Leggett & Platt Boston Consulting Group Matrix

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Leggett & Platt Bundle

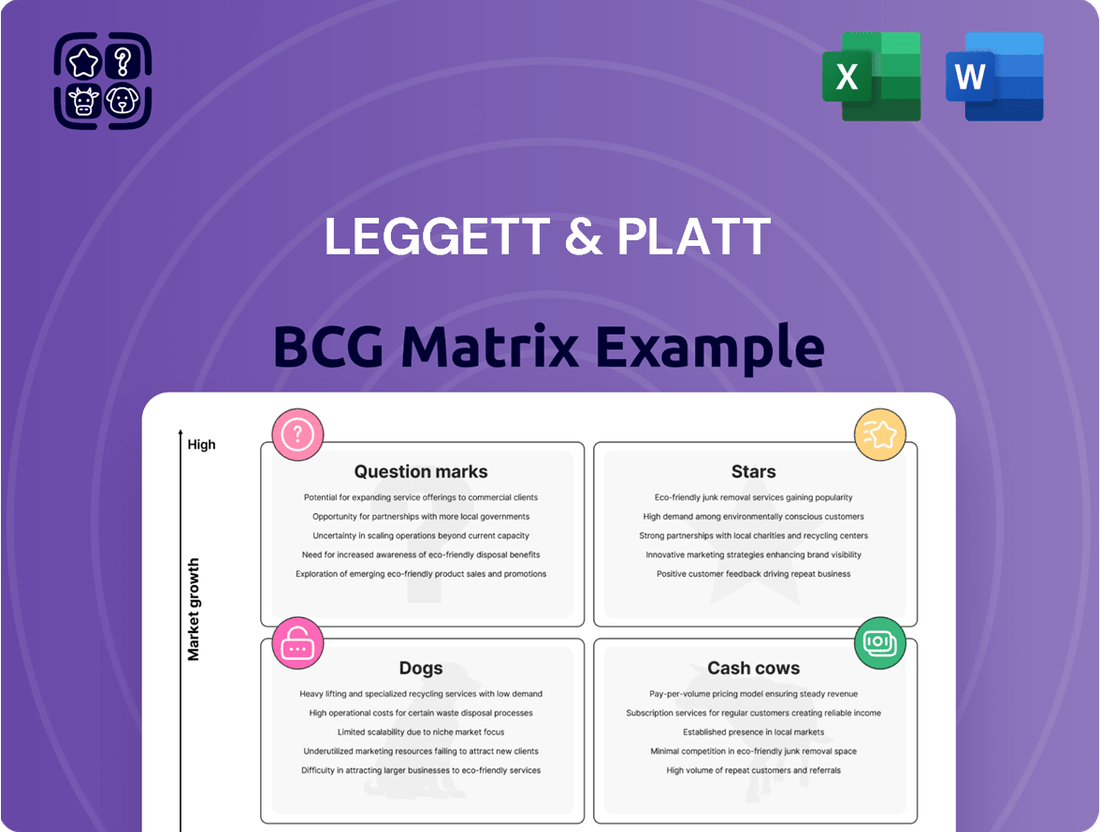

Leggett & Platt's BCG Matrix is a powerful tool for understanding its diverse product portfolio. This strategic framework helps categorize each business unit based on market share and market growth, revealing critical insights into their current performance and future potential.

Imagine knowing which of Leggett & Platt's offerings are market leaders (Stars), which are reliable cash generators (Cash Cows), which are lagging behind (Dogs), and which hold uncertain promise (Question Marks).

This preview offers a glimpse into that strategic clarity, but to truly grasp the nuances and actionable intelligence, you need the complete picture.

Purchase the full BCG Matrix to gain a comprehensive breakdown of each segment, empowering you to make informed decisions about resource allocation, investment, and strategic direction.

Don't just understand the theory; unlock the practical application of the BCG Matrix for Leggett & Platt and chart a course for sustained growth and profitability.

Stars

Leggett & Platt's Geo Components business showed resilience in Q1 2025, exceeding expectations despite initial weather-related slowdowns in the civil construction market. The company anticipates sustained robust demand within this sector, highlighting a growing market segment where Geo Components holds a significant competitive advantage. This upward trajectory, bolstered by an established market footprint, strongly positions Geo Components as a potential Star within Leggett & Platt's portfolio.

Despite a challenging overall bedding market, Leggett & Platt's Trade Rod and Wire Sales demonstrated resilience. In Q1 2025, trade rod sales were notably strong, and trade wire sales remained steady, acting as a crucial buffer against downturns in other bedding segments. This performance highlights a persistent demand for these essential components within their specific market niche.

This sustained demand for trade rod and wire, key inputs for many manufacturers, signals a solid market standing for Leggett & Platt in this area. Their ability to maintain sales even when the broader bedding industry experiences softness positions these product lines favorably for continued expansion within their respective segments.

Leggett & Platt's Aerospace Tubing and Fabricated Assemblies, prior to its divestiture, demonstrated characteristics of a Star within the company's portfolio. This segment experienced robust demand and growth, which was instrumental in counterbalancing downturns in other Specialized Products divisions. Its focus on intricate tube and duct assemblies for both commercial and military aircraft, along with space launch vehicles, placed it in a high-growth, specialized sector.

The aerospace industry, a key market for this segment, has shown resilience and expansion. For instance, the global aerospace market size was valued at approximately $874.5 billion in 2023 and is projected to grow. This environment supported the strong performance metrics of Leggett & Platt's aerospace unit, positioning it as a Star.

The strategic decision to divest this segment was driven by portfolio optimization, not a reflection of the unit's performance. Companies often divest strong-performing but non-core assets to streamline operations and focus on primary business areas. This move aimed to enhance overall strategic focus and capital allocation for Leggett & Platt.

Innovation in Higher-Value Bedding Content

Leggett & Platt's 2024 restructuring targets innovation in higher-value bedding content, responding to evolving customer and end-consumer demands. This strategic shift focuses on premium components designed to meet a market increasingly seeking differentiation and advanced features.

This emphasis on premium bedding components, if it resonates with market demand, could see these innovative offerings become future stars within the company's portfolio. By 2024, the bedding industry saw a growing consumer preference for enhanced comfort and technological integration in mattresses and accessories.

- Focus on premium materials and advanced construction techniques.

- Development of smart bedding features and enhanced ergonomic designs.

- Targeting a market segment willing to pay a premium for superior sleep solutions.

Operational Efficiency Improvements

Leggett & Platt's focus on operational efficiency is a key driver for its Stars. The company's 2024 restructuring plan and positive Q1 2025 results underscore this commitment. These efforts are not just about cost-cutting; they translate into tangible benefits like improved profitability and expanded margins.

These internal strengths directly bolster the competitive standing of Leggett & Platt's more successful product lines. By operating more leanly and profitably, these segments are better positioned to capitalize on growth opportunities within their respective markets.

Essentially, enhanced efficiency allows these Stars to gain market share more effectively and at a higher profit level. This virtuous cycle reinforces their dominance and potential for future expansion.

- Focus on Cost Optimization: Leggett & Platt's 2024 restructuring aimed to streamline operations, a move that typically enhances efficiency.

- Margin Expansion: Q1 2025 results indicated margin improvements, a direct outcome of effective operational management.

- Competitive Advantage: Operational efficiency strengthens the ability of Star products to outcompete rivals in growing markets.

- Profitability Enhancement: Improved efficiency directly contributes to higher profitability for the company's leading product segments.

Leggett & Platt's Geo Components business is a prime example of a Star. Its resilience in Q1 2025, exceeding expectations in the civil construction market, showcases strong demand and a competitive edge. This upward trajectory, supported by an established market footprint, solidifies its position as a Star.

The Trade Rod and Wire Sales also demonstrate Star characteristics, maintaining steady performance even when the broader bedding market faced challenges. This consistent demand for essential components highlights a solid market standing and potential for continued expansion.

Leggett & Platt's former Aerospace Tubing and Fabricated Assemblies segment was also a Star, experiencing robust growth that countered downturns elsewhere. Its specialization in high-demand aerospace components placed it in a strong, growing sector before its strategic divestiture.

The company's 2024 focus on innovative, premium bedding components, designed to meet evolving consumer preferences for advanced features, also has the potential to become a Star. This strategic shift targets a market segment seeking superior sleep solutions, a growing trend by 2024.

| Business Segment | Market Growth | Competitive Position | Star Potential |

|---|---|---|---|

| Geo Components | High (Civil Construction) | Strong | High |

| Trade Rod & Wire | Steady (Bedding Components) | Strong | High |

| Aerospace Tubing & Fabricated Assemblies (Divested) | High (Aerospace) | Strong | High (Historically) |

| Innovative Bedding Components | Growing (Premium Bedding) | Developing | High (Future Potential) |

What is included in the product

The Leggett & Platt BCG Matrix analyzes its diverse business units by market share and growth rate.

It guides strategic decisions on investing in Stars, milking Cash Cows, nurturing Question Marks, and divesting Dogs.

Clear visualization of Leggett & Platt's portfolio, reducing strategic uncertainty.

Cash Cows

Leggett & Platt's traditional bedding components represent a classic cash cow. Even with recent softness in U.S. and European bedding markets, this segment is projected to account for 39% of their net trade sales in 2025.

Despite low market growth, Leggett & Platt holds a dominant market share, enabling substantial cash flow generation. This consistent cash infusion is critical for funding the company's strategic investments and managing its debt obligations.

Leggett & Platt's automotive seat comfort and convenience systems, particularly their seat support and lumbar technologies, are firmly positioned as Cash Cows. Despite a noticeable softening in automotive demand during the latter half of 2024 and into early 2025, the company's deep-rooted market penetration and existing long-term supplier agreements provide a stable foundation for consistent cash flow. This segment is expected to continue generating significant, reliable cash, even with tempered growth expectations. For instance, in 2023, Leggett & Platt reported approximately $4.4 billion in total revenue, with their Automotive segment contributing a substantial portion, underscoring the segment's maturity and cash-generating power.

Leggett & Platt's flooring underlayment segment is a classic cash cow. Operating within the mature flooring industry, this business benefits from a well-established market position and predictable demand, even as growth opportunities are limited. This maturity translates into a steady stream of reliable cash flow for the company.

The company has been actively restructuring its flooring underlayment operations. These efforts are designed to streamline processes and boost efficiency. The goal is to maximize the cash-generating potential of this mature business segment.

Home Furniture Components

Home Furniture Components, a segment where Leggett & Platt provides essential parts, is a classic example of a Cash Cow within their business portfolio. Despite the furniture market experiencing subdued demand in 2024, this division continues to be a reliable generator of substantial cash flow.

This stability is a direct result of Leggett & Platt's established market dominance in a mature, low-growth industry. The consistent cash generated here is crucial, as it fuels investments in other, more promising business units, effectively subsidizing their growth initiatives.

- Mature Market: The home furniture components sector is characterized by slow growth and high market saturation.

- Strong Market Share: Leggett & Platt holds a leading position, ensuring consistent revenue despite economic headwinds.

- Cash Generation: The business reliably produces significant cash, vital for funding other L&P segments.

- 2024 Outlook: While facing weak demand, the segment's profitability remains robust due to its established cost structure and market position.

Drawn Steel Wire and Steel Rod Production

Leggett & Platt's internal production of drawn steel wire and steel rod is a vital component of their business, underpinning numerous product lines, notably bedding. This capability is a classic example of a Cash Cow within the BCG Matrix.

Despite a general trend of declining volumes across some segments of Leggett & Platt's operations, the sales figures for trade rod and wire demonstrate a persistent and strong demand for these essential materials. For instance, in the first quarter of 2024, sales within the Steel Products segment, which includes rod and wire, remained a significant contributor to the company's overall revenue, reflecting this steady demand.

This foundational production capacity is not only critical for Leggett & Platt's internal supply chain but also generates consistent revenue from external sales. Operating in a relatively stable commodity market, these operations benefit from predictable demand, allowing them to act as a reliable source of cash flow for the company.

- Core Input: Steel rod and wire production is essential for many Leggett & Platt products, especially in the bedding sector.

- Sustained Demand: Strong trade sales of rod and wire show ongoing high-volume requirements for these materials, even with overall volume shifts.

- Stable Market: The commodity nature of steel rod and wire contributes to a predictable market environment, supporting consistent cash generation.

- 2024 Performance: The Steel Products segment, encompassing these operations, continued to be a stable revenue driver for Leggett & Platt in early 2024.

Leggett & Platt's bedding components, a long-standing pillar of their business, continue to function as a cash cow. Despite a challenging market for bedding in 2024, this segment is projected to remain a significant contributor to overall sales, representing approximately 39% of net trade sales in 2025. Its dominance in a mature, low-growth market ensures a steady and reliable cash flow, crucial for funding other areas of the company.

Preview = Final Product

Leggett & Platt BCG Matrix

The Leggett & Platt BCG Matrix document you are currently previewing is the exact, fully formatted report you will receive immediately after purchase. This comprehensive analysis, designed for strategic insight, will be delivered without any watermarks or demo content, ensuring you get a professional and ready-to-use tool for your business planning.

Dogs

Leggett & Platt's Specialty Foam segment faced a significant downturn in 2024 due to the planned exit of a major customer. This event, coupled with existing demand softness in the market, led to a substantial reduction in sales volume, impacting the segment's overall performance and profitability.

The company reported that this customer exit was anticipated, but its full effect became apparent in late 2024 and continued into Q1 2025. This situation aligns with the characteristics of a Dog in the BCG matrix, where the business unit has low market share and low growth prospects, requiring careful management of resources.

Given the combined pressures of customer loss and market headwinds, Specialty Foam is currently consuming resources without generating commensurate returns. This strategic position necessitates a review of its future viability and resource allocation within Leggett & Platt's broader portfolio.

Leggett & Platt's Hydraulic Cylinders segment likely falls into the 'Dog' quadrant of the BCG Matrix. This is due to a reported demand softening in the latter half of 2024, with projections indicating continued weak demand throughout 2025.

The company is actively restructuring this business. This restructuring effort, coupled with the challenging demand environment, suggests a low market share within a low-growth industry, characteristic of a Dog.

Leggett & Platt's legacy innerspring operations in Mexico and China are being repositioned as Dogs within its BCG Matrix. In 2024, the company announced a significant restructuring, which includes exiting its Mexican innerspring business entirely and scaling back its operations in China. This move suggests these segments were not generating the desired returns or market traction.

The decision to withdraw from Mexico and downsize in China points to these innerspring operations facing challenges, likely characterized by low market share and stagnant or declining growth prospects. For instance, while specific financial data for these individual operations isn't publicly detailed, Leggett & Platt's overall Bedding segment revenue saw a modest increase in the first quarter of 2024, indicating a mixed performance across its bedding product lines, with some areas requiring divestment or consolidation.

Certain Consolidated Bedding Facilities

Leggett & Platt's strategic consolidation of up to 15 bedding facilities, impacting approximately $100 million in annual sales, signals a move to divest underperforming assets. These facilities likely operated in a mature, low-growth segment of the bedding market with limited market share, making their consolidation a logical step for improving overall operational efficiency. This action aligns with a typical Stars and Question Marks rebalancing within a BCG Matrix framework, shedding assets that no longer contribute significantly to growth or profitability.

The decision to consolidate these bedding facilities points to a proactive management approach in addressing operational inefficiencies and optimizing the company's footprint.

- Facility Consolidation: Leggett & Platt plans to consolidate up to 15 bedding facilities.

- Sales Impact: This consolidation is expected to reduce annual sales by approximately $100 million.

- Strategic Rationale: The move indicates the divestiture of underperforming assets, likely those with low market share in low-growth segments.

- BCG Matrix Implication: This aligns with divesting "Dogs" or underperforming "Question Marks" to focus resources on more promising areas.

Divested Small U.S. Machinery Business

Leggett & Platt's early March 2025 divestiture of a small U.S. machinery business aligns with its strategic repositioning. This action strongly suggests the business unit was categorized as a Dog within the BCG Matrix, characterized by a low market share and limited growth potential.

Such a move is typical when a company aims to streamline operations and focus resources on more promising segments. For instance, in 2024, Leggett & Platt reported a focus on optimizing its portfolio, which often involves shedding underperforming assets.

- Divestiture Rationale: The machinery business likely exhibited declining revenues or profitability, making it a candidate for divestment to improve overall company performance.

- Strategic Alignment: This unit probably did not fit with Leggett & Platt's future growth strategies or competitive advantages.

- Resource Reallocation: Proceeds from the sale can be reinvested in core businesses or areas with higher growth prospects.

- BCG Matrix Placement: Its low market share and likely low growth prospects firmly place it in the Dog quadrant.

Leggett & Platt's Specialty Foam segment, impacted by a major customer exit in 2024 and market softness, exhibits Dog characteristics due to low market share and growth prospects.

The Hydraulic Cylinders segment is also likely a Dog, facing continued weak demand throughout 2025 and undergoing restructuring, indicating low growth and market share.

Legacy innerspring operations in Mexico and China, with restructuring and exits in 2024, are repositioned as Dogs due to challenges and low growth potential.

Consolidation of up to 15 bedding facilities, affecting $100 million in sales, signifies divestiture of underperforming assets with low market share in low-growth segments, aligning with shedding Dogs.

| Business Segment | BCG Quadrant | Key Indicators |

| Specialty Foam | Dog | Major customer exit (2024), market softness |

| Hydraulic Cylinders | Dog | Weak demand (2024-2025), restructuring |

| Legacy Innerspring (Mexico/China) | Dog | Exits/scaling back (2024), low growth prospects |

| Consolidated Bedding Facilities | Dog | Underperforming assets, low market share in mature segments |

Question Marks

Leggett & Platt's strategic pivot towards innovation and premium bedding products, a move initiated post-restructuring, positions these new offerings as Question Marks within their portfolio. This category signifies products with potential for significant growth, fueled by increasing consumer interest in advanced bedding technologies and comfort features. For instance, the company has highlighted a focus on integrated cooling technologies and personalized support systems as key areas for differentiation in the evolving bedding market.

Currently, these high-value bedding lines exhibit a low market share, a characteristic typical of emerging products or those in the early stages of market penetration. Despite the promising market growth trajectory, driven by consumer demand for enhanced sleep experiences, Leggett & Platt is still in the process of establishing and scaling these innovative product introductions. The company's 2024 investor communications have emphasized the importance of these new, higher-margin product lines as a cornerstone of their future growth strategy.

Leggett & Platt's 'Specialized Products' segment, encompassing specialty foams, is likely investigating novel applications for its materials. These emerging areas, such as advanced packaging solutions for sensitive electronics or specialized acoustic dampening in electric vehicles, represent potential Stars in the BCG matrix. For instance, the automotive sector's increasing demand for lightweight, sound-absorbing materials, driven by electrification trends, presents a significant growth avenue. While specific new applications may currently hold a low market share, their high growth potential positions them as key future contributors.

Leggett & Platt's investments in operational efficiency technologies can be viewed through the lens of a strategic product development. These aren't tangible goods sold externally, but rather internal advancements designed to boost profitability. The company is actively upgrading its systems and processes to streamline operations and reduce costs.

These technology upgrades fall into a high-growth strategic area, mirroring a 'star' in the BCG matrix due to the widespread adoption and benefits of efficiency technologies across industries. However, their immediate impact on Leggett & Platt's overall efficiency and profitability, akin to market share, might be relatively low during the initial implementation phases. This represents a strategic investment with long-term potential.

For instance, in 2023, Leggett & Platt reported capital expenditures of $342.6 million, with a significant portion allocated to enhancing manufacturing capabilities and automation. This focus on internal operational improvements is crucial for maintaining competitiveness in a dynamic market.

Strategic Portfolio Review Initiatives

Leggett & Platt's strategic portfolio review initiatives are actively probing for new growth avenues, a critical component of their BCG matrix analysis. This involves a deep dive into existing business units to identify those that truly align with the company's long-term vision and possess the potential for significant expansion. The company is essentially looking to nurture potential "Stars" by identifying and investing in nascent ventures that, while currently small in market share, exhibit characteristics of high future growth. For instance, in early 2024, Leggett & Platt announced its intention to explore strategic alternatives for its Bedding Components segment, signaling a potential shift in portfolio focus and the identification of areas requiring re-evaluation for optimal long-term fit.

These strategic moves are designed to uncover and cultivate businesses that are currently in the "Question Marks" quadrant of the BCG matrix. These are businesses operating in high-growth markets but with relatively low market share, requiring significant investment to capture a larger portion of the market. Leggett & Platt's commitment to this evaluation process underscores a proactive approach to portfolio management, aiming to reallocate resources towards opportunities with the highest potential return on investment. As of their latest reporting, the company's focus on innovation and diversification suggests a deliberate effort to build a stronger future pipeline.

- Portfolio Optimization: Assessing which business units represent the best long-term strategic fit, potentially leading to divestitures or significant reinvestment.

- New Venture Exploration: Actively seeking out and evaluating emerging market opportunities and innovative business models.

- Resource Allocation: Directing capital and management attention towards identified high-growth potential areas, even if currently small.

- Risk Mitigation: Proactively addressing underperforming or non-strategic assets to improve overall company performance and resilience.

Steel-Related Tariff Benefits for Domestic Production

Leggett & Platt anticipates that steel-related tariffs will provide a significant tailwind for domestic production, particularly in the bedding sector. These tariffs are expected to bolster demand for locally sourced materials, potentially offsetting anticipated volume declines. This creates a classic Question Mark scenario for L&P, presenting a high-growth opportunity where swift market share capture is crucial to capitalize on the favorable pricing environment. For instance, in 2024, the average price of hot-rolled steel coil saw fluctuations, but the overall trend suggests increased costs for imported steel, making domestic alternatives more competitive.

The strategic implications for Leggett & Platt are clear: leverage the tariff benefits to gain an edge.

- Tariff Impact: Increased cost of imported steel makes domestic steel more attractive, boosting demand for L&P's domestically produced components.

- Market Opportunity: The bedding industry, facing lower volumes, can find renewed growth potential through domestically sourced materials made more cost-effective by tariffs.

- Strategic Imperative: L&P must invest in capacity and marketing to rapidly increase market share in this tariff-advantaged segment.

- 2025 Outlook: The company expects these benefits to directly counter volume weakness, highlighting the strategic importance of this developing market dynamic.

Leggett & Platt's focus on innovative bedding products, such as those with advanced cooling or personalized support, represents a strategic move into a high-growth market. These new offerings currently have a low market share, characteristic of Question Marks, requiring significant investment to capture market potential. The company’s 2024 investor communications highlighted these premium lines as crucial for future growth.

The company's exploration of new applications for its specialized foams, potentially in areas like advanced electronics packaging or electric vehicle acoustics, also falls into the Question Mark category. These ventures operate in high-growth sectors but are in their nascent stages for L&P, needing strategic investment to develop market share. This aligns with the company's ongoing review of its portfolio for future growth opportunities.

The impact of steel tariffs presents another Question Mark for Leggett & Platt, creating a high-growth opportunity in domestic production, particularly for bedding components. To capitalize on this, the company must invest in capacity and marketing to quickly gain market share in this tariff-advantaged segment, with 2025 outlooks suggesting these benefits will offset volume weakness.

| Category | Market Growth | Market Share | Strategic Implication |

| Innovative Bedding Products | High | Low | Invest to gain share, capitalize on consumer demand for advanced sleep technology. |

| New Foam Applications | High | Low | Strategic investment in R&D and market development for emerging sectors. |

| Tariff-Advantaged Steel Products | High | Low | Rapid capacity and marketing investment to capture share driven by favorable domestic pricing. |

BCG Matrix Data Sources

Our BCG Matrix is built on verified market intelligence, combining financial data, industry research, official reports, and expert commentary to ensure reliable, high-impact insights.