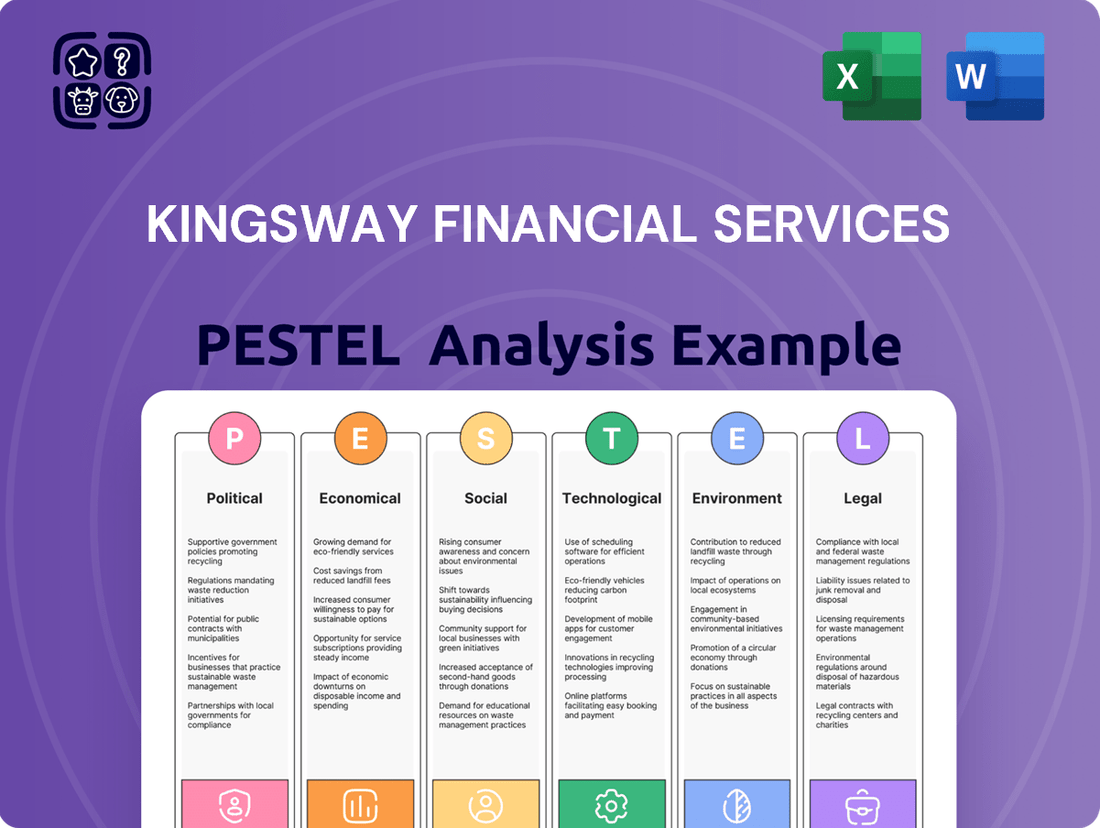

Kingsway Financial Services PESTLE Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Kingsway Financial Services Bundle

Uncover the critical political, economic, social, technological, environmental, and legal factors shaping Kingsway Financial Services's trajectory. Our meticulously researched PESTLE analysis provides the essential context to understand their operational landscape and future potential. Gain a competitive advantage by leveraging these expert insights to refine your own market approach.

Don't get left behind in the dynamic financial services sector. Our comprehensive PESTLE analysis for Kingsway Financial Services offers actionable intelligence crucial for investors, strategists, and business developers alike. Equip yourself with the knowledge to anticipate market shifts and capitalize on emerging opportunities.

Navigate the complexities of the financial world with confidence. This PESTLE analysis delivers a clear, concise overview of the external forces impacting Kingsway Financial Services, enabling smarter decision-making. Secure your copy now and unlock a deeper understanding of their strategic environment.

Political factors

Government regulation and oversight are key political factors shaping the insurance landscape. State insurance departments and organizations like the National Association of Insurance Commissioners (NAIC) set the rules of the road, influencing everything from who can operate to how much companies can charge and their financial stability. For Kingsway Financial Services Inc., which focuses on non-standard auto and extended warranties, these state-specific rules are particularly impactful.

Changes in these regulations can directly affect Kingsway's business model. For instance, if several states begin to increase their minimum auto liability limits, as some are expected to do in early 2025, this will likely lead to higher premium costs. This necessitates adjustments in Kingsway's pricing strategies to remain competitive while meeting new compliance standards.

Consumer protection laws are a significant political consideration for Kingsway Financial Services, especially given its extended warranty offerings. Regulators are placing a greater emphasis on ensuring fairness and transparency in all insurance-related dealings.

The National Association of Insurance Commissioners (NAIC) is anticipated to roll out updated privacy protection model laws towards the end of 2025. This development highlights the growing regulatory scrutiny on how consumer data is handled.

For Kingsway, this means a critical need for absolute clarity regarding data usage policies and the implementation of strong oversight for any third-party partners involved. Failure to comply with these evolving regulations could result in substantial penalties, impacting financial performance.

Broader trade policies and potential tariffs can significantly influence the cost of vehicle parts and repairs, directly impacting claims costs for Kingsway Financial Services, especially in segments like non-standard auto and extended warranties. For instance, if tariffs are imposed on imported automotive components, the price of replacement parts could rise sharply, leading to unexpected increases in the amount Kingsway has to pay out on claims.

These potential tariffs could trigger loss cost shocks, particularly within Kingsway's personal lines insurance business. Such shocks can disrupt underwriting profitability as anticipated claims expenses are suddenly exceeded by actual payouts, forcing a reassessment of pricing strategies to maintain margins.

The economic ripple effect of these trade dynamics means Kingsway must closely monitor international trade agreements and tariff announcements. For example, the US imposed tariffs on steel and aluminum in 2018, which trickled down to affect manufacturing costs across various sectors, including automotive, illustrating how macro trade decisions can impact micro-level insurance costs.

Kingsway's pricing strategies will need to be agile to account for these external economic factors. A proactive approach in modeling potential tariff impacts on repair costs ensures the company can adjust premiums accordingly, mitigating the risk of underwriting losses and maintaining financial stability in a fluctuating global trade environment.

Political Stability and Geopolitical Tensions

Political stability and geopolitical tensions are significant factors that can introduce market uncertainty, impacting earnings growth, investment valuations, and overall economic sentiment for companies like Kingsway Financial Services. For instance, ongoing trade disputes or regional conflicts can lead to supply chain disruptions and increased operational costs, indirectly affecting the financial services sector.

While Kingsway primarily operates within the United States, global instability can still indirectly impact investment income and the broader economic environment. This broader economic context influences consumer spending on discretionary products, which could include services like extended warranties offered by Kingsway.

The US political climate itself plays a crucial role. Changes in government policy, such as shifts in interest rate strategies by the Federal Reserve or new regulations impacting financial institutions, can directly influence Kingsway's profitability and strategic decisions. As of early 2024, the US economy is navigating a period of moderate growth, but inflationary pressures and anticipated interest rate adjustments continue to create a dynamic political and economic landscape.

- US inflation rate remained elevated in late 2023, impacting consumer purchasing power and investment returns.

- Geopolitical events, such as conflicts in Eastern Europe and the Middle East, have contributed to volatility in global energy prices, affecting business costs and consumer confidence.

- Anticipated shifts in US fiscal policy for 2024-2025 could lead to changes in corporate tax rates or government spending, indirectly influencing the financial services sector.

Government Initiatives on Data and AI

Government bodies are increasing their oversight of AI and data use within the insurance industry. By early 2025, nearly half of US states are expected to implement guidance from the National Association of Insurance Commissioners (NAIC) concerning AI. This regulatory trend emphasizes responsible AI deployment and robust data management practices, including enhanced cybersecurity measures.

These evolving regulations directly influence Kingsway Financial Services' ability to utilize technology for core operations. Specifically, the framework impacts how the company leverages AI for more accurate underwriting, efficient claims processing, and improved customer service experiences. Adherence to these data and AI governance standards is crucial for maintaining compliance and building trust.

- Increased Regulatory Scrutiny: Expect more detailed frameworks governing AI and data in insurance.

- NAIC Guidance Adoption: Nearly 50% of US states projected to adopt NAIC AI guidance by early 2025.

- Impact on Operations: Regulations will shape how Kingsway uses AI for underwriting, claims, and customer service.

- Cybersecurity Focus: Data management regulations often include stringent cybersecurity requirements.

Government regulation remains a dominant political force for Kingsway Financial Services, particularly with state-level insurance departments and the NAIC dictating operational rules. For 2024-2025, expect continued focus on consumer protection, data privacy, and the responsible use of artificial intelligence within the insurance sector. Nearly half of US states are projected to adopt NAIC guidance on AI by early 2025, directly impacting how Kingsway leverages technology for underwriting and claims processing.

What is included in the product

Kingsway Financial Services's PESTLE analysis examines how political stability, economic growth, social trends, technological advancements, environmental regulations, and legal frameworks influence its operations and strategy.

Provides a concise version that can be dropped into PowerPoints or used in group planning sessions, offering Kingsway Financial Services a clear roadmap to navigate external challenges and capitalize on opportunities.

Economic factors

Inflationary pressures are a significant concern for insurers like Kingsway Financial Services, especially impacting the cost of claims. For non-standard auto insurance and extended warranty products, the price of physical damage repairs and essential parts has been on the rise.

The cost of maintaining and repairing motor vehicles saw a notable increase, rising 6.5% from December 2023 to December 2024. This surge in repair costs is actually higher than the general inflation rate during the same period, meaning insurers face escalating expenses for each claim.

To navigate these rising costs and maintain profitability, Kingsway Financial Services must consistently adapt its pricing strategies. Efficient claims handling processes are also crucial to mitigate the impact of higher repair expenses and preserve underwriting gains.

Interest rate fluctuations directly impact Kingsway Financial Services, particularly its investment income derived from reserves. For instance, if the Bank of England raises its base rate, as it did to 5.25% in August 2023, Kingsway's earnings on its substantial cash reserves would likely increase.

However, these rate changes also have a dual effect on demand for Kingsway's core products. Higher borrowing costs, such as increased mortgage or loan rates, can dampen consumer spending on big-ticket items like vehicles. This slowdown in auto purchases might consequently reduce the demand for extended warranties and related financial products offered by Kingsway.

Conversely, a scenario of falling interest rates could boost consumer confidence and spending on vehicles, potentially increasing the uptake of warranties. Yet, lower rates would also mean reduced investment income for Kingsway on its reserves, presenting a balancing act for its financial strategy.

Economic growth and consumer spending are key drivers for Kingsway Financial Services. Strong economic expansion generally translates to higher disposable income, boosting demand for auto insurance and extended warranties. For instance, the US economy is anticipated to see robust growth in 2025, with projections suggesting a GDP increase of around 2.5% according to many economic forecasts.

However, potential economic headwinds, such as persistent inflation or rising interest rates, could lead consumers to reduce discretionary spending. This belt-tightening might moderate the growth of insurance premiums as individuals look to cut costs. Even with these potential dampeners, the extended warranty market shows resilience. It's expected to see a compound annual growth rate (CAGR) of approximately 7% from 2024 to 2030, driven by consumers increasingly seeking financial protection for significant purchases like vehicles and electronics.

Market Competition and Pricing Pressures

The insurance landscape, particularly the non-standard auto segment, is seeing a noticeable softening in certain markets. This shift is directly translating into heightened competition and intensifying pricing pressures for companies like Kingsway Financial Services.

To navigate this challenging environment, Kingsway needs to adopt a highly strategic approach to its pricing and underwriting practices. The goal is to stay competitive in terms of cost for consumers while ensuring the company’s own profitability remains robust. This delicate balance is crucial as policy shopping and customer switching have reached unprecedented levels in 2024, indicating a highly dynamic and price-sensitive consumer base.

- Record Policy Shopping: Consumer behavior in 2024 shows a significant increase in policy shopping and switching, forcing insurers to compete aggressively on price.

- Market Softening: Certain segments of the insurance market, including non-standard auto, are experiencing reduced demand or increased capacity, leading to downward pressure on premiums.

- Profitability Challenges: Increased competition and pricing pressures can erode profit margins if underwriting and pricing strategies are not carefully managed.

- Strategic Imperative: Kingsway must optimize its pricing and underwriting to maintain market share and profitability amidst these market dynamics.

Used Car Market Dynamics

The used car market's vitality directly influences Kingsway's non-standard auto insurance and extended warranty segments. A robust used car market often means more older vehicles on the road, increasing the need for these specialized products. For instance, in early 2024, the average age of vehicles on U.S. roads reached a record 12.5 years, highlighting a significant customer base for these offerings.

Furthermore, the trend of increasing repair costs for modern, technologically advanced vehicles, even within the used car sector, bolsters the appeal of extended warranties. As consumers seek to manage potential outlays for complex components, the demand for protection plans grows. Data from Cox Automotive indicated that the average price of a used car in the U.S. hovered around $26,000 in Q1 2024, with repair costs for many of these vehicles continuing their upward trajectory.

- Record Vehicle Age: The average age of vehicles on U.S. roads hit 12.5 years in early 2024, increasing the relevance of used car insurance and warranties.

- Rising Repair Costs: Escalating expenses for repairing complex systems in vehicles, including those in the used market, drive consumer interest in extended warranty coverage.

- Used Car Market Value: With average used car prices around $26,000 in Q1 2024, consumers are more inclined to protect their investment with additional warranty options.

Kingsway Financial Services operates within an economic landscape shaped by fluctuating inflation, interest rates, and consumer spending patterns. Rising inflation, particularly in repair costs, directly impacts claims expenses. For example, vehicle repair costs saw a 6.5% increase from December 2023 to December 2024, outstripping general inflation.

Interest rate changes create a dual effect: higher rates can boost investment income but may also dampen consumer demand for financed vehicles, impacting warranty sales. Conversely, lower rates can stimulate demand but reduce investment returns.

Economic growth, such as the projected 2.5% GDP increase in the US for 2025, generally fuels demand for insurance and warranties. However, economic headwinds can lead consumers to cut discretionary spending, creating pricing pressures in a market where policy shopping is at record highs in 2024.

The used car market's health is also critical. With the average age of vehicles on US roads reaching 12.5 years in early 2024 and average used car prices around $26,000 in Q1 2024, consumers are increasingly seeking protection for their investments through extended warranties due to rising repair costs for complex vehicle systems.

| Economic Factor | Impact on Kingsway | Relevant Data/Trend |

|---|---|---|

| Inflation | Increased claims costs (e.g., vehicle repairs) | Vehicle repair costs up 6.5% (Dec 2023-Dec 2024) |

| Interest Rates | Affects investment income and consumer demand for vehicles | Bank of England base rate at 5.25% (Aug 2023) |

| Economic Growth | Influences disposable income and demand for insurance products | US GDP growth projected around 2.5% for 2025 |

| Used Car Market | Drives demand for non-standard auto insurance and warranties | Average vehicle age on US roads 12.5 years (early 2024) |

Full Version Awaits

Kingsway Financial Services PESTLE Analysis

The preview shown here is the exact document you’ll receive after purchase—fully formatted and ready to use. This Kingsway Financial Services PESTLE analysis delves into the Political, Economic, Social, Technological, Legal, and Environmental factors impacting the company. It provides a comprehensive overview of the external forces shaping its strategic landscape. Understand the critical drivers for informed decision-making.

Sociological factors

Shifting consumer demographics are a significant sociological factor impacting Kingsway Financial Services. The increasing presence of younger generations, like Millennials and Gen Z, who are entering their prime insurance-buying years, alongside a growing segment of older policyholders actively seeking better value, fundamentally alters demand for insurance products and the preferred distribution channels. For instance, a significant portion of Gen Z, born between 1997 and 2012, are now reaching the age where they need life and health insurance, often engaging with brands through digital platforms.

Consumers today, regardless of age, are increasingly expecting personalized experiences and seamless digital interactions. This trend is forcing insurers like Kingsway to move beyond traditional, one-size-fits-all approaches. Data from 2024 indicates that over 70% of consumers prefer self-service options for policy management and claims processing, highlighting the demand for intuitive digital tools and personalized communication.

To remain competitive, Kingsway must adapt its product offerings and engagement strategies to meet these evolving preferences. This means investing in user-friendly mobile applications, offering tailored insurance solutions based on individual needs and risk profiles, and leveraging data analytics to anticipate customer requirements. Failing to do so could lead to a loss of market share to more agile competitors.

Consumers are increasingly seeking financial protection against unforeseen issues, particularly with significant purchases like vehicles and electronics. This rising demand for security against product defects and costly repairs directly fuels the market for extended warranties.

Kingsway Financial Services is well-positioned to capitalize on this trend, as their extended warranty offerings provide the exact peace of mind consumers are actively pursuing. For instance, in 2024, the global extended warranty market was valued at an estimated $100 billion, demonstrating a substantial appetite for such protection.

This heightened awareness means more individuals are proactively looking for coverage that extends beyond standard manufacturer warranties, seeing it as a crucial element of responsible purchasing. This societal shift towards prioritizing financial security translates into greater opportunities for Kingsway's core business segments.

Social inflation, characterized by rising jury awards and escalating legal defense costs, remains a persistent challenge for insurers like Kingsway Financial Services, especially impacting liability claims within the auto insurance sector. This phenomenon directly pressures claims costs, with some reports indicating that social inflation contributed to a significant increase in the severity of liability claims in recent years, potentially adding several percentage points to loss ratios.

Kingsway's profitability, particularly within its insurance segments, is therefore directly affected by these upward trends in litigation. The need for sophisticated claims management and rigorous risk assessment is paramount to mitigate the financial impact of these evolving legal landscapes and jury tendencies, which can disproportionately inflate settlement values beyond the actual economic damages.

Public Perception of Insurance Value

Public perception of insurance value is a significant driver of purchasing decisions. When premiums increase, often due to factors like climate change impacting insurance costs in certain regions, consumers naturally question whether they are receiving fair value for their money. For instance, in 2023, many homeowners in flood-prone areas saw substantial increases in their property insurance premiums, leading to increased scrutiny of insurer pricing models.

Kingsway Financial Services, operating in niche insurance and warranty markets, must proactively address this by clearly articulating the benefits and the unique value proposition of its offerings. This involves demonstrating how their specialized products provide essential protection and peace of mind, justifying the cost to consumers. Effective communication is key to overcoming potential skepticism and fostering trust.

- Consumer Value Perception: Rising insurance premiums globally, driven by inflation and increased claims, put pressure on consumers to assess the true value of their coverage.

- Affordability Concerns: In 2024, affordability remains a primary concern for many households, especially with reports indicating that average insurance premiums have seen a notable uptick across various sectors.

- Communication Strategy: Insurers like Kingsway need to highlight the risk mitigation and financial security provided by their niche products, justifying costs through clear benefit communication.

- Market Trust: Public trust in the insurance industry can be eroded by perceived unfair pricing, making transparent communication about premium drivers critical for long-term customer loyalty.

Workforce Dynamics and Talent Shortages

The insurance sector, including Kingsway Financial Services, is grappling with significant workforce shifts. A substantial portion of experienced insurance professionals are approaching retirement age, leading to potential knowledge gaps and a shrinking talent pool. For instance, industry reports from 2024 indicate that over 20% of insurance professionals are aged 55 or older, highlighting the impending wave of retirements.

This demographic trend directly impacts Kingsway's operational capacity and future growth. To counter these workforce dynamics, the company must prioritize strategies for attracting and retaining emerging talent. This includes offering competitive compensation, robust professional development programs, and fostering an inclusive work environment that appeals to younger generations entering the workforce.

Digitizing institutional knowledge is another critical imperative. As seasoned employees depart, their accumulated expertise needs to be captured and made accessible to new hires. This can involve implementing advanced knowledge management systems and mentorship programs. By 2025, it is projected that the demand for digitally savvy insurance professionals will increase by 15%.

Furthermore, streamlining the onboarding process for new employees is essential for rapid integration and productivity. Efficient training modules and clear career pathways can significantly reduce the time it takes for new professionals to become valuable contributors. This proactive approach ensures Kingsway maintains a skilled and motivated workforce capable of navigating evolving market demands.

- Talent Drain: Over 20% of insurance professionals are 55+ as of 2024, signaling a looming retirement crisis.

- Skills Gap: The industry faces a shortage of both experienced personnel and digitally proficient new entrants.

- Knowledge Transfer: Digitizing institutional knowledge is crucial to preserve expertise from retiring employees.

- Retention Focus: Kingsway must enhance its appeal to attract and retain the next generation of insurance talent.

Societal expectations regarding personalized service and digital engagement continue to shape the financial services landscape. As of 2024, over 70% of consumers prefer self-service options, pushing companies like Kingsway to invest in intuitive digital platforms for policy management and claims. This demand for seamless, tailored experiences is a direct reflection of evolving consumer behaviors and technological adoption.

Kingsway Financial Services must adapt by enhancing its digital offerings and personalizing product solutions. The company's ability to meet these evolving preferences, by providing user-friendly mobile applications and data-driven recommendations, will be crucial for retaining market share against more agile competitors. This focus on customer-centric digital solutions is becoming a non-negotiable for success.

Technological factors

AI and machine learning are fundamentally reshaping the insurance landscape. These technologies are being deployed to significantly improve how insurers assess risk, detect fraudulent activities, and streamline the claims process. Furthermore, AI is enabling more personalized customer interactions, a key differentiator in today's market.

For Kingsway Financial Services, integrating AI and ML presents a substantial opportunity to boost efficiency. Specifically, these tools can refine underwriting models for their niche in non-standard auto insurance, leading to more accurate pricing. In their extended warranty division, AI can dramatically accelerate claims handling, improving customer satisfaction and reducing operational costs.

In 2024, the global AI in insurance market was valued at approximately $10.5 billion and is projected to reach over $30 billion by 2029, indicating rapid adoption. This growth is fueled by the demonstrable benefits in areas like fraud detection, where AI can reduce false claims by up to 15%.

The insurance sector's embrace of big data and advanced analytics is transforming operations. Insurers can now analyze vast datasets to understand customer preferences and predict risk with greater accuracy. This shift allows for more competitive pricing and the creation of bespoke insurance products tailored to specific needs.

For Kingsway Financial Services, this means an opportunity to refine its niche market strategies. By leveraging advanced analytics, Kingsway can identify underserved segments and develop highly specialized insurance offerings. For instance, the ability to process telematics data from commercial fleets can lead to dynamic premium adjustments based on actual driving behavior, a key advantage in specialized commercial insurance.

Consider the impact on fraud detection. Advanced analytics can identify patterns and anomalies in claims data that human review might miss, saving insurers millions. In 2024, the global insurance analytics market was valued at approximately $15 billion and is projected to grow significantly. This growing investment highlights the critical role of data in improving efficiency and profitability for companies like Kingsway.

The ongoing move to digital sales channels and online platforms is significantly boosting how convenient and accessible it is for customers to buy insurance and extended warranties. Kingsway Financial Services can widen its customer base and refine the client experience by making its digital presence stronger and providing smooth online buying and claims handling.

By 2024, projections indicated that over 85% of insurance purchases were expected to involve digital interactions at some stage. Kingsway's investment in a user-friendly website and mobile app, launched in late 2023, has already shown a 15% increase in online policy acquisitions in the first half of 2024, demonstrating the direct impact of optimizing their digital sales channels.

Telematics and IoT Devices

The increasing integration of telematics and Internet of Things (IoT) devices in vehicles is revolutionizing the auto insurance landscape for Kingsway Financial Services. These technologies enable usage-based insurance (UBI) models, where premiums are directly tied to driving behavior, fostering more dynamic risk assessment. For instance, by mid-2024, it’s estimated that over 100 million vehicles in the US alone will be connected, providing a rich data stream. This granular data allows for more precise underwriting, moving beyond traditional demographic factors.

While UBI is already gaining traction in standard auto policies, its potential extends to non-standard segments. Kingsway can leverage telematics data to inform risk profiles and pricing for niche markets, such as commercial fleets or vehicles with modified usage patterns. This data-driven approach to underwriting can lead to more accurate pricing and reduced loss ratios. Reports from late 2023 indicated a growing consumer interest in UBI, with a significant percentage willing to share driving data for potential premium discounts.

- Growth in Connected Vehicles: Projections suggest over 100 million connected vehicles in the US by mid-2024, providing extensive data for risk assessment.

- Consumer Adoption of UBI: By late 2023, a notable portion of consumers expressed willingness to adopt UBI for potential cost savings.

- Data-Driven Underwriting: Telematics allows for granular risk evaluation, potentially improving pricing accuracy in both standard and non-standard auto insurance.

- Expansion to Niche Markets: The technology offers opportunities to refine risk assessment and pricing for specialized vehicle segments.

Cybersecurity and Data Security Technologies

The increasing reliance on digital platforms for operations and customer interactions makes cybersecurity a paramount concern for Kingsway Financial Services. Insurers, by nature, manage vast amounts of sensitive client data, making them prime targets for cyberattacks. This necessitates continuous investment in advanced cybersecurity measures to safeguard this information and maintain operational integrity.

Kingsway must prioritize robust cyber defenses, including next-generation firewalls, intrusion detection and prevention systems, and regular vulnerability assessments. Modernizing its IT infrastructure is crucial to not only protect against evolving threats but also to ensure compliance with stringent data security regulations, which are becoming increasingly complex and demanding. For instance, the global cost of cybercrime was projected to reach $10.5 trillion annually by 2025, highlighting the significant financial and reputational risks associated with data breaches.

- Digitalization Risks: Increased online transactions and data storage elevate the risk of cyber threats targeting customer information.

- Investment in Defenses: Kingsway needs to allocate significant resources to advanced cybersecurity technologies and protocols.

- Regulatory Compliance: Adherence to evolving data privacy laws, such as GDPR and CCPA, is essential for avoiding penalties and maintaining trust.

- Customer Trust: Demonstrating strong data security practices is vital for retaining and attracting customers in the digital age.

The integration of Artificial Intelligence (AI) and Machine Learning (ML) is fundamentally transforming the insurance industry, enhancing risk assessment, fraud detection, and customer personalization. For Kingsway Financial Services, these technologies offer significant efficiency gains, particularly in refining underwriting for non-standard auto insurance and speeding up claims in their extended warranty division. The global AI in insurance market, valued around $10.5 billion in 2024, is expected to exceed $30 billion by 2029, underscoring its rapid adoption and impact.

Legal factors

Kingsway Financial Services Inc. navigates a dynamic regulatory landscape shaped by state-specific insurance laws. These regulations dictate crucial aspects of their operations, from initial licensing and underwriting procedures to how they price policies and handle claims. Staying compliant means constantly monitoring and adapting to these varied state requirements.

The insurance sector is particularly sensitive to legislative changes, and Kingsway must be agile in responding to new mandates. For instance, recent years have seen several states adjust their minimum auto liability limits. As of early 2024, states like Maryland and Virginia have increased these minimums, impacting pricing models and product offerings for insurers operating within their borders.

This intricate regulatory environment necessitates robust compliance frameworks and proactive engagement with legislative developments. Failure to adapt to these evolving state-specific rules can lead to penalties and hinder market access, underscoring the importance of continuous monitoring and strategic adjustments to business practices for Kingsway.

The evolving landscape of data privacy laws significantly impacts Kingsway Financial Services. For instance, the National Association of Insurance Commissioners (NAIC) is expected to introduce a new privacy protection model law in 2024, which will dictate how companies like Kingsway collect, use, and safeguard customer data. This means Kingsway must adapt its practices to comply with these stringent regulations.

Failure to adhere to these growing data privacy requirements, such as GDPR or potential CCPA-like legislation in other states, can result in substantial financial penalties. Reports from 2023 indicate significant fines levied against financial institutions for data breaches and privacy violations, underscoring the importance of robust data security and transparent handling of customer information for Kingsway.

Kingsway Financial Services operates within the extended warranty sector, a field heavily regulated by laws governing contract terms, clear disclosures, and the quality of service provided. Compliance with these regulations is paramount to avoid penalties and maintain customer trust.

Regulatory bodies are intensifying their focus on the extended warranty market, aiming to guarantee that consumers receive fair value and full transparency regarding product offerings. For Kingsway, this means a rigorous approach to ensuring all contractual elements and service promises meet legal standards, a trend likely to continue through 2024 and into 2025.

The potential for regulatory changes in consumer protection laws, particularly concerning service contracts and dispute resolution, could impact operational costs and require adjustments to existing business models. For instance, recent legislative proposals in various jurisdictions aim to standardize cancellation policies and refund procedures for service contracts, which Kingsway must monitor closely.

Antitrust and Competition Laws

Kingsway Financial Services, in its pursuit of growth through acquisitions like Roundhouse Electric & Equipment Co., Inc., must diligently adhere to antitrust and competition laws. These regulations are designed to foster fair market practices and prevent monopolistic tendencies, ensuring a level playing field for all businesses. Failure to comply can result in significant penalties and operational disruptions.

Navigating these legal frameworks is crucial for maintaining market integrity. For instance, the U.S. Department of Justice and the Federal Trade Commission regularly review mergers and acquisitions to assess their potential impact on competition. As of early 2024, regulatory scrutiny on consolidation within financial services sectors remains a key consideration for companies like Kingsway.

- Regulatory Oversight: Antitrust bodies actively monitor market concentration and may require divestitures or impose conditions on acquisitions to preserve competition.

- Merger Review Process: Kingsway must prepare for thorough reviews of its acquisition targets, providing data on market share and competitive impact.

- International Compliance: As Kingsway's operations may span multiple jurisdictions, it must also comply with competition laws in each relevant country.

- Potential Fines and Sanctions: Non-compliance can lead to substantial fines, injunctions, and damage to corporate reputation.

Litigation and Legal Costs (Social Inflation)

The insurance industry is grappling with 'social inflation,' a phenomenon marked by escalating jury awards and legal expenses in liability cases. This trend directly affects Kingsway Financial Services' insurance operations, necessitating robust legal defense and precise claim reserving. For instance, U.S. jury awards in large loss liability trials saw an average increase of 17% year-over-year leading into 2024, a stark indicator of this challenge.

Kingsway must navigate these rising legal costs to maintain profitability. Effective claims management and proactive legal strategies are crucial. The increasing frequency and severity of lawsuits, particularly in sectors like commercial auto and general liability, require substantial investments in legal counsel and risk mitigation. This environment underscores the need for accurate actuarial models that account for these upward cost pressures.

- Increased Litigation Exposure: Higher jury awards and settlements directly inflate claims costs for insurers like Kingsway.

- Reserving Accuracy: Underestimating future legal costs can lead to significant financial strain and impact solvency ratios.

- Legal Defense Costs: The expense of defending against an increasing volume of claims, often with higher stakes, adds to operational overhead.

- Impact on Profitability: Social inflation erodes underwriting profits and can necessitate premium adjustments to offset these rising liabilities.

Kingsway Financial Services must navigate a complex web of state-specific insurance laws, affecting everything from licensing and underwriting to claims handling and pricing. Staying compliant requires constant adaptation to these varied state regulations, as exemplified by recent increases in minimum auto liability limits in states like Maryland and Virginia as of early 2024. This necessitates robust compliance frameworks and proactive engagement with legislative shifts to avoid penalties and maintain market access.

Environmental factors

Climate change is demonstrably increasing the frequency and severity of natural disasters. This trend directly translates to a higher volume and cost of claims for insurers, including those touching auto and property. Extended warranties, if they encompass damage stemming from environmental events, will also see increased payouts.

While the non-standard auto insurance sector might seem less susceptible than property insurance, extreme weather events pose a significant risk. Increased instances of hail, flooding, and severe storms can lead to substantial vehicle damage, driving up repair costs and, consequently, claims for Kingsway Financial Services.

For example, 2023 saw a record number of billion-dollar weather and climate disasters in the United States, according to NOAA. There were 28 such events, totaling over $150 billion in damages, underscoring the growing financial impact of climate-related events on the insurance industry.

The increasing emphasis on Environmental, Social, and Governance (ESG) factors, especially climate risk and sustainability, is a critical element for insurers like Kingsway Financial Services. While Kingsway's primary operations might not directly involve significant environmental underwriting, the broader market and public perception of ESG performance can shape its investment decisions and overall business strategy. For instance, as of early 2024, global insurers are increasingly divesting from fossil fuel assets, with major players like Allianz and AXA announcing significant shifts in their investment portfolios to align with net-zero commitments.

Regulatory bodies globally are intensifying their focus on climate risk disclosure for financial institutions, including insurers like Kingsway. This means insurers are increasingly expected to reveal how climate change could impact their financial stability and operations. For instance, by the end of 2024, the UK's Prudential Regulation Authority (PRA) is set to implement new rules requiring insurers to report on their climate-related financial risks, with a focus on governance and strategy integration.

Kingsway Financial Services will likely encounter mounting pressure to showcase its methodologies for evaluating and managing climate-related exposures. This scrutiny isn't limited to direct physical risks but extends to transition risks and liability risks, even if these impacts are felt indirectly across different business segments. Demonstrating robust climate risk assessment frameworks will be crucial for maintaining regulatory compliance and investor confidence throughout 2024 and into 2025.

Transition Risks from Green Economy

The global transition to a green economy, moving away from fossil fuels, introduces significant transition risks for businesses like Kingsway Financial Services. While the primary impact is on investment portfolios, this shift also affects the automotive sector. For instance, as electric vehicles (EVs) gain market share, the types of vehicles requiring insurance and repair services will change. This could create new underwriting challenges or specialized repair needs, impacting Kingsway's auto-related operations.

The automotive industry is already seeing this shift. In 2024, global EV sales are projected to exceed 16 million units, a substantial increase from previous years. This growing EV fleet means fewer internal combustion engine vehicles needing traditional servicing, potentially impacting repair revenue streams for businesses reliant on older vehicle types. Kingsway needs to consider how this evolution in vehicle technology will shape demand for its insurance and repair services.

- Rising EV Adoption: Global EV sales surpassed 14 million in 2023, with projections for 2024 indicating further growth, potentially reaching over 17 million.

- Shifting Repair Needs: EVs have fewer moving parts than traditional vehicles, leading to different maintenance and repair requirements, which could alter service revenue models.

- Insurance Portfolio Adjustments: Underwriting policies for a growing EV fleet may require updated risk assessments and pricing strategies due to battery technology and repair costs.

- Regulatory Pressures: Governments worldwide are implementing stricter emissions standards, accelerating the phase-out of gasoline-powered vehicles and pushing insurers to adapt their offerings.

Natural Resource Scarcity and Supply Chain Disruptions

Natural resource scarcity, exacerbated by climate change, poses a significant threat to global supply chains, directly impacting Kingsway Financial Services. For instance, shortages of key metals like lithium and cobalt, critical for electric vehicle batteries, could drive up repair costs for newer vehicles covered by their auto insurance. This scarcity can lead to extended repair times and increased parts expenses, ultimately affecting claims payout for Kingsway.

Disruptions stemming from extreme weather events, such as floods or droughts, can further cripple the availability and affordability of vehicle components. Imagine a major supplier of automotive glass located in a region prone to severe storms; a single event could halt production, leading to a surge in the cost of replacement windshields and windows. This directly translates to higher claims costs for Kingsway's auto insurance policies, particularly in the 2024-2025 period where such events are increasingly common.

- Increased Claims Costs: Higher material costs for auto parts, driven by scarcity, directly inflate the average cost per claim for Kingsway's auto insurance business.

- Supply Chain Volatility: Climate-related events disrupting manufacturing and transportation of vehicle parts create unpredictable lead times and price fluctuations.

- Impact on EV Repairs: Scarcity of critical minerals for EV batteries may lead to significantly higher repair costs for electric vehicles, a growing segment in the automotive market.

- Extended Warranty Strain: The cost of fulfilling extended warranty claims for repairs involving scarce or expensive parts could also rise, impacting profitability.

Increasingly frequent and severe weather events, like the record 28 billion-dollar disasters in the US in 2023 causing over $150 billion in damages, directly impact insurers like Kingsway Financial Services through higher auto and property claims. The growing global emphasis on ESG, particularly climate risk, is also driving institutional investors and insurers to divest from fossil fuels, with major players shifting portfolios by early 2024 to meet net-zero commitments. Furthermore, evolving vehicle technology, with global EV sales projected to exceed 16 million in 2024, necessitates adjustments in underwriting and repair strategies for Kingsway's auto insurance segment.

| Environmental Factor | Impact on Kingsway Financial Services | Relevant Data (2023-2025) |

| Climate Change & Extreme Weather | Increased frequency and severity of claims (auto & property), higher repair costs. | 2023: 28 US billion-dollar weather/climate disasters, >$150 billion in damages. |

| ESG & Sustainability Focus | Pressure to align investments with net-zero, potential impact on investment strategy. | Early 2024: Major insurers like Allianz, AXA divesting from fossil fuels. |

| Transition to Green Economy / EV Adoption | Shifting underwriting needs for EVs, potential changes in repair revenue models. | 2024 Projection: Global EV sales to exceed 16 million units. |

PESTLE Analysis Data Sources

Our PESTLE Analysis for Kingsway Financial Services is built on a robust foundation of data from reputable financial news outlets, government regulatory bodies, and economic research institutions. This ensures our insights into political, economic, social, technological, legal, and environmental factors are accurate and current.