KBC Group SWOT Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

KBC Group Bundle

KBC Group, a prominent European financial institution, exhibits significant strengths in its diversified business model and strong market presence across key regions. However, it also navigates inherent weaknesses related to its exposure to economic downturns and the competitive financial landscape. Understanding these internal factors is crucial for any strategic evaluation.

Externally, KBC Group benefits from opportunities such as digital transformation and evolving customer needs, presenting avenues for growth and innovation. Conversely, it faces threats from regulatory changes, cybersecurity risks, and shifting economic conditions that could impact its performance and profitability.

Want the full story behind KBC Group's strengths, risks, and growth drivers? Purchase the complete SWOT analysis to gain access to a professionally written, fully editable report designed to support planning, pitches, and research.

Strengths

KBC Group's integrated bank-insurance model is a significant strength, offering diversified revenue streams that boost resilience. This synergy means they aren't solely dependent on banking or insurance, making them more robust during economic shifts. For instance, by combining these services, KBC can leverage cross-selling opportunities, presenting clients with a full spectrum of financial solutions from a single provider.

KBC Group commands a significant presence in its primary markets, notably Belgium and the Czech Republic. These markets, often structured as oligopolies, provide a foundation for sustained profitability.

The company's extensive reach and deep roots within these regions foster strong, enduring customer connections and predictable growth trajectories. KBC Group's strategic direction prioritizes reinforcing its leading status in these crucial territories.

For instance, as of the first quarter of 2024, KBC Belgium reported a net profit of €760 million, demonstrating the strength of its core market operations.

KBC Group's financial performance is a significant strength, evidenced by a robust net profit of €546 million in the first quarter of 2025. This follows a strong full-year performance in 2024, where the group achieved a net profit of €3.415 billion.

The company's capitalization is equally impressive, boasting a fully loaded Common Equity Tier 1 (CET1) ratio of 14.5% as of March 31, 2025. This ratio significantly surpasses regulatory requirements, highlighting a solid and secure financial foundation.

This robust capital position provides KBC Group with considerable flexibility, enabling strategic investments in growth opportunities and supporting consistent, attractive dividend payouts to shareholders.

Advanced Digitalization and Innovation

KBC Group stands out as a digital-first pioneer, exemplified by its KBC Mobile app, which garnered recognition as a leading global banking app in 2024. This advanced digitalization is a significant strength, enhancing customer accessibility and convenience.

The strategic integration of artificial intelligence, particularly through its virtual assistant 'Kate,' is another key strength. Kate not only streamlines KBC’s internal operations but also significantly elevates the customer experience by offering personalized financial insights and services.

This commitment to digital transformation directly translates into improved operational efficiency and a stronger, more engaged customer base. For instance, KBC reported a substantial increase in digital transaction volumes in 2024, underscoring the success of its digital initiatives.

Key aspects of KBC's advanced digitalization and innovation include:

- Leading Mobile Banking Platform: KBC Mobile recognized globally in 2024 for its user-centric design and comprehensive features.

- AI-Powered Customer Service: Virtual assistant 'Kate' provides personalized financial advice and 24/7 support, handling millions of customer queries annually.

- Enhanced Operational Efficiency: Digital tools and AI streamline back-office processes, reducing costs and improving service delivery times.

- Data-Driven Personalization: Leveraging data analytics to offer tailored financial products and recommendations, boosting customer loyalty and product uptake.

Commitment to Sustainability and ESG

KBC Group demonstrates a profound commitment to sustainability by integrating Environmental, Social, and Governance (ESG) principles across its strategic and operational framework. This dedication is evident in its proactive offering of sustainable investment funds, green bonds, and responsible lending initiatives, all designed to minimize environmental impact and foster financial inclusivity.

The company's consistent recognition, including its inclusion in the CDP Climate A List for three consecutive years up to 2023, underscores the effectiveness of its sustainability efforts. This external validation highlights KBC's leadership in driving responsible business practices within the financial sector, reinforcing its appeal to ethically-minded investors and stakeholders.

- Strategic Integration of ESG: ESG is woven into the core of KBC's business strategy and daily operations.

- Sustainable Financial Products: KBC actively provides sustainable investment funds, green bonds, and responsible lending options.

- Environmental Impact Reduction: Initiatives focus on reducing the company's carbon footprint and promoting environmental stewardship.

- External Recognition: KBC has been acknowledged on the CDP Climate A List for three consecutive years (as of 2023).

KBC Group's integrated bank-insurance model is a significant strength, offering diversified revenue streams that boost resilience and foster cross-selling opportunities. This synergy means they aren't solely dependent on banking or insurance, making them more robust during economic shifts.

The company commands a strong market position in Belgium and the Czech Republic, which are key oligopolistic markets providing a foundation for sustained profitability and deep customer relationships. This focus on core territories supports predictable growth trajectories.

KBC Group demonstrates robust financial performance, evidenced by a net profit of €546 million in Q1 2025 and €3.415 billion for the full year 2024. Its fully loaded CET1 ratio of 14.5% as of March 31, 2025, significantly surpasses regulatory requirements, offering financial flexibility for investments and dividends.

The group is a digital-first pioneer, with its KBC Mobile app recognized globally in 2024. The integration of AI through its virtual assistant 'Kate' enhances customer experience and operational efficiency, leading to increased digital transaction volumes in 2024.

| Metric | Value | As of |

|---|---|---|

| Net Profit (Q1 2025) | €546 million | March 31, 2025 |

| Full Year Net Profit (2024) | €3.415 billion | December 31, 2024 |

| CET1 Ratio (Fully Loaded) | 14.5% | March 31, 2025 |

What is included in the product

Analyzes KBC Group’s competitive position through key internal and external factors, highlighting its strong digital capabilities and customer focus while acknowledging regulatory challenges and market competition.

Offers a clear, structured view of KBC Group's competitive landscape, easing the pain of uncertainty in strategic decision-making.

Weaknesses

KBC Group's geographic concentration in Belgium and Central Europe presents a notable weakness. While active in several countries, the heavy reliance on these core markets means that regional economic downturns or specific regulatory shifts can have a disproportionate impact on the group's overall financial health. For instance, a significant economic slowdown in Belgium, which historically accounts for a substantial portion of KBC's revenues, could severely affect its profitability.

KBC Group's profitability is significantly tied to interest rate movements, particularly its net interest income. For instance, in the first quarter of 2024, KBC reported a net interest income of €1,471 million, a figure that can be directly impacted by shifts in the economic environment.

A sustained period of low or volatile interest rates could compress KBC's net interest margins, directly affecting its earnings potential. This necessitates a proactive approach to financial management, ensuring strategies are in place to navigate these market dynamics.

KBC Group faces a highly competitive environment within its core European markets. Established players, often operating in oligopolistic structures, present a significant challenge, demanding constant innovation to maintain market share. For instance, in Belgium, the banking sector is dominated by a few major institutions, intensifying the fight for customers.

Emerging fintech companies are also disrupting traditional banking models, forcing KBC to invest heavily in digital transformation and new product development to stay relevant. This pressure can constrain expansion into new segments or geographies, as resources are primarily directed towards defending existing market positions.

The need to continuously invest in technology and customer experience to counter competitive threats puts a strain on profitability. In 2023, KBC allocated significant capital towards its digital strategy, a trend expected to continue through 2024 and 2025 as they aim to enhance their digital offerings against agile competitors.

Potential for Integration Complexities Post-Acquisition

While strategic acquisitions, such as the integration of 365 Bank in Slovakia, present KBC Group with clear growth avenues, the actual process of merging these entities into its established bank-insurance framework can introduce significant operational hurdles. These complexities often stem from the need to harmonize disparate IT infrastructures, align distinct corporate cultures, and consolidate diverse product portfolios, all of which demand substantial investment and can potentially divert managerial attention from key business functions.

For instance, integrating a new bank's IT systems can be a multi-year endeavor, often involving millions in capital expenditure. KBC's 2023 annual report detailed significant IT upgrade projects, underscoring the resource intensity of such integrations. Failure to smoothly integrate systems can lead to inefficiencies, data inconsistencies, and a suboptimal customer experience, impacting the anticipated synergies from the acquisition.

The cultural alignment between KBC and its acquired entities is another critical weakness. Differences in management styles, employee expectations, and overall organizational ethos can slow down decision-making and hinder the realization of strategic objectives. This was a noted challenge in previous cross-border integrations within the European banking sector, requiring dedicated change management efforts.

- IT System Integration: Aligning legacy systems with KBC's core banking and insurance platforms is complex and costly.

- Cultural Assimilation: Merging different corporate cultures requires robust change management to avoid internal friction.

- Product Harmonization: Standardizing product offerings across acquired entities can be a lengthy process, impacting cross-selling opportunities.

- Resource Allocation: Integration efforts can consume significant financial and human capital, potentially impacting organic growth initiatives.

Regulatory and Tax Burden in CEE Markets

KBC's significant presence in Central and Eastern European (CEE) markets exposes it to a heightened risk of fluctuating regulatory landscapes and the potential for government-imposed bank-specific taxes or levies. For instance, countries like Hungary, Romania, and Poland have previously implemented such measures. These interventions can directly curtail profitability and restrict operational agility within these key growth territories, injecting a degree of unpredictability into KBC's future earnings trajectory.

The impact of these regulatory and tax burdens can be substantial. For example, in 2023, several CEE countries continued to grapple with inflation and the subsequent policy responses, which often included measures affecting the financial sector. KBC's earnings from these regions are therefore subject to this inherent volatility, requiring constant monitoring and strategic adaptation to mitigate adverse effects.

- Regulatory Uncertainty: CEE markets present a risk of sudden regulatory shifts impacting banking operations.

- Bank-Specific Taxes: The imposition of special taxes or reserve requirements on banks in CEE countries can directly affect profitability.

- Impact on Profitability: Governmental interventions in CEE markets have a direct bearing on KBC's net income and financial performance.

- Operational Flexibility: New regulations or taxes can limit KBC's ability to operate freely and pursue strategic initiatives in these regions.

KBC Group's significant reliance on interest income makes it vulnerable to interest rate fluctuations. For example, while net interest income was robust at €1,471 million in Q1 2024, a prolonged period of low rates could compress margins. This sensitivity necessitates agile financial strategies to maintain profitability amidst changing market conditions.

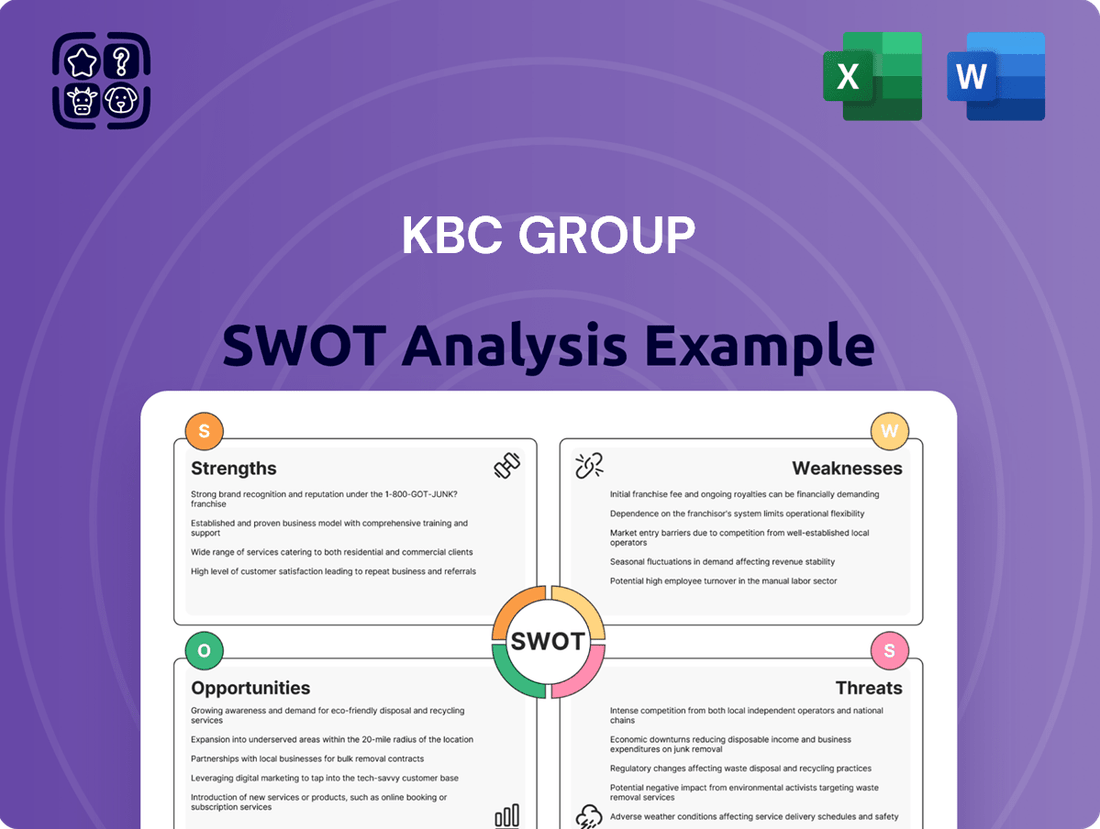

Preview Before You Purchase

KBC Group SWOT Analysis

This preview reflects the real document you'll receive—professional, structured, and ready to use. You're viewing the actual SWOT analysis for KBC Group, detailing its Strengths, Weaknesses, Opportunities, and Threats. The full, comprehensive report is available immediately after purchase, offering deep insights into KBC Group's strategic position.

Opportunities

KBC can significantly boost efficiency and customer experience by expanding artificial intelligence beyond its current use, like the virtual assistant Kate. This means leveraging AI for more sophisticated tasks, potentially automating complex processes and offering hyper-personalized financial advice.

By channeling more resources into digital platforms, KBC can foster deeper customer relationships and simultaneously trim operational expenses. For instance, in 2024, KBC reported a 10% year-on-year increase in digital customer interactions across its core markets, highlighting the growing reliance on these channels.

The development of new, AI-driven financial products, such as personalized investment portfolios or predictive budgeting tools, represents a substantial growth avenue. This strategic move taps into a market increasingly seeking tailored digital financial solutions.

Further integration of AI can streamline risk management, fraud detection, and back-office operations, leading to cost savings and improved accuracy. KBC's ongoing digital transformation initiatives are expected to contribute an additional 5% to its operating income by the end of 2025.

KBC's integrated bank-insurance model presents a significant opportunity for cross-selling. In 2024, KBC continued to focus on enhancing its digital platforms to facilitate these synergies. The group aims to leverage customer data, which saw a 15% increase in analytical utilization in early 2025, to identify prime cross-selling moments, potentially boosting revenue per customer by an estimated 5-7% by year-end 2025.

The global shift towards sustainability presents a substantial opportunity for KBC. As of early 2024, the sustainable finance market is experiencing robust growth, with assets under management in ESG funds projected to reach $50 trillion by 2025, according to Morningstar. KBC can capitalize on this by broadening its suite of green bonds and sustainable investment options.

By enhancing its responsible lending practices and developing innovative ESG-focused products, KBC can attract a widening base of ethically minded investors and clients. This strategic alignment with growing environmental and social awareness not only strengthens KBC's market position but also reinforces its existing strong commitment to ESG principles.

Strategic Acquisitions and Partnerships

KBC Group has significant opportunities to strengthen its market standing and capabilities through strategic acquisitions and partnerships. These moves can unlock entry into new, specialized market segments or bolster its presence in existing core regions, especially in areas like digital banking and sustainable finance.

The acquisition of 365 Bank in Slovakia, finalized in early 2024, serves as a prime example of this strategy. This move is projected to generate substantial synergies and solidify KBC's leadership position within the Slovak banking sector, underscoring the group's commitment to growth through consolidation and integration.

Further opportunities lie in forming alliances with FinTech companies to accelerate digital transformation and enhance customer offerings.

Strategic acquisitions can expand KBC's technological prowess and market reach.

Partnerships offer a pathway to innovate and enter niche financial segments.

The 365 Bank acquisition in Slovakia exemplifies KBC's pursuit of market leadership and synergy realization.

Focusing on digital and sustainable finance areas presents key growth avenues.

Leveraging Data Analytics for Personalized Offerings

KBC Group can significantly enhance its customer relationships by employing advanced data analytics on its vast customer information. This allows for the creation of truly personalized financial advice and customized product packages, moving beyond generic offerings.

By understanding individual customer behaviors and preferences, KBC can proactively anticipate needs and deliver solutions that resonate deeply. This data-driven strategy is key to boosting customer satisfaction and solidifying loyalty in a competitive market.

For instance, KBC's digital channels collected approximately 10 million customer interactions in 2023, providing a rich dataset. Leveraging this, they can identify patterns for cross-selling opportunities, such as offering tailored investment advice to customers showing interest in specific market trends.

- Personalized Advice: Offering investment recommendations based on individual risk profiles and financial goals.

- Tailored Bundles: Creating product packages that combine savings accounts, insurance, and loans based on customer life stages.

- Proactive Engagement: Identifying customers likely to need mortgage refinancing and reaching out with customized offers.

- New Revenue Streams: Monetizing data insights through partnerships or premium personalized services.

KBC can leverage its integrated bank-insurance model for significant cross-selling opportunities, capitalizing on increased digital customer interactions. The group's data analytics, which saw a 15% uplift in utilization in early 2025, allows for identifying prime moments to offer tailored products, potentially increasing revenue per customer by 5-7% by year-end 2025.

The growing sustainable finance market, projected to reach $50 trillion in assets under management by 2025, offers KBC a chance to expand its green bond and sustainable investment offerings. By developing innovative ESG-focused products, KBC can attract ethically-minded investors and clients, reinforcing its commitment to sustainability.

Strategic acquisitions and partnerships present avenues for KBC to enhance its technological capabilities and market reach. The successful acquisition of 365 Bank in Slovakia in early 2024 exemplifies this, solidifying KBC's leadership and demonstrating the potential for growth through consolidation.

Expanding AI capabilities beyond virtual assistants can automate complex processes and offer hyper-personalized financial advice, boosting efficiency and customer experience. KBC's digital transformation initiatives are anticipated to contribute an additional 5% to operating income by the end of 2025.

Threats

KBC faces significant pressure from nimble fintech firms and tech giants like Apple and Google, which are increasingly encroaching on traditional banking and insurance services. These disruptors often leverage advanced technology to offer more streamlined, personalized, and cost-effective solutions, directly challenging KBC's established market position.

For instance, in 2024, the global fintech market was valued at over $2.4 trillion, with projections indicating substantial growth, highlighting the scale of this competitive threat. KBC must therefore accelerate its digital transformation and embrace new technologies to counter the agility and innovation of these new market entrants.

The threat is amplified as Big Tech companies, with their vast customer bases and data analytics capabilities, can offer integrated financial products seamlessly within their existing ecosystems. This poses a direct challenge to KBC's customer loyalty and ability to retain market share in key financial services segments.

Economic downturns, such as a potential recession in the Eurozone, coupled with persistent high inflation, pose a significant threat to KBC Group. These conditions can dampen consumer and business confidence, leading to reduced demand for loans and financial products. For instance, if inflation remains elevated above central bank targets throughout 2024 and into 2025, it could force further interest rate hikes, squeezing borrowers and increasing the likelihood of loan defaults.

Geopolitical instability, particularly in Europe, presents another substantial risk. Ongoing conflicts or new trade policy shifts could disrupt financial markets and impact KBC's investment portfolios. For example, heightened tensions in Eastern Europe or unexpected changes in international trade agreements could introduce significant volatility, affecting KBC's asset valuations and overall profitability in its key operating regions.

The European banking sector is navigating a tougher regulatory environment, with new rules like Basel IV demanding higher capital buffers. For KBC Group, this means more rigorous compliance, which can translate into higher operational costs and potentially limit how they can deploy their capital. For instance, as of late 2023, European banks were still implementing Basel III finalization, often referred to as Basel IV, which is estimated to increase capital requirements for some institutions.

Cybersecurity Risks and Data Breaches

As a leading digital financial institution, KBC Group is constantly navigating the evolving landscape of cybersecurity threats. The sheer volume of sensitive customer data processed daily makes the group a prime target for sophisticated cyberattacks. A significant breach could result in substantial financial penalties and a severe blow to the trust KBC has built with its clientele. For instance, in 2023, the financial services sector globally saw a notable increase in ransomware attacks, with average costs escalating, underscoring the financial implications for institutions like KBC.

The potential fallout from a successful cyberattack extends beyond immediate financial costs. Reputational damage can be long-lasting, impacting customer retention and acquisition efforts. KBC must therefore maintain robust and continuously updated cybersecurity defenses, requiring ongoing, significant investment to stay ahead of emerging threats. Reports from late 2024 indicate that the average cost of a data breach in the financial sector has continued its upward trend, emphasizing the critical need for proactive security measures.

Key cybersecurity risks for KBC include:

- Phishing and Social Engineering Attacks: Exploiting human vulnerabilities to gain unauthorized access.

- Ransomware and Malware: Encrypting data and demanding payment for its release.

- Insider Threats: Malicious or accidental data leaks by employees.

- DDoS Attacks: Overwhelming systems to disrupt services.

Fluctuations in Exchange Rates

KBC Group's international operations expose it to the inherent risk of fluctuating exchange rates, particularly given its significant presence in Central and Eastern European markets where local currencies can deviate from the Euro. A notable example from 2024 data indicates that currencies like the Czech Koruna and Hungarian Forint experienced periods of volatility against the Euro, directly impacting the Euro-denominated value of KBC's earnings and assets in these regions. For instance, a substantial depreciation of the Czech Koruna could lead to a direct reduction in the reported Euro value of its Czech subsidiary's profits. This currency risk means that even if KBC's underlying business performance in these countries remains strong, adverse currency movements can still negatively affect its consolidated financial statements. The group actively manages this exposure through hedging strategies, but extreme or prolonged currency swings can still pose a threat to profitability and the translation of foreign assets and liabilities.

KBC faces intense competition from agile fintech companies and tech giants, which are increasingly offering streamlined and cost-effective financial solutions. For instance, the global fintech market's valuation exceeding $2.4 trillion in 2024 underscores the scale of this disruption, pressuring KBC to accelerate its digital transformation efforts.

Economic headwinds, including potential Eurozone recessions and persistent inflation throughout 2024-2025, threaten to reduce demand for KBC's products and increase loan default risks. Geopolitical instability in Europe also poses a significant threat, potentially disrupting financial markets and impacting KBC's investment portfolios through increased volatility.

The group is also subject to a tightening regulatory environment in Europe, with evolving capital requirements like Basel IV potentially increasing operational costs and limiting capital deployment flexibility. Furthermore, KBC's extensive digital operations make it a prime target for sophisticated cyberattacks, with the financial sector globally experiencing rising costs associated with data breaches in 2023 and 2024, highlighting the critical need for robust cybersecurity defenses.

SWOT Analysis Data Sources

This KBC Group SWOT analysis is informed by comprehensive financial reports, detailed market intelligence, and expert industry analysis. These reliable sources ensure a robust understanding of KBC's strategic position.