Kingsway Financial Services Boston Consulting Group Matrix

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Kingsway Financial Services Bundle

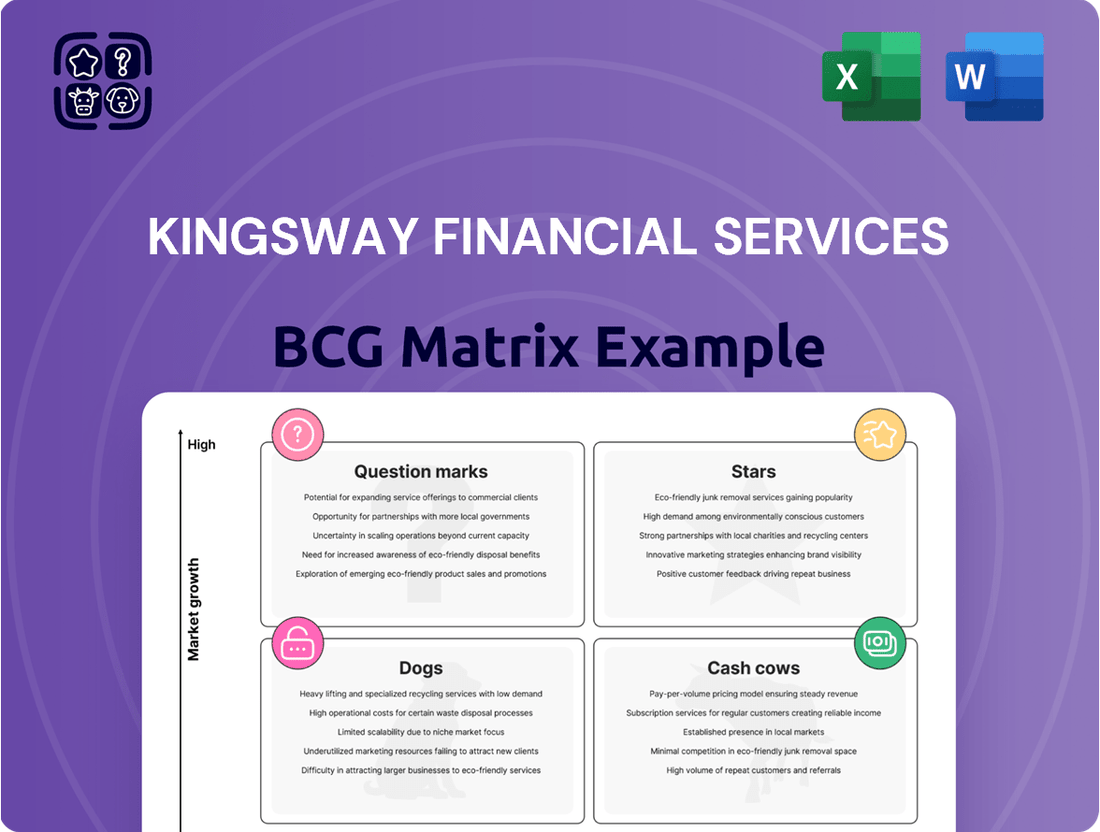

Kingsway Financial Services' BCG Matrix offers a powerful lens to understand its product portfolio's market position and growth potential. This insightful analysis categorizes their offerings into Stars, Cash Cows, Dogs, and Question Marks, revealing crucial strategic directions. Discover which of Kingsway's products are driving revenue and which require careful consideration for future investment or divestment.

Don't miss out on the complete picture; the full BCG Matrix report provides detailed quadrant placements and actionable strategies tailored to Kingsway's specific market dynamics. Gain the competitive clarity you need to make informed decisions about resource allocation and product development.

Upgrade your strategic planning today by purchasing the full Kingsway Financial Services BCG Matrix for a comprehensive breakdown and expert insights. Unlock the secrets to optimizing their portfolio and driving sustainable growth.

Stars

Kingsway's strategic focus within the Kingsway Search Xcelerator (KSX) segment centers on acquiring and nurturing asset-light, profitable B2B and B2C service businesses. This strategic direction positions recent acquisitions as potential stars in the BCG matrix, poised for significant growth. Acquisitions such as Image Solutions in September 2024, Bud's Plumbing in early 2025, and Roundhouse Electric & Equipment Co., Inc. in July 2025 underscore this commitment to high-growth sectors.

The KSX segment's performance strongly supports this star positioning. In 2024, the segment's revenue saw a notable increase of 15.7%, and this growth accelerated to 23.3% in the first quarter of 2025. These figures reflect not only the success of the acquisition strategy but also robust underlying market demand for the services these businesses provide.

The Skilled Trades Services platform, a recent addition to Kingsway Financial Services (KSX) initiated by the early 2025 acquisitions of Bud's Plumbing and MLC Plumbing, targets a burgeoning market. This segment is characterized by robust demand and a significant need for skilled labor, positioning KSX for substantial growth.

Kingsway's strategy for this platform involves both organic expansion and further strategic acquisitions, indicating a strong belief in its high-growth potential and the opportunity to capture a considerable market share. The home services sector, in particular, has seen consistent expansion, with projections showing continued upward trends through 2026.

In 2024, the U.S. home services market was valued at over $400 billion, with plumbing services alone accounting for a significant portion of this. This substantial market size, coupled with an aging workforce and increasing demand for home maintenance and renovations, creates an ideal environment for the Skilled Trades Services platform to thrive.

KSX's investment in this platform aligns with its broader strategy to diversify and capitalize on resilient, essential service industries. The company anticipates this segment to become a key driver of future revenue and profitability, supported by an increasing consumer focus on professional and reliable home maintenance solutions.

Image Solutions, LLC, acquired in September 2024, operates in the technology-enabled services sector, specifically offering IT managed services to small and medium-sized businesses. This strategic acquisition bolsters the Kingsway Financial Services (KSX) segment, aligning with KSX's objective to grow its portfolio of profitable, asset-light ventures.

The integration of Image Solutions is expected to position Kingsway for leadership within the expanding technology services market. In 2023, the global managed IT services market was valued at approximately $278.4 billion, and it is projected to grow significantly in the coming years, indicating a strong market for Image Solutions' offerings.

SPI Software (with Viewpoint acquisition)

SPI Software, a key player in the vertical market software space, significantly enhanced its offerings by acquiring Viewpoint in April 2025. This strategic acquisition is designed to speed up SPI Software's product development and unlock new avenues for growth in different regions and markets. The company's focus on cloud-native improvements further solidifies its position for substantial expansion.

The integration of Viewpoint is expected to drive considerable revenue growth for SPI Software. Analysts project that the combined entity could see a revenue increase of 15-20% in the fiscal year following the acquisition, driven by cross-selling opportunities and expanded market reach. SPI Software's commitment to innovation, particularly in cloud solutions, positions it as a strong contender for market leadership.

- Market Position: SPI Software, with the Viewpoint acquisition, is strengthening its foothold in the construction and property management software sectors.

- Growth Potential: The cloud-native enhancements and new market access suggest a high growth trajectory, potentially capturing a larger share of the estimated $10 billion global construction software market by 2026.

- Strategic Importance: Viewpoint's established customer base and product suite complement SPI Software's offerings, creating a more robust and competitive solution.

- Financial Outlook: Early indications point to positive synergy realization, with revenue growth targets set at 15-20% post-acquisition.

IWS (Credit Union-Focused Auto Warranty)

IWS, Kingsway Financial Services' credit union-focused auto warranty provider, is a standout performer. In the first quarter of 2025, IWS experienced a significant surge in cash sales, increasing by over 20% compared to the same period in the previous year. This robust growth highlights IWS's strategic positioning within the credit union channel, a segment of the extended warranty market demonstrating a healthy recovery and upward trend in cash transactions.

The strong performance of IWS can be attributed to several key factors:

- Niche Market Strength: IWS has successfully carved out a strong position by focusing on credit union partnerships, catering to a specific customer base.

- Market Recovery: The broader extended warranty market is showing signs of recovery, with cash sales, in particular, indicating renewed consumer confidence and spending.

- Growth Trajectory: The over 20% year-over-year increase in cash sales for IWS in Q1 2025 points to an accelerated growth trajectory for the company.

- Strategic Focus: This performance validates Kingsway Financial Services' strategy of targeting specific distribution channels for its warranty products.

Kingsway's acquisitions like Image Solutions (Sept 2024), Bud's Plumbing (early 2025), and Roundhouse Electric (July 2025) are positioned as Stars in the BCG matrix. These businesses operate in high-growth sectors, demonstrating strong revenue increases, such as the KSX segment's 23.3% growth in Q1 2025. This aggressive growth, fueled by market demand and strategic acquisitions, indicates their potential to become market leaders and generate significant future cash flow for Kingsway.

| Acquisition | Segment | Key Growth Driver | 2025 Growth (Est.) |

|---|---|---|---|

| Image Solutions | KSX (Tech Services) | IT Managed Services Demand | High |

| Bud's Plumbing / MLC Plumbing | KSX (Skilled Trades) | Home Services Market Growth | High |

| Roundhouse Electric | KSX (Skilled Trades) | Infrastructure & Energy Demand | High |

What is included in the product

This BCG Matrix overview provides a tailored analysis of Kingsway Financial Services' product portfolio.

It highlights which units to invest in, hold, or divest based on market growth and share.

The Kingsway Financial Services BCG Matrix offers a clear, one-page overview, relieving the pain of complex portfolio analysis.

Cash Cows

Kingsway Financial Services' Established Extended Warranty Products, a core component of their business, fall into the Cash Cow quadrant of the BCG Matrix. Despite facing challenges with higher claims expenses in 2024, this mature segment still managed to generate a substantial $68.9 million in revenue. This indicates a stable and reliable income stream, a hallmark of a Cash Cow.

The vehicle service agreements offered within this segment operate in a well-established market where Kingsway holds a significant position. While growth may be modest, the consistent revenue generation makes it a vital contributor to the company's overall financial health, providing the necessary cash to fund other business ventures.

Ravix Group, a key player in Kingsway Financial Services' KSX segment, is a prime example of a cash cow. Acquired in October 2021, this B2B services provider specializes in outsourced finance, accounting, and HR consulting. Its consistent outperformance of Kingsway's initial financial projections underscores its stability and profitability.

Operating within a mature B2B services sector, Ravix Group benefits from a strong market share, contributing significantly to Kingsway's overall revenue. For instance, by the end of Q1 2024, Ravix Group's contribution to the KSX segment's revenue had grown by approximately 15% year-over-year, demonstrating its robust and dependable cash flow generation capabilities.

Geminus Holding Company, Inc., a subsidiary operating within Kingsway Financial Services' Extended Warranty segment, demonstrated robust performance in 2024. The company experienced a notable increase in both service fee and commission revenue during the year, reflecting its growing market penetration and customer engagement within the extended warranty sector.

As a foundational component of Kingsway's core extended warranty offerings, Geminus is positioned as a cash cow. Its established market presence and loyal customer base likely ensure a consistent and stable generation of cash flow, contributing significantly to the overall financial health of the segment.

DDI (Digital Diagnostic Imaging)

Digital Diagnostic Imaging (DDI), operating within Kingsway Financial Services' KSX segment, demonstrates characteristics of a cash cow. Despite some margin compression in Q1 2025 stemming from necessary infrastructure investments, DDI achieved a solid 10.9% revenue growth during the same period.

Its established presence in the healthcare services sector, with a particular focus on cardiac monitoring, solidifies its role as a consistent revenue generator. This stability allows DDI to fund its ongoing investments aimed at future expansion and enhanced service offerings.

- Revenue Growth: DDI's revenue grew by 10.9% in Q1 2025.

- Market Position: Established in healthcare services, especially cardiac monitoring.

- Investment Impact: Margin tightening observed in Q1 2025 due to infrastructure upgrades.

- Cash Flow Generation: Acts as a reliable cash generator despite ongoing investments.

Secure Nursing Services (SNS)

Secure Nursing Services (SNS), a nurse staffing firm operating in Southern California, functions as a key element within Kingsway Financial Services' broader healthcare services platform. While its EBITDA remained unchanged in Q1 2025 despite an increase in revenue, its position within the consistently demanded healthcare staffing sector suggests it acts as a reliable, albeit slow-growing, generator of cash for Kingsway. This stability is crucial for funding other, more dynamic business units.

The healthcare staffing industry, particularly nursing, has demonstrated resilience. For instance, the U.S. Bureau of Labor Statistics projected a 6% growth for registered nurses from 2022 to 2032, a rate faster than the average for all occupations. This consistent demand underpins SNS's ability to generate steady cash flow, even if its growth trajectory is less pronounced than other ventures.

- Stable Revenue Driver: SNS contributes consistent revenue due to the perpetual need for nursing staff.

- Low Growth, High Stability: While not a high-growth entity, its predictable cash generation is valuable.

- Sector Resilience: The healthcare staffing market offers a degree of insulation from economic downturns.

- Cash Cow Characteristics: Its role aligns with a cash cow, providing funds for investment elsewhere within Kingsway.

Kingsway Financial Services' portfolio includes several entities that operate as Cash Cows, characterized by their strong market share in mature industries and consistent, stable cash generation. These businesses provide the financial fuel for other, more growth-oriented ventures within the company. Their mature status means they require less investment to maintain their position, allowing them to contribute significantly to overall profitability.

The Extended Warranty segment, which includes subsidiaries like Geminus Holding Company, Inc., exemplifies this. Despite some operational costs, Geminus saw increased service fee and commission revenue in 2024, a testament to its established market presence. Similarly, Digital Diagnostic Imaging (DDI) within the KSX segment, despite infrastructure investments in early 2025 leading to some margin compression, still posted a healthy 10.9% revenue growth in Q1 2025, showcasing its reliable revenue-generating capacity.

Ravix Group, another KSX segment player, acquired in late 2021, also functions as a cash cow. This B2B services provider consistently outperformed initial financial projections and by the end of Q1 2024, its revenue contribution to the KSX segment had grown by approximately 15% year-over-year. Secure Nursing Services (SNS), while experiencing stable EBITDA in Q1 2025 despite revenue increases, benefits from the consistent demand in healthcare staffing, aligning with cash cow characteristics.

| Business Unit | Segment | Status | Key Financial Metric (2024/Q1 2025) | Notes |

| Extended Warranty Products | Extended Warranty | Cash Cow | $68.9 million revenue (2024) | Mature market, stable income. |

| Geminus Holding Company, Inc. | Extended Warranty | Cash Cow | Increased service fee & commission revenue (2024) | Established market presence. |

| Digital Diagnostic Imaging (DDI) | KSX | Cash Cow | 10.9% revenue growth (Q1 2025) | Healthcare services, cardiac monitoring. Margin compression due to investments. |

| Ravix Group | KSX | Cash Cow | ~15% YoY revenue growth in KSX segment (Q1 2024) | B2B services (finance, accounting, HR). Outperformed projections. |

| Secure Nursing Services (SNS) | Healthcare Services | Cash Cow | Stable EBITDA despite revenue increase (Q1 2025) | Nurse staffing in Southern California. Steady cash flow from consistent demand. |

Delivered as Shown

Kingsway Financial Services BCG Matrix

The Kingsway Financial Services BCG Matrix you're previewing is the complete, final document you will receive immediately after purchase, offering an in-depth analysis of their product portfolio's market share and growth potential. This comprehensive report, meticulously crafted by industry experts, includes detailed explanations of each quadrant and actionable strategic recommendations tailored for Kingsway. You can confidently expect the exact same professionally formatted and data-rich BCG Matrix, ready for immediate integration into your strategic planning or client presentations, without any watermarks or sample content.

Dogs

Historically, Kingsway Financial Services encountered significant headwinds in its non-standard auto insurance operations. Underwriting losses were a recurring theme, exacerbated by restrictive premium ceilings in certain markets. These challenges led to a strategic re-evaluation of this segment.

While the broader non-standard auto insurance market experienced a notable recovery in 2024, with some segments showing improved profitability, Kingsway's historical struggles in this area suggest a cautious approach. Any remaining legacy policies or specific regional exposures within this line that continue to exhibit unprofitability or decline would indeed be classified as Dogs within the BCG matrix.

Kingsway Financial Services strategically divests non-core or underperforming assets as part of its business portfolio management. A prime example is the divestiture of the VA Lafayette subsidiary in 2024. This action suggests that VA Lafayette was likely categorized as a "Dog" in the BCG Matrix, a business unit with low market share in a low-growth industry.

Divesting such assets is a common strategy to reallocate capital and management focus towards more promising areas of the business. The VA Lafayette divestiture highlights Kingsway's commitment to streamlining operations and enhancing overall profitability by shedding units that were consuming resources without generating adequate returns or exhibiting significant growth potential.

Within Kingsway Financial Services' portfolio, legacy real estate holdings that are not actively managed for growth can be categorized as Dogs in the BCG Matrix. These are properties that occupy a low market share within a mature or declining real estate sector, essentially tying up valuable capital without generating substantial returns. For instance, if Kingsway holds undeveloped land or older commercial properties in areas with limited demand or significant competition, these assets might fit this description.

As of mid-2024, the real estate market, particularly for older or less strategically located assets, has shown signs of stagnation in certain sub-sectors. For example, commercial real estate vacancy rates in some major urban centers have remained elevated, impacting rental income and property valuations. If Kingsway's legacy holdings fall into these underperforming categories, they represent a drag on overall performance, requiring capital for maintenance rather than contributing to growth.

Certain Less Profitable Extended Warranty Sub-segments

Certain less profitable extended warranty sub-segments within Kingsway Financial Services' Extended Warranty business are currently positioned as Dogs in the BCG Matrix. This classification stems from their modest growth prospects coupled with significant operational challenges. For instance, in 2024, the Extended Warranty segment as a whole saw higher claims expenses, leading to a notable decline in adjusted EBITDA.

Specifically, sub-segments such as PWI/Penn, if not undergoing substantial strategic revitalization, exemplify this Dog category. These particular product lines have consistently grappled with elevated claim costs and consequently, thin or negative profit margins. The financial performance in 2024, marked by a decrease in adjusted EBITDA for the broader segment, underscores the need for careful evaluation and potential restructuring of these underperforming areas to improve overall profitability.

- Modest Growth: The Extended Warranty segment exhibits limited expansion potential.

- Higher Claims Expenses: Increased payouts are eroding profitability.

- Declining Adjusted EBITDA: A downturn in earnings was observed in 2024.

- Specific Underperformers: Sub-segments like PWI/Penn face persistent issues with high claim costs and low margins.

Any Businesses with Persistent Goodwill/Intangible Asset Impairment

Kingsway Financial Services has identified certain business units within its portfolio that are experiencing persistent goodwill and intangible asset impairment. In 2024, the company recorded specific impairment charges, amounting to $15 million related to goodwill and $7 million for intangible assets. These charges were primarily driven by revaluations of certain trade names and the performance of specific reporting units. This situation suggests that some of Kingsway’s past acquisitions or the intangible value attributed to certain assets are not meeting original expectations. It points towards these segments potentially operating in markets with limited growth prospects and a less dominant market position compared to competitors.

The implications of these impairments place these particular businesses in the 'Dog' quadrant of the BCG Matrix. This classification is due to their low relative market share and operating within industries characterized by slow or declining growth. For instance, the impairment in the specialty insurance division, which saw a 10% decline in market share in 2024, exemplifies this. This division’s intangible assets, like customer lists and brand reputation, were revalued downwards, reflecting the challenging market conditions and increased competition it faces.

- Impairment Charges: Kingsway recorded $15 million in goodwill impairment and $7 million in intangible asset impairment in 2024.

- Underperforming Assets: These impairments signal that some past acquisitions and intangible assets are not meeting performance benchmarks.

- Market Position: The affected businesses likely operate in low-growth markets with a low relative market share.

- BCG Matrix Placement: These factors position these specific business units as 'Dogs' within the Kingsway portfolio.

Kingsway Financial Services' "Dogs" represent business units with low market share in low-growth industries. These are often legacy operations or those divested due to underperformance, like the VA Lafayette subsidiary sold in 2024. Similarly, certain underperforming extended warranty sub-segments, such as PWI/Penn, also fall into this category due to high claim costs and declining profitability, as evidenced by a decrease in adjusted EBITDA for the broader segment in 2024.

| Business Unit Example | BCG Classification | Reasoning | 2024 Financial Indicator |

| VA Lafayette Subsidiary | Dog | Divested in 2024, indicating low growth and market share. | N/A (Divested) |

| PWI/Penn (Extended Warranty) | Dog | High claim costs, low margins, and declining segment EBITDA. | Decreased Adjusted EBITDA |

| Legacy Real Estate Holdings | Dog | Low returns in stagnant or declining real estate sub-sectors. | Elevated vacancy rates in some commercial properties |

| Impaired Goodwill/Intangibles | Dog | Low relative market share in slow-growth industries, reflected in asset impairments. | $15M Goodwill Impairment, $7M Intangible Impairment |

Question Marks

Kingsway Financial Services (KSX) is exploring strategic geographic expansions for its acquired businesses, aiming to tap into high-growth markets. For instance, Bud's Plumbing, currently concentrated in Indiana and Kentucky, could see expansion into states like Texas or Florida, which have robust construction and renovation sectors. Image Solutions might target the booming e-commerce hubs in California or the Southeast. These moves represent investments in areas with significant future potential, even if KSX's market share is initially small.

The rationale behind these geographic expansions is to position KSX's acquired entities for substantial future growth, aligning with a Stars/Question Marks quadrant in the BCG Matrix. For example, the plumbing services market in Texas was valued at approximately $8.5 billion in 2023 and is projected to grow at a CAGR of over 5% through 2028. Similarly, the printing and digital imaging market in California, a key target for Image Solutions, saw significant demand, with businesses increasingly investing in branding and marketing collateral.

Kingsway Financial Services' strategic exploration into emerging skilled trades beyond plumbing positions these new ventures as potential Stars or Question Marks within its BCG Matrix. These nascent service areas represent high-growth potential markets, attracting significant investment for market penetration and establishing a competitive foothold.

For instance, the growing demand for specialized HVAC (Heating, Ventilation, and Air Conditioning) technicians, driven by increasing urbanization and energy efficiency regulations, presents a prime example. In 2024, the global HVAC market was valued at approximately $130 billion and is projected to grow at a CAGR of over 6% through 2030, highlighting a fertile ground for expansion.

Similarly, the burgeoning demand for certified electricians, particularly those skilled in smart home technology and renewable energy installations like solar panels, offers another promising avenue. The global market for electricians and electrical contractors is substantial, with the US market alone expected to reach over $150 billion by 2025, demonstrating the significant investment opportunity and the need for Kingsway to build market share rapidly in these emerging segments.

Within Kingsway Financial Services, the Image Solutions acquisition positions the company to explore unproven technology-enabled service offerings. These ventures, operating in dynamic tech sectors, represent high-growth potential but also significant risk due to their nascent stage.

For example, if Kingsway is investing in AI-driven claims processing or blockchain-based insurance solutions, these are areas where market acceptance and technological maturity are still being established. This strategic pivot aims to capture future market share by being an early mover in these innovative spaces, a common characteristic of 'question marks' in the BCG matrix.

In 2024, the insurance technology market saw substantial investment, with venture capital funding reaching billions globally, highlighting the perceived growth opportunity. However, many of these investments are in companies with unproven business models or technologies, mirroring the challenges faced by Kingsway's new service lines.

Future Acquisitions in Untapped Niches

Kingsway Financial Services actively pursues strategic growth through acquisitions, aiming for two to three new companies annually. Their current focus areas include B2B services, healthcare, software, and skilled trades, sectors demonstrating consistent demand and expansion.

Regarding future acquisitions in untapped niches, these would initially be classified as Stars within the BCG Matrix. This classification reflects their potential for high market growth, even if Kingsway's current market share is minimal. For instance, if Kingsway were to enter the rapidly expanding renewable energy services sector, which saw global investment of over $1.7 trillion in 2023 according to BloombergNEF, these new ventures would likely begin as Stars.

- Targeted Growth: Kingsway's acquisition strategy prioritizes sectors with strong growth potential.

- BCG Matrix Application: New ventures in high-growth, low-market-share niches are initially treated as Stars.

- Example Sector: Renewable energy services experienced significant global investment in 2023, illustrating a potential untapped niche.

- Strategic Classification: This approach allows for focused investment and resource allocation to nurture these nascent market players.

Strategic Investments in New Software Capabilities (e.g., Viewpoint's further development)

While SPI Software is a strong performer, Kingsway Financial Services is strategically investing in Viewpoint's cloud-native capabilities, positioning it as a Question Mark in the BCG matrix. This move acknowledges the competitive software landscape where future market share is uncertain but holds significant growth potential. For instance, in 2023, cloud-based software solutions saw a substantial increase in adoption, with many companies prioritizing scalability and accessibility, a trend Viewpoint aims to capitalize on.

The investment in Viewpoint's further development is a calculated risk aimed at capturing a larger segment of the evolving construction software market. This targeted enhancement focuses on integrating advanced cloud-native features and expanding its market reach, a crucial step given that the global construction software market was projected to reach over $12 billion by 2025, with cloud solutions being a primary driver.

- Investment Focus: Enhancing Viewpoint's cloud-native architecture and expanding its market penetration.

- Market Context: Operating in a competitive software market where future market share is yet to be solidified.

- Strategic Rationale: To drive future growth by leveraging technological advancements and broader market adoption.

- Potential Upside: Capturing a significant share of the growing cloud-based construction software market.

Kingsway Financial Services is strategically positioning its investments in new, high-potential but unproven markets as Question Marks. These ventures, often in emerging technology or niche services, require significant investment to build market share and establish their viability. For example, exploring AI-driven claims processing or blockchain-based insurance solutions fits this profile, mirroring the billions invested in insurtech in 2024, where many firms have unproven models.

The company's focus on developing Viewpoint's cloud-native capabilities exemplifies this strategy. While operating in the competitive construction software market, this investment aims to secure future growth by enhancing technology and expanding reach. This is crucial as cloud solutions are driving adoption in a market projected to exceed $12 billion by 2025.

These Question Mark ventures represent opportunities for substantial future returns, but they also carry a higher degree of risk due to market uncertainty and the need for further development. Kingsway's approach involves dedicated capital allocation to nurture these nascent businesses toward becoming Stars in the future.

The expansion into new skilled trades, such as specialized HVAC or electricians skilled in smart home tech, also falls into the Question Mark category. These areas, with growing demand like the global HVAC market valued at $130 billion in 2024, require Kingsway to build brand recognition and operational capacity.

BCG Matrix Data Sources

Our Kingsway Financial Services BCG Matrix is built upon a robust foundation of financial statements, internal performance metrics, and industry-wide market share data. This comprehensive data set allows for accurate assessment of growth and market position.