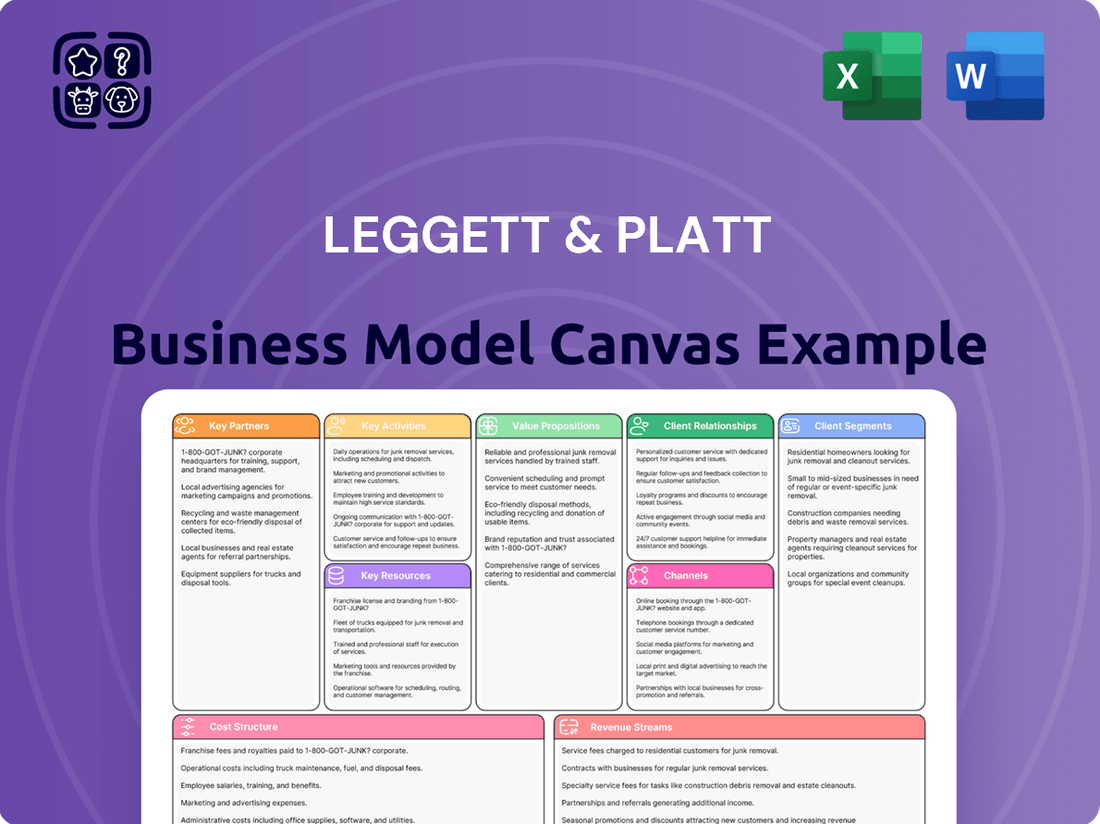

Leggett & Platt Business Model Canvas

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Leggett & Platt Bundle

Unlock the strategic blueprint behind Leggett & Platt's diversified business. This comprehensive Business Model Canvas details how they serve diverse customer segments with innovative bedding components, furniture, and flooring solutions. Understand their key partnerships and revenue streams that fuel their market leadership.

Dive deeper into Leggett & Platt’s real-world strategy with the complete Business Model Canvas. From value propositions to cost structure, this downloadable file offers a clear, professionally written snapshot of what makes this company thrive—and where its opportunities lie.

Partnerships

Leggett & Platt's key partnerships with raw material suppliers are foundational to its operations. These suppliers provide essential components like steel rod, wire, and chemicals for foam, directly influencing production capabilities and cost structures.

In 2024, Leggett & Platt's commitment to strong supplier relationships is critical for navigating fluctuating material costs and ensuring supply chain stability. For instance, the price of hot-rolled steel coil, a significant input, saw volatility throughout 2023 and into early 2024, making reliable sourcing paramount.

These partnerships enable Leggett & Platt to manage selling price adjustments effectively, passing on material cost changes to customers. A consistent and cost-efficient supply chain directly supports the company's ability to maintain production volumes and manage its cost of goods sold.

Leggett & Platt's automotive partnerships with Original Equipment Manufacturers (OEMs) are fundamental to its success in the automotive sector. These collaborations focus on supplying advanced seat comfort and convenience systems, along with other specialized engineered components. These are not casual arrangements; they often involve deep, long-term engagements where Leggett & Platt works hand-in-hand with carmakers on the design and integration of new vehicle programs, ensuring their solutions meet rigorous industry specifications and evolving consumer demands.

The financial impact of these relationships is substantial. For instance, in 2023, Leggett & Platt's Automotive segment generated approximately $770 million in revenue, a significant portion of which is directly attributable to these OEM partnerships. These ongoing collaborations are crucial for securing future business, as design wins today translate into production volumes for years to come, making these OEM relationships a cornerstone of the company's automotive strategy and a key driver of its financial performance in this segment.

Leggett & Platt's strategic alliances with bedding manufacturers and prominent retailers are fundamental to its operational success. These partnerships are not merely transactional; they are deeply integrated into product innovation and market access strategies.

By collaborating closely with mattress makers and major bedding distributors, Leggett & Platt ensures its components are at the forefront of design and performance. This symbiotic relationship allows for rapid adaptation to shifting consumer preferences and helps navigate the dynamic retail environment.

In 2023, Leggett & Platt's Bedding segment, a core area for these partnerships, generated approximately $1.7 billion in revenue, highlighting the significant contribution of these key relationships to the company's financial performance. This figure underscores the scale and importance of their collaborations within the bedding industry.

Technology and Innovation Partners

Leggett & Platt's collaborations with technology and innovation partners are crucial for developing cutting-edge materials and manufacturing techniques. These alliances drive advancements in areas like bio-based foam and enhanced innerspring designs, directly impacting product performance and sustainability. By integrating these innovations, the company aims to boost product longevity, improve recovery characteristics, and facilitate end-of-life recycling, ultimately delivering more valuable content to their diverse customer base.

These strategic partnerships enable Leggett & Platt to stay ahead in a competitive market by leveraging external expertise and research capabilities. For instance, in 2024, investments in advanced material science research through these collaborations contributed to the development of new product lines focused on enhanced comfort and environmental responsibility. The company’s commitment to innovation, often fueled by these key partnerships, is a cornerstone of its strategy to offer differentiated and sustainable solutions.

- Focus on advanced materials: Partnerships are key to developing next-generation foams and spring technologies.

- Enhancing product lifecycle: Collaborations target improvements in durability, recovery, and recyclability.

- Driving sustainability: Innovation partners help Leggett & Platt create more eco-friendly products, such as bio-based alternatives.

- Delivering higher value: These technological advancements translate into superior product offerings for customers.

Logistics and Distribution Partners

Leggett & Platt's strategic alliances with logistics and distribution partners are crucial for its global operations. These partnerships ensure the efficient movement of components and finished goods across its extensive worldwide manufacturing footprint. In 2024, optimizing this network remained a key focus to shorten delivery times and control transportation expenses, which is vital given their diverse customer base.

These collaborations allow Leggett & Platt to manage complex supply chains effectively, ensuring that raw materials reach manufacturing facilities and finished products reach customers on schedule. A well-oiled distribution network directly impacts customer satisfaction and operational efficiency.

- Global Reach: Partners facilitate delivery across numerous countries, supporting Leggett & Platt's international presence.

- Cost Optimization: Strategic alliances help negotiate favorable rates and optimize routes, reducing overall logistics costs.

- Timely Deliveries: Efficient distribution networks are essential for meeting customer demand and maintaining competitive lead times.

- Supply Chain Resilience: Robust partnerships enhance the ability to navigate disruptions and ensure continuity of supply.

Leggett & Platt's key partnerships extend to financial institutions and investors, crucial for capital allocation and strategic growth initiatives. These relationships provide access to funding for research and development, acquisitions, and operational enhancements.

In 2024, the company's ability to secure favorable financing terms from these partners directly impacts its investment capacity. For instance, Leggett & Platt's debt-to-equity ratio, a metric closely watched by lenders and investors, influences its cost of capital and overall financial flexibility.

These financial partnerships are fundamental to executing long-term strategic plans, including potential divestitures or significant capital expenditures, ensuring the company remains well-positioned for future market opportunities.

What is included in the product

A detailed breakdown of Leggett & Platt's diversified manufacturing and marketing strategy, outlining their approach to serving various industrial and consumer markets through distinct product lines.

Leggett & Platt's Business Model Canvas acts as a pain point reliever by providing a clear, structured framework that simplifies complex strategic thinking, making it easier to identify and address operational inefficiencies.

This one-page snapshot of Leggett & Platt's business model effectively alleviates the pain of information overload and organizational confusion, offering a readily understandable overview for all stakeholders.

Activities

Leggett & Platt's key activities center on designing and manufacturing engineered components for its various business segments, such as bedding, automotive, and furniture. This involves intricate processes like drawing steel rods and wire, pouring foam, and assembling sophisticated systems.

These operations demand high efficiency and stringent quality control to satisfy the diverse requirements of different industries. For instance, in 2023, the company reported a significant portion of its revenue derived from its Bedding segment, highlighting the importance of its component manufacturing within that sector.

Leggett & Platt dedicates significant resources to Research and Development, a core activity focused on creating novel products and enhancing current offerings. A prime example is their work on advanced materials for the automotive sector, aiming to reduce vehicle weight and improve fuel economy, a critical factor in today's market. They also prioritize sustainable innovation, such as developing eco-friendly foam technologies for bedding and furniture.

This commitment to R&D is crucial for maintaining Leggett & Platt's competitive edge and responding to dynamic customer needs, particularly the growing demand for performance and environmental responsibility. Their R&D efforts directly contribute to their reputation as a leader in engineered solutions across various industries. In 2023, Leggett & Platt reported research and development expenses of $152.1 million, underscoring their investment in future growth and innovation.

Leggett & Platt's supply chain management is a cornerstone, focused on sourcing materials globally and ensuring efficient logistics and inventory control. This involves a constant effort to anticipate and address potential shortages, streamline the movement of goods, and uphold ethical sourcing standards. Their 2023 annual report highlighted ongoing investments in supply chain resilience, a critical factor given the global economic environment.

A key activity is optimizing material flow to maintain production continuity and adapt to changing market demands. This includes managing relationships with a vast network of suppliers, ensuring quality and reliability. In 2023, Leggett & Platt continued to refine its inventory management strategies, aiming to balance availability with carrying costs.

Sales, Marketing, and Customer Support

Leggett & Platt's sales and marketing efforts are crucial for connecting with its diverse customer base, which includes manufacturers, retailers, and end consumers across various industries. The company employs a multi-faceted approach to reach these segments effectively.

Strong customer support, including technical assistance and relationship management, is paramount. This focus helps Leggett & Platt understand evolving customer needs, build lasting loyalty, and encourage continued business. This proactive engagement is key to their sustained market presence.

- Sales Reach: Leggett & Platt serves a broad spectrum of customers, from large industrial manufacturers requiring specialized components to retailers stocking consumer-facing products.

- Marketing Strategy: Their marketing likely involves targeted campaigns, trade shows, and digital outreach to highlight product innovation and value propositions for each customer segment.

- Customer Support: Providing technical expertise and responsive service is vital for maintaining strong relationships and ensuring product satisfaction, which drives repeat purchases.

- Data-Driven Insights: By analyzing customer interactions and market trends, Leggett & Platt can refine its sales and support strategies, as demonstrated by their consistent financial performance and market share in key areas. For instance, their focus on innovation and customer needs has contributed to their revenue streams, with the company reporting significant sales in its diversified product segments.

Operational Restructuring and Efficiency Initiatives

Leggett & Platt’s key activities heavily involve operational restructuring and efficiency initiatives. A major focus for 2024 and extending into 2025 is the consolidation of manufacturing and distribution facilities. This strategic move is designed to streamline operations and cut costs.

These efficiency improvements are crucial for enhancing profitability by reducing complexity. The company is actively working to better align its production capacity with fluctuating regional market demands.

- Facility Consolidation: Ongoing efforts to reduce the number of manufacturing and distribution sites.

- Operational Efficiency: Implementing process improvements to boost productivity and lower operating expenses.

- Capacity Alignment: Adjusting production levels to match specific regional market needs.

- Profitability Enhancement: Initiatives directly targeting an increase in profit margins through cost reduction and improved output.

Leggett & Platt's key activities include the design and manufacturing of specialized components across its diverse segments, like bedding and automotive, requiring precision engineering and quality assurance. Their focus on innovation drives the development of new materials and eco-friendly solutions, as evidenced by their $152.1 million investment in research and development in 2023. Furthermore, robust supply chain management and ongoing operational restructuring, including facility consolidation, are critical for efficiency and cost reduction, aiming to enhance profitability in a dynamic market.

| Key Activity Area | Description | 2023 Data/Significance |

|---|---|---|

| Design & Manufacturing | Creating engineered components for various industries. | Significant revenue driver, especially from the Bedding segment. |

| Research & Development | Innovating new products and improving existing ones. | $152.1 million in R&D expenses in 2023; focus on advanced materials and sustainability. |

| Supply Chain Management | Global sourcing, logistics, and inventory control. | Ongoing investments in supply chain resilience; optimizing material flow and supplier relationships. |

| Operational Restructuring | Facility consolidation and efficiency initiatives. | Strategic focus for 2024-2025 to streamline operations and reduce costs. |

| Sales & Marketing | Connecting with diverse customer bases through targeted outreach. | Multi-faceted approach including technical assistance and relationship management. |

Preview Before You Purchase

Business Model Canvas

The Leggett & Platt Business Model Canvas you're previewing is the definitive document you'll receive upon purchase. This isn't a sample; it's a direct representation of the comprehensive analysis you'll gain access to. Upon completing your order, you will instantly download this exact file, complete with all its strategic insights and professionally formatted sections, ready for your immediate use and adaptation.

Resources

Leggett & Platt operates a vast global network of manufacturing facilities, including specialized steel rod mills, wire drawing mills, and foam pouring plants. These aren't just buildings; they represent the core of their ability to produce a wide range of products. In 2023, the company's capital expenditures for property, plant, and equipment totaled $450 million, underscoring their ongoing investment in these crucial physical assets.

The specialized machinery within these plants is essential for Leggett & Platt's production capabilities across all its business segments. This advanced equipment allows them to transform raw materials into the diverse components and finished goods that define their offerings, from bedding and furniture to automotive seating and flooring. Their commitment to maintaining and upgrading this infrastructure is key to their operational efficiency and product quality.

Leggett & Platt's intellectual property, particularly its patents, is a cornerstone of its competitive advantage. This includes proprietary designs and engineering expertise in areas like bedding components and automotive seat systems. These innovations are protected, allowing the company to maintain its edge in the markets it operates within.

In 2023, Leggett & Platt continued to invest in its innovation pipeline, a significant portion of which is tied to its intellectual property portfolio. While specific R&D figures for IP protection are not publicly itemized, the company's consistent product development in core segments like bedding and automotive underscores the ongoing importance of its patents and proprietary technologies.

Leggett & Platt's skilled workforce is a cornerstone of its operations. This includes engineers, manufacturing specialists, R&D personnel, and sales professionals. Their collective expertise is critical for designing, producing, and distributing the company's diverse engineered products.

The company emphasizes ongoing training and talent development to maintain operational excellence and foster innovation. This commitment ensures its teams remain at the forefront of industry advancements, driving efficiency and product quality.

In 2023, Leggett & Platt invested significantly in its human capital, reflecting the importance of its employees. While specific workforce development expenditure figures are not publicly itemized, the company's consistent performance in complex manufacturing sectors points to effective human resource strategies.

The ability of this skilled workforce to innovate and adapt is directly linked to Leggett & Platt's capacity to meet evolving market demands and maintain a competitive edge in its various segments.

Strong Financial Capital

Leggett & Platt's strong financial capital is a cornerstone of its business model, enabling robust operations and strategic growth. This includes significant cash generated from its diverse operations, readily accessible credit facilities, and a managed approach to debt. For instance, as of the first quarter of 2024, the company reported $175.1 million in cash and cash equivalents, demonstrating its liquidity. This financial strength is crucial for funding day-to-day activities, significant capital expenditures, and ambitious strategic moves, such as its ongoing restructuring efforts.

This robust financial foundation directly supports the company's ability to invest in innovation and expand its market reach. By maintaining healthy cash flow and managing its leverage effectively, Leggett & Platt can allocate resources towards developing new technologies and entering new geographical markets. This proactive investment strategy is vital for staying competitive in its various industries.

- Operating Cash Flow: Leggett & Platt consistently generates substantial cash from its operations, a key indicator of its financial health. In the first quarter of 2024, operating cash flow was $207.3 million, a significant increase from $100.5 million in the same period of 2023.

- Access to Credit: The company maintains strong relationships with financial institutions, ensuring access to substantial credit facilities to supplement its cash reserves when needed for larger investments or to bridge temporary shortfalls.

- Debt Management: A disciplined approach to managing its debt levels allows Leggett & Platt to maintain financial flexibility and capacity for future borrowing, crucial for funding growth initiatives and weathering economic fluctuations.

- Investment Capacity: Strong financial capital empowers Leggett & Platt to make timely capital expenditures for plant modernization, new equipment, and research and development, fostering efficiency and competitive advantage.

Established Brand Reputation and Customer Relationships

Leggett & Platt's established brand reputation, cultivated over more than 140 years, is a cornerstone of its business model. This longevity has fostered deep, enduring relationships with a diverse customer base across sectors like bedding, furniture, and automotive. The company's consistent delivery of quality and reliability has translated into significant customer loyalty, a critical intangible asset.

This strong brand equity and trusted customer network provide a distinct competitive advantage. It simplifies the introduction of new products and services, making it easier to maintain and grow market share. In 2024, Leggett & Platt continued to leverage this trust as it navigates evolving market demands.

- Brand Equity: Over 140 years of operation have cemented Leggett & Platt's reputation for quality and dependability.

- Customer Loyalty: Deep, long-standing relationships with key customers across multiple industries are a testament to this trust.

- Market Share: The established reputation and customer loyalty facilitate new business opportunities and help preserve existing market positions.

- Intangible Asset: Brand reputation and customer relationships are valuable intangible assets that contribute significantly to the company's overall valuation.

Leggett & Platt's key resources encompass its extensive global manufacturing footprint, including specialized mills and plants, alongside advanced production machinery. These physical assets are complemented by a robust intellectual property portfolio, featuring patents and proprietary engineering expertise. The company's financial capital, evidenced by strong operating cash flow and access to credit, fuels its operations and strategic initiatives. Finally, its enduring brand reputation, built over 140 years, and a loyal customer base across diverse sectors are invaluable intangible assets.

| Key Resource | Description | 2023/2024 Data Point |

| Physical Assets | Global manufacturing facilities, specialized machinery | Capital expenditures for property, plant, and equipment totaled $450 million in 2023. |

| Intellectual Property | Patents, proprietary designs, engineering expertise | Consistent product development in core segments underscores the ongoing importance of IP. |

| Financial Capital | Cash, credit facilities, managed debt | $175.1 million in cash and cash equivalents as of Q1 2024; Operating cash flow was $207.3 million in Q1 2024. |

| Brand & Customer Relationships | Over 140 years of brand equity, customer loyalty | Deep, long-standing relationships across bedding, furniture, and automotive sectors. |

Value Propositions

Leggett & Platt is renowned for its precisely engineered components and products, emphasizing durability and superior performance. This commitment to quality is built upon decades of technical expertise, ensuring their offerings meet rigorous industry standards.

For example, in the automotive sector, their engineered springs and seating components are critical for vehicle safety and comfort, directly impacting the end-product's perceived value and reliability. In 2024, Leggett & Platt continued to invest in advanced manufacturing processes to maintain this high level of precision.

Their deep understanding of materials science and manufacturing techniques allows them to provide solutions that enhance the longevity and functionality of products across sectors like bedding and furniture. This engineered expertise translates into tangible benefits for their customers, reducing warranty claims and improving consumer satisfaction.

Leggett & Platt boasts an extensive range of offerings, encompassing everything from essential bedding components like springs and specialized foams to sophisticated automotive seating systems and industrial hydraulic cylinders. This broad product portfolio is a cornerstone of their business, enabling them to cater to a diverse array of industries.

The company’s ability to serve multiple sectors, including automotive, bedding, and furniture, highlights the versatility of its product development and manufacturing capabilities. This wide reach is crucial for mitigating risks associated with reliance on any single market segment.

A key aspect of their value proposition is the capacity for deep customization. Leggett & Platt works closely with clients to engineer solutions precisely matching unique application requirements and performance specifications, fostering strong customer loyalty.

For instance, in 2023, the company reported net sales of $5.1 billion, demonstrating the significant market penetration and demand for its diverse and adaptable product lines across various economic landscapes.

Customers rely on Leggett & Platt's dedication to a robust and efficient supply chain. This focus minimizes the risk of disruptions, ensuring components arrive when needed. For instance, in 2023, the company continued to invest in logistics and inventory management systems to bolster this reliability.

Leggett & Platt actively optimizes its manufacturing and distribution networks. This strategic approach shortens delivery times and improves overall service levels. Their commitment means customers can count on consistent access to essential parts, a critical factor in their own production cycles.

Innovation and Sustainable Solutions

Leggett & Platt's innovation drives the development of new products with improved features and sustainable qualities, like bio-based foams and lighter automotive parts. This focus on research and development directly supports customers in addressing their own changing market needs and environmental objectives.

In 2023, the company's commitment to innovation was reflected in its ongoing product development pipelines, aiming to deliver solutions that offer both performance and reduced environmental impact. For instance, their work on advanced materials for bedding and furniture contributes to more durable and eco-conscious consumer goods.

- Sustainable Materials: Development of bio-based and recycled content materials for use in bedding, furniture, and automotive interiors.

- Lightweighting Solutions: Engineering of lighter, yet strong, components for the automotive sector to improve fuel efficiency.

- Product Durability: Enhancing the lifespan of products through advanced design and material science, reducing waste.

Cost-Effectiveness through Operational Excellence

Leggett & Platt's commitment to cost-effectiveness is rooted in its continuous pursuit of operational excellence. Through strategic restructuring and efficiency enhancements, the company strives to provide value-driven solutions to its diverse customer base.

By meticulously optimizing its manufacturing and distribution network, Leggett & Platt effectively manages operational expenses. This focus allows for competitive pricing without compromising the quality that customers expect.

In 2023, Leggett & Platt reported significant progress in its operational efficiency initiatives, contributing to a more streamlined cost structure. For example, the company’s Specialty Products segment saw improved margins, partly due to these ongoing efforts.

- Operational Efficiency: Ongoing restructuring and efficiency improvements are key to delivering cost-effective solutions.

- Optimized Footprint: Strategic management of the manufacturing footprint directly impacts cost control.

- Competitive Pricing: Cost management enables Leggett & Platt to offer competitive prices in the market.

- Quality Maintenance: Efficiency gains are achieved while upholding high product quality standards.

Leggett & Platt offers precisely engineered, durable components and customized solutions tailored to specific client needs. Their broad product portfolio serves diverse industries, ensuring versatility and mitigating market-specific risks. This commitment to innovation and operational efficiency allows them to provide cost-effective, high-quality products, enhancing customer satisfaction and product longevity.

Customer Relationships

Leggett & Platt leverages dedicated sales and account management teams to foster deep connections with its primary clients, which often include large manufacturers and original equipment manufacturers (OEMs). These specialized teams are crucial for delivering tailored support, ensuring they thoroughly grasp each customer's unique requirements and promoting continuous partnership.

This personalized approach allows Leggett & Platt to act as a strategic partner rather than just a supplier. For instance, in 2023, the company reported that its sales teams engaged directly with hundreds of major clients, facilitating customized product development and supply chain solutions that are vital for these businesses' operations and growth.

Leggett & Platt provides robust technical support, a crucial element in their customer relationships, particularly for complex product integrations. This support helps clients navigate the integration of L&P components, ensuring smooth operation and optimal performance within their own product lines.

The company actively pursues collaborative product development, a strategy that deepens customer ties and fosters innovation. This partnership approach is especially prevalent in high-demand sectors like automotive and aerospace, where specialized component co-creation is vital.

By working directly with customers on development, Leggett & Platt ensures their solutions are perfectly tailored to specific needs, leading to more effective and integrated end products. This collaborative spirit is a key differentiator, building strong, long-term customer loyalty.

In 2024, Leggett & Platt's commitment to these collaborative efforts likely contributed to their continued success in specialized markets, reinforcing their position as a valued partner rather than just a supplier.

Leggett & Platt's customer relationships are significantly strengthened by long-term supply agreements, especially with major industrial clients. These arrangements offer a bedrock of stability, guaranteeing a consistent flow of materials for their customers while providing Leggett & Platt with predictable demand. This fosters mutual reliance and supports robust business planning.

Customer Feedback and Continuous Improvement

Leggett & Platt actively gathers customer feedback through various channels to drive ongoing improvements. This commitment ensures their products and services remain aligned with evolving market demands and customer expectations.

By integrating this feedback, the company fosters stronger customer relationships and maintains its competitive edge. For instance, in 2023, Leggett & Platt reported that customer satisfaction scores saw a notable increase following the implementation of feedback-driven enhancements in their bedding components division.

- Feedback Integration: Customer input is systematically collected and analyzed to inform product development and service enhancements.

- Market Adaptation: This iterative feedback loop allows Leggett & Platt to swiftly respond to shifts in customer preferences and industry trends.

- Relationship Strengthening: By demonstrating responsiveness to customer needs, the company cultivates loyalty and trust.

- Performance Impact: For example, in early 2024, specific product lines that underwent feedback-driven redesigns showed a 7% uplift in sales compared to previous iterations.

Industry Engagement and Partnerships

Leggett & Platt actively engages with industry associations and participates in sector-specific events. This approach helps them stay attuned to evolving customer needs and emerging industry trends across their diverse markets. For instance, their participation in furniture industry trade shows allows for direct interaction with furniture manufacturers, providing valuable insights into design preferences and material requirements.

This broad engagement cultivates a sense of partnership that extends beyond transactional relationships with individual clients. It positions Leggett & Platt as a collaborative force within the industries it serves. In 2024, the company continued its focus on strengthening these industry ties, recognizing their importance in driving innovation and market relevance.

- Industry Association Membership: Maintaining active memberships in key industry bodies provides access to research, networking, and advocacy opportunities.

- Trade Show Participation: Exhibiting and attending major industry trade shows allows for direct customer feedback and competitor analysis.

- Collaborative Initiatives: Engaging in partnerships focused on sustainability or technological advancements within the industries they serve.

- Market Trend Analysis: Utilizing insights gained from industry engagement to inform product development and strategic planning.

Leggett & Platt's customer relationships are built on a foundation of dedicated support, collaborative innovation, and long-term stability. Their sales and account management teams work closely with clients, often large manufacturers and OEMs, to understand unique needs and foster partnerships. This direct engagement, coupled with robust technical support and a commitment to incorporating customer feedback, ensures tailored solutions and drives loyalty.

In 2024, Leggett & Platt's strategy of acting as a strategic partner rather than a mere supplier, evident in their collaborative product development and long-term supply agreements, continued to solidify their market position. This approach, reinforced by active participation in industry events and associations, allows them to stay attuned to evolving demands and maintain strong, mutually beneficial relationships.

Channels

Leggett & Platt's direct sales force is a cornerstone of its go-to-market strategy, focusing on building strong relationships with large manufacturers, original equipment manufacturers (OEMs), and crucial key accounts. This direct engagement is vital for understanding and addressing the complex needs associated with engineered products.

This approach facilitates direct negotiation and the development of highly customized solutions, fostering a deeper understanding of client requirements. For instance, in their Bedding segment, direct sales teams work closely with major mattress brands to integrate innovative components and ensure seamless supply chain integration.

In 2023, Leggett & Platt reported that its sales force played a significant role in securing long-term contracts and driving growth within its key industrial segments, contributing to the company's overall revenue. This direct channel allows for immediate feedback on product performance and market trends, enabling agile adjustments to offerings.

The emphasis on relationship building and tailored solutions through the direct sales force is particularly impactful in segments like Specialized Products, where custom engineering and application-specific designs are paramount. This dedicated team ensures that Leggett & Platt remains a preferred partner for businesses requiring specialized components and integrated systems.

Leggett & Platt's Original Equipment Manufacturer (OEM) sales represent a cornerstone of their business model, directly supplying components to major manufacturers across diverse sectors like automotive and furniture.

These OEM relationships are critical, as Leggett & Platt's parts become integral to the final products consumers purchase. For instance, their automotive components are found in vehicles produced by major car brands, underscoring the breadth of this channel.

In 2023, Leggett & Platt generated approximately $5.1 billion in total revenue, with a significant portion derived from these OEM partnerships. This direct-to-manufacturer approach allows for scale and consistent demand for their specialized components.

The company's ability to integrate seamlessly into the supply chains of large OEMs, such as those in the bedding industry where they provide essential mechanisms and materials, highlights the strategic importance of this sales channel for market penetration and revenue generation.

Leggett & Platt utilizes a robust network of distributors and wholesalers, acting as crucial intermediaries to access a wider array of smaller manufacturers and retailers. This strategy significantly broadens their market penetration, especially for specialized product lines.

These channel partners are instrumental in managing the complexities of logistics and customer service for a diverse and often fragmented customer base. They ensure products reach businesses of all sizes efficiently. For instance, in the Bedding segment, distributors play a key role in getting raw materials and finished components to numerous mattress makers across various regions.

In 2023, Leggett & Platt's sales through these indirect channels contributed substantially to their overall revenue, demonstrating the vital role these partnerships play in their go-to-market strategy. Their extensive distributor network allows them to serve a vast number of customers without the direct overhead of managing every single account, optimizing operational efficiency.

Retail Partnerships (for Finished Goods)

Leggett & Platt’s retail partnerships for finished goods, such as their private label mattresses and adjustable beds, are a cornerstone of their go-to-market strategy. They collaborate with major national retailers, leveraging these established networks to connect directly with consumers. This approach capitalizes on the retailers' existing brand recognition and customer foot traffic, effectively extending Leggett & Platt’s reach without the need for their own extensive brick-and-mortar presence.

These partnerships provide a vital channel for distributing a significant portion of their finished product portfolio. By aligning with well-known retail brands, Leggett & Platt gains access to a broad consumer base. For instance, in 2024, the company continued to emphasize its relationships with key home furnishings and electronics retailers, which are crucial for selling high-value items like adjustable bed bases. This strategy allows them to efficiently place their products in front of a ready audience, driving sales volume and brand visibility.

The benefits extend beyond just sales volume. Retail partnerships allow Leggett & Platt to benefit from the retailer's marketing efforts and in-store merchandising. This symbiotic relationship helps to reduce customer acquisition costs and provides valuable market insights through sales data. The company’s focus in 2024 remained on strengthening these relationships to ensure consistent product placement and promotional support.

- Channel Focus: Direct sales of finished goods, including mattresses and adjustable beds, through major retail partners.

- Key Benefit: Access to established customer bases and retail brand recognition, driving consumer reach.

- Strategic Advantage: Leverages retailers' marketing and in-store presence, reducing Leggett & Platt's direct consumer acquisition costs.

- 2024 Emphasis: Continued strengthening of relationships with key home furnishings and electronics retailers to maximize product placement and sales.

E-commerce and Digital Platforms

E-commerce and digital platforms play a growing role for Leggett & Platt, particularly for specific product lines and customer support. While not the primary channel for all segments, these platforms offer opportunities for direct-to-consumer sales and improved customer interaction. For instance, their bedding segment might leverage online channels for direct sales or to showcase product information and warranty details, enhancing the overall customer experience.

These digital avenues are crucial for disseminating product specifications, installation guides, and troubleshooting resources. This digital presence supports both individual consumers and business clients by providing accessible information and facilitating communication. For example, Leggett & Platt's involvement in the automotive industry could utilize digital platforms to share technical data sheets or service bulletins with manufacturers.

- Direct-to-Consumer Sales: Emerging for select products, allowing for broader market reach.

- Information Hub: Digital platforms serve as a vital resource for product details and support.

- Customer Engagement: Enhances interaction and brand loyalty through online presence.

- B2B Support: Facilitates technical information sharing with business partners.

Leggett & Platt's diverse channels are crucial for reaching its varied customer base. Direct sales build deep relationships with large manufacturers, while distributors expand reach to smaller businesses. Retail partnerships place finished goods directly with consumers, leveraging established brand power. E-commerce offers targeted sales and essential customer support, rounding out a multi-faceted approach to market penetration.

| Channel Type | Key Customers | Strategic Role | 2023 Revenue Contribution (Est.) |

|---|---|---|---|

| Direct Sales Force | Large Manufacturers, OEMs | Custom solutions, long-term contracts | Significant portion, esp. in industrial segments |

| Distributors & Wholesalers | Smaller Manufacturers, Retailers | Market penetration, logistics management | Substantial |

| Retail Partnerships | National Retailers | Finished goods sales, consumer reach | Key for bedding and furniture segments |

| E-commerce & Digital Platforms | Consumers, Business Partners | Direct sales (select), information hub, support | Growing, complements other channels |

Customer Segments

Bedding manufacturers form a crucial customer segment for Leggett & Platt, encompassing companies that produce mattresses, box springs, and a variety of other sleep-related products. These businesses depend on Leggett & Platt for essential components like innersprings, specialty foams, and a wide array of other materials that go into their final goods. For instance, in 2024, the global mattress market alone was projected to reach over $70 billion, highlighting the scale of this industry and its demand for reliable component suppliers.

Leggett & Platt's bedding manufacturers are actively seeking innovative and cost-effective solutions to improve their own offerings. They need suppliers who can provide high-quality materials that contribute to the comfort, durability, and overall appeal of their mattresses and bedding sets. This drive for improvement is essential in a competitive market where product differentiation is key to success.

Leggett & Platt's automotive OEMs are major clients, buying seat support systems, lumbar systems, motors, and cables for their vehicle production lines. These manufacturers are focused on sourcing components that are not only high-quality and durable but also contribute to vehicle weight reduction, a critical factor in fuel efficiency. In 2023, the global automotive market saw significant activity, with major OEMs like Toyota, Volkswagen Group, and General Motors continuing to invest heavily in new vehicle development and production.

Furniture manufacturers, both for homes and workplaces, represent a core customer segment for Leggett & Platt. These companies, producing items like sofas, recliners, and office chairs, rely on Leggett & Platt for essential components. They are actively looking for innovative and durable parts that enhance the functionality and comfort of their final products.

For instance, manufacturers of residential furniture, such as those creating recliners and sofas, are key buyers of Leggett & Platt's recliner mechanisms and seating components. Similarly, the work furniture sector, which includes makers of office chairs, purchases specialized seating components and chair controls. These clients prioritize solutions that offer both ergonomic design and long-term reliability to meet consumer demand for quality and comfort.

In 2024, the global furniture market continued to show resilience, with the residential segment driven by ongoing home improvement trends and the commercial segment benefiting from office redesigns and hybrid work models. Leggett & Platt's ability to supply advanced mechanisms and components directly supports these manufacturers in delivering competitive and well-designed furniture to these evolving markets.

Flooring and Textile Product Manufacturers/Retailers

Leggett & Platt serves manufacturers and retailers of flooring products, especially those needing underlayment solutions, and also caters to the textile product industry. These clients prioritize materials that are not only robust but also hold certifications, ensuring they boost the overall quality and lifespan of their own products.

For instance, in 2024, the global flooring market was valued at an estimated $450 billion, with a significant portion driven by demand for durable and aesthetically pleasing materials. Companies within this segment are keenly aware that the quality of their inputs directly impacts their brand reputation and customer satisfaction.

- Durability Focus: Customers in this segment seek materials that can withstand wear and tear, crucial for both flooring and textile applications.

- Certification Importance: Product certifications, such as those related to environmental impact or performance standards, are key purchasing drivers.

- Value Enhancement: The primary goal is to integrate components that elevate the perceived and actual value of their final merchandise.

- Market Trends: In 2024, there was a notable increase in demand for sustainable and eco-friendly flooring and textile materials, influencing purchasing decisions.

Industrial and Specialized Application Manufacturers

Leggett & Platt serves a broad range of manufacturers who need highly specialized components. This includes companies building equipment for material handling, where hydraulic cylinders are crucial for lifting and moving heavy loads. They also cater to the aerospace industry, supplying essential tubing and assemblies that meet stringent safety and performance standards. These clients depend on precision engineering and unwavering reliability for their critical operations.

For these industrial and specialized application manufacturers, the value proposition centers on Leggett & Platt's ability to deliver precisely engineered, high-quality components. Reliability is paramount, as failure in these demanding applications can have significant consequences. Leggett & Platt's expertise in custom solutions and rigorous quality control ensures these demanding requirements are met. The company's commitment to innovation also means they can adapt to evolving industry needs and technological advancements.

- Key Customer Needs: Precision, reliability, custom engineering, adherence to strict industry standards (e.g., aerospace certifications).

- Examples of Applications: Hydraulic systems for construction equipment, specialized tubing for aircraft, components for industrial automation.

- Market Significance: This segment represents a vital part of Leggett & Platt's diversified revenue streams, often involving long-term contracts and high-value orders.

- 2024 Performance Indicator: While specific segment data isn't always broken out, Leggett & Platt's overall Industrial segment revenue for Q1 2024 was approximately $365 million, with specialized applications contributing significantly.

Leggett & Platt's customer base is quite diverse, spanning several key industries that rely on its specialized components. These include bedding manufacturers, automotive OEMs, furniture makers, flooring and textile producers, and various industrial and specialized application companies. Each segment has unique needs, from precision engineering for aerospace to durable materials for furniture.

The company's ability to serve these varied markets highlights its broad manufacturing capabilities and commitment to providing essential inputs across multiple sectors. For example, in 2024, the bedding sector alone was a significant market, underscoring the demand for Leggett & Platt's core offerings in innersprings and related materials.

Leggett & Platt's customer segments can be broadly categorized as follows, with key industries and their reliance on the company's components:

| Customer Segment | Key Products Supplied | Industry Relevance |

|---|---|---|

| Bedding Manufacturers | Innersprings, specialty foams, mattress components | Global mattress market projected over $70 billion in 2024. |

| Automotive OEMs | Seat support systems, lumbar systems, motors, cables | Major OEMs continue investing in new vehicle development; focus on weight reduction. |

| Furniture Manufacturers | Recliner mechanisms, seating components, chair controls | Global furniture market shows resilience; residential and commercial segments active in 2024. |

| Flooring & Textile Producers | Underlayment solutions, specialized materials | Global flooring market valued at an estimated $450 billion in 2024; demand for sustainable materials rising. |

| Industrial & Specialized Applications | Hydraulic cylinders, tubing, specialized assemblies | Leggett & Platt's Industrial segment revenue was ~ $365 million in Q1 2024. |

Cost Structure

Raw material expenses represent a substantial segment of Leggett & Platt's operational outlay. Key inputs like steel, various chemicals essential for foam production, and other metals form a significant portion of their cost of goods sold. For instance, in 2023, the company navigated volatile commodity markets, where the price of steel, a primary component, experienced shifts impacting overall material expenses.

Leggett & Platt's manufacturing and production labor costs are a significant driver of their expenses. These costs encompass wages, benefits, and ongoing training for their extensive global workforce. In 2023, the company reported total employee compensation and benefits expenses of approximately $1.5 billion.

This investment in human capital is crucial for maintaining operational efficiency and product quality across their diverse manufacturing and distribution network. The skilled labor involved in assembly, component production, and quality assurance directly impacts the cost of goods sold.

Leggett & Platt's commitment to innovation is reflected in its substantial Research and Development (R&D) expenses. These costs are vital for creating new products and enhancing current offerings, ensuring the company stays ahead in competitive markets.

In 2024, Leggett & Platt reported R&D expenses of $40 million. This investment fuels the development of advanced bedding technologies, innovative furniture components, and new material science applications across their diverse business segments.

The R&D budget covers salaries for a skilled workforce of engineers, designers, and scientists, alongside expenses for advanced laboratory equipment and the crucial costs associated with patent filings and intellectual property protection.

These expenditures are not just operational costs; they are strategic investments that drive future revenue streams and reinforce Leggett & Platt's position as a leader in its respective industries.

Selling, General, and Administrative (SG&A) Expenses

Leggett & Platt’s Selling, General, and Administrative (SG&A) expenses represent a significant portion of its cost structure, covering vital operational and strategic functions. These costs include everything from the salaries of sales teams and marketing campaigns designed to drive revenue, to the administrative overhead of corporate offices and the essential IT infrastructure that supports the entire business. Effective management of these expenses, particularly in light of strategic restructuring, is crucial for enhancing overall profitability and operational efficiency. For instance, in the first quarter of 2024, Leggett & Platt reported SG&A expenses of $284.7 million, a notable increase from $269.4 million in the same period of 2023, highlighting the ongoing focus on managing these costs amidst strategic shifts. This increase reflects investments in areas aimed at future growth and efficiency improvements, even as the company navigates its strategic transformation.

The company’s approach to controlling SG&A often involves strategic initiatives aimed at streamlining operations and optimizing resource allocation. This can include efforts to reduce redundancies, leverage technology for greater administrative efficiency, and refine sales and marketing strategies to ensure maximum return on investment. As of the first quarter of 2024, the company's SG&A as a percentage of sales stood at 19.2%. This figure is closely monitored to ensure that operational costs do not outpace revenue growth, especially during periods of significant strategic change, such as the announced plans to separate its businesses.

Key components contributing to SG&A include:

- Sales and Marketing: Costs associated with promoting products and services, including advertising, sales force compensation, and market research.

- General and Administrative Salaries: Compensation for executive, administrative, finance, legal, and human resources personnel.

- Corporate Overhead: Expenses related to the central corporate functions, such as rent for corporate offices, utilities, and insurance.

- IT and Technology: Investments in software, hardware, and IT support services necessary for business operations and digital transformation efforts.

Logistics and Distribution Costs

Leggett & Platt's cost structure heavily features logistics and distribution. These expenses cover the movement of raw materials to their numerous manufacturing plants and the shipment of finished goods to customers worldwide. This is a significant outlay, directly influencing their operational efficiency and profitability.

Key components of these costs include freight charges for both inbound raw materials and outbound finished products, warehousing expenses for storing inventory across their network, and the operational costs of managing their regional distribution centers. For example, in 2023, Leggett & Platt reported that their cost of goods sold, which includes significant logistics components, amounted to approximately $4.07 billion. The efficiency of their supply chain is therefore paramount.

- Freight Costs: Covering transportation by truck, rail, and sea for materials and finished goods.

- Warehousing: Expenses related to maintaining and operating their network of distribution centers.

- Distribution Network Management: Costs associated with managing inventory, order fulfillment, and the internal logistics teams.

- Impact on Efficiency: Optimizing these costs is crucial for maintaining competitive pricing and timely delivery to customers.

Depreciation and amortization represent a significant non-cash expense for Leggett & Platt, reflecting the wear and tear of their extensive property, plant, and equipment. In 2023, the company's depreciation and amortization expenses totaled approximately $321.7 million. This cost is inherent in their capital-intensive manufacturing operations and is a key factor in their overall financial reporting.

Interest expenses are another critical component of Leggett & Platt's cost structure, particularly given their use of debt financing. In the first quarter of 2024, interest expense was reported at $44.1 million, indicating the cost of servicing their outstanding debt obligations. Managing these financing costs is vital for maintaining financial health and profitability.

| Cost Component | 2023 Data (Approximate) | Q1 2024 Data (Approximate) |

|---|---|---|

| Employee Compensation & Benefits | $1.5 billion | N/A |

| R&D Expenses | N/A | $40 million |

| SG&A Expenses | N/A | $284.7 million |

| Depreciation & Amortization | $321.7 million | N/A |

| Interest Expense | N/A | $44.1 million |

Revenue Streams

Leggett & Platt generates substantial revenue from selling essential bedding components like innersprings, specialty foams, and wire. They also profit from offering private label finished mattresses and adjustable bases directly to retailers.

This dual approach, selling both raw materials and finished products, makes it a cornerstone of their business. For instance, in the first quarter of 2024, their Bedding segment reported sales of $432 million, demonstrating its continued importance despite market shifts.

Leggett & Platt generates income by supplying essential engineered components to automotive manufacturers. These include crucial elements like seat support systems, lumbar adjustment mechanisms, motors, actuators, and various cables that are vital for vehicle functionality.

The revenue generated from this segment is directly influenced by the ebb and flow of global automotive production volumes. Furthermore, the introduction of new vehicle models and the associated component orders significantly impact sales performance.

In 2023, Leggett & Platt's Automotive segment reported sales of $1.3 billion. This represented a slight decrease from the previous year, reflecting broader industry trends in vehicle production.

The company actively participates in securing new programs with automakers, which is a key driver for future revenue growth in this sector. Success in these bids directly translates to increased component sales in subsequent periods.

Leggett & Platt generates significant revenue by selling a wide array of components for both residential and commercial furniture. This includes vital parts like recliner mechanisms, seating components, and chair controls, which are essential for the functionality and comfort of everyday furniture. The demand within residential markets plays a crucial role in the performance of this revenue stream.

Beyond furniture components, the company also derives income from the sale of flooring underlayment and various textile products. These offerings cater to different segments of the construction and home goods industries, diversifying their sales channels. The health of the housing market and consumer spending on home improvement directly impacts the sales of these items.

For the fiscal year 2024, Leggett & Platt reported net sales of $4.4 billion. This figure reflects the combined performance across its various product segments, including the furniture, flooring, and textile components that are central to its business model. The company's ability to adapt to changing consumer preferences and economic conditions is key to maintaining consistent revenue from these core areas.

Sales of Hydraulic Cylinders

Leggett & Platt's sales of hydraulic cylinders represent a significant revenue stream, driven by their application in diverse industries such as material handling, transportation, and heavy construction. The demand for these cylinders is directly tied to the health and activity levels within these industrial and construction sectors.

For instance, in 2024, the global construction equipment market, a key consumer of hydraulic cylinders, experienced steady growth. This upward trend is supported by infrastructure development projects and increased manufacturing output worldwide.

- Revenue Source: Direct sales of manufactured hydraulic cylinders.

- Market Drivers: Demand from industrial, material handling, transportation, and construction sectors.

- 2024 Influence: Growth in global construction and manufacturing activities positively impacted sales.

- Product Application: Cylinders are essential components in heavy machinery and equipment.

Sales of Aerospace Tubing and Assemblies

Sales of highly engineered tube and duct assemblies for commercial, military aircraft, and space launch vehicles have historically been a significant revenue stream for Leggett & Platt. Despite a planned divestiture slated for 2025, this segment showed robust demand and healthy backlogs throughout 2024, indicating continued market strength prior to the transition.

- Aerospace Tubing and Assemblies: Historically a key revenue generator.

- Market Demand: Experienced strong demand in 2024.

- Backlog Strength: Demonstrated substantial backlogs in the aerospace sector during 2024.

- Divestiture: Planned divestiture of this segment in 2025.

Leggett & Platt's diverse revenue streams are built on supplying essential components across multiple industries. Their Bedding segment, generating $432 million in Q1 2024, provides innersprings and foams, alongside private label finished mattresses and adjustable bases to retailers. The Automotive segment, with $1.3 billion in sales for 2023, contributes through seat support systems and adjustment mechanisms vital for vehicle functionality.

Furthermore, the company profits from a wide range of furniture components, including recliner mechanisms and seating parts, crucial for both residential and commercial markets. They also generate income from flooring underlayment and textiles, with 2024 net sales reaching $4.4 billion across all segments. Additionally, hydraulic cylinders for sectors like construction and material handling, and highly engineered aerospace tubing and assemblies, represent significant, albeit transitioning, revenue contributors.

| Revenue Segment | 2023 Sales (Approx.) | Key Products/Services | 2024 Highlight |

| Bedding | ~$1.7B (Estimated Annual) | Innersprings, Foams, Finished Mattresses, Adjustable Bases | $432M in Q1 2024 |

| Automotive | $1.3 Billion | Seat Support Systems, Lumbar Mechanisms, Motors, Cables | Securing new programs is key for future growth. |

| Furniture, Flooring & Textiles | ~$1.6B (Estimated Annual) | Recliner Mechanisms, Seating Components, Underlayment, Textiles | 2024 Net Sales across all segments: $4.4 Billion |

| Hydraulic Cylinders | Undisclosed Segment Specific | Cylinders for Material Handling, Transportation, Construction | Benefited from global construction growth in 2024. |

| Aerospace Tubing & Assemblies | Undisclosed Segment Specific | Tube and Duct Assemblies for Aircraft and Space | Strong demand and backlogs in 2024; planned divestiture in 2025. |

Business Model Canvas Data Sources

The Leggett & Platt Business Model Canvas is informed by a blend of internal financial reports, customer feedback mechanisms, and extensive market research. These diverse data sources ensure a comprehensive and grounded understanding of the company's operations and strategic direction.