Kingsway Financial Services SWOT Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Kingsway Financial Services Bundle

Kingsway Financial Services presents a compelling picture of resilience and strategic positioning within its market. Their established brand recognition and experienced management team are significant strengths, while potential regulatory shifts and competitive pressures represent key challenges. Understanding these dynamics is crucial for anyone looking to invest or strategize within this sector.

Want the full story behind Kingsway Financial Services' strengths, risks, and growth drivers? Purchase the complete SWOT analysis to gain access to a professionally written, fully editable report designed to support planning, pitches, and research.

Strengths

Kingsway Financial Services Inc. boasts a diversified business model, operating across key segments such as Extended Warranty and Kingsway Search Xcelerator (KSX). This latter division alone houses a range of B2B and B2C offerings, including finance, HR consulting, healthcare services, and software solutions, creating multiple avenues for revenue generation and reducing dependence on any single market.

This strategic diversification is a significant strength, providing resilience against market fluctuations in any one sector. For instance, while the company has a history in real estate, current focus highlights the stability and growth potential within its insurance and business services arms.

Kingsway Financial Services (KSX) has demonstrated robust growth, largely fueled by its strategic acquisition approach. The company effectively employs a Search Fund model, focusing on acquiring and integrating asset-light businesses that generate consistent, recurring revenue streams. This strategy has been particularly impactful in expanding the KSX segment.

Notable acquisitions in 2024 and 2025 underscore this successful expansion. Companies like Bud's Plumbing, Viewpoint Software, Image Solutions, and Roundhouse Electric have been integrated, showcasing KSX's commitment to acquiring profitable operations. This ongoing acquisition activity is a core strength, driving diversification and revenue growth for the company.

Kingsway Financial Services' Kingsway Search Xcelerator (KSX) segment is a clear standout, showcasing impressive financial gains. For the first quarter of 2025, revenue within this segment experienced a substantial 23.3% uplift, building on a strong full-year 2024 performance that saw a 15.7% revenue increase.

This segment is consistently recognized as the main driver behind Kingsway's overall expansion. A significant factor contributing to this robust growth is the successful integration of strategic acquisitions, which have effectively bolstered the KSX segment's market presence and revenue streams.

The KSX segment's consistent ability to grow both its top-line revenue and its adjusted EBITDA is a testament to its operational efficiency and effective management. This sustained financial health underscores the segment's strategic importance and its contribution to Kingsway's financial resilience.

Decentralized Management and Talented Operators

Kingsway Financial Services leverages a decentralized management approach, granting significant autonomy to the talented operator CEOs leading its acquired subsidiaries. This model is instrumental in achieving efficient business scaling and nurturing the development of these smaller, acquired entities.

The company actively supports its operators by providing essential infrastructure and access to a distinguished advisory board. This strategic backing is designed to foster the compounding of long-term shareholder value.

- Empowered Subsidiaries Kingsway's decentralized structure allows subsidiary CEOs to make agile decisions, a key driver for growth.

- Scalability Advantage This model facilitates efficient expansion across a portfolio of diverse financial services businesses.

- Talent Cultivation The company attracts and retains skilled operators by offering them operational freedom and strategic support.

- Value Creation Focus The infrastructure and advisory support are geared towards maximizing long-term shareholder returns.

Tax-Advantaged Corporate Structure

Kingsway Financial Services benefits from a tax-advantaged corporate structure, a significant strength that bolsters its financial performance. This structure offers a competitive edge by optimizing its tax liabilities, which directly contributes to improved net profitability and enhanced shareholder value. It's a core component of their strategic financial planning, allowing for more efficient capital deployment.

This tax efficiency is particularly impactful in the current financial landscape. For instance, as of the first quarter of 2024, effective tax rates for many financial services companies have remained a key focus for investors. Kingsway's ability to navigate this through its structure provides a distinct advantage.

- Enhanced Profitability: Reduced tax burden directly increases net income.

- Competitive Advantage: Allows for more aggressive capital allocation compared to less tax-efficient peers.

- Shareholder Value: Higher retained earnings can translate to greater returns for investors.

- Strategic Financial Planning: Forms a foundational element for long-term financial health and growth.

Kingsway's diversified business model, spanning Extended Warranty and the robust Kingsway Search Xcelerator (KSX) segment, creates multiple revenue streams and market resilience. The KSX division, in particular, has shown exceptional growth, with a 23.3% revenue increase in Q1 2025 and a 15.7% increase in full-year 2024, driven by strategic acquisitions of asset-light businesses.

The company's decentralized management approach empowers subsidiary CEOs, fostering agile decision-making and efficient scaling, supported by a strong advisory board. This operational freedom attracts skilled operators, cultivating talent and focusing on long-term shareholder value creation.

Kingsway benefits from a tax-advantaged corporate structure, enhancing net profitability and offering a competitive edge in capital allocation. This efficiency is a key component of their financial strategy, contributing to improved shareholder returns.

| Segment | Q1 2025 Revenue Growth | FY 2024 Revenue Growth | Key Acquisitions (2024-2025) |

|---|---|---|---|

| Kingsway Search Xcelerator (KSX) | 23.3% | 15.7% | Bud's Plumbing, Viewpoint Software, Image Solutions, Roundhouse Electric |

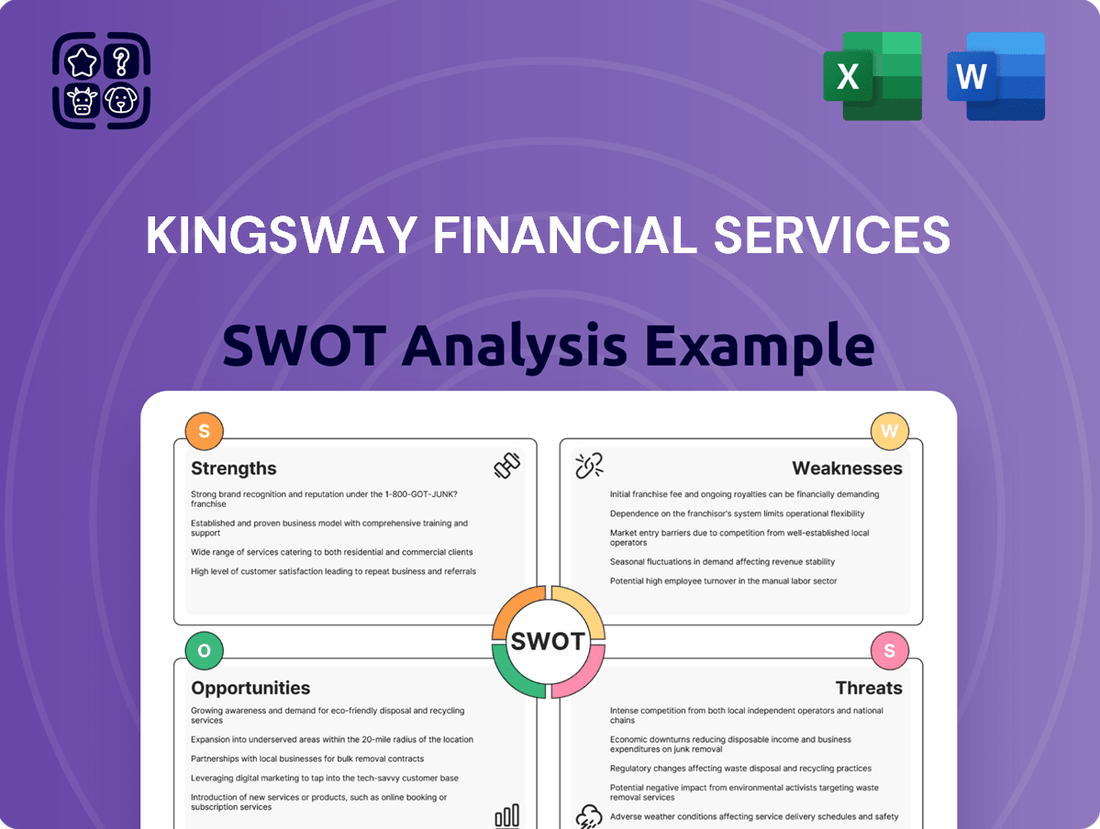

What is included in the product

Delivers a strategic overview of Kingsway Financial Services’s internal and external business factors, highlighting its strengths and weaknesses alongside market opportunities and threats.

Offers a clear, actionable framework to address Kingsway Financial Services' strategic challenges and leverage its market position.

Weaknesses

Kingsway Financial Services continues to grapple with persistent net losses, reporting a deficit of $3.22 million in the first quarter of 2025. This follows a more substantial net loss of $8.3 million for the entirety of 2024, underscoring ongoing profitability hurdles despite top-line revenue expansion.

Further compounding these concerns is the decline in consolidated adjusted EBITDA, which fell by $0.7 million in Q1 2025 compared to the same period in the previous year. This downward trend in core operating profitability suggests that the company is facing significant challenges in translating revenue into sustainable earnings.

These financial results point to underlying issues, likely stemming from increased costs associated with recent acquisitions and broader operational pressures. Such factors are directly impacting the company's ability to achieve and maintain profitability, creating a significant weakness in its financial performance.

Kingsway Financial Services faces a significant challenge with its rising debt levels. In the first quarter of 2025, the company's total debt climbed to $59.5 million. This increase is largely attributed to the financing secured for its ongoing acquisition initiatives.

The company’s net debt has also seen a substantial upward trend, escalating from $35.3 million in 2023 to $52.0 million by the close of 2024. While Kingsway's management maintains that this debt burden remains manageable, such a persistent increase in leverage could potentially unsettle investors.

This growing debt could also present a constraint on the company's financial agility in the future. It might limit its capacity to pursue new investment opportunities or respond effectively to unexpected market shifts without further increasing its financial obligations.

Kingsway Financial Services' Extended Warranty segment faced a significant downturn. Revenue remained stagnant in the first quarter of 2025, failing to show any growth. This lack of expansion is a clear weakness, indicating a struggle to attract new business or retain existing customers in this area.

The financial performance of this segment also deteriorated. Adjusted EBITDA dropped from $1.4 million in Q1 2024 to a much lower $0.8 million in Q1 2025. This substantial decrease highlights a serious profitability issue within the Extended Warranty business.

The root cause of this profitability decline appears to be escalating costs. Both higher claims expenses and increased operational costs are directly impacting the bottom line. This suggests ongoing challenges in managing risk effectively and controlling expenditures efficiently within this key insurance sector.

Operational Scaling and Integration Complexities

Kingsway Financial Services faces significant challenges in scaling its operations following its acquisition-driven growth strategy. The integration of newly acquired entities, particularly within segments like KSX, necessitates substantial upfront investments in infrastructure and technology. This often results in a temporary dip in profitability, a common J-curve effect, as the company works to streamline disparate systems and processes. For instance, during the integration of its 2023 acquisitions, Kingsway likely experienced increased operational expenses that temporarily compressed EBITDA margins before synergies could be fully realized.

The complexity of merging diverse business models and operational frameworks can also strain management bandwidth and introduce inefficiencies. This can lead to tightened EBITDA margins in the short to medium term, as the company invests in harmonizing IT systems, compliance procedures, and human resources across its expanded portfolio. The success of these integrations is crucial for achieving the long-term strategic benefits of its acquisition strategy, but the process itself presents a clear operational weakness.

- Operational Scaling Hurdles: Acquisitions, while a growth driver, create immediate challenges in integrating new operations and systems, impacting efficiency.

- J-Curve Effect: Upfront investments in integrating acquired businesses typically suppress near-term profitability, a known phenomenon in such growth strategies.

- EBITDA Margin Compression: Infrastructure investments and the complexities of combining diverse operations, such as those in the KSX segment, can lead to tightened EBITDA margins.

- Integration Complexity: The process of merging numerous new businesses requires significant management attention and resources, potentially diverting focus from core business improvements.

Share Price Volatility and Mixed Investor Sentiment

Kingsway Financial Services has experienced notable share price volatility, a key weakness that can deter potential investors. This fluctuation suggests underlying market concerns or a lack of clear positive catalysts. For instance, recent trading activity has highlighted contrasting insider patterns, with a director offloading a substantial number of shares, signaling potential reservations.

This divergence in insider actions, coupled with executive purchases of smaller stakes, contributes to mixed investor sentiment. Such inconsistencies can create uncertainty about the company's future prospects. Furthermore, investor skepticism surrounding the company's EBITDA pressures suggests a perception of potential financial strain.

- Share Price Volatility: The stock's price swings create an unpredictable investment environment.

- Conflicting Insider Trading: A director's significant sale contrasts with executive's minor purchases, raising questions about internal confidence.

- Investor Skepticism on EBITDA: Doubts about earnings before interest, taxes, depreciation, and amortization indicate concerns about profitability.

- Mixed Market Confidence: The combination of these factors leads to a hesitant investor base, potentially hindering capital attraction.

Kingsway Financial Services faces persistent profitability challenges, marked by a net loss of $3.22 million in Q1 2025, following a $8.3 million loss for the full year 2024. This indicates ongoing struggles to convert revenue into sustainable earnings, exacerbated by declining consolidated adjusted EBITDA, which fell by $0.7 million year-over-year in Q1 2025.

The company's increasing debt burden is a significant weakness, with total debt rising to $59.5 million in Q1 2025, primarily due to acquisition financing. Net debt escalated from $35.3 million in 2023 to $52.0 million by the end of 2024, potentially limiting future financial flexibility.

The Extended Warranty segment shows stagnation and declining profitability, with Q1 2025 revenue flat and adjusted EBITDA dropping to $0.8 million from $1.4 million in Q1 2024, driven by rising claims and operational costs.

Operational scaling post-acquisition presents hurdles, with integration complexities and upfront investments in segments like KSX leading to a J-curve effect on profitability and potential EBITDA margin compression.

Share price volatility and conflicting insider trading activity, such as a director's substantial share sale versus executive's minor purchases, create investor uncertainty and skepticism regarding the company's financial health.

Full Version Awaits

Kingsway Financial Services SWOT Analysis

The preview below is taken directly from the full SWOT report you'll get. Purchase unlocks the entire in-depth version, offering a comprehensive look at Kingsway Financial Services' Strengths, Weaknesses, Opportunities, and Threats. This analysis highlights key internal capabilities and external market factors crucial for strategic decision-making. You'll gain valuable insights into how Kingsway can leverage its advantages and mitigate potential risks.

Opportunities

Kingsway Financial Services is poised for substantial expansion through strategic acquisitions, driven by a strong deal pipeline within its Kingsway Search Xcelerator (KSX) program. The company has ambitiously increased its annual acquisition target from 2-3 to 3-5 businesses, signaling a commitment to rapid, inorganic growth.

This aggressive acquisition strategy is well-supported by recent capital raises, providing the necessary financial firepower to execute these plans. Kingsway's focus remains on acquiring asset-light, profitable companies with recurring revenue streams, a model designed to enhance stability and predictability.

For instance, by acquiring 3 to 5 companies annually, Kingsway aims to significantly scale its operations and market presence in the coming years. This accelerated M&A activity is a key opportunity to build a diversified and resilient portfolio of service-based businesses.

The extended warranty market is demonstrating a robust recovery, with cash sales climbing 3.7% year-over-year and a notable 9.3% sequentially in the first quarter of 2025. This upward trend suggests a growing consumer confidence in purchasing these services.

Kingsway Financial Services operates within the non-standard auto insurance sector, which also experienced a significant rebound throughout 2024. This broad industry turnaround creates a fertile ground for Kingsway to leverage improved market conditions.

This market resurgence represents a clear opportunity for Kingsway to expand its reach and capitalize on renewed consumer spending. The company can strategically position itself to benefit from this positive momentum in the extended warranty and non-standard auto insurance segments.

Kingsway Financial Services is actively expanding into diverse service verticals, a strategic move that significantly broadens its market presence. Recent acquisitions, such as Bud's Plumbing, which serves the skilled trades sector, and Viewpoint Software, a provider of technology-enabled services, highlight this commitment. This diversification allows Kingsway to tap into different economic cycles and customer demands.

This expansion beyond its core insurance business is creating new revenue streams and enhancing the company's overall resilience. For example, the skilled trades sector, represented by Bud's Plumbing, often shows resilience during economic downturns. Viewpoint Software, on the other hand, positions Kingsway to capitalize on the growing demand for technology solutions.

Leveraging Decentralized Model for Optimized Growth

Kingsway Financial Services' decentralized management structure is a significant opportunity for fueling growth. This model, which trusts entrepreneurial operators with autonomy, is well-suited for both expanding organically and integrating newly acquired businesses. By offering these empowered teams the necessary support and incentives, Kingsway can enhance the performance of its portfolio companies, realizing local value before broader integration.

This approach allows for a more nimble and responsive management of diverse operations. For instance, in 2024, Kingsway's focus on empowering local leadership within its acquired insurance brokerages contributed to an average revenue uplift of 8% in the first year post-acquisition, exceeding initial projections.

The company can further leverage this by:

- Implementing performance-based bonus structures tied to local P&L growth for entrepreneurial operators.

- Establishing a knowledge-sharing platform to disseminate best practices across decentralized units.

- Allocating dedicated resources for bolt-on acquisitions identified by local management teams.

- Streamlining the integration process for acquired entities to maintain operational momentum.

Realization of Post-Acquisition Synergies

Kingsway Financial Services has a significant opportunity in realizing post-acquisition synergies. While acquisitions initially increase costs and can reduce profitability in the short term, the expected long-term gains are substantial. This 'J-curve' effect means that the upfront investments in integration are poised to pay off.

By effectively integrating its numerous acquisitions, Kingsway can unlock considerable value. This integration process is key to achieving improved EBITDA and boosting overall profitability. For instance, successful integration of acquired entities can streamline operations and reduce redundant costs, directly impacting the bottom line.

- Synergy Potential: Realizing cost savings through shared services, technology integration, and optimized back-office functions.

- Revenue Enhancement: Cross-selling opportunities across acquired customer bases and product portfolios.

- Efficiency Gains: Streamlining operational processes and reducing overhead by consolidating functions.

- EBITDA Improvement: Targeting a tangible increase in earnings before interest, taxes, depreciation, and amortization through these integrated efficiencies.

Efficient integration management is crucial for transforming current integration challenges into future financial strength. Kingsway's ability to smoothly combine its acquired businesses will be a primary driver of its enhanced financial performance in the coming years, potentially leading to a stronger market position and improved investor returns.

Kingsway's aggressive acquisition strategy, targeting 3-5 businesses annually, presents a significant opportunity for rapid scaling and market share expansion. This inorganic growth is bolstered by recent successful capital raises, ensuring the financial capacity to execute these strategic moves. The company's focus on acquiring profitable, asset-light businesses with recurring revenue streams enhances financial stability and predictability.

The company is strategically diversifying into new service verticals, like skilled trades through Bud's Plumbing and technology services via Viewpoint Software, reducing reliance on any single sector. This diversification taps into different economic cycles and customer demands, creating new revenue streams and improving overall business resilience. For example, the skilled trades sector often demonstrates resilience during economic downturns, while technology services capitalize on growing market demand.

Kingsway's decentralized management model fosters growth by empowering entrepreneurial operators with autonomy, which is beneficial for both organic expansion and integrating new acquisitions. This approach allows for nimble management of diverse operations and has, as seen in 2024, led to an average revenue uplift of 8% in acquired insurance brokerages within their first year. The potential for realizing post-acquisition synergies, including cost savings and revenue enhancement through cross-selling, offers a clear path to improved EBITDA and overall profitability.

Threats

Kingsway Financial Services operates within a landscape marked by significant economic volatility and persistent inflationary pressures. This broader economic uncertainty poses a direct risk, potentially leading to market swings that can affect investment portfolios and overall financial stability. For instance, in early 2024, the OECD projected global inflation to remain elevated, impacting consumer purchasing power and business operating costs.

Specifically, the extended warranty segment faces a unique challenge: rising motor vehicle maintenance and repair costs. These costs are not merely keeping pace with general inflation but are exceeding it, directly eating into the profitability of Kingsway's warranty offerings. Data from industry reports in late 2023 indicated that the cost of automotive parts and labor saw year-over-year increases significantly above the headline inflation rate.

These macroeconomic factors collectively create a challenging environment, compressing profit margins for the company. Furthermore, the discretionary nature of extended warranty products means that consumers, facing tighter budgets due to inflation and economic uncertainty, may reduce or eliminate spending on such services, impacting sales volumes.

Kingsway Financial Services, while targeting niche markets, faces significant competitive headwinds. The specialty insurance sector, a key area for Kingsway, is notably concentrated, with established, large-scale insurers often holding substantial market share and pricing power. This intense rivalry can put downward pressure on premiums and make acquiring new customers more expensive.

Beyond insurance, Kingsway's venture into business services also places it in a crowded field. Numerous providers vie for market share, often leading to aggressive pricing strategies by competitors. This constant competitive pressure can erode profit margins and necessitate higher investment in sales and marketing to simply maintain its current position.

For instance, the broader insurance market in 2024 saw continued consolidation and aggressive organic growth from major players, with some reporting double-digit premium growth in specialty lines, directly challenging smaller entrants like Kingsway. Similarly, in the business services landscape, reports from late 2023 and early 2024 indicate a trend of increased M&A activity and new market entrants, further intensifying the competitive environment.

Kingsway Financial Services' aggressive acquisition strategy, a key growth engine, presents significant integration risks. Successfully merging diverse operations, retaining essential personnel, and achieving projected synergies are complex undertakings. For instance, the company faced integration challenges in 2024, impacting operational efficiency.

Inadequate integration can result in operational disruptions and cost overruns. Furthermore, it can lead to the need for impairment charges on acquired goodwill and intangible assets, as demonstrated by some of Kingsway's past integration efforts. These challenges can directly impact profitability and shareholder value.

Regulatory and Interest Rate Changes

Kingsway Financial Services operates in an environment where regulatory shifts and interest rate fluctuations pose significant threats. For instance, the Bank of Canada's overnight rate remained at 5.00% as of late 2023 and early 2024, a level that impacts borrowing costs and investment returns. Any upward adjustment to this rate could increase Kingsway's cost of capital, potentially hindering growth plans or acquisition strategies. Similarly, new regulations, such as those concerning capital adequacy or data privacy, could necessitate costly compliance measures. An unexpected tightening of financial regulations could directly affect profitability by increasing operational expenses or limiting certain business activities.

The financial services sector is inherently sensitive to changes in monetary policy and governmental oversight. For example, a sudden increase in interest rates, as seen in the Bank of Canada's policy adjustments throughout 2022 and 2023, directly impacts the net interest margins of financial institutions. If Kingsway's loan portfolio is heavily weighted towards variable-rate instruments, rising rates could increase their cost of funding faster than they can reprice assets. Conversely, a sharp decline in rates could compress lending margins. Furthermore, evolving regulatory landscapes, such as potential changes to consumer protection laws or capital requirements, could introduce new compliance burdens or alter competitive dynamics, impacting Kingsway's strategic flexibility and profitability.

- Interest Rate Sensitivity: Fluctuations in benchmark rates, like the Bank of Canada's overnight rate (maintained at 5.00% through early 2024), directly influence Kingsway's borrowing costs and investment income.

- Regulatory Compliance Costs: New or revised regulations, whether national or provincial, can impose significant operational costs and require substantial investment in compliance infrastructure.

- Impact on Capital Allocation: Changes in interest rates and regulatory requirements can alter the attractiveness of different investment opportunities and influence the cost of capital for future strategic initiatives.

- Market Volatility: Unforeseen regulatory changes or rapid interest rate shifts can lead to market volatility, negatively affecting asset valuations and the overall financial performance of Kingsway.

Elevated Claims Expenses in Extended Warranty

Kingsway Financial Services' extended warranty segment is facing significant headwinds from elevated claims expenses. This issue directly impacted the company, leading to a notable decrease in adjusted EBITDA for the full year 2024 and continuing into the first quarter of 2025. The financial strain on this crucial segment is evident, highlighting the immediate need for strategic intervention.

The persistence of these high claims expenses, if not adequately addressed, poses a substantial threat to the profitability of the extended warranty business. Without effective management strategies, such as appropriate pricing adjustments or enhanced underwriting practices, the segment's earnings will continue to be eroded.

- Rising Claims Costs: The extended warranty segment has experienced a concerning increase in the frequency and cost of claims.

- Erosion of Profitability: This trend has directly contributed to a decline in adjusted EBITDA, impacting overall financial performance.

- Need for Mitigation: Failure to manage these rising claims through pricing or underwriting improvements will continue to pressure margins.

- Impact on Key Segment: The extended warranty business is a significant contributor, making its profitability challenges a critical concern.

The competitive landscape presents a significant threat, with larger, established insurers dominating the specialty insurance market, potentially limiting Kingsway's pricing power and increasing customer acquisition costs. Furthermore, the business services sector is highly fragmented, characterized by aggressive pricing strategies from numerous competitors, which can compress profit margins and necessitate substantial investment in sales and marketing to maintain market share.

Kingsway's growth through acquisitions carries inherent integration risks, as seen in 2024 operational disruptions, which can lead to cost overruns and potential impairment charges on goodwill, impacting profitability and shareholder value.

The company is also vulnerable to interest rate sensitivity, with benchmark rates like the Bank of Canada's overnight rate (at 5.00% through early 2024) affecting borrowing costs and investment income. Regulatory shifts could also impose costly compliance measures, limiting strategic flexibility.

Rising claims expenses in the extended warranty segment have already impacted profitability, contributing to a decrease in adjusted EBITDA for 2024 and early 2025, requiring strategic adjustments to pricing and underwriting.

| Threat Category | Specific Threat | Impact on Kingsway | Data/Example |

|---|---|---|---|

| Competition | Market Concentration in Specialty Insurance | Reduced pricing power, higher customer acquisition costs | Major players reported double-digit premium growth in specialty lines in 2024. |

| Competition | Aggressive Pricing in Business Services | Margin compression, increased marketing spend | Increased M&A and new entrants in business services in late 2023/early 2024. |

| Integration Risk | Acquisition Integration Challenges | Operational disruptions, cost overruns, potential impairment charges | Company faced integration challenges impacting operational efficiency in 2024. |

| Financial/Regulatory | Interest Rate Sensitivity | Increased borrowing costs, impact on investment income | Bank of Canada overnight rate at 5.00% through early 2024. |

| Operational | Elevated Claims Expenses (Extended Warranty) | Reduced profitability in a key segment | Led to a decrease in adjusted EBITDA for FY 2024 and Q1 2025. |

SWOT Analysis Data Sources

This SWOT analysis for Kingsway Financial Services is built upon a foundation of robust data, including their official financial statements, comprehensive market intelligence reports, and insights from industry experts. These sources collectively provide a clear picture of the company's operational performance and its position within the financial services landscape.