Knight-Swift Transportation Business Model Canvas

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Knight-Swift Transportation Bundle

Unlock the strategic blueprint behind Knight-Swift Transportation's operational excellence. This comprehensive Business Model Canvas dissects their approach to customer relationships, revenue streams, and cost structure, offering a clear vision of their competitive advantage. Ideal for anyone seeking to understand the dynamics of the trucking industry.

Partnerships

Knight-Swift Transportation actively collaborates with technology and software providers to drive operational advancements. These partnerships are essential for implementing cutting-edge solutions in areas like route optimization and fleet management. For instance, a recent collaboration with Netradyne in April 2025 highlights their commitment to integrating AI and edge computing to bolster fleet safety and overall efficiency.

By integrating advanced analytics and automation through these tech partnerships, Knight-Swift aims to maintain a competitive edge in the dynamic logistics industry. These collaborations allow them to leverage specialized expertise, ensuring their systems remain at the forefront of technological innovation.

Knight-Swift Transportation actively partners with a substantial network of independent contractors and owner-operators. These crucial relationships allow the company to flexibly scale its operational capacity by supplementing its owned fleet. This model is key for Knight-Swift to adapt to fluctuating market demands and expand its service reach efficiently.

By engaging independent contractors, Knight-Swift avoids the significant capital expenditure and ongoing costs associated with owning every vehicle in its fleet. This strategy boosts operational flexibility and allows for quicker adjustments to fleet size based on freight volumes. For instance, as of the first quarter of 2024, Knight-Swift's total fleet, including leased and independent contractor equipment, provides extensive coverage across North America.

These partnerships also create valuable business opportunities for individual drivers, offering them a platform to operate their own businesses within Knight-Swift’s extensive network. This symbiotic relationship benefits both parties, as drivers gain access to consistent freight and support, while Knight-Swift secures reliable capacity and broadens its service capabilities without the full burden of fleet ownership for every unit.

Knight-Swift Transportation relies heavily on robust relationships with truck and trailer manufacturers like PACCAR and Wabash National. These partnerships are crucial for sourcing a modern, efficient fleet, ensuring access to cutting-edge vehicle technologies and reliable parts. In 2024, the company continued to invest in fleet modernization, aiming to balance the benefits of new technology with cost-efficiency, a key factor in managing operational expenses.

Maintaining a high level of fleet availability is paramount, and this is achieved through strong ties with parts and maintenance suppliers. These collaborations guarantee timely access to essential components, minimizing costly vehicle downtime. By controlling maintenance costs and ensuring operational readiness, Knight-Swift can better manage its overall cost per mile, a critical metric for profitability in the trucking industry.

The company is also actively exploring and piloting advanced emissions-reducing technologies, including electric and hydrogen-powered vehicles, in partnership with manufacturers. These pilot programs, ongoing through 2024, are essential for understanding the long-term viability and operational impact of these next-generation trucks, aligning with both environmental goals and future regulatory requirements.

Logistics and Intermodal Partners

Knight-Swift strategically partners with key players in the logistics and intermodal space to broaden its service capabilities. These collaborations are crucial for offering seamless, end-to-end supply chain solutions that go beyond traditional over-the-road trucking.

By integrating with rail carriers, Knight-Swift enhances its intermodal offerings, allowing for more efficient and cost-effective long-haul transportation. This synergy enables the company to provide customers with a diverse range of integrated transportation options, effectively creating a multimodal network.

These partnerships are vital for diversifying Knight-Swift's service portfolio and strengthening its competitive edge in the market. For instance, in 2024, Knight-Swift continued to leverage its extensive network, which includes significant intermodal capacity, to capture a larger share of freight that benefits from rail integration.

The benefits of these alliances are clear:

- Expanded Service Reach: Access to rail networks allows Knight-Swift to handle longer-haul freight more efficiently.

- Cost Efficiencies: Intermodal transport often presents cost savings compared to 100% truckload for long distances.

- Sustainability: Rail transport generally has a lower carbon footprint per ton-mile, aligning with growing ESG demands.

- Customer Value: Offering multimodal solutions provides customers with greater flexibility and optimized supply chain strategies.

Acquired Entities' Existing Relationships

Knight-Swift leverages the established customer and supplier networks of its acquired entities, such as Dependable Highway Express (DHE) and U.S. Xpress. This integration immediately broadens their market reach and operational capacity.

By absorbing these existing relationships, Knight-Swift gains instant access to new customer segments and supplier agreements. This significantly accelerates their expansion, particularly in the Less-Than-Truckload (LTL) market, enhancing their ability to offer comprehensive coast-to-coast services and improve route density.

For instance, the 2023 acquisition of U.S. Xpress, a significant player with its own established partnerships, directly added to Knight-Swift's existing customer base and supplier agreements. Similarly, the 2024 acquisition of DHE further solidified their LTL capabilities by bringing in DHE's established client relationships and vendor contracts.

These inherited partnerships are crucial for:

- Expanding customer reach

- Strengthening supplier diversification

- Enhancing service density and network efficiency

- Accelerating market penetration in acquired segments

Knight-Swift's key partnerships extend to technology providers, enabling advancements in fleet management and safety, as seen with their April 2025 collaboration with Netradyne. They also rely on a vast network of independent contractors, providing flexible capacity and business opportunities for drivers, bolstering their fleet to meet fluctuating market needs as of Q1 2024. Furthermore, strategic alliances with rail carriers enhance their intermodal services, offering cost efficiencies and broader customer value.

What is included in the product

Knight-Swift Transportation's Business Model Canvas focuses on optimizing freight movement by leveraging a large, company-owned fleet and independent contractor network to serve diverse customer segments across North America.

It emphasizes cost efficiency through scale, technology integration for route optimization, and strong customer relationships built on reliability and capacity.

Knight-Swift's Business Model Canvas acts as a pain point reliever by streamlining complex logistics into a clear, actionable framework, making it easier to identify and address operational inefficiencies.

Activities

Truckload transportation services are the bedrock of Knight-Swift's operations, covering a vast spectrum of freight needs across North America. This includes the crucial movement of dry van, refrigerated, flatbed, and specialized cargo, essentially acting as the backbone for many industries. The company's expertise lies in managing the entire logistics chain, from efficient dispatching and meticulous route planning to the safe loading, transportation, and final unloading of goods.

This core activity is not just a service; it's Knight-Swift's primary engine for growth and profitability. In fact, the truckload segment consistently represents the largest portion of Knight-Swift's revenue. For instance, in the first quarter of 2024, Knight-Swift reported total operating revenue of $1.56 billion, with its Truckload segment being the dominant contributor to this figure, underscoring its critical importance to the company's financial performance.

Knight-Swift's less-than-truckload (LTL) operations are a core, growing activity. This involves expertly consolidating numerous smaller shipments from different clients onto single trailers, optimizing transport efficiency. This expansion is supported by a strong terminal infrastructure and advanced logistics management.

The company is actively investing in its LTL network, demonstrated by recent strategic acquisitions and the establishment of new service centers. These moves are crucial for managing the complexities of consolidating diverse freight volumes and ensuring timely deliveries across an expanding geographic footprint.

In 2024, Knight-Swift continued to enhance its LTL capabilities, aiming to capture more market share in this segment. The company’s focus on operational excellence and network density directly contributes to its competitive advantage in handling less-than-truckload freight.

Knight-Swift Transportation actively engages in logistics and brokerage services, acting as a crucial intermediary to arrange freight movement for clients. This segment leverages both the company's extensive fleet of trucks and a network of third-party carriers to meet diverse shipping needs. In 2024, this diversified approach allows them to offer adaptable solutions, especially when demand outpaces their dedicated asset capacity.

These services are designed to optimize supply chains, providing customers with more than just transportation. Knight-Swift's brokerage arm also encompasses aspects of warehousing and distribution, offering a more comprehensive logistics package. This flexibility is particularly valuable during periods of market volatility, ensuring consistent service delivery for their clients.

Fleet Management and Maintenance

Knight-Swift Transportation's key activity of fleet management and maintenance is crucial for operational efficiency and safety. This involves the constant upkeep of a vast array of tractors and trailers. The company prioritizes regular servicing and repairs to keep its extensive fleet in optimal condition. For instance, in 2023, Knight-Swift reported operating approximately 21,000 tractors and 70,000 trailers, underscoring the scale of this operation.

Strategic equipment updates are also central to this activity, ensuring the fleet remains modern, reliable, and compliant with evolving safety and environmental regulations. Knight-Swift actively explores and tests new technologies aimed at reducing emissions, reflecting a commitment to sustainability. This proactive approach helps mitigate risks associated with aging equipment and ensures compliance with stringent industry standards.

- Fleet Size: Operates a substantial fleet, including around 21,000 tractors and 70,000 trailers as of 2023.

- Maintenance Focus: Emphasizes regular scheduled maintenance and timely repairs to maximize asset availability and minimize downtime.

- Equipment Modernization: Strategically replaces older equipment with newer, more fuel-efficient, and technologically advanced models.

- Environmental Compliance: Actively pilots and adopts technologies to reduce emissions and meet environmental standards.

Network Expansion and Integration

Knight-Swift Transportation actively pursues network expansion through both opening new service centers and strategic acquisitions. A significant recent example is the acquisition of U.S. Xpress, a deal valued at approximately $843 million, which closed in 2024. This move is designed to bolster network density and broaden geographical reach.

The integration of acquired companies, such as DHE and the aforementioned U.S. Xpress, is a critical activity. The goal is to merge their operations seamlessly into Knight-Swift's existing infrastructure. This integration process aims to unlock efficiencies and enhance the overall service capabilities offered to customers across a more extensive network.

- Organic Growth: Establishing new service centers to increase operational footprint.

- Inorganic Growth: Acquiring complementary businesses to expand market share and network reach.

- Integration Efforts: Merging acquired entities like U.S. Xpress to create a cohesive and efficient operation.

- Efficiency Gains: Streamlining combined resources to improve service delivery and cost management.

Knight-Swift's core truckload operations are central, handling diverse freight like dry van and refrigerated goods. This segment remains their primary revenue driver, accounting for the largest share of their business. In the first quarter of 2024, total operating revenue reached $1.56 billion, with truckload being the dominant contributor.

The expansion of their Less-Than-Truckload (LTL) services is a key activity, focusing on consolidating smaller shipments for efficiency. Investments in terminals and new service centers in 2024 are strengthening this growing segment. This strategic focus aims to capture more market share by optimizing network density and delivery times.

Logistics and brokerage services are vital for offering flexible solutions, utilizing both their own fleet and third-party carriers. This allows Knight-Swift to manage varying demand and provide comprehensive supply chain support, including warehousing. In 2024, this adaptability was crucial for meeting client needs during fluctuating market conditions.

Fleet management and maintenance are critical, ensuring the operational readiness of their substantial fleet, which included approximately 21,000 tractors and 70,000 trailers in 2023. Regular servicing, strategic equipment upgrades for efficiency and emissions reduction, and compliance with regulations are paramount. This proactive maintenance strategy minimizes downtime and ensures safety.

Network expansion, notably through the $843 million acquisition of U.S. Xpress in 2024, is a significant activity. Integrating acquired companies aims to enhance network density and geographical reach. These efforts are designed to unlock operational efficiencies and improve service delivery across an expanded footprint.

| Key Activity | Description | 2024 Impact/Data |

| Truckload Transportation | Core freight movement (dry van, reefer, flatbed). | Dominant revenue segment; Q1 2024 revenue $1.56 billion. |

| LTL Operations | Consolidating smaller shipments. | Strategic investment in network expansion and service centers. |

| Logistics & Brokerage | Arranging freight movement via own fleet & third parties. | Offers flexible supply chain solutions; supports asset capacity. |

| Fleet Management & Maintenance | Upkeep of tractors and trailers. | ~21,000 tractors, ~70,000 trailers (2023); focus on modernization. |

| Network Expansion | Organic growth (new centers) & acquisitions. | Acquisition of U.S. Xpress ($843M) in 2024; integration efforts. |

What You See Is What You Get

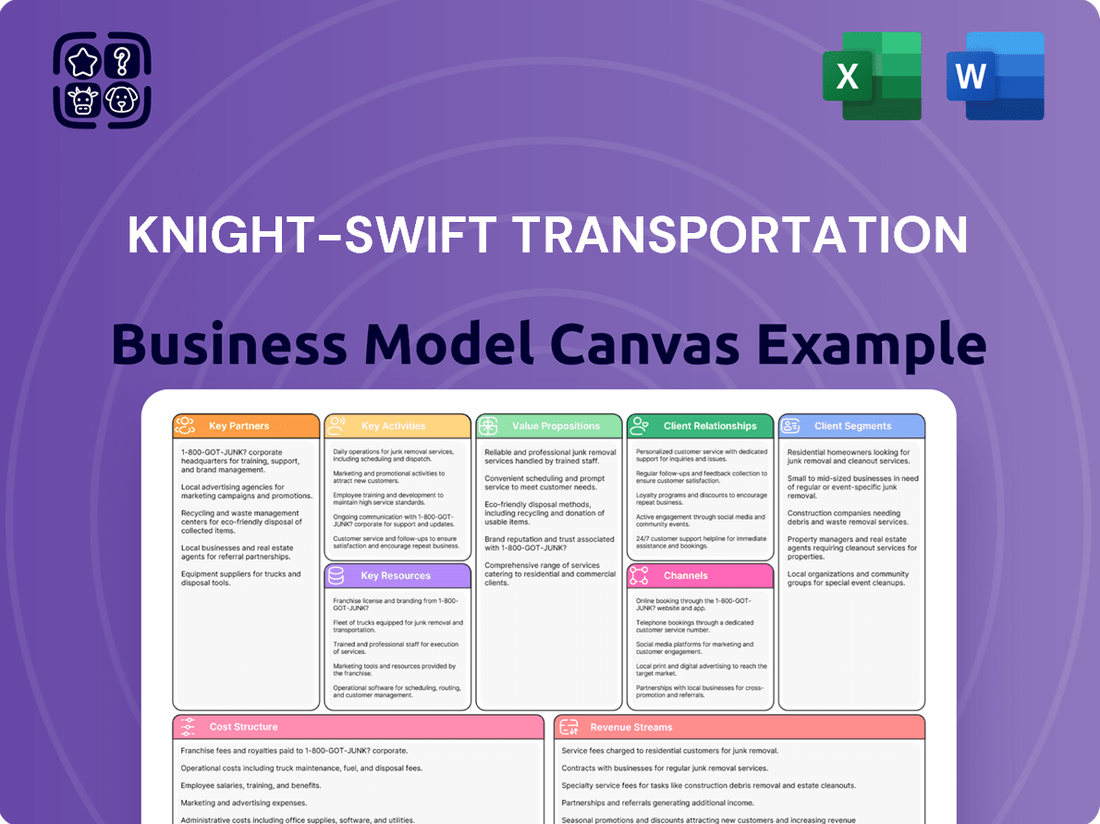

Business Model Canvas

The Business Model Canvas for Knight-Swift Transportation you are previewing is the exact document you will receive upon purchase. This comprehensive overview details their core operations, customer segments, value propositions, revenue streams, and key resources, offering a transparent look into their industry-leading strategies. You'll gain immediate access to this fully formatted and ready-to-use analysis, reflecting the depth and detail of the final deliverable.

Resources

Knight-Swift Transportation boasts one of North America's most extensive and varied fleets, a critical asset for its business model. This massive collection of equipment includes thousands of tractors and trailers designed for a wide range of freight types, from standard dry van and temperature-controlled refrigerated units to open flatbeds and specialized haulage.

This substantial physical infrastructure is the bedrock of Knight-Swift's capacity to offer all-encompassing transportation solutions. By owning and operating such a large fleet, the company can effectively serve diverse customer needs and leverage significant economies of scale in its operations.

As of the first quarter of 2024, Knight-Swift operated approximately 22,000 tractors and over 60,000 trailers. This extensive fleet directly supports their ability to generate revenue across various segments of the freight market, contributing to their position as a leading carrier.

Knight-Swift Transportation leverages a strategic network of over 100 terminals and service centers across North America. This extensive infrastructure is vital for supporting its core truckload business and its rapidly growing Less-Than-Truckload (LTL) segment. These facilities act as critical hubs, enabling efficient freight consolidation, essential vehicle maintenance, and crucial driver support services, thereby boosting the company's operational reach and network density.

In 2024, the company continued to invest in optimizing this network. For instance, during the first quarter of 2024, Knight-Swift reported a capital expenditure of $235.3 million, a significant portion of which is allocated to enhancing its terminal capabilities and service center infrastructure. This ongoing investment underscores the network's importance in driving operational efficiencies and expanding service offerings, particularly within the competitive LTL market.

Knight-Swift Transportation's skilled workforce, comprising professional drivers, maintenance technicians, and logistics experts, is a cornerstone of its operations. This extensive team is crucial for maintaining the company's vast fleet and ensuring efficient delivery across its network. In 2024, Knight-Swift continued its focus on attracting and retaining these vital personnel, understanding that their expertise directly impacts service reliability and customer satisfaction.

The company's commitment to driver recruitment and retention is particularly significant, as these professionals are the frontline of their service. In the competitive trucking industry, having a stable and experienced driver pool directly translates to operational capacity. Knight-Swift's efforts in this area are designed to mitigate the effects of driver shortages and maintain a high standard of performance.

Advanced Technology and IT Systems

Knight-Swift Transportation's sophisticated IT infrastructure is a core resource, featuring advanced Transportation Management Systems (TMS) and route optimization software. These systems are crucial for streamlining complex logistics, ensuring efficient deliveries, and managing their extensive fleet. Continuous investment in platform harmonization further enhances operational synergy across their various business units.

Data analytics platforms play a vital role in identifying efficiencies and improving service levels. Real-time tracking and communication systems keep drivers, customers, and dispatchers connected, enabling proactive problem-solving. For instance, in 2024, Knight-Swift continued to invest in technology upgrades aimed at improving visibility and control over their supply chain operations.

- Advanced TMS and Route Optimization: These tools are fundamental to managing a large fleet and optimizing delivery routes for fuel efficiency and timely arrivals.

- Data Analytics Capabilities: Leveraged to gain insights into operational performance, customer needs, and market trends, driving informed decision-making.

- Real-Time Tracking and Communication: Essential for maintaining visibility of shipments, managing driver schedules, and communicating effectively with all stakeholders.

- Ongoing Technology Investment: Commitment to upgrading and integrating IT systems to maintain a competitive edge in the logistics industry.

Strong Brand Reputation and Financial Capital

Knight-Swift Transportation benefits significantly from a robust brand reputation built on consistent reliability and high-quality service within the competitive trucking sector. This strong market perception is a key asset, attracting and retaining both customers and skilled drivers.

Its solid financial standing is equally crucial, providing the necessary capital to fuel growth and operational excellence. This financial strength allows for continuous investment in modernizing its extensive fleet, expanding its geographical reach through both organic development and strategic acquisitions, and implementing cutting-edge technological solutions. For instance, in 2024, Knight-Swift continued its strategy of fleet modernization, aiming to improve fuel efficiency and driver comfort, which directly supports its brand promise.

The company's financial capital also supports strategic initiatives like network expansion. This includes investing in new terminals and optimizing existing routes, which further solidifies its service capabilities and market position. In 2024, the company reported significant capital expenditures dedicated to fleet upgrades and facility improvements, underscoring this commitment.

These two elements, strong brand reputation and substantial financial capital, work in tandem to reinforce Knight-Swift's business model:

- Brand Reputation: A recognized name synonymous with dependable and quality transportation services.

- Financial Capital: Enables substantial investments in fleet modernization, network expansion, and technology adoption.

- Fleet Investment: Continual upgrades in 2024 focused on efficiency and driver satisfaction.

- Network Expansion: Strategic growth through acquisitions and organic development, bolstered by financial resources.

Knight-Swift Transportation's key resources are its expansive fleet, strategic terminal network, skilled workforce, and advanced IT infrastructure. These elements collectively enable the company to provide reliable and efficient transportation services across North America. Investment in these resources, as seen in 2024 capital expenditures, underpins their operational capacity and competitive advantage.

| Key Resource | Description | 2024 Relevance/Data |

|---|---|---|

| Fleet | Extensive tractors and trailers for diverse freight. | Approx. 22,000 tractors, 60,000+ trailers (Q1 2024). |

| Network | Over 100 terminals and service centers. | $235.3M capital expenditure (Q1 2024) for infrastructure enhancement. |

| Workforce | Skilled drivers, technicians, and logistics experts. | Focus on recruitment and retention to ensure operational capacity. |

| IT Infrastructure | Advanced TMS, route optimization, data analytics. | Ongoing investment in technology upgrades for improved visibility and control. |

Value Propositions

Knight-Swift Transportation provides a wide array of transportation solutions, encompassing dry van, refrigerated, and flatbed truckload services. This broad offering ensures customers can meet diverse shipping requirements with a single, reliable partner, streamlining their logistics operations.

Beyond traditional truckload, the company extends its capabilities to include Less Than Truckload (LTL) services, intermodal transportation, and comprehensive logistics management. This integrated approach allows for greater flexibility and efficiency in managing complex supply chains.

In 2023, Knight-Swift's total operating revenue reached $6.4 billion, reflecting the demand for its comprehensive service portfolio. The company's ability to offer multiple transportation modes under one roof is a significant advantage for businesses seeking consolidated shipping solutions.

The brokerage segment of Knight-Swift further enhances its value proposition by connecting shippers with a wider network of carriers. This capability is crucial for managing fluctuating freight volumes and ensuring capacity, especially during peak seasons.

Knight-Swift boasts an unparalleled network across North America, encompassing the United States, Canada, and Mexico. This extensive reach is supported by a substantial fleet and a dense web of terminals, enabling efficient and reliable transportation services. The company’s commitment to network expansion, often fueled by strategic acquisitions, directly translates to enhanced service capabilities for a broad customer base.

Knight-Swift Transportation's value proposition of Reliability and Operational Excellence is built on a foundation of consistent, on-time delivery. This is crucial for shippers who depend on predictable freight movement. In 2024, the company continued to invest in its modern fleet, aiming to minimize downtime and maximize efficiency, which directly contributes to their service reliability.

Their disciplined operational execution ensures that freight moves smoothly through their network. This focus on high service standards sets them apart in a competitive market where dependability is paramount. For instance, their dedication to maintaining fleet readiness supports their ability to meet demanding delivery schedules.

Scalability and Flexibility

Knight-Swift leverages its expansive asset base and a substantial network of independent contractors to provide highly scalable transportation solutions. This allows them to adeptly manage fluctuating customer demand and varying freight volumes, ensuring capacity is available when needed.

This flexibility is a core value proposition for clients facing dynamic shipping requirements. It enables businesses to rapidly adjust their logistics operations in response to evolving market conditions, a critical advantage in today's fast-paced economy.

For instance, in 2024, Knight-Swift continued to operate a vast fleet, which is fundamental to its ability to scale services up or down. Their independent contractor model further enhances this agility, allowing for quick adjustments to capacity without the fixed overhead of company-owned equipment for every surge.

Key aspects of their scalability and flexibility include:

- Extensive owned and contracted fleet: Facilitates rapid capacity adjustments to meet demand spikes.

- Diverse service offerings: Catering to a wide range of freight types and customer needs, from dry van to temperature-controlled.

- Nationwide network: Enables efficient coverage and rapid deployment of resources across North America.

- Technology integration: Advanced systems for load optimization and real-time tracking enhance operational efficiency and responsiveness.

Technology-Enhanced Visibility and Efficiency

Knight-Swift leverages technology to give customers clear insight into their freight's journey, enhancing transparency and predictability. This technological investment also streamlines operations, leading to more efficient routing and reduced transit times, which directly benefits clients through better planning and cost savings. For instance, their commitment to real-time tracking and advanced dispatch systems helps minimize empty miles, a key efficiency driver in the trucking industry.

This focus on technology translates into a tangible competitive advantage by offering a more responsive and integrated transportation solution. Customers benefit from a smoother process, from booking to final delivery. In 2024, the company continued to invest in its digital platforms to further improve user experience and operational insights for shippers.

- Enhanced Shipment Visibility: Real-time tracking and detailed status updates for all loads.

- Optimized Route Planning: Utilizing advanced software to find the most efficient and cost-effective routes.

- Reduced Transit Times: Minimizing delays through smart logistics and proactive management.

- Cost Savings for Clients: Achieved through improved efficiency, fuel management, and reduced operational disruptions.

Knight-Swift's value proposition centers on providing a comprehensive suite of transportation solutions, from specialized truckload services like refrigerated and flatbed to integrated LTL and intermodal options. This broad service portfolio simplifies logistics for customers by offering a single, dependable partner for diverse shipping needs.

The company emphasizes reliability and operational excellence, ensuring consistent, on-time deliveries. Their significant investment in a modern fleet, a strategy continued in 2024, directly supports this commitment by minimizing equipment downtime and maximizing operational efficiency.

Knight-Swift offers unparalleled scalability and flexibility through its extensive owned and contracted fleet, coupled with a vast North American network. This allows them to adeptly manage fluctuating freight volumes and customer demand, a crucial advantage in dynamic market conditions. For instance, in 2024, their fleet size remained a key enabler of this agility.

Leveraging advanced technology, Knight-Swift provides enhanced shipment visibility and optimized route planning. This focus on digital integration streamlines operations, reduces transit times, and ultimately delivers cost savings and greater predictability for their clients.

| Value Proposition Component | Description | Supporting Data/Fact |

|---|---|---|

| Comprehensive Transportation Solutions | Offers diverse services including dry van, refrigerated, flatbed, LTL, and intermodal. | In 2023, operating revenue was $6.4 billion, showcasing broad market demand. |

| Reliability & Operational Excellence | Focuses on consistent, on-time delivery and disciplined execution. | Continued investment in fleet modernization in 2024 to enhance efficiency and minimize downtime. |

| Scalability & Flexibility | Utilizes extensive owned and contracted fleets to manage fluctuating demand. | Independent contractor model supports quick capacity adjustments for dynamic shipping requirements. |

| Technology Integration & Transparency | Provides real-time tracking and optimized routing for efficient logistics. | Investments in digital platforms in 2024 aimed at improving user experience and operational insights. |

Customer Relationships

Knight-Swift Transportation often assigns dedicated account managers to its larger and more complex clients. This personalized approach is key to building and maintaining strong, long-term relationships by deeply understanding each customer's unique needs and operational intricacies. For example, in 2023, they served a significant portion of Fortune 500 companies, many of whom benefit from this dedicated service model.

This dedicated management ensures consistent service quality and a proactive stance on problem-solving, offering tailored transportation solutions that align precisely with client requirements. This focus on personalized service directly contributes to enhanced customer loyalty and drives repeat business, a crucial element for sustained growth.

Knight-Swift Transportation leverages digital channels like online portals and Electronic Data Interchange (EDI) to streamline customer interactions for quoting, booking, and tracking shipments. This digital infrastructure provides customers with self-service capabilities and real-time updates, significantly boosting convenience and operational efficiency.

In 2024, the company continued to invest in its digital platforms, aiming to reduce manual processes and improve data accuracy across its extensive network. The efficiency gains from these digital tools are crucial for managing the high volume of transactions characteristic of a large-scale transportation provider, contributing to faster turnaround times and enhanced customer satisfaction.

Knight-Swift Transportation prioritizes customer satisfaction through dedicated service and support centers. These hubs are crucial for handling inquiries, resolving transportation-related issues, and offering ongoing assistance, ensuring a smooth experience for their clients.

In 2024, Knight-Swift's commitment to customer support is evident in its operational efficiency, aiming to minimize transit disruptions and provide timely updates. This focus on reliable communication and problem-solving directly impacts customer retention and builds long-term partnerships.

Strategic Partnerships and Collaborations

Knight-Swift fosters strategic partnerships with key accounts, deeply integrating with their operations to optimize supply chains and co-create customized logistics solutions. This collaborative model moves beyond standard service provision, focusing on shared growth and enhanced operational efficiencies. For instance, in 2024, the company continued to leverage these deep relationships to secure long-term contracts and expand service offerings for major clients across diverse industries like retail and manufacturing.

These alliances are crucial for Knight-Swift's ability to offer tailored services that address specific customer needs, ranging from dedicated fleet management to complex intermodal solutions. Such partnerships are characterized by open communication and joint planning, allowing for proactive adjustments to market dynamics and transportation challenges. The company’s 2024 performance reports highlighted the significant contribution of these strategic accounts to its revenue stability and growth trajectory.

- Key Account Integration: Knight-Swift works closely with major clients to optimize supply chains and develop bespoke logistics.

- Mutual Growth Focus: The company prioritizes collaborative relationships that aim for shared efficiency gains and expansion.

- 2024 Performance: Strategic partnerships contributed to stable revenue and growth for Knight-Swift in the past year.

- Tailored Solutions: This approach enables the delivery of customized services, from dedicated fleets to intermodal transport.

Feedback Mechanisms and Continuous Improvement

Knight-Swift Transportation actively solicits customer feedback through various channels, including post-service surveys and direct outreach from account managers. This proactive approach allows them to pinpoint specific areas where service delivery can be enhanced. For instance, in late 2023 and early 2024, feedback highlighted opportunities to streamline communication regarding load status updates, leading to investments in more robust tracking technology.

The company leverages this collected data to drive continuous improvement initiatives. By analyzing recurring themes and specific suggestions, Knight-Swift refines its operational processes and service offerings. This commitment ensures that their solutions remain aligned with evolving customer needs, fostering stronger, more resilient business relationships.

- Customer Feedback Channels: Surveys, direct communication, and account manager interactions.

- Areas for Improvement: Identified through analysis of feedback, focusing on operational efficiency and communication.

- Impact on Services: Feedback directly informs refinements to service delivery and technological investments.

- Relationship Strengthening: Continuous improvement based on customer input solidifies long-term partnerships.

Knight-Swift Transportation fosters strong customer relationships through a multi-faceted approach, blending dedicated account management with robust digital self-service options. In 2024, the company continued its investment in digital platforms to enhance efficiency and provide real-time updates, a move that supports the high volume of transactions typical for a large-scale logistics provider.

Their commitment to customer support is demonstrated through proactive issue resolution and consistent communication, which are vital for maintaining client loyalty and securing repeat business. Strategic partnerships with key accounts, a focus in 2024, involve deep integration into client operations to co-create optimized logistics solutions, contributing significantly to revenue stability.

Actively seeking and acting upon customer feedback, gathered through surveys and direct outreach, allows Knight-Swift to continuously refine its services and technology. This iterative process, evident in their 2024 initiatives to improve load status communication, strengthens partnerships by ensuring their offerings remain aligned with evolving client needs.

| Customer Relationship Strategy | Key Features | 2024 Focus/Impact |

|---|---|---|

| Dedicated Account Management | Personalized service for complex clients | Servicing a significant portion of Fortune 500 companies, ensuring tailored solutions. |

| Digital Self-Service | Online portals, EDI for quoting, booking, tracking | Investment in platforms to reduce manual processes and improve data accuracy. |

| Customer Support Centers | Inquiry handling, issue resolution, ongoing assistance | Minimizing transit disruptions and providing timely, reliable communication. |

| Strategic Partnerships | Deep integration, co-creation of logistics solutions | Securing long-term contracts and expanding services for major clients, driving revenue stability. |

| Feedback Integration | Surveys, direct outreach, analysis for improvement | Refining services based on input, enhancing communication and operational efficiency. |

Channels

Knight-Swift Transportation leverages a direct sales force and dedicated account managers to cultivate relationships with major enterprise clients. This approach facilitates in-depth discussions regarding specialized shipping needs and the negotiation of intricate, multi-year agreements. For instance, in 2023, their dedicated sales efforts contributed to securing a significant portion of their revenue from these larger, strategic accounts, reflecting the value placed on personalized service and tailored solutions in the enterprise logistics sector.

Knight-Swift Transportation leverages online portals and digital platforms as key customer-facing channels. These digital tools allow customers to easily access a suite of services, including obtaining shipping quotes, booking freight, and real-time tracking of their shipments. This digital infrastructure is designed for maximum convenience and efficiency, serving a broad customer base from small businesses to large enterprises.

The company's commitment to digital accessibility is evident in its user-friendly interfaces, enabling seamless account management and transaction processing. For instance, in 2024, Knight-Swift continued to invest in enhancing its digital capabilities, reflecting the growing demand for integrated online logistics solutions. This focus ensures that clients can manage their transportation needs effectively, anytime and anywhere.

Knight-Swift leverages its brokerage and logistics networks to extend its reach beyond its owned fleet. This allows them to tap into a vast pool of third-party carriers, fulfilling a wider array of customer needs, especially for specialized or overflow freight.

In 2024, the company's non-asset-based segments, which include brokerage, played a significant role in their overall revenue. These divisions are crucial for providing comprehensive supply chain solutions and capturing market share that might otherwise be missed.

This channel effectively acts as an extension of their core trucking operations, enabling them to offer a more complete transportation service. By managing and coordinating freight for other carriers, Knight-Swift enhances its value proposition to shippers.

The strategic use of these networks in 2024 demonstrates Knight-Swift's commitment to adaptability in a dynamic freight market, ensuring they can meet varied customer demands efficiently.

Industry Conferences and Trade Shows

Knight-Swift Transportation actively participates in industry conferences and trade shows, leveraging these platforms for lead generation and to showcase its extensive service offerings. These events are crucial for connecting with potential clients and strengthening the company's brand within the competitive transportation landscape. For instance, in 2024, the company continued its engagement with key industry gatherings, which are vital for staying abreast of market trends and client needs.

These engagements allow Knight-Swift to demonstrate its capabilities, from dedicated and irregular freight to temperature-controlled and flatbed services. By exhibiting at major events, the company reinforces its image as a comprehensive logistics solutions provider. In 2023, the transportation industry saw significant investment in technology and sustainability, themes frequently discussed at these conferences, providing Knight-Swift with opportunities to highlight its own advancements.

- Lead Generation: Attending industry events provides direct access to potential customers actively seeking transportation solutions.

- Networking: Building relationships with clients, partners, and industry influencers is a key benefit of conference participation.

- Brand Visibility: Showcasing services and expertise at trade shows enhances Knight-Swift's presence and recognition in the market.

- Market Intelligence: Conferences offer insights into emerging trends, competitor strategies, and customer expectations, informing business development.

Strategic Acquisitions

Strategic acquisitions are a crucial channel for Knight-Swift Transportation, enabling rapid growth and market share expansion. These moves allow the company to quickly absorb established customer bases and service networks, bypassing the slower organic growth process. For instance, the 2021 acquisition of DHE Transportation in Arizona brought in approximately $70 million in annual revenue and a significant fleet. More recently, the monumental acquisition of U.S. Xpress in 2023, valued at $840 million, significantly broadened Knight-Swift's reach, especially in the less-than-truckload (LTL) and dedicated freight sectors. This integration is expected to unlock substantial synergies and enhance operational efficiencies across a larger network.

These acquisitions serve as a direct pathway to immediate customer base expansion and deeper market penetration. By bringing acquired businesses into the Knight-Swift fold, the company inherits their existing client relationships and gains access to new geographic territories or specialized service offerings. This strategic approach accelerates Knight-Swift's ability to serve a wider array of customers and industries, solidifying its position as a leading transportation provider.

- Acquisition of DHE Transportation (2021): Added approximately $70 million in annual revenue and expanded Knight-Swift's footprint in Arizona.

- Acquisition of U.S. Xpress (2023): A major strategic move valued at $840 million, significantly increasing Knight-Swift's scale and market presence, particularly in LTL and dedicated freight.

- Customer Base Integration: Acquired companies bring established customer relationships, providing an immediate influx of business and revenue.

- Market Penetration: Acquisitions allow for rapid entry into new geographic regions or specialized market segments where the acquired company already has a strong presence.

Knight-Swift Transportation utilizes its direct sales force and dedicated account managers to build strong relationships with major enterprise clients. This direct approach allows for detailed discussions about specific shipping needs and the negotiation of complex, long-term contracts, ensuring tailored solutions are provided.

In 2024, the company continued to enhance its digital platforms and online portals, offering customers convenient access to services like instant quotes, freight booking, and real-time shipment tracking. These digital tools are designed for maximum efficiency, serving a wide range of customers from small businesses to large corporations.

Knight-Swift actively engages in industry conferences and trade shows, using these events for lead generation and to showcase its comprehensive service portfolio. These gatherings are vital for connecting with potential clients and strengthening brand recognition within the competitive logistics market.

Strategic acquisitions are a key channel for Knight-Swift, facilitating rapid expansion and market share growth by integrating established customer bases and service networks. The 2023 acquisition of U.S. Xpress for $840 million significantly broadened their capabilities, particularly in LTL and dedicated freight services.

| Channel | Description | 2023/2024 Impact |

|---|---|---|

| Direct Sales & Account Management | Cultivating relationships with major enterprise clients for specialized needs and long-term agreements. | Secured significant revenue from strategic accounts in 2023, highlighting the value of personalized service. |

| Digital Portals & Online Platforms | Providing easy access to quotes, booking, and real-time tracking for a broad customer base. | Continued investment in 2024 to enhance digital capabilities, meeting the demand for integrated online logistics. |

| Industry Conferences & Trade Shows | Lead generation and showcasing services to potential clients and industry influencers. | Ongoing engagement in 2024 at key industry gatherings to stay updated on trends and client needs. Discussed technology and sustainability in 2023 events. |

| Strategic Acquisitions | Rapid growth and market share expansion through acquiring other companies. | U.S. Xpress acquisition (2023) for $840M significantly expanded scale and market presence, especially in LTL and dedicated freight. DHE Transportation acquisition (2021) added $70M revenue. |

Customer Segments

Large enterprise shippers, such as major manufacturers, retailers, and distributors, represent a core customer segment for Knight-Swift Transportation. These businesses typically have substantial and intricate freight volumes, often spanning multiple transportation modes like truckload, less-than-truckload (LTL), and intermodal. Knight-Swift's ability to offer integrated supply chain solutions is crucial for this group.

These high-volume clients prioritize dependable service, significant capacity, and cutting-edge technology to manage their complex logistics. For instance, in 2024, Knight-Swift continued to leverage its extensive fleet and network to meet the demands of these large enterprises, ensuring timely deliveries and efficient movement of goods across North America.

Mid-sized businesses represent a significant customer segment for Knight-Swift, encompassing a wide array of companies needing consistent freight services that may not require the intricate logistics of larger enterprises. These businesses look to Knight-Swift for dependable and cost-effective transportation solutions, leveraging the company’s broad capabilities in both full truckload (FTL) and less-than-truckload (LTL) shipping.

Knight-Swift's extensive network and diversified service portfolio are particularly attractive to this segment, offering efficiency and scalability. As of the first quarter of 2024, Knight-Swift reported a total operating revenue of $1.5 billion, underscoring its capacity to serve a large and varied customer base, including these crucial mid-sized businesses.

Small and Medium-Sized Businesses (SMBs) represent a significant customer base for Knight-Swift, often requiring less frequent or smaller volume shipments. These companies frequently rely on Less Than Truckload (LTL) services or brokerage solutions to manage their logistics efficiently. Knight-Swift caters to this segment by offering accessible digital platforms and a wide-reaching service network, ensuring flexibility and competitive pricing to meet their diverse needs.

Freight Brokers and 3PLs

Knight-Swift Transportation recognizes freight brokers and third-party logistics (3PL) providers as key customer segments. These entities rely on Knight-Swift's extensive network and diverse fleet capabilities to meet the shipping needs of their own client bases. This relationship is fundamentally a partnership, where Knight-Swift acts as a crucial capacity provider.

The company’s ability to offer consistent and reliable freight capacity makes it an attractive partner for brokers and 3PLs looking to scale their operations and serve a broader range of industries. This segment is vital for filling capacity and generating consistent revenue streams.

- Capacity Partner: Freight brokers and 3PLs utilize Knight-Swift's significant trucking capacity to fulfill their clients' shipping demands, especially for long-haul and specialized freight.

- Strategic Alliance: This segment fosters a partnership-driven relationship, where Knight-Swift's scale and service offerings complement the broker's market access and customer relationships.

- Revenue Diversification: Serving this segment allows Knight-Swift to gain exposure to a wider variety of freight markets and customer types beyond direct shippers.

- Operational Efficiency: By providing reliable capacity, Knight-Swift helps brokers and 3PLs improve their operational efficiency and customer satisfaction.

Specific Industry Verticals

Knight-Swift Transportation strategically serves distinct industry verticals, recognizing that each sector has unique freight requirements. This focus allows them to offer specialized services and equipment, ensuring optimal delivery for a diverse client base. For instance, the consumer goods and retail sectors often demand timely deliveries and specialized handling, while the food and beverage industry necessitates refrigerated transport for perishables.

Their tailored solutions are designed to meet these specific demands. This includes providing refrigerated trailers for the food and beverage sector, ensuring temperature-controlled environments for sensitive products. In 2024, Knight-Swift's commitment to specialized equipment and services within these verticals directly supports supply chain efficiency for businesses across key economic areas.

- Consumer Goods: Efficient and reliable transport for a wide range of products, from electronics to household items.

- Retail: Just-in-time delivery crucial for inventory management and meeting consumer demand, particularly in fashion and electronics.

- Manufacturing: Transporting raw materials and finished goods, often requiring specialized handling for heavy or oversized items.

- Food & Beverage: Emphasis on refrigerated and temperature-controlled logistics to maintain product integrity for both fresh and frozen goods, a critical need in this sector.

Knight-Swift Transportation’s customer base is diverse, encompassing large enterprise shippers, mid-sized businesses, and small to medium-sized businesses (SMBs). These clients rely on Knight-Swift for dependable and scalable freight solutions, ranging from full truckload to less-than-truckload services.

Additionally, freight brokers and third-party logistics (3PL) providers are critical partners, leveraging Knight-Swift's extensive capacity to serve their own clients. The company also caters to specific industry verticals, offering specialized transport for sectors like consumer goods, retail, manufacturing, and food & beverage, as demonstrated by their continued investment in refrigerated fleets in 2024.

| Customer Segment | Key Needs | Knight-Swift Offering | 2024 Relevance |

|---|---|---|---|

| Large Enterprise Shippers | High volume, integrated solutions, dependability, technology | Integrated supply chain, extensive network, advanced tracking | Continued demand for efficient large-scale logistics |

| Mid-sized Businesses | Consistent, cost-effective FTL/LTL services | Broad capabilities, network efficiency, scalability | Supported by $1.5B Q1 2024 revenue, indicating strong service to this group |

| SMBs | Smaller volumes, LTL, brokerage, accessible platforms | Wide network, flexible pricing, digital tools | Catering to diverse needs with competitive solutions |

| Freight Brokers/3PLs | Reliable capacity, scale, market access | Extensive fleet, consistent service, partnership model | Vital for capacity utilization and revenue generation |

| Industry Verticals (e.g., Food & Beverage) | Specialized equipment, temperature control, timely delivery | Refrigerated transport, tailored solutions, industry expertise | Critical for maintaining product integrity and supply chain efficiency |

Cost Structure

Driver wages and benefits represent a substantial component of Knight-Swift's operating expenses, directly influenced by the persistent industry-wide driver shortage. The company invests heavily in competitive compensation packages, including wages, health insurance, retirement plans, and various incentives, to attract and retain a skilled driving force.

In 2024, Knight-Swift's commitment to its drivers is evident in its continued focus on recruitment and retention strategies, aiming to mitigate the impact of this shortage. This investment is crucial for maintaining operational capacity and ensuring reliable service delivery.

Fuel expenses represent a significant variable cost for Knight-Swift Transportation, directly tied to the price of oil and the sheer volume of miles their extensive fleet travels. In 2024, this cost remains a primary focus for operational efficiency and profitability. The company actively works to offset this volatility through implemented fuel surcharge programs, which adjust pricing based on fuel market fluctuations, ensuring a degree of cost recovery.

Knight-Swift is also strategically investing in advanced, fuel-efficient technologies and exploring alternative fuel sources. These investments are crucial for long-term cost management and environmental responsibility. For instance, the company has been adopting newer truck models designed for better miles per gallon. In the first quarter of 2024, Knight-Swift reported fuel costs as a substantial portion of their operating expenses, underscoring the impact of these efforts.

Knight-Swift Transportation’s cost structure heavily relies on equipment ownership and maintenance. This includes the significant capital outlay for purchasing or leasing their vast fleet of tractors and trailers. In 2024, the company continued its strategic investments in fleet modernization, aiming to improve fuel efficiency and reduce breakdowns. Depreciation on this massive asset base is a substantial ongoing expense, alongside the critical costs of routine repairs and preventative maintenance to ensure operational readiness and safety across their network.

Terminal and Facility Operating Costs

Terminal and facility operating costs represent a substantial portion of Knight-Swift Transportation's expenses. These include outlays for rent, utilities, property taxes, and the salaries of personnel managing their widespread network of terminals and service centers.

Knight-Swift's strategic expansion of its Less-Than-Truckload (LTL) network has notably increased these operational expenditures. The company anticipated significant startup and integration costs associated with this growth throughout 2024 and into 2025. For instance, in Q1 2024, Knight-Swift reported a slight increase in selling, general, and administrative expenses, which would encompass some of these facility-related costs, even as they integrate new LTL capabilities.

- Rent and Lease Payments: Costs associated with leasing or owning a significant number of terminals across North America.

- Utilities and Maintenance: Expenses for electricity, water, heating, cooling, and general upkeep of these facilities.

- Property Taxes: Taxes levied on the real estate owned or leased by the company for its operational footprint.

- Staffing Costs: Salaries and benefits for terminal managers, administrative staff, and maintenance personnel.

- LTL Network Integration Costs: Additional expenses incurred in 2024 and 2025 due to the expansion and consolidation of LTL operations.

Insurance and Claims Costs

Insurance and claims costs are a significant part of Knight-Swift's operating expenses due to the inherent risks in trucking. For 2024, it's estimated these costs can fluctuate based on accident frequency, severity, and insurance market conditions. A robust safety program directly impacts these expenditures.

Knight-Swift's commitment to safety initiatives is paramount in mitigating these expenses. Investments in driver training, advanced safety technology in their fleet, and preventative maintenance all work to reduce the likelihood of accidents, cargo damage, and subsequent claims. Effective risk management is key to controlling these variable costs.

- Safety initiatives directly impact insurance premiums and claims payouts.

- Accidents, cargo damage, and liability claims are primary drivers of these costs.

- Knight-Swift's focus on risk management aims to minimize these expenditures.

- Insurance and claims represent a substantial operating expense for transportation companies.

Knight-Swift's cost structure is heavily weighted towards variable expenses like driver wages, fuel, and equipment maintenance, with fixed costs including terminal operations and insurance. In 2024, driver compensation and benefits remain a top expense, driven by industry-wide shortages, while fuel costs continue to be a significant factor, mitigated partly by fuel surcharges and efficiency investments. The company's ongoing modernization of its fleet and expansion of its LTL network also contribute to substantial capital and operational expenditures throughout 2024 and into 2025.

| Cost Category | Description | 2024 Impact/Focus |

|---|---|---|

| Driver Wages & Benefits | Compensation, health insurance, retirement, incentives | High due to driver shortage; focus on recruitment & retention |

| Fuel Expenses | Cost of fuel for fleet operations | Significant variable cost; managed via surcharges & efficiency |

| Equipment Ownership & Maintenance | Tractor/trailer acquisition, depreciation, repairs | Substantial capital outlay; focus on fleet modernization |

| Terminal & Facility Operations | Rent, utilities, taxes, staffing for terminals | Increased by LTL expansion; integration costs noted |

| Insurance & Claims | Premiums and payouts related to accidents, cargo damage | Mitigated by safety programs and risk management |

Revenue Streams

Knight-Swift Transportation's main revenue comes from its extensive truckload freight services. This includes transporting goods in dry vans, refrigerated trailers, flatbeds, and specialized equipment. They focus on moving full truckloads for businesses throughout North America.

In 2023, Knight-Swift reported approximately $6.9 billion in total revenue, with the majority stemming from its dedicated and irregular route truckload segments. This demonstrates the significant contribution of their core freight operations to the company's financial performance.

Knight-Swift's Less-Than-Truckload (LTL) freight revenue is a key growth engine, built on efficiently combining smaller shipments from various clients onto single trailers. This strategy optimizes capacity and serves a broader customer base.

The company has seen impressive expansion in its LTL segment, fueled by strategic acquisitions and ongoing network enhancements. This has translated into robust year-over-year growth, underscoring the increasing demand for their LTL services.

For instance, in the first quarter of 2024, Knight-Swift reported a significant increase in their LTL revenue, demonstrating the success of their expansion efforts. The company's dedicated LTL operations have become a substantial contributor to overall financial performance.

Knight-Swift's logistics and brokerage segment generates revenue by connecting shippers with carriers, utilizing its own fleet and a network of third-party providers. This service acts as a crucial intermediary, offering flexible transportation solutions. In 2023, Knight-Swift's non-asset-based brokerage revenue was approximately $1.5 billion, demonstrating significant growth and contribution to the company's overall financial performance.

Intermodal Services Revenue

Knight-Swift Transportation generates significant revenue from its intermodal services, a key component of its diversified business model. This segment involves transporting goods using a combination of trucking and rail, providing customers with efficient and often more sustainable logistics solutions.

The intermodal service leverages the strengths of both transportation modes. While trucking offers flexibility and door-to-door delivery, rail provides cost savings and reduced emissions for long-haul movements. This synergy directly translates into revenue for Knight-Swift.

In 2024, Knight-Swift's intermodal segment continued to be a vital revenue driver. For instance, in the first quarter of 2024, the company reported total operating revenue of $1.5 billion, with intermodal contributing a substantial portion. This highlights the ongoing importance of this service line.

- Intermodal Revenue Contribution: Intermodal services represent a significant revenue stream for Knight-Swift, capitalizing on the growing demand for cost-effective and environmentally conscious freight solutions.

- Cost and Environmental Benefits: By combining truck and rail, Knight-Swift offers customers a service that can reduce transportation costs and carbon footprints, making it an attractive option.

- 2024 Performance Snapshot: In Q1 2024, Knight-Swift's intermodal segment played a crucial role in their overall financial performance, contributing to their total operating revenue of $1.5 billion.

- Diversified Portfolio: The intermodal service diversifies Knight-Swift's revenue streams, reducing reliance on any single transportation mode and enhancing business resilience.

Ancillary Services and Equipment-Related Revenue

Knight-Swift Transportation also generates income from a variety of ancillary services tied to its core operations. These include leasing out its extensive fleet of trucks and trailers to other carriers or for specialized needs, offering repair and maintenance services to third parties, and providing extended warranty programs for its equipment. The company also benefits from the sale of used equipment, turning depreciated assets into a revenue stream.

These additional revenue streams are crucial for maximizing the utilization of Knight-Swift's assets and capitalizing on its established expertise in fleet management and maintenance. For instance, in 2024, the company continued to see robust demand for its maintenance services, contributing to overall profitability beyond its primary freight hauling business.

- Equipment Leasing: Offering fleet and trailer rentals to supplement income and asset utilization.

- Repair and Maintenance: Providing expert repair services to external clients, leveraging their technical capabilities.

- Warranty Programs: Generating revenue through service contracts and extended warranties on owned equipment.

- Used Equipment Sales: Monetizing older assets through strategic remarketing and sales.

Knight-Swift's revenue diversification is evident across several key areas beyond its primary truckload operations. The company actively generates income through its Less-Than-Truckload (LTL) services, which efficiently consolidate smaller shipments. Furthermore, its logistics and brokerage segment acts as a vital intermediary, connecting shippers with carriers, and in 2023, this non-asset-based brokerage revenue reached approximately $1.5 billion. Intermodal services, combining trucking and rail, also represent a substantial and growing revenue driver, as seen in the first quarter of 2024 where total operating revenue was $1.5 billion.

| Revenue Stream | 2023 Revenue (Approx.) | Notes |

|---|---|---|

| Truckload Freight | ~$5.4 billion | Core business, including dedicated and irregular routes. |

| Less-Than-Truckload (LTL) | Growing segment | Strategic expansion and network enhancements driving growth. |

| Logistics & Brokerage | ~$1.5 billion | Non-asset-based, connecting shippers with carriers. |

| Intermodal | Significant contributor | Leverages trucking and rail for cost-effective, sustainable solutions. |

Business Model Canvas Data Sources

The Knight-Swift Transportation Business Model Canvas is informed by a blend of public financial disclosures, industry analysis reports, and operational data. These sources provide a comprehensive view of revenue streams, cost structures, and market positioning.