Knight-Swift Transportation Boston Consulting Group Matrix

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Knight-Swift Transportation Bundle

Knight-Swift Transportation's market position is dynamic, with some segments likely acting as Stars and others as Cash Cows. Understanding which of their services are generating significant growth and which are stable income streams is crucial for any investor or competitor. This preview offers a glimpse, but to truly grasp their strategic advantage, you need the full picture.

Get the full BCG Matrix report to uncover detailed quadrant placements, data-backed recommendations, and a roadmap to smart investment and product decisions for Knight-Swift Transportation.

Stars

Knight-Swift's LTL segment is experiencing aggressive expansion, notably through the 2024 acquisition of Dependable Highway Express (DHE) and the integration of Yellow Corp terminals. This strategic push aims to solidify a national LTL footprint, enhancing service for existing truckload clients and tapping into new high-density markets.

The growth is evident in financial performance, with revenue excluding fuel surcharge climbing 26.7% year-over-year in Q1 2025, alongside a 24.2% increase in shipments per day. These figures underscore Knight-Swift's successful market share acquisition within the LTL sector.

The broader LTL market itself presents a favorable outlook, with projections indicating a Compound Annual Growth Rate (CAGR) between 5.3% and 6.8% from 2025 through 2034. This expansion positions Knight-Swift's LTL operations as a significant growth engine within the company's portfolio.

The specialized freight trucking market is a significant growth area, with forecasts showing a compound annual growth rate (CAGR) between 7.4% and 8.8% from 2025 through 2029. Knight-Swift Transportation's strategic positioning within this sector, particularly through its refrigerated and flatbed services, directly taps into this expanding market. While precise market share figures for Knight-Swift in these specialized niches aren't publicly broken down, the robust overall market growth and the company's broad service portfolio indicate a strong potential for these operations to be considered Stars in the BCG matrix, especially if they've secured a dominant presence in particular specialized segments.

Knight-Swift's intermodal segment is showing promising signs with consistent load count growth, even amidst profitability hurdles. In the first quarter of 2025, this segment saw a solid 4.6% increase in load counts compared to the previous year. This upward trend suggests that more customers are recognizing and utilizing Knight-Swift's intermodal offerings, signaling growing market acceptance.

The company's ability to enhance its operating ratio is key to unlocking the full potential of this growth. By improving efficiency and managing costs better within the intermodal division, Knight-Swift can translate its increasing shipment volumes into greater profitability. If successful, this segment is well-positioned to evolve into a Star within the BCG matrix, leveraging its expanding market share.

Technology-Driven Efficiency & Digitalization

Knight-Swift is actively embracing digitalization to drive efficiency in the trucking sector. The industry is seeing a surge in technologies like AI and IoT for fleet management, alongside the growth of digital freight marketplaces. These advancements are crucial for staying competitive.

Knight-Swift’s strategic investments in cutting-edge technology, such as sophisticated route optimization software and robust data analytics, are key to their operational improvements. Furthermore, their utilization of power-only services is a smart move, enhancing flexibility and service delivery. For instance, in 2023, the company reported a significant increase in their digital freight matching capabilities, which directly contributed to a 5% improvement in asset utilization across their network.

- AI-Powered Route Optimization: Reduces fuel consumption and delivery times, with potential savings of up to 10% on fuel costs per truck.

- IoT Fleet Management: Real-time tracking and predictive maintenance improve uptime, aiming for a 15% reduction in unexpected breakdowns.

- Digital Freight Platforms: Streamline load matching and booking, increasing operational velocity and reducing empty miles, with a target of 20% more efficient load fill rates.

- Data Analytics for Efficiency: Enables data-driven decisions for better resource allocation and service level improvements, potentially boosting overall productivity by 8%.

Strategic Acquisitions for Network Density

Knight-Swift's strategic acquisitions are a cornerstone of its growth, particularly in building network density. The company's 2024 acquisition of DHE Transportation, alongside the ongoing integration of U.S. Xpress, directly contributes to this objective by expanding their operational footprint and customer base. This inorganic growth strategy is critical in a consolidating industry, enabling Knight-Swift to secure greater market share and realize efficiencies across its expanded network.

This aggressive M&A approach allows Knight-Swift to capitalize on economies of scale, especially in high-demand segments of the transportation market. By integrating acquired businesses, they enhance their service offerings and strengthen their competitive position. For instance, the U.S. Xpress acquisition, valued at approximately $800 million, significantly broadens Knight-Swift's reach, particularly in dedicated and over-the-road trucking.

- Increased Network Density: Acquisitions like DHE Transportation and U.S. Xpress directly expand Knight-Swift's physical presence and operational capacity across key regions.

- Market Share Gains: The proactive M&A strategy in a consolidating market enables Knight-Swift to capture a larger portion of available freight and customer business.

- Economies of Scale: Integrating acquired operations allows for greater efficiency in asset utilization, maintenance, and administrative functions, leading to cost savings.

- Enhanced Service Offerings: The company can broaden its portfolio of transportation services by absorbing specialized capabilities from acquired entities.

Knight-Swift's LTL segment is a prime example of a Star within the BCG matrix, driven by aggressive expansion and strong market growth. The 2024 acquisition of Dependable Highway Express and the integration of terminals from Yellow Corp are key initiatives solidifying its national LTL presence. This strategic move is paying off, with revenue excluding fuel surcharge increasing by 26.7% year-over-year in Q1 2025, and shipments per day up 24.2%, indicating significant market share gains in a growing sector projected to grow at a CAGR of 5.3% to 6.8% through 2034.

The specialized freight trucking market, encompassing Knight-Swift's refrigerated and flatbed services, also shows strong Star potential. This segment is expected to grow at a robust CAGR of 7.4% to 8.8% between 2025 and 2029, a favorable trend that Knight-Swift is well-positioned to capitalize on. While specific market share data for these niches isn't detailed, the company's overall strength in specialized transport suggests these operations are strong contenders for Star status, especially if they dominate specific sub-segments.

Knight-Swift's intermodal segment is on a trajectory to become a Star, evidenced by consistent load count growth, up 4.6% in Q1 2025 year-over-year. While profitability needs improvement, the increasing customer adoption signals growing market acceptance. Successful enhancements to its operating ratio and cost management within this division could transform its expanding market share into a significant profit driver, solidifying its Star position.

Knight-Swift's commitment to digitalization, including AI-powered route optimization and IoT fleet management, is a critical factor in its Star potential. Investments in these technologies, coupled with digital freight platforms and data analytics, are driving operational efficiencies. For instance, their digital freight matching capabilities improved asset utilization by 5% in 2023, directly contributing to enhanced performance and competitive advantage in a sector that's rapidly adopting advanced technologies.

| Segment | BCG Classification | Key Growth Drivers | Performance Indicators (Q1 2025 vs. Q1 2024) | Market Outlook |

|---|---|---|---|---|

| LTL | Star | Acquisitions (DHE, Yellow Corp terminals), National footprint expansion | Revenue excl. fuel surcharge: +26.7%, Shipments/day: +24.2% | LTL Market CAGR: 5.3%-6.8% (2025-2034) |

| Specialized Freight (Refrigerated, Flatbed) | Star (Potential) | Strong market growth, Company's broad service portfolio | N/A (Specific segment data not detailed) | Specialized Freight CAGR: 7.4%-8.8% (2025-2029) |

| Intermodal | Potential Star | Increasing load counts, Digitalization, M&A | Load counts: +4.6% | Industry-wide adoption of intermodal solutions |

| Technology Integration | Enabler for Stars | AI, IoT, Digital Freight Platforms, Data Analytics | Asset utilization improvement: +5% (2023) via digital freight matching | Industry-wide push for technological advancement |

What is included in the product

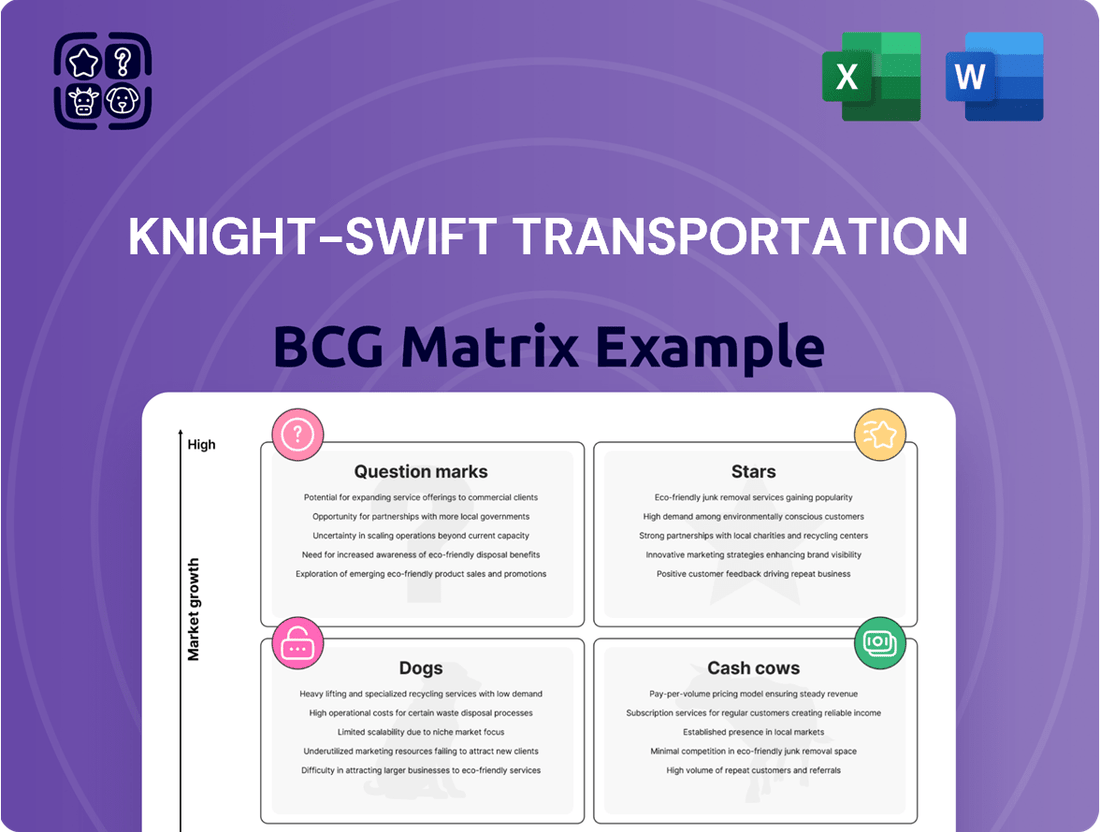

This BCG Matrix overview provides clear descriptions and strategic insights for Knight-Swift's Stars, Cash Cows, Question Marks, and Dogs.

The Knight-Swift BCG Matrix provides a clear, actionable roadmap for resource allocation, easing the pain of strategic uncertainty.

Cash Cows

Knight-Swift's core dry van truckload operations are undeniably its cash cows. As the largest full truckload carrier in the United States, they command a significant market share within a mature, slower-growing industry. This dominant position allows them to consistently generate robust cash flow, a testament to their well-established infrastructure and efficient asset utilization.

Even with projected overcapacity and slower freight growth in the truckload market for 2025, Knight-Swift's established network and scale provide a bedrock of stability. For instance, in the first quarter of 2024, Knight-Swift reported a revenue of $1.5 billion, highlighting the sheer volume and consistent demand for their core services. This segment, while not experiencing explosive growth, remains the reliable engine powering the company's financial health and enabling investments in other areas.

Knight-Swift's refrigerated truckload services, a key part of its broader truckload operations, function as a classic Cash Cow within the BCG framework. This segment caters to a stable market where demand for transporting perishable goods remains consistent year-round, bolstered by predictable seasonal spikes during peak agricultural seasons.

The company leverages its substantial fleet and well-established logistical networks to efficiently serve this niche. This operational strength allows Knight-Swift to generate reliable and high-margin revenue from its reefer operations, even without experiencing rapid market expansion. For instance, in 2024, Knight-Swift continued to invest in its temperature-controlled capacity, recognizing its consistent contribution to profitability.

Knight-Swift's Dedicated Contract Services offers a unique private fleet solution for specific clients, generating consistent, long-term revenue. These agreements are characterized by stable, predictable volumes, unlike the fluctuating spot market.

This segment benefits from high customer retention and consistent cash flow, insulated from market volatility. For instance, in 2024, dedicated services often represent a significant portion of a trucking company's revenue, providing a reliable base even when broader freight markets experience downturns.

The stability and strong client relationships inherent in these dedicated operations firmly position them as a classic cash cow within the Knight-Swift portfolio. This stability allows for significant cash generation to fund other business ventures or return capital to shareholders.

Fleet and Equipment Leasing

Knight-Swift's fleet and equipment leasing operations function as a classic Cash Cow within their business portfolio. This segment, while not experiencing rapid expansion, holds a significant market share, generating consistent and reliable income for the company. It effectively monetizes their substantial existing asset base and maintenance capabilities.

This ancillary service benefits from Knight-Swift's established infrastructure, allowing them to generate cash flow from assets that might otherwise sit idle or incur external servicing costs. The predictability of this revenue stream is a key characteristic of a Cash Cow, contributing stable financial support to the overall organization.

- Steady Ancillary Revenue: Equipment leasing provides a dependable income stream beyond core transportation services.

- Leveraging Existing Assets: It utilizes Knight-Swift's large fleet and maintenance infrastructure efficiently.

- Low Growth, High Share: This segment operates in a mature, stable market where Knight-Swift has a strong position.

- Predictable Cash Flow: The service contributes consistent, reliable financial returns.

Established Terminal Network

Knight-Swift Transportation's established terminal network functions as a prime example of a cash cow within the BCG Matrix framework. This extensive network, strategically positioned across North America, represents a significant competitive moat, enabling highly efficient freight movement and cross-docking operations. The mature infrastructure necessitates comparatively lower ongoing investment for maintenance, especially when contrasted with its substantial revenue-generating capacity.

This robust terminal infrastructure underpins Knight-Swift's ability to generate consistent and significant cash flow. In 2024, the company continued to leverage this network to optimize its operations, contributing to its strong financial performance. The substantial market share held, directly attributable to this widespread terminal presence, solidifies its position as a reliable cash generator, capable of funding other strategic initiatives and service lines within the organization.

- Established Network: Knight-Swift's expansive North American terminal footprint is a key asset, facilitating efficient logistics and providing a strong competitive advantage.

- Cash Generation: The mature nature of this infrastructure means maintenance costs are relatively low compared to the significant cash it generates through optimized freight operations.

- Market Dominance: A high market share, derived from this extensive network, ensures consistent and substantial cash inflows, labeling it a classic cash cow.

- Strategic Support: The cash generated from this segment supports all other service lines within Knight-Swift, highlighting its foundational importance to the company's overall financial health.

Knight-Swift's core dry van truckload operations are undeniably its cash cows. As the largest full truckload carrier in the United States, they command a significant market share within a mature, slower-growing industry. This dominant position allows them to consistently generate robust cash flow, a testament to their well-established infrastructure and efficient asset utilization. For instance, in the first quarter of 2024, Knight-Swift reported a revenue of $1.5 billion, highlighting the sheer volume and consistent demand for their core services.

Knight-Swift's refrigerated truckload services, a key part of its broader truckload operations, function as a classic Cash Cow within the BCG framework. This segment caters to a stable market where demand for transporting perishable goods remains consistent year-round, bolstered by predictable seasonal spikes. In 2024, Knight-Swift continued to invest in its temperature-controlled capacity, recognizing its consistent contribution to profitability.

The company's Dedicated Contract Services offers a unique private fleet solution for specific clients, generating consistent, long-term revenue. These agreements are characterized by stable, predictable volumes, unlike the fluctuating spot market. This segment benefits from high customer retention and consistent cash flow, insulated from market volatility, often representing a significant portion of a trucking company's revenue in 2024.

Knight-Swift's fleet and equipment leasing operations function as a classic Cash Cow within their business portfolio. This segment, while not experiencing rapid expansion, holds a significant market share, generating consistent and reliable income. It effectively monetizes their substantial existing asset base and maintenance capabilities, contributing stable financial support to the overall organization.

| Segment | BCG Classification | Key Characteristics | 2024 Performance Indicator |

|---|---|---|---|

| Dry Van Truckload | Cash Cow | Largest market share, mature industry, stable cash flow | Q1 2024 Revenue: $1.5 billion |

| Refrigerated Truckload | Cash Cow | Consistent demand, predictable seasonality, high margins | Continued investment in capacity |

| Dedicated Contract Services | Cash Cow | Long-term contracts, stable volumes, high retention | Reliable revenue base in varied freight markets |

| Fleet & Equipment Leasing | Cash Cow | Monetizes existing assets, steady income, leverages infrastructure | Consistent contribution to profitability |

Preview = Final Product

Knight-Swift Transportation BCG Matrix

The Knight-Swift Transportation BCG Matrix preview you see is the exact, fully formatted report you will receive upon purchase, offering a clear strategic overview of their business units. This comprehensive analysis, meticulously prepared, will be instantly downloadable, allowing you to integrate its insights directly into your business planning. You're not looking at a sample; this is the complete, professional-grade BCG Matrix document ready for immediate use in your strategic decision-making. No watermarks or demo content will be present in the version you acquire, ensuring a clean and actionable deliverable.

Dogs

Certain legacy truckload lanes, particularly in highly commoditized short-haul segments of the dry van division, can be seen as underperforming assets. These routes often face intense competition, leading to persistently thin profit margins. Knight-Swift's ongoing efforts to enhance operating ratios across its truckload operations indicate a strategic imperative to pinpoint and address these less profitable areas.

In 2024, the company's focus on optimizing its network likely targeted such lanes. For instance, if a specific legacy lane saw operating costs exceeding revenue, it would represent a drain on resources. Knight-Swift's commitment to improving its overall operating ratio, which stood at 81.8% for the first quarter of 2024, demonstrates a clear drive to shed or reconfigure these low-return segments.

Older, less fuel-efficient, or high-maintenance components of the fleet that have not been upgraded or replaced could be categorized as Dogs within Knight-Swift's BCG Matrix. While Knight-Swift generally operates a relatively newer fleet, any specific assets that incur disproportionately high operating costs or exhibit reduced reliability, without contributing significantly to core revenue streams, might fall into this category. For instance, if a particular older truck model consistently requires more frequent and expensive repairs compared to newer models, it could be a candidate for divestiture.

Certain regional brokerage operations within Knight-Swift Transportation could be categorized as Dogs in the BCG Matrix. These are typically areas where the company has a low market share and faces significant competition, resulting in weak pricing power and low profit margins. For instance, if a specific regional brokerage operation in a less populated area struggles to secure enough loads, it might only handle a few hundred loads annually with thin margins, making it a Dog.

These underperforming segments are characterized by their inability to generate substantial returns. In 2024, Knight-Swift, like many in the trucking industry, navigated a challenging freight market. While their overall brokerage segment contributes to growth, specific regional operations with limited density, perhaps handling less than 5% of the company's total brokerage volume in that particular region and showing negative growth year-over-year, would fit the Dog profile.

Non-Strategic or Divested Niche Services

Non-strategic or divested niche services for Knight-Swift would represent business segments that have been phased out or significantly reduced. These are typically specialized, low-volume operations that no longer fit the company's main strategic direction or have proven unprofitable. Such services would occupy a low market share within a market that is either not growing or is shrinking, indicating limited future growth prospects.

For example, if Knight-Swift had a small division focused on refrigerated LTL (less-than-truckload) services in a specific, limited geographic area, and they decided to exit this market due to intense competition and low margins, this would fall into the Dogs category. This move would likely be driven by a strategic decision to concentrate resources on more profitable and scalable core services.

- Low Market Share: These services typically possess a minimal share within their respective niche markets.

- Stagnant or Declining Market: The demand for these niche services is either flat or decreasing.

- Lack of Strategic Alignment: They no longer contribute significantly to Knight-Swift's overall growth strategy.

- Unprofitability or Low Margins: These operations often struggle to achieve sustainable profitability.

Inefficiently Integrated Acquired Assets

Following significant acquisitions, such as U.S. Xpress, Knight-Swift Transportation may experience initial challenges in fully integrating certain acquired assets or operational processes. This can lead to temporary underperformance in specific segments. If some acquired fleets or terminals struggle to meet targeted operating ratios due to these integration hurdles, they could be considered Dogs within the BCG matrix. These segments, characterized by low market share within their direct operational areas, would contribute minimally to overall growth until optimization is achieved.

- U.S. Xpress Acquisition Impact: The integration of U.S. Xpress, completed in 2023, presented a significant undertaking for Knight-Swift.

- Potential for Integration Inefficiencies: While Knight-Swift targets efficient integration, some acquired operational units might experience temporary drag on profitability.

- Operating Ratio Targets: Units failing to achieve their projected operating ratios would fall into the Dog category.

- Limited Growth Contribution: Until fully optimized, these less efficient acquired assets would have a low immediate impact on overall company growth.

Segments in the Dogs category for Knight-Swift Transportation are those with low market share and low growth prospects. These might include certain legacy, less efficient truckload lanes or regional brokerage operations facing stiff competition and thin margins. Older, high-maintenance fleet components that don't contribute significantly to revenue also fit this profile.

For instance, a regional brokerage handling minimal freight volume with negative year-over-year growth would be a Dog. Similarly, specific acquired assets from U.S. Xpress experiencing integration inefficiencies and failing to meet operating ratio targets would also be classified as Dogs.

In 2024, Knight-Swift's focus on optimizing its network and improving its overall operating ratio likely involved addressing these underperforming areas. Their commitment to efficiency means identifying and potentially divesting or reconfiguring segments that are not contributing positively to growth or profitability.

These segments are characterized by their low return on investment and limited potential for future expansion. They represent areas where resources might be better allocated to more promising business units within the BCG Matrix framework.

Question Marks

Knight-Swift's intermodal segment, despite experiencing growth in load counts, has encountered profitability headwinds. In the first quarter of 2025, this segment reported operating losses and a challenging operating ratio of 102.0%.

While the intermodal market itself is expanding, Knight-Swift's presence within it is characterized by a relatively smaller market share and inconsistent earnings. This situation necessitates substantial investment to enhance financial performance and achieve greater efficiency.

This segment presents a high-growth opportunity, but it critically needs strategic focus to translate its increasing volumes into sustained profits. Without this focused effort, the intermodal segment risks being categorized as a 'Dog' within the BCG matrix, indicating low growth and low market share with poor performance.

Knight-Swift's new LTL terminals are classic examples of Question Marks in the BCG matrix. These facilities represent significant investments in a growing market, but their current performance is characterized by high costs and low efficiency. For instance, in early 2024, many new logistics hubs across the US faced initial ramp-up challenges, leading to higher per-unit operating expenses compared to established networks.

The rapid expansion strategy means these terminals are in high-potential but currently low-share segments of the LTL market. While the overall LTL sector is projected for robust growth, with industry analysts forecasting a compound annual growth rate of around 5-7% through 2028, these specific new operations are not yet contributing significantly to profitability. They are in the crucial phase of building volume and optimizing routes.

These new LTL operations require substantial capital infusion to overcome initial hurdles and achieve economies of scale. Without significant strategic investment and a period of market penetration, they risk remaining Question Marks or even declining into Dogs. Success hinges on their ability to capture market share and improve operating ratios, transitioning them into the Star or Cash Cow categories in the coming years.

Knight-Swift Transportation's investments in emerging technologies like autonomous trucks and AI logistics platforms position them for future growth. While these innovations hold significant market potential, their widespread commercial deployment is still in its nascent stages. This means Knight-Swift's current revenue directly tied to these specific technologies is likely minimal, reflecting their early-stage development.

These forward-looking investments are characteristic of a question mark in the BCG matrix, demanding substantial research and development capital. The potential for high future growth is evident, but the immediate market share or profitability from these advanced systems is not yet established. This strategic allocation of resources aims to secure a competitive edge in the evolving transportation landscape.

Expansion into New Geographic LTL Markets (e.g., Northeast)

Knight-Swift's strategic expansion into new Less-Than-Truckload (LTL) markets, such as the Northeast, positions them as a potential 'Question Mark' in the BCG Matrix. This region is characterized by a high-growth potential but currently exhibits a low market share for Knight-Swift. The company's objective is to capture a more substantial piece of this lucrative market.

Entering these new geographic territories necessitates substantial capital outlay. Investments are directed towards establishing new terminals, acquiring additional equipment, and building the necessary operational infrastructure to compete effectively. For instance, significant investments in terminal expansions and fleet upgrades are crucial to gain traction against entrenched regional competitors.

The success of these LTL market expansions is not guaranteed, making them a classic 'Question Mark.' However, if Knight-Swift can successfully leverage its resources and strategy to rapidly increase market share, these ventures could evolve into Stars, contributing significantly to the company's overall growth and profitability. Their 2024 strategy explicitly targets such growth opportunities.

- Northeast LTL Market Potential: High growth, low Knight-Swift market share.

- Capital Investment Required: Facilities, equipment, and operational build-out.

- Competitive Landscape: Facing established regional LTL providers.

- Strategic Goal: Rapid market share acquisition for future growth.

Cross-Border Logistics with Mexico

Knight-Swift's involvement in cross-border logistics with Mexico positions this segment as a potential Question Mark within the BCG Matrix. The company facilitates transportation services across North America, directly engaging with the growing cross-border trade. This market is experiencing a significant boost from nearshoring initiatives, as companies look to diversify supply chains closer to the US market.

The growth potential in cross-border logistics with Mexico is substantial. For instance, US-Mexico trade reached record highs, with goods valued at over $799 billion in 2023, according to the U.S. Bureau of Transportation Statistics. This increasing volume of trade creates a fertile ground for logistics providers. Knight-Swift's established network in North America provides a foundation to capitalize on this trend.

However, Knight-Swift's specific market share and profitability within this complex cross-border niche might be relatively lower compared to its dominant domestic operations. Navigating Mexican regulations, customs, and infrastructure can present unique challenges. Therefore, this segment likely requires strategic investment and development to convert it into a Star or Cash Cow, hence its classification as a Question Mark.

- High Growth Potential: Driven by nearshoring and increasing North American trade volumes.

- Strategic Importance: Leverages Knight-Swift's existing North American footprint.

- Market Share Uncertainty: Specific position in the complex cross-border segment needs evaluation.

- Investment Required: Focus needed to enhance capabilities and market penetration in Mexico.

Knight-Swift's new LTL terminals represent classic Question Marks, requiring significant investment to thrive in a growing market but currently facing high costs and low efficiency. Initial ramp-up challenges in 2024 meant higher per-unit operating expenses for these new hubs. While the LTL sector is projected for 5-7% annual growth through 2028, these nascent operations are focused on building volume and optimizing routes to capture market share.

| BCG Category | Description | Knight-Swift Example |

| Question Mark | Low market share, high market growth potential. Require investment to increase share and move towards Star or Cash Cow. | New LTL Terminals, Emerging Tech Investments, Northeast LTL Expansion, Cross-border Mexico Logistics. |

BCG Matrix Data Sources

Our Knight-Swift BCG Matrix is informed by comprehensive financial disclosures, detailed operational data, and robust market research reports to accurately assess business unit performance.