KBC Group Porter's Five Forces Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

KBC Group Bundle

KBC Group operates within a dynamic financial services landscape, where understanding competitive forces is paramount. The intensity of rivalry among established banks and emerging fintechs significantly shapes market strategy. Buyer power, particularly from large corporate clients, can exert considerable pressure on pricing and service offerings.

The threat of new entrants, while potentially mitigated by regulatory hurdles, remains a factor to monitor as digital innovation accelerates. Supplier power, though less pronounced in traditional banking, can emerge through technology providers and data sources critical to KBC's operations.

The threat of substitutes, from alternative investment platforms to digital payment solutions, constantly challenges traditional banking models. This brief snapshot only scratches the surface. Unlock the full Porter's Five Forces Analysis to explore KBC Group’s competitive dynamics, market pressures, and strategic advantages in detail.

Suppliers Bargaining Power

KBC Group's reliance on technology providers for its digital banking and insurance operations is significant. Core banking systems, cybersecurity, and advanced data analytics platforms are all crucial. This dependence grants considerable leverage to vendors offering specialized or proprietary technologies essential for KBC's day-to-day functions and future growth.

The bargaining power of these technology suppliers can range from moderate to high. This is particularly true for niche or proprietary solutions where switching costs are substantial or where the technology is a key differentiator. For instance, a specialized IFRS9 solution from a provider like ElysianNxt, critical for regulatory compliance and financial reporting, would likely hold significant sway.

The bargaining power of suppliers in the human capital realm is significantly shaped by the availability of specialized skills, particularly in fields like IT, data science, and advanced financial analysis. When demand for these skills outstrips supply, employees acting as suppliers of labor gain considerable leverage, driving up salary and benefit expectations. For instance, in 2024, the global shortage of cybersecurity professionals meant that companies often had to offer compensation packages exceeding 15% above market rates to secure top talent.

KBC Group actively mitigates this supplier power by investing in its internal talent pipeline through robust continuous training and development programs. By cultivating in-house expertise, especially in critical areas like data science, KBC reduces its reliance on external hires for these specialized roles, thereby strengthening its negotiating position. This strategy helps control labor costs and ensures a steady supply of skilled professionals aligned with the group's strategic objectives.

Data and information providers hold moderate bargaining power over KBC Group. Access to accurate, timely market data, credit ratings, and economic forecasts is fundamental to KBC's robust risk management and critical investment decisions. Providers with unique or consolidated datasets can leverage this position by dictating pricing and licensing agreements.

Interbank and Wholesale Funding Markets

The interbank and wholesale funding markets act as crucial suppliers for KBC Group, influencing its cost of capital. These markets wield significant power, with their leverage dictated by prevailing interest rates and overall investor sentiment. For instance, in early 2024, increased uncertainty in global financial markets led to wider credit spreads, directly impacting the cost of wholesale funding for many European banks.

KBC's ability to manage this bargaining power is evident in its robust liquidity profile. Maintaining a strong liquidity coverage ratio (LCR) is paramount, allowing the group to navigate periods of market stress. KBC reported an LCR of 155% as of Q1 2024, well above regulatory requirements, demonstrating its capacity to access funding even when market conditions are less favorable.

- Market Conditions: Fluctuations in benchmark interest rates, like EURIBOR, directly affect KBC's borrowing costs.

- Investor Confidence: A decline in confidence can lead to higher risk premiums demanded by wholesale funding providers.

- Liquidity Management: KBC's proactive approach to maintaining ample liquidity mitigates the suppliers' power.

- Cost of Capital: The price KBC pays for wholesale funds directly impacts its profitability and lending margins.

Regulatory and Compliance Services

Regulatory and compliance services, while not traditional suppliers, exert significant bargaining power on KBC Group. These services are essential for navigating evolving financial landscapes, particularly with directives like Basel IV and the Corporate Sustainability Reporting Directive (CSRD). For instance, the implementation costs associated with CSRD alone are projected to be substantial for financial institutions, indicating a strong demand for specialized compliance expertise.

The increasing intricacy of global financial regulations means KBC Group must invest heavily in legal, consulting, and auditing support. This necessity gives providers of these specialized services considerable leverage, as they possess the unique knowledge and accreditation required for adherence. The demand for these critical services is expected to remain high, solidifying their bargaining power.

- Increased regulatory complexity drives demand for specialized compliance expertise.

- Financial institutions like KBC Group face significant investment in legal and consulting services to meet new standards.

- Providers of regulatory and compliance services hold elevated bargaining power due to their niche knowledge.

The bargaining power of KBC Group's suppliers is a key factor in its operational costs and strategic flexibility. This power is influenced by the availability of substitutes, the uniqueness of supplier offerings, and the overall importance of the supplier to KBC's business.

In 2024, technology providers offering specialized platforms, such as AI-driven fraud detection or advanced customer analytics, held considerable sway due to high switching costs and the critical nature of these systems for KBC's digital banking and insurance segments. Similarly, the market for highly skilled talent, especially in cybersecurity and data science, saw suppliers (employees) dictating terms, with salary premiums often exceeding 15% for in-demand roles.

Furthermore, wholesale funding markets, acting as suppliers of capital, demonstrated significant power in early 2024 due to heightened global market uncertainty, which widened credit spreads and increased KBC's borrowing costs. KBC's robust liquidity, evidenced by a Q1 2024 Liquidity Coverage Ratio of 155%, helps to temper this supplier power.

| Supplier Category | Bargaining Power Factor | Example Impact on KBC | 2024 Data Point |

|---|---|---|---|

| Technology Providers | Uniqueness of technology, high switching costs | Increased costs for essential digital banking platforms | High demand for specialized AI fraud detection solutions |

| Human Capital (Specialized Skills) | Scarcity of talent, high demand | Elevated salary and benefit costs for IT and data science roles | 15%+ salary premium for cybersecurity professionals |

| Wholesale Funding Markets | Market sentiment, interest rate environment | Higher cost of capital due to wider credit spreads | Increased credit spreads in early 2024 |

What is included in the product

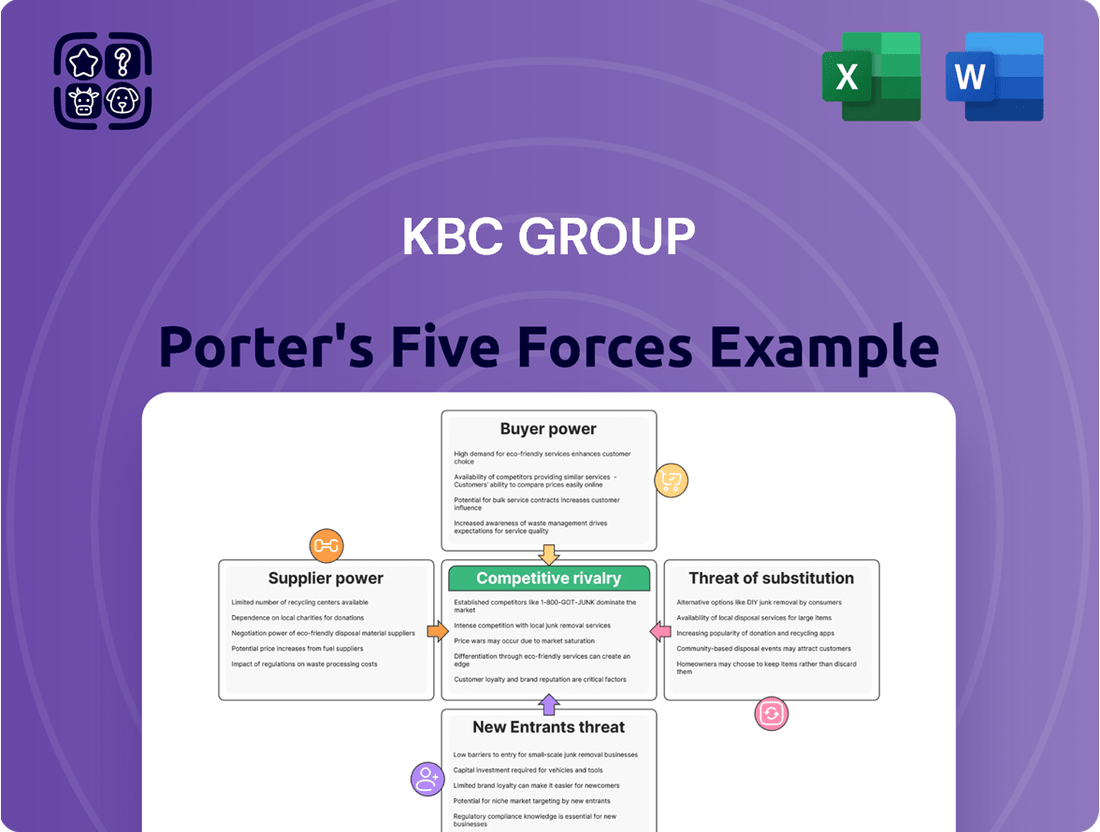

This Porter's Five Forces analysis for KBC Group identifies the intensity of rivalry, the bargaining power of customers and suppliers, the threat of new entrants, and the threat of substitutes within the banking and insurance sectors.

Effortlessly identify and quantify competitive pressures, allowing for proactive strategy adjustments to mitigate threats and capitalize on opportunities within the banking sector.

Customers Bargaining Power

Customers of KBC Group, encompassing retail clients, small and medium-sized enterprises (SMEs), and mid-cap businesses, face a vast array of financial service providers. This includes not only established banks but also the rapidly growing challenger banks and innovative fintech companies, offering a wide spectrum of products and services. The sheer volume of these alternatives significantly amplifies customer bargaining power, as switching providers becomes increasingly feasible and often attractive.

KBC's operational footprint across Belgium, the Czech Republic, Slovakia, Hungary, and Bulgaria further underscores the competitive intensity. In 2024, the European financial services market continued to see strong competition, with an estimated 3,500+ banks operating across the EU, many of which offer services directly competitive with KBC’s core offerings. This broad availability of choice means customers can readily compare pricing, features, and service quality, forcing providers like KBC to remain competitive to retain their customer base.

For fundamental banking products like current and savings accounts, customers often face minimal hurdles when switching providers, particularly as digital onboarding becomes more prevalent. Many financial institutions, including KBC's competitors, now offer streamlined online account opening, making it easier than ever for consumers to move their funds. This low switching cost effectively enhances customer bargaining power, forcing KBC to maintain competitive interest rates and a high standard of customer service to retain its client base.

Customers in mature financial markets, especially for products like mortgages and basic savings, exhibit significant price sensitivity. This means KBC must maintain competitive interest rates and fees to attract and retain business. For instance, in Q1 2025, KBC's performance highlighted a strong reliance on net interest income, underscoring the impact of pricing decisions.

Digital Empowerment and Information Access

The digital age has dramatically shifted the bargaining power of customers in the financial sector. With the proliferation of digital platforms and financial aggregators, customers now possess unprecedented access to information. They can easily compare financial products, analyze pricing, and read reviews from other users. This increased transparency directly challenges traditional information asymmetries that once heavily favored financial institutions like KBC Group.

This newfound knowledge empowers customers to negotiate more effectively for better terms and rates. They are no longer reliant solely on the information provided by their bank. In 2024, for example, fintech innovations continued to drive this trend, with many comparison sites offering real-time data on mortgage rates and investment products. KBC's strategic response, including the development of its digital assistant 'Kate', aims to directly address this empowered customer base by enhancing engagement and providing personalized, readily accessible information.

- Increased Information Accessibility: Digital platforms and aggregators provide customers with detailed product information and pricing comparisons.

- Reduced Information Asymmetry: Customers can now easily access data that previously gave financial institutions a significant advantage.

- Enhanced Negotiation Power: Informed customers are better positioned to negotiate favorable terms and rates.

- Digital Assistant Adoption: KBC's 'Kate' is an example of how banks are adapting to improve customer experience in this transparent environment.

Customer Segmentation and Diversification

KBC Group's diverse customer base, ranging from individual retail clients to small and medium-sized enterprises (SMEs) and mid-cap companies, significantly dilutes customer bargaining power. This broad reach across multiple countries means KBC isn't unduly dependent on any single customer segment or a few large clients. For instance, as of the first quarter of 2024, KBC reported a strong customer base, with a significant portion of its revenue derived from its retail banking operations across its core markets.

The geographic diversification of KBC's income further reinforces this. With operations in Belgium, the Czech Republic, Bulgaria, Hungary, Slovakia, and Ireland, the company benefits from varied economic cycles and customer behaviors. This geographical spread prevents any one region's customer base from exerting disproportionate influence over KBC's strategic decisions or pricing, thereby mitigating customer bargaining power.

- Diversified Customer Segments: KBC serves retail, SME, and mid-cap clients, reducing reliance on any single group.

- Geographic Income Distribution: Operations in multiple countries limit the impact of localized customer concentration.

- Reduced Dependence: No single client segment or large customer accounts for an overwhelming share of KBC's revenue.

- Mitigated Buyer Power: The broad customer base and geographic spread inherently lessen the ability of customers to dictate terms.

Customers of KBC Group possess considerable bargaining power due to the sheer volume of financial service providers available and the ease with which they can switch. This is amplified by digital platforms offering easy price and feature comparisons, forcing KBC to remain competitive in pricing and service quality. For instance, in 2024, the European financial services landscape featured over 3,500 banks, many directly competing with KBC.

The low switching costs for fundamental banking products, coupled with increased customer awareness fueled by digital tools, further empower consumers. This transparency allows customers to negotiate better terms, as seen with the rise of comparison sites for products like mortgages. KBC's response, such as developing its digital assistant 'Kate', reflects an effort to cater to this more informed and demanding customer base.

| Factor | Impact on KBC | Evidence/Data (2024/Q1 2025) |

|---|---|---|

| Availability of Alternatives | High Customer Bargaining Power | 3,500+ EU banks; rise of fintechs and challenger banks. |

| Switching Costs | Low for basic products; High Customer Bargaining Power | Prevalence of digital onboarding and easy account transfers. |

| Customer Information Access | High Customer Bargaining Power | Digital platforms, aggregators, comparison sites providing transparency. |

| Price Sensitivity | High Customer Bargaining Power for certain products | Reliance on net interest income in Q1 2025 performance underscores pricing importance. |

What You See Is What You Get

KBC Group Porter's Five Forces Analysis

This preview showcases the comprehensive Porter's Five Forces Analysis for KBC Group, detailing the competitive landscape within the banking and insurance sectors. You're looking at the actual document; once you complete your purchase, you’ll get instant access to this exact, professionally written analysis, ready for immediate use.

Rivalry Among Competitors

KBC Group operates within largely mature European banking and insurance sectors. This means that growth is primarily driven by taking market share from rivals rather than by an expanding overall market. This dynamic naturally fuels intense rivalry among established players like KBC.

The competitive landscape in these mature markets compels companies to employ aggressive strategies. These tactics are aimed at both attracting new customers and ensuring the loyalty of existing ones, often leading to price wars or enhanced service offerings. For instance, in 2024, European banks saw continued pressure on net interest margins due to sustained competition.

Looking ahead to 2025, the outlook for the European banking sector suggests this intense competition will persist. Analysts predict that factors such as digital transformation and the ongoing pursuit of operational efficiencies will further sharpen the competitive edge required for success.

KBC operates in highly competitive environments, facing formidable rivals like ING Group and BNP Paribas in Belgium, and Erste Group and UniCredit in Central Europe. These established players often boast comparable financial strength, deep customer loyalty, and extensive branch and digital networks, intensifying the fight for market share. In 2023, for instance, the Belgian banking sector saw intense competition for mortgages, with key players offering attractive rates to capture new business.

Many core banking and insurance products offered by KBC are becoming increasingly standardized, making it a challenge to stand out based purely on product features. This commoditization shifts the competitive battleground to factors like pricing, the caliber of customer service, and the ease of digital interaction. Consequently, margins tend to shrink, necessitating ongoing investment in new and improved offerings to maintain an edge.

In 2024, the banking sector globally continues to grapple with this product homogenization. For instance, basic savings accounts and mortgage products often feature similar interest rates and terms across multiple institutions. This forces companies like KBC to focus on customer experience and digital innovation to capture market share, rather than relying on unique product specifications alone.

KBC's strategic advantage lies in its integrated bancassurance approach, which combines banking and insurance services seamlessly. Furthermore, its commitment to digital transformation, exemplified by platforms like Kate, offers a more personalized and convenient customer journey. These elements are crucial in differentiating KBC in a market where product features alone are often insufficient to attract and retain customers.

High Exit Barriers

The banking and insurance sectors, where KBC Group operates, present substantial exit barriers. These are largely due to the immense capital investments required to establish and maintain operations, coupled with stringent regulatory frameworks governing financial institutions. The potential social and economic fallout from the failure of large financial entities further discourages competitors from exiting the market, ensuring sustained rivalry even in challenging economic conditions.

These high exit barriers mean that companies like KBC Group are unlikely to see competitors readily withdraw, leading to persistent and intense competition. KBC's robust capital reserves, a critical factor in navigating these dynamics, provide a buffer against market volatility and allow for continued strategic maneuvering within a competitive landscape.

- High Capital Requirements: Financial institutions typically require billions in capital to operate, a significant hurdle for new entrants and a deterrent for existing players considering an exit.

- Regulatory Hurdles: Strict licensing, compliance, and capital adequacy ratios imposed by authorities like the European Central Bank make winding down operations a complex and costly process.

- Social and Economic Impact: The interconnectedness of financial markets means that the failure of a major bank or insurer can have systemic consequences, leading regulators to intervene and make exits difficult.

- KBC's Capital Strength: As of the first quarter of 2024, KBC Group reported a strong Common Equity Tier 1 (CET1) ratio of 15.8%, demonstrating its financial resilience and ability to withstand competitive pressures.

Strategic Acquisitions and Consolidation

The European banking landscape is experiencing a resurgence in mergers and acquisitions (M&A) as institutions prioritize achieving greater scale and diversifying their operations. This trend directly fuels competitive rivalry, as banks actively pursue inorganic growth to bolster their market positions and operational efficiencies.

KBC Group itself is actively participating in this consolidation wave. A prime example is their acquisition of 365.bank in Slovakia, a move that underscores the intense competition and the strategic importance of M&A in the current market. Such acquisitions by major players intensify the pressure on other banks to either consolidate or risk being outmaneuvered.

- Increased M&A Activity: European banking M&A activity saw a notable increase in 2023 and early 2024, driven by the pursuit of scale and efficiency.

- KBC's Strategic Move: KBC Group's acquisition of 365.bank in Slovakia is a clear demonstration of leveraging M&A for market expansion and competitive advantage.

- Heightened Competition: These strategic acquisitions intensify competition, forcing other banks to re-evaluate their own growth strategies and market positioning.

- Focus on Efficiency: Consolidation allows banks to reduce costs through economies of scale and streamline operations, creating a more competitive cost structure.

KBC Group faces intense competition within mature European banking and insurance markets, where growth is primarily achieved by gaining market share rather than market expansion. This rivalry compels aggressive strategies like price wars and enhanced service offerings, as seen with continued pressure on net interest margins in 2024.

Standardized products force KBC to compete on customer service and digital innovation, as basic offerings often feature similar terms across institutions. This dynamic intensifies the battleground beyond product features, impacting profit margins and necessitating continuous investment in differentiation.

The European banking sector's M&A surge, including KBC's acquisition of 365.bank in Slovakia, heightens competition as firms seek scale and efficiency. This consolidation trend forces other players to adapt or risk being outmaneuvered, creating a more challenging competitive environment.

| Rival | Primary Markets | Competitive Strategy Focus |

|---|---|---|

| ING Group | Belgium, Netherlands | Digital transformation, customer experience |

| BNP Paribas | France, Belgium | Integrated financial services, international presence |

| Erste Group | Central & Eastern Europe | Regional focus, digital offerings |

| UniCredit | Italy, Central & Eastern Europe | Scale, cost efficiency, digital banking |

SSubstitutes Threaten

The surge in fintech and digital payment platforms presents a substantial threat of substitutes for KBC Group. Companies like Revolut and Wise offer streamlined digital payment solutions and international money transfers, often at lower costs than traditional bank offerings. In 2023, the global digital payments market was valued at over $8.5 trillion, a figure expected to grow significantly, highlighting the increasing consumer preference for these alternatives.

For KBC Group, the threat of substitutes in asset management and savings is significant. Direct investment platforms, cryptocurrencies, and emerging alternative asset classes present compelling alternatives to traditional bank deposits or KBC's managed funds. For instance, the global cryptocurrency market capitalization, while volatile, reached over $2.5 trillion in early 2024, indicating a substantial shift in investor interest away from conventional savings. This allows customers to bypass KBC's asset management services, directly impacting KBC's fee income streams.

Customers can easily access these substitutes, often through user-friendly, low-cost online platforms. This disintermediation means KBC risks losing valuable client relationships and the associated revenue. To counter this, KBC's strategy emphasizes offering a comprehensive suite of financial products and advisory services, aiming to keep customers within its ecosystem and retain their assets under management.

Insurtech companies pose a significant threat by offering innovative, technology-driven insurance solutions. These startups, often unburdened by legacy systems, can rapidly develop and deploy niche products like usage-based auto insurance or highly personalized health plans, directly challenging KBC's traditional product lines.

For instance, by mid-2024, the insurtech sector continued its robust growth, with venture capital funding reaching billions globally, indicating a strong appetite for these disruptive models. This influx of capital allows insurtechs to aggressively target customer segments with offerings that are often more flexible and digitally accessible than those provided by established players like KBC.

KBC's integrated bancassurance model, which combines banking and insurance services, provides a degree of resilience. However, the agility of insurtechs in adapting to evolving consumer demands for on-demand and customized coverage means KBC must continuously innovate its insurance product portfolio to remain competitive.

Big Tech Entering Financial Services

Big Tech firms are a significant threat to traditional financial services. Companies like Apple, Google, and Amazon are leveraging their massive customer bases and sophisticated data analytics to offer payment solutions and lending services. For example, Apple Pay has seen substantial growth, processing billions of dollars in transactions. This encroaches directly on revenue streams for banks like KBC.

These tech giants benefit from immense brand loyalty and vast financial resources, allowing them to invest heavily in user experience and competitive pricing. Their ability to integrate financial services seamlessly into existing platforms creates a highly attractive alternative for consumers. In 2023, Google Pay reported over 150 million monthly active users globally, illustrating the scale of their reach.

KBC is actively working to counter this threat by enhancing its own digital offerings. Its strong digital banking platform and focus on customer-centric innovation are crucial for retaining its market share. By providing competitive digital tools and personalized financial advice, KBC aims to match the convenience and appeal offered by Big Tech substitutes.

- Growing Adoption of Digital Payments: Global digital payment transaction volumes are projected to reach over $10 trillion by 2025, highlighting the expanding market Big Tech is targeting.

- Big Tech's Financial Muscle: Companies like Alphabet (Google) and Meta Platforms (Facebook) hold hundreds of billions in cash reserves, enabling aggressive market entry and product development in financial services.

- Customer Data Advantage: Big Tech firms possess unparalleled amounts of consumer data, which they can use to offer more personalized and potentially cheaper financial products than incumbents.

- KBC's Digital Investment: KBC has committed significant capital to its digital transformation, aiming to maintain parity or superiority in user experience against tech competitors.

Non-Bank Lending and Crowdfunding

Non-bank lenders and crowdfunding platforms present a growing threat of substitutes for KBC Group, particularly in serving small and medium-sized enterprises (SMEs) and mid-cap companies. These alternative financing channels often provide greater flexibility and accessibility than traditional bank loans, especially for businesses that might not fit standard banking criteria.

For instance, by mid-2024, the alternative lending market continued to expand, with many fintech platforms offering faster approval times and customized loan structures. Crowdfunding, in particular, has seen significant growth in Europe, allowing businesses to raise capital directly from a large pool of investors, bypassing traditional financial institutions altogether. This diversification of funding options means KBC faces increased competition for its lending services, potentially impacting its market share.

- Alternative Financing Growth: The global alternative lending market was projected to reach over $1.5 trillion by 2025, indicating a substantial shift away from traditional banking for some segments.

- Crowdfunding's Reach: In 2023, European crowdfunding platforms facilitated billions of euros in funding for businesses, demonstrating their increasing relevance.

- Flexibility Advantage: Non-bank lenders often cater to niche markets or businesses with unique risk profiles, offering solutions that traditional banks may not.

Despite these evolving threats, KBC Group has demonstrated resilience. In its latest financial reports for the first half of 2024, KBC noted strong loan growth, suggesting effective strategies to retain and attract clients in a competitive landscape.

The threat of substitutes for KBC Group is multifaceted, stemming from digital payment platforms, asset management alternatives, insurtechs, Big Tech firms, and non-bank lenders. These substitutes often offer greater convenience, lower costs, and more tailored solutions, directly challenging KBC's traditional revenue streams and customer relationships.

The increasing adoption of digital payment solutions by companies like Revolut and Wise, alongside the substantial growth in the global digital payments market, valued at over $8.5 trillion in 2023, illustrates a significant shift in consumer preference. Similarly, the burgeoning cryptocurrency market, which reached over $2.5 trillion in early 2024, highlights a growing disinterest in traditional savings vehicles, impacting KBC's asset management services.

| Substitute Type | Key Players/Examples | Impact on KBC | Market Size/Growth Indicator (2023/2024 Data) | KBC Mitigation Strategy |

| Digital Payments | Revolut, Wise | Reduced transaction fees, disintermediation | Global digital payments market > $8.5 trillion (2023) | Enhancing digital offerings, integrated services |

| Asset Management Alternatives | Direct investment platforms, Cryptocurrencies | Loss of AUM, reduced fee income | Crypto market cap > $2.5 trillion (early 2024) | Comprehensive financial product suite, advisory services |

| Insurtech | Various startups | Loss of insurance market share, reduced premiums | Billions in global VC funding for insurtech | Continuous product innovation, digital accessibility |

| Big Tech | Apple, Google, Amazon | Competition in payments, lending, data advantage | Google Pay > 150 million monthly active users (2023) | Strengthening digital banking, customer experience |

| Non-Bank Lenders/Crowdfunding | Fintech platforms | Reduced lending market share, competition for SMEs | Alternative lending market projected > $1.5 trillion by 2025; European crowdfunding facilitated billions in 2023 | Focus on relationship banking, tailored lending solutions |

Entrants Threaten

The financial services sector, particularly banking and insurance where KBC operates, faces significant hurdles due to extremely high capital requirements. Regulatory frameworks like Basel IV mandate substantial capital reserves, creating a formidable barrier to entry for potential new competitors. These stringent requirements mean that any new entrant would need immense financial backing to even begin operating at a competitive scale, making it incredibly challenging to disrupt established players like KBC. KBC’s strategic focus on maintaining strong capitalization, aiming to be among the better-capitalized institutions, further solidifies its position against nascent threats.

New entrants in the financial services sector, particularly those aiming to operate like KBC Group, encounter formidable regulatory and licensing requirements. Obtaining necessary banking and insurance licenses is a lengthy and costly endeavor, demanding substantial capital and adherence to strict operational standards. For instance, in 2024, the average time to obtain a full banking license in many European Union countries could extend beyond 18 months and involve millions in upfront investment.

Furthermore, compliance with Anti-Money Laundering (AML) and Know Your Customer (KYC) regulations is paramount, requiring robust systems and ongoing vigilance. The increasing complexity of data privacy laws, such as GDPR, adds another layer of compliance burden. In 2024, fines for data privacy breaches can run into billions of euros, making non-compliance a significant risk.

The evolving regulatory landscape, including initiatives like the European AI Act, introduces new compliance obligations for technology integration. This means new entrants must not only meet existing financial regulations but also anticipate and adapt to emerging rules governing artificial intelligence and data governance. These comprehensive barriers significantly protect established players like KBC Group by elevating the cost and complexity of market entry.

The threat of new entrants is significantly mitigated by the crucial role of brand reputation and trust in financial services. Established institutions like KBC Group have cultivated decades of trust, a vital asset that new players find incredibly difficult to replicate quickly. Customers entrust their savings and investments to entities they perceive as stable and reliable, making brand loyalty a powerful barrier.

In 2023, KBC Group’s customer satisfaction scores remained consistently high, reflecting this established trust. For instance, their Net Promoter Score (NPS) in key markets indicated a strong positive sentiment, outperforming many emerging competitors. This deep-seated trust, built over years of dependable service, deters potential new entrants who lack this foundational element.

Furthermore, KBC’s integrated bank-insurance model actively fosters customer loyalty. By offering a comprehensive suite of financial products, they create stickier relationships, making it less likely for customers to switch to a new, unproven entity. This holistic approach reinforces the brand's value proposition and strengthens its competitive moat against newcomers.

Economies of Scale and Distribution Networks

The threat of new entrants for KBC Group is significantly mitigated by its established economies of scale and deeply entrenched distribution networks. Reaching KBC's operational efficiency, particularly in technology and back-office functions, would demand substantial upfront capital for any newcomer. For instance, KBC's extensive network, including 1,106 banking branches as of the end of 2023, coupled with robust digital channels, presents a formidable barrier to entry.

New players would struggle to match KBC's cost advantages derived from these large-scale operations and widespread market presence. Competing on price or achieving comparable market penetration requires an investment level that is often prohibitive for emerging financial institutions.

- Economies of Scale: KBC leverages massive scale across its operations, reducing per-unit costs.

- Distribution Network: A vast physical (1,106 branches end-2023) and digital presence is difficult and costly to replicate.

- Capital Requirements: New entrants need significant funding to build similar infrastructure and achieve competitive pricing.

- Brand Loyalty: KBC's established brand and customer relationships create inertia against new competitors.

Customer Switching Costs and Incumbent Advantages

While the initial effort to switch banks might seem minimal, KBC Group's strategy of deeply integrating banking, insurance, and asset management creates substantial implicit switching costs for its customers. These embedded costs arise from the convenience and established trust within KBC's unified ecosystem, making it challenging for new entrants to lure away existing clients. For instance, in 2024, KBC reported a significant portion of its customer base utilizing multiple product categories, indicating a high level of ecosystem engagement.

New competitors face a significant hurdle in replicating KBC's established customer relationships and the perceived value of its comprehensive, digitally-driven offerings. Dislodging these deeply rooted connections requires more than just competitive pricing; it necessitates a comparable level of integrated service and digital sophistication. KBC's continued investment in digital transformation, evidenced by its 2024 digital banking growth figures, further solidifies its competitive moat against potential new entrants.

- High Ecosystem Integration: KBC's bundled financial services create sticky customer relationships.

- Implicit Switching Costs: Customers face hidden costs in leaving the integrated KBC platform.

- Digital Convenience Advantage: KBC's digital offerings enhance customer retention.

- Incumbent Relationship Strength: Established trust and convenience are barriers for new players.

The threat of new entrants for KBC Group is significantly low due to immense capital requirements, stringent regulatory hurdles, and the high cost of obtaining necessary licenses. For instance, in 2024, establishing a new bank in major European markets often necessitates hundreds of millions of euros in initial capital and can take over 18 months for regulatory approval, creating a substantial barrier to entry.

New entrants also struggle to overcome KBC's established brand loyalty and the deep trust it has cultivated with its customer base. KBC's 2023 customer satisfaction scores consistently outpaced emerging competitors, highlighting the difficulty new players face in replicating this foundational element of trust and reliability.

Furthermore, KBC's significant economies of scale and its extensive, integrated distribution network, comprising 1,106 banking branches as of the end of 2023, provide a cost advantage that is nearly impossible for new entrants to match. This scale, combined with high customer ecosystem integration and implicit switching costs, makes it exceptionally challenging for new players to attract and retain KBC's clientele.

| Factor | Impact on New Entrants | KBC's Advantage |

|---|---|---|

| Capital Requirements | Extremely High (e.g., €100M+ for banking license) | Established, strong capitalization |

| Regulatory Hurdles | Lengthy approval processes (18+ months in 2024), complex compliance (AML, KYC, Data Privacy) | Experienced compliance infrastructure |

| Brand Reputation & Trust | Difficult and time-consuming to build | Decades of cultivated trust, high customer satisfaction (2023) |

| Economies of Scale | High upfront investment needed to match | Significant cost efficiencies from large operations |

| Distribution Network | Costly and time-consuming to replicate (1,106 branches end-2023) | Widespread physical and digital reach |

| Customer Ecosystem Integration | Challenging to create comparable sticky relationships | Bundled services foster high customer retention |

Porter's Five Forces Analysis Data Sources

Our KBC Group Porter's Five Forces analysis is built on a foundation of robust data, including KBC's annual and quarterly financial reports, investor presentations, and official press releases. We also integrate insights from reputable financial news outlets and industry-specific publications to capture current market dynamics and competitive landscapes.