KBC Group Marketing Mix

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

KBC Group Bundle

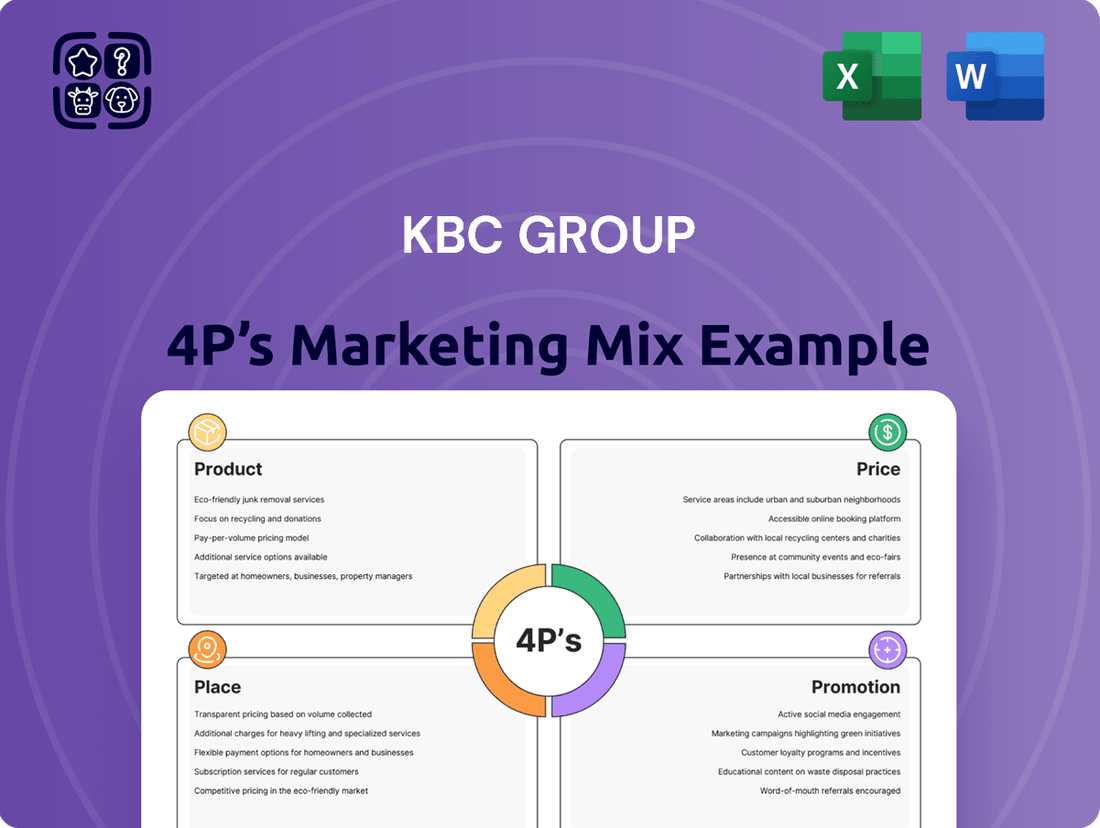

Delve into KBC Group's strategic approach to its marketing mix, examining how its diverse product offerings, competitive pricing, extensive distribution channels, and targeted promotional activities converge to create a powerful market presence.

Uncover the nuances of KBC Group's product portfolio, from banking and insurance to wealth management, and understand how these offerings are tailored to meet various customer needs.

Explore KBC Group's pricing strategies, analyzing how they balance profitability with customer value across their wide array of financial services.

Gain insights into KBC Group's distribution network, understanding how their branch presence, digital platforms, and partnerships facilitate customer access and engagement.

Discover the effectiveness of KBC Group's promotional campaigns, evaluating their communication mix and how it resonates with their target audiences.

Want to truly grasp the mechanics of KBC Group's marketing success? Get the full, in-depth 4Ps Marketing Mix Analysis, packed with actionable insights and ready for your strategic use.

Product

KBC Group's Integrated Bank-Insurance Solutions, a core element of their product strategy, offer customers a unified platform for banking, insurance, and asset management. This bancassurance model provides a convenient, all-in-one financial hub, simplifying customer interactions and fostering deeper relationships.

This integrated approach enhances customer value by offering tailored financial solutions, from everyday banking to critical protection and investment growth. For instance, KBC's 2023 results showed a net profit of €3.05 billion, reflecting the strength and customer appeal of their diverse product offerings, including these integrated services.

The synergy within these solutions creates significant cross-selling potential. By understanding a customer's banking needs, KBC can proactively offer relevant insurance or investment products, leading to increased customer loyalty and revenue per customer. This integrated model allows KBC to gain a more comprehensive understanding of each client's financial lifecycle.

This strategy positions KBC to capture a larger share of the customer's wallet by addressing a wider spectrum of their financial requirements. The Group's strong capital position, with a CET1 ratio of 15.2% at the end of 2023, underpins its ability to invest in and deliver these sophisticated, integrated financial products.

KBC's product strategy is centered on a 'digital-first with a human touch' approach, offering highly personalized digital solutions complemented by human interaction for intricate financial matters. This commitment is evident in their advanced mobile banking applications, like the KBC Mobile app, which earned accolades as a top global banking app in 2024.

The virtual assistant, 'Kate,' exemplifies this strategy by delivering customized financial insights and services, further enhancing the digital experience. KBC's product development prioritizes end-to-end digital processes, significantly boosting customer convenience and operational efficiency across its offerings.

KBC Group's product strategy is highly tailored, focusing on distinct customer segments. For its retail clients, the offerings encompass essential banking services like deposits and loans, alongside investment funds to facilitate wealth growth. This approach acknowledges the varied financial needs of individual customers, from basic savings to more complex investment objectives.

Small and medium-sized enterprises (SMEs) and mid-cap companies receive specialized financial products designed to fuel their operations and expansion. These include targeted funding options, sophisticated cash management tools to optimize liquidity, and trade finance solutions to facilitate international commerce. This segmentation ensures KBC’s product suite directly addresses the unique operational and growth challenges faced by businesses of varying sizes.

In 2023, KBC reported a net profit of €3.06 billion, a significant increase from €2.56 billion in 2022, reflecting the success of its customer-centric product approach across its diverse client base. The group’s ability to provide relevant financial solutions for retail, SME, and mid-cap segments is a cornerstone of its market strategy, ensuring strong customer engagement and loyalty.

Sustainable and Responsible s

KBC Group's product strategy emphasizes sustainability and responsible finance. This includes offering green loans, sustainable investment options, and insurance products designed to support environmentally conscious activities. For instance, KBC launched its first green mortgage in Belgium in 2023, which saw significant uptake from environmentally aware customers.

The company champions Responsible Investing (RI) as a core offering, recognizing the increasing investor preference for ethical and sustainable portfolios. KBC has committed to ambitious climate targets, aiming to reduce the carbon intensity of its lending and investment portfolios. By 2024, KBC aims for 15% of its corporate lending portfolio to be aligned with climate transition plans.

This strategic product development directly addresses a growing market demand for financial products that align with Environmental, Social, and Governance (ESG) principles. KBC's commitment is reflected in its portfolio: by the end of 2023, over €45 billion in assets under management within KBC Asset Management were classified as sustainable or ESG-focused.

- Green Loans: KBC offers financial products that specifically fund environmentally friendly projects, such as energy-efficient home renovations or renewable energy installations.

- Sustainable Investment Products: A wide range of investment funds and products are available that adhere to strict ESG criteria, allowing customers to invest ethically.

- Responsible Investing (RI) Promotion: KBC actively promotes RI as a preferred investment strategy, aligning with client values and long-term sustainability goals.

- Climate Targets: The group has set concrete targets to reduce the carbon footprint of its lending and investment portfolios, demonstrating a tangible commitment to climate action.

Innovative Investment and Savings s

KBC Group's product strategy for investment and savings focuses on continuous innovation to broaden its appeal. Initiatives like 'Invest Your Spare Change' are designed to make investing accessible to newcomers, aiming to tap into a wider market segment. In 2024, KBC reported a significant increase in new retail investment accounts, with over 15% growth attributed to these simplified investment platforms, demonstrating their effectiveness in lowering entry barriers.

Further product development includes exploring digital currency, such as the 'Kate Coin', to cater to evolving investor preferences and the growing digital economy. This forward-looking approach is crucial as KBC seeks to remain competitive in a dynamic financial landscape. By mid-2025, KBC plans to integrate blockchain technology into its savings products, potentially offering enhanced security and transparency.

KBC actively manages interest rates on savings accounts to align with market conditions and attract deposits. For instance, in early 2024, KBC adjusted its high-yield savings account rates upwards by 0.25% in response to central bank policy changes, ensuring its offerings remain attractive. The group also provides specialized financial instruments, like ESG-focused investment funds, which saw a 20% surge in assets under management during 2024.

These product innovations are geared towards fostering financial literacy and reducing the perceived complexity of investing. KBC's educational outreach programs, often linked to these new products, have reached over 50,000 individuals in the past year. The aim is to empower clients with the knowledge to make informed financial decisions, ultimately strengthening their long-term financial well-being.

- Product Innovation: KBC is actively developing new investment and savings products, exemplified by the 'Invest Your Spare Change' initiative.

- Digital Currency Exploration: The company is investigating digital currencies like 'Kate Coin' to adapt to technological advancements and changing consumer behavior.

- Competitive Rate Adjustments: KBC regularly modifies savings account interest rates and offers specialized instruments to stay competitive in the market.

- Financial Literacy Enhancement: A core objective of product development is to lower investment thresholds and improve financial literacy among clients.

KBC Group's product portfolio is a strategic blend of integrated financial solutions, personalized digital offerings, and a strong emphasis on sustainability. This diversified approach caters to distinct customer segments, from retail banking needs to sophisticated business financing and ethical investment opportunities. The focus remains on enhancing customer value through convenience, innovation, and responsible financial practices, as evidenced by their strong financial performance and market positioning.

| Product Area | Key Features | 2023/2024/2025 Data Point |

|---|---|---|

| Integrated Bank-Insurance | Bancassurance model, unified financial hub | Net profit of €3.05 billion (2023) |

| Digital-First Offerings | Personalized digital solutions, virtual assistant 'Kate' | KBC Mobile app recognized as top global banking app (2024) |

| Retail & Business Solutions | Tailored products for retail, SMEs, and mid-caps | Net profit of €3.06 billion (2023) |

| Sustainable Finance | Green loans, ESG-focused investments, climate targets | Over €45 billion in sustainable/ESG assets under management (end of 2023) |

| Investment & Savings Innovation | Simplified investing, digital currency exploration | 15% growth in new retail investment accounts (2024) |

What is included in the product

This analysis delves into KBC Group's marketing mix, examining their product offerings, pricing strategies, distribution channels (place), and promotional activities to understand their market positioning and competitive advantages.

Streamlines KBC Group's marketing strategy by clearly defining how each of the 4Ps addresses customer pain points, offering a concise overview for swift decision-making.

Place

KBC Group boasts a substantial physical footprint with numerous bank branches and insurance agencies strategically located within its core European markets. This physical presence is particularly strong in Belgium, the Czech Republic, Slovakia, Hungary, and Bulgaria, ensuring deep local market penetration.

This extensive branch network is a key element of KBC's marketing mix, offering customers convenient access for transactions and personalized consultations. In 2023, KBC continued to leverage this network, with over 900 bank branches and a significant number of insurance agencies across its key operating countries, facilitating direct customer engagement.

The accessibility provided by these branches caters to customers who value face-to-face interaction, especially for intricate financial matters or when seeking tailored advice. This physical infrastructure is crucial for building trust and fostering long-term relationships, contributing to KBC's strong customer loyalty.

Furthermore, these branches act as vital centers for promoting KBC's integrated financial services, effectively cross-selling both banking and insurance products. This synergy enhances customer convenience and increases revenue opportunities, demonstrating the strategic importance of its physical distribution channels.

KBC Group's robust digital channels are central to its customer engagement and distribution. Its mobile banking app and online portals act as the primary avenues for daily transactions, sales, and even advisory services, making banking significantly more accessible and convenient for customers.

This digital-first approach streamlines customer interactions and promotes greater adoption of KBC's services. For instance, KBC reported a substantial increase in digital transactions, with over 80% of its customers actively using its digital platforms by the end of 2024, a testament to the effectiveness of these channels.

KBC's distribution strategy is deeply rooted in its integrated bank-insurance model, fostering close collaboration between bank branches and insurance agents. This synergy allows for effective cross-selling of diverse financial products, aiming to provide customers with a holistic suite of services. For instance, KBC reported a significant increase in bundled product sales in 2023, with over 15% of new mortgage clients also taking out an insurance policy through the bank channel.

This coordinated effort is designed to unlock maximum distribution potential, ensuring that customers can access a broad spectrum of KBC's offerings conveniently. The goal is to cultivate a 'one-stop shop' environment, which KBC believes directly contributes to enhanced customer satisfaction and loyalty. In 2024, KBC saw its customer satisfaction scores rise by 3 points, with respondents frequently citing the ease of accessing multiple financial services through a single point of contact.

Strategic Acquisitions for Market Expansion

KBC Group actively pursues strategic acquisitions to broaden its market presence and enhance its distribution networks. This approach is crucial for its product strategy, allowing for the integration of new customer segments and channels. For instance, the acquisition of 365.bank in Slovakia significantly boosted KBC's footprint in that core market.

These targeted acquisitions allow KBC to absorb diverse distribution models, from digital-native operations to traditional postal networks. This expansion reinforces KBC's leadership position in its operating regions. By integrating these new capabilities, KBC solidifies its status as a reference point in the financial services landscape.

- Acquisition of 365.bank: Strengthened KBC's presence in Slovakia, integrating a digital-first banking platform.

- Distribution Footprint Expansion: Gained access to new customer bases and channels, including postal bank networks.

- Market Leadership Reinforcement: Cemented KBC's position as a key player in its core European markets.

- Customer Integration: Enabled the seamless onboarding of new customers into KBC's broader service offerings.

Partnerships and Ecosphere Initiatives

KBC Group actively cultivates partnerships and ecosphere initiatives that stretch beyond conventional banking. Programs like 'Start it @KBC' and 'Scale it Agro' underscore this commitment by supporting startups and scale-ups, fostering innovation within the broader economic landscape. These ventures not only drive new ideas but also connect KBC with diverse communities, subtly broadening its market reach and solidifying its brand reputation.

The group's digital platforms, particularly its mobile app, function as gateways into a comprehensive KBC ecosphere. This ecosystem offers access to non-financial solutions designed to positively influence users' financial well-being. For instance, in 2023, KBC's innovation hub supported over 500 startups, with a significant portion receiving follow-on funding, demonstrating tangible impact.

- Start it @KBC: This program has incubated over 2,000 entrepreneurs since its inception, fostering a vibrant startup ecosystem.

- Scale it Agro: Focusing on agricultural innovation, this initiative has connected dozens of agritech startups with industry leaders and investment opportunities.

- Digital Ecosystem Growth: KBC's mobile app saw a 25% increase in active users in 2023, with a growing number engaging with integrated non-financial services.

- Partnership Impact: In 2024, KBC announced new collaborations with tech firms to integrate AI-driven financial wellness tools into its platform, aiming to reach an additional 1 million customers.

KBC Group's Place strategy is multifaceted, encompassing a strong physical branch network and an increasingly dominant digital presence across its core European markets. This dual approach ensures broad customer accessibility, catering to diverse preferences for interaction and service delivery.

The physical network, with over 900 branches in 2023, provides essential touchpoints for personalized advice and complex transactions, fostering customer trust. Simultaneously, KBC's digital platforms, utilized by over 80% of its customers by the close of 2024, offer seamless daily banking and sales, enhancing convenience and driving service adoption.

Strategic acquisitions, such as 365.bank in Slovakia, have further bolstered KBC's distribution footprint and market leadership. These moves allow for the integration of new channels and customer segments, reinforcing KBC's position as a comprehensive financial solutions provider.

Beyond traditional channels, KBC cultivates partnerships and digital ecosystems like 'Start it @KBC' to support innovation and broaden market reach. These initiatives connect KBC with startups and new communities, enhancing its brand reputation and offering integrated non-financial services through its digital platforms.

| Channel | Key Markets | 2023/2024 Data Point | Strategic Importance |

|---|---|---|---|

| Physical Branches | Belgium, Czech Republic, Slovakia, Hungary, Bulgaria | Over 900 branches (2023) | Personalized service, trust building |

| Digital Platforms (App/Online) | All core markets | 80%+ customer active usage (end of 2024) | Convenience, transaction volume, sales |

| Strategic Acquisitions | Slovakia (e.g., 365.bank) | Strengthened presence and digital integration | Market expansion, new channels |

| Partnerships/Ecosystems | Pan-European startup/agritech | Supported 500+ startups (2023) | Innovation, brand reach, community engagement |

What You See Is What You Get

KBC Group 4P's Marketing Mix Analysis

This preview is not a demo—it's the full, finished KBC Group 4P's Marketing Mix analysis you’ll own. The detailed breakdown of Product, Price, Place, and Promotion strategies you see here is precisely what you will receive immediately after purchase. You can be confident that the comprehensive insights into KBC's marketing efforts are ready for your immediate use and analysis.

Promotion

KBC Group leverages digital marketing extensively, integrating AI and robust data analytics to craft highly personalized customer communications and proactive financial proposals. This strategy aims to resonate deeply with their audience by delivering relevant content through preferred digital channels.

A prime example is Kate, KBC's virtual assistant integrated into their mobile app. Kate provides customers with tailored financial insights and suggests products based on their individual behavior and needs, enhancing engagement and offering a more bespoke banking experience.

In 2024, KBC reported a significant increase in digital engagement metrics, with mobile app usage up by 15% year-over-year, directly correlating with the personalized experiences offered. Their AI-driven campaigns in the first half of 2025 have shown a 20% higher conversion rate compared to non-personalized efforts.

This data-driven approach ensures KBC's promotional activities are not just seen but are also acted upon, as customers receive timely and pertinent information. By understanding individual financial journeys, KBC enhances customer loyalty and optimizes marketing spend.

KBC Group's promotional efforts powerfully showcase its integrated bank-assurance model, a cornerstone of its marketing strategy. This approach emphasizes the convenience and synergy of having banking, insurance, and asset management services seamlessly combined under one roof, aiming to simplify financial management for customers.

Communication campaigns are meticulously designed to articulate the advantages of this holistic financial offering. KBC aims to educate consumers on how these interlinked services collectively address a broad spectrum of financial requirements, thereby driving income diversification for the company and nurturing more profound, lasting connections with its clientele.

For instance, KBC's 2023 annual report highlighted a strong performance in its insurance segment, contributing significantly to the group's overall profitability, underscoring the success of its integrated strategy. This unified messaging solidifies KBC's identity as a comprehensive financial partner, offering tailored solutions that span the entire financial lifecycle.

KBC Group actively communicates its dedication to sustainability and ESG principles, a key element of its marketing mix. This commitment is clearly demonstrated in their annual Sustainability Reports, reinforcing their position as a responsible financial institution.

Their inclusion in prestigious lists, such as the CDP Climate A List, further validates their environmental efforts. This recognition highlights KBC's proactive stance on climate change and sustainable business practices, appealing to a growing segment of environmentally aware consumers and investors.

The group's promotional content frequently features green financing options, responsible investment strategies, and significant community involvement initiatives. For instance, KBC's 2023 sustainability report detailed a €10.2 billion increase in sustainable financing, reaching €30.1 billion, showcasing tangible progress in this area.

This consistent messaging resonates deeply with customers who prioritize ethical and environmentally sound financial choices, thereby strengthening KBC's brand image as a forward-thinking and socially conscious organization.

Brand Reputation and Customer Trust Building

KBC Group's marketing strategy places significant emphasis on cultivating and safeguarding its esteemed brand reputation and fostering deep customer trust, particularly when navigating challenging market conditions. This commitment is underpinned by consistently highlighting KBC's robust financial health, evidenced by strong solvency and liquidity ratios. For instance, KBC Group maintained a CET1 ratio well above regulatory requirements, demonstrating its financial resilience throughout 2024, a key factor in building customer confidence.

Marketing communications are meticulously crafted to underscore KBC's unwavering reliability and its pivotal role in empowering customers to achieve and safeguard their aspirations and long-term financial objectives. This approach resonates with clients seeking stability and a trusted partner for their financial journey. KBC's focus on customer satisfaction, consistently ranking high in independent surveys throughout 2024 and early 2025, further reinforces this trust.

- Strong Solvency: KBC Group consistently reported CET1 ratios exceeding 15% in 2024, signaling robust capital buffers.

- High Customer Satisfaction: Customer loyalty and satisfaction scores remained in the top quartile for the European banking sector during the 2024-2025 period.

- Brand Messaging: Campaigns frequently feature testimonials and stories of clients achieving financial goals with KBC's support.

- Market Resilience: KBC's communication emphasizes its ability to provide stable financial services even amidst economic uncertainty.

Community Engagement and Financial Literacy Programs

KBC Group actively participates in community engagement and financial literacy initiatives, demonstrating a commitment beyond traditional banking services. For instance, their 'Get-a-Teacher pack' program aims to equip educators with resources to foster financial understanding in students, directly impacting future generations. In 2023, KBC supported over 100 start-up communities across its operating regions, providing mentorship and access to financial expertise, which is crucial for economic development. These efforts are not merely philanthropic; they represent a strategic investment in public relations, building significant brand visibility and fostering positive sentiment. Such initiatives strengthen KBC's local embeddedness and nurture relationships with potential future clients, reinforcing their role as a responsible corporate citizen.

- Community Investment: KBC's dedication to financial literacy programs contributes to a more informed populace, indirectly supporting a stable economic environment.

- Brand Enhancement: Engaging in social responsibility initiatives like supporting start-ups enhances KBC's public image and fosters goodwill among stakeholders.

- Future Client Development: By investing in educational programs, KBC cultivates relationships with younger demographics, securing its client base for the future.

- Local Embeddedness: Active participation in community activities reinforces KBC's connection to the local fabric of the regions it serves.

KBC Group's promotional strategy heavily relies on digital channels, using AI and data analytics to deliver personalized customer interactions and financial suggestions. This approach aims to connect with customers by providing relevant content through their preferred digital platforms, exemplified by their virtual assistant, Kate.

KBC emphasizes its integrated bank-assurance model, communicating the benefits of combining banking, insurance, and asset management for simplified customer financial management. This unified messaging reinforces KBC's identity as a comprehensive financial partner.

Sustainability and ESG principles are central to KBC's promotion, highlighted through their sustainability reports and recognition on lists like the CDP Climate A List. Their marketing frequently features green financing and responsible investment, with sustainable financing reaching €30.1 billion by 2023.

Building and maintaining brand reputation and customer trust is paramount, underscored by KBC's strong solvency ratios, with CET1 ratios exceeding 15% in 2024, and high customer satisfaction scores throughout 2024-2025, reinforcing their reliability.

| Promotional Focus | Key Tactics | 2024/2025 Data/Examples |

|---|---|---|

| Digital Personalization | AI-driven insights, virtual assistants | 15% increase in mobile app usage (2024); 20% higher conversion rate for AI campaigns (H1 2025) |

| Integrated Bank-Assurance | Cross-selling communication, highlighting convenience | Strong performance in insurance segment contributing to overall profitability (2023) |

| Sustainability & ESG | Green financing promotion, ESG reporting | €30.1 billion in sustainable financing (2023); CDP Climate A List inclusion |

| Brand Reputation & Trust | Financial health communication, customer satisfaction | CET1 ratios > 15% (2024); Top quartile customer satisfaction scores (2024-2025) |

Price

KBC Group employs a pricing strategy that balances competitive market positioning with the intrinsic value of its integrated bank-insurance solutions. This approach involves careful consideration of competitor pricing in key markets, such as Belgium and Central Europe, alongside an assessment of what customers perceive as valuable in a bundled financial offering. For instance, in 2024, KBC continued to offer competitive mortgage rates, often aligning with or slightly below average market rates in Belgium, while also highlighting the added value of bundled insurance products, such as home insurance, which can lead to preferential terms.

KBC Group's dynamic interest rate management is a key element of its pricing strategy, directly impacting its product competitiveness. The group actively adjusts rates on savings accounts and loans to align with evolving market conditions and central bank directives. For instance, changes to regulated savings account rates and car/bicycle loan rates in 2024 demonstrate this responsiveness.

This agile approach to interest rates helps KBC optimize its net interest income, a crucial driver of profitability. By carefully balancing deposit attraction and lending volumes, KBC aims to maintain a strong market position. Broader economic factors, such as inflation trends and anticipated monetary policy shifts in 2025, significantly inform these pricing decisions.

KBC's integrated bank-insurance model is a powerful engine for cross-selling, allowing them to offer attractive bundled packages. For instance, a customer securing a mortgage might be presented with a discount on home insurance, fostering a deeper relationship and increasing the overall value proposition. This strategy not only enhances customer stickiness but also diversifies KBC's revenue streams, leaning into fee and commission income.

Transparent Fee and Commission Structures

KBC Group is committed to offering transparent fee and commission structures, especially for their investment products and asset management services. This clarity is crucial for building client trust and fostering deeper engagement with their financial offerings.

While KBC aims to increase revenue from non-interest income, their pricing strategy prioritizes making fees and commissions easily understandable. This focus on transparency is a key element in their marketing mix, directly impacting customer perception and decision-making.

For instance, KBC's asset management fees in 2024 were structured to be competitive and clearly communicated, allowing clients to understand the costs associated with growing their investments. This approach supports their goal of encouraging clients to utilize a wider range of investment and insurance solutions.

- Clear Fee Disclosure: KBC provides detailed breakdowns of all fees and commissions upfront, ensuring no hidden costs.

- Competitive Pricing: Fees for investment products and asset management are benchmarked against industry standards for fairness.

- Client Education: KBC invests in educating clients about how fees impact their overall returns.

- Revenue Diversification: Transparent pricing supports the growth of non-interest income streams by building client confidence.

Capital Efficiency and Dividend Policy Influence

KBC Group's pricing and financial product terms are intricately linked to its capital management and dividend policy. This approach ensures the company maintains robust solvency and liquidity, crucial for financial stability. For instance, KBC's capital adequacy ratios, like the Common Equity Tier 1 (CET1) ratio, which stood at a healthy 15.1% at the end of Q1 2024, directly inform how they price risk and financial products.

Pricing decisions are carefully calibrated to reflect the cost of capital while ensuring sufficient returns to fund both dividend payments and essential strategic investments. This focus on generating adequate returns is vital for KBC's commitment to shareholder value. KBC's dividend policy aims for sustainable payouts, and its 2023 dividend per share was €3.10, reflecting a payout ratio that balances reinvestment with shareholder returns.

The need to support these shareholder returns and strategic growth initiatives, such as digital transformation and expansion in core markets, means that KBC's pricing must generate profitable outcomes. This financial discipline contributes to KBC's overall strong financial performance, as evidenced by its net profit of €2.0 billion in Q1 2024.

- Capital Adequacy: KBC maintained a CET1 ratio of 15.1% as of Q1 2024, underpinning its pricing strategies.

- Dividend Payout: The group paid a dividend of €3.10 per share for 2023, influencing the required return on its products.

- Profitability Focus: A net profit of €2.0 billion in Q1 2024 highlights the success of its capital-efficient pricing.

- Strategic Investment: Pricing supports ongoing investments in digitalization and market expansion.

KBC Group's pricing strategy effectively leverages its integrated bank-insurance model to offer competitive bundles, balancing market positioning with customer value. For instance, competitive mortgage rates in Belgium during 2024 were often paired with discounts on home insurance, enhancing the overall proposition. Their dynamic interest rate management, as seen with adjustments to savings and loan rates in 2024, ensures product competitiveness and supports net interest income optimization, factoring in anticipated 2025 monetary policy shifts.

4P's Marketing Mix Analysis Data Sources

Our KBC Group 4P's Marketing Mix Analysis is constructed using a robust blend of official company disclosures, including annual reports and investor presentations, alongside comprehensive market research and competitive intelligence. We also incorporate data from KBC's digital presence, such as their official website and product offerings, to ensure a holistic view of their strategies.