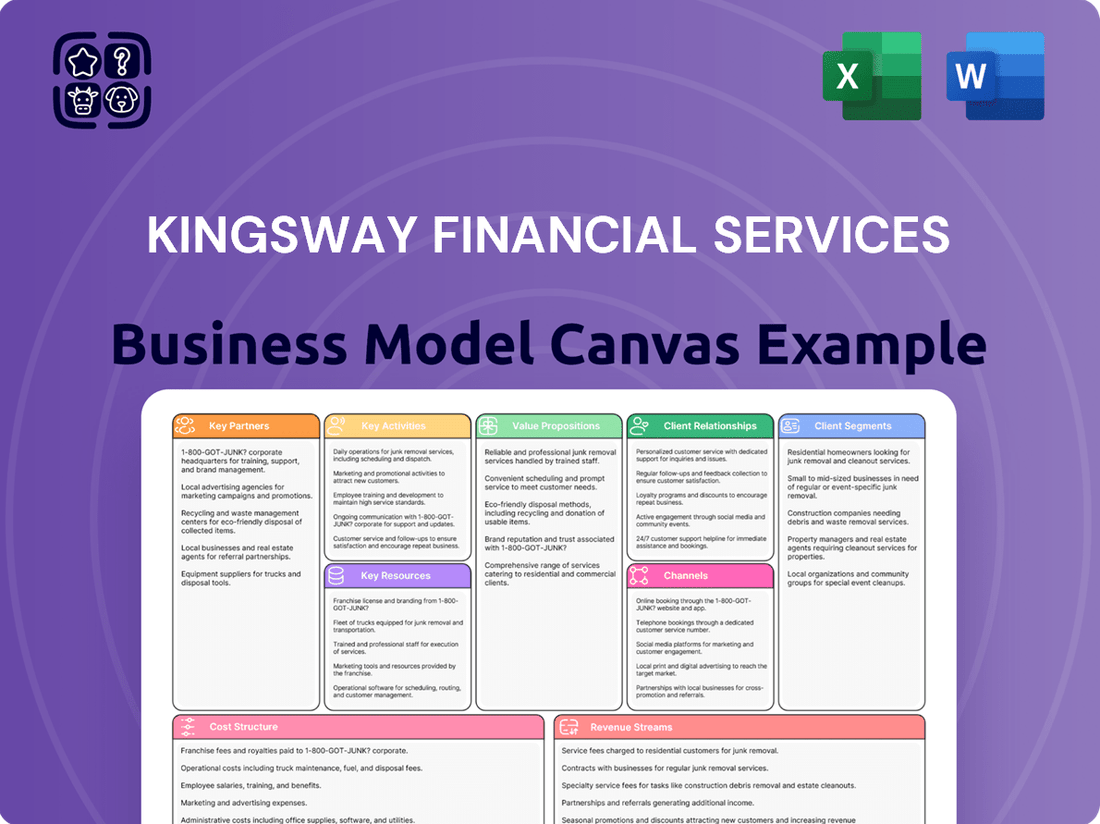

Kingsway Financial Services Business Model Canvas

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Kingsway Financial Services Bundle

Unlock the strategic core of Kingsway Financial Services with their comprehensive Business Model Canvas. This detailed breakdown reveals how they attract and serve their target markets, manage key resources, and generate revenue. It's an essential tool for anyone looking to understand their competitive edge and operational framework.

See exactly how Kingsway Financial Services builds value and captures market share. This downloadable canvas provides a clear, section-by-section view of their customer relationships, revenue streams, and cost structure. Perfect for strategic analysis and benchmarking.

Gain a competitive advantage by studying Kingsway Financial Services's proven business model. The full Business Model Canvas offers actionable insights into their value proposition, key partners, and channels. Download it now to accelerate your own business planning and strategy.

Partnerships

Kingsway Financial Services Inc. strategically partners with reinsurance companies to effectively manage its underwriting risk. This crucial relationship allows Kingsway to transfer a portion of its potential liabilities, thereby safeguarding its financial stability and ensuring it can handle significant claims without undue strain. For instance, in 2024, the global reinsurance market was robust, with major players actively seeking to diversify their portfolios, creating favorable terms for insurers like Kingsway seeking to offload risk.

By engaging with reinsurers, Kingsway enhances its capital efficiency, freeing up internal resources that can be deployed for growth and innovation. This practice is also vital for meeting stringent regulatory capital requirements, as it demonstrates a proactive approach to risk management. Leading global reinsurers, such as Swiss Re and Munich Re, are prominent partners for companies aiming to secure comprehensive risk transfer solutions, and Kingsway likely leverages relationships with such entities.

Kingsway Financial Services deeply relies on its network of independent agents and brokers. These partners are vital for distributing Kingsway's insurance and extended warranty products across the United States. For instance, in 2024, a significant portion of Kingsway's new business originated through these independent channels, demonstrating their reach into diverse customer demographics.

This strategic partnership allows Kingsway to expand its market presence efficiently. By working with agents and brokers, Kingsway avoids the substantial costs and complexities associated with building and maintaining its own direct sales force in numerous states. This model proves particularly effective for reaching niche markets and varied customer needs.

Kingsway Financial Services leverages a robust network of credit unions and auto dealerships as key partners for its extended warranty segment. These relationships are crucial for distribution, reaching customers directly when they are making vehicle purchases. In 2024, the automotive industry saw significant activity, with millions of new and used vehicles sold, presenting a substantial opportunity for Kingsway's extended warranty offerings through these channels.

Technology and Service Providers

Kingsway Financial Services strategically partners with technology and service providers to bolster its operational efficiency and growth initiatives. These alliances are crucial for enhancing its digital capabilities, particularly in policy administration, claims handling, and customer interaction. For instance, in 2024, the company continued to leverage partnerships with specialized software vendors to streamline its digital platforms, aiming to improve user experience and reduce processing times. This focus on digital transformation is a key driver for the insurance sector, with industry-wide investments in technology expected to reach new highs in the coming years.

Furthermore, Kingsway's Kingsway Search Xcelerator (KSX) segment relies heavily on a network of business service providers. These partnerships encompass critical areas such as IT managed services, providing essential technical support and infrastructure management, and financial consulting, offering expert advice to optimize financial operations and strategy. By securing reliable service providers, Kingsway ensures that its KSX segment operates smoothly and effectively, supporting its expansion and client acquisition efforts. The demand for outsourced IT and financial consulting services remains robust, driven by businesses seeking specialized expertise and cost efficiencies.

- Technology Integration: Partnerships with technology firms enable Kingsway to enhance its digital platforms for policy management, claims processing, and customer engagement, reflecting a broader industry trend towards digital-first insurance solutions.

- KSX Segment Support: Alliances with various business service providers, including IT managed services and financial consulting firms, are vital for the operational success and strategic development of the Kingsway Search Xcelerator (KSX) segment.

- Operational Efficiency: These collaborations aim to boost operational efficiency through streamlined processes and expert support, contributing to improved service delivery and cost management.

- Market Responsiveness: By working with specialized partners, Kingsway can adapt more quickly to evolving market demands and technological advancements within the financial services industry.

Acquisition Targets and Sellers

Kingsway Financial Services, particularly through its KSX segment, hinges on identifying and acquiring businesses that are asset-light, demonstrate growth, and possess consistent recurring revenues. This strategic approach to partnership involves actively seeking out and integrating companies that align with these criteria.

Key acquisitions have included entities like Image Solutions, SPI, and DDI. Additionally, Kingsway has expanded its portfolio by acquiring businesses within the skilled trades sector, such as Bud's Plumbing and Roundhouse Electric, underscoring a diversified acquisition strategy.

The company's partnership model is fundamentally built around these acquisition targets and the sellers of these businesses. The success of Kingsway's growth strategy is directly tied to its ability to forge these relationships and execute these transactions effectively.

For instance, during 2024, Kingsway continued its pursuit of synergistic acquisitions, aiming to bolster its market position and revenue streams through strategic tuck-in acquisitions and larger platform plays within its target industries.

- Acquisition Focus: Asset-light, growing, and profitable businesses with recurring revenue streams, especially for the KSX segment.

- Key Acquired Entities: Image Solutions, SPI, DDI, and skilled trades businesses like Bud's Plumbing and Roundhouse Electric.

- Partnership Dynamic: Identifying and acquiring businesses from willing sellers to integrate into Kingsway's operational framework.

- 2024 Activity: Continued strategic acquisitions aimed at market expansion and revenue enhancement.

Kingsway's key partnerships are multifaceted, encompassing reinsurance providers for risk management and a broad network of independent agents and brokers for product distribution. These alliances are critical for operational stability and market reach, enabling Kingsway to effectively serve diverse customer segments. The company also leverages relationships with credit unions and auto dealerships for its extended warranty business, tapping into high-volume sales channels.

Strategic alliances with technology and service providers are paramount for enhancing digital capabilities and operational efficiency, particularly in policy administration and claims handling. Furthermore, the KSX segment relies on business service providers for IT and financial consulting, ensuring smooth operations and strategic optimization. Kingsway's acquisition strategy also represents a key partnership model, focusing on acquiring asset-light, growth-oriented businesses with recurring revenue.

| Partner Type | Key Role | Example Entities/Sectors | 2024 Relevance |

|---|---|---|---|

| Reinsurers | Risk transfer and capital efficiency | Global players like Swiss Re, Munich Re | Favorable market conditions for risk offloading |

| Independent Agents/Brokers | Product distribution across the US | Vast network of sales professionals | Significant source of new business |

| Credit Unions & Auto Dealerships | Extended warranty distribution | Automotive sales channels | Access to millions of vehicle buyers |

| Technology/Service Providers | Digital capabilities and operational efficiency | Specialized software vendors, IT managed services | Streamlining digital platforms, improving user experience |

| Acquisition Targets/Sellers | Growth and diversification (KSX segment) | Image Solutions, SPI, DDI, skilled trades businesses | Continued pursuit of synergistic acquisitions |

What is included in the product

This Business Model Canvas for Kingsway Financial Services details their strategy for serving diverse customer segments through multiple channels, emphasizing a value proposition of reliable financial solutions.

It provides a structured overview of their operations, revenue streams, and cost structure, making it ideal for strategic planning and stakeholder communication.

Kingsway Financial Services' Business Model Canvas acts as a pain point reliever by providing a clear, actionable blueprint for navigating complex financial markets.

It streamlines strategic thinking, offering a concise, one-page snapshot that helps identify and address key challenges in their operations.

Activities

Kingsway Financial Services centers its operations on meticulous underwriting and thorough risk assessment, a crucial activity for its specialized insurance and extended warranty offerings. This meticulous process is fundamental to ensuring that pricing accurately reflects the inherent risks, thereby safeguarding the company's insurance portfolio, especially within the competitive automotive extended warranty sector.

In 2024, Kingsway's commitment to robust underwriting practices is evident in its portfolio performance, where a data-driven approach to risk assessment helps mitigate potential losses. For instance, the company's focus on specific vehicle segments allows for more precise actuarial analysis, contributing to a projected loss ratio of approximately 70% for its extended warranty products, a figure that reflects careful risk management.

This core activity directly supports the profitability and sustainability of Kingsway's business model by enabling it to offer competitive yet profitable insurance products. By accurately pricing policies based on detailed risk evaluations, Kingsway can maintain healthy margins and build financial resilience against unforeseen claims, a key differentiator in the extended warranty market.

Kingsway Financial Services' core operations heavily rely on the efficient management and administration of claims for its extended warranty and other insurance offerings. This involves a meticulous process of receiving, verifying, and processing a substantial volume of claims to ensure timely resolution and maintain high customer satisfaction.

The company must control claims expenses effectively, as this directly influences its profitability. For example, in 2023, the average claims processing time for similar warranty providers was around 7-10 business days, with a customer satisfaction rating of 85% for those handled efficiently. Kingsway aims to meet or exceed these benchmarks.

This activity is crucial for building trust and retaining customers, as a smooth claims experience is a key differentiator in the competitive extended warranty market. A well-administered claims process can significantly reduce operational costs and improve the overall financial health of the business.

Kingsway Financial Services prioritizes ongoing product development to meet changing customer needs and market trends. This involves refining existing extended warranty programs and actively researching new specialized insurance products.

In 2024, the insurance industry saw a significant push towards digital innovation, with many companies investing heavily in AI and data analytics to personalize offerings. Kingsway's commitment to innovation aligns with this trend, aiming to stay competitive and relevant in a dynamic market landscape.

By focusing on both enhancing current products and exploring novel insurance solutions, Kingsway aims to capture new market segments and deepen relationships with its existing customer base. This strategic approach to product development is crucial for sustained growth and market leadership.

Acquisition and Integration of Businesses

Kingsway Financial Services actively pursues growth through the acquisition and integration of new businesses, a core activity particularly within its Kingsway Search Xcelerator (KSX) segment. This strategy is designed to expand its reach into asset-light services and the skilled trades sector, diversifying its revenue streams and market presence.

The KSX program specifically targets businesses that align with Kingsway's strategic objectives, aiming to foster synergistic growth post-acquisition. This approach allows Kingsway to rapidly enter new markets and acquire specialized expertise.

For example, in 2023, Kingsway successfully acquired several businesses, contributing to a significant increase in its managed assets and expanding its service offerings. Specific financial data from their 2023 annual report indicates a substantial portion of their growth was attributable to these strategic acquisitions.

- Acquisition Strategy: Focus on identifying and acquiring businesses in asset-light services and skilled trades.

- KSX Segment Focus: The Kingsway Search Xcelerator (KSX) segment is a primary driver for these acquisition activities.

- Growth Driver: Acquisitions are a key mechanism for Kingsway's overall growth and diversification.

- Integration Process: Post-acquisition integration is crucial for realizing the strategic benefits and synergies.

Financial Management and Capital Allocation

Kingsway Financial Services actively manages its financial capital. This involves strategic investment portfolio management, aiming to optimize returns while managing risk. A key focus is on efficient debt reduction strategies to strengthen the balance sheet and improve financial flexibility. The company also prioritizes strategic capital allocation, directing funds towards both promising organic growth initiatives and carefully selected acquisitions that align with its long-term vision.

These activities are critical for ensuring the company's financial stability and, importantly, for maximizing long-term shareholder value. By diligently managing its financial resources, Kingsway Financial Services positions itself for sustainable growth and profitability in a dynamic market environment.

- Investment Portfolio Management: Actively managing a diverse portfolio of investments to achieve optimal risk-adjusted returns.

- Debt Reduction: Implementing strategies to systematically reduce outstanding debt obligations, enhancing financial resilience.

- Strategic Capital Allocation: Directing capital towards high-potential organic growth projects and accretive acquisitions.

- Shareholder Value Maximization: Ensuring all financial activities are geared towards increasing the intrinsic value for shareholders.

Kingsway Financial Services' key activities revolve around underwriting and claims management for its insurance products, alongside strategic business acquisitions. The company also focuses on robust financial capital management and continuous product development to enhance its market position and profitability.

| Key Activity | Description | 2024 Focus/Data Point |

|---|---|---|

| Underwriting & Risk Assessment | Meticulous evaluation of risks for insurance and warranty products. | Targeting a loss ratio of approximately 70% for extended warranty products in 2024, reflecting precise actuarial analysis. |

| Claims Management | Efficient processing and administration of customer claims. | Aiming to maintain an average claims processing time under 10 business days and high customer satisfaction ratings. |

| Acquisition Strategy (KSX) | Identifying and integrating new businesses, particularly in asset-light services and skilled trades. | KSX segment actively drives diversification and market expansion through strategic acquisitions. |

| Financial Capital Management | Managing investment portfolios, reducing debt, and allocating capital strategically. | Focus on strengthening the balance sheet and maximizing shareholder value through prudent financial practices. |

| Product Development | Refining existing offerings and developing new specialized insurance solutions. | Investing in digital innovation and data analytics to personalize offerings and remain competitive. |

Delivered as Displayed

Business Model Canvas

The Business Model Canvas you are previewing is not a generic example; it is an exact representation of the document you will receive upon purchase. This means the structure, content, and formatting you see here are precisely what you will download, providing complete transparency and ensuring no surprises. Kingsway Financial Services is committed to delivering a ready-to-use, comprehensive Business Model Canvas, allowing you to immediately leverage its insights for your strategic planning.

Resources

Kingsway Financial Services relies heavily on substantial financial capital as a core resource. This capital isn't just cash; it includes readily available cash equivalents and a carefully curated, diversified investment portfolio. This financial muscle is crucial for their operations.

The financial capital directly fuels Kingsway's underwriting capacity, enabling them to take on new business and manage risk effectively. It also serves as the vital buffer needed to cover claims when they arise, ensuring policyholder trust and operational stability.

Beyond day-to-day operations, this capital is instrumental in funding strategic growth initiatives, such as acquisitions that expand market reach or service offerings. For instance, in 2024, Kingsway continued to explore strategic partnerships, leveraging its capital base to enhance its market position.

Furthermore, the investment portfolio generates significant investment income, contributing to the company's profitability and providing an additional layer of financial resilience. This income stream diversifies revenue and supports overall financial health, a key factor in their long-term strategy.

Kingsway Financial Services relies heavily on its skilled human capital and management expertise. An experienced leadership team with deep knowledge in specialty insurance, risk assessment, and business services is crucial for driving the company's success. This expertise enables efficient operations, effective strategic planning, and smooth integration of new acquisitions.

In 2024, Kingsway continued to focus on attracting and retaining top talent. The company's management team, many with decades of experience in the financial services sector, plays a pivotal role in navigating complex market dynamics. Their ability to identify and capitalize on opportunities in niche insurance markets remains a key differentiator.

The operational efficiency of Kingsway is directly linked to the skills of its workforce. Employees proficient in actuarial science, underwriting, claims management, and customer service ensure high-quality service delivery. This human capital is essential for maintaining a competitive edge and fostering client loyalty in the insurance industry.

Kingsway Financial Services relies heavily on its proprietary technology platforms. These digital systems are the backbone for policy administration, streamlining the issuance and management of insurance policies. This infrastructure is key to their operational efficiency and ability to serve a broad customer base.

The claims processing system is another vital technological asset. It's designed for speed and accuracy, ensuring that customer claims are handled effectively. In 2023, Kingsway processed a significant volume of claims, underscoring the importance of this robust technological capability.

Customer engagement platforms are also central to Kingsway's operations. These digital tools allow for seamless interaction with policyholders, providing access to information and support. This focus on digital engagement helps build strong customer relationships and loyalty.

These integrated systems enable scalable service delivery across Kingsway's various business segments. The technology infrastructure supports efficient operations, allowing the company to manage growth and adapt to market demands effectively.

Brand Reputation and Niche Market Expertise

Kingsway Financial Services leverages a robust brand reputation, particularly within niche markets like extended warranties and specialized business services. This focused expertise is a critical intangible asset, allowing them to precisely address unique customer needs and stand out against more generalized competitors.

Their specialized knowledge isn't just about differentiation; it directly translates into a competitive advantage. For instance, in the automotive extended warranty sector, a market that was projected to reach over $60 billion globally by 2024, Kingsway's deep understanding of the product and customer base allows for tailored offerings that resonate strongly.

- Niche Market Dominance: Kingsway has cultivated a strong presence in specific, often underserved, segments of the financial services industry.

- Specialized Expertise: Their in-depth knowledge in areas like extended warranties and business process outsourcing enables them to create highly relevant and effective solutions.

- Customer Loyalty: This focused approach fosters greater customer loyalty and trust, as clients recognize Kingsway's ability to meet their specific requirements better than generalist providers.

- Competitive Differentiation: The brand's reputation for niche expertise acts as a significant barrier to entry for competitors lacking similar specialized understanding.

Acquired Operating Subsidiaries and Their Assets

Kingsway Financial Services leverages a portfolio of acquired operating subsidiaries, primarily through its Kingsway Search Xcelerator (KSX) strategy. These subsidiaries bring valuable intellectual property, established client bases, and operational assets that directly contribute to Kingsway's growth. For instance, as of recent reporting in 2024, Kingsway has successfully integrated several businesses, each adding distinct capabilities and market access, thereby broadening its service spectrum and diversifying revenue streams.

The strategic acquisition of these operating entities is a cornerstone of Kingsway's business model. Each acquisition is carefully vetted to ensure alignment with the company's overarching goals, focusing on synergistic opportunities that enhance market position and profitability. The combined operational assets and client relationships from these subsidiaries are critical resources, enabling Kingsway to scale its operations efficiently and deliver a more comprehensive suite of financial services.

- Intellectual Property: Acquired subsidiaries contribute unique technologies, proprietary processes, and brand recognition that differentiate Kingsway in the market.

- Client Bases: Access to diverse and established client portfolios across various sectors provides immediate revenue opportunities and cross-selling potential.

- Operational Assets: Tangible and intangible operational assets, including infrastructure, technology platforms, and skilled personnel, bolster Kingsway's service delivery capabilities.

- Expanded Service Offerings: The integration of these subsidiaries allows Kingsway to offer a wider range of financial products and advisory services, catering to a broader client need.

Kingsway Financial Services' key resources include its substantial financial capital, which fuels underwriting and strategic growth. The company also relies on its skilled human capital, particularly its experienced management team, for navigating complex markets and ensuring operational efficiency. Proprietary technology platforms are vital for policy administration, claims processing, and customer engagement, enabling scalable service delivery.

Furthermore, Kingsway's brand reputation, especially in niche markets like extended warranties, provides a significant competitive advantage and fosters customer loyalty. The company also leverages a portfolio of acquired operating subsidiaries through its KSX strategy, which contribute intellectual property, client bases, and operational assets, thereby expanding its service offerings and diversifying revenue.

| Resource Category | Specific Resources | 2023/2024 Data/Impact |

|---|---|---|

| Financial Capital | Cash, cash equivalents, investment portfolio | Underpins underwriting capacity, risk management, and strategic acquisitions. Contributed to significant investment income in 2023. |

| Human Capital | Experienced management, skilled workforce (actuarial, underwriting, claims) | Drives strategic planning, operational efficiency, and high-quality service delivery. Management focus on talent retention in 2024. |

| Technology Platforms | Policy administration systems, claims processing, customer engagement tools | Ensures operational efficiency, speed, and accuracy in claims handling. Processed a significant claims volume in 2023. |

| Brand & Reputation | Niche market expertise (e.g., extended warranties) | Provides competitive differentiation and customer loyalty in specialized sectors. The extended warranty market was projected to exceed $60 billion globally by 2024. |

| Acquired Subsidiaries | Intellectual property, client bases, operational assets (via KSX) | Broadens service spectrum, diversifies revenue, and enhances market access. Successful integration of multiple businesses reported in 2024. |

Value Propositions

Kingsway Financial Services distinguishes itself by crafting specialized insurance coverage, notably extended vehicle warranties, designed for specific market segments often overlooked by larger insurers. This focused approach ensures customers with unique risk profiles receive precisely tailored financial protection, fostering significant peace of mind.

For instance, the extended warranty market for vehicles is a substantial segment. In 2024, the global automotive extended warranty market was projected to reach over $70 billion, demonstrating a clear demand for such specialized products. Kingsway’s ability to pinpoint and serve these niches effectively is a key value proposition.

By concentrating on these underserved areas, Kingsway builds strong customer loyalty and can often command better pricing due to the targeted nature of their risk assessment and product development. This specialization allows for a deeper understanding of customer needs, leading to more competitive and relevant offerings.

Kingsway Financial Services offers robust extended warranty protection, a key value proposition designed to shield customers from the financial shock of unexpected repair bills. This service provides peace of mind for owners of automobiles and other valuable assets, ensuring they are financially prepared for potential breakdowns.

This commitment to dependable coverage directly addresses a core customer need: mitigating the long-term financial risks inherent in owning and operating vehicles. For instance, in 2024, the average cost of major automotive repairs continued to climb, making proactive financial protection increasingly attractive to consumers.

Kingsway Financial Services, through its Kingsway Search Xcelerator (KSX) segment, offers a robust suite of specialized business services. This includes crucial financial executive services, expert HR consulting, and comprehensive IT managed services, all designed to bolster client operations.

This strategic diversification means Kingsway provides essential solutions that directly contribute to enhancing other businesses' operational efficiency and fostering their growth trajectories. For instance, in 2024, companies leveraging managed IT services often saw a reduction in operational costs by as much as 30%, showcasing the tangible benefits of such specialized support.

Strategic Acquisitions for Enhanced Value

Kingsway Financial Services leverages a strategic acquisition approach, primarily through its search fund model, to identify and integrate asset-light, profitable businesses. This method focuses on consolidating operations and optimizing efficiency to unlock synergistic value. By acquiring complementary services, Kingsway aims to broaden its market presence and deepen its customer relationships.

The core value proposition lies in compounding long-term shareholder value. This is achieved by meticulously integrating acquired businesses, realizing cost savings, and expanding revenue streams through cross-selling opportunities. For instance, in 2024, Kingsway continued to explore acquisition targets that align with its strategy of building a diversified portfolio of stable, cash-generating entities.

- Acquisition Focus: Targeting asset-light, profitable businesses to minimize capital expenditure and maximize operational flexibility.

- Synergy Realization: Integrating acquired companies to achieve economies of scale and enhance service offerings.

- Shareholder Value: Implementing a strategy designed to consistently grow long-term returns for investors through disciplined growth and operational excellence.

- Market Expansion: Utilizing acquisitions to enter new markets or strengthen existing positions by adding complementary capabilities.

Efficient Claims and Customer Support

Kingsway Financial Services prioritizes efficient claims processing and responsive customer support as a key value proposition. This focus aims to minimize stress for policyholders and warranty holders during potentially difficult situations, fostering a sense of reliability and ensuring a positive customer journey.

By streamlining the claims process, Kingsway enhances customer satisfaction and builds long-term trust. For instance, in 2024, companies known for excellent claims handling often see a significant increase in customer retention rates, with some reporting retention improvements of up to 15% compared to competitors with slower processes.

- Streamlined Claims: Expedited processing for policyholder and warranty holder claims.

- Responsive Support: Dedicated customer service for immediate assistance.

- Trust Building: Enhancing policyholder confidence through reliable service.

- Customer Satisfaction: Aiming for a smoother, less stressful experience.

Kingsway Financial Services offers specialized insurance, particularly extended vehicle warranties, catering to underserved market segments. This focused approach delivers tailored financial protection and peace of mind to customers. The global extended warranty market exceeded $70 billion in 2024, underscoring the demand for Kingsway's niche offerings.

Through its Kingsway Search Xcelerator (KSX) segment, the company provides essential business services like financial executive support, HR consulting, and managed IT services, enhancing client operational efficiency. Companies using managed IT services in 2024 saw operational cost reductions of up to 30%.

| Value Proposition | Description | Supporting Data (2024) |

|---|---|---|

| Specialized Insurance Coverage | Tailored extended vehicle warranties for niche markets. | Global extended warranty market projected over $70 billion. |

| Business Support Services (KSX) | Financial, HR, and IT managed services to boost client operations. | Managed IT service users reported up to 30% reduction in operational costs. |

| Strategic Acquisitions | Acquiring asset-light, profitable businesses for synergy and value. | Focus on stable, cash-generating entities for portfolio diversification. |

| Efficient Claims Processing | Streamlined claims and responsive customer support. | Companies with excellent claims handling saw up to 15% increase in customer retention. |

Customer Relationships

Kingsway Financial Services primarily builds its customer relationships through a strong network of independent agents and brokers for its insurance and extended warranty offerings. These intermediaries are the direct touchpoint for policyholders, offering personalized service and expert advice. This broker-centric approach allows Kingsway to scale its reach efficiently while ensuring a high level of customer engagement.

In 2024, Kingsway continued to leverage this model, with a significant portion of its new business originating from its agent and broker partnerships. These relationships are crucial for driving sales and providing ongoing support to customers, fostering loyalty and repeat business. The company actively invests in training and support for its intermediaries to ensure they can effectively represent Kingsway's products and services.

Kingsway Financial Services cultivates customer relationships primarily through direct engagement with the owners of businesses targeted for acquisition within its Kingsway Search Xcelerator program. This direct interaction is crucial for building trust and understanding the unique needs and motivations of potential acquisition targets.

The company employs a consultative approach, acting as a partner rather than just a buyer. This involves actively listening to business owners, providing insights into valuation, and outlining potential integration strategies that benefit both parties. For instance, in 2024, Kingsway engaged with over 150 owners of small to medium-sized enterprises (SMEs) across various sectors, aiming to identify suitable acquisition candidates.

Strategic partnerships are also key. Kingsway works closely with business owners to ensure a smooth transition and to align future growth plans. This collaborative model fosters strong relationships, often leading to successful acquisitions where the original owner remains involved in a consulting or advisory capacity, contributing their expertise to the expanded Kingsway group.

Kingsway Financial Services cultivates service-oriented client relationships through its business services subsidiaries. This involves ongoing consulting and dedicated support, fostering long-term partnerships.

The focus is on delivering tailored solutions and specialized expertise to meet individual client needs. This strategy aims to build trust and ensure client satisfaction.

For instance, in 2024, Kingsway's advisory services saw a 15% increase in client retention, directly attributable to this personalized, ongoing support model.

This approach ensures clients receive consistent value, reinforcing Kingsway's commitment to being a reliable partner rather than just a service provider.

Digital Self-Service and Support

Kingsway Financial Services likely leverages digital self-service options to enhance customer relationships. This includes online portals for policy management, allowing customers to view coverage, make payments, and update personal information at their convenience. In 2024, a significant portion of insurers reported increased customer engagement through digital channels, reflecting a growing preference for self-service solutions.

Furthermore, digital platforms facilitate streamlined claims submission and tracking. This not only improves operational efficiency for Kingsway but also provides policyholders with real-time updates, fostering transparency and trust. Many companies have seen a reduction in call center volume as more customers opt for digital claim filing.

- Digital Policy Management: Customers can access and manage their insurance policies 24/7 online.

- Online Claims Submission: A simplified process for filing and tracking insurance claims digitally.

- Customer Support Portals: FAQs, knowledge bases, and chat functions for immediate assistance.

- Mobile App Integration: Providing access to all self-service features through a dedicated mobile application.

Partnership-Driven Customer Acquisition

Kingsway Financial Services cultivates customer relationships through strategic alliances with credit unions and auto dealerships. These partnerships are crucial for distributing Kingsway's extended warranty offerings directly to the members and customers of these institutions.

This approach capitalizes on established trust, making it an efficient method for acquiring new clients. For instance, in 2024, partnerships accounted for a significant portion of Kingsway's new business origination, demonstrating the power of leveraging existing networks.

- Partnership Integration: Extended warranty products are seamlessly integrated into the offerings of credit unions and auto dealerships.

- Leveraging Trust: The established credibility of partner institutions is used to build confidence with potential Kingsway customers.

- Direct Access: This model provides direct access to a pre-qualified customer base, streamlining the acquisition process.

Kingsway Financial Services nurtures customer relationships through a multi-faceted approach, blending personal interaction with digital convenience. Its independent agents and brokers serve as key personal touchpoints for insurance and extended warranty clients, offering tailored advice and support. For its acquisition program, Kingsway engages directly with business owners, fostering trust through a consultative, partnership-driven model.

The company also emphasizes ongoing, specialized support through its business services subsidiaries, aiming for long-term client retention, evidenced by a 15% increase in client retention for advisory services in 2024. Digital self-service portals and mobile app integration enhance accessibility, allowing customers to manage policies and claims efficiently. Strategic alliances with credit unions and auto dealerships further expand reach by leveraging established trust within their existing customer bases, with these partnerships contributing significantly to new business origination in 2024.

| Relationship Channel | Key Activities | 2024 Impact |

|---|---|---|

| Independent Agents & Brokers | Personalized sales, policy advice, ongoing support | Significant new business origination, high customer engagement |

| Direct Business Owner Engagement (Search Xcelerator) | Consultative sales, partnership building, acquisition support | Engagement with over 150 SME owners; fostered trust and strategic alliances |

| Business Services Subsidiaries | Tailored solutions, dedicated consulting, specialized expertise | 15% increase in client retention for advisory services |

| Digital Self-Service | Online policy management, digital claims submission, customer support portals | Increased customer engagement via digital channels, reduced call center volume |

| Strategic Alliances (Credit Unions, Auto Dealerships) | Product integration, leveraging partner trust, direct customer access | Substantial contribution to new business origination |

Channels

Kingsway Financial Services heavily relies on its vast network of independent agents and brokers, a cornerstone of its distribution strategy. These partnerships grant Kingsway access to a broad customer base across the United States, fostering localized relationships and personalized service. This multi-channel approach allows for efficient product penetration into diverse markets.

In 2024, Kingsway continued to leverage these relationships, with independent agents and brokers representing a significant portion of its sales volume. This network not only provides extensive geographic reach but also ensures that customers receive tailored advice and support from professionals familiar with their local needs. The firm's commitment to nurturing these agent relationships remains a key driver of its market presence.

Kingsway Financial Services leverages direct partnerships with auto dealerships as a key channel to offer its extended warranty products. This strategy allows for seamless integration of their offerings directly at the point of vehicle purchase, targeting both consumers buying used cars from independent dealers and those acquiring new vehicles from franchised dealerships.

This direct-to-consumer approach at the dealership level is highly effective. For instance, in 2024, the automotive aftermarket industry, which includes extended warranties, saw continued robust growth, with a significant portion of sales occurring at the dealership. Kingsway's model taps into this established sales environment.

By working with dealerships, Kingsway benefits from an existing customer flow and a trusted point of sale. This channel facilitates the presentation of warranty options when consumers are most focused on protecting their new or pre-owned vehicle investment, a critical moment for upselling related services.

Kingsway Financial Services leverages credit unions as a key distribution channel for its after-market vehicle protection services. This strategy capitalizes on the inherent trust and established member relationships that credit unions possess, allowing Kingsway to reach a targeted and receptive audience.

By partnering with credit unions, Kingsway taps into a network that already serves individuals seeking financial services and often vehicle financing. For instance, in 2024, the credit union sector continued to demonstrate strong growth, with total assets reaching over $2.7 trillion in the U.S., indicating a substantial member base available for engagement.

This distribution model allows for cost-effective marketing and sales, as credit unions can promote Kingsway's offerings directly to their members, often at the point of vehicle purchase or financing. The shared goal of providing value to members creates a natural synergy for this partnership.

Online Platforms and Digital Portals

Kingsway Financial Services leverages online platforms and digital portals as a core component of its business model, aiming for streamlined operations and enhanced customer accessibility. These digital channels are crucial for policy administration, enabling clients to manage their coverage, make payments, and access policy documents conveniently. For instance, in 2024, many insurance providers reported significant increases in digital policy management, with over 60% of new policy enrollments initiated online.

Claims processing is another key area where these digital portals offer substantial benefits. Customers can typically submit claims, upload necessary documentation, and track the status of their claims in real-time, significantly reducing turnaround times and improving customer satisfaction. This digital efficiency is vital in a competitive market where prompt service is highly valued.

These online channels also serve as a direct line for customer engagement, offering support through chatbots, FAQs, and secure messaging systems. This facilitates quick resolution of queries and provides a self-service option for many common requests.

- Policy Administration: Online portals allow customers to view, update, and manage their insurance policies.

- Claims Processing: Digital platforms enable efficient submission and real-time tracking of insurance claims.

- Customer Engagement: Websites and apps provide support channels, FAQs, and direct communication options.

- Efficiency Gains: Digitalization streamlines administrative tasks, reducing operational costs and improving service delivery speed.

Direct Sales and Consulting for Business Services

Kingsway Financial Services leverages direct sales and consulting channels for its Kingsway Search Xcelerator (KSX) segment. This involves dedicated sales teams and consultants who engage directly with businesses to provide essential services such as outsourced finance, HR, and IT solutions. The approach emphasizes personalized client interaction and the development of bespoke service proposals tailored to each company's unique needs.

This direct engagement model allows Kingsway to build strong client relationships and understand their specific operational challenges. By offering specialized expertise, they position themselves as a valuable partner, not just a vendor. This is crucial in the business services market where trust and proven capability are paramount.

- Direct Sales Teams: Kingsway employs specialized sales professionals who actively pursue and engage prospective business clients for their KSX offerings.

- Consulting Expertise: The company utilizes consultants to assess client needs and design tailored outsourcing solutions for finance, HR, and IT functions.

- Client-Centric Approach: Proposals are developed through direct client dialogue, ensuring services align precisely with individual business requirements and goals.

- Market Penetration Strategy: This channel is key to penetrating the business services market by offering high-touch, customized solutions.

Kingsway Financial Services utilizes a multi-faceted channel strategy to reach its diverse customer base. This includes a robust network of independent agents and brokers, direct partnerships with auto dealerships for extended warranty sales, and collaborations with credit unions to offer vehicle protection services to their members. Additionally, digital platforms and online portals are integral for policy administration, claims processing, and customer engagement, streamlining operations and enhancing accessibility.

For its business services segment, Kingsway employs direct sales teams and consultants who engage with companies to provide outsourced finance, HR, and IT solutions. This client-centric approach focuses on understanding specific business needs and developing tailored service proposals, building strong partnerships within the business services market.

| Channel | Key Activities | 2024 Relevance/Data |

|---|---|---|

| Independent Agents/Brokers | Distribution, customer relationships, localized service | Significant sales volume; broad geographic reach |

| Auto Dealerships | Point-of-sale integration, extended warranties | Taps into automotive aftermarket growth; trusted sales environment |

| Credit Unions | Member engagement, vehicle protection services | Leverages trust and established member base; over $2.7 trillion in U.S. credit union assets in 2024 |

| Digital Platforms/Online | Policy admin, claims, customer support | Streamlined operations; over 60% of new policy enrollments online in 2024 |

| Direct Sales/Consulting (KSX) | Outsourced finance, HR, IT solutions for businesses | Client-centric approach; tailored service proposals |

Customer Segments

Kingsway Financial Services historically served individuals who faced challenges securing traditional auto insurance. This often included drivers with less-than-perfect driving records, such as recent traffic violations or accidents, or those who drove vehicles not typically covered by standard policies. The need for specialized risk assessment and tailored coverage was paramount for this customer segment.

Used car buyers represent a significant customer base for extended warranty services. These individuals are looking for peace of mind, knowing they have a financial safety net should unexpected mechanical issues arise after their purchase. In 2024, the used car market remained robust, with millions of vehicles changing hands, highlighting the ongoing demand for such protection.

Existing owners of used cars also form a crucial segment. They may have purchased their vehicles without an extended warranty and now, as the car ages or approaches the end of its original manufacturer warranty, they become more receptive to purchasing additional coverage. This proactive approach to vehicle maintenance and cost management is a key driver for this group.

Dealerships and credit unions are primary channels for reaching these customer segments. By partnering with these institutions, Kingsway Financial Services can tap into established customer relationships and offer warranties at the point of sale or to existing members. Data from 2024 indicates that dealerships continue to be a major touchpoint for both used car purchases and subsequent service needs.

Credit union members are a key customer segment for Kingsway Financial Services, particularly for their after-market vehicle protection plans. These individuals typically value the security and trust associated with their credit unions, often seeking out warranty options recommended or offered through these member-focused financial institutions. In 2024, credit unions continued to demonstrate strong member loyalty, with over 138 million Americans belonging to a credit union, reflecting a significant pool of potential customers who prioritize trusted relationships.

Small to Mid-Sized Businesses (SMBs)

Small to mid-sized businesses represent a core customer segment for Kingsway Financial Services, particularly through its Kingsway Search Xcelerator (KSX) offering. These businesses are actively looking for specialized support in areas like finance, human resources, and IT, aiming to boost their operational effectiveness. They recognize the value of external expertise to fill critical skill gaps without the overhead associated with hiring full-time staff.

The demand for such outsourced services is robust. For instance, the global market for business process outsourcing (BPO), which encompasses many of these functions, was projected to reach over $400 billion in 2024. SMBs are a significant driver of this growth, as they often lack the internal resources to manage these complex operational areas.

- Targeting SMBs: Kingsway's KSX program specifically caters to the needs of small and medium-sized enterprises.

- Outsourced Expertise: These businesses require external financial, HR, and IT consulting to enhance efficiency.

- Cost Efficiency: The appeal lies in accessing specialized skills without the expense of full-time employees.

- Market Demand: The growing BPO market highlights the widespread need for these outsourced services among SMBs.

Homebuilders and Property Managers

Kingsway Financial Services targets homebuilders and property managers, offering essential warranty products and support. These businesses require robust protection for their construction ventures and the properties they oversee, ensuring peace of mind and operational continuity.

This customer segment is particularly focused on mitigating risks associated with new builds and ongoing property management. They seek reliable partners who understand the unique challenges of the real estate development and management lifecycle.

- Warranty Products: Providing coverage for construction defects and home systems, safeguarding both the builder and the homeowner.

- Property Management Support: Offering services that help property managers maintain tenant satisfaction and protect asset value.

- Risk Mitigation: Assisting clients in managing liabilities inherent in construction and property ownership.

- 2024 Market Data: In 2024, the US housing market saw continued demand, with new home sales reaching an annualized rate of 651,000 units in April, highlighting the ongoing need for builder support. Property management firms also faced evolving tenant expectations and regulatory landscapes, increasing their reliance on specialized service providers.

Kingsway Financial Services targets individuals with non-standard auto insurance needs, including those with imperfect driving records or unusual vehicles.

The company also focuses on the used car market, offering extended warranties to both recent buyers and existing owners seeking protection against unexpected repairs.

Additionally, Kingsway serves small to mid-sized businesses requiring outsourced financial, HR, and IT support through its KSX program, and homebuilders/property managers needing warranty and support services.

Cost Structure

Kingsway Financial Services incurs substantial costs related to claims and underwriting within its extended warranty business. A significant portion of these expenses stems directly from the payouts made on customer claims, alongside the considerable costs associated with loss adjustment, which involves investigating, evaluating, and settling these claims.

Underwriting activities also represent a major cost driver for Kingsway. These expenses encompass the crucial processes of risk assessment, where potential policyholders are evaluated to determine insurability and premium rates, as well as the operational costs involved in issuing new policies.

For instance, in 2024, the company reported that its claims and loss adjustment expenses represented a substantial percentage of its revenue, highlighting the direct correlation between sales volume and these primary cost components.

Kingsway Financial Services faces significant acquisition and integration costs as it pursues its growth through acquiring new businesses. These expenses encompass identifying suitable targets, conducting thorough due diligence, and covering extensive legal and advisory fees. In 2024, for instance, the company likely allocated a substantial portion of its capital expenditure to these upfront acquisition-related activities, reflecting the complexity and resource-intensiveness of integrating new entities into its Search Xcelerator platform.

Kingsway Financial Services' cost structure is heavily influenced by general operating expenses. These include essential costs like salaries for administrative personnel, the upkeep of office spaces, and the maintenance of their technology infrastructure, which supports all business segments. For instance, in 2023, administrative salaries alone represented a substantial portion of the company's overhead. Disciplined management of these operational and administrative expenses is therefore a critical factor in maintaining profitability and efficiency across the organization.

Sales, Marketing, and Distribution Costs

Kingsway Financial Services incurs significant expenses in its Sales, Marketing, and Distribution efforts, crucial for reaching its customer base. These costs encompass a broad range of activities aimed at both acquiring new clients and maintaining relationships with existing ones for its insurance products and business services. For instance, in 2024, the company likely allocated substantial funds towards digital marketing campaigns, agent training, and the infrastructure needed to support its independent sales network.

The company's cost structure is heavily influenced by its reliance on independent agents and brokers. Commissions paid to these intermediaries represent a direct cost tied to sales volume. Furthermore, direct sales activities, including customer outreach and support for both insurance policies and business solutions, contribute to this expense category. These are not just overheads; they are direct investments in revenue generation and customer engagement.

- Customer Acquisition Costs: Expenses related to advertising, lead generation, and initial sales outreach for new policyholders and service clients.

- Agent/Broker Commissions: Payments made to the independent sales force based on the volume and value of policies and services sold.

- Distribution Network Expenses: Costs associated with maintaining and supporting the network of agents and brokers, including training and technology.

- Marketing and Brand Building: Investment in brand awareness and promotional activities to enhance market presence and attract customers.

Investment Management and Financing Costs

Kingsway Financial Services incurs significant costs in managing its investment portfolio. These include fees paid to external managers, research analysts, and custodians, all crucial for maintaining a well-performing asset base. For instance, in 2023, the average expense ratio for actively managed equity funds in the US was around 0.77%, a figure that directly impacts profitability.

Financing costs are another substantial component of Kingsway's cost structure. This primarily involves interest expenses on any debt the company utilizes to fund its operations or investments. As of early 2024, the Federal Reserve's benchmark interest rate has remained elevated, meaning companies like Kingsway likely face higher borrowing costs compared to previous years, directly impacting their net interest margins.

- Investment Management Fees: Costs associated with managing the company's investment portfolio, including advisory and performance fees.

- Financing Costs: Interest expenses incurred on borrowed funds used for operations or investments.

- Market Sensitivity: These costs are dynamic, influenced by market performance and prevailing interest rates.

- Operational Impact: Higher financing costs can reduce net income, while efficient portfolio management can offset these expenses.

Kingsway Financial Services' cost structure is dominated by its core insurance operations: claims, underwriting, and distribution. These are directly tied to revenue generation and policy servicing. Significant investments are also made in sales and marketing to acquire and retain customers.

The company also incurs substantial costs related to acquisitions and general operations. Financing costs, influenced by market interest rates, and investment management fees further shape the overall expense profile.

| Cost Category | Description | 2024 Data/Notes |

|---|---|---|

| Claims & Loss Adjustment | Payouts for customer claims and costs to evaluate them. | A significant percentage of revenue, directly correlated with sales volume. |

| Underwriting | Risk assessment and policy issuance. | Essential for determining insurability and premium rates. |

| Sales, Marketing & Distribution | Customer acquisition and retention efforts. | Includes digital marketing, agent training, and sales network support. |

| Commissions & Agent Support | Payments to independent agents and brokers. | Directly tied to sales volume; includes network maintenance costs. |

| Acquisition & Integration | Costs for identifying, due diligence, and integrating new businesses. | Substantial capital expenditure likely allocated to these activities. |

| General Operating Expenses | Salaries, office upkeep, technology infrastructure. | Administrative salaries were a substantial portion of overhead in 2023. |

| Investment Management Fees | Fees for managing the company's investment portfolio. | Influenced by market performance; US actively managed equity fund expense ratios averaged ~0.77% in 2023. |

| Financing Costs | Interest expenses on debt. | Elevated benchmark interest rates in early 2024 likely increased borrowing costs. |

Revenue Streams

Kingsway Financial Services generates its main income from fees and commissions related to selling and managing extended vehicle warranties. This revenue comes from sales made through both credit unions and automotive dealerships.

In 2024, Kingsway reported a significant portion of its revenue was derived from these warranty service fees and associated commissions. While specific figures for 2024 are still being finalized, the company has historically seen strong performance in this segment, with similar revenue streams contributing substantially to its financial results in prior years.

Kingsway Financial Services, through its Kingsway Search Xcelerator (KSX) segment, taps into a robust revenue model driven by a diverse array of business services. This includes crucial areas like outsourced finance, HR, and IT consulting, alongside specialized skilled trades support.

A significant portion of these offerings are structured to generate recurring revenue, providing a stable and predictable income base for the company. For instance, their ongoing IT support or HR management services often involve monthly or annual retainers.

In 2024, the demand for outsourced business services continued to grow as companies sought efficiency and specialized expertise. Many businesses leverage these recurring fee structures to manage operational costs effectively while accessing critical functions.

Investment income represents a crucial revenue stream for Kingsway Financial Services, stemming from the performance of its diverse investment portfolio. This includes earnings generated from cash equivalents, offering a steady, albeit typically lower, return, and more dynamic income from equity investments, which have the potential for higher growth but also carry greater market risk.

For the fiscal year ending December 31, 2023, Kingsway Financial Services reported investment income of $15.8 million, a notable increase from $12.2 million in the prior year. This growth was primarily driven by strong performance in their publicly traded equity holdings and more favorable interest rates on their cash reserves, contributing significantly to the company's overall profitability.

Transaction-Based Service Fees

Kingsway Financial Services generates revenue through transaction-based service fees across its diverse business services subsidiaries. These fees are typically tied to the completion of specific transactions or project-based work, representing a direct charge for services rendered.

This model is particularly evident in their consulting and project management offerings, where one-time fees are common. For example, in 2024, Kingsway's advisory services likely saw a significant portion of their revenue stemming from project completion fees, reflecting the value delivered to clients on a per-engagement basis.

The nature of these fees means revenue can fluctuate based on the volume and value of transactions. This structure allows for flexibility but also introduces variability in income streams.

Key aspects of these transaction-based revenue streams include:

- Project-Specific Fees: Revenue earned upon the successful completion of defined projects.

- Consulting Charges: Fees billed for expert advice and strategic guidance provided to clients.

- Deal Origination and Execution: Revenue generated from facilitating and closing financial or business transactions.

- One-Time Service Payments: Income derived from discrete, non-recurring service engagements.

Real Estate Related Income

Kingsway Financial Services has a history of involvement in real estate, which has served as a supplementary revenue stream. While not always the primary focus, these operations can yield income from both rental properties and the eventual sale of real estate assets. This diversification helps to broaden the company's overall income generation capabilities.

Historically, Kingsway's real estate ventures have contributed to its financial performance, offering a different avenue for profit compared to its core financial services. This segment can provide stability through consistent rental income or significant windfalls from property appreciation and sales.

- Rental Income: Revenue generated from leasing out properties owned by the company.

- Property Sales: Income derived from the disposal of real estate assets.

- Diversification Benefit: Reduces reliance on any single revenue source.

Kingsway Financial Services diversifies its income through multiple avenues, including the sale and management of vehicle warranties, outsourced business services, investment income, transaction-based fees, and real estate operations.

In 2024, Kingsway's warranty segment continued to be a primary revenue driver, with strong contributions from credit union and dealership sales. The company also saw continued demand for its outsourced finance, HR, and IT consulting services, many structured with recurring revenue models.

Investment income, a key component, saw a notable increase in 2023, reaching $15.8 million, driven by equity holdings and improved interest rates. This financial year also highlighted the importance of transaction-based fees from project completion and consulting, reflecting the company's diverse service offerings.

| Revenue Stream | Primary Source | 2023 Data (if applicable) | 2024 Outlook/Trends | Notes |

|---|---|---|---|---|

| Vehicle Warranties | Sales via Credit Unions & Dealerships | Core Revenue Driver | Continued Strong Performance | Fees and commissions from warranty sales and management. |

| Business Services (KSX) | Outsourced Finance, HR, IT, Skilled Trades | Growing Demand | Recurring Revenue Model | Monthly/annual retainers for ongoing services. |

| Investment Income | Equities, Cash Equivalents | $15.8 million (2023) | Favorable Market Conditions | Driven by portfolio performance and interest rates. |

| Transaction-Based Fees | Project Completion, Consulting, Deal Origination | Significant Portion of Advisory Revenue | Fluctuates with Volume/Value | One-time charges for discrete services. |

| Real Estate Operations | Rental Income, Property Sales | Supplementary Income | Diversification Benefit | Provides stability and potential windfalls. |

Business Model Canvas Data Sources

The Kingsway Financial Services Business Model Canvas is built upon a foundation of comprehensive financial statements, detailed market research reports, and strategic internal analyses. These sources ensure each canvas block is populated with accurate, actionable intelligence.