Knight-Swift Transportation PESTLE Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Knight-Swift Transportation Bundle

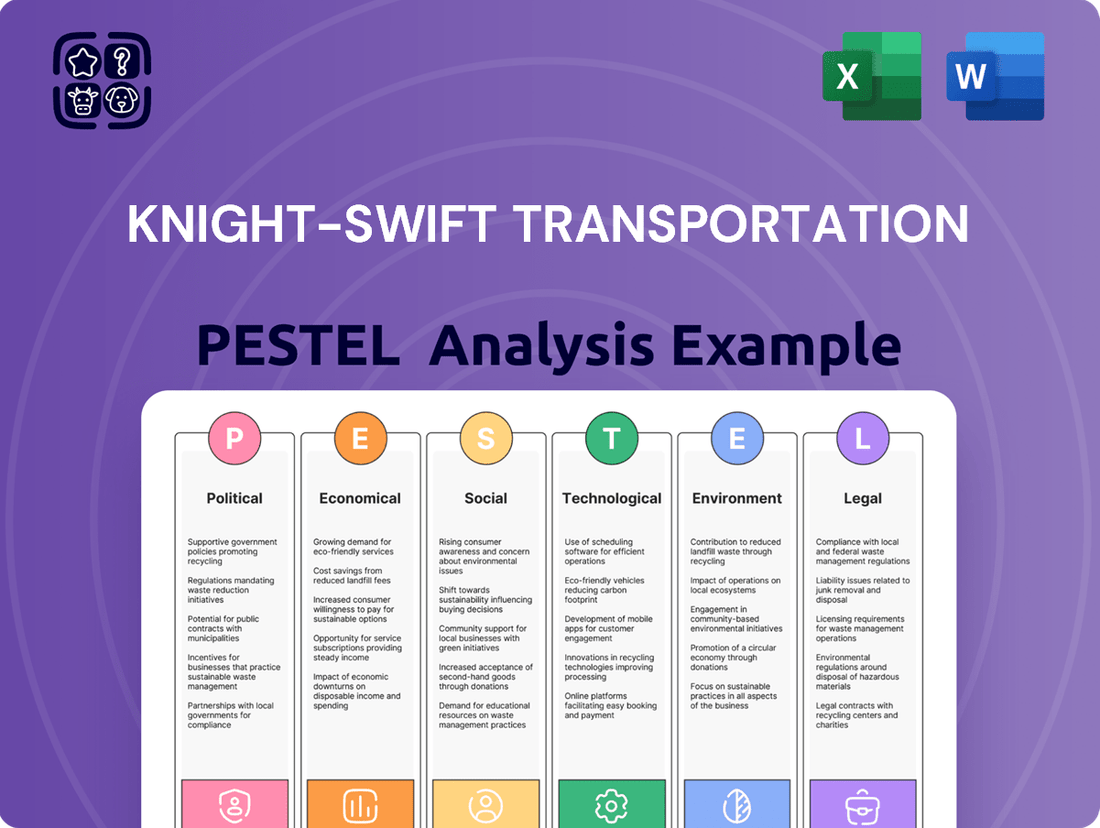

Unlock the critical external factors shaping Knight-Swift Transportation's trajectory with our comprehensive PESTLE analysis. From evolving environmental regulations to the economic impact of fuel prices, understand the political, economic, social, technological, legal, and environmental forces at play. This analysis is your roadmap to anticipating challenges and capitalizing on opportunities within the transportation sector. Download the full version now to gain actionable intelligence and sharpen your strategic advantage.

Political factors

Government regulations significantly shape Knight-Swift's operations. Changes in federal and state rules, covering areas like driver hours-of-service, speed restrictions, and safety mandates, directly affect how the company operates and the costs associated with compliance. For example, the Federal Motor Carrier Safety Administration (FMCSA) recently withdrew a proposed rule for speed limiters, a move that can reduce compliance burdens and associated expenses for carriers like Knight-Swift.

The broader political landscape, particularly the administration's approach to industry oversight, plays a crucial role. A leaning towards deregulation can create opportunities for operational flexibility and cost savings, potentially benefiting companies like Knight-Swift. Conversely, increased oversight might lead to higher compliance expenditures. Industry advocacy groups report that regulatory relief efforts could save the trucking sector millions annually, underscoring the financial implications of policy shifts.

Knight-Swift Transportation, as a major North American carrier, is significantly influenced by the trade policies and cross-border relations among the U.S., Canada, and Mexico. Changes in trade agreements, like potential updates or renegotiations of frameworks such as the USMCA (United States-Mexico-Canada Agreement), directly impact freight flows.

Tariffs or altered customs procedures can disrupt supply chains, affecting the volume of goods transported and the efficiency of cross-border trucking operations. For instance, a sudden imposition of tariffs on certain goods could reduce demand for transportation services on those specific lanes.

The freight market experiences volatility due to the inherent unpredictability of these political factors. For example, in 2024, ongoing discussions and potential adjustments to trade regulations between these countries continue to create an environment where freight volumes can fluctuate, impacting Knight-Swift's operational planning and revenue streams.

Government investment in transportation infrastructure, like roads and bridges, directly impacts how efficiently and affordably trucking companies like Knight-Swift operate. Increased spending means smoother transit, less wear on trucks, and potentially lower fuel costs. For example, the U.S. Bipartisan Infrastructure Law allocated $1.2 trillion in 2021, with a significant portion directed towards transportation, aiming to modernize networks through 2026.

Conversely, underinvestment leads to congestion and deteriorates road conditions, increasing operational expenses through slower delivery times and higher maintenance needs for Knight-Swift's fleet. Policies encouraging specific infrastructure, such as the development of autonomous freight corridors, could also reshape how trucking companies function, potentially increasing efficiency and safety in the coming years.

Labor and Employment Policies

Government policies significantly shape Knight-Swift's labor landscape. Minimum wage adjustments directly impact operating costs, while regulations around unionization can affect workforce stability and negotiation dynamics. For instance, the Federal Motor Carrier Safety Administration (FMCSA) continues to refine its Entry-Level Driver Training (ELDT) standards, aiming to bolster safety and address persistent driver shortages.

Recent policy discussions have focused on strategies to attract and retain drivers. Pilot programs allowing drivers under 21 to operate commercial vehicles in interstate commerce, such as those under the Infrastructure Investment and Jobs Act, aim to expand the potential talent pool. Conversely, enhanced training requirements, while beneficial for safety, can also increase onboarding costs and time.

- Driver Shortage Impact: The American Trucking Associations (ATA) estimated a shortage of over 78,000 drivers in 2023, a number projected to grow if not addressed by policy and industry initiatives.

- Wage Trends: Average annual wages for heavy and tractor-trailer truck drivers were approximately $53,000 in May 2023, according to the Bureau of Labor Statistics, with potential for higher earnings based on experience and routes, influenced by minimum wage laws.

- Training Mandates: The ELDT rule, fully implemented in February 2022, requires new commercial drivers to complete specific training from registered providers, impacting recruitment pipelines.

Environmental Regulations and Incentives

Political pressure for emission reductions is increasingly shaping the trucking industry. Governments are enacting stricter standards for heavy-duty vehicles, pushing companies like Knight-Swift to adapt. For example, the U.S. Environmental Protection Agency (EPA) finalized new greenhouse gas emission standards for medium-duty and heavy-duty vehicles in March 2024, aiming to significantly cut emissions through 2032. This regulatory environment directly impacts Knight-Swift's fleet modernization plans and operational costs.

These evolving environmental regulations often come with incentives designed to encourage the adoption of cleaner technologies. Governments are offering tax credits and grants for purchasing zero-emission vehicles (ZEVs) and investing in charging infrastructure. In 2024, the Inflation Reduction Act continues to provide substantial tax credits for electric vehicles, which could influence Knight-Swift's long-term fleet investment strategies, potentially shifting capital towards electric or hydrogen-powered trucks to comply with future mandates and leverage financial benefits.

- Stricter Emission Standards: New EPA rules from March 2024 target significant reductions in CO2 and NOx emissions for heavy-duty vehicles, impacting fleet compliance.

- ZEV Incentives: Government programs, like those under the Inflation Reduction Act, offer tax credits for electric trucks, potentially lowering the upfront cost for Knight-Swift.

- Infrastructure Investment: Political will to build out charging and refueling networks for ZEVs is crucial for the widespread adoption and operational feasibility for large fleets.

- California's Advanced Clean Fleets Rule: This rule, and similar initiatives in other states, mandates a transition to zero-emission vehicles for commercial fleets, directly affecting operational planning for companies with significant operations in these regions.

Government infrastructure spending directly impacts Knight-Swift's operational efficiency and costs. The U.S. Bipartisan Infrastructure Law, allocating $1.2 trillion starting in 2021, with substantial funds for transportation networks through 2026, aims to improve road conditions and reduce transit times. Conversely, underinvestment could lead to increased congestion and wear on the company's fleet, raising maintenance expenses.

Political decisions regarding trade agreements, such as potential adjustments to the USMCA, significantly influence freight volumes and cross-border trucking operations for Knight-Swift. Tariffs or altered customs procedures can disrupt supply chains, affecting the predictability of freight flows and revenue. For instance, in 2024, ongoing trade policy discussions between the U.S., Canada, and Mexico continue to create market volatility.

Labor policies, including minimum wage adjustments and training mandates like the FMCSA's Entry-Level Driver Training (ELDT) standards, directly affect Knight-Swift's operating costs and driver recruitment. Initiatives like pilot programs allowing younger drivers in interstate commerce, as part of the Infrastructure Investment and Jobs Act, aim to alleviate driver shortages, which the ATA estimated at over 78,000 drivers in 2023.

Environmental regulations, such as the EPA's March 2024 finalized greenhouse gas emission standards for heavy-duty vehicles, are pushing Knight-Swift towards fleet modernization and cleaner technologies. Government incentives, like tax credits for electric vehicles under the Inflation Reduction Act, may influence the company's capital allocation towards zero-emission vehicles to comply with mandates and leverage financial benefits.

What is included in the product

This PESTLE analysis meticulously examines the Political, Economic, Social, Technological, Environmental, and Legal forces impacting Knight-Swift Transportation, providing a comprehensive understanding of its operating landscape.

It offers actionable insights into how these external factors create both challenges and strategic advantages for Knight-Swift Transportation, enabling informed decision-making.

Knight-Swift's PESTLE analysis offers a clear, summarized version of external factors impacting the transportation industry, simplifying complex market dynamics for quick referencing during strategic planning and stakeholder discussions.

Economic factors

The overall health of the economy, as reflected in Gross Domestic Product (GDP) growth, is a primary driver of freight demand. When the economy expands, businesses produce and sell more goods, necessitating increased transportation. For instance, a projected 2.3% GDP growth in the US for 2024, followed by an estimated 1.9% in 2025, suggests a supportive environment for freight volumes.

Consumer spending and industrial production are key indicators that directly correlate with freight volumes. A dip in these areas, such as the observed moderation in consumer spending in early 2025, typically translates to fewer goods needing to be shipped, thereby reducing demand for trucking services and potentially pressuring freight rates.

While the freight market has experienced a period of rebalancing, with capacity adjusting to demand, projections for 2025 point towards a gradual recovery. This recovery is anticipated to see an uptick in freight volumes, which, coupled with ongoing capacity management, could lead to an improvement in trucking rates throughout the year.

Fuel price volatility is a major concern for Knight-Swift Transportation, as diesel and gasoline costs represent a substantial portion of their operating expenses. Fluctuations driven by global oil prices, supply disruptions like production cuts, and demand shifts directly impact the company's bottom line.

The company's profitability is closely tied to these fuel costs, often leading to the implementation of fuel surcharges to offset increases. Projections for 2025 suggest diesel prices will remain under $4 per gallon, offering some stability.

However, the trucking industry must remain vigilant, as geopolitical events can trigger sudden and significant price swings in the fuel market, creating uncertainty for carriers like Knight-Swift.

Interest rates significantly impact Knight-Swift's ability to finance new trucks and trailers. As of early 2024, the Federal Reserve maintained a target range for the federal funds rate between 5.25% and 5.50%. Higher borrowing costs make acquiring new assets more expensive, potentially slowing down fleet upgrades.

For instance, if Knight-Swift needs to finance a $150,000 truck, a 1% increase in interest rates on a 5-year loan could add approximately $7,500 in total interest costs. This elevated cost can lead to a more cautious stance on capital expenditures, impacting the pace of fleet modernization efforts and overall expansion plans.

Inflation and Operating Costs

Inflation significantly impacts Knight-Swift's operating expenses. Higher prices for essential inputs like fuel, truck parts, tires, and maintenance directly increase the cost of doing business. For example, the average cost of new heavy-duty truck tires saw an increase of approximately 5-10% in late 2023 and early 2024 compared to the previous year.

Furthermore, rising insurance premiums present a substantial challenge. Increased accident frequency and severity, coupled with higher repair costs, have driven up insurance rates for trucking companies. This escalating expense puts pressure on Knight-Swift to adjust its freight rates and potentially impacts driver compensation and benefits to offset these rising costs.

- Fuel: While fuel prices can be volatile, sustained inflationary periods lead to higher average operating costs.

- Parts and Maintenance: The cost of replacement parts and servicing has seen an upward trend due to supply chain issues and general inflation.

- Tires: Tire costs are a significant expenditure, and inflation has contributed to their price escalation.

- Insurance: Increased claims and legal settlements have pushed insurance premiums higher for carriers.

Consumer Spending Patterns

Consumer spending habits significantly influence the demand for truckload transportation, a core business for Knight-Swift Transportation. Shifts in consumer preference, such as a move towards experiences and services rather than physical goods, can directly dampen the need for freight movement. For instance, in early 2024, reports indicated a continued trend of consumers allocating more discretionary income to travel and entertainment compared to durable goods, which are typically transported by truck.

This pivot can lead to reduced freight volumes and consequently impact Knight-Swift's overall revenue. If consumers prioritize spending on services, the demand for transporting manufactured goods, raw materials, and retail products may stagnate or decline. Data from the Bureau of Economic Analysis for 2023 showed that spending on services outpaced spending on goods, a trend that analysts projected to continue into 2024, posing a challenge for freight carriers.

- Consumer shift to services impacts goods transportation demand.

- In 2023, services spending growth outpaced goods spending.

- Reduced demand for physical goods transport affects freight volumes.

- Knight-Swift's revenue is directly tied to freight volume performance.

Economic growth is a significant driver for Knight-Swift, with projected US GDP growth of 2.3% in 2024 and 1.9% in 2025 indicating a supportive environment for freight demand. Consumer spending, particularly on goods, directly correlates with trucking volumes, though a shift towards services spending, observed in 2023 and projected for 2024, could moderate freight demand.

Interest rates impact capital expenditure; the Federal Reserve's target range of 5.25%-5.50% in early 2024 means higher borrowing costs for fleet expansion. Inflation affects operating expenses, with diesel prices projected to stay below $4/gallon in 2025, offering some relief, though fuel cost volatility remains a concern.

The trucking industry navigates a market rebalancing, with freight volumes expected to gradually recover in 2025. This recovery, combined with capacity management, could improve trucking rates, but persistent inflation in parts, maintenance, and insurance continues to pressure operating costs.

What You See Is What You Get

Knight-Swift Transportation PESTLE Analysis

The preview shown here is the exact document you’ll receive after purchase—fully formatted and ready to use. This comprehensive PESTLE analysis for Knight-Swift Transportation delves into the Political, Economic, Social, Technological, Legal, and Environmental factors impacting their operations. Understanding these elements is crucial for strategic planning and identifying potential opportunities and threats in the transportation industry. The insights provided will equip you to make informed decisions regarding market entry, competitive positioning, and risk management for Knight-Swift.

Sociological factors

The trucking industry, including major players like Knight-Swift Transportation, continues to grapple with a significant driver shortage. This isn't just a domestic issue; it's a global challenge impacting freight capacity and driving up operational expenses. For instance, in 2024, estimates suggested a shortfall of over 70,000 drivers in the US alone.

Several factors fuel this persistent shortage. An aging driver population, with the average age of long-haul truck drivers hovering around 45, means a substantial portion of the workforce is nearing retirement. Simultaneously, attracting younger individuals is proving difficult due to demanding schedules and lifestyle challenges.

To combat this, companies are investing heavily in retention and recruitment strategies. This includes enhancing compensation packages, offering better benefits, and improving overall working conditions to make the profession more appealing. Knight-Swift, for example, has highlighted its focus on driver pay and home time as key retention tools.

Demographic shifts are significantly impacting Knight-Swift Transportation's labor pool. The trucking industry, including Knight-Swift, faces a long-term challenge with an aging driver population; the average age of a truck driver in the US was around 46 in 2023. Conversely, there's a notably low percentage of younger individuals entering the profession, exacerbating potential labor shortages.

To address this, Knight-Swift must adapt its recruitment and retention strategies. This includes creating work environments and offering benefits that appeal to a more diverse and younger workforce, potentially incorporating technology and improved work-life balance initiatives. For instance, by 2025, companies that successfully attract younger talent will likely see a competitive advantage.

Public perception of the trucking industry significantly impacts Knight-Swift. Concerns about safety, environmental footprint, and driver well-being are prominent. For instance, a 2024 survey indicated that while most Americans rely on trucking, a notable percentage still express concerns about truck safety on roadways, influencing potential regulatory changes.

Knight-Swift's commitment to improving safety protocols and reducing emissions directly addresses these public concerns. By investing in advanced driver-assistance systems and exploring alternative fuel technologies, the company aims to cultivate a more positive public image. This proactive approach is crucial for attracting new talent to a sector facing driver shortages.

Health and Safety Standards for Drivers

Societal expectations and regulatory focus on driver well-being significantly impact transportation companies like Knight-Swift. Concerns about driver fatigue, overall health, and the availability of essential amenities are paramount. These factors directly influence how companies structure their operations and driver schedules.

In response, there's a growing emphasis on enhancing driver working conditions and implementing robust wellness programs. Knight-Swift, for instance, has invested in initiatives aimed at improving driver retention by addressing these critical areas. This shift is driven by a recognition that a healthy and well-supported driver force is crucial for efficient and safe operations.

- Driver Fatigue Management: Stricter Hours of Service regulations, like those from the FMCSA, aim to combat driver fatigue, a leading cause of accidents.

- Health and Wellness Programs: Companies are introducing health screenings, mental health support, and fitness incentives to improve driver well-being.

- Amenities and Rest Stops: Societal pressure and regulatory push are leading to better access to clean and safe rest areas, a persistent challenge for long-haul truckers.

- Retention Efforts: In 2023, the trucking industry faced a driver shortage, with retention being a key strategy, underscoring the importance of addressing driver satisfaction and health.

Impact of E-commerce on Logistics

The relentless expansion of e-commerce directly shapes consumer demands, pushing for quicker delivery times and a wider array of shipping options. This societal shift has significantly boosted the need for streamlined last-mile delivery networks and more flexible less-than-truckload (LTL) freight solutions.

Transportation providers like Knight-Swift are compelled to innovate, integrating advanced logistics technologies to meet these evolving customer expectations. For instance, the U.S. e-commerce sales were projected to reach $1.7 trillion in 2024, a substantial increase from previous years, underscoring the immense pressure on logistics infrastructure.

- Increased Demand for Speed: Consumers now expect deliveries within days, or even hours, impacting scheduling and operational efficiency.

- Growth in LTL Shipments: The rise of online retail, particularly for smaller businesses and direct-to-consumer models, fuels the LTL segment.

- Technology Adoption: Investment in real-time tracking, route optimization software, and warehouse automation is becoming critical for competitiveness.

- Last-Mile Challenges: Urban congestion and the sheer volume of individual deliveries create significant logistical hurdles and opportunities.

Societal trends, particularly the growing emphasis on work-life balance and driver well-being, directly influence recruitment and retention efforts for companies like Knight-Swift. Addressing driver fatigue and ensuring adequate rest are paramount, impacting operational scheduling and company policies.

Public perception of the trucking industry, including safety and environmental concerns, also plays a significant role, prompting investments in advanced safety features and cleaner technologies. For example, by 2025, companies prioritizing driver wellness and sustainable practices are expected to gain a competitive edge in attracting talent.

The relentless expansion of e-commerce has amplified demand for faster deliveries, pushing the industry, including Knight-Swift, to adopt advanced logistics and embrace flexible shipping solutions like LTL. This shift is supported by substantial growth in e-commerce sales, projected to exceed $1.7 trillion in the US for 2024.

| Sociological Factor | Impact on Knight-Swift | Industry Trend / Data (2024-2025) |

|---|---|---|

| Driver Shortage & Aging Workforce | Increased recruitment costs, higher wages, focus on retention strategies. | Estimated US driver shortage of over 70,000 in 2024; average driver age ~46. |

| Public Perception & Safety Concerns | Need for investment in safety technology and corporate social responsibility initiatives. | Ongoing public reliance on trucking coupled with concerns about road safety influencing regulations. |

| E-commerce Growth & Delivery Expectations | Demand for faster, more flexible shipping; investment in technology and LTL services. | US e-commerce sales projected to reach $1.7 trillion in 2024, driving increased freight volume. |

| Driver Well-being & Work-Life Balance | Implementation of wellness programs, improved working conditions, and better amenities. | Focus on driver retention through addressing health, fatigue management, and access to rest stops. |

Technological factors

Technological advancements in autonomous driving are steadily progressing, with SAE Level 4 systems seeing initial commercial deployments on specific freight corridors. This technology, while not yet ubiquitous, offers the potential for significant improvements in road safety by reducing human error, a major cause of accidents. Companies like Waymo Via and Aurora are actively testing and operating autonomous trucks, indicating a tangible shift towards this future.

The promise of autonomous trucking extends to operational efficiencies, including optimized fuel consumption through consistent speed and braking patterns. Knight-Swift, like other major carriers, is closely monitoring and potentially investing in these developments, as they could lead to substantial reductions in labor and fuel costs over the long term. For instance, the potential for platooning, where trucks travel closely together to reduce aerodynamic drag, could boost fuel economy by up to 10%.

The ongoing advancements in telematics and fleet management systems are significantly boosting Knight-Swift's operational capabilities. These technologies now provide sophisticated real-time tracking, allowing for precise monitoring of vehicle locations and driver behavior. This enhanced visibility is crucial for optimizing routes, which directly impacts fuel consumption and delivery times.

Fuel efficiency monitoring, a key benefit of these systems, helps Knight-Swift reduce a major operational expense. For instance, by analyzing data from telematics, companies can identify and address inefficient driving practices. Predictive maintenance, powered by sensor data, allows for proactive servicing, minimizing costly breakdowns and downtime, a critical factor in the trucking industry where every hour counts.

These technological upgrades translate into tangible cost reductions and improved safety. In 2023, the adoption of advanced fleet management solutions has been linked to significant fuel savings, with some carriers reporting reductions of up to 5-10%. Furthermore, telematics contribute to safer operations by monitoring driver adherence to speed limits and harsh braking, thereby lowering accident risks and associated insurance premiums.

Knight-Swift Transportation is leveraging big data analytics and AI to sharpen its operational edge. These technologies are instrumental in refining pricing strategies, improving the accuracy of demand forecasts, and optimizing the entire logistics network. For instance, advanced analytics can predict freight volumes with greater precision, allowing for more efficient capacity planning.

The company is also integrating AI into its vehicle systems, notably through AI-powered camera setups. These systems enhance a truck's ability to perceive its surroundings, which is crucial for safety and efficiency. Adaptive AI models further contribute by enabling dynamic adjustments to driving behavior, responding in real-time to changing road conditions and traffic patterns, a significant advancement in autonomous or semi-autonomous driving capabilities.

In 2024, the logistics sector saw substantial investment in AI and data analytics, with companies aiming to reduce operational costs and boost delivery times. Knight-Swift's commitment to these areas is expected to yield tangible benefits, potentially improving fuel efficiency and reducing transit times. The ongoing development in AI for perception systems is a key technological factor shaping the future of trucking operations.

Electrification and Alternative Fuels

The transportation sector is increasingly focusing on electrification and alternative fuels to curb emissions. Companies like Knight-Swift Transportation are exploring these avenues, recognizing their importance in meeting environmental regulations and sustainability targets.

The development and adoption of electric vehicles (EVs), renewable natural gas (RNG), and hydrogen fuel cell technologies are pivotal for reducing the carbon footprint of trucking operations. While the initial cost and the need for robust charging or refueling infrastructure present hurdles, several major carriers, including those in Knight-Swift's operational sphere, are actively piloting programs and investing in these cleaner fuel solutions. For instance, in 2024, the U.S. Department of Energy reported significant advancements in battery technology, aiming to improve EV range and reduce charging times, which are critical factors for long-haul trucking.

- EV Adoption: Major trucking manufacturers are expanding their electric truck lineups, with initial deployments showing promise for regional haul applications.

- RNG Growth: The use of renewable natural gas is gaining traction, offering a lower-carbon alternative that can utilize existing infrastructure, with projections indicating a substantial increase in RNG availability for heavy-duty vehicles by 2025.

- Hydrogen Fuel Cells: Investments in hydrogen fuel cell technology continue, with pilot programs demonstrating the potential for zero-emission long-haul trucking, although widespread infrastructure remains a key challenge.

- Regulatory Push: Increasingly stringent emissions standards globally are accelerating the demand for and development of these alternative fuel technologies, pushing companies to innovate and adapt their fleets.

Cybersecurity in Transportation Systems

The increasing digitalization of transportation systems, including those operated by Knight-Swift, brings significant cybersecurity risks. As fleets become more interconnected and reliant on digital platforms for everything from route optimization to vehicle diagnostics, the potential for cyber threats to disrupt operations or compromise sensitive data grows. Ensuring robust cybersecurity measures is therefore paramount for maintaining safety and reliability across logistics networks.

Cyberattacks in the transportation sector can have far-reaching consequences. For instance, a successful ransomware attack on a major logistics provider could halt operations for days, leading to significant financial losses and supply chain disruptions. The financial impact is substantial, with the global cybersecurity market for transportation projected to reach $17.7 billion by 2027, indicating a clear recognition of these threats.

- Increased Connectivity Risks: As vehicles and infrastructure become more connected, the attack surface for cyber threats expands, requiring constant vigilance and updated security protocols.

- Data Protection: Protecting sensitive customer and operational data from breaches is critical, as data loss or theft can lead to severe reputational damage and regulatory penalties.

- Operational Disruption: Cyberattacks can disable critical transportation systems, leading to significant delays, increased costs, and safety concerns for drivers and the public.

- Evolving Threat Landscape: The sophistication of cyber threats is constantly increasing, necessitating continuous investment in advanced cybersecurity solutions and employee training.

Technological advancements continue to reshape trucking, with autonomous driving systems like Waymo Via and Aurora making initial freight corridor deployments. These innovations promise enhanced safety and operational efficiency, potentially reducing labor and fuel costs. Platooning technology, for instance, could improve fuel economy by up to 10% by reducing aerodynamic drag.

Telematics and AI are boosting Knight-Swift's capabilities through real-time tracking, optimized routing, and predictive maintenance, leading to cost reductions and improved safety. For example, telematics can yield fuel savings of 5-10%, while also monitoring driver behavior to lower accident risks.

Electrification and alternative fuels like RNG and hydrogen are gaining traction to meet environmental targets, with significant progress in battery technology in 2024 improving EV range. The market for transportation cybersecurity is projected to reach $17.7 billion by 2027, highlighting the growing need for robust digital defenses.

Legal factors

The Federal Motor Carrier Safety Administration (FMCSA) continues to shape the trucking landscape for Knight-Swift. Ongoing regulations like Electronic Logging Devices (ELDs) and the Drug and Alcohol Clearinghouse mandate strict adherence, influencing operational efficiency and driver management. For instance, the FMCSA’s Safety Measurement System (SMS) revisions in 2024 are expected to further scrutinize carrier safety performance, potentially impacting Knight-Swift’s CSA scores and insurance premiums.

Upcoming changes, such as the elimination of MC numbers by December 2024 and stricter enforcement of drug and alcohol violations, will necessitate proactive adaptation. Knight-Swift must ensure all systems and processes are updated to reflect these evolving compliance requirements. The FMCSA’s focus on safety, underscored by its proposed rule on speed limiters for heavy-duty trucks, indicates a continued push for enhanced road safety standards that will directly affect fleet operations.

Hours-of-service (HOS) regulations are a cornerstone of driver safety and significantly impact Knight-Swift's operational capacity. These rules dictate how long drivers can operate commercial motor vehicles, directly influencing delivery schedules and fleet utilization. For instance, the 11-hour driving limit within a 14-hour on-duty window requires meticulous route planning and efficient load management to maximize productivity while ensuring compliance.

Recent adjustments, like the 30-minute break requirement after 8 hours of driving, aim to enhance safety but also add complexity to scheduling. Knight-Swift, like all carriers, must navigate these rules, which can affect driver availability and therefore the number of loads that can be moved daily. The company's ability to adapt to these regulations, including potential future pilot programs exploring flexible scheduling, is crucial for maintaining competitive efficiency in the 2024-2025 period.

Knight-Swift Transportation must navigate stringent federal and state environmental regulations, particularly the U.S. Environmental Protection Agency (EPA) and California Air Resources Board (CARB) emission standards for heavy-duty trucks. These rules necessitate ongoing investment in advanced, cleaner engine technologies and operational changes aimed at reducing air pollution from their fleet.

Failure to adhere to these emission mandates can lead to substantial financial penalties. For instance, in 2023, the EPA continued to enforce regulations requiring new heavy-duty vehicles to meet strict nitrogen oxide (NOx) and particulate matter (PM) limits, impacting fleet upgrade cycles and capital expenditure planning for companies like Knight-Swift.

Labor Laws and Employment Regulations

Knight-Swift Transportation operates within a complex web of labor laws and employment regulations that directly affect its operational costs and human resource strategies. These legal frameworks, covering worker classification, wage and hour mandates, and critical health and safety standards, are paramount to managing its substantial driver workforce. In 2024, the trucking industry continues to grapple with the independent contractor versus employee debate, with potential misclassification leading to significant penalties and back pay claims. For instance, California's AB5, while facing ongoing legal challenges, has underscored the heightened scrutiny on worker classification across the nation.

Changes or stricter enforcement of these regulations can have a substantial impact on Knight-Swift's ability to recruit and retain qualified drivers. For example, increases in minimum wage laws or the implementation of new safety protocols, such as enhanced Hours of Service (HOS) rules, directly influence labor expenses and the efficiency of fleet operations. The Federal Motor Carrier Safety Administration (FMCSA) regularly reviews and updates safety regulations, which could necessitate investments in new equipment or training, impacting profitability. In 2024, the driver shortage remains a critical issue, and compliance with evolving labor laws is a key factor in attracting and keeping talent.

- Worker Classification: Ongoing legal challenges, like those stemming from California's AB5, continue to shape how drivers are classified, potentially impacting Knight-Swift's labor costs and legal exposure.

- Wage and Hour Laws: Adherence to federal and state minimum wage, overtime, and per diem regulations is crucial for managing driver compensation and avoiding costly disputes.

- Health and Safety Standards: Compliance with FMCSA regulations, including Hours of Service (HOS) limits and vehicle maintenance requirements, directly influences driver availability and operational efficiency.

- Driver Recruitment and Retention: Evolving labor laws can affect a company's attractiveness to potential drivers and influence the strategies needed to retain its existing workforce in a competitive market.

Tort Reform and Liability Laws

The trucking industry, including companies like Knight-Swift, faces significant legal challenges related to accident liability and the increasing frequency of 'nuclear verdicts'. These massive jury awards, often exceeding tens of millions of dollars, directly inflate insurance premiums and necessitate robust risk management strategies. For instance, the American Transportation Research Institute (ATRI) has highlighted that litigation costs, particularly those stemming from plaintiff attorney advertising and the resulting lawsuits, represent a substantial operational burden.

Tort reform efforts are crucial for companies operating in this environment. The goal of such reforms is to establish a more predictable and equitable legal framework, thereby mitigating the financial volatility caused by excessively large jury awards. By limiting non-economic damages or capping punitive damages, tort reform seeks to reduce the overall cost of doing business and enhance financial stability for transportation providers.

- Impact of Nuclear Verdicts: Large jury awards significantly increase insurance costs for carriers.

- Litigation Costs: ATRI data consistently points to litigation as a major expense category for trucking firms.

- Tort Reform Objectives: Aims to create a fairer legal system and reduce financial burdens on businesses.

- Potential Benefits: Tort reform could lead to more stable insurance rates and improved risk management.

Knight-Swift must remain vigilant regarding evolving federal and state regulations concerning emissions, particularly those from the EPA and CARB, which mandate cleaner engine technologies and impact fleet upgrade cycles. Continued scrutiny of driver classification under labor laws, exemplified by challenges to California's AB5, presents potential risks for labor costs and legal exposure. The increasing trend of substantial jury awards, or nuclear verdicts, directly escalates insurance premiums and necessitates robust risk management strategies to mitigate financial volatility.

Environmental factors

Transportation companies like Knight-Swift face growing demands from regulators, investors, and the public to significantly cut their carbon emissions. This environmental pressure is pushing them to set and meet ambitious CO2 reduction goals.

Knight-Swift has already demonstrated progress by surpassing its 2025 target, achieving a 5% reduction in CO2 per mile. Looking ahead, the company has set an even more aggressive goal of a 50% reduction in CO2 per mile by 2035.

The push for zero-emission vehicles (ZEVs), including battery electric trucks, is accelerating, driven by environmental concerns and regulatory pressures. Knight-Swift Transportation, like others in the industry, faces the need to invest in these advanced technologies and the supporting infrastructure, like charging stations. This transition requires substantial capital outlay for new fleet acquisitions and the development of fueling capabilities.

By 2024, the commercial electric truck market is projected to see significant growth, with major manufacturers like Volvo, Freightliner, and PACCAR introducing more models. For instance, Freightliner's eCascadia, a leading BEV truck, has already begun wider deployment, indicating the growing viability of electric long-haul trucking. This shift directly impacts Knight-Swift's operational costs and long-term fleet strategy.

Knight-Swift Transportation actively pursues fuel efficiency beyond alternative fuels. This includes adopting trucks with advanced aerodynamic designs to minimize drag, a key factor in reducing energy expenditure. For instance, in 2023, the company continued to integrate newer, more aerodynamic tractor models into its fleet, contributing to an estimated 1-2% improvement in fuel economy per vehicle compared to older models.

Optimized route planning is another critical component of their fuel efficiency strategy. By leveraging sophisticated software to identify the most direct and efficient routes, Knight-Swift aims to cut down on unnecessary mileage and idling time. This focus is particularly relevant in 2024 as fuel prices remain a significant operational cost.

Driver training programs are also integral, focusing on behaviors like smooth acceleration, maintaining consistent speeds, and proper braking techniques. These human-centric initiatives are vital, as driver actions can significantly impact fuel consumption. For example, studies show that improved driving habits can yield a 5-10% reduction in fuel use.

These combined fuel efficiency initiatives directly support both environmental stewardship by lowering greenhouse gas emissions and economic objectives by reducing operating expenses. The company recognizes that sustained efforts in these areas are crucial for long-term profitability and sustainability in the transportation sector.

Waste Management and Recycling Programs

Knight-Swift Transportation, like many in the logistics sector, faces increasing scrutiny regarding its waste management and recycling initiatives. Environmental considerations now significantly extend to how the company handles operational waste, encompassing vital recycling programs for used tires, motor oil, and various other materials generated from fleet maintenance and operations. The company's commitment to sustainability directly impacts its environmental footprint.

Focusing on eco-friendly facilities and operational practices is becoming a critical differentiator. This includes investing in more sustainable maintenance procedures and exploring waste-to-energy solutions where feasible. For instance, in 2024, the trucking industry has seen a growing trend towards closed-loop recycling systems for lubricants, aiming to recover and reuse valuable components, thereby reducing virgin material consumption and disposal volumes. Knight-Swift's efforts in this area are directly aligned with broader industry shifts towards circular economy principles.

- Tire Recycling: In 2023, the U.S. generated approximately 300 million scrap tires, with a significant portion being recycled into new products or used for energy recovery. Knight-Swift's participation in these programs is crucial for managing a key waste stream.

- Oil Recycling: Used motor oil is a significant byproduct of fleet operations. By partnering with certified recycling facilities, companies like Knight-Swift can ensure this hazardous waste is processed safely and sustainably, often re-refined into new lubricating oils.

- Fleet Efficiency Initiatives: Beyond direct waste recycling, efforts to improve fuel efficiency, such as adopting aerodynamic technologies and optimizing routing, indirectly reduce the environmental impact associated with vehicle maintenance and resource consumption.

- Facility Sustainability: Investments in eco-friendly building materials, energy-efficient lighting, and water conservation measures within maintenance depots and administrative offices contribute to a minimized overall environmental footprint.

Climate Change Impact on Operations

Climate change poses significant environmental challenges for Knight-Swift Transportation, influencing operational efficiency. More frequent and intense extreme weather events, such as hurricanes and severe winter storms, can directly impact road conditions, leading to temporary closures and significant delays across their extensive network.

These disruptions increase operational risks by affecting delivery times and fuel consumption. For instance, the National Oceanic and Atmospheric Administration (NOAA) reported that in 2023, the U.S. experienced 28 separate billion-dollar weather and climate disasters, highlighting the increasing frequency of such impactful events. Planning for these seasonal demand fluctuations, especially in the wake of natural disasters, becomes crucial for maintaining supply chain resilience and managing customer expectations.

- Increased Fuel Costs: Extreme weather can lead to detours and slower speeds, increasing fuel consumption and costs.

- Infrastructure Damage: Roads and bridges can be damaged by severe weather, requiring longer, less efficient routes.

- Supply Chain Volatility: Natural disasters can disrupt the flow of goods, impacting Knight-Swift's ability to pick up and deliver freight.

- Regulatory Changes: Growing awareness of climate change could lead to stricter environmental regulations on emissions and fuel efficiency for trucking fleets.

Environmental regulations are increasingly shaping the trucking industry, pushing companies like Knight-Swift to adopt greener practices. This includes a strong focus on reducing carbon emissions, with Knight-Swift aiming for a 50% reduction in CO2 per mile by 2035, a significant step from their current progress.

The transition to zero-emission vehicles (ZEVs), such as electric trucks, is a major environmental trend. This shift requires substantial investment in new fleets and charging infrastructure, with the commercial electric truck market expected to grow significantly by 2024, featuring more models from major manufacturers.

Beyond ZEVs, Knight-Swift is implementing fuel efficiency measures like aerodynamic designs and optimized routing, contributing to better fuel economy. Driver training also plays a role, as improved driving habits can reduce fuel consumption by 5-10%, directly impacting both environmental footprint and operational costs.

Waste management and recycling are also key environmental considerations. Knight-Swift's efforts in recycling used tires and motor oil, alongside facility sustainability, align with industry trends towards circular economy principles and minimizing overall environmental impact.

PESTLE Analysis Data Sources

This Knight-Swift Transportation PESTLE analysis draws from official government transportation and labor statistics, economic reports from entities like the Bureau of Labor Statistics and the Federal Reserve, and industry-specific publications detailing technological advancements and environmental regulations.