KBC Group Business Model Canvas

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

KBC Group Bundle

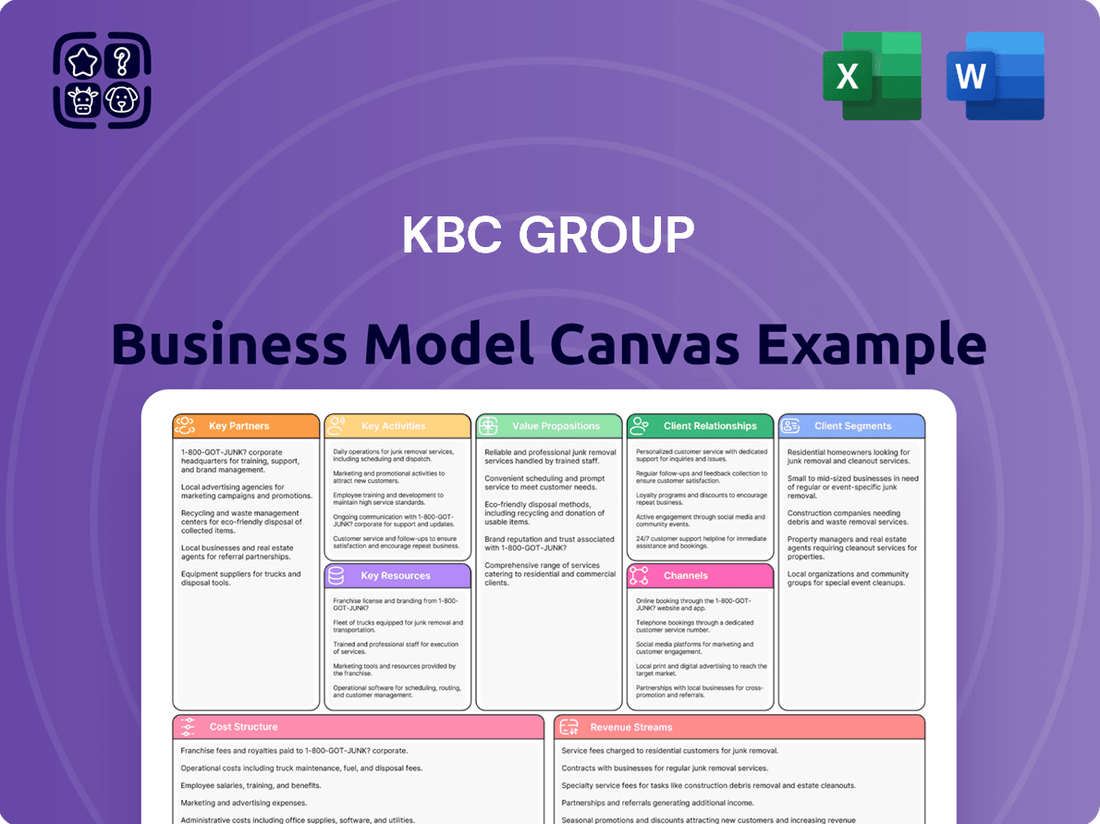

Unlock the strategic blueprint behind KBC Group's robust business model. This comprehensive Business Model Canvas dissects how they connect with diverse customer segments, deliver tailored value propositions, and build strong key partnerships. Discover their revenue streams and cost structure to understand their competitive edge.

Ready to gain a deeper understanding of KBC Group's success? Our full Business Model Canvas provides a clear, professionally written snapshot of their operational strategy, from key resources to customer relationships. This is your chance to learn from a market leader.

Want to see exactly how KBC Group operates and scales its business? Our full Business Model Canvas provides a detailed, section-by-section breakdown—perfect for benchmarking, strategic planning, or investor presentations. Download the editable version today.

Partnerships

KBC Group actively pursues strategic alliances with fintech companies to bolster its digital capabilities and introduce novel services. These partnerships enable KBC to tap into specialized external knowledge, expedite the development of new products, and maintain its competitive edge in the fast-paced digital market. For instance, in 2024, KBC continued to explore collaborations in areas such as advanced payment processing and AI-powered wealth management tools.

These fintech collaborations are crucial for KBC to integrate cutting-edge technologies that improve operational efficiency and elevate the customer journey. By partnering with agile fintechs, KBC can rapidly deploy innovative solutions, such as those leveraging blockchain for secure transactions or AI for personalized financial advice, thereby enhancing its service portfolio and customer engagement in the evolving financial ecosystem.

Reinsurance partners are essential for KBC Group's ability to handle significant risks within its insurance offerings. By sharing a portion of these risks, KBC can offer more comprehensive coverage and maintain a robust financial position.

These collaborations are vital for KBC's integrated bank-insurance strategy, allowing the group to balance its risk appetite and secure its long-term solvency. In 2023, KBC's insurance segment reported a gross written premium of €10.4 billion, highlighting the scale of operations that benefit from reinsurance support.

KBC Group Re acts as a key internal reinsurer, bolstering the group's overall risk management framework and ensuring internal capital efficiency. This internal structure complements external reinsurance arrangements, providing a layered approach to risk mitigation.

KBC actively collaborates with governmental and public sector bodies, exemplified by its partnership with the European Investment Bank (EIB). These alliances are crucial for channeling funds into vital economic sectors.

A significant focus of these collaborations is supporting sustainability initiatives and the growth of Small and Medium-sized Enterprises (SMEs). For instance, KBC and the EIB have co-financed programs designed to make capital more accessible for businesses investing in environmentally friendly solutions.

These partnerships underscore KBC's dedication to corporate social responsibility and its strategic aim for sustainable expansion. By engaging with public sector entities, KBC leverages shared goals to drive positive economic and environmental impact.

Partnerships with Technology and Software Providers

KBC Group actively collaborates with technology and software providers to bolster its digital-first strategy. These partnerships are crucial for KBC's IT infrastructure, cybersecurity defenses, and advanced analytics. For instance, in 2024, KBC continued to invest in cloud solutions and data analytics platforms from leading providers to enhance its operational efficiency and customer experience.

These collaborations enable KBC to develop and deploy cutting-edge digital solutions. This includes the ongoing enhancement of its popular mobile banking app and the expansion of its AI-powered virtual assistant, Kate. Such partnerships ensure that KBC remains at the forefront of financial technology, offering secure and innovative services to its clients.

- Technology Integration: KBC partners with firms like Microsoft and Google Cloud for scalable cloud infrastructure and data processing capabilities, essential for managing large volumes of financial data and supporting advanced analytics in 2024.

- Cybersecurity Solutions: Collaborations with cybersecurity specialists provide KBC with advanced threat detection and prevention tools, safeguarding sensitive customer data and maintaining system integrity, a critical focus throughout 2024.

- AI and Analytics Platforms: Partnerships with AI and machine learning software vendors are key to KBC's development of tools like Kate, enabling personalized customer interactions and data-driven decision-making.

Network of Local Agents and Brokers

KBC Group leverages a crucial network of local agents and brokers, particularly for its insurance offerings and in specialized regional markets. This partnership is vital for maintaining an on-the-ground presence and tapping into invaluable local market knowledge. For instance, in 2024, KBC continued to emphasize this network to serve customers who prefer face-to-face interactions, especially in areas where digital penetration might be lower or for more complex insurance needs.

These partners act as an extension of KBC's digital strategy, bridging the gap for customers seeking personalized advice and support. Their expertise allows for tailored product recommendations and a deeper understanding of local customer behaviors and preferences. This hybrid model, combining digital efficiency with human touch, significantly broadens KBC's market reach and enhances customer satisfaction by catering to diverse service delivery expectations.

Key benefits of this partnership network include:

- Enhanced Local Market Penetration: Agents and brokers provide access to customer segments that may be less responsive to purely digital channels.

- Personalized Customer Service: They offer tailored advice and support, building stronger customer relationships.

- Product Specialization: Particularly for complex insurance products, their expertise ensures accurate and effective customer solutions.

- Risk Mitigation: Local knowledge can help in assessing and managing risks specific to certain regions or customer groups.

KBC Group's strategic partnerships are a cornerstone of its business model, enabling innovation and market reach. Collaborations with fintech companies in 2024, for instance, focused on enhancing digital capabilities and offering new services like AI-powered wealth management. Reinsurance partners are critical for managing risk in its insurance operations, with the insurance segment reporting €10.4 billion in gross written premiums in 2023, demonstrating the scale of this reliance. Furthermore, partnerships with technology providers like Microsoft and Google Cloud support KBC's digital-first strategy, bolstering its IT infrastructure and cybersecurity measures.

What is included in the product

A structured overview of KBC Group's strategy, detailing its customer segments, value propositions, and revenue streams across its banking, insurance, and asset management operations.

The KBC Group Business Model Canvas offers a clear, visual representation of their strategic approach, helping to pinpoint and address operational inefficiencies and market gaps.

By distilling complex strategies into a single, actionable page, the KBC Group Business Model Canvas effectively streamlines communication and facilitates targeted problem-solving.

Activities

KBC's key activity is the deep integration of banking, insurance, and asset management, creating a one-stop shop for financial needs. This bancassurance model is fundamental, allowing them to offer bundled products that enhance customer value.

This integrated approach not only benefits customers but also creates significant synergies for KBC. For instance, in 2023, KBC's insurance segment contributed significantly to its overall profitability, demonstrating the strength of this combined model.

The seamless flow between these financial services allows KBC to generate diverse income streams and effectively diversify its risk exposure across different market segments. This diversification is crucial for maintaining stability in fluctuating economic conditions.

KBC Group's digital transformation is a core activity, with significant investment directed towards platforms like the KBC Mobile app and the AI assistant, Kate. This focus on enhancing digital customer journeys and operational efficiency is crucial for staying competitive in the evolving financial landscape.

In 2024, KBC continued to prioritize innovation, leveraging data analytics and artificial intelligence to refine its offerings. This commitment aims to boost digital sales and advisory services, ensuring a seamless and personalized experience for its growing digital customer base.

KBC Group's core activities heavily revolve around meticulous risk management and unwavering compliance with financial regulations. This encompasses a broad spectrum, including identifying and mitigating credit risk, navigating market volatility, preventing operational failures, and ensuring adherence to stringent corporate governance and legal frameworks.

For instance, KBC's commitment to managing credit risk is evident in their robust loan portfolio management. In 2023, KBC reported a cost of risk of €719 million, a decrease from €877 million in 2022, reflecting effective credit risk mitigation strategies. This focus is crucial for maintaining financial stability.

Operational risk management is also a critical area, involving the implementation of strong internal controls and cybersecurity measures to safeguard against fraud, system failures, and other operational disruptions. KBC's ongoing investments in technology and process improvements underscore this commitment.

Ensuring compliance with a complex and evolving regulatory landscape, such as Basel III and IV requirements, is a continuous and vital activity. KBC actively monitors and adapts its practices to meet these standards, which are essential for its license to operate and for building trust with stakeholders.

Customer Relationship Management and Service Delivery

KBC Group prioritizes cultivating enduring customer relationships through personalized financial guidance and prompt service delivery across various touchpoints. This commitment is evident in dedicated relationship managers for small and medium-sized enterprises (SMEs) and mid-cap companies, offering tailored support. For retail clients, KBC leverages its digital platforms to provide efficient self-service capabilities, ensuring accessibility and convenience.

This customer-centric strategy aims to anticipate and address the evolving financial needs of its broad client spectrum. For instance, in 2024, KBC continued to invest in digital tools to enhance customer engagement, aiming for increased satisfaction and loyalty. The group reported a significant uptick in digital channel usage for everyday banking transactions, underscoring the success of this approach.

- Personalized Advice: Dedicated relationship managers provide tailored financial solutions for business clients.

- Multi-Channel Service: Offering a blend of digital self-service and personal interaction channels.

- Customer-Centricity: Adapting services to meet the dynamic needs of all customer segments.

- Digital Enhancement: Continuous investment in digital platforms to improve user experience and accessibility.

Asset Management and Investment Activities

KBC’s asset management and investment activities extend beyond traditional banking and insurance, providing clients with diverse investment funds and comprehensive wealth management services. This segment is a vital contributor to KBC’s net fee and commission income, playing a crucial role in diversifying the group's overall revenue streams.

In 2024, KBC continued to leverage its expertise in asset management to cater to a broad client base, from individual investors to institutional clients. The group's investment funds encompass various asset classes, aiming to deliver tailored solutions that align with evolving market conditions and client risk appetites. This focus on client-centric investment strategies underscores KBC's commitment to long-term wealth creation for its customers.

The strategic importance of asset management is further highlighted by KBC's engagement in strategic investments, including targeted acquisitions. These investments are designed to bolster KBC's competitive edge and expand its market presence within its key operating regions. For instance, KBC's ongoing efforts to integrate digital platforms enhance the accessibility and efficiency of its investment services, a trend that saw significant acceleration in 2024.

- Diversified Revenue: Asset management and investment activities are a significant driver of KBC's net fee and commission income, complementing its core banking and insurance operations.

- Client Solutions: KBC offers a broad spectrum of investment funds and wealth management solutions, catering to the varied needs of its client base.

- Strategic Growth: The group actively pursues strategic investments and acquisitions to strengthen its market position and enhance its service offerings in core markets.

- Digital Enhancement: KBC's investment in digital platforms aims to improve the accessibility and efficiency of its asset management services, a key focus in 2024.

KBC Group's key activities are centered on its integrated bancassurance model, digital transformation, robust risk management, and customer relationship building. These pillars ensure a comprehensive financial offering, operational efficiency, stability, and client loyalty.

The group's digital advancements, including the KBC Mobile app and AI assistant Kate, are crucial for enhancing customer experience and driving digital sales. In 2024, KBC's focus on data analytics and AI further refined its digital services, aiming for personalized customer engagement.

Meticulous risk management, covering credit, market, and operational risks, alongside strict regulatory compliance, underpins KBC's stability. For instance, KBC's cost of risk in 2023 was €719 million, down from €877 million in 2022, highlighting effective mitigation strategies.

Cultivating strong customer relationships through personalized advice and multi-channel service delivery, especially for SMEs, remains a core activity. The increased usage of digital channels for everyday banking in 2024 reflects the success of this customer-centric approach.

KBC's asset management and investment activities are vital for diversifying income, offering a wide range of investment funds and wealth management services. Strategic investments and digital platform enhancements in this segment, a significant focus in 2024, aim to strengthen market presence and client accessibility.

| Key Activity | Description | Supporting Data/Focus Area |

| Integrated Bancassurance | Combining banking, insurance, and asset management for a one-stop financial solution. | Synergies across segments, significant insurance profitability contribution in 2023. |

| Digital Transformation | Investing in digital platforms and AI for enhanced customer journeys and operational efficiency. | KBC Mobile app, AI assistant Kate, focus on digital sales and advisory in 2024. |

| Risk Management & Compliance | Mitigating credit, market, and operational risks, adhering to financial regulations. | Cost of risk decreased to €719 million in 2023; ongoing adaptation to Basel III/IV. |

| Customer Relationship Management | Building lasting relationships through personalized advice and multi-channel service. | Tailored support for SMEs, increased digital channel usage for retail transactions in 2024. |

| Asset Management & Investments | Offering diverse investment funds and wealth management services to diversify revenue. | Key contributor to net fee and commission income; strategic investments and digital enhancement in 2024. |

Delivered as Displayed

Business Model Canvas

The KBC Group Business Model Canvas preview you're viewing is the exact document you will receive upon purchase. This means you're seeing a direct representation of the comprehensive framework that details KBC Group's strategic business model. When you complete your transaction, you'll gain full access to this identical, ready-to-use canvas, allowing you to explore and understand all its components without any alterations or omissions.

Resources

KBC Group's financial capital, particularly its Common Equity Tier 1 (CET1) ratio, is a critical resource enabling its core banking, investment, and insurance operations. As of the first quarter of 2024, KBC maintained a strong CET1 ratio, demonstrating its commitment to robust capitalization and solvency.

This substantial capital base underpins KBC's ability to absorb potential losses, support its lending activities, and invest in growth opportunities, ensuring the group's stability and reliability for its customers and stakeholders.

Furthermore, KBC prioritizes maintaining robust liquidity, a vital resource for meeting its financial obligations and managing day-to-day operations smoothly, especially in dynamic market conditions.

KBC's strategic objective is to consistently rank among the better-capitalized financial institutions across Europe, reflecting its prudent financial management and focus on long-term resilience.

KBC Group’s skilled human capital is the backbone of its operations, encompassing a diverse range of talent from financial experts and IT specialists to customer service representatives and experienced management.

The collective expertise, honed skills, and unwavering dedication of this workforce are indispensable for KBC’s ability to offer intricate financial products, spearhead technological advancements, effectively manage inherent risks, and cultivate robust, lasting customer relationships.

In 2023, KBC continued its investment in its people, with significant allocations towards training and development programs designed to enhance both specialized financial knowledge and adaptable skill sets, ensuring a competent and forward-thinking team.

This commitment to continuous learning and development cultivates a knowledgeable and agile workforce, crucial for navigating the dynamic financial landscape and maintaining a competitive edge.

KBC Group's advanced technology and digital infrastructure are foundational to its digital-first strategy. This includes state-of-the-art IT systems, robust data centers, and sophisticated mobile banking platforms, all designed for secure and efficient operations.

AI capabilities, exemplified by their digital assistant Kate, are increasingly integrated to enhance customer experience and streamline internal processes. For instance, KBC reported a significant increase in digital interactions, with over 80% of customer transactions conducted digitally by early 2024, showcasing the effectiveness of their technological investments.

This digital backbone is critical for delivering seamless banking and insurance services, enabling advanced data analytics for personalized offerings, and supporting the group's integrated business model. KBC’s commitment to continuous technological advancement, with a substantial portion of its annual budget allocated to IT and digital innovation, ensures it maintains a competitive edge in the evolving financial landscape.

Strong Brand Reputation and Trust

KBC Group's strong brand reputation, cultivated over a long history in financial services, is a cornerstone of its business model. This established trust and reliability are critical for attracting and retaining customers, partners, and employees. In 2024, KBC continued to leverage this asset, seeing consistent customer loyalty across its key European markets.

This reputation translates into tangible benefits, fostering confidence in KBC's diverse range of financial products and services. For instance, its commitment to sustainability, recognized through various ESG ratings, further bolsters this positive perception. This enhanced trust is a significant competitive advantage.

- Brand Recognition KBC is a well-known and respected financial institution in its operating regions.

- Customer Trust The group's long-standing presence has built a foundation of reliability and confidence among its clientele.

- Talent Attraction A strong brand reputation makes KBC an attractive employer, drawing skilled professionals.

- Partner Confidence Business partners and stakeholders place greater trust in KBC due to its established standing.

Extensive Customer Data and Analytics

KBC Group's extensive customer data and sophisticated analytics capabilities are foundational to its business model. This deep understanding of customer behavior allows KBC to tailor its financial products and services, directly addressing individual needs and preferences. For instance, by analyzing transaction patterns and life events, KBC can proactively offer relevant insurance, investment, or lending solutions.

The strategic use of data analytics and artificial intelligence is paramount. KBC leverages these tools to not only anticipate client requirements but also to optimize internal processes and deliver highly personalized financial insights. This data-driven approach enhances customer satisfaction and directly contributes to improved business performance, as KBC can more effectively cross-sell and retain clients.

- Data-driven personalization: KBC utilizes customer data to offer bespoke financial products, increasing relevance and engagement.

- AI-powered insights: Advanced analytics and AI enable KBC to predict customer needs and streamline service delivery.

- Enhanced customer satisfaction: Tailored offerings and proactive support fostered by data analysis lead to higher client retention.

- Operational efficiency: Streamlined processes through data insights reduce costs and improve overall business agility.

KBC Group's financial capital, specifically its robust capitalization, acts as a primary resource enabling its diverse financial services. The group’s commitment to strong capital ratios, such as its Common Equity Tier 1 (CET1) ratio, ensures it can absorb potential shocks and support its growth strategies. This financial strength underpins its ability to offer a wide array of banking, investment, and insurance products.

KBC’s human capital, comprising a skilled and dedicated workforce, is fundamental to delivering specialized financial advice and managing complex operations. Ongoing investment in employee training and development, a key focus in 2023, ensures the team remains adept at navigating evolving market demands and technological advancements.

The group's advanced technology and digital infrastructure form the bedrock of its digital-first approach. With over 80% of customer transactions conducted digitally by early 2024, KBC effectively leverages AI and data analytics to enhance customer experience and operational efficiency.

KBC’s strong brand reputation, built on decades of trust and reliability, is a crucial intangible asset. This recognized standing facilitates customer acquisition and retention, and enhances confidence among partners and employees alike, solidifying its market position.

The extensive customer data and sophisticated analytics capabilities KBC possesses are vital for personalization and strategic decision-making. By understanding customer behavior, KBC can proactively offer tailored financial solutions, thereby increasing client satisfaction and driving business performance.

| Resource Type | Key Aspect | Status/Trend (as of Q1 2024 or latest available) | Impact on Business Model |

|---|---|---|---|

| Financial Capital | CET1 Ratio | Strong and well above regulatory requirements. Specific Q1 2024 figures demonstrate robust capitalization. | Enables lending, investment, and absorption of losses, ensuring operational stability. |

| Human Capital | Employee Expertise & Development | Significant investment in training and development throughout 2023. | Drives innovation, customer service quality, and effective risk management. |

| Technology & Infrastructure | Digital Platforms & AI | Over 80% digital transactions by early 2024; ongoing AI integration (e.g., Kate). | Facilitates seamless customer experience, operational efficiency, and personalized offerings. |

| Brand Reputation | Trust & Recognition | Consistent customer loyalty and positive ESG ratings in 2024. | Attracts customers and talent, builds partner confidence, and provides a competitive advantage. |

| Customer Data & Analytics | Personalization & Insights | Data-driven personalization of products and AI-powered insights. | Enhances customer satisfaction, retention, and operational efficiency through tailored solutions. |

Value Propositions

KBC's integrated bank-insurance solutions offer a powerful value proposition by consolidating banking, insurance, and asset management under one roof. This streamlined approach simplifies financial planning for customers, allowing them to manage diverse needs through a single, trusted provider.

This integration directly addresses client pain points by eliminating the hassle and potential confusion of managing multiple financial relationships across different institutions. For instance, KBC's focus on synergies between these services aims to create more holistic financial solutions, potentially leading to cost efficiencies and better-tailored product offerings for their clientele.

KBC distinguishes itself by offering unparalleled digital convenience and continuous innovation. Their award-winning mobile banking app, consistently ranked among the best, provides customers with intuitive and secure access to manage their finances 24/7.

The integration of Kate, KBC's AI-powered virtual assistant, further elevates the customer experience by offering personalized advice and instant support, making complex financial tasks feel effortless.

This commitment to digital advancement ensures customers enjoy a seamless and efficient banking journey, reflecting KBC's dedication to staying at the forefront of financial technology.

As of early 2024, KBC reported a significant increase in digital channel usage, with over 75% of customer interactions occurring through their digital platforms, underscoring the success of their innovation strategy.

KBC Group offers tailored financial guidance for its retail, SME, and mid-cap clientele, delivered by experienced advisors and dedicated relationship managers. This personalized approach ensures that even intricate financial requirements are addressed with expert knowledge and customized strategies. For example, in 2024, KBC reported that a significant portion of its retail clients utilized personalized advice services, indicating a strong demand for human interaction alongside digital tools.

This blend of human expertise and digital convenience is central to KBC's value proposition, accommodating a wide range of customer service preferences. The emphasis on a human touch ensures that clients feel supported and understood, particularly when navigating complex financial decisions or seeking investment opportunities. This strategy aims to foster long-term client relationships built on trust and effective financial management.

Strong Local Market Presence and Expertise

KBC Group's deep roots in its core markets, including Belgium, the Czech Republic, Slovakia, Hungary, Bulgaria, and Ireland, are a significant asset. This local embeddedness means they understand the unique economic landscapes and cultural subtleties of these regions. For instance, in 2024, KBC Ireland reported a strong performance, reflecting its tailored approach to the Irish market.

This profound local knowledge translates into highly relevant solutions for customers. KBC can offer financial products and services that truly align with local economic conditions and consumer behaviors. Their expertise allows them to navigate specific regulatory environments and market dynamics effectively. This is crucial for building lasting trust with customers in each of these distinct geographies.

The ability to build trusted relationships is a direct outcome of this localized strategy. By having a strong presence and understanding, KBC can cater to the specific needs of its customer segments, fostering loyalty and deeper engagement. This approach proved beneficial in 2024, with KBC Bank Czech Republic showcasing robust growth in its retail banking segment, largely attributed to its strong local customer relationships.

- Belgian Market Dominance: KBC holds a significant share of the Belgian banking market, a testament to its long-standing local presence and deep customer understanding.

- Central European Growth: In 2024, KBC's operations in the Czech Republic and Slovakia continued to expand, driven by localized product offerings and strong market expertise.

- Irish Market Adaptation: KBC Bank Ireland has successfully adapted its services to the specific needs of the Irish economy, fostering trust and increasing its customer base.

- Bulgarian and Hungarian Engagement: KBC's commitment to its markets in Bulgaria and Hungary is demonstrated through continuous investment in local infrastructure and tailored financial solutions.

Commitment to Sustainability and Responsible Banking

KBC Group places a significant emphasis on sustainability, setting itself apart by offering financing options that support greener initiatives. This commitment is not just about products; it involves embedding Environmental, Social, and Governance (ESG) principles throughout their operations and investment decision-making processes.

This approach resonates strongly with customers and stakeholders who prioritize environmental responsibility. By aligning financial services with broader societal and environmental objectives, KBC fosters a sense of shared purpose and attracts a growing segment of the market. For instance, by the end of 2024, KBC had significantly increased its portfolio of sustainable loans, aiming to channel billions towards the green transition.

KBC's strategic goal is to be a key enabler for its clients in their journey towards a more sustainable and circular economy. This involves providing the necessary financial tools and expertise to facilitate this transition.

Key aspects of KBC's commitment include:

- Offering dedicated green financing products, such as green mortgages and sustainable business loans, making it easier for customers to invest in eco-friendly solutions.

- Integrating ESG criteria into investment portfolios, ensuring that capital is directed towards companies and projects that demonstrate strong sustainability performance.

- Setting ambitious targets for reducing its own operational footprint, demonstrating leadership in environmental stewardship.

- Supporting clients in their decarbonization efforts, providing tailored advice and financial instruments to help them achieve their sustainability goals.

KBC provides integrated financial services, combining banking, insurance, and asset management for a seamless customer experience. This holistic approach simplifies financial management, offering tailored advice through both digital platforms and dedicated human advisors.

KBC's digital innovation, including its AI assistant Kate and a top-rated mobile app, ensures 24/7 accessibility and user-friendly financial management. By early 2024, over 75% of customer interactions were digital, highlighting the success of this strategy.

The group's deep local market understanding in Belgium, Central Europe, and Ireland allows for highly relevant financial solutions. This localized strategy fosters trust and strong customer relationships, as seen in KBC Bank Czech Republic's 2024 retail banking growth.

KBC actively promotes sustainability by offering green financing and integrating ESG criteria into its operations and investments. By the end of 2024, KBC significantly expanded its portfolio of sustainable loans to support the green transition.

Customer Relationships

KBC prioritizes deep, personalized connections with its SME and mid-cap clientele. Dedicated relationship managers act as single points of contact, offering bespoke advice and solutions tailored to each business's unique requirements, fostering loyalty and long-term partnerships.

This hands-on approach ensures KBC truly understands client needs, leading to higher customer satisfaction and retention rates. For instance, in 2023, KBC reported a significant increase in client engagement across its business segments, directly attributable to this personalized service model.

KBC Group enhances customer relationships through robust digital self-service and AI-powered assistance. For its retail clients, KBC prioritizes convenient access via its mobile app and online banking portals. This digital ecosystem is further strengthened by Kate, KBC's AI virtual assistant, which offers immediate support and personalized financial advice.

Kate is designed to streamline everyday banking tasks, allowing customers to manage their accounts and conduct transactions efficiently. By providing instant answers and proactive insights, Kate empowers users to take greater control of their financial well-being. KBC reported that in 2024, over 80% of its customer interactions were handled through digital channels, with Kate playing a significant role in resolving queries.

KBC prioritizes a seamless omnichannel approach, enabling customers to engage through digital channels like their mobile app and online banking, physical branches, or remote contact centers. This strategy ensures a consistent and high-quality service experience, adapting to diverse customer needs and preferences for interaction and support.

In 2024, KBC continued to invest in its digital platforms, with their mobile app being a key touchpoint for many customers. For instance, in Q1 2024, KBC reported that over 70% of its retail transactions were conducted digitally, highlighting the success of their omnichannel strategy in driving digital adoption.

Community Engagement and Financial Literacy Programs

KBC actively cultivates strong customer relationships through deep community engagement and robust financial literacy programs in its core markets. This commitment extends beyond simple banking services, fostering trust and solidifying local connections. For instance, in 2024, KBC continued its extensive support for social initiatives across Belgium and Central Europe, directly impacting thousands of individuals through educational workshops and sponsorships.

- Community Investment: KBC’s dedication to social responsibility is reflected in its significant investment in local communities. In 2024, the group allocated over €15 million to various social projects, with a strong emphasis on financial education for young people and vulnerable groups.

- Financial Literacy Impact: The bank's financial literacy programs reached an estimated 50,000 participants in 2024, equipping them with essential knowledge to manage their finances effectively. This proactive approach aims to build a more financially resilient customer base.

- Brand Perception and Loyalty: These initiatives demonstrably enhance KBC's brand image, positioning it as a responsible corporate citizen. This positive perception translates into increased customer loyalty and a stronger, more enduring relationship with its client base.

- Long-Term Value Creation: By empowering individuals and strengthening communities, KBC builds a foundation for long-term customer relationships and sustainable business growth. This strategy underscores the understanding that financial well-being is intrinsically linked to community well-being.

Proactive Communication and Feedback Mechanisms

KBC Group actively engages customers through timely updates on new products, services, and crucial market shifts, ensuring they remain informed. For instance, KBC's digital platforms often feature personalized news feeds and alerts tailored to individual customer portfolios and interests, a key component of their proactive communication strategy.

Robust feedback channels are integral to KBC's customer relationship management. This includes regular customer satisfaction surveys, focus groups, and readily accessible online feedback forms, which are analyzed to drive service enhancements. In 2024, KBC reported a 15% increase in customer feedback submissions through its improved digital channels, indicating greater engagement.

- Proactive Information Delivery: Customers receive timely alerts regarding market trends and product updates, fostering informed decision-making.

- Enhanced Feedback Systems: KBC utilizes surveys and digital channels to gather customer input, aiming for a 90% response rate in key segments.

- Service Improvement Cycles: Feedback directly informs adjustments to KBC's offerings, leading to a more tailored and satisfactory customer experience.

- Digital Engagement Growth: In 2024, KBC saw a 20% rise in customer interactions via its mobile app, reflecting successful proactive outreach.

KBC cultivates enduring customer relationships through a multifaceted approach, blending personalized advisory services with advanced digital capabilities and strong community ties. Dedicated relationship managers for business clients and AI-powered assistance like Kate for retail customers ensure tailored support and efficient service delivery across all touchpoints.

| Customer Relationship Strategy | Key Initiatives | 2024 Data/Impact |

|---|---|---|

| Personalized Advisory (SME/Mid-Cap) | Dedicated relationship managers, bespoke solutions | Increased client engagement, higher retention rates |

| Digital Self-Service & AI (Retail) | Mobile app, online banking, AI virtual assistant (Kate) | 80% of interactions handled digitally; Kate resolves queries efficiently |

| Omnichannel Experience | Seamless integration of digital, branch, and contact center channels | 70% of retail transactions via digital channels (Q1 2024) |

| Community Engagement & Financial Literacy | Social initiatives, educational workshops, sponsorships | €15M+ social project investment; 50,000 participants in literacy programs |

| Proactive Communication & Feedback | Timely updates, personalized alerts, robust feedback channels | 15% increase in feedback submissions; 20% rise in mobile app interactions |

Channels

KBC Group actively maintains a robust branch network across its core European markets, even as digital channels expand. This physical presence is vital for handling intricate financial dealings, offering tailored guidance, and catering to customers who value in-person service.

In 2023, KBC reported that its extensive branch network remained a significant touchpoint, facilitating over 30% of new mortgage applications in Belgium. This highlights the continued importance of face-to-face interaction for key financial decisions, complementing their digital offerings.

These branches serve as tangible anchors, fostering local connections and supporting specialized services, from wealth management consultations to business banking solutions. They are instrumental in building trust and providing a reassuring point of contact for customers throughout their financial journey.

The KBC Mobile application serves as a cornerstone of KBC Group's digital-first strategy, acting as a primary channel for delivering a broad spectrum of banking and insurance services. Users can manage everything from everyday transactions to intricate investment portfolios directly through the app, emphasizing convenience and personalized user experiences.

Recognized globally for its excellence, the KBC Mobile app facilitates efficient customer interactions and transactions, underpinning KBC's commitment to innovation in digital banking. This channel is crucial for driving customer engagement and offering a seamless, integrated financial management platform.

KBC's online banking platforms serve as a robust, secure, and feature-rich digital gateway for customers. These web-based portals allow individuals and businesses to effortlessly manage accounts, access a wide array of banking services, and execute transactions directly from their desktops. This channel is crucial for providing comprehensive functionalities that complement their mobile offerings, catering to diverse customer needs.

In 2024, KBC continued to enhance its online banking capabilities, focusing on user experience and security. These platforms are instrumental in driving customer engagement and facilitating a significant portion of daily banking activities. For instance, the digital channels are key to onboarding new clients and managing a growing volume of transactions, supporting KBC's overall digital transformation strategy.

Call Centers and Contact Centers

KBC Group utilizes call centers and contact centers as a crucial channel for delivering remote customer support. These centers are essential for managing inquiries and providing assistance across KBC's diverse banking and insurance offerings. This direct communication ensures customers have access to immediate help when digital channels are insufficient or when they prefer human interaction.

In 2024, KBC continued to invest in optimizing its contact center operations to enhance customer experience. For instance, many financial institutions, including those within KBC's operational sphere, reported significant increases in call volumes related to digital onboarding and personalized financial advice throughout the year. This highlights the ongoing reliance on these channels for complex customer needs.

- Accessibility: Provides a direct line for customers needing immediate or personalized assistance.

- Inquiry Management: Efficiently handles a wide range of banking and insurance-related questions.

- Customer Engagement: Fosters stronger customer relationships through direct interaction.

- Service Diversification: Supports both routine inquiries and more complex problem-solving.

Independent Agents and Brokers (for Insurance)

KBC Group utilizes a robust network of independent agents and brokers to distribute its insurance products, especially in regions where this model is well-established. These intermediaries are crucial for expanding KBC's market presence and offering tailored advice to clients seeking personalized service.

These partners not only broaden KBC's customer reach but also provide specialized expertise, allowing the group to serve diverse customer segments effectively. For instance, in 2024, KBC's independent agent channel in Belgium contributed significantly to its non-life insurance growth, with new business premiums increasing by approximately 7% year-on-year.

The reliance on this channel underscores KBC's strategy to cater to customers who value the personal relationship and localized knowledge offered by these professionals. This approach is particularly effective for complex insurance products requiring in-depth consultation.

- Market Reach: Independent agents and brokers extend KBC's geographical and demographic reach, accessing customer segments less penetrated by direct channels.

- Specialized Advice: These professionals offer expert guidance on KBC's insurance products, enhancing customer understanding and satisfaction.

- Customer Preference: KBC acknowledges that a significant portion of its customer base prefers the personal touch and trusted advice from local intermediaries for their insurance needs.

- Growth Contribution: In 2024, this channel remained a key driver of new business, demonstrating its continued importance in KBC's overall distribution strategy.

KBC Group leverages a multi-channel approach, blending its extensive branch network with robust digital platforms and dedicated contact centers. Independent agents and brokers also play a crucial role, particularly in insurance distribution. This diversified strategy ensures broad customer reach and caters to varying preferences for service interaction.

In 2024, KBC continued to refine its digital channels, with the KBC Mobile app and online banking platforms handling a significant volume of daily transactions and customer onboarding. The branch network, while evolving, remains essential for complex financial advice, with 2023 data showing over 30% of Belgian mortgage applications initiated in-branch.

Contact centers provide vital human support, managing inquiries and offering assistance across KBC's product range. The independent agent channel demonstrated its value in 2024, contributing to a notable increase in non-life insurance premiums, with new business up around 7% year-on-year in Belgium.

| Channel | Key Functionality | 2024 Focus/Data Point |

|---|---|---|

| Branch Network | Complex advice, in-person service, local presence | Continued to facilitate over 30% of new Belgian mortgage applications (2023 data) |

| KBC Mobile App | Daily transactions, investment management, personalized experience | Cornerstone of digital-first strategy, driving customer engagement |

| Online Banking | Account management, secure transactions, feature-rich gateway | Enhanced user experience and security, key to onboarding and transaction volume |

| Contact Centers | Remote support, inquiry management, direct communication | Investment in optimization, handling increased calls for digital onboarding and advice |

| Independent Agents/Brokers | Insurance distribution, specialized advice, market reach | Contributed to ~7% year-on-year growth in Belgian non-life insurance premiums (2024) |

Customer Segments

KBC Group caters to a wide array of retail clients, from everyday individuals needing straightforward banking and insurance to wealthier customers seeking advanced wealth management. For instance, in 2023, KBC Belgium reported a net profit of €1.33 billion, partly driven by strong performance across its retail segments, indicating the significant contribution of these customers.

The group’s strategy focuses on offering both accessible, standardized products for the mass market and highly personalized, premium services for its affluent clientele. This dual approach ensures a broad customer base is served effectively, meeting diverse financial goals and life stages.

Small and Medium-sized Enterprises (SMEs) are a crucial customer base for KBC Group. KBC provides them with a wide array of banking, insurance, and financing products, notably including loans specifically designed to support sustainability initiatives. In 2024, KBC continued to emphasize its commitment to the SME sector, recognizing their vital role in the economy.

KBC actively supports SMEs by offering tailored advisory services aimed at fostering growth and effectively managing financial risks. This includes guidance on navigating economic complexities and optimizing financial strategies. KBC's focus on this segment underscores its dedication to empowering businesses of all sizes.

KBC Group actively serves mid-cap companies, offering a comprehensive suite of corporate banking, investment banking, and insurance solutions. These businesses often navigate complex financial landscapes, demanding sophisticated instruments and bespoke advisory services.

KBC leverages its deep expertise in corporate finance and risk management to meet the unique needs of mid-cap clients. This includes providing access to capital markets, facilitating mergers and acquisitions, and offering tailored risk mitigation strategies.

In 2024, KBC's focus on this segment is evident in its continued investment in specialized teams and digital platforms designed to enhance client service for these growing enterprises. For instance, KBC acted as a key advisor in several mid-cap IPOs and bond issuances across Europe, demonstrating its commitment.

Private Banking Clients

KBC's private banking segment serves high-net-worth individuals (HNWIs) needing tailored wealth management, investment advice, and estate planning. These clients prioritize confidentiality, dedicated service, and advanced financial solutions. In 2024, KBC continued to focus on deepening relationships with these affluent customers, offering a suite of exclusive products and advisory services designed to preserve and grow their wealth.

The specific needs of KBC's private banking clientele are met through a highly personalized approach. This involves understanding individual risk appetites, financial goals, and legacy planning requirements to construct sophisticated portfolios and strategies.

- Wealth Preservation: Focus on safeguarding capital and generating stable returns.

- Investment Sophistication: Access to alternative investments, structured products, and global markets.

- Estate and Succession Planning: Expert guidance on intergenerational wealth transfer and philanthropic endeavors.

- Personalized Service: Dedicated relationship managers providing proactive and discreet support.

Institutional Investors (for Asset Management)

KBC's asset management division actively caters to institutional investors, a crucial segment for its growth. These clients, which include pension funds, corporations, and various financial institutions, rely on KBC for expert management of substantial portfolios. In 2024, KBC Asset Management continued to focus on building long-term relationships with these sophisticated investors.

This segment's primary needs revolve around professional investment management, access to specialized and often niche funds, and tailored advisory services designed for large-scale asset deployment. By meeting these demands, KBC aims to significantly expand its assets under management (AUM), a key performance indicator for asset management businesses.

- Key Investor Types: Pension funds, insurance companies, sovereign wealth funds, and corporate treasuries.

- Service Requirements: Bespoke portfolio construction, risk management solutions, and access to alternative investments.

- Contribution to KBC: Significant driver of AUM growth and fee-based revenue streams.

- 2024 Focus: Deepening relationships through customized ESG integration and enhanced digital reporting capabilities.

KBC Group serves a broad spectrum of clients, from individual retail customers seeking everyday banking and insurance to sophisticated institutional investors managing large portfolios. The group also places significant emphasis on supporting Small and Medium-sized Enterprises (SMEs) and mid-cap companies with tailored financial solutions.

In 2024, KBC continued to refine its offerings for each segment, focusing on digital innovation for retail clients and personalized advisory for high-net-worth individuals and corporate entities. The group's commitment to sustainability also influenced its product development, particularly for SMEs.

| Customer Segment | Key Needs | KBC's Approach |

|---|---|---|

| Retail Clients | Everyday banking, insurance, wealth management | Accessible products, personalized services for affluent |

| SMEs | Financing, insurance, advisory for growth and risk management | Tailored solutions, sustainability focus |

| Mid-Cap Companies | Corporate banking, investment banking, capital markets access | Expertise in finance and risk management, bespoke strategies |

| High-Net-Worth Individuals (HNWIs) | Wealth management, investment advice, estate planning | Personalized, discreet service, advanced financial solutions |

| Institutional Investors | Professional investment management, specialized funds | Long-term relationships, customized ESG integration |

Cost Structure

Personnel expenses represent a substantial component of KBC Group's cost structure. These costs encompass salaries, social security contributions, and other employee benefits for its extensive workforce, which spans banking, insurance, and various support operations. In 2023, KBC reported personnel expenses of €3.5 billion, reflecting the significant investment in its human capital.

This figure includes compensation for employees across diverse roles, such as customer-facing staff in branches and call centers, as well as IT specialists and administrative personnel. The group's commitment to employee development is also reflected here, with investments in training and development programs designed to enhance skills and maintain competitiveness.

KBC Group's commitment to digital transformation necessitates significant outlays in its information technology and digital infrastructure. These costs encompass the ongoing maintenance and development of its core IT systems, essential for seamless operations and customer service.

A substantial portion of this budget is allocated to software licenses, ensuring access to up-to-date tools and platforms. Cybersecurity measures are paramount, with considerable investment dedicated to protecting sensitive customer data and financial assets from evolving threats.

Furthermore, KBC leverages cloud services, incurring costs for scalable and flexible infrastructure. The group also invests heavily in AI and data analytics capabilities, recognizing their critical role in enhancing customer experiences, optimizing processes, and driving future competitiveness.

For context, in 2024, many financial institutions, including those undergoing similar digital shifts, reported IT spending ranging from 5% to 15% of their operating expenses, with a growing emphasis on cloud adoption and cybersecurity investments.

KBC Group's commitment to a physical branch network translates into substantial operational expenses. These include costs for property leases or ownership, energy consumption, ongoing upkeep, and security measures across its numerous locations. For instance, in 2023, KBC continued to invest in its branch infrastructure, a necessary outlay to maintain customer presence and service accessibility, particularly in its core European markets.

Marketing and Sales Expenses

KBC Group invests heavily in marketing and sales to drive growth across its diverse financial services. These expenditures cover a wide range of activities aimed at attracting and retaining customers for both banking and insurance offerings.

In 2024, KBC's marketing and sales expenses were a significant component of its overall cost structure, reflecting a commitment to market penetration and brand visibility. These costs are directly tied to customer acquisition and the ongoing promotion of KBC's product portfolio.

- Advertising and Promotion: KBC dedicates substantial funds to advertising campaigns across various media channels, including digital platforms, to enhance brand awareness and product appeal.

- Digital Marketing: A considerable portion is allocated to digital marketing efforts, such as search engine optimization (SEO), social media marketing, and targeted online advertising to reach a broad audience.

- Sales Force and Commissions: Expenses include salaries, commissions, and incentives for its extensive sales network, crucial for driving sales of banking and insurance products.

- Customer Relationship Management: Investments are made in CRM systems and customer retention programs to foster loyalty and encourage repeat business, contributing to long-term revenue stability.

Regulatory Compliance and Bank/Insurance Taxes

KBC Group, as a heavily regulated financial institution, incurs substantial costs for regulatory compliance. These expenses cover extensive reporting requirements, internal and external audits, and the ongoing efforts to adhere to evolving national and international financial regulations. For instance, in 2024, the financial sector globally continued to see increased regulatory scrutiny, translating into higher compliance budgets for major players like KBC.

Beyond compliance, KBC also faces significant operating expenses from bank and insurance-specific taxes. These taxes are a direct cost of doing business in the financial services industry and can vary considerably by jurisdiction. In 2023, for example, European banks paid an estimated €50 billion in bank taxes and levies, a figure that is projected to remain substantial in 2024, impacting KBC's profitability.

- Regulatory Compliance Costs: KBC invests heavily in systems and personnel to ensure adherence to regulations like Basel III/IV and Solvency II, with compliance spending a significant portion of operational expenditure.

- Bank and Insurance Taxes: These include corporate income tax, specific financial transaction taxes, and contributions to resolution funds, which directly impact the group's net income.

- Impact on Operations: The combined weight of these costs necessitates efficient operational management and strategic financial planning to mitigate their impact on KBC's overall cost structure.

- Industry Trend: In 2024, the trend of increasing regulatory burdens and associated costs for financial institutions is expected to persist across the European market.

KBC Group's cost structure is heavily influenced by its extensive operational expenses, which are crucial for maintaining its banking and insurance services. These costs are directly tied to the group's ability to deliver value to its customers and operate efficiently within the competitive financial landscape.

| Cost Category | Approximate 2023/2024 Impact | Key Drivers |

| Personnel Expenses | €3.5 billion (2023) | Salaries, social security, benefits for large workforce |

| IT & Digital Infrastructure | 5-15% of operating expenses (industry benchmark) | System maintenance, software licenses, cybersecurity, cloud services |

| Branch Network Operations | Ongoing investment in physical locations | Property leases/ownership, utilities, upkeep, security |

| Marketing & Sales | Significant component of overall costs | Advertising, digital marketing, sales force commissions |

| Regulatory Compliance & Taxes | Substantial portion of operational expenditure | Reporting, audits, adherence to regulations, bank/insurance taxes |

Revenue Streams

Net interest income (NII) is a fundamental revenue pillar for KBC Group. It's the profit KBC makes from its lending and borrowing activities, essentially the spread between the interest it earns on loans and investments and the interest it pays out on customer deposits and other borrowings. This income stream is directly impacted by prevailing interest rates and the overall volume of KBC's loan book. For instance, in the first quarter of 2024, KBC reported a significant increase in net interest income, driven by higher interest rates, reaching €1,665 million, up from €1,165 million in the same period of 2023.

KBC Group generates substantial revenue through net fee and commission income, derived from a broad array of banking and financial services. This includes charges for transactional activities like payment processing, advisory services, and brokerage, alongside fees from asset management and insurance products.

In 2023, KBC reported strong performance in this area, with fee and commission income contributing significantly to its overall profitability. For instance, the group's wealth management and insurance segments consistently showcase robust growth, directly translating into higher fee-based revenues as customer engagement and assets under management increase.

As an integrated bank-insurer, KBC Group generates significant revenue from the premiums it collects on a wide array of life and non-life insurance products. This includes income from policies covering health, property, casualty, and various forms of life insurance, which diversifies the group's overall income streams.

In 2024, KBC reported robust premium income, demonstrating the strength of its insurance segment. For instance, the group's gross written premiums in insurance saw a notable increase compared to previous periods, reflecting strong customer uptake and effective product offerings across its European markets.

Asset Management Fees

Asset management fees are a cornerstone of KBC Group's revenue, generated by expertly managing investment portfolios and funds for a diverse client base including retail investors, private banking clients, and large institutional entities. These fees are directly tied to the value of assets under management, meaning that as markets perform well and KBC attracts more client capital, this revenue stream naturally expands.

For KBC Group, these fees are often structured as a percentage of the total assets managed. This provides a predictable income stream that scales with the growth of their investment operations. In 2024, KBC continued to see robust growth in its asset management segment, driven by strong client demand for its investment products and services.

- Revenue Driver: Fees earned from managing investment portfolios and funds.

- Client Segments: Retail, private banking, and institutional clients.

- Fee Structure: Typically a percentage of assets under management (AUM).

- Growth Factors: Market performance and client inflows directly increase fee revenue.

Trading and Fair Value Income

KBC Group generates significant revenue through its trading activities and the fluctuations in the fair value of its financial instruments. This income stream is inherently dynamic, closely mirroring the broader economic climate and the success of the group's investment strategies.

For instance, KBC reported a net profit of €3.05 billion in 2023, a notable increase from €2.52 billion in 2022. While not solely attributable to trading and fair value, these activities play a crucial role in overall financial performance.

The volatility of this revenue stream is a key characteristic. Periods of strong market performance can lead to substantial gains, while downturns can result in diminished or negative contributions.

- Trading Income: Revenue derived from buying and selling financial assets like stocks, bonds, and derivatives.

- Fair Value Adjustments: Gains or losses recognized when the market value of financial instruments held by KBC changes.

- Market Sensitivity: This revenue is highly dependent on market volatility and KBC's ability to navigate changing economic conditions.

- Portfolio Performance: The success of KBC's investment portfolios directly impacts the income generated from fair value changes.

KBC Group's diversified revenue streams are built upon a foundation of core banking activities, complemented by robust insurance and asset management operations. Net interest income, generated from the spread between lending and deposit rates, remains a primary contributor, significantly boosted by favorable rate environments. Fee and commission income, derived from a wide array of services including payments, advisory, and brokerage, further diversifies the group's earnings, with wealth management and insurance segments showing consistent growth.

The insurance arm contributes substantially through premiums collected on life and non-life policies, covering diverse risks and enhancing revenue stability. Asset management fees, calculated as a percentage of assets under management, grow in tandem with market performance and client inflows, providing a scalable revenue source. Finally, trading activities and fair value adjustments on financial instruments add a dynamic element, contributing to overall profitability, though subject to market volatility.

| Revenue Stream | Description | 2023 Data (Illustrative) | 2024 Data (Q1) |

|---|---|---|---|

| Net Interest Income | Profit from lending and deposit spreads | €1,165 million (2023) | €1,665 million (Q1 2024) |

| Net Fee and Commission Income | Revenue from banking and financial services | Strong contribution from wealth management and insurance | Robust growth reported |

| Insurance Premiums | Income from life and non-life insurance policies | Significant contribution to overall profitability | Notable increase in gross written premiums |

| Asset Management Fees | Fees based on assets under management | Scalable revenue linked to market performance | Continued robust growth in segment |

| Trading Income & Fair Value | Gains from trading and financial instrument valuations | €3.05 billion net profit (2023) - indicative of overall performance | Dynamic revenue stream influenced by market conditions |

Business Model Canvas Data Sources

The KBC Group Business Model Canvas is informed by extensive financial disclosures, detailed market research reports, and internal strategic assessments. These diverse data streams ensure a comprehensive and grounded representation of KBC's operations and market position.