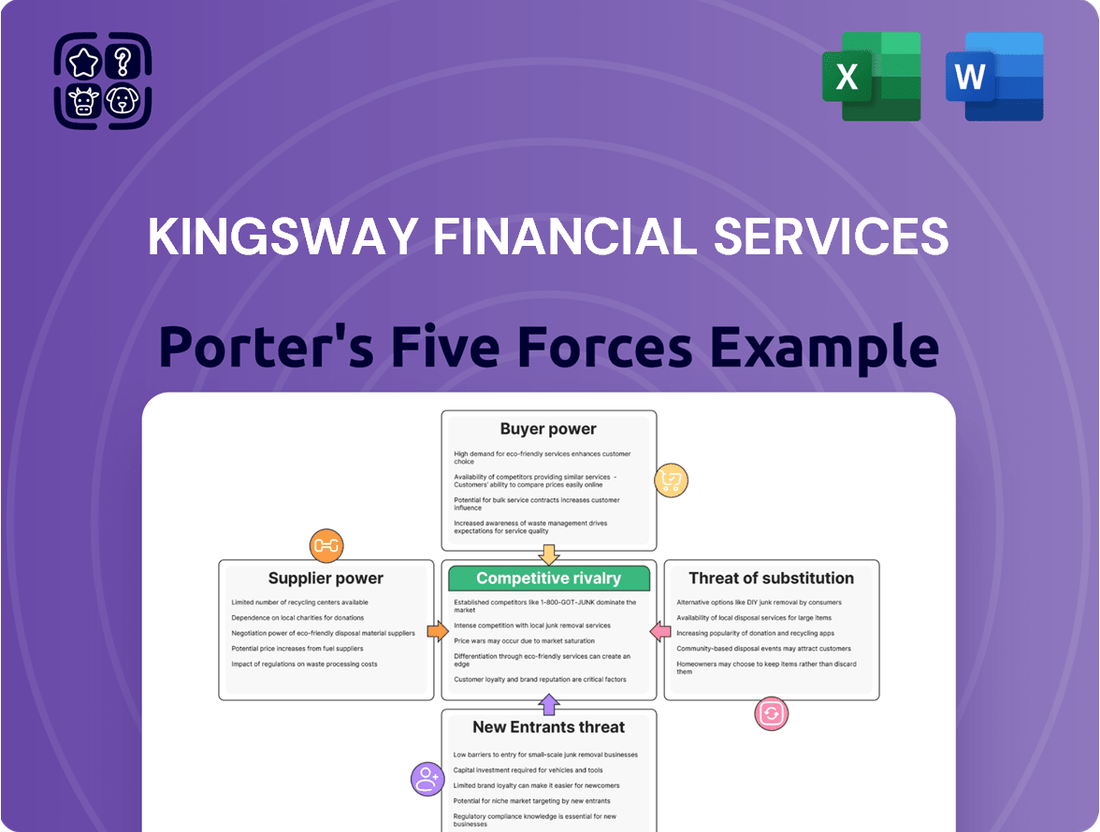

Kingsway Financial Services Porter's Five Forces Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Kingsway Financial Services Bundle

Kingsway Financial Services operates within a dynamic insurance landscape, where the bargaining power of buyers can significantly impact pricing and profitability. Understanding the intensity of this force is crucial for strategic planning.

The threat of new entrants presents another key consideration, as regulatory hurdles and capital requirements influence how easily competitors can emerge. Analyzing this pressure point reveals potential market disruptions.

The availability of substitute products or services poses a constant challenge, forcing Kingsway to differentiate its offerings and maintain customer loyalty.

Supplier power, though perhaps less pronounced in insurance, still plays a role, particularly concerning technology providers and reinsurers.

Finally, the competitive rivalry within the insurance sector dictates pricing strategies and marketing efforts, directly affecting Kingsway's market share.

This preview is just the beginning. The full analysis provides a complete strategic breakdown of Kingsway Financial Services’s market position, competitive intensity, and external threats—all in one powerful analysis.

Suppliers Bargaining Power

Kingsway Financial Services, especially in its Extended Warranty division, depends heavily on reinsurers to manage risk. A concentrated reinsurance market, where a few large companies hold sway, grants these suppliers considerable leverage. They can influence pricing, terms, and the availability of coverage, directly impacting Kingsway's ability to underwrite profitably and maintain competitive product offerings.

The reinsurance landscape experienced some turbulence in late 2024 and early 2025, with reports of challenges in treaty renewals. This environment can embolden reinsurers, giving them more power to set more stringent conditions and potentially higher costs for insurers like Kingsway. For instance, some segments of the property catastrophe reinsurance market saw price increases in the mid-single digits to low double-digit percentages in early 2025 renewals, indicating a firmer market for reinsurers.

Insurers, particularly in specialized areas like non-standard auto insurance, rely heavily on sophisticated technology for underwriting and claims processing. This reliance grants significant bargaining power to providers of niche data and AI-driven analytical tools. For instance, companies offering unique risk assessment data for non-standard auto policies can command higher prices.

The high switching costs associated with integrating new data providers or AI platforms further solidify supplier power. Insurers invest considerable resources in data integration and model calibration, making a shift to a competitor a complex and expensive undertaking. This dependence is amplified in 2024 as insurers continue to enhance their use of advanced analytics to gain a competitive edge.

Kingsway Financial Services, like any financial services holding company, relies heavily on its access to capital for operations, acquisitions, and growth. Suppliers of this capital – banks, debt holders, and equity investors – possess significant bargaining power. This power can manifest through the interest rates charged on loans, the terms and conditions of debt agreements, and the expectations set by equity investors, especially in light of Kingsway's reported net loss of $2.6 million for the year ended December 31, 2024.

The ability of capital providers to influence Kingsway's financial flexibility is a key concern. For instance, if investor sentiment turns negative due to the 2024 losses, Kingsway might face higher borrowing costs or more stringent lending covenants on future debt issuances. This directly impacts the company's ability to fund strategic initiatives and maintain operational stability.

Claims Management and Legal Service Providers

The bargaining power of suppliers, particularly claims management and legal service providers, is a significant factor for Kingsway Financial Services, especially in the non-standard auto insurance sector. This segment inherently deals with a high volume of claims, often leading to complex legal challenges. External claims adjusters, specialized legal firms, and established repair networks function as critical suppliers, directly impacting Kingsway's operational efficiency and cost structure.

The leverage these suppliers hold can be substantial. If they possess unique expertise, such as specialized fraud detection or niche legal defense capabilities, their ability to command higher fees or dictate terms increases. Furthermore, in localized markets where Kingsway operates, a limited number of high-quality service providers can consolidate their bargaining power. For instance, a recent industry report highlighted that in certain regions, the cost of specialized legal services for insurance claims saw an average increase of 7% in 2024, directly squeezing insurer margins.

- Specialized Expertise: Providers with niche skills in areas like subrogation or severe injury claims can demand premium rates.

- Market Concentration: Limited competition among qualified legal or claims management firms in specific geographic areas enhances their bargaining power.

- Contractual Terms: The terms negotiated in service agreements, including payment schedules and performance metrics, heavily influence Kingsway's costs.

- Regulatory Compliance: Suppliers adept at navigating complex insurance regulations may hold an advantage, making them indispensable.

Talent Pool and Human Capital

The availability of skilled professionals, such as actuaries, underwriters, and IT specialists, is a critical factor for Kingsway Financial Services. In 2024, the insurance sector, like many others, experienced a competitive landscape for specialized talent.

A tight labor market, particularly for those with advanced analytics and cybersecurity skills, can significantly amplify the bargaining power of employees. This translates into increased compensation expectations and potential retention challenges for companies like Kingsway, impacting operational costs across its various business segments.

- Talent Scarcity: Reports in early 2024 indicated persistent shortages in actuarial science and data analytics roles within financial services.

- Wage Inflation: The demand for experienced professionals led to an upward pressure on salaries, with some specialized roles seeing double-digit percentage increases year-over-year.

- Retention Costs: Increased competition for talent raises the cost of retaining key employees, as companies must offer competitive benefits and compensation packages.

The bargaining power of suppliers for Kingsway Financial Services is amplified by specialized expertise and market concentration within critical service areas like claims management and legal support, particularly in the non-standard auto insurance sector. These suppliers can command higher fees or dictate terms when they possess unique skills, such as advanced fraud detection capabilities, or when there's limited competition in specific operating regions. For example, the cost of specialized legal services for insurance claims saw an average increase of 7% in 2024 in certain regions, impacting insurer margins.

What is included in the product

This analysis details the competitive landscape for Kingsway Financial Services by examining the bargaining power of buyers and suppliers, the threat of new entrants and substitutes, and the intensity of rivalry within the industry.

Instantly pinpoint competitive threats and opportunities with Kingsway Financial Services' Porter's Five Forces analysis, designed to alleviate the pain of uncertainty.

Customers Bargaining Power

Customers in niche insurance markets, like non-standard auto insurance, often display significant price sensitivity. This is driven by their specific risk profiles and potentially fewer alternative providers, granting them a degree of bargaining power. For instance, in 2024, the average premium for non-standard auto insurance remained considerably higher than standard policies, prompting consumers to actively seek the most cost-effective options available.

Similarly, the market for extended warranties shows a growing consumer demand for demonstrable value and competitive pricing. This trend reflects a broader shift in consumer behavior towards greater fiscal prudence. Kingsway Financial Services must therefore focus on offering attractive rates without compromising its profit margins to effectively capture and retain market share in these sensitive segments.

Kingsway Financial Services faces customer bargaining power stemming from the availability of alternative providers, particularly in its niche segments like non-standard auto insurance and extended warranties. Customers can often find comparable coverage from larger national insurers or other specialized companies, diluting Kingsway's unique appeal.

Low switching costs further empower these customers. The ease of obtaining online quotes and making policy adjustments means that if a customer is dissatisfied with Kingsway's offerings or pricing, they can readily transition to a competitor with minimal friction, directly impacting Kingsway's customer retention and pricing flexibility.

The proliferation of digital platforms and comparison websites significantly amplifies customer bargaining power. These tools provide unprecedented access to information about pricing, policy details, and customer satisfaction ratings across the insurance landscape. For instance, in 2024, comparison sites continue to be a primary research channel for a substantial portion of consumers seeking insurance, allowing them to readily benchmark Kingsway's offerings against rivals. This transparency empowers customers to negotiate better terms or switch providers if they find more attractive alternatives, directly impacting Kingsway's ability to retain clients and maintain premium pricing.

Customer Segmentation and Product Differentiation

Kingsway Financial Services targets specific customer segments, including those seeking non-standard auto insurance and extended warranties. Their distribution through credit unions and used car dealerships creates a focused market. However, if these specialized products lack significant differentiation beyond basic coverage or pricing, customers retain considerable bargaining power. They can easily switch to competitors offering more attractive terms or broader options, especially if Kingsway's offerings are perceived as commoditized.

The ability of customers to switch providers easily, even within niche markets, underscores their influence. For instance, if competitors in the non-standard auto insurance space offer more competitive pricing or more flexible coverage options, Kingsway's customer base could shift. In 2024, the non-standard auto insurance market continued to see significant competition, with some providers leveraging technology to offer personalized pricing, which could put pressure on companies with less differentiated products.

- Niche Focus: Kingsway's specialization in non-standard auto and extended warranties concentrates its customer base.

- Differentiation Impact: Product uniqueness and tailored features directly counter customer bargaining power.

- Competitive Landscape: The availability of alternative providers with flexible plans empowers customers.

- Customer Loyalty: Loyalty built on specialization can erode if competitors offer superior value or customization.

Impact of Economic Conditions on Demand

Economic conditions significantly influence customer bargaining power, particularly for services like insurance and extended warranties. For instance, the rising cost of living and specific repair expenses directly impact how much consumers can afford to spend on these products. Between December 2023 and 2024, motor vehicle maintenance and repair costs saw a notable increase of 6.5%.

This upward trend in repair costs puts pressure on consumers, making them more sensitive to the price of related services. Kingsway Financial Services, like other insurers, faces customers who are increasingly looking for value and may seek to reduce coverage or negotiate better terms to manage their budgets. This heightened price sensitivity amplifies customer leverage.

The impact of these economic factors can be summarized as follows:

- Increased Price Sensitivity: Consumers are more likely to compare prices and seek discounts when their overall expenses rise.

- Demand for Value: Customers will scrutinize the benefits offered against the cost, pushing providers to demonstrate clear value propositions.

- Potential for Reduced Coverage: In response to economic pressures, customers might opt for lower coverage levels or forgo optional add-ons.

- Negotiating Leverage: The collective behavior of price-conscious customers strengthens their ability to negotiate more favorable terms with service providers.

Kingsway Financial Services operates in markets where customers wield considerable bargaining power. This is largely due to the availability of alternatives and low switching costs, particularly in niche areas like non-standard auto insurance. The increasing reliance on digital comparison tools in 2024 further empowers consumers to readily benchmark prices and policy features, intensifying competitive pressure.

Economic headwinds, such as the 6.5% increase in motor vehicle repair costs observed between late 2023 and 2024, also heighten customer price sensitivity. This makes consumers more inclined to seek out the most cost-effective options and negotiate for better terms, directly impacting Kingsway's pricing flexibility and retention strategies.

| Factor | Impact on Kingsway | Customer Action |

|---|---|---|

| Availability of Alternatives | Reduces pricing power | Switch to competitor |

| Low Switching Costs | Increases churn risk | Easily change providers |

| Digital Comparison Tools | Enhances price transparency | Benchmark and negotiate |

| Economic Pressures | Heightens price sensitivity | Seek discounts or lower coverage |

Full Version Awaits

Kingsway Financial Services Porter's Five Forces Analysis

This preview shows the exact document you'll receive immediately after purchase—no surprises, no placeholders. It details Kingsway Financial Services' competitive landscape, analyzing the intensity of rivalry, the bargaining power of buyers and suppliers, the threat of new entrants, and the threat of substitute products. This comprehensive Porter's Five Forces analysis provides critical insights into the strategic positioning and potential challenges faced by Kingsway Financial Services within the financial services industry.

Rivalry Among Competitors

Kingsway Financial Services operates in the non-standard auto and extended warranty sectors, facing a crowded competitive landscape. This market includes specialized providers alongside larger, more diversified insurance giants such as State Farm and Progressive, who can leverage their scale and existing customer bases to offer similar products.

The sheer number and varied nature of these competitors, from niche players to national carriers, significantly heighten the rivalry. This intensity is particularly notable as recent data indicates a strengthening in the non-standard auto market, signaling increased profitability and attracting further competition.

The non-standard auto insurance sector demonstrated a remarkable turnaround in 2024, shifting from a significant underwriting loss to a net underwriting gain. This recovery, coupled with the extended warranty market's projected strong growth through 2033, signals increasing attractiveness for the industry.

Such positive growth and improving profitability are powerful magnets for competition. Existing companies are motivated to capture a larger slice of this expanding pie, while new entrants may find the market conditions compelling enough to consider entering, thereby intensifying the rivalry among participants.

Kingsway Financial Services emphasizes product differentiation and a niche market strategy, aiming to carve out distinct positions within the insurance and business services sectors. This approach can effectively blunt direct competition by catering to specialized customer needs that larger, more generalized players might overlook.

The intensity of rivalry hinges on Kingsway's ability to offer truly unique value propositions. If competitors can readily mimic Kingsway's specialized products or services, or if they also target the same narrow market segments, the competitive pressure will remain considerable. For instance, in the specialty insurance market, insurers often compete on claims handling speed and customer service, areas where differentiation is key to retaining clients.

Consider the Canadian specialty insurance market, a key area for Kingsway. While overall insurance growth was modest in 2024, niche segments like commercial property or cyber liability saw higher demand. For example, cyber insurance premiums continued to rise, driven by increased threat activity. Kingsway's success in these areas directly correlates with how effectively it can differentiate its underwriting, pricing, or claims support compared to other insurers vying for the same specialized business.

Kingsway's focus on areas like surety bonds or specific commercial insurance lines means its competitive set is often smaller but highly specialized. If other firms in these niches are also innovating or offering competitive pricing, the rivalry can be intense, regardless of the niche's size. The ability to maintain a competitive edge relies on continuous product development and a deep understanding of evolving client requirements within these focused markets.

Exit Barriers and Industry Consolidation

Kingsway Financial Services operates within an industry characterized by significant exit barriers. These include the substantial investment in specialized IT systems for claims processing and underwriting, coupled with stringent regulatory capital requirements that make it difficult for undercapitalized firms to simply walk away. Long-term customer relationships and contractual obligations further anchor companies to the market, even when profitability wanes, thereby intensifying competitive rivalry.

The broader insurance sector experienced a notable uptick in mergers and acquisitions towards the end of 2024, signaling a trend toward industry consolidation. However, within the non-standard auto insurance segment where Kingsway is active, these exit barriers can trap less efficient players. This situation can sustain a higher level of competition than might otherwise be expected, as struggling entities remain operational due to these impediments.

Specific factors contributing to these high exit barriers for companies like Kingsway include:

- Specialized Assets: Significant investment in proprietary underwriting and claims management software, which has limited resale value outside the insurance context.

- Regulatory Obligations: Compliance with solvency regulations and reserve requirements necessitates substantial capital, making a swift exit financially prohibitive.

- Long-Term Contracts: Existing policyholder agreements and service level agreements create ongoing commitments that are costly to terminate prematurely.

Technological Advancements and Digitalization

The insurance sector's competitive landscape is intensifying due to rapid technological advancements and digitalization. Insurers are heavily investing in areas like artificial intelligence (AI), advanced data analytics, and digital customer platforms to gain an edge. This technological race means companies that are slower to adapt face significant pressure. For instance, the global InsurTech market was valued at approximately $70 billion in 2023 and is projected to grow substantially, indicating the scale of investment and innovation.

This digital transformation directly fuels competitive rivalry. Insurers are leveraging technology to refine underwriting accuracy, streamline claims processing, and enhance customer engagement. Those lagging in adopting these innovations, such as AI-powered risk assessment tools or seamless mobile claims submission, find themselves at a disadvantage against digitally adept competitors. By 2024, it's estimated that over 60% of insurers are actively exploring or implementing AI solutions in their operations.

- AI in Underwriting: Companies using AI for risk assessment can offer more competitive pricing and faster policy issuance, pressuring rivals with traditional methods.

- Digital Claims Processing: Streamlined, app-based claims submission and processing significantly improve customer satisfaction and reduce operational costs, creating a benchmark for others.

- Data Analytics for Personalization: Advanced analytics allow for hyper-personalized insurance products and pricing, a capability that traditional insurers may struggle to replicate.

- Customer Experience Platforms: Investment in user-friendly digital portals and mobile apps is becoming crucial for customer retention and acquisition in a competitive market.

Kingsway Financial Services faces intense competition, particularly in the non-standard auto and extended warranty sectors, from both specialized providers and large insurers. The market's improved profitability in 2024, with the non-standard auto sector moving from underwriting losses to gains, is attracting more players. This heightened competition means Kingsway must continuously innovate and differentiate its offerings, such as in specialty insurance lines like cyber or surety bonds, to maintain its market position.

The rivalry is further fueled by high exit barriers, including significant investments in specialized technology and stringent regulatory capital requirements, which keep even struggling firms in the market. Additionally, rapid technological adoption, particularly AI and advanced data analytics, is reshaping the competitive landscape, forcing insurers to invest heavily to keep pace or risk falling behind.

| Competitive Factor | Kingsway's Position | Market Trend | Impact on Rivalry |

|---|---|---|---|

| Number of Competitors | High (specialty and large insurers) | Increasing due to market recovery | Intensifies price and service competition |

| Product Differentiation | Niche strategy focus | Growing importance of unique value propositions | Rivalry high if differentiation is easily matched |

| Technological Adoption | Investing in digital platforms | Rapid AI and data analytics implementation | Pressure on slower adopters, driving innovation race |

| Exit Barriers | High (IT, capital, contracts) | Keep firms operational despite performance | Sustains higher competition levels |

SSubstitutes Threaten

For individuals and businesses with strong financial footing or a lower tolerance for risk, self-insurance presents a viable alternative to traditional insurance products. This means they might choose to set aside their own funds to cover potential losses, like unexpected equipment breakdowns, rather than purchasing a service contract or insurance policy. This approach is particularly common for smaller, more predictable risks where the cost of insurance premiums might outweigh the potential payout.

This trend towards risk retention is growing. For instance, in 2024, a significant portion of small businesses surveyed indicated they were increasing their self-funded reserves for potential cyber incidents, viewing it as more cost-effective than comprehensive cyber insurance. This directly impacts insurers like Kingsway, as it reduces the pool of customers opting for their risk-transfer solutions.

The availability of strong public transportation networks and evolving alternative mobility options presents a significant threat of substitutes for non-standard auto insurance. For instance, in cities with well-developed transit systems, individuals may opt out of car ownership altogether, thereby eliminating the need for auto insurance. In 2023, the number of shared mobility users, including ride-sharing and bike-sharing, continued to grow, demonstrating a shift in transportation preferences.

These alternatives directly address the core need that auto insurance mitigates – the risk associated with personal vehicle use. If individuals increasingly rely on ride-sharing services, public transit, or even car-sharing platforms, the underlying demand for owning and insuring a personal vehicle, particularly a non-standard one, diminishes. This trend suggests a potential reduction in the addressable market for non-standard auto insurers.

Consumers increasingly view general savings or emergency funds as a viable substitute for product-specific warranties, particularly for items like automobiles and electronics. This trend is fueled by a desire for greater financial control and a skepticism towards the often-restrictive terms of extended warranties. For instance, by mid-2024, the average emergency fund held by households in developed economies had grown, reflecting a heightened awareness of financial preparedness.

Direct Repair Services and Manufacturer Warranties

The threat of substitutes for Kingsway Financial Services' extended warranty products is significant, particularly from direct repair services and existing manufacturer warranties. Independent repair shops and original equipment manufacturers (OEMs) can offer competitive pricing for repairs, directly challenging the value proposition of an extended warranty. For instance, in 2024, the average cost of common auto repairs continued to rise, making upfront repair costs a more direct comparison point for consumers considering extended coverage.

Standard manufacturer warranties, typically lasting between three to five years or a certain mileage, also act as a powerful substitute. These warranties are often included with the purchase of a new vehicle, effectively eliminating the immediate need for an aftermarket extended warranty. This reduces the addressable market for Kingsway's products, as many consumers are already covered for the initial ownership period.

- Direct Repair Services: Independent mechanics and dealerships offer repair services that can be perceived as a direct substitute for extended warranty coverage, especially if their pricing is attractive or their service quality is highly regarded.

- Manufacturer Warranties: New vehicle purchases typically come with a manufacturer's warranty (e.g., 3-year/36,000-mile comprehensive, 5-year/60,000-mile powertrain), which covers many potential repair needs during the initial ownership period, thereby substituting the need for an extended warranty.

- Cost Comparison: Consumers may opt to self-insure by setting aside funds for potential repairs rather than paying for an extended warranty, especially if they perceive the likelihood of major repairs within the warranty period to be low.

- Perceived Value: If the cost of an extended warranty is high relative to the perceived risk of repairs, or if consumers have had negative experiences with warranty claims in the past, they are more likely to view direct repair services or self-insuring as viable substitutes.

Government Programs and Social Safety Nets

Government programs and social safety nets present a potential threat of substitutes for Kingsway Financial Services. While not direct competitors, these public initiatives can diminish the perceived necessity for certain private insurance products. For instance, robust unemployment benefits or universal healthcare coverage might reduce the demand for income protection or medical expense insurance, respectively.

In 2024, the ongoing expansion of social welfare initiatives in many developed nations continues to shape consumer behavior. For example, several European countries have increased their social security spending, with some allocating over 30% of their GDP to social protection in recent years. This broad public support can indirectly impact the market for private financial products by offering a baseline of security.

- Government social spending: Many governments globally are increasing social safety net expenditures. For example, the OECD reported an average increase in social spending among member countries during the early 2020s, which has continued to influence economic recovery and individual financial planning.

- Reduced demand for private alternatives: When public programs offer substantial coverage for risks like unemployment, illness, or retirement, individuals may feel less compelled to purchase equivalent private insurance policies.

- Impact on niche markets: Kingsway's specialized offerings could face reduced uptake if government initiatives provide a satisfactory alternative, even if it's a more generalized form of protection.

- Regulatory landscape: Changes in government policy regarding social programs can directly alter the competitive landscape for private financial service providers.

Consumers increasingly view self-insurance through general savings or emergency funds as a strong substitute for product-specific warranties, especially for items like vehicles and electronics. This trend is driven by a desire for more financial control and skepticism towards restrictive warranty terms. By mid-2024, households in developed economies saw their average emergency funds grow, indicating a heightened focus on financial preparedness.

The threat of substitutes for Kingsway Financial Services' extended warranty products is significant, particularly from direct repair services and existing manufacturer warranties. Independent repair shops and original equipment manufacturers (OEMs) can offer competitive pricing for repairs, directly challenging the value proposition of an extended warranty. For instance, in 2024, the average cost of common auto repairs continued to rise, making upfront repair costs a more direct comparison point for consumers considering extended coverage.

Standard manufacturer warranties, typically lasting three to five years or a certain mileage, also act as a powerful substitute. These are often included with new vehicle purchases, effectively eliminating the immediate need for an aftermarket extended warranty and reducing the addressable market for Kingsway's products.

| Substitute | Description | Impact on Kingsway | 2024 Data/Trend |

|---|---|---|---|

| Self-Insurance/Emergency Funds | Consumers setting aside personal funds for potential repairs. | Reduces demand for extended warranties. | Growing emergency funds, with households prioritizing financial preparedness. |

| Direct Repair Services | Independent mechanics and dealerships offering repairs. | Competes on price and service quality, potentially bypassing warranty providers. | Rising average cost of common auto repairs in 2024, making upfront costs more comparable. |

| Manufacturer Warranties | Included with new vehicle purchases, covering initial repair needs. | Directly covers many potential repair issues, negating the need for aftermarket extensions. | Standard 3-5 year/mileage coverage remains a primary substitute for new vehicle buyers. |

Entrants Threaten

The insurance sector, particularly specialized areas like non-standard auto insurance and extended warranty coverage, demands considerable upfront capital and navigates a complex web of regulations. New companies entering this space must contend with substantial financial commitments to secure necessary licenses and meet stringent solvency requirements. For instance, in 2024, regulatory capital requirements for insurance companies varied significantly by state, with some demanding minimum surplus levels in the tens of millions of dollars, a substantial barrier for aspiring entrants.

Navigating the intricate state-specific regulatory landscape presents another formidable challenge. Compliance with varying rules on policy forms, claims handling, and consumer protection across different jurisdictions necessitates significant legal and operational investment. This regulatory complexity, coupled with the sheer financial burden of capital reserves, effectively deters many potential new competitors from entering the market, thereby reducing the threat of new entrants for established players like Kingsway Financial Services.

Established players like Kingsway Financial Services have a significant advantage due to their deeply ingrained brand recognition and the trust they've cultivated over years of operation. Their established relationships, for instance, with credit unions and dealerships in providing extended warranties, create a loyal customer base that is less likely to switch to a new provider. This existing trust acts as a substantial barrier for new entrants.

New companies entering the financial services market must therefore undertake significant and costly marketing campaigns to build brand awareness and a reputation for reliability. Overcoming the inherent customer preference for established, trusted brands in a sector where financial security is paramount requires substantial investment and a long-term commitment to proving their mettle. For example, in 2023, the average marketing spend for a new financial service to reach a comparable level of brand awareness to an established player could easily run into millions of dollars, a hurdle many startups struggle to clear.

Incumbent insurers like Kingsway Financial Services often leverage significant economies of scale in areas such as underwriting and claims processing. This allows them to spread fixed costs over a larger volume of business, leading to lower per-unit costs. For example, in 2023, major global insurers reported operating expense ratios often below 20%, a benchmark difficult for new entrants to match immediately.

New entrants face a steep climb to achieve comparable cost efficiencies. Without the established infrastructure and volume, they may incur higher per-transaction costs for essential services, placing them at a distinct price disadvantage. This can make it challenging to compete on price with established players who benefit from years of operational experience and optimized processes.

Access to Distribution Channels

Kingsway Financial Services effectively utilizes established distribution channels, including credit unions and a wide network of used car dealerships, to market its extended warranty products. This deep integration creates a significant hurdle for newcomers looking to penetrate the market.

New entrants often face substantial challenges in replicating these established relationships. Without pre-existing partnerships, they struggle to gain the necessary visibility and reach their intended customer base, impacting their ability to compete effectively.

- Established Networks: Kingsway's reliance on credit unions and dealerships provides immediate access to a large customer pool.

- Barrier to Entry: New competitors must invest heavily in building similar distribution networks or finding alternative, often less efficient, channels.

- Customer Reach: Without these established channels, new entrants may find it difficult to reach potential customers for extended warranty products.

Data and Technology Infrastructure

The insurance industry's increasing reliance on advanced data analytics and robust technology infrastructure presents a significant hurdle for potential new entrants. Companies like Kingsway Financial Services leverage sophisticated platforms for risk assessment and customer relationship management, requiring substantial upfront investment. In 2024, the global InsurTech market is projected to reach over $60 billion, highlighting the competitive technological landscape. Newcomers must not only develop comparable data handling capabilities but also invest heavily in cybersecurity and compliance, making it difficult to compete with established players who have already built this essential infrastructure.

Building and acquiring comprehensive, high-quality data sets is a critical challenge. Insurers need vast historical data for accurate actuarial modeling and pricing. For instance, a new entrant would need to amass years of claims data across various risk categories to develop competitive products. This data acquisition process is time-consuming and expensive, especially when competing against incumbents that possess proprietary and extensive datasets cultivated over decades. The ongoing development of AI and machine learning capabilities further elevates the technological barrier.

- Data Infrastructure Costs: Establishing the necessary data warehousing, processing, and analytical tools can cost millions of dollars.

- Talent Acquisition: Hiring skilled data scientists and IT professionals is crucial and highly competitive in 2024.

- Regulatory Compliance: Meeting stringent data privacy regulations like GDPR and CCPA requires significant technological and operational investment.

- Legacy System Integration: For incumbents, integrating new technologies with existing systems is a challenge, but new entrants lack the established base to build upon.

The threat of new entrants for Kingsway Financial Services is significantly mitigated by high capital requirements and stringent regulatory hurdles within the insurance sector, particularly for specialized niches. For instance, in 2024, minimum capital reserves for insurers in many U.S. states often exceeded $10 million, a substantial barrier. This financial and regulatory complexity deters many potential competitors, preserving market share for established entities.

Kingsway benefits from established brand loyalty and deep distribution networks, primarily with credit unions and car dealerships, for its extended warranty products. Building comparable trust and reach requires new entrants to invest heavily in marketing and relationship building, a process that can take years and millions of dollars. For example, the average cost to acquire a new customer in financial services can be substantial, often in the hundreds of dollars.

Economies of scale also play a crucial role, allowing Kingsway to operate with lower per-unit costs in underwriting and claims processing. In 2023, many large insurers maintained operating expense ratios below 20%, a level difficult for new, smaller entrants to match. This cost advantage makes it challenging for newcomers to compete on price effectively.

Technological sophistication, including advanced data analytics and robust IT infrastructure, further elevates the barrier to entry. Companies like Kingsway leverage extensive data for risk assessment, a capability requiring significant investment in technology and talent. The global InsurTech market's projected growth to over $60 billion in 2024 underscores the competitive technological landscape new entrants must navigate, including substantial spending on cybersecurity and data compliance.

Porter's Five Forces Analysis Data Sources

Our Kingsway Financial Services Porter's Five Forces analysis is built upon a foundation of comprehensive data, including their annual financial reports, investor relations materials, and industry-specific market research from reputable firms like IBISWorld and S&P Global Market Intelligence.