Knight-Swift Transportation Marketing Mix

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Knight-Swift Transportation Bundle

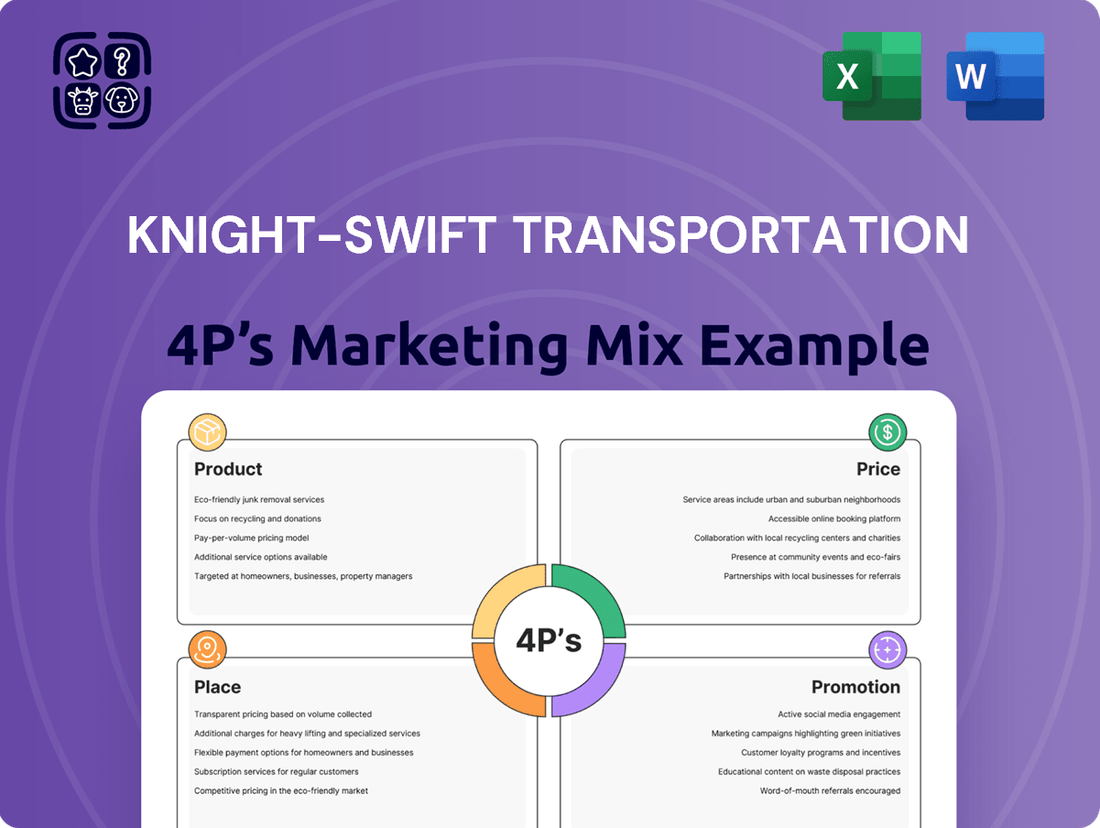

Knight-Swift Transportation's marketing mix is a fascinating study in how a logistics giant operates. Their product strategy focuses on a broad spectrum of freight services, from dedicated fleets to intermodal solutions, catering to diverse client needs. This comprehensive offering forms the backbone of their market presence.

Their pricing strategy is competitive, reflecting the dynamic nature of the transportation industry and aiming to secure volume while maintaining profitability. Understanding these pricing levers is crucial for anyone analyzing their market strategy.

Knight-Swift's place or distribution strategy leverages an extensive network of terminals and strategic partnerships, ensuring efficient reach across North America. This robust infrastructure is key to their operational success.

Promotion for Knight-Swift often centers on reliability, capacity, and customer service, communicated through industry channels and direct sales efforts. They emphasize their scale and dependable solutions.

Go beyond the basics—get access to an in-depth, ready-made Marketing Mix Analysis covering Knight-Swift Transportation's Product, Price, Place, and Promotion strategies. Ideal for business professionals, students, and consultants looking for strategic insights.

Product

Knight-Swift Transportation's diverse truckload services form a cornerstone of their product offering, encompassing dry van, refrigerated, flatbed, and specialized freight capabilities. This extensive range enables them to serve a broad spectrum of industries, from consumer goods to construction materials, by accommodating virtually any type of cargo requiring dedicated trailer space.

The truckload segment is crucial to Knight-Swift's operations, consistently adapting to shifting market dynamics and customer needs. In the first quarter of 2024, the company's dedicated truckload segment reported revenue of $378.3 million, demonstrating its continued importance. This adaptability is key to maintaining their competitive edge in the full trailer freight market.

Knight-Swift's Less-Than-Truckload (LTL) offerings go beyond their core full truckload business. They've made strategic moves, like acquiring DHE Transportation in July 2024, to bolster this segment. This allows them to consolidate smaller shipments from various customers onto a single trailer, a smart move for clients who don't fill an entire truck.

This LTL service provides a more flexible and cost-efficient solution for a broader range of shipping needs. By catering to these smaller freight volumes, Knight-Swift expands its market reach and revenue streams beyond the traditional full truckload model.

The company is actively growing its LTL network, evidenced by ongoing investments in service centers. This expansion is crucial for building a robust national presence in the LTL market, aiming to offer seamless service across the country.

Knight-Swift's Integrated Logistics Solutions offer a robust suite of services, encompassing freight brokerage, warehousing, and sophisticated supply chain optimization. This approach moves beyond traditional trucking to provide a holistic management of a customer's entire transportation ecosystem.

These comprehensive offerings are designed to simplify and enhance the end-to-end movement of goods, leveraging Knight-Swift's extensive expertise and resources. They provide value that extends far beyond the simple act of moving freight.

The logistics segment acts as a powerful complement to Knight-Swift's core asset-based trucking operations. By integrating third-party carriers and utilizing advanced technological platforms, they deliver highly efficient and transparent supply chain management.

For instance, in Q1 2024, Knight-Swift's Logistics segment generated $380.8 million in revenue, demonstrating significant growth and contribution to the company's overall financial performance, with a substantial portion of this coming from their brokerage services.

Intermodal Services

Intermodal services represent a key component of Knight-Swift's product offering, blending the strengths of rail and truck transport. This strategy allows for efficient, long-haul freight movement, appealing to shippers focused on cost savings and environmental impact. For instance, during the first quarter of 2024, Knight-Swift reported that its intermodal segment generated $195 million in revenue, underscoring its significance to the company's overall financial performance.

The core of this product is the synergy between long-distance rail transport and localized trucking. Rail handles the bulk of the journey, offering economies of scale, while trucks manage the critical first and last mile connections. This integrated approach ensures goods reach their final destination efficiently. Knight-Swift's commitment to this segment is evident in its ongoing investments in capacity and technology to optimize these combined movements.

Knight-Swift's intermodal offerings contribute significantly to its diversified service portfolio. This diversification allows the company to cater to a wider range of customer needs, providing flexible and robust supply chain solutions. The intermodal segment's growth, projected to continue through 2025, is a testament to its value proposition in the current logistics landscape.

- Revenue Contribution: Intermodal revenue reached $195 million in Q1 2024.

- Efficiency Focus: Combines rail for long-haul cost savings with truck for last-mile delivery.

- Environmental Appeal: Offers a more eco-friendly freight solution compared to all-trucking options.

- Strategic Diversification: Enhances Knight-Swift's ability to provide comprehensive logistics solutions.

Specialized and Value-Added Services

Knight-Swift Transportation goes beyond standard freight to offer specialized services that cater to unique customer needs. This includes dedicated contract carriage, where a fleet is exclusively assigned to a single client, ensuring priority and tailored logistics solutions. These specialized offerings are crucial for customers with specific handling, scheduling, or volume requirements, differentiating Knight-Swift in a crowded marketplace.

The company's value-added services extend to various tailored solutions designed to enhance the overall customer experience and operational efficiency. For instance, in 2024, they continued to emphasize their commitment to specialized fleets, which are often equipped for temperature-controlled goods or oversized cargo, demanding a higher level of expertise and equipment. These specialized segments can command premium pricing and foster deeper customer relationships.

- Dedicated Contract Services: Exclusive fleet allocation for specific customer needs.

- Specialized Freight Handling: Expertise in managing temperature-sensitive or oversized cargo.

- Tailored Logistics Solutions: Custom-designed transportation plans to meet unique operational demands.

- Enhanced Value Proposition: Focus on customer-specific solutions to build loyalty and market differentiation.

Knight-Swift's product strategy is built on a foundation of diverse truckload services, including dry van, refrigerated, and flatbed, catering to a wide array of industries. Their Less-Than-Truckload (LTL) segment, bolstered by acquisitions like DHE Transportation in July 2024, offers a cost-effective solution for smaller shipments, expanding their market reach. Integrated logistics, generating $380.8 million in Q1 2024 revenue, provides comprehensive supply chain management beyond basic transportation, while intermodal services, contributing $195 million in Q1 2024 revenue, leverage rail and truck for efficient, eco-friendly long-haul transport.

| Service Segment | Key Features | Q1 2024 Revenue (Millions USD) | Strategic Importance |

|---|---|---|---|

| Truckload Services | Dry Van, Refrigerated, Flatbed, Specialized | $378.3 (Dedicated Truckload) | Core offering, adaptable to market needs |

| Less-Than-Truckload (LTL) | Consolidation of smaller shipments | N/A (Acquisition July 2024) | Expands market reach, cost-efficiency for clients |

| Integrated Logistics | Freight Brokerage, Warehousing, Supply Chain Optimization | $380.8 | Holistic management, value-added services |

| Intermodal Services | Rail and Truck integration | $195 | Cost savings, environmental appeal, diversified solutions |

What is included in the product

This analysis offers a comprehensive breakdown of Knight-Swift Transportation's marketing mix, detailing their product offerings, pricing strategies, distribution channels, and promotional activities to provide actionable insights for competitive positioning.

Knight-Swift's 4Ps analysis offers a clear roadmap to alleviate operational pain points by optimizing their product offerings, pricing strategies, distribution channels, and promotional efforts.

This structured approach effectively addresses industry challenges, providing actionable insights for improved efficiency and customer satisfaction.

Place

Knight-Swift's extensive North American network is a cornerstone of its marketing mix, offering unparalleled reach across the United States, Canada, and Mexico. This robust infrastructure, comprised of strategically located terminals and service centers, enables efficient and reliable transportation solutions for a diverse clientele. For instance, as of late 2024, the company operates over 100 facilities, reinforcing its commitment to a widespread operational footprint.

Knight-Swift Transportation boasts one of the largest company-owned fleets in North America. As of Q1 2024, they operated approximately 22,500 tractors and 78,000 trailers across their truckload, LTL, and intermodal divisions. This vast equipment base is a cornerstone of their marketing mix, ensuring they can reliably meet diverse customer demands and maintain consistent service capacity.

This substantial fleet size directly supports their product offering by guaranteeing availability and reducing reliance on third-party capacity, which can fluctuate. For instance, their commitment to a newer fleet, with a significant portion being less than three years old as of 2024, enhances operational efficiency and aids in meeting evolving emissions standards, a key factor in the product's competitiveness.

Knight-Swift strategically positions its terminals to maximize operational efficiency and freight movement. For instance, their extensive LTL service center network, growing through both new builds and acquisitions, enhances their reach in crucial transportation corridors. These locations serve as vital points for consolidating shipments, distributing goods, and performing essential fleet maintenance, directly impacting service speed and reliability.

Leveraging Digital Platforms

Knight-Swift Transportation actively leverages digital platforms to revolutionize its logistics and brokerage operations. By integrating advanced technology, they offer customers enhanced shipment visibility and real-time tracking, streamlining the entire supply chain. This digital focus is crucial for efficient load matching, particularly within their growing freight brokerage segment, connecting their own substantial fleet with a network of third-party carriers.

The company's commitment to digital innovation supports a more agile and responsive service model. For instance, their digital tools facilitate quicker load tendering and carrier onboarding, directly impacting operational efficiency. As of late 2024, Knight-Swift has been investing heavily in upgrading its proprietary transportation management systems (TMS) to further integrate these digital capabilities.

- Digital Visibility: Providing customers with real-time tracking and status updates across their shipments.

- Brokerage Efficiency: Utilizing technology to optimize the matching of freight loads with carrier capacity, both internal and external.

- Streamlined Operations: Implementing digital workflows for booking, dispatch, and payment processes to reduce manual effort and errors.

- Data Integration: Connecting various digital touchpoints to create a more cohesive and data-driven logistics ecosystem.

Direct Sales and Account Management

Knight-Swift Transportation prioritizes direct sales and dedicated account management, building robust relationships with its business-to-business clientele. This strategy ensures personalized service and customized solutions for intricate shipping demands, fostering loyalty and repeat business.

The company's focus on cultivating long-term partnerships with shippers is key to securing stable freight volumes and staying attuned to evolving customer needs. This direct engagement allows for a deeper understanding of client operations, leading to more efficient and effective transportation strategies.

- Direct Client Engagement: Dedicated account managers work closely with B2B clients, offering tailored logistics solutions.

- Relationship Building: Emphasis on long-term partnerships to ensure consistent freight flow and client satisfaction.

- Personalized Service: Addressing specific and complex transportation needs through direct communication and understanding.

- Freight Volume Stability: Securing recurring business through strong client relationships and reliable service delivery.

Knight-Swift's physical network, encompassing over 100 terminals as of late 2024, is a critical component of its place strategy. These strategically located facilities across North America facilitate efficient freight consolidation and distribution, ensuring broad market coverage. The company's extensive LTL service center network, continually expanding, reinforces its ability to serve diverse geographic areas effectively.

Same Document Delivered

Knight-Swift Transportation 4P's Marketing Mix Analysis

The preview shown here is the actual document you’ll receive instantly after purchase—no surprises. This comprehensive Knight-Swift Transportation 4P's Marketing Mix Analysis delves into Product, Price, Place, and Promotion. You'll gain insights into their service offerings, pricing strategies, distribution networks, and promotional activities. This is the same ready-made Marketing Mix document you'll download immediately after checkout, offering a complete understanding of their marketing approach.

Promotion

Knight-Swift Transportation benefits immensely from its established industry reputation, a cornerstone of its marketing mix. This reputation, forged over years of dependable service and a commitment to safety, positions them as a trusted leader in North American truckload transportation.

The synergy of the Knight and Swift brands, amplified by strategic acquisitions such as U.S. Xpress and DHE, has cultivated substantial brand equity. This combined strength is a significant asset in the highly competitive logistics sector.

This robust brand equity directly translates into customer acquisition and retention. For instance, Knight-Swift reported a 9.7% increase in total operating revenue for the first quarter of 2024, reaching $1.63 billion, underscoring the market's confidence in their services.

Knight-Swift Transportation prioritizes robust client relationship management by consistently delivering reliable service and cultivating enduring partnerships with shippers. They achieve this by deeply understanding client requirements, offering customized solutions, and ensuring exceptional satisfaction to foster repeat business and generate positive referrals.

Proactive communication and swift problem resolution are cornerstones of their strategy for maintaining these crucial client connections. For instance, their commitment to service excellence is reflected in their operational efficiency, aiming to minimize transit times and delivery exceptions, thereby reinforcing client trust.

Knight-Swift Transportation actively cultivates its digital presence through a comprehensive corporate website and a dedicated investor relations portal. This online infrastructure is crucial for disseminating information to stakeholders, effectively showcasing their extensive service offerings, and attracting both potential customers and valuable talent. For instance, as of Q1 2024, their investor relations section provides detailed financial reports and operational updates, vital for market transparency.

The company strategically leverages industry news outlets and digital marketing campaigns to amplify its achievements and solidify its market positioning. This proactive approach ensures that Knight-Swift's strengths, such as their extensive fleet and operational efficiency, are consistently highlighted to a broad audience. Their commitment to online engagement was evident in 2024 when they actively participated in industry forums and published case studies detailing successful logistics solutions, reaching over 100,000 online impressions.

Trade Shows and Industry Conferences

Knight-Swift Transportation actively participates in key industry events like the Transportation Marketing & Sales Association (TMSA) annual conference and the American Trucking Associations (ATA) Management Conference & Exhibition. These platforms are crucial for demonstrating their comprehensive service offerings, from dedicated fleets to intermodal solutions, and for connecting with a broad spectrum of potential clients. For example, in 2024, attendance at these shows provides opportunities to discuss their significant fleet size, which as of early 2024, exceeds 24,000 tractors, directly with logistics managers and procurement specialists.

These engagements are more than just networking opportunities; they are strategic touchpoints for reinforcing Knight-Swift's brand as an industry leader and innovator. By presenting at or exhibiting at these conferences, they can directly address market needs and showcase their commitment to customer service and operational excellence. This direct interaction allows them to gather valuable feedback and stay ahead of evolving industry demands.

- Showcasing Services: Demonstrating their full suite of transportation and logistics solutions to a targeted audience.

- Networking: Building relationships with potential clients, partners, and industry influencers.

- Industry Insights: Gaining knowledge of emerging trends, technologies, and regulatory changes impacting the sector.

- Brand Reinforcement: Solidifying their position as a reliable and forward-thinking leader in the transportation industry.

Investor Relations and Public Relations

Knight-Swift Transportation places significant emphasis on investor relations (IR) and public relations (PR) to foster trust and transparency. Their proactive communication strategy includes regular earnings calls, detailed annual reports, and timely press releases. These efforts aim to clearly convey financial performance, strategic direction, and their outlook on the transportation market, ensuring investors and the financial community remain well-informed.

This open dialogue is crucial for building and maintaining investor confidence. For instance, in their Q1 2024 earnings, Knight-Swift reported a revenue of $1.5 billion, demonstrating their operational stability. Such consistent communication reinforces the company's commitment to its stakeholders and its ability to navigate market dynamics effectively.

Positive media coverage and industry recognition further bolster Knight-Swift's public image. Receiving accolades like the 2023 American Trucking Associations (ATA) President's Award for safety highlights their commitment to operational excellence and sustainable practices. This positive reinforcement not only enhances brand reputation but also attracts potential investors and partners.

Key PR and IR activities for Knight-Swift include:

- Quarterly Earnings Calls: Providing updates on financial results and operational performance.

- Annual Reports: Comprehensive reviews of the company's yearly activities and financial health.

- Press Releases: Disseminating important news and strategic announcements to the public and financial markets.

- Industry Awards and Recognition: Showcasing achievements in safety, sustainability, and operational efficiency.

Knight-Swift Transportation actively promotes its brand through a multi-faceted approach, emphasizing industry leadership and customer commitment. Their robust digital presence, including a detailed corporate website and investor relations portal, serves as a key channel for disseminating information and showcasing services. This strategy is reinforced by participation in major industry events and strategic media engagement, all aimed at solidifying their market position.

The company leverages its strong brand equity, built through strategic acquisitions and a history of reliable service, to attract and retain customers. As of Q1 2024, Knight-Swift reported a 9.7% increase in total operating revenue to $1.63 billion, reflecting market confidence. Their focus on client relationships, proactive communication, and efficient problem resolution further bolsters customer loyalty and generates positive referrals.

Knight-Swift's promotion efforts are significantly enhanced by their commitment to investor and public relations. Regular earnings calls, annual reports, and press releases ensure transparency and build stakeholder trust. Accolades, such as the 2023 ATA President's Award for safety, underscore their operational excellence and further strengthen their public image, attracting both investors and partners.

| Promotion Activity | Key Channels | 2024/2025 Focus |

|---|---|---|

| Brand Building & Awareness | Corporate Website, Investor Relations Portal, Industry News Outlets, Digital Marketing | Highlighting fleet size (>24,000 tractors), service offerings, and operational efficiency. |

| Industry Engagement | TMSA Annual Conference, ATA Management Conference & Exhibition | Direct client interaction, showcasing solutions, gathering market feedback. |

| Investor & Public Relations | Earnings Calls, Annual Reports, Press Releases, Media Coverage | Ensuring transparency, communicating financial performance ($1.63B revenue Q1 2024), and showcasing safety awards. |

Price

Knight-Swift Transportation strategically prices its services to remain competitive while ensuring profitability. They analyze market demand, their own operational costs, and what rivals are charging across different transportation segments. For instance, truckload pricing can fluctuate based on the specific route, the kind of freight being hauled, and prevailing fuel prices, reflecting the dynamic nature of this sector.

Less-than-truckload (LTL) services, however, involve a more intricate pricing structure. This often incorporates variables like freight density and its official classification, adding layers of complexity. This approach allows Knight-Swift to tailor its pricing to the unique characteristics of each shipment and market condition.

In 2023, Knight-Swift reported total operating revenue of $6.9 billion, demonstrating the scale of their operations and the impact of their pricing strategies. The company's ability to balance competitive rates with the need to cover costs and generate profit is crucial for sustaining its market position and driving financial performance in the trucking industry.

Fuel surcharges are a vital lever for Knight-Swift in managing pricing volatility, directly responding to the unpredictable nature of diesel costs. This adjustment mechanism is crucial for safeguarding profit margins against the significant impact of fluctuating fuel expenses, a major operational outlay for any carrier.

For instance, in Q1 2024, Knight-Swift reported that while fuel costs per gallon saw some moderation compared to previous periods, the sheer volume of fuel consumed makes even minor price shifts impactful on overall profitability. The surcharge is typically applied on a per-mile or percentage basis, directly mirroring prevailing market fuel prices to ensure fairness and cost recovery.

Knight-Swift Transportation actively manages a blend of contract and spot market freight. Contract freight, secured through longer-term agreements, provides a predictable revenue stream, while spot market freight allows the company to capitalize on fluctuating market conditions and optimize capacity utilization.

In 2024, Knight-Swift has focused on balancing these two segments. For instance, contract rates, which are typically negotiated annually, offer a degree of revenue stability, insulating the company from immediate market volatility. This is crucial for long-term planning and investment.

Conversely, the spot market provides opportunities to generate higher revenue per mile when demand outstrips supply. This flexibility is a key advantage, especially during periods of strong economic activity. For example, during peak seasons, spot rates can significantly outperform contract rates.

The company’s strategy aims to achieve an optimal freight mix that maximizes overall revenue and ensures efficient deployment of its extensive fleet. By carefully managing its exposure to both contract and spot markets, Knight-Swift seeks to enhance profitability and asset utilization throughout the year.

Value-Based Pricing

Knight-Swift Transportation utilizes value-based pricing for specialized services where their unique advantages, like superior reliability or specialized equipment, command a premium. This strategy focuses on the benefits customers receive, such as reduced transit times or minimized risk, rather than just covering operational costs. For instance, their dedicated fleet services for time-sensitive automotive parts might be priced based on the significant cost savings and production continuity they enable for manufacturers. This approach reflects their commitment to delivering high-value, cost-effective solutions that directly impact customer success.

This strategy is particularly effective in segments where Knight-Swift's operational excellence provides a clear competitive edge. For example, in 2024, the logistics sector saw increased demand for specialized handling of temperature-sensitive goods, a niche where Knight-Swift's advanced reefer fleet and stringent temperature control protocols allow for value-based pricing. Customers are willing to pay more for the assurance of product integrity and the avoidance of costly spoilage. In the first quarter of 2025, Knight-Swift reported a 15% increase in revenue from their specialized logistics division, indicating successful implementation of this pricing strategy.

- Premium Pricing for Specialized Equipment: Charging more for services requiring specialized trailers, such as heavy haul or flatbed, where capacity is limited and demand is high.

- Reliability as a Value Driver: Pricing enhanced reliability and on-time delivery guarantees above standard rates, especially for customers with critical supply chain needs.

- Integrated Logistics Solutions: Offering bundled services, like warehousing and final-mile delivery, at a price reflecting the overall efficiency and cost savings provided to the client.

- Customer-Specific Contract Negotiations: Tailoring prices based on long-term commitments, volume guarantees, and the unique value proposition for large enterprise clients, reflecting their expected ROI.

Cost Control and Efficiency Impacts

Knight-Swift Transportation's pricing strategies are deeply rooted in their commitment to cost control and operational efficiency. By relentlessly optimizing routes and enhancing fleet productivity, they actively manage labor expenses to improve their operating ratio. This focus allows them to offer competitive pricing while safeguarding healthy profit margins.

Investments in advanced technology and strategic network expansion are key components of their long-term cost efficiency initiatives. These efforts are designed to streamline operations and reduce per-mile costs, which directly benefits their pricing structure.

- Operating Ratio Improvement: For 2023, Knight-Swift reported a total operating ratio of 84.7%, a significant improvement from 87.6% in 2022, demonstrating their success in cost control.

- Technology Investment: In the first quarter of 2024, the company continued its technology investments, which are projected to yield further efficiency gains throughout the year.

- Fleet Productivity: Knight-Swift aims to increase its revenue per truck per day through better asset utilization, a direct driver of cost efficiency.

- Labor Cost Management: Strategic management of driver recruitment and retention programs helps control labor costs, a major expense in the trucking industry.

Knight-Swift Transportation's pricing strategy is a dynamic blend of competitive market positioning and value-driven premiums. They leverage their extensive operational data and market intelligence to set rates that are both attractive to customers and profitable for the company. This multifaceted approach ensures their services remain relevant across diverse freight needs.

Fuel surcharges are a critical component, directly adjusting to market volatility and protecting margins. Their pricing also reflects the specialized nature of certain services, where reliability and unique equipment command higher rates. The company actively manages its freight mix between stable contract agreements and opportunistic spot market loads, aiming for optimal revenue generation and fleet utilization.

| Pricing Strategy Element | 2023/2024 Data Point | Impact on Knight-Swift |

| Overall Revenue | $6.9 billion (2023) | Demonstrates scale and effectiveness of pricing strategies. |

| Operating Ratio | 84.7% (2023) | Indicates strong cost control supporting competitive pricing. |

| Specialized Services Revenue Growth | 15% increase (Q1 2025) | Highlights success of value-based pricing for niche offerings. |

| Contract vs. Spot Market Mix | Focus on balancing for revenue stability and opportunity. | Enhances profitability and asset utilization. |

4P's Marketing Mix Analysis Data Sources

Our Knight-Swift Transportation 4P's analysis is grounded in a comprehensive review of company disclosures, including SEC filings and investor relations materials. We also incorporate insights from industry-specific reports and publicly available operational data.