KBC Group PESTLE Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

KBC Group Bundle

Navigate the complex external forces impacting KBC Group with our comprehensive PESTLE analysis. Understand how political stability, economic shifts, and evolving social trends are shaping the financial landscape. Discover the technological advancements and environmental regulations that present both challenges and opportunities for KBC Group.

Gain a strategic advantage by delving into the legal frameworks and global market dynamics influencing KBC Group's operations. This meticulously researched PESTLE analysis offers actionable intelligence, empowering you to anticipate market shifts and refine your own strategies.

Don't get left behind; unlock a deeper understanding of KBC Group's operating environment. Purchase the full PESTLE analysis now and equip yourself with the insights needed to make informed decisions and secure your competitive edge.

Political factors

KBC Group's European operational base exposes it to significant geopolitical risks, particularly those arising from the US presidential election. The potential for renewed protectionist trade policies, such as increased tariffs, is a major concern. KBC's chief economist has warned that such measures could trigger global stagflationary impacts, which would negatively affect growth and inflation dynamics in key markets like Belgium and the broader Eurozone.

These trade conflicts and political shifts require KBC to maintain vigilant monitoring of both global and local political landscapes. By actively tracking these developments, the bank aims to proactively identify and mitigate the associated risks, ensuring greater resilience in its operations and financial strategies amidst an evolving international environment.

The political landscapes across KBC Group's core markets—Belgium, the Czech Republic, Slovakia, Hungary, Bulgaria, and Ireland—present a dynamic backdrop for its operations. Government stability is paramount, as it fosters a predictable regulatory environment and consistent economic policy, crucial for the financial sector. For instance, Belgium, as KBC's home market, has seen a shift towards coalition governments, which can sometimes lead to slower policy implementation but also a broader consensus on economic direction. In 2024, many of these nations are navigating electoral cycles, with potential for policy adjustments impacting banking regulations and fiscal strategies.

Instability, conversely, can introduce significant policy uncertainties. A change in government, especially in countries like Hungary or Bulgaria, might lead to shifts in banking supervision, capital requirements, or even state intervention in financial markets. This necessitates KBC's constant vigilance to adapt its strategies. For example, upcoming elections in several of these countries in 2024 and 2025 could signal changes in approach to digital banking initiatives or environmental, social, and governance (ESG) regulations, directly influencing KBC's strategic investments and operational frameworks.

KBC Group operates within a highly regulated financial sector, facing escalating demands from European Union regulators and supervisory authorities. These evolving requirements, driven by bodies like the European Banking Authority (EBA) and the European Central Bank (ECB), necessitate constant adaptation and substantial investment in compliance infrastructure.

The ongoing push for enhanced financial stability means KBC must dedicate significant resources to meet new prudential standards and reporting obligations. For instance, the ECB's ongoing supervisory activities, including stress tests and asset quality reviews, directly impact capital requirements and operational strategies for banks like KBC.

Proactive and transparent engagement with these regulatory bodies is paramount for KBC to effectively navigate this complex and dynamic environment. Staying ahead of anticipated regulatory changes, such as those related to digital finance or sustainability reporting, allows KBC to mitigate risks and maintain its license to operate.

EU Policy Agenda and Integration

The European Union's policy agenda, particularly initiatives from the European Commission, significantly shapes KBC Group's operating environment as a prominent European bank-insurer. For instance, upcoming revisions to the Sustainable Finance Disclosure Regulation (SFDR) and potential simplifications in reporting frameworks are key areas KBC is monitoring closely, aiming to ensure compliance and leverage new opportunities in sustainable finance. The ongoing implementation of Basel IV recommendations also necessitates strategic adjustments to capital requirements and risk management practices.

KBC must proactively align its business strategies with these evolving EU-level directives and the broader integration efforts across the bloc. This includes adapting to new solvency requirements and capital adequacy rules that will be phased in, impacting lending capacities and investment strategies. For example, the phased implementation of Basel IV, expected to be fully in effect by January 2025, will introduce updated credit risk, operational risk, and market risk frameworks for banks.

- SFDR Refinements: KBC is preparing for potential changes to SFDR, which could alter disclosure requirements for sustainable financial products, impacting product development and marketing.

- Basel IV Implementation: The bank is integrating the final Basel IV rules, which aim to increase the robustness of the banking sector, potentially affecting its risk-weighted assets and capital ratios.

- Digital Finance Strategy: The EU's focus on digital finance, including regulations for crypto-assets and digital operational resilience (DORA), presents both compliance challenges and opportunities for KBC's digital service offerings.

National Bank Taxes and Fiscal Policies

National bank taxes and fiscal policies are critical considerations for KBC Group. Governments in its operating markets frequently implement fiscal policies, including specific taxes levied on banks, which directly impact the company's profitability. For instance, KBC Group highlighted significant bank taxes in its first quarter 2025 results, which notably affected its net earnings.

These fiscal measures can vary considerably across countries, influencing KBC's strategic planning and financial performance in each jurisdiction.

- KBC Group's Q1 2025 results were impacted by substantial bank taxes.

- Changes in national fiscal policies can directly affect KBC's profitability and strategic decisions.

- The specific tax regimes in core markets are a key political factor influencing KBC's financial health.

- Fluctuations in government fiscal policies require KBC to adapt its financial strategies in each operating country.

Political stability across KBC Group's key European markets, including Belgium, the Czech Republic, and Ireland, is crucial for a predictable regulatory and economic environment. Electoral cycles in these nations throughout 2024 and 2025 introduce potential policy shifts that could affect banking regulations and fiscal strategies, necessitating KBC's adaptive planning.

What is included in the product

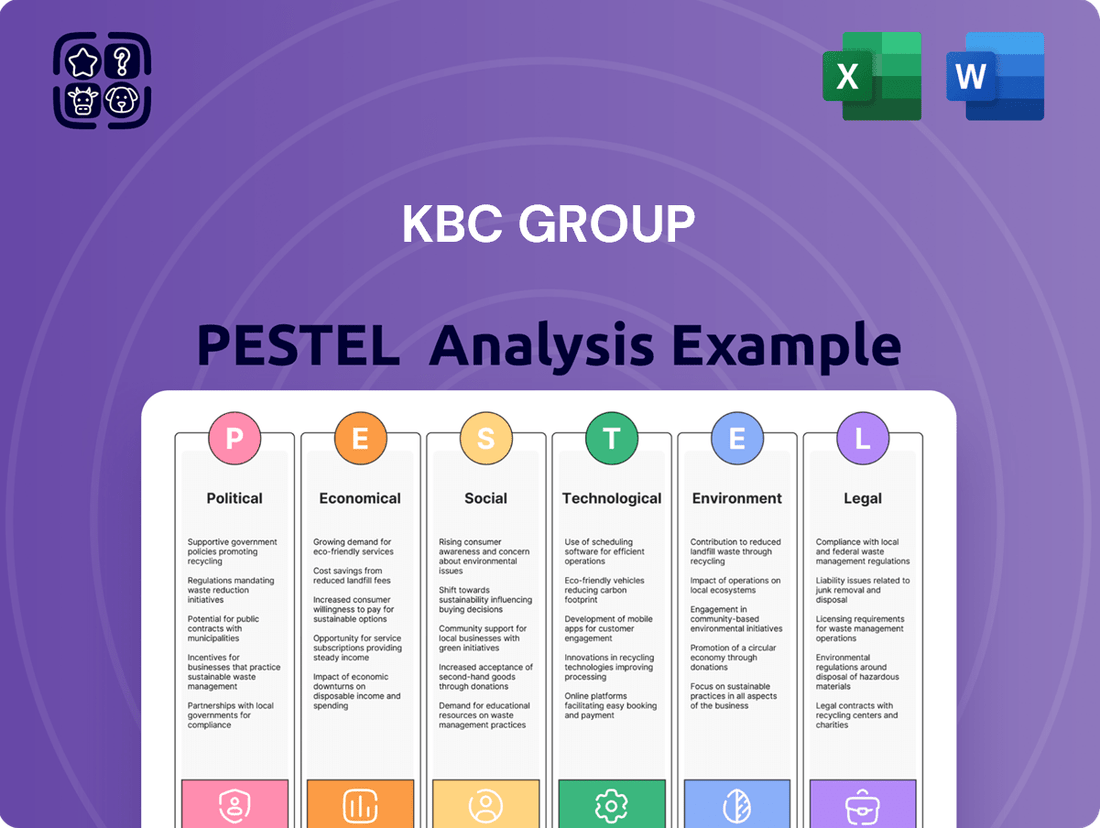

This PESTLE analysis of KBC Group examines the impact of Political, Economic, Social, Technological, Environmental, and Legal factors on its operations and strategic positioning.

It provides a comprehensive understanding of the external landscape, highlighting key trends and potential challenges for informed decision-making.

Offers a distilled KBC Group PESTLE analysis, presenting key external factors in a digestible format to alleviate the burden of sifting through extensive research during strategic discussions.

Economic factors

The interest rate environment is a crucial factor for KBC Group. As of mid-2024, interest rates in the Eurozone, KBC's primary market, have seen a gradual increase from historically low levels. This shift impacts KBC's net interest income, as lending rates typically adjust faster than deposit rates. For instance, a 0.25% increase in the European Central Bank's key interest rate can translate to billions in additional net interest income for major banks, depending on their balance sheet structure.

Inflation also plays a significant role. While moderate inflation can support lending growth, persistently high inflation, as seen in 2023 and continuing into 2024, can erode the real value of assets and increase operational costs for KBC. For example, if inflation outpaces wage growth and other income streams, it can lead to a squeeze on consumer spending, indirectly affecting loan demand and the bank's overall profitability. The ECB's target inflation rate is 2%, but recent figures have been considerably higher, necessitating careful monetary policy adjustments.

KBC has noted that a movement of funds from term deposits, which typically carry higher interest rates, to more liquid savings accounts can affect short-term profitability. This behavioral shift by customers is often driven by uncertainty or the expectation of further rate hikes. In 2024, the ongoing divergence in deposit rates across different maturities means KBC must carefully manage its funding costs to maintain healthy lending margins.

The European Central Bank's monetary policy is directly influenced by inflation data. Decisions made by the ECB regarding interest rates and quantitative easing programs create the economic backdrop for KBC's operations. For example, the ECB's rate hikes throughout 2023 and into 2024 were aimed at curbing inflation, which in turn influences KBC's cost of capital and the pricing of its financial products.

GDP growth in KBC's core European markets directly influences its performance, affecting loan demand, credit quality, and overall business activity. For instance, a robust economy typically translates to higher borrowing by individuals and businesses, boosting KBC's interest income and fee generation.

KBC itself has acknowledged the impact of global economic uncertainties, lowering its growth forecasts for Belgium and the broader Eurozone for 2025. This cautious outlook, driven by geopolitical factors, suggests a potentially more subdued environment for banking operations in the near term.

The group's strategic adjustments are closely tied to these GDP trends. By monitoring economic growth patterns in countries like the Czech Republic, Slovakia, Hungary, Bulgaria, and Ireland, KBC can better anticipate market shifts and refine its lending strategies, capital allocation, and risk management approaches.

For 2024, the International Monetary Fund (IMF) projects a Eurozone GDP growth of 1.7%, with Belgium expected to grow by 1.5%. For 2025, forecasts suggest a slight slowdown to 1.8% for the Eurozone. These figures provide a baseline against which KBC's own performance will be measured, highlighting the sensitivity of its business model to macroeconomic conditions.

Consumer spending and credit demand are critical drivers for KBC Group, especially within its retail banking and small and medium-sized enterprise (SME) operations. When people feel confident about the economy, have stable jobs, and more money in their pockets, they tend to spend more and borrow for bigger purchases like homes or cars. This directly impacts how many loans KBC can issue and how well those loans perform.

For KBC, a strong domestic economy like Belgium's provides a solid foundation for growth. In 2024, Belgium saw robust consumer spending, partly fueled by a tight labor market and rising wages. For example, retail sales in Belgium grew by an estimated 2.5% in the first half of 2024 compared to the same period in 2023, indicating healthy demand for goods and services, which in turn supports credit appetite.

The demand for credit from both consumers and businesses directly influences KBC's loan portfolio volume and quality. Higher disposable incomes and positive economic outlooks encourage more borrowing, boosting KBC's interest income. Conversely, economic downturns can lead to reduced spending and a rise in loan defaults, impacting the bank's profitability and risk management strategies.

Looking ahead to 2025, KBC anticipates continued stable consumer spending in its core markets, supported by projected modest economic growth. However, rising interest rates, while beneficial for net interest margins, could temper credit demand slightly as borrowing becomes more expensive. KBC is monitoring these trends closely to manage its loan book effectively.

Geopolitical Shocks to the Global Economy

Geopolitical shocks, such as the ongoing conflict in Ukraine and tensions in the Middle East, continue to ripple through the global economy. These events don't just cause direct political disruption; they create significant economic uncertainty. For instance, the war in Ukraine has been a major contributor to elevated energy prices and supply chain disruptions, impacting global GDP growth forecasts. In 2024, the IMF projected a global growth rate of 3.2%, a figure susceptible to further revisions based on escalating geopolitical tensions.

These uncertainties create a volatile business environment, particularly for financial institutions like KBC Group. Fluctuations in commodity prices, shifting trade policies, and potential sanctions can directly impact financial markets, affecting everything from stock valuations to interest rates. This volatility makes long-term financial planning more challenging and increases the risk profile for investments. The ongoing trade disputes, particularly between major economic powers, also introduce persistent uncertainty, affecting international trade volumes and investment flows.

- Impact on Inflation: Geopolitical events have a direct correlation with inflation. The energy price shocks stemming from the Ukraine conflict, for example, contributed significantly to inflation rates exceeding 5% in many advanced economies in 2023.

- GDP Growth Revisions: International organizations frequently revise GDP growth forecasts downwards following major geopolitical escalations. The World Bank, for example, has noted that protracted conflicts can shave percentage points off projected economic growth.

- Financial Market Volatility: Stock market indices often experience sharp declines during periods of heightened geopolitical risk. For instance, major indices saw significant drops in early 2022 following the invasion of Ukraine.

- Supply Chain Disruptions: Geopolitical instability frequently leads to disruptions in global supply chains, impacting the availability and cost of goods, a factor that continues to be a concern in 2024.

Exchange Rate Fluctuations in Non-Euro Markets

KBC Group's exposure to non-Euro markets, specifically in Central and Eastern Europe (Czech Republic, Hungary, Bulgaria), means it's directly impacted by exchange rate volatility. For instance, during 2024, the Czech Koruna (CZK) experienced fluctuations against the Euro. A weaker CZK, when translated back into KBC's reporting currency (Euro), would reduce the Euro-denominated value of profits earned in the Czech Republic. This directly affects KBC's consolidated financial performance and its overall balance sheet. Similarly, the Hungarian Forint (HUF) and Bulgarian Lev (BGN) also saw movements, presenting similar translation risks.

These currency shifts can significantly alter the reported financial results from KBC’s operations in these regions. For example, if the Czech Koruna depreciates by 5% against the Euro in a given quarter, the Euro equivalent of profits generated in CZK will shrink by that same percentage before any other factors are considered. This poses a tangible risk to KBC's overall profitability and the perceived strength of its balance sheet.

- Czech Koruna (CZK) to Euro (EUR) exchange rate saw a notable appreciation in late 2023 and early 2024, potentially boosting reported Euro earnings for KBC's Czech operations.

- The Hungarian Forint (HUF) experienced volatility throughout 2024, with periods of depreciation against the Euro that could negatively impact KBC's Hungarian segment's reported results.

- The Bulgarian Lev (BGN) remains pegged to the Euro, offering relative stability but still subject to broader Eurozone economic sentiment influencing KBC's Bulgarian business.

- In 2024, emerging market currencies, including those in KBC's operating regions, faced headwinds from global interest rate differentials and geopolitical events, directly affecting translation gains or losses.

Economic factors significantly shape KBC Group's operational landscape. Interest rate shifts, like those seen in the Eurozone in mid-2024, directly impact net interest income, with a 0.25% ECB rate hike potentially yielding billions in additional income for large banks. Inflation also plays a key role; while moderate levels can aid lending, high inflation erodes asset value and increases costs, with the ECB targeting 2% but facing higher figures in 2023-2024.

GDP growth in KBC's core European markets is a critical determinant of performance, influencing loan demand and credit quality. For example, the IMF projects 1.7% Eurozone GDP growth for 2024, with Belgium at 1.5%, indicating a baseline for KBC's business activity. Consumer spending and credit demand are vital, with Belgium's retail sales growing an estimated 2.5% in H1 2024, supporting credit appetite.

Geopolitical events, such as the conflict in Ukraine, contribute to economic uncertainty and inflation, with global GDP growth forecasts like the IMF's 3.2% for 2024 being susceptible to these shocks. Exchange rate volatility, particularly with KBC's non-Euro markets like the Czech Republic, directly affects consolidated financial results; a 5% depreciation of the Czech Koruna against the Euro, for instance, would reduce the Euro value of profits earned there.

| Economic Factor | 2024 Impact/Outlook | 2025 Outlook | KBC Relevance |

|---|---|---|---|

| Interest Rates (Eurozone) | Gradual increase from historic lows. | Continued moderate levels. | Impacts net interest income and funding costs. |

| Inflation | Higher than ECB target (2%), impacting costs and consumer spending. | Expected to moderate but remain a focus. | Affects operational costs and real value of assets. |

| GDP Growth (Eurozone) | Projected at 1.7% (IMF). | Slight slowdown to 1.8% projected. | Drives loan demand and credit quality. |

| Consumer Spending (Belgium) | Robust growth in H1 2024 (est. 2.5% retail sales). | Anticipated stable, supported by modest economic growth. | Key driver for retail banking and credit demand. |

| Geopolitical Events | Contributing to inflation and global uncertainty. | Continued potential for disruption. | Creates market volatility and impacts growth forecasts. |

| Exchange Rates (CZK/EUR) | Fluctuations impacting reported earnings from Czech operations. | Continued volatility expected. | Translation risk for non-Euro segment profits. |

Preview Before You Purchase

KBC Group PESTLE Analysis

The preview shown here is the exact document you’ll receive after purchase—fully formatted and ready to use. This comprehensive PESTLE analysis of KBC Group delves into the Political, Economic, Social, Technological, Legal, and Environmental factors impacting their operations. It provides a strategic overview essential for understanding the external forces shaping the banking and insurance sectors. You'll gain insights into market trends and potential challenges.

Sociological factors

Societal shifts are profoundly reshaping how customers interact with financial services, with a strong lean towards digital channels for both banking and insurance. This trend directly impacts KBC Group's operational strategy, pushing them to adapt and innovate in the digital space.

KBC's commitment to this digital evolution is clearly demonstrated through its 'Digital First with a Human Touch' strategy. A prime example of this success is their mobile app, which has seen significant user adoption. Furthermore, their virtual assistant, Kate, was recognized as the best banking app globally in 2024, highlighting the effectiveness of their digital investments.

The ongoing increase in digital adoption necessitates sustained investment in creating and maintaining user-friendly and highly secure digital platforms. This continuous development ensures KBC can meet evolving customer expectations and maintain a competitive edge in the digital financial landscape.

KBC Group actively champions financial literacy and inclusion, seeing it as a core part of its societal responsibility. For instance, in 2024, KBC partnered with local educational institutions to deliver financial education programs to over 5,000 students across Belgium, aiming to equip the younger generation with essential money management skills.

The group's commitment extends to underserved populations through microfinance and microinsurance. In 2024, KBC's microfinance initiatives provided essential startup capital to over 1,000 rural entrepreneurs in Poland, fostering economic growth and self-sufficiency. This focus on expanding access to financial services is crucial for broader societal well-being.

Demographic shifts, particularly the aging populations in KBC's core European markets, directly impact the demand for financial services. For instance, in Belgium, the median age has steadily increased, projected to reach around 45 years by 2030, which will likely boost demand for retirement planning, wealth accumulation, and specialized insurance products for seniors.

KBC must strategically adapt its product portfolio and service delivery to address the changing needs of these demographic segments. This includes offering more flexible pension solutions, enhanced wealth management services tailored for later life, and potentially new offerings related to long-term care, reflecting a growing segment of the population requiring such support.

The evolving preferences of different age groups, from younger generations seeking digital-first banking and investment platforms to older demographics valuing personalized advice, necessitate a multi-faceted approach. KBC's ability to innovate and personalize its offerings will be crucial for retaining existing customers and attracting new ones across the demographic spectrum, especially as the proportion of individuals over 65 in the Eurozone is expected to surpass 25% by 2030.

Societal Trust in Financial Institutions

Societal trust in financial institutions is a cornerstone of KBC Group's operational stability and growth. In 2024, public perception of banks remained a key differentiator, with institutions prioritizing transparency and ethical practices seeing stronger customer retention. KBC’s ongoing investments in clear communication regarding its financial health and product offerings, coupled with a robust approach to data privacy, directly address this critical factor.

KBC's dedication to responsible banking, including adherence to stringent sustainability policies and Environmental, Social, and Governance (ESG) principles, actively cultivates public trust. For instance, KBC's commitment to financing sustainable projects, with a growing portfolio in green bonds and renewable energy investments, resonates positively with an increasingly socially conscious consumer base. This focus on ESG was highlighted in their 2024 sustainability reports, showcasing a tangible impact.

- Customer Loyalty: Higher trust levels correlate directly with increased customer retention and reduced attrition rates.

- Reputation Management: A strong reputation built on trust mitigates reputational risks and enhances brand value.

- Regulatory Compliance: Proactive adherence to financial regulations, a key aspect of ethical conduct, bolsters trust and lowers the risk profile.

- ESG Integration: KBC's demonstrable commitment to ESG principles, such as increased sustainable financing, builds confidence among stakeholders.

Employee Well-being and Talent Retention

KBC Group recognizes that employee well-being and talent retention are paramount to its success, directly impacting operational efficiency and the quality of services delivered. A strong focus here means KBC is better positioned to attract and keep the skilled individuals needed to navigate a dynamic financial landscape.

As a significant employer, KBC's human resources strategies are key. This includes cultivating an environment that encourages learning and innovation, which is essential for staying competitive. For instance, KBC has been exploring pilot programs in areas like Generative AI, demonstrating a commitment to equipping its workforce with future-ready skills.

- Employee well-being initiatives: KBC has implemented various programs aimed at supporting employee health and mental wellness, contributing to a more engaged and productive workforce.

- Diversity and Inclusion: KBC is committed to fostering a diverse and inclusive workplace, with targets for gender representation in leadership roles and initiatives promoting equitable opportunities across all levels.

- Talent Development: Investments in continuous learning and development, including access to training and exposure to new technologies like AI, are central to KBC's talent retention strategy.

- Competitive Compensation: KBC offers competitive salary and benefits packages, benchmarked against industry standards, to attract and retain top talent in the financial sector.

Societal expectations are increasingly focused on digital-first interactions and personalized financial advice, which KBC Group addresses through its 'Digital First with a Human Touch' strategy. The recognition of its virtual assistant, Kate, as the best banking app globally in 2024 underscores this commitment.

KBC's dedication to financial literacy and inclusion is evident in its 2024 initiatives, which saw partnerships with educational institutions to reach over 5,000 students in Belgium, alongside microfinance programs supporting over 1,000 rural entrepreneurs in Poland.

Demographic shifts, particularly aging populations in Europe, are influencing KBC's service offerings, with an expected rise in demand for retirement planning and wealth management services. The proportion of individuals over 65 in the Eurozone is projected to exceed 25% by 2030, highlighting this trend.

Public trust, bolstered by KBC's emphasis on transparency, ethical practices, and ESG integration, is crucial. Their 2024 sustainability reports showcase significant investments in sustainable projects, aligning with a growing socially conscious consumer base.

Technological factors

KBC Group is a leader in digital transformation, prioritizing its 'Digital First with a Human Touch' strategy. This focus is evident in its substantial investments in developing advanced digital banking capabilities. The group's commitment to innovation is a cornerstone of its operational approach.

The success of KBC's mobile banking app, awarded the title of 'Best Banking App in the World' in 2024, highlights the effectiveness of its digital initiatives. Furthermore, the development of its virtual assistant, Kate, showcases KBC's dedication to creating intuitive and personalized customer interactions through technology.

KBC Group is heavily investing in artificial intelligence and data analytics to sharpen its competitive edge. These technologies are fundamental to their strategy for enhancing customer interactions, tailoring product recommendations, and boosting internal process efficiency. For instance, KBC's virtual assistant, Kate, uses AI to deliver personalized financial advice and simplify banking operations for customers.

The group's commitment to responsible AI implementation is evident in its phased approach, which involves careful testing and a robust ethical guideline structure. This ensures that AI is deployed in a way that maintains customer trust and data security, a critical factor in the financial services industry. By focusing on controlled experimentation, KBC aims to maximize the benefits of AI while mitigating potential risks, reflecting a forward-thinking approach to technological adoption.

With KBC Group's accelerating digital transformation, cybersecurity and data protection are no longer optional but essential. The increasing volume of sensitive customer information handled online necessitates robust defenses against evolving cyber threats.

The Digital Operational Resilience Act (DORA), set to take full effect in January 2025, will impose significant new requirements on financial institutions like KBC. This regulation mandates comprehensive frameworks for managing ICT risk, including cybersecurity, and requires detailed incident reporting, placing a premium on proactive risk mitigation.

To comply with DORA and maintain customer trust, KBC must make substantial, ongoing investments in its IT infrastructure. This includes upgrading cybersecurity controls, implementing advanced threat detection systems, and ensuring swift, transparent incident reporting mechanisms are in place to protect data integrity and operational continuity.

FinTech Innovation and Competition

The financial technology (FinTech) landscape is evolving at an unprecedented speed, presenting both significant opportunities and considerable challenges for established players like KBC Group. These innovations are reshaping customer expectations and operational efficiencies across the financial services sector. Staying ahead necessitates a proactive approach to embracing new technologies and adapting business models accordingly, ensuring KBC can leverage these advancements for growth and competitive advantage.

KBC's strategic flexibility, bolstered by its regulatory standing, positions it well to navigate this dynamic environment. The group has demonstrated this by investing in high-potential digital banking segments, such as its acquisition of 365.bank in Slovakia, a move that underscores its commitment to expanding its digital footprint. This strategic maneuver allows KBC to tap into growing markets and cater to a more digitally-native customer base.

To maintain its competitive edge, KBC must prioritize ongoing innovation and explore strategic partnerships with emerging FinTech companies. This collaborative approach can accelerate the development and deployment of cutting-edge financial solutions. For instance, by mid-2024, FinTech funding globally saw significant activity, with digital banking and payments platforms attracting substantial investment, indicating strong market confidence in these areas.

- Digital Transformation: KBC's investment in digital banking, like the 365.bank acquisition, reflects a broader industry trend where banks are prioritizing online and mobile platforms to enhance customer experience.

- FinTech Investment Trends (2024-2025): Continued venture capital investment in FinTech is expected, particularly in areas like AI-driven financial advisory and blockchain-based payment systems, signaling key areas for potential collaboration and competition.

- Regulatory Adaptability: KBC's regulatory headroom allows for quicker adoption of new technologies and business models, a critical factor in outmaneuvering slower-moving competitors in the rapidly evolving FinTech space.

Blockchain Technology and Digital Currencies

Blockchain technology, particularly in the realm of digital currencies, presents significant technological factors for KBC Group. KBC has actively engaged with this by exploring and implementing blockchain, notably through initiatives like its 'Kate Coin' digital currency. This allows customers to earn and spend digital currency by interacting with KBC and its partner offerings, showcasing a commitment to leveraging emerging tech for new customer value and engagement.

The strategic exploration of digital currencies like Kate Coin by KBC signifies a forward-looking approach to financial services. By integrating blockchain, KBC aims to create innovative loyalty programs and enhance customer interaction, potentially differentiating itself in a competitive market. This move aligns with broader trends in the financial sector, where digital assets are increasingly being viewed as a means to streamline transactions and build customer loyalty.

The ongoing development and adoption of blockchain and digital currencies are crucial considerations for KBC's technological landscape. As of early 2025, the global digital currency market continues to evolve, with increasing institutional interest and regulatory clarity emerging. KBC's early adoption of Kate Coin positions it to capitalize on these shifts, fostering digital innovation within its customer base.

- Blockchain Exploration: KBC's 'Kate Coin' initiative demonstrates proactive engagement with blockchain technology.

- Customer Engagement: The digital currency aims to enhance customer loyalty and interaction with KBC products and partners.

- Market Trends: KBC's efforts align with the growing global trend of digital currency adoption in finance.

- Innovation Driver: Blockchain implementation signals KBC's commitment to technological innovation in its service offerings.

KBC Group's 'Digital First with a Human Touch' strategy drives significant investment in advanced digital banking capabilities. The group's mobile banking app was recognized as the 'Best Banking App in the World' in 2024, underscoring its success in digital innovation.

Artificial intelligence and data analytics are central to KBC's strategy for enhancing customer experience and operational efficiency. Their virtual assistant, Kate, leverages AI for personalized financial advice, reflecting a commitment to intuitive customer service.

The Digital Operational Resilience Act (DORA), effective January 2025, necessitates substantial IT infrastructure upgrades for KBC, particularly in cybersecurity and incident reporting, to ensure compliance and data protection.

KBC is actively exploring blockchain technology, exemplified by its 'Kate Coin' initiative, which aims to create new customer engagement models and loyalty programs through digital currency. This aligns with broader industry trends in digital asset adoption.

Legal factors

KBC Group operates under the stringent capital requirements of the EU's Capital Requirements Regulation III (CRR III) and Capital Requirements Directive VI (CRD VI), which fully applied from January 1, 2025. These regulations are designed to implement the final Basel III standards, ensuring greater financial stability across the banking sector.

The group has demonstrated a robust approach to compliance, consistently maintaining a Common Equity Tier 1 (CET1) ratio that comfortably exceeds regulatory minimums. As of the first quarter of 2025, KBC reported a CET1 ratio of 15.1%, significantly above the European Banking Authority's requirements, highlighting its proactive strategy to bolster resilience and prudential strength.

The Digital Operational Resilience Act (DORA), set to take effect on January 17, 2025, imposes stringent requirements on financial entities like KBC to bolster their digital and operational resilience. This includes implementing comprehensive stress testing, efficient incident recovery plans, and advanced cybersecurity measures.

KBC Group must meticulously align its IT infrastructure and operational workflows with DORA's mandates to ensure continued financial stability and protect against evolving digital threats. Non-compliance could lead to significant penalties and reputational damage.

The European Banking Authority (EBA) reported that in 2023, the financial sector experienced a 30% increase in cyberattack attempts, highlighting the critical need for the proactive resilience measures DORA demands.

The Corporate Sustainability Reporting Directive (CSRD) significantly impacts KBC Group, requiring extensive sustainability disclosures. For KBC, this directive means reporting on Fiscal Year 2024 data, with the first wave of reporting due in 2025. This regulatory shift mandates a deeper dive into environmental, social, and governance (ESG) performance, affecting how KBC communicates its sustainability efforts.

KBC's 2024 Annual Report is expected to feature a detailed Sustainability Statement, compiled in accordance with the European Sustainability Reporting Standards (ESRS). These standards ensure a high level of transparency and comparability across companies, pushing KBC to provide granular data on its impact and strategies related to sustainability. This will influence KBC's operational practices and strategic decision-making.

The EU Taxonomy Regulation, which classifies environmentally sustainable economic activities, also plays a role. While not directly a reporting mandate like CSRD, it guides KBC's investment and lending activities, influencing which sectors and projects are considered sustainable within the EU. This framework encourages KBC to align its business operations with the EU's climate and environmental objectives, impacting its long-term financial planning and risk management.

Anti-Money Laundering (AML) Regulations

KBC Group must navigate increasingly stringent Anti-Money Laundering (AML) regulations, a trend set to intensify with new EU directives and the anticipated launch of the Anti-Money Laundering Authority (AMLA) in 2025. This evolving landscape demands significant investment in compliance infrastructure. For instance, the EU's 6th Anti-Money Laundering Directive, effective from mid-2024, broadens the scope of predicate offenses for money laundering, requiring financial institutions to adapt their risk assessments and due diligence procedures.

To meet these enhanced compliance measures, KBC needs robust IT systems capable of sophisticated data analysis and real-time customer screening. The financial sector is facing escalating costs associated with AML compliance, with reports indicating that global spending on AML compliance could exceed $30 billion annually by 2025. This necessitates a proactive approach to technology adoption and process refinement to effectively combat financial crime.

- Stricter EU Directives: Upcoming regulations will mandate more rigorous customer due diligence and reporting.

- AMLA Establishment: The new Anti-Money Laundering Authority, operational in 2025, will centralize supervision and enforcement.

- Technological Investment: KBC must invest in advanced IT and data analytics for effective transaction monitoring and risk management.

- Increased Compliance Costs: Financial institutions are experiencing rising operational expenses related to AML compliance, estimated to reach tens of billions globally.

Payment Services Directive 3 (PSD3) and Consumer Protection

Work is progressing on the Payment Services Directive 3 (PSD3), which is designed to boost transparency in payment services and reinforce transaction security. This directive, alongside other consumer protection legislation, directly shapes KBC Group's approach to developing and delivering its payment products and services. KBC must adhere to stringent rules regarding transaction processes and the resolution of customer disputes, ensuring robust protection for its clientele.

The ongoing evolution of payment regulations, such as PSD3, necessitates continuous adaptation within KBC's operational framework. For instance, PSD3 is expected to introduce stricter requirements for strong customer authentication (SCA) and data sharing, potentially impacting the user experience and the cost of implementing new payment solutions. KBC's commitment to consumer protection means investing in systems that guarantee clear communication about fees, transparent dispute resolution mechanisms, and secure handling of customer data, aligning with the EU's broader goals for a safer digital financial environment.

- Enhanced Security Measures: PSD3 is anticipated to mandate even stronger authentication protocols, potentially impacting KBC's digital banking platforms.

- Improved Transparency: Regulations will likely require clearer disclosure of transaction fees and terms, enhancing consumer trust.

- Dispute Resolution: KBC must maintain efficient and fair processes for handling customer disputes related to payment services.

- Data Protection: Adherence to evolving data privacy rules is critical for safeguarding customer information within payment systems.

KBC Group faces a dynamic legal environment with the full application of CRR III and CRD VI from January 1, 2025, reinforcing capital adequacy. The Digital Operational Resilience Act (DORA), effective January 17, 2025, mandates robust cybersecurity and incident response, a critical area given the 30% rise in cyberattack attempts in 2023 reported by the EBA. Furthermore, the Corporate Sustainability Reporting Directive (CSRD) requires KBC to report on its 2024 ESG performance in 2025, emphasizing transparency through European Sustainability Reporting Standards (ESRS).

The evolving Anti-Money Laundering (AML) landscape, with new EU directives and the 2025 launch of the Anti-Money Laundering Authority (AMLA), necessitates significant investment in compliance technology. KBC must also adapt to Payment Services Directive 3 (PSD3), which aims to enhance payment transparency and security, potentially impacting user experience and implementation costs for new payment solutions.

Environmental factors

KBC Group actively addresses climate change by acknowledging both physical risks, like extreme weather events, and transition risks, stemming from shifts to a low-carbon economy. The company has established concrete climate targets for 2030 across significant sectors within its loan portfolio, aiming to align its operations with the goals of the Paris Agreement.

To manage and reduce these environmental exposures, KBC has developed sophisticated tools. These include a comprehensive Climate Risk Impact Map and a localized Environmental Risk Impact Map, providing detailed assessments to inform mitigation strategies and ensure responsible financial practices.

KBC Group is actively embedding Environmental, Social, and Governance (ESG) criteria across its business. This commitment is evident in their expanding portfolio of sustainable investment funds and their involvement in issuing green bonds. Furthermore, KBC is prioritizing responsible lending, ensuring that its financing activities support environmentally and socially beneficial projects.

The group's strategic objective is to amplify its positive societal contributions. KBC aims to achieve this by actively financing and providing expert advice on initiatives that generate tangible environmental and social benefits. This approach directly supports their alignment with the UN Principles for Responsible Banking and the broader Sustainable Development Goals (SDGs).

KBC Group is actively developing and promoting green financial products to encourage sustainability. This includes offering loans specifically for renewable energy projects, home insulation upgrades, and the installation of electric vehicle charging infrastructure. For example, KBC reported in early 2024 that its green mortgage offerings had seen a significant uptake, with over 15% of new mortgages issued in the past year being categorized as green.

Beyond lending, KBC also provides insurance solutions designed for environmentally conscious consumers and businesses. This encompasses extended coverage options for hybrid and electric vehicles, reflecting the growing market for these cleaner transportation alternatives. In 2024, the demand for their specialized EV insurance policies increased by 25% compared to the previous year, highlighting a tangible shift in consumer preference.

Direct Environmental Footprint Reduction

KBC Group is actively working to shrink its direct environmental impact. The company has made significant strides, achieving a 68% reduction in its operational footprint over the last decade. This commitment translates into concrete actions like curbing energy usage and sourcing 100% of its electricity from renewable sources.

These efforts are embedded in KBC's daily operations, ensuring sustainable practices are adopted throughout its offices and business activities.

- Operational Footprint Reduction: KBC has reduced its operational environmental footprint by 68% in the past 10 years.

- Energy Consumption: The group prioritizes limiting its energy consumption across all facilities.

- Renewable Electricity: KBC is committed to using 100% renewable electricity for its operations.

- Sustainable Practices: Implementation of sustainable practices is a core element of KBC's facility and operational management.

ESG Reporting and Transparency Requirements

KBC Group is navigating a landscape of increasingly stringent environmental, social, and governance (ESG) reporting requirements. These mandates, particularly within the European Union, are designed to enhance transparency and accountability. The EU Taxonomy, for instance, sets clear criteria for what constitutes an environmentally sustainable economic activity, impacting how financial institutions like KBC categorize and report their investments. This regulatory push is not just about compliance; it's about demonstrating a commitment to sustainable finance.

The expansion of Pillar 3 ESG disclosures to all EU banks in January 2025 is a significant development. This means KBC, like its peers, must provide more detailed information on the ESG risks and opportunities they face, as well as their strategies for managing them. This enhanced disclosure aims to give investors and stakeholders a clearer picture of a bank's resilience and long-term value creation potential in a world increasingly focused on sustainability.

KBC's proactive approach is evident in its reporting. The company's 2024 Sustainability Report and Annual Report already incorporate mandatory disclosures under the Corporate Sustainability Reporting Directive (CSRD). This directive requires comprehensive reporting on a company's ESG impacts, governance, and strategy, pushing for greater transparency and comparability across businesses. KBC's inclusion of these disclosures underscores its commitment to openly communicating its environmental, social, and governance performance.

Key aspects of KBC's ESG reporting include:

- Alignment with EU Taxonomy: Reporting on the proportion of KBC's assets that are environmentally sustainable according to EU criteria.

- Pillar 3 ESG Disclosures: Providing detailed information on ESG risks, capital requirements related to these risks, and management strategies.

- CSRD Compliance: Ensuring comprehensive and standardized reporting of environmental, social, and governance impacts, as mandated by the EU.

- Transparency on Climate-Related Risks: Disclosing the physical and transition risks associated with climate change and KBC's strategies to mitigate them.

KBC Group is actively working to reduce its direct environmental impact, having achieved a 68% reduction in its operational footprint over the past decade by limiting energy consumption and sourcing 100% of its electricity from renewables.

The company is also promoting green finance, with over 15% of new mortgages issued in early 2024 being green mortgages, and saw a 25% increase in demand for its specialized electric vehicle insurance policies in the same year.

KBC is committed to aligning with the Paris Agreement, setting concrete climate targets for 2030 across key sectors in its loan portfolio and utilizing tools like a Climate Risk Impact Map to manage environmental exposures.

Increased regulatory focus, including mandatory EU ESG reporting under CSRD from 2024 and Pillar 3 ESG disclosures from January 2025, is driving KBC to enhance transparency on its environmental performance and strategies.

| Environmental Factor | KBC Group's Action/Data | Year/Period |

| Operational Footprint Reduction | 68% reduction | Past 10 years |

| Renewable Electricity Sourcing | 100% | Current commitment |

| Green Mortgages Uptake | Over 15% of new mortgages | Early 2024 |

| EV Insurance Demand Increase | 25% | 2024 vs. previous year |

| Climate Targets | Established for 2030 across significant loan portfolio sectors | Ongoing |

PESTLE Analysis Data Sources

Our PESTLE Analysis for KBC Group is meticulously constructed using a diverse range of data sources, including reports from international financial institutions like the IMF and World Bank, as well as official government publications and reputable financial news outlets.