Leggett & Platt PESTLE Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Leggett & Platt Bundle

Navigate the complex external landscape affecting Leggett & Platt with our comprehensive PESTLE analysis. Understand how political shifts, economic volatility, and evolving social trends are impacting their operations and market position. Gain actionable insights into technological advancements and environmental regulations that could shape future growth. This ready-to-use analysis is perfect for investors and strategic planners seeking a competitive edge. Download the full version now and unlock the intelligence you need to make informed decisions.

Political factors

Leggett & Platt, a global manufacturer, navigates a complex landscape shaped by international trade policies and tariffs. These directly affect the cost of essential raw materials, such as steel, and finished goods like innersprings and mattresses. Fluctuations in these policies can lead to higher import expenses, necessitate adjustments in sales pricing, and alter the company's competitive standing in various markets.

The company explicitly acknowledges these trade-related challenges in its 2024 annual report, identifying increased trade costs, including tariffs, as a significant risk factor. For instance, in early 2024, the US continued to evaluate Section 232 tariffs on steel imports, which directly impacts Leggett & Platt's input costs for many of its U.S.-based manufacturing operations.

Geopolitical tensions, particularly the ongoing situation between China and Taiwan, represent a significant risk for Leggett & Platt's extensive global supply chains and manufacturing operations. The company's automotive division, which relies heavily on semiconductor components, is especially vulnerable to any disruptions within the global semiconductor industry. These potential supply chain interruptions could directly impact production and product availability.

Leggett & Platt acknowledges these critical geopolitical risks, explicitly detailing them within its 2024 annual report. This highlights the company's awareness of how global political instability can directly influence its business performance and operational continuity. The company's reliance on international markets and diverse manufacturing locations means it must actively monitor and mitigate these evolving geopolitical landscapes.

Government regulations, particularly those concerning environmental protection and labor standards, significantly shape Leggett & Platt's operating expenses and the necessity for adherence. The company actively implements policies to ensure all operations align with current laws, projecting that ongoing compliance will not materially impact its capital spending, profitability, or market standing.

Recent legal scrutiny, such as actions by the U.S. Department of Labor concerning hiring practices, highlights the critical and continuous need for stringent compliance measures across the organization. For instance, in 2023, the company reported general compliance costs that were not deemed material to its financial statements, though specific regulatory changes could alter this outlook.

Government Spending and Economic Stimulus

Government spending significantly impacts Leggett & Platt's markets. For instance, increased federal spending on housing initiatives, like those aimed at boosting affordable housing construction, directly fuels demand for building materials and components that Leggett & Platt supplies. Similarly, infrastructure projects can boost demand for certain industrial components. The US government's focus on infrastructure renewal, with significant allocations in recent years, could indirectly benefit segments of Leggett & Platt's business, particularly those serving construction and manufacturing sectors.

Economic stimulus packages, while broad, can also indirectly support Leggett & Platt. For example, measures designed to boost consumer spending can lead to higher demand for furniture and bedding, key markets for the company. In 2024, the Federal Reserve's monetary policy, including any potential rate adjustments, will continue to influence borrowing costs for consumers and businesses, impacting durable goods purchases. Leggett & Platt's diversified product lines mean it navigates a range of government-influenced economic trends, from residential construction to automotive manufacturing.

- Housing Market Influence: Government policies supporting homeownership or construction, such as mortgage interest deductions or housing development grants, can increase demand for Leggett & Platt's bedding components and building materials.

- Infrastructure Spending: Federal and state investments in infrastructure projects, like highway or bridge construction, can drive demand for industrial products and engineered components used in these sectors.

- Macroeconomic Stimulus: Broader economic stimulus measures aimed at boosting consumer confidence and spending can indirectly benefit Leggett & Platt by increasing sales of furniture, bedding, and automotive interiors.

- Regulatory Environment: Government regulations concerning environmental standards, safety, or trade policies can affect manufacturing costs and market access for Leggett & Platt's diverse product portfolio.

Political Stability in Operating Regions

Political stability in the 18 countries where Leggett & Platt operates is paramount for its global manufacturing network, which includes 135 facilities. Any significant political shifts or unexpected policy changes in these operating regions, particularly those affecting tax structures or trade agreements, pose a direct risk to the company's financial health and the smooth functioning of its supply chains. For instance, the company's 2024 annual report explicitly highlights the potential impact of alterations in U.S. or foreign legal and legislative frameworks as a key risk factor.

These political uncertainties can manifest in various ways, directly influencing operational costs and market access.

- Regulatory Changes: New or revised regulations concerning environmental standards, labor laws, or product safety can increase compliance costs and necessitate operational adjustments.

- Trade Policies: Fluctuations in tariffs, import/export restrictions, or the imposition of new trade barriers can disrupt the flow of raw materials and finished goods, impacting profitability.

- Taxation: Modifications to corporate tax rates, the introduction of new taxes, or changes in tax treaty agreements can directly affect Leggett & Platt's net income and cash flow.

- Geopolitical Instability: Broader geopolitical tensions or conflicts in operating regions can lead to supply chain disruptions, increased security costs, and potential damage to physical assets.

Government policies significantly influence Leggett & Platt's operations, from trade agreements impacting raw material costs to regulations on environmental and labor standards. The company must navigate these evolving political landscapes, as highlighted in its 2024 reports, to manage compliance costs and maintain market access across its 18 operating countries. Political stability is crucial for its 135 global facilities, with shifts in tax structures or trade policies posing direct risks.

Government spending on initiatives like infrastructure and housing directly boosts demand for Leggett & Platt's products, while macroeconomic stimulus can indirectly support sales of furniture and bedding. For instance, ongoing U.S. infrastructure investments could benefit segments serving construction. The company's 2024 financial statements indicate that general compliance costs were not material, but specific regulatory changes could alter this outlook.

The company's extensive global supply chain, including its automotive division's reliance on semiconductors, is particularly vulnerable to geopolitical tensions, such as those involving China and Taiwan. Leggett & Platt's 2024 annual report explicitly identifies these geopolitical risks as significant, underscoring the need for active monitoring and mitigation strategies to ensure operational continuity and product availability.

Political Factors Affecting Leggett & Platt (2024-2025 Outlook)

| Factor | Impact on Leggett & Platt | Data/Example (2024-2025) |

| Trade Policies & Tariffs | Increased costs for raw materials (steel) and finished goods; affects pricing and competitiveness. | US Section 232 tariffs on steel imports continued to be evaluated in early 2024, directly impacting input costs. |

| Geopolitical Instability | Disruptions to global supply chains and manufacturing, particularly for automotive semiconductors. | Ongoing tensions between China and Taiwan pose a significant risk to the company's extensive global operations. |

| Government Regulations | Impacts operating expenses and requires adherence to environmental and labor standards. | Company projects ongoing compliance will not materially impact capital spending or profitability; noted U.S. Dept. of Labor scrutiny in 2023. |

| Government Spending & Stimulus | Boosts demand for building materials, components, furniture, and bedding; influences consumer spending. | US infrastructure spending and potential Federal Reserve monetary policy adjustments in 2024 influence borrowing costs and durable goods purchases. |

What is included in the product

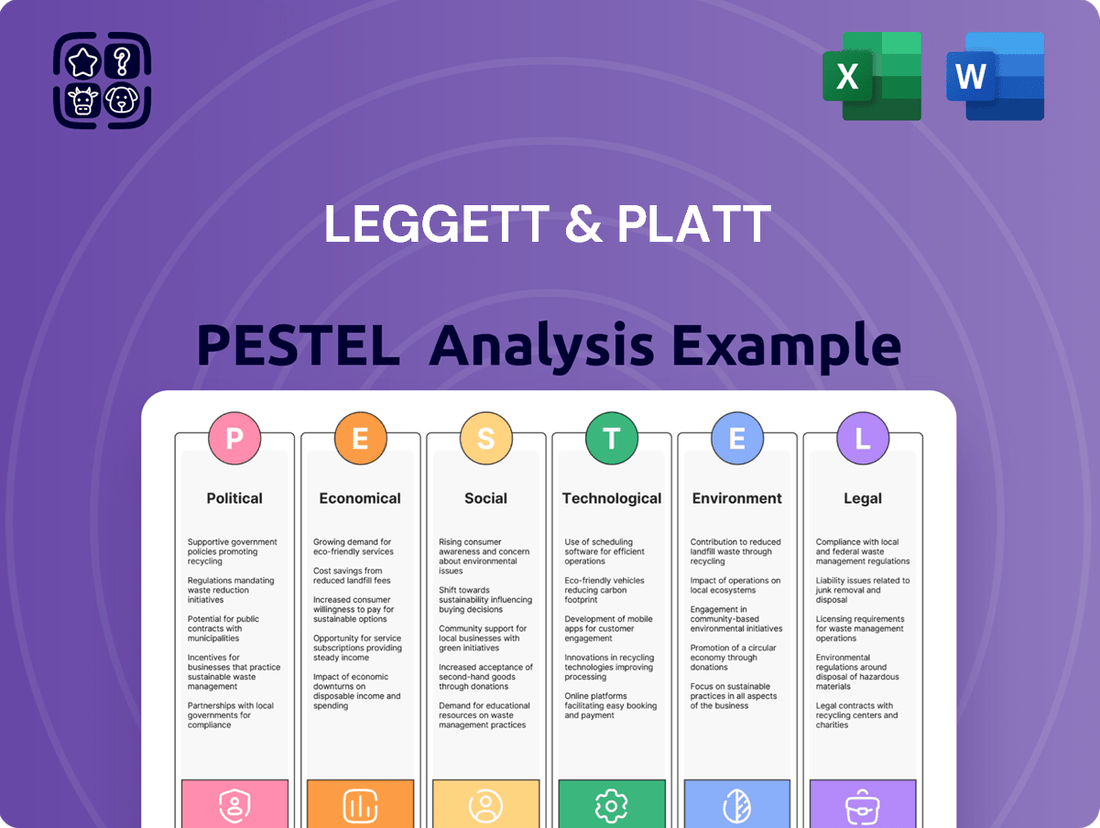

This PESTLE analysis provides a comprehensive examination of the external macro-environmental factors influencing Leggett & Platt, covering Political, Economic, Social, Technological, Environmental, and Legal dimensions.

Provides a concise overview of external factors impacting Leggett & Platt, simplifying complex market dynamics for strategic decision-making.

Economic factors

Leggett & Platt's revenue streams are intrinsically linked to the pulse of global economic growth and the willingness of consumers to spend. This connection is especially pronounced in its core residential markets for bedding and furniture, as well as within the automotive industry. For instance, the company's 2024 financial results reflected this reality, showing the impact of persistent softness in demand across its residential segments.

The automotive and Hydraulic Cylinders divisions also experienced a noticeable cooling in demand during the same period. Economic instability often translates into lower consumer confidence, leading individuals to postpone significant purchases like furniture or vehicles. Furthermore, businesses tend to scale back capital expenditures during uncertain times, which directly dampens sales volumes for companies like Leggett & Platt that supply components to these sectors.

Fluctuations in the cost of essential raw materials like steel and chemicals directly impact Leggett & Platt's profitability. In 2024, the company faced challenges with raw material-related selling price decreases and compressed metal margins, though these were somewhat mitigated by efficiency gains.

The company's capacity to absorb or transfer rising raw material expenses to its customers is a key determinant of its sustained profit margins. For instance, in Q1 2024, Leggett & Platt reported that raw material costs were a significant factor influencing their financial performance, contributing to a 3% decrease in net sales compared to the prior year's first quarter.

Interest rate fluctuations directly impact consumer spending on major purchases such as homes and cars. For Leggett & Platt, this means changes in demand for their bedding components and residential furniture, as higher borrowing costs deter consumers. For instance, a 0.25% increase in the Federal Reserve's benchmark rate, as seen in early 2024, can translate to noticeably higher monthly payments on mortgages and auto loans, potentially dampening sales for L&P's customers.

Furthermore, rising interest rates elevate Leggett & Platt's own cost of capital. This affects their ability to finance operations, invest in new projects, and manage existing debt. With the company actively working to reduce its debt load, a sustained period of higher interest rates could slow deleveraging efforts and constrain financial flexibility through 2024 and into 2025.

Currency Exchange Rate Fluctuations

Leggett & Platt, as a global entity with operations spanning multiple countries, faces significant risks tied to currency exchange rate fluctuations. These shifts can directly influence how competitive its products appear in international markets and, importantly, impact the company's reported financial performance when overseas earnings are translated back into U.S. dollars. For instance, in the first quarter of 2025, adverse currency movements contributed to a reduction in reported sales within certain business segments for Leggett & Platt.

The volatility of exchange rates presents a dynamic challenge for companies like Leggett & Platt. A stronger U.S. dollar, for example, can make American goods more expensive for foreign buyers, potentially dampening demand. Conversely, a weaker dollar can boost export competitiveness but also increase the cost of imported materials. These constant movements require careful management and hedging strategies to mitigate financial impacts.

- Impact on Competitiveness: Exchange rate shifts can alter the price points of Leggett & Platt's products in international markets, affecting sales volumes.

- Financial Reporting Effects: Fluctuations directly influence the value of foreign earnings when converted to U.S. dollars, impacting the company's consolidated financial statements.

- Q1 2025 Sales: Currency headwinds were noted as a factor that reduced sales in specific segments during the first quarter of 2025 for Leggett & Platt.

Housing and Automotive Market Health

The health of the housing market is a significant economic driver for Leggett & Platt. Strong housing starts and robust consumer spending on home furnishings directly translate to increased demand for the company's bedding components, such as innersprings and adjustable bases, as well as flooring underlayment. Conversely, a downturn in housing construction and renovation can dampen sales for these product lines.

Similarly, the automotive industry's performance is crucial for Leggett & Platt's automotive segment, which produces seat support systems and other components. Higher vehicle production and sales generally lead to greater demand for these specialized products. The company's financial reports for 2024 indicated that weakened demand in both the U.S. and European bedding markets, coupled with a noticeable softening in its automotive businesses, had a direct negative impact on overall sales volume.

For instance, in Q1 2024, Leggett & Platt reported a 7% decrease in total sales, with specific segments experiencing more pronounced declines. The Residential Furnishings segment, heavily reliant on housing market activity, saw sales fall by 10%, while the Automotive segment experienced a 5% drop. This highlights the direct correlation between these consumer-facing markets and the company's top-line performance.

- Housing Market Impact: Demand for bedding components and flooring underlayment is directly tied to new home construction and renovation activity.

- Automotive Market Impact: Sales of seat support systems and other automotive components are influenced by vehicle production and sales volumes.

- 2024 Performance Data: Leggett & Platt experienced reduced sales volume in 2024 due to weak demand in U.S. and European bedding markets and a softening automotive sector.

- Segmental Declines: In Q1 2024, the Residential Furnishings segment sales decreased by 10%, and the Automotive segment sales fell by 5%.

Economic factors significantly shape Leggett & Platt's performance by influencing consumer spending and raw material costs. Persistent softness in demand across residential and automotive sectors, as seen in 2024, directly impacts sales volumes. Fluctuations in raw material prices, such as steel, also compress profit margins, with efficiency gains playing a role in mitigation efforts.

Interest rate changes affect consumer purchasing power for big-ticket items and influence the company's cost of capital. Currency exchange rate volatility can alter international competitiveness and impact reported foreign earnings. The health of the housing and automotive markets remains a critical determinant of demand for Leggett & Platt's diverse product lines.

| Economic Factor | Impact on Leggett & Platt | 2024/2025 Data Example |

| Consumer Spending & Demand | Lower disposable income or confidence reduces purchases of furniture, bedding, and vehicles. | Weakness in U.S. and European bedding markets, plus automotive softening, reduced overall sales volume in 2024. |

| Raw Material Costs | Increases in steel, chemicals, etc., squeeze profit margins if not passed on to customers. | Q1 2024 saw raw material costs contributing to a 3% decrease in net sales. |

| Interest Rates | Higher rates deter consumer borrowing for homes/cars and increase the company's cost of debt. | Fed rate hikes in early 2024 could slow Leggett & Platt's debt reduction efforts. |

| Currency Exchange Rates | Adverse movements can reduce the value of foreign sales when converted to USD and affect export pricing. | Q1 2025 experienced currency headwinds reducing sales in specific segments. |

Same Document Delivered

Leggett & Platt PESTLE Analysis

The preview shown here is the exact document you’ll receive after purchase—fully formatted and ready to use. This comprehensive PESTLE analysis of Leggett & Platt delves into the Political, Economic, Social, Technological, Legal, and Environmental factors impacting the company's operations and strategic decisions. Understanding these external forces is crucial for any stakeholder looking to assess Leggett & Platt's market position and future outlook.

Sociological factors

Leggett & Platt is keenly observing shifting consumer tastes, particularly the growing desire for home goods that are environmentally friendly, technologically advanced, or tailored to individual needs. This trend directly shapes how the company approaches new product design and how it communicates with its customer base. For instance, the automotive sector is seeing a push for lighter materials that enhance fuel economy, a demand Leggett & Platt is addressing with its component solutions.

Demographic shifts, such as an aging population and increasing urbanization, are significantly reshaping consumer needs. By 2024, the global population aged 65 and over is projected to reach over 770 million, a trend that can increase demand for adaptable and comfortable home furnishings, potentially benefiting Leggett & Platt's adjustable bed bases and specialized seating components. Urbanization, with a growing percentage of the world's population living in cities, influences household size and living space requirements, pushing demand towards more compact and multi-functional furniture solutions.

These long-term societal changes necessitate that Leggett & Platt continually adapt its product portfolio. For instance, evolving household formation patterns, including smaller family units and an increase in single-person households, directly impact the demand for specific furniture sizes and types. The company must remain agile in its product development to align with these evolving living spaces and preferences to maintain its market position.

Leggett & Platt's manufacturing success hinges on a skilled workforce, manageable labor costs, and high employee engagement. In 2024, the company continued to focus on its people, aiming to foster a supportive environment and a robust company culture through strategic talent acquisition and retention initiatives.

Recent labor reviews underscore the critical need for fair hiring and equal employment opportunities, reflecting broader societal expectations and influencing Leggett & Platt's approach to workforce management. These factors directly impact operational efficiency and the company's ability to innovate and adapt in a competitive market.

Health and Safety Standards

Societal expectations for robust health and safety standards significantly influence Leggett & Platt's operational strategies and resource allocation towards safety initiatives. This societal push encourages companies like Leggett & Platt to prioritize worker well-being, often translating into stricter internal protocols and investments in advanced safety equipment and training.

Leggett & Platt actively manages its commitment to workplace safety through its SafeGuard program, a comprehensive health and safety management system designed to minimize risks and prevent accidents. The company's dedication to this system is reflected in its performance metrics, with an incident rate consistently reported as lower than the industry average, underscoring its proactive approach to safeguarding its workforce.

- 2023 Safety Performance: Leggett & Platt reported a Total Recordable Incident Rate (TRIR) of 1.63 in 2023, which is notably below the Bureau of Labor Statistics (BLS) manufacturing average for that year.

- SafeGuard Program Focus: The SafeGuard system emphasizes hazard identification, risk assessment, and continuous improvement in safety procedures across all company facilities.

- Employee Training Investment: Significant resources are allocated annually to employee training programs focused on safety awareness, proper equipment operation, and emergency response protocols.

- Regulatory Compliance: The company adheres to all Occupational Safety and Health Administration (OSHA) regulations and often implements internal standards that exceed these minimum requirements to foster a culture of safety.

Corporate Social Responsibility and Brand Reputation

Consumers and stakeholders are increasingly scrutinizing corporate behavior, demanding tangible commitments to social responsibility and ethical operations. This heightened expectation directly influences brand perception and loyalty, making robust Corporate Social Responsibility (CSR) a critical differentiator. Companies demonstrating genuine dedication to environmental, social, and governance (ESG) principles often enjoy stronger brand reputations and greater stakeholder trust.

Leggett & Platt explicitly details its commitment to ESG principles, encompassing ethical business conduct, respect for human rights, and active community involvement within its sustainability reports. For example, in its 2023 ESG Report, the company highlighted initiatives focused on reducing its environmental footprint and enhancing employee well-being. This transparency and action contribute significantly to building and maintaining a positive brand image.

The company's focus on CSR directly impacts its brand reputation and fosters trust among its diverse stakeholders. This includes individual consumers who are more likely to purchase from brands aligned with their values, as well as institutional investors who increasingly integrate ESG factors into their investment decisions. Leggett & Platt's reported progress in areas such as diversity and inclusion, as noted in their 2024 proxy statement, further bolsters this reputation.

- Consumer Preference: Studies show a growing percentage of consumers, often exceeding 70% in recent surveys, prefer to buy from brands with demonstrated social responsibility.

- Investor Focus: ESG funds saw substantial inflows in 2024, indicating institutional investors' commitment to companies with strong CSR performance.

- Employee Attraction: A strong CSR record can improve employee recruitment and retention, with many job seekers prioritizing ethical employers.

- Risk Mitigation: Proactive CSR can reduce reputational damage and regulatory scrutiny, safeguarding brand value.

Societal expectations regarding ethical business practices and corporate social responsibility significantly influence Leggett & Platt's operational strategies and market positioning. Consumers and investors alike are increasingly prioritizing companies that demonstrate a commitment to environmental stewardship, social equity, and sound governance (ESG). This trend is evident in consumer purchasing habits, where a notable percentage, often exceeding 70% in recent surveys, favor brands with a proven track record of social responsibility.

Leggett & Platt addresses these expectations by integrating ESG principles into its core business, as highlighted in its 2023 ESG Report which detailed efforts in environmental footprint reduction and employee well-being. Furthermore, the company's 2024 proxy statement emphasizes progress in areas like diversity and inclusion, reinforcing its dedication to ethical operations and enhancing brand reputation. This focus is critical as ESG funds continued to attract substantial investment inflows throughout 2024, signaling institutional investor preference for companies with strong CSR performance.

Technological factors

Leggett & Platt's embrace of advanced manufacturing, including automation and robotics, is key to boosting efficiency and cutting costs. In 2024, the company initiated a restructuring plan specifically designed to streamline its manufacturing operations and consolidate production sites, directly targeting improved operational performance.

These technological advancements are projected to significantly enhance product quality and, consequently, bolster profitability. For instance, the automotive sector, a significant market for Leggett & Platt's components, saw industrial robot installations increase by 6% globally in 2023, reaching a new record of 553,000 units, indicating a strong industry trend toward automation that Leggett & Platt can leverage.

Innovations in material science are a significant technological driver for Leggett & Platt. The development of lighter, stronger, and more sustainable materials directly influences their product design and manufacturing. For instance, advancements in composite materials could lead to more durable yet lighter furniture components, reducing shipping costs and environmental impact.

Leggett & Platt is actively pursuing product innovation, with a focus on lightweight materials that enhance fuel efficiency in automotive applications. Their automotive division, which provides seating solutions and components, benefits immensely from materials that reduce vehicle weight, thereby improving gas mileage. This focus aligns with the broader industry trend towards electrification and lightweighting in automotive manufacturing.

The company's commitment to material science innovation is evident in its ongoing research and development efforts. By integrating new materials, Leggett & Platt aims to create products that offer superior performance, durability, and sustainability, giving them a competitive edge. For example, in 2023, the company continued to explore advanced polymers and alloys for their bedding and furniture segments, seeking to balance cost-effectiveness with enhanced product features.

Leggett & Platt's commitment to research and development is a crucial technological factor, driving innovation across its diverse product lines. The company consistently invests in R&D to create novel bedding components, enhance automotive seating technologies, and refine specialty foam formulations. This focus ensures they remain at the forefront, offering customers solutions that meet evolving market demands.

In 2023, Leggett & Platt reported $159.5 million in selling, general, and administrative expenses, a significant portion of which is allocated to R&D efforts aimed at product development and process improvement. This investment is vital for maintaining their competitive advantage in the furniture, bedding, and automotive sectors, particularly as they introduce new materials and manufacturing techniques.

Smart Home and Automotive Technologies

The increasing prevalence of smart home and automotive technologies offers Leggett & Platt significant avenues for product innovation. Imagine smart bedding that adjusts to sleep patterns or advanced automotive seating with integrated climate control and massage features. These advancements align with consumer demand for connected and personalized experiences.

The automotive sector's pivot towards electrification is a key technological driver. This shift necessitates lighter, more durable, and potentially more sustainable components for vehicles, presenting opportunities for Leggett & Platt's materials and seating solutions. For example, the global electric vehicle market was valued at approximately $396.6 billion in 2023 and is projected to grow substantially, creating a larger market for innovative automotive interior components.

- Smart Home Integration: Opportunities exist to embed sensors and connectivity into bedding, furniture, and other home goods for enhanced comfort and functionality.

- Automotive Innovation: Development of advanced seating systems focusing on ergonomics, lightweight materials, and integrated smart features for electric and autonomous vehicles.

- Sustainable Materials: Leveraging new materials and manufacturing processes to meet the sustainability demands driven by both smart home and automotive electrification trends.

Data Analytics and Supply Chain Optimization

Leggett & Platt is increasingly leveraging data analytics to sharpen its supply chain management, aiming for greater efficiency and quicker responses to market shifts. This involves sophisticated demand forecasting and gaining deeper operational insights across its network.

The company's commitment to supply chain resilience is evident in how its team approaches supplier assessment. A key focus is on evaluating and strengthening cybersecurity controls among its partners, recognizing the interconnected risks in today's digital landscape.

To bolster these efforts, Leggett & Platt utilizes a third-party risk-monitoring platform. This tool helps them proactively identify and mitigate potential vulnerabilities stemming from their external supplier relationships, ensuring a more secure and reliable supply chain.

For instance, in 2023, Leggett & Platt reported that advancements in their supply chain technology and data utilization contributed to improved inventory management, with a goal to reduce carrying costs by approximately 5% in the upcoming fiscal year. This reflects a tangible benefit derived from their technological investments in analytics.

- Data-driven demand forecasting to minimize stockouts and overstock situations.

- Enhanced supplier risk assessment with a strong emphasis on cybersecurity.

- Implementation of third-party risk monitoring platforms for proactive threat detection.

- Operational insights derived from analytics to drive efficiency and responsiveness.

Leggett & Platt is actively integrating advanced manufacturing technologies, including automation and robotics, to boost operational efficiency and reduce costs. The company's 2024 restructuring plan, focused on streamlining production, directly supports this technological drive.

Innovations in material science are also pivotal, with a focus on developing lighter, stronger, and more sustainable materials. This is particularly relevant for their automotive division, where lighter components can improve fuel efficiency, aligning with the industry's trend towards electrification.

The company's investment in research and development, totaling $159.5 million in SG&A expenses in 2023, fuels product innovation across its segments, from smart home integration to advanced automotive seating.

Leveraging data analytics for supply chain management is another key technological factor, enabling better demand forecasting and supplier risk assessment, particularly concerning cybersecurity. These efforts aim to improve inventory management and operational responsiveness.

| Technological Factor | Description | Impact on Leggett & Platt | Relevant Data/Trend |

| Automation & Robotics | Implementing advanced machinery for manufacturing processes. | Increased efficiency, reduced labor costs, improved product consistency. | Global industrial robot installations grew by 6% in 2023. |

| Material Science Innovation | Developing and utilizing new, advanced materials. | Lighter, stronger, more sustainable products; reduced shipping costs. | Focus on advanced polymers and alloys for furniture and bedding segments (2023). |

| Smart Technology Integration | Embedding connectivity and intelligence into products. | Enhanced consumer experience, new product functionalities in home and automotive. | Growth in smart home and electric vehicle markets. |

| Data Analytics & AI | Utilizing data for forecasting, optimization, and risk management. | Improved supply chain efficiency, better inventory control, enhanced cybersecurity. | Goal to reduce inventory carrying costs by 5% through technology (2023). |

Legal factors

Leggett & Platt, like all manufacturers, must navigate a complex web of product safety and quality regulations across its global markets. For instance, in the United States, the Consumer Product Safety Commission (CPSC) sets standards for furniture safety, impacting Leggett & Platt's bedding and furniture components. Failure to comply can lead to significant penalties and reputational damage, as seen with past recalls in the furniture industry impacting millions of dollars in potential losses.

Adherence to these stringent rules is not just a legal obligation but a cornerstone of consumer trust. In 2024, reports indicated that product liability claims in the manufacturing sector cost businesses billions annually, highlighting the financial risks of non-compliance. Leggett & Platt's commitment to quality inherently means meeting and often exceeding these mandated safety benchmarks, ensuring their products are reliable and safe for end-users.

Intellectual property laws are fundamental to Leggett & Platt's business, particularly for its innovations in engineered components and bedding technologies. The company relies on patents to protect its unique product designs and manufacturing processes, ensuring its competitive edge. For instance, in 2023, Leggett & Platt continued to invest in research and development, a significant portion of which is aimed at creating new, patentable technologies. The strength and enforcement of these IP laws directly impact the company's ability to monetize its R&D investments and maintain market share.

Leggett & Platt must navigate a complex web of labor and employment laws, encompassing wage and hour rules, anti-discrimination statutes, and workplace safety mandates. Failure to comply can result in significant penalties and reputational damage.

The U.S. Department of Labor's 2024 review of a Leggett & Platt facility concerning alleged hiring discrimination underscores the critical need for strict adherence to federal employment laws, such as Executive Order 11246. This highlights the ongoing scrutiny of employment practices.

For instance, in 2023, the Equal Employment Opportunity Commission (EEOC) reported over 70,000 private sector discrimination charges filed, indicating a robust enforcement environment that companies like Leggett & Platt must proactively address.

International Trade Laws and Anti-dumping Duties

Leggett & Platt navigates a complex web of international trade laws, particularly those concerning anti-dumping and countervailing duties. These regulations directly affect the cost of imported raw materials and finished products crucial to its operations.

For instance, duties imposed on innersprings, a key component in Leggett & Platt's bedding segment, can significantly alter its cost structure. Similarly, tariffs on steel wire rod, a fundamental input for many of its products, and on finished mattresses directly impact profitability and pricing strategies.

The enforcement of these duties can reshape the competitive landscape by making imported goods more expensive, potentially benefiting domestic producers. However, it also presents challenges for Leggett & Platt, which sources globally.

- Impact on Material Costs: Anti-dumping duties on steel wire rod can increase manufacturing expenses for Leggett & Platt's various divisions.

- Competitive Dynamics: Tariffs on imported innersprings and finished mattresses can shift market share towards domestic production, affecting Leggett & Platt's sourcing and sales strategies.

- Regulatory Compliance: The company must remain vigilant in adhering to evolving international trade regulations to avoid penalties and disruptions.

- 2024/2025 Outlook: Ongoing trade disputes and potential new tariffs in key markets for furniture and bedding components present a continued risk to Leggett & Platt's cost management and market access.

Data Privacy and Cybersecurity Regulations

Leggett & Platt, like all modern businesses, faces a complex web of data privacy and cybersecurity regulations. As digital operations expand, adherence to laws such as the EU's General Data Protection Regulation (GDPR) and California's Consumer Privacy Act (CCPA) is paramount. These regulations govern how the company collects, stores, and processes personal data, with significant penalties for non-compliance.

The company's commitment to cybersecurity extends into its supply chain, a critical area given the interconnected nature of modern business. Protecting sensitive company and customer data from breaches is not just a legal necessity but also crucial for maintaining trust and operational integrity. In 2024, reported data breaches in the manufacturing sector continued to rise, underscoring the ongoing challenge.

Specific to Leggett & Platt's operational context, compliance with these evolving legal frameworks requires robust internal controls and continuous monitoring. This includes:

- Data Protection Officer appointments and ongoing training for employees handling personal data.

- Regular cybersecurity audits and penetration testing to identify and address vulnerabilities.

- Implementing strong encryption and access control measures for all digital assets.

- Developing and maintaining incident response plans to effectively manage potential data breaches.

Legal factors significantly shape Leggett & Platt's operational landscape, demanding strict adherence to product safety standards, intellectual property rights, and labor laws. The company's global reach necessitates navigating diverse international trade regulations, including anti-dumping duties and tariffs, which directly impact material costs and competitive dynamics.

Environmental factors

The demand for robust sustainability and ESG reporting is intensifying, with investors, consumers, and regulators all pushing for greater transparency from companies like Leggett & Platt. This means Leggett & Platt must actively showcase its environmental, social, and governance performance.

Leggett & Platt's commitment is demonstrated through its 2024 Sustainability Report, which outlines its current strategies and advancements in ESG. This report serves as a key document in communicating their progress to stakeholders.

Furthermore, the company is strategically aligning its future ESG disclosures with the International Sustainability Standards Board (ISSB) standards. This move, expected to be fully implemented by fiscal year 2025, signifies a proactive approach to meet evolving global reporting benchmarks, ensuring comparability and credibility in their sustainability data.

Responsible sourcing of key materials like steel and chemicals is a significant environmental focus for Leggett & Platt. The company's commitment to sustainability extends to its global supply chain, where rigorous supplier qualification and risk management are in place to ensure ethical practices. This approach is crucial given the increasing scrutiny on the environmental impact of raw material extraction and processing.

Leggett & Platt is increasingly focused on managing manufacturing waste and embracing circular economy principles, critical environmental considerations. Their product design emphasizes durability and recyclability, aiming to reduce landfill impact and recover valuable materials. For instance, in 2023, the company continued initiatives like repurposing dust from their rod mill for zinc recovery, a tangible step towards resource efficiency.

Energy Consumption and Greenhouse Gas Emissions

Reducing energy consumption and greenhouse gas (GHG) emissions is a key environmental objective. For instance, in 2023, Leggett & Platt reported a 3% decrease in its Scope 1 and Scope 2 GHG emissions compared to its 2022 baseline, reaching 1,150,000 metric tons of CO2 equivalent. The company has also begun its first global water use inventory to better understand its impact.

Looking ahead, Leggett & Platt is committed to further action. It plans to evaluate its value chain emissions, often referred to as Scope 3, and intends to set a formal climate reduction target by the close of 2025. This proactive approach signals a growing awareness of the company's broader environmental footprint beyond its direct operations.

- Energy Efficiency Initiatives: Leggett & Platt is investing in technologies and processes to lower its energy usage across manufacturing facilities.

- GHG Emission Tracking: The company actively measures its Scope 1 and Scope 2 GHG emissions, providing a quantifiable baseline for reduction efforts.

- Water Resource Management: The initiation of a global water use inventory highlights a commitment to understanding and managing water consumption.

- Future Climate Targets: A planned evaluation of value chain emissions and the establishment of a climate reduction target by the end of 2025 demonstrate forward-looking environmental strategy.

Climate Change and Physical Risks

Climate change presents significant physical risks to Leggett & Platt's operations. Increased frequency and intensity of severe weather events, such as hurricanes and floods, could directly damage manufacturing facilities and distribution centers, leading to costly repairs and prolonged operational downtime. For instance, the company's extensive manufacturing footprint across various regions makes it susceptible to localized climate impacts.

Beyond direct damage, indirect effects of climate change pose substantial challenges. Disruptions in global supply chains, stemming from extreme weather impacting raw material sources or transportation networks, can lead to increased input costs and production delays. This was evident in recent years where weather-related events globally impacted logistics and material availability, affecting numerous industries.

Leggett & Platt has formally acknowledged these environmental factors and their potential impact on its business. This recognition is documented in its official filings with the Securities and Exchange Commission (SEC), where the company outlines its strategies for managing climate-related risks and ensuring business continuity. These disclosures highlight the company's awareness of the evolving regulatory and operational landscape shaped by climate change.

- Physical Damage: Potential for direct harm to manufacturing plants and warehouses from extreme weather.

- Supply Chain Vulnerability: Increased risk of disruptions and higher costs due to climate-induced events affecting suppliers and logistics.

- Operational Disruption: Possibility of extended shutdowns and reduced production capacity following severe weather incidents.

- SEC Disclosure: Company formally recognizes and reports on climate change as a material risk in its financial filings.

Leggett & Platt's environmental strategy is increasingly focused on reducing its carbon footprint and improving resource efficiency. The company reported a 3% decrease in Scope 1 and Scope 2 GHG emissions in 2023, reaching 1,150,000 metric tons of CO2 equivalent. They are also initiating a global water use inventory and plan to set formal climate reduction targets by the end of 2025, including an evaluation of Scope 3 emissions.

The company is actively managing manufacturing waste and adopting circular economy principles, evident in initiatives like zinc recovery from mill dust. Responsible sourcing of materials like steel and chemicals is also a key environmental focus, with rigorous supplier qualification processes in place to ensure ethical and sustainable practices throughout their global supply chain.

Climate change poses physical risks, such as potential damage to facilities from extreme weather, and indirect risks like supply chain disruptions. Leggett & Platt acknowledges these risks and outlines its management strategies in its SEC filings, demonstrating a commitment to adapting to the evolving environmental landscape.

| Environmental Focus Area | 2023 Data/Initiatives | Future Goals/Plans |

|---|---|---|

| GHG Emissions | 3% reduction in Scope 1 & 2 emissions (vs. 2022 baseline) | Evaluate Scope 3 emissions, set formal climate reduction target by end of 2025 |

| Resource Management | Ongoing zinc recovery from mill dust | Initiated global water use inventory |

| Supply Chain | Rigorous supplier qualification for materials (steel, chemicals) | Continued focus on responsible sourcing |

| Climate Risk Awareness | Acknowledged in SEC filings | Ongoing risk management and business continuity planning |

PESTLE Analysis Data Sources

Our Leggett & Platt PESTLE analysis is meticulously crafted using data from reputable sources like the U.S. Census Bureau, the Bureau of Labor Statistics, and industry-specific market research firms. We also incorporate insights from global economic reports and legislative updates to ensure a comprehensive view.