platt's 2025 sales outlook, as guided by the company, likely incorporates a degree of caution stemming from these cyclical pressures. The company's performance is therefore closely tied to the health of the overall economy and consumer spending habits.

- Exposure to Residential Furniture: A significant portion of Leggett & Platt's revenue is tied to the residential furniture market, which is highly sensitive to consumer discretionary spending.

- Automotive Industry Dependence: The company's automotive segment faces fluctuations based on new vehicle production and sales, directly impacted by economic conditions and consumer confidence.

- Impact of Interest Rates: Elevated interest rates can dampen demand for large purchases like furniture and vehicles, negatively affecting Leggett & Platt's sales.

- Forecasting Challenges: The cyclical nature of its core markets makes consistent sales forecasting and operational planning more difficult.

Raw Material Cost Pressures and Metal Margin Compression

Leggett & Platt has faced significant headwinds from volatile raw material costs, especially for steel, a key component in its diverse product lines. These fluctuations have directly squeezed their metal margins, forcing price reductions that have negatively impacted overall sales and profitability. For instance, during the first quarter of 2024, the company reported that increased steel costs contributed to a decline in its adjusted EBITDA margin.

The company's performance is particularly sensitive to steel prices, which saw considerable volatility throughout 2023 and into early 2024. This input cost pressure has led to a challenging environment where even with higher sales volumes in some segments, the profitability per unit has diminished due to the need to pass on some of the cost increases or absorb them to remain competitive. Managing these ongoing input cost pressures remains a critical and persistent challenge for Leggett & Platt's operational efficiency and financial health.

- Volatile Steel Prices: Fluctuations in the cost of steel directly impact Leggett & Platt's production expenses.

- Margin Compression: Rising raw material costs have led to a reduction in profit margins on metal-based products.

- Reduced Selling Prices: The company has had to decrease selling prices in response to raw material cost decreases, affecting top-line revenue.

- Persistent Challenge: Effectively managing these input cost pressures is an ongoing operational hurdle.

Leggett & Platt's sales have been declining, with a 7% drop in the first quarter of 2025 compared to the prior year, driven by weak demand in key areas like bedding, furniture, and automotive. The company's ongoing restructuring efforts are expected to cause approximately $45 million in sales attrition in 2025, raising concerns about market share loss despite potential short-term efficiency gains.

The company carries a substantial debt burden of $1.9 billion as of March 31, 2025, with a net debt to adjusted EBITDA ratio of 3.77x, indicating significant financial leverage that could hinder growth and increase vulnerability to interest rate hikes.

Leggett & Platt's reliance on cyclical industries like residential furniture and automotive makes it highly susceptible to economic downturns and fluctuating consumer spending, complicating sales forecasting and operational planning.

Volatile raw material costs, particularly for steel, have squeezed margins and forced price adjustments, negatively impacting profitability, as evidenced by a decline in adjusted EBITDA margins in early 2024 due to increased steel costs.

Same Document Delivered

Leggett & Platt SWOT Analysis

This preview reflects the real document you'll receive—professional, structured, and ready to use. You're getting a genuine glimpse into the detailed Leggett & Platt SWOT analysis. The full, comprehensive report is unlocked immediately after your purchase. This ensures you have all the insights you need without any hidden surprises.

Opportunities

Leggett & Platt's comprehensive restructuring plan is a significant opportunity, poised to deliver ongoing financial advantages. This strategic initiative, which involves consolidating facilities and streamlining operations, is projected to continue yielding substantial annualized earnings before interest and taxes (EBIT) benefits.

For 2025, the company anticipates realizing an incremental EBIT benefit in the range of $35 million to $40 million. This targeted focus on enhancing efficiency and reducing costs is crucial for bolstering the company's financial performance and improving profit margins, especially as market conditions gradually stabilize.

Leggett & Platt is undertaking a thorough review of its business segments to identify areas that best align with its long-term strategic vision. This proactive approach is designed to sharpen the company's focus and optimize resource allocation.

As part of this strategic recalibration, the company is exploring the potential divestiture of its Aerospace division. This move is intended to streamline the overall portfolio, allowing for a more concentrated effort on core, high-growth areas.

The sale of the Aerospace business, if completed, could unlock significant value and provide additional capital. For instance, in 2023, the Aerospace segment generated approximately $334 million in revenue, representing a notable portion of the company's overall sales.

Proceeds from such a divestiture could be reinvested into businesses with stronger growth prospects or used to strengthen the balance sheet, ultimately contributing to a more agile and financially robust enterprise. This strategic evaluation is key to positioning Leggett & Platt for future success in a dynamic market.

Leggett & Platt has a significant opportunity to boost its growth by concentrating on developing new products and incorporating more high-value elements into its existing lines. This means looking for ways to enhance what they offer, making their products more appealing and profitable.

A key area for this is in the bedding sector, where they can further combine their expertise in both innerspring and foam technologies to create more complete, finished mattresses. This integration allows for greater control over the final product and potentially higher margins.

Furthermore, the automotive industry presents another avenue for innovation. Continuing to develop advanced and specialized products for vehicles can help Leggett & Platt stand out in a competitive market and secure a larger share of more lucrative segments.

For instance, by innovating in areas like advanced seating solutions or specialized automotive components, Leggett & Platt can differentiate itself. This strategy not only strengthens its market position but also targets higher-margin business opportunities, contributing to overall financial performance.

Growth in Specific Product Areas Despite Overall Declines

Even as some parts of Leggett & Platt’s business faced headwinds, specific product areas demonstrated notable strength. For example, the Bedding Products segment saw an increase in higher trade rod and wire sales, indicating demand in that niche. Similarly, the Textiles division experienced growth, contributing positively to the company's overall performance.

These pockets of resilience offer clear opportunities for targeted investment and strategic focus. By channeling resources into these growing segments, Leggett & Platt can leverage existing momentum. For 2023, while overall sales declined, the company noted that its Bedding segment's volume was impacted by lower demand, but average selling prices increased, and wire sales within Bedding showed strength.

Management has highlighted the importance of focusing on these areas. For instance, the company's strategic review in 2023 identified opportunities to capitalize on the positive trends within certain product lines. The company's commitment to innovation in these specific areas is expected to drive future growth.

Key areas of opportunity include:

- Increased demand for specialized rod and wire products within the Bedding segment.

- Expansion of offerings and market share in the growing Textiles division.

- Leveraging product innovation to further penetrate resilient market niches.

Improving Operational Efficiencies Beyond Formal Restructuring

Leggett & Platt is actively seeking efficiency gains beyond its formal restructuring. A key focus area is the implementation of superior processes within its Specialty Foam operations. The company also aims to boost profitability in its Automotive segment by reducing costs and integrating more automation.

These ongoing initiatives are designed to yield lasting improvements in the company's financial performance. For instance, the company has been investing in automation, with capital expenditures on property, plant, and equipment totaling $223.4 million in 2023, signaling a commitment to modernizing its operations for greater efficiency.

- Specialty Foam: Adoption of best-in-class manufacturing processes to streamline production and reduce waste.

- Automotive Segment: Targeted cost reduction programs and increased automation to improve margins.

- Continuous Improvement: A company-wide philosophy focused on incremental enhancements to drive sustained profitability.

Leggett & Platt's strategic focus on optimizing its business portfolio presents a significant opportunity. The potential divestiture of the Aerospace division, which generated $334 million in revenue in 2023, could unlock capital for reinvestment in higher-growth areas or balance sheet strengthening.

Further opportunities lie in product innovation, particularly within the Bedding segment, by integrating innerspring and foam technologies for higher-margin finished mattresses. The automotive sector also offers potential through advanced seating solutions and specialized components, aiming for more lucrative market segments.

Despite some segment challenges, specific areas like the Bedding Products' trade rod and wire sales and the Textiles division showed resilience and growth in 2023, indicating strong potential for targeted investment and expansion.

The company's ongoing pursuit of operational efficiencies, including investments in automation totaling $223.4 million in 2023, promises sustained profitability improvements across its Specialty Foam and Automotive segments.

Threats

Leggett & Platt faces a significant threat from persistently weak demand in its key residential markets, especially within the U.S. and European bedding and home furniture segments. This prolonged softness has demonstrably hampered sales volumes throughout 2024.

Company projections indicate this challenging demand environment is likely to continue, presenting an ongoing obstacle to achieving robust sales recovery and impacting overall financial performance for the foreseeable future.

Broader economic headwinds are a significant concern for Leggett & Platt. Elevated interest rates, for instance, make it more expensive for consumers and businesses to finance purchases of goods like furniture and bedding, which directly impacts demand for the company's products. This can lead to reduced sales volumes and ultimately affect profitability across its various business segments.

The specter of a potential recession also looms large, further contributing to cautious consumer spending. When economic outlooks are uncertain, households tend to cut back on discretionary purchases. As a manufacturer tied to cyclical industries, Leggett & Platt is particularly vulnerable to these shifts, as demand for its components and finished goods can decline sharply during economic downturns.

For example, in the first quarter of 2024, Leggett & Platt reported a net sales decrease of 10% compared to the prior year, reflecting some of these macroeconomic pressures. This illustrates how sensitive the company's performance is to broader economic trends and consumer sentiment.

Leggett & Platt operates in intensely competitive markets where numerous companies vie for customers with similar products. This crowded field necessitates constant vigilance and adaptation to stay ahead. For instance, the bedding components segment, a key area for L&P, sees strong competition from both domestic and international players, impacting pricing power.

Foreign manufacturers, in particular, pose a significant threat. Their often lower production costs can translate into more aggressive pricing, directly challenging Leggett & Platt's market share and profitability. This pressure requires L&P to focus on operational efficiency and innovation to maintain its competitive edge, especially as global supply chains become more interconnected.

The need for continuous innovation and stringent cost management is paramount in this environment. Companies like Leggett & Platt must invest in research and development to differentiate their offerings while simultaneously optimizing their supply chain and manufacturing processes to keep costs in check. Failure to do so could lead to erosion of market position and reduced earnings potential.

Supply Chain Disruptions and Cost Volatility

Leggett & Platt continues to navigate a landscape where supply chain snags remain a significant concern. While some areas have seen improvement, the company still faces potential disruptions from shortages of crucial components like foam chemicals and semiconductors. These material scarcities can directly impact manufacturing output and the ability to meet customer demand.

The cost of raw materials, particularly steel, presents another persistent threat. Fluctuations in steel prices can directly increase Leggett & Platt's operational expenses, squeezing profit margins. This cost volatility also poses a risk to production timelines, potentially delaying product delivery and affecting customer satisfaction.

- Supply Chain Vulnerability: Shortages of foam chemicals and semiconductors remain a risk.

- Freight Challenges: Continued disruptions in freight logistics can impact delivery efficiency.

- Raw Material Cost Volatility: Fluctuations in steel prices directly affect operational costs.

- Margin Pressure: Increased input costs threaten to reduce profitability.

- Production Schedule Impacts: Disruptions can lead to delays in manufacturing and delivery.

Regulatory and Geopolitical Risks

Leggett & Platt must navigate a complex landscape of evolving regulations. For instance, stricter environmental standards, particularly those addressing climate change impacts, could necessitate significant capital investments in cleaner technologies and updated manufacturing processes, potentially increasing operational costs. As of early 2024, the focus on ESG (Environmental, Social, and Governance) reporting continues to intensify, with companies like Leggett & Platt facing increased scrutiny and compliance burdens.

Geopolitical instability presents another significant threat. Disruptions stemming from international conflicts can directly impact global supply chains, as seen with the semiconductor shortages that affected various manufacturing sectors throughout 2022 and 2023, potentially hindering production and increasing material costs for Leggett & Platt's diverse product lines.

Data protection laws, such as GDPR and CCPA, are also becoming more stringent. Ensuring compliance across the company's operations, especially concerning customer and employee data, requires ongoing investment in cybersecurity measures and data management systems, adding to overhead expenses.

The cumulative effect of these regulatory and geopolitical risks can lead to increased compliance costs and potential operational interruptions, directly impacting the company's financial performance and strategic flexibility.

- Environmental Regulations: Increased costs for compliance with climate-related standards.

- Geopolitical Instability: Supply chain disruptions and material cost volatility.

- Data Protection Laws: Investment in cybersecurity and data management systems.

- Compliance Costs: Potential for higher operational overhead and reduced profit margins.

Leggett & Platt faces significant threats from ongoing weakness in key residential markets, particularly in the U.S. and Europe for bedding and home furniture. This persistent demand softness, evident throughout 2024, directly impacts sales volumes and is projected to continue, hindering recovery. Economic headwinds, including elevated interest rates, make financing purchases more expensive, dampening consumer and business spending on goods like furniture.

The competitive landscape is intense, with foreign manufacturers often leveraging lower costs to offer more aggressive pricing, pressuring Leggett & Platt's market share and profitability. Supply chain vulnerabilities, such as shortages of foam chemicals and semiconductors, alongside volatile raw material costs like steel, continue to pose risks to production and margins. For example, in Q1 2024, net sales decreased by 10%, reflecting these pressures.

Additionally, evolving regulations, especially environmental standards, may require substantial capital investments, increasing operational costs. Geopolitical instability can further disrupt supply chains and increase material expenses, while stringent data protection laws necessitate ongoing investment in cybersecurity. These factors collectively contribute to higher compliance costs and potential operational interruptions.

SWOT Analysis Data Sources

This Leggett & Platt SWOT analysis is built upon a robust foundation of information, drawing from official financial filings, comprehensive market research reports, and expert industry analyses to provide a well-rounded and insightful perspective.