Leggett & Platt Porter's Five Forces Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Leggett & Platt Bundle

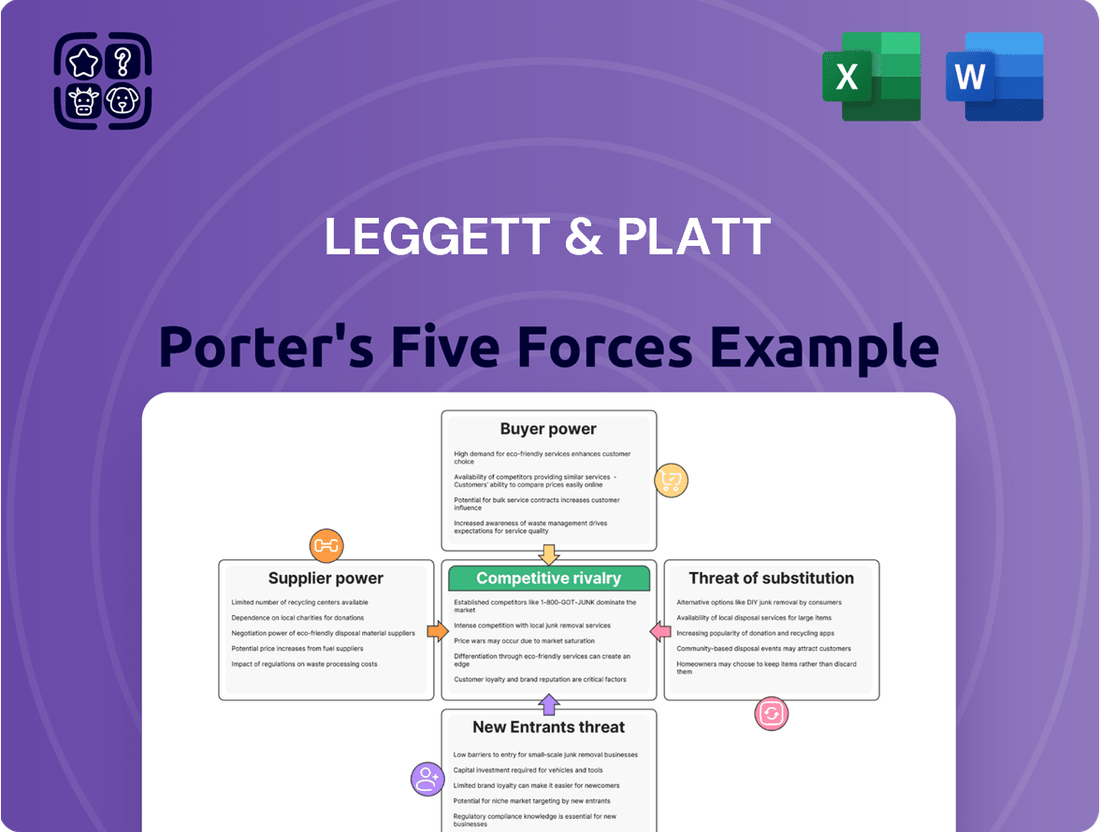

Leggett & Platt operates in a competitive landscape shaped by several key forces. Understanding the bargaining power of buyers, the threat of new entrants, and the intensity of rivalry is crucial for strategic planning.

The influence of suppliers and the availability of substitute products also play significant roles in Leggett & Platt's market dynamics. This framework allows for a comprehensive assessment of the industry's profitability and attractiveness.

This brief snapshot only scratches the surface. Unlock the full Porter's Five Forces Analysis to explore Leggett & Platt’s competitive dynamics, market pressures, and strategic advantages in detail.

Suppliers Bargaining Power

Supplier concentration significantly influences bargaining power. Leggett & Platt's reliance on critical raw materials like steel, chemicals, and specialized foams means that if these markets are dominated by a few major suppliers, those suppliers gain considerable leverage over pricing and terms. This can directly impact Leggett & Platt's cost of goods sold.

While Leggett & Platt benefits from vertical integration through its own steel rod mill, which likely mitigates external supplier power for certain steel wire components, the company is not entirely insulated. The broader metals market can still experience metal margin compression, a situation where the cost of raw metals rises faster than the price of finished goods, squeezing profitability and highlighting ongoing supplier influence.

For instance, in 2024, global steel prices have seen volatility, influenced by factors such as geopolitical events and production levels in major producing countries. This volatility can directly translate into increased input costs for companies like Leggett & Platt that utilize steel in their manufacturing processes, even with internal production capabilities.

Leggett & Platt's bargaining power of suppliers is influenced by the nature of its inputs. If the company relies heavily on specialized or proprietary components, its suppliers hold more sway. For example, in 2024, suppliers of advanced engineered foams or patented metal alloys could command higher prices due to the unique value they bring, impacting Leggett & Platt's cost structure.

Conversely, if a significant portion of Leggett & Platt's raw materials are commodity-like, such as basic steel or standard lumber, the bargaining power of those suppliers is diminished. The availability of multiple suppliers for these common materials allows Leggett & Platt to switch providers, thereby negotiating better terms. This was evident in early 2024, where a stable supply of common metals kept supplier leverage in check for those specific inputs.

However, the presence of specialized inputs, even if a smaller portion of the total, can concentrate power. Suppliers of unique chemical compounds for specialized foam production or patented spring technologies for bedding products can exert considerable influence. This differentiation means that while Leggett & Platt might have broad purchasing power for some materials, specific critical components can significantly alter the supplier dynamic, as seen with certain advanced material providers in Q1 2024.

Leggett & Platt faces significant bargaining power from its suppliers due to potentially high switching costs. If Leggett & Platt were to change suppliers for key components like specialty metals or engineered foam, the company might need to invest in retooling its manufacturing lines, which can be a substantial capital expenditure.

Furthermore, qualifying a new supplier involves rigorous testing and validation processes to ensure components meet Leggett & Platt's stringent quality and performance standards. This requalification period can lead to production delays and increased costs, giving existing suppliers leverage.

Given Leggett & Platt's diverse product portfolio, which includes bedding, furniture, and flooring components, the switching costs will vary. For highly customized or proprietary materials, the cost and complexity of finding and integrating a new supplier are likely to be much higher than for more commoditized raw materials.

Threat of Forward Integration by Suppliers

The threat of suppliers integrating forward into Leggett & Platt's operations, such as manufacturing or product assembly, is a key factor influencing supplier bargaining power. If suppliers can credibly become competitors, their leverage over Leggett & Platt rises.

While this threat is typically minimal for broad-spectrum raw material providers, it becomes more relevant for suppliers of highly specialized components. For instance, in the automotive sector, a supplier of advanced seating mechanisms might possess the technical expertise and capital to directly produce finished seating units, thereby competing with Leggett & Platt's own assembly operations.

Leggett & Platt's 2024 financial reports indicate a diversified supply chain, with significant portions of its cost of goods sold attributed to raw materials like steel and foam. However, the company also relies on specialized component suppliers for items such as motors for adjustable beds and advanced suspension systems for furniture. The potential for these specialized suppliers to move downstream, particularly those with unique intellectual property or patented technologies, warrants careful monitoring.

- Forward Integration Risk: While general raw material suppliers pose little forward integration threat, specialized component suppliers with proprietary technology could potentially enter Leggett & Platt's value chain.

- Impact on Bargaining Power: A credible threat of forward integration by suppliers directly amplifies their bargaining power, as they can shift from supplier to competitor.

- Industry Examples: In sectors where Leggett & Platt operates, such as bedding and furniture, suppliers of complex mechanical or electronic components have a higher potential for forward integration than basic material providers.

- Leggett & Platt's 2024 Context: The company's reliance on specialized components in 2024, though a smaller segment of its overall supply costs, presents a more concentrated area for this specific threat.

Importance of Leggett & Platt to Suppliers

Leggett & Platt's substantial size and diversified operations mean it is likely a crucial customer for many of its suppliers. If a supplier relies heavily on Leggett & Platt for a significant portion of its revenue, that supplier's bargaining power would be diminished because they are dependent on the company's continued business. This dependency can limit a supplier's ability to dictate terms or raise prices significantly.

The company's broad product portfolio, spanning bedding components, furniture, and automotive parts, allows it to source a wide array of raw materials and finished goods. This broad demand base can make Leggett & Platt a vital client for numerous suppliers across different industries. For instance, in 2023, Leggett & Platt reported approximately $5.1 billion in revenue, indicating substantial purchasing volume that would be attractive to many suppliers.

- Customer Dependence: Suppliers who derive a large percentage of their income from Leggett & Platt have less leverage.

- Diversified Sourcing: Leggett & Platt's broad product lines enable it to spread its purchasing across many suppliers, reducing reliance on any single one.

- Purchasing Volume: The company's significant annual revenue suggests it represents a substantial portion of business for its key suppliers, potentially tempering their power.

The bargaining power of suppliers for Leggett & Platt is a critical factor affecting its profitability. High supplier concentration, specialized inputs, and significant switching costs can all empower suppliers. Conversely, Leggett & Platt's large purchasing volume and diversified operations can reduce supplier leverage by making the company a vital customer.

In 2024, the company's reliance on specific materials like steel, foam, and specialized components means that shifts in commodity prices or the availability of unique inputs directly impact Leggett & Platt’s cost structure and overall financial performance.

The threat of suppliers integrating forward, while less common for basic material providers, is a concern for those supplying specialized components, potentially turning them into competitors.

Leggett & Platt's 2023 revenue of approximately $5.1 billion underscores its substantial purchasing power, which can serve as a counter-balance to supplier influence, particularly for more commoditized inputs.

| Factor | Impact on Leggett & Platt | 2024 Relevance/Data |

|---|---|---|

| Supplier Concentration | High concentration increases supplier power. | Volatile global steel prices in 2024 affected raw material costs. |

| Switching Costs | High costs for specialized components empower suppliers. | Retooling and requalification processes can be costly. |

| Customer Dependence | Low dependence on Leggett & Platt increases supplier power. | Leggett & Platt's 2023 revenue of $5.1 billion suggests significant purchasing volume. |

| Forward Integration | Threat amplifies supplier bargaining power. | Specialized component suppliers with proprietary tech pose a greater risk. |

What is included in the product

Analyzes the competitive intensity and profitability of Leggett & Platt's diverse markets by examining supplier power, buyer power, threat of new entrants, threat of substitutes, and rivalry among existing competitors.

Instantly visualize the impact of each of Porter's Five Forces on Leggett & Platt's profitability with a dynamic dashboard, simplifying complex competitive landscapes.

Customers Bargaining Power

Leggett & Platt's customer base includes major players in industries like automotive and bedding. For instance, in 2023, the company reported that its automotive segment generated $1.5 billion in revenue, indicating significant business with large automotive manufacturers who often purchase in high volumes.

These large customers, by virtue of their substantial purchase volumes, possess considerable bargaining power. Their ability to commit to large orders or shift their business to competitors means they can often negotiate more favorable pricing and payment terms with suppliers like Leggett & Platt.

The concentration of purchasing power among these key clients can exert downward pressure on Leggett & Platt's profit margins. For example, if a few major bedding manufacturers represent a significant portion of the company's bedding components revenue, they can leverage this to demand better pricing.

Customer switching costs play a significant role in shaping Leggett & Platt's bargaining power. If customers can easily switch to a competitor’s components without incurring substantial expenses or disruptions, their power increases. For instance, if Leggett & Platt supplies generic components easily replicable by others, customers face minimal switching costs, potentially leading to price pressures.

However, for highly specialized or integrated products, like the automotive seat support systems Leggett & Platt is known for, switching costs can be considerably higher. These costs can include the expense of re-tooling, redesigning products, extensive testing, and potential supply chain reconfigurations. In 2023, the automotive sector, a key market for Leggett & Platt, continued to emphasize integrated solutions, suggesting that for these specific product lines, customer switching costs remain a mitigating factor against their bargaining power.

Leggett & Platt's success hinges on its ability to differentiate its engineered components and products. When offerings are highly specialized or customized, customers have fewer readily available alternatives, which naturally weakens their bargaining power. This focus on unique solutions is key to minimizing price sensitivity.

The company's strategic emphasis on innovation and incorporating higher-value content into its products is designed to amplify this differentiation. By offering distinct advantages and performance benefits, Leggett & Platt aims to reduce the likelihood of customers switching to competitors based solely on price. This strategy directly combats direct price pressure from buyers.

For instance, in the automotive sector, Leggett & Platt's specialized seating mechanisms and comfort systems are often tailored to specific vehicle models and performance requirements. This level of customization means that automakers seeking these particular features cannot easily substitute them with generic components, thereby limiting their leverage in price negotiations.

Threat of Backward Integration by Customers

The possibility of Leggett & Platt's customers manufacturing components themselves, essentially backward integrating, is a key factor influencing their bargaining power. This threat becomes more pronounced when components are standardized and readily replicable. For instance, if a major bedding manufacturer, a significant customer for Leggett & Platt's spring systems, possessed the expertise and capital to produce these springs internally, it would undoubtedly increase their leverage in price negotiations. This is especially true for very large customers who might have existing manufacturing infrastructure that could be adapted.

The credible threat of backward integration directly strengthens customer bargaining power. This means customers can demand lower prices or better terms, knowing they have an alternative to purchasing from Leggett & Platt. This dynamic is particularly relevant for standardized components where the switching costs for the customer are relatively low, and the technical barriers to entry for self-manufacturing are manageable.

Consider the case of large furniture retailers or bedding manufacturers. In 2023, the global bedding market was valued at over $60 billion, with major players operating on significant scales. If even a few of these large entities, perhaps those with substantial capital expenditure budgets, decided to explore in-house production of certain components currently supplied by Leggett & Platt, it would send a clear signal. This signals their willingness and capability to exert greater control over their supply chain, thereby amplifying their bargaining position.

- Threat of Backward Integration: Customers may produce components themselves.

- Impact on Bargaining Power: Increases customer leverage, especially for standardized parts.

- Customer Profile: Larger customers with manufacturing capabilities are more likely to integrate backward.

- Market Context: The significant scale of the bedding market (over $60 billion in 2023) suggests large customers have the potential to self-manufacture.

Customer Price Sensitivity

Leggett & Platt's customer base, ranging from manufacturers and retailers to end consumers, exhibits varying degrees of price sensitivity. In segments characterized by commodity-like products, customers are highly attuned to price, granting them significant bargaining power. Conversely, segments offering specialized or differentiated products may afford Leggett & Platt more pricing flexibility.

The company's recent performance underscores this dynamic. Weak demand within the residential furnishings and automotive sectors in 2023 and early 2024 has intensified pricing pressures. This suggests a heightened price sensitivity among customers in these particular markets, forcing Leggett & Platt to contend with more demanding negotiations.

- Residential Furnishings: Demand weakness has led to increased price sensitivity among furniture manufacturers and retailers.

- Automotive: Similar to residential, the automotive sector has experienced pricing pressures due to reduced demand, impacting Leggett & Platt's automotive components business.

- Commodity Segments: Products sold in highly competitive, undifferentiated markets inherently carry higher customer price sensitivity.

- Specialty Segments: Where Leggett & Platt offers unique features or proprietary technology, customer price sensitivity is typically lower.

The bargaining power of Leggett & Platt's customers is significant, particularly among large clients in industries like automotive and bedding. These substantial buyers, often accounting for a considerable portion of revenue, can leverage their volume to negotiate favorable pricing and terms. In 2023, Leggett & Platt's automotive segment alone generated $1.5 billion in revenue, highlighting the economic clout of its automotive customers.

Customer switching costs also play a crucial role. While specialized products, such as automotive seat support systems, create higher switching costs for customers due to re-tooling and redesign needs, generic components offer fewer barriers. The global bedding market, valued at over $60 billion in 2023, presents a scenario where large bedding manufacturers could potentially develop in-house capabilities for standardized components, thereby increasing their bargaining power.

Leggett & Platt mitigates this by focusing on product differentiation through innovation and specialized solutions. For example, tailored automotive seating mechanisms are difficult to substitute. Weak demand in the residential furnishings and automotive sectors during late 2023 and early 2024 has amplified customer price sensitivity, intensifying negotiation pressures for the company.

| Factor | Impact on Bargaining Power | Leggett & Platt Relevance |

| Customer Volume | High for large buyers | Significant for automotive ($1.5B revenue in 2023) and bedding sectors |

| Switching Costs | Low for generic parts, High for specialized solutions | Automotive seat systems have high switching costs; bedding components can vary |

| Threat of Backward Integration | Moderate to High for standardized components | Potential for large bedding manufacturers to self-produce springs |

| Price Sensitivity | High in weak demand markets | Increased in residential furnishings and automotive in late 2023/early 2024 |

Same Document Delivered

Leggett & Platt Porter's Five Forces Analysis

This preview shows the exact document you'll receive immediately after purchase—no surprises, no placeholders. This comprehensive Porter's Five Forces analysis of Leggett & Platt details the competitive landscape, examining the bargaining power of buyers, the threat of new entrants, the bargaining power of suppliers, the threat of substitute products, and the intensity of rivalry within the industry. Understand the strategic positioning and potential challenges Leggett & Platt faces through this in-depth evaluation.

Rivalry Among Competitors

Leggett & Platt operates in several industries, including bedding, automotive, and flooring components. The bedding market, a significant segment for Leggett, has shown a slow growth trajectory, with reports indicating modest single-digit growth in recent years. Similarly, the automotive components sector has faced headwinds, influenced by global production fluctuations and shifts in vehicle manufacturing. These mature or slowly expanding markets naturally amplify competitive rivalry, as companies vie for existing market share rather than benefiting from rapid market expansion.

The company's own financial reports underscore this dynamic. For instance, Leggett & Platt reported declining sales in its residential and automotive segments during 2023, a trend that continued into early 2024, driven by weak consumer demand and broader economic slowdowns. This contraction or stagnation in key operational areas forces established players like Leggett & Platt to intensify their competitive efforts, focusing on efficiency, innovation, and strategic pricing to capture or retain their positions within these challenging markets.

Leggett & Platt operates in a market with a significant number of competitors, ranging from large, diversified companies to highly specialized niche players. This broad competitive base intensifies rivalry across various fronts, including pricing, product innovation, and market share grabs. For instance, companies like Tempur Sealy International, a major bedding manufacturer, and automotive seating suppliers such as Adient and Lear Corporation, represent different but relevant competitive pressures.

Leggett & Platt faces varying degrees of product differentiation across its diverse segments. In some areas, like basic bedding components, products can be more commoditized, leading to significant price competition. However, in engineered components for industries like automotive or industrial applications, innovation in features and quality allows for stronger differentiation, enabling more stable pricing and distinct market positions.

Exit Barriers for Competitors

Leggett & Platt faces significant exit barriers within the diversified manufacturing sector, particularly for competitors heavily invested in specialized machinery and dedicated production lines. These assets, often costly and not easily repurposed, trap capital and make withdrawal from the market financially punitive. For instance, the specialized nature of machinery for producing springs, foam, or metal components means that selling these assets on the secondary market often yields a fraction of their original cost, thereby increasing the cost of exiting.

High fixed costs associated with large-scale manufacturing facilities also contribute to elevated exit barriers. Companies must continue to service debt and maintain these plants even if market demand wanes, a situation that can prolong intense competition. This can lead to persistent overcapacity, as struggling firms remain in the market longer than economically rational due to the difficulty of shedding these substantial overheads.

The capital-intensive nature of manufacturing components, a core aspect of Leggett & Platt's operations, inherently creates substantial exit barriers. For example, companies operating in segments like bedding components or automotive seating often require significant upfront investment in specialized equipment and facilities. This financial commitment makes it exceedingly difficult for competitors to simply walk away from their investments, even when facing declining profitability.

- Specialized Assets: Competitors often possess machinery uniquely suited for producing specific components, making resale difficult and costly.

- High Fixed Costs: Significant investments in manufacturing plants and equipment create ongoing financial obligations that hinder exit.

- Capital Intensity: The requirement for large capital outlays in manufacturing exacerbates the difficulty and expense of leaving the market.

- Overcapacity Risk: High exit barriers can trap firms in declining markets, leading to prolonged periods of intense rivalry and surplus production capacity.

Strategic Stakes and Aggressiveness

Competitive rivalry is intense for Leggett & Platt, particularly in its core segments like Bedding and Furniture components. Companies in these sectors often have significant strategic stakes tied to market share and profitability. For instance, a strong position in the bedding market is crucial for maintaining brand recognition and driving volume. Competitors frequently engage in aggressive tactics, including price adjustments and enhanced product development, to capture or defend their market presence.

Leggett & Platt's own strategic maneuvers, such as its announced restructuring plan aimed at streamlining operations and divesting underperforming businesses, highlight the high stakes involved. This plan, which began in 2023 and continues into 2024, signals a strong focus on enhancing profitability and solidifying its market position amidst fierce competition. The company's commitment to operational efficiency is a direct response to the pressures exerted by rivals who are also striving for greater market share and improved financial performance.

Key competitors in the bedding components market, such as HSM (Hickory Springs Manufacturing) and others, are also actively investing in innovation and supply chain optimization. This creates a dynamic environment where staying ahead requires continuous adaptation and aggressive pursuit of efficiency gains. The industry's relatively mature nature means that growth often comes at the expense of rivals, further fueling aggressive competitive behavior.

- Strategic Importance: Market share and profitability are paramount for companies like Leggett & Platt in the bedding and furniture components industries, driving aggressive competition.

- Competitive Tactics: Rivalry often manifests through pricing strategies, research and development investments, and aggressive marketing campaigns.

- Leggett & Platt's Response: The company's 2023-2024 restructuring plan emphasizes operational efficiency and profitability, reflecting the high stakes in maintaining its market standing.

- Industry Dynamics: The mature nature of many of Leggett & Platt's markets encourages a zero-sum game where capturing market share often means taking it from competitors.

Competitive rivalry is a significant force for Leggett & Platt, especially in its established markets like bedding and furniture components. Companies in these sectors often prioritize market share and profitability, leading to aggressive strategies like price adjustments and robust product development. For instance, in 2023, Leggett & Platt's sales in its residential segment saw a decline, intensifying the need to compete effectively for existing demand.

The company's strategic moves, such as its ongoing restructuring initiated in 2023 and continuing through 2024, directly address this intense rivalry. This plan focuses on improving efficiency and profitability, essential for maintaining its competitive edge. Key rivals in the bedding components space, like HSM, are also investing heavily in innovation and supply chain improvements, creating a dynamic where continuous adaptation is crucial.

The mature nature of many of Leggett & Platt's operating segments means that growth is often achieved by gaining share from competitors. This zero-sum dynamic fuels aggressive competition, making every strategic decision critical. For example, the automotive components sector, another key area for Leggett & Platt, faces ongoing pressures from global production shifts and evolving manufacturing practices, demanding constant competitive vigilance.

| Segment | 2023 Sales (USD Billion) | Key Competitor Example | Competitive Intensity Factor |

|---|---|---|---|

| Bedding Components | 1.6 (approx.) | HSM | High (Mature Market, Price Sensitivity) |

| Furniture Components | 1.5 (approx.) | Leggett & Platt's own internal divisions | High (Product Differentiation, Cost Efficiency) |

| Automotive Components | 1.2 (approx.) | Adient, Lear Corporation | Moderate to High (Industry Shifts, Global Production) |

SSubstitutes Threaten

The threat of substitutes for Leggett & Platt's components, which are primarily used in bedding and furniture, is a significant consideration. Alternative materials and technologies could potentially fulfill the same core functions, thereby reducing demand for L&P's products. For instance, in the bedding sector, innovations like advanced foam technologies or air-based support systems that don't require traditional innersprings represent viable substitutes.

The availability and attractiveness of these substitutes directly impact Leggett & Platt's pricing power and market share. If consumers perceive alternative solutions as equally effective and perhaps more cost-efficient or innovative, the pressure on L&P to maintain its competitive edge intensifies. For example, the growing popularity of direct-to-consumer mattress brands often leveraging foam or hybrid designs could be seen as a substitute for traditional innerspring-based mattresses, a key market for L&P.

The price-performance trade-off for substitutes is a critical consideration for Leggett & Platt. Customers are constantly evaluating if alternative materials or designs can deliver comparable or superior functionality at a more attractive price point. For instance, if a competitor offers a bedding component that performs similarly to Leggett & Platt's but at a 15% lower cost, it directly pressures Leggett & Platt's market share.

Substitutes that present a more favorable price-performance ratio can rapidly diminish demand for Leggett & Platt's current offerings. This means assessing whether innovations in, say, foam technology or spring systems from other industries provide a compelling value proposition that diverts customers away from traditional furniture and bedding components.

The threat of substitutes for Leggett & Platt's diverse product lines, particularly in bedding and furniture components, is influenced by customer switching costs. For many of their original equipment manufacturer (OEM) clients, the financial costs of switching to a different supplier for components like springs, foams, or mechanisms are relatively low. These costs typically involve minimal tooling changes or simply re-qualifying new suppliers.

Beyond direct financial outlays, non-financial switching costs also play a role. These can include the time and effort required to re-engineer products, test new materials, and retrain production staff. For instance, a furniture manufacturer accustomed to Leggett & Platt's specific spring tension or foam density might face disruptions in their established manufacturing processes if they switch to a provider with different specifications.

The ease with which customers can adopt new technologies or materials from substitute providers further amplifies this threat. As of 2024, advancements in materials science and manufacturing automation, such as more efficient foam molding techniques or innovative metal forming processes, can lower the barrier to entry for new competitors. This makes it simpler for customers to explore and integrate alternative components, thereby increasing the pressure from substitutes on Leggett & Platt.

Technological Advancements Driving Substitutes

Technological advancements are a significant driver of the threat of substitutes for Leggett & Platt. Rapid innovation, particularly in materials science and manufacturing, can quickly introduce compelling alternatives across the company's diverse business segments, including automotive, bedding, and flooring. For instance, advancements in lighter, stronger composite materials could offer alternatives to traditional metal components in automotive applications, potentially impacting demand for Leggett & Platt's automotive products. Similarly, new mattress technologies or sleep surface innovations could emerge as substitutes for conventional spring systems and foam products.

Leggett & Platt itself actively engages in innovation, acknowledging this dynamic. The company's commitment to developing new and improved products is a direct response to the ever-present threat of substitutes. In 2023, Leggett & Platt invested approximately $228 million in capital expenditures, a portion of which is allocated to enhancing manufacturing capabilities and developing new product lines that can compete with emerging alternatives. This proactive approach aims to stay ahead of the curve and mitigate the impact of disruptive technologies.

The emergence of new substitutes is often accelerated by breakthroughs that offer improved performance, lower costs, or enhanced sustainability. Consider the bedding sector: advancements in cooling technologies or biodegradable materials could present viable alternatives to traditional innerspring mattresses. In the automotive sector, the push for electrification and lightweighting is already spurring the development of new materials and designs that could displace conventional components.

The constant evolution of technology means that what is considered a staple today can become a substitute tomorrow. This necessitates continuous monitoring and adaptation within Leggett & Platt's product development and strategic planning processes. The company's diversified portfolio provides some resilience, but the underlying trend of technological innovation across all its markets remains a key factor in assessing the threat of substitutes.

Buyer Propensity to Substitute

Leggett & Platt faces a moderate threat from substitutes, as its diverse customer base, ranging from furniture manufacturers to automotive suppliers, has varying propensities to switch. For instance, in the bedding sector, consumers might opt for memory foam mattresses over traditional spring systems, impacting Leggett & Platt's spring component sales. Similarly, in the automotive industry, a growing demand for lighter, more fuel-efficient vehicles could encourage the adoption of composite materials or alternative seating designs that bypass traditional metal frame structures. This propensity is amplified by factors such as evolving design aesthetics and a desire for enhanced functionalities.

Several factors influence the buyer propensity to substitute Leggett & Platt's products. Environmental concerns are increasingly driving demand for sustainable materials, potentially leading customers to seek alternatives made from recycled or bio-based components. Evolving design trends, particularly in home furnishings and automotive interiors, can also spur substitution if new styles require different types of support systems or materials that Leggett & Platt does not currently offer. For example, a shift towards modular furniture might reduce the need for integrated spring systems, while advancements in electric vehicle technology could necessitate lighter, more integrated seating solutions that differ from current offerings.

- Bedding Market Shift: The ongoing consumer preference for foam-based mattresses over traditional innerspring systems represents a significant substitution threat for Leggett & Platt's bedding components.

- Automotive Lightweighting: The automotive industry's push for fuel efficiency, as evidenced by the increasing use of advanced composites and aluminum, poses a risk to traditional metal-based seating structures.

- Design Innovation: Emerging trends in furniture, such as minimalist designs or modular systems, may reduce reliance on certain foundational components where Leggett & Platt holds a strong position.

- Material Science Advancements: Innovations in material science offering comparable or superior performance at a lower cost or with a better environmental profile can also drive substitution.

The threat of substitutes for Leggett & Platt (L&P) is moderate, influenced by evolving consumer preferences and technological advancements across its key markets. In the bedding sector, the shift towards foam and hybrid mattresses continues to challenge traditional innerspring demand, a core area for L&P. Similarly, the automotive industry's focus on lightweighting and new materials presents potential substitutes for L&P's metal-based seating components.

Customer switching costs for L&P's components are generally low, both financially and non-financially. This ease of substitution is amplified by ongoing innovations in materials science and manufacturing, making it simpler for competitors to introduce alternative solutions. For instance, by mid-2024, advancements in foam molding and metal forming are enabling new entrants to more readily offer comparable products.

The price-performance ratio of substitutes is a critical factor. If alternative materials or designs offer similar or better functionality at a lower cost, L&P faces increased pressure. This dynamic is evident in the bedding market, where some direct-to-consumer brands offer mattresses with advanced foam technologies at competitive price points, directly substituting traditional innerspring systems.

Leggett & Platt's proactive investment in innovation, such as the approximately $228 million in capital expenditures in 2023, is a strategic response to mitigate the threat of substitutes. This spending aims to enhance manufacturing and develop new product lines that can effectively compete with emerging alternatives across its diverse segments.

| Key Substitute Threats | Impact on L&P | Example |

| Foam & Hybrid Mattresses | Reduced demand for innersprings | Consumer preference for memory foam mattresses over coil systems. |

| Advanced Composites/Aluminum in Automotive | Potential displacement of metal seating frames | Lightweighting initiatives in EV manufacturing favoring non-traditional materials. |

| Sustainable Materials | Demand for eco-friendly alternatives | Bio-based foams or recycled materials in furniture and bedding. |

| New Sleep Technologies | Disruption of traditional comfort systems | Innovations in adjustable air beds or phase-change materials for temperature regulation. |

Entrants Threaten

Entering the diversified engineered components and products sector demands considerable financial muscle. Newcomers must secure substantial funding to establish state-of-the-art manufacturing facilities, acquire advanced machinery, and invest in ongoing research and development. For instance, in 2023, Leggett & Platt reported capital expenditures of $432.7 million, underscoring the scale of investment needed to maintain and grow operations in this capital-intensive industry.

Leggett & Platt's established extensive manufacturing footprint and high degree of vertical integration represent significant capital barriers. Building a comparable network of production sites and controlling various stages of the supply chain requires billions in upfront investment, making it exceedingly difficult for smaller, less-capitalized entities to compete effectively on scale and cost.

Leggett & Platt likely benefits from significant economies of scale in production and procurement. For instance, in 2023, the company reported net sales of approximately $4.9 billion. This substantial revenue suggests a large operational volume, allowing them to negotiate better prices for raw materials like steel and foam, and to spread fixed manufacturing costs over a greater number of units.

New entrants would find it challenging to match these cost efficiencies. Without the established infrastructure and purchasing power of a company like Leggett & Platt, a new player would likely face higher per-unit production costs. This cost disadvantage makes it difficult for them to offer competitive pricing, thus diminishing the threat of new entrants.

The company's extensive distribution network also contributes to economies of scale. Efficient logistics reduce transportation costs per unit, further solidifying their cost advantage over smaller, less established competitors.

New companies face significant hurdles in accessing established distribution channels and supply chains, particularly within industries like furniture manufacturing where Leggett & Platt operates. Building relationships with key retailers and securing reliable sourcing for raw materials, such as steel and foam, requires time and substantial investment. For instance, Leggett & Platt's extensive network of suppliers and its direct relationships with major furniture retailers are not easily replicated by newcomers.

Established players like Leggett & Platt have cultivated decades-long partnerships, offering them preferential terms and guaranteed access to critical resources. This makes it difficult for new entrants to compete on price and availability, as they often lack the volume and trust to negotiate favorable agreements. In 2023, Leggett & Platt reported over $5 billion in revenue, underscoring its significant market presence and the strength of its existing distribution and supply chain infrastructure.

Proprietary Product Technology or Experience

Leggett & Platt's threat of new entrants is significantly mitigated by its proprietary product technology and extensive manufacturing experience. The company holds numerous patents across its diverse product lines, creating substantial hurdles for new players attempting to replicate its engineered solutions and specialized components. This intellectual property, coupled with decades of accumulated know-how in areas like advanced spring technology and foam innovation, makes direct replication costly and time-consuming.

The company's consistent investment in research and development, evidenced by its ongoing patent filings and new product introductions, further solidifies these barriers. For instance, in 2023, Leggett & Platt continued to emphasize innovation, a strategy that directly strengthens its proprietary advantages. This focus ensures that potential competitors face not only the challenge of matching existing technologies but also the prospect of a continuously evolving product landscape.

Key proprietary strengths include:

- Patented technologies in bedding components: Leggett & Platt holds patents for unique spring systems and comfort materials that are difficult and expensive for new entrants to develop.

- Specialized manufacturing processes: The company possesses proprietary manufacturing techniques, particularly in metal fabrication and foam production, which are not easily transferable or replicable.

- Engineered product expertise: Years of experience in designing and producing complex engineered products for industries like automotive and aerospace create a deep well of knowledge that new firms would struggle to match quickly.

- Focus on innovation pipeline: Leggett & Platt's commitment to R&D ensures a continuous stream of new, protected products, keeping competitors at bay by constantly raising the technological bar.

Government Policy and Regulation

Government policy and regulation can significantly influence the threat of new entrants. For instance, stringent environmental standards, such as those mandated by the EPA for emissions or waste disposal, can require substantial upfront investment in compliance technology and processes. In 2024, industries facing evolving climate regulations may see higher entry barriers due to the need for sustainable practices and reporting.

Compliance with industry-specific standards, like those in the automotive sector which adhere to safety and performance benchmarks, adds another layer of complexity. New entrants must invest in research, development, and quality control to meet these established benchmarks, potentially increasing initial capital requirements.

Consider the impact of licensing requirements and permits, which can also act as a barrier. For example, obtaining necessary permits for manufacturing or operating in certain jurisdictions can be a time-consuming and costly process.

- Environmental Regulations: New entrants must factor in compliance costs for emissions, waste management, and sustainable sourcing, especially with increasing global focus on ESG (Environmental, Social, and Governance) factors.

- Industry Standards: Meeting established safety, quality, and performance benchmarks, common in sectors like aerospace or pharmaceuticals, demands significant investment in R&D and quality assurance.

- Licensing and Permits: The complexity and cost associated with obtaining operational licenses and permits can deter new players, particularly in highly regulated industries.

- Government Subsidies/Incentives: Conversely, government support for certain industries or technologies (e.g., renewable energy) can lower entry barriers and encourage new entrants.

The threat of new entrants for Leggett & Platt is significantly low due to substantial capital requirements and established economies of scale. The need for extensive manufacturing facilities, advanced machinery, and ongoing R&D, as highlighted by Leggett & Platt's 2023 capital expenditures of $432.7 million, creates a formidable financial barrier.

Furthermore, Leggett & Platt's vast operational scale, evidenced by its 2023 net sales of approximately $4.9 billion, allows for significant cost advantages in procurement and production. These economies of scale, coupled with established distribution networks and long-standing supplier relationships, make it exceedingly difficult for new players to compete on price and efficiency.

Leggett & Platt's proprietary technologies and extensive manufacturing experience, protected by numerous patents, also act as a strong deterrent. The company's continuous investment in R&D, ensuring a pipeline of innovative and protected products, further solidifies these barriers, making direct replication a costly and time-consuming endeavor for potential entrants.

Government regulations and industry standards, while potentially increasing costs for all, disproportionately impact new entrants who must invest heavily to achieve compliance. For instance, meeting stringent environmental or safety standards requires upfront capital that smaller, less-established firms may struggle to secure, thereby mitigating the threat of new competition.

Porter's Five Forces Analysis Data Sources

Our Leggett & Platt Porter's Five Forces analysis is built upon a foundation of comprehensive data, including Leggett & Platt's official SEC filings, annual reports, and investor presentations. We supplement this with industry-specific market research reports from firms like IBISWorld and financial data from platforms such as S&P Capital IQ to provide a robust understanding of the competitive landscape.