K+S SWOT Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

K+S Bundle

K+S, a global player in potash and salt, boasts significant strengths in its established market presence and access to vital resources. However, understanding the full picture requires a deeper dive into potential threats like fluctuating commodity prices and evolving environmental regulations.

Our comprehensive K+S SWOT analysis goes beyond these highlights, revealing actionable insights into their competitive advantages and operational challenges. Discover the strategic opportunities they can leverage and the weaknesses that need careful management to ensure continued success.

Want the full story behind K+S's market position, growth drivers, and potential risks? Purchase the complete SWOT analysis to gain access to a professionally written, fully editable report designed to support your strategic planning, investment decisions, or competitive analysis.

Strengths

K+S maintains a leading global market position as a prominent producer of potash and salt, leveraging its extensive production network across Europe and North America.

The company commands a significant market share in both segments, driven by its well-established global distribution channels.

Its long-standing operational history, dating back to the 19th century, reinforces its reputation as a reliable partner for diverse industrial and agricultural customers.

This deep experience and established infrastructure contribute to its strong competitive standing in the global commodity market through 2024 and 2025.

K+S boasts a diversified product portfolio, serving agriculture, industry, consumers, and communities with a broad range of offerings. Beyond standard potash fertilizers and de-icing salt, the company produces high-purity salts essential for pharmaceutical and food sectors. This wide array of products, which contributed to an adjusted Group EBITDA of €1,489 million in 2023, mitigates risks linked to single market volatility. It ensures multiple robust revenue streams, enhancing stability even with expected lower fertilizer demand in 2024.

K+S benefits significantly from its geographically diversified production footprint, with major facilities spanning Europe and North America. This strategic presence, including operations like the Bethune mine in Canada and German sites such as Zielitz, enhances supply chain resilience by reducing dependence on a single region. For 2024, the company's balanced global output helps mitigate regional market volatility and logistical challenges. This broad reach facilitates efficient distribution and improved access to key agricultural markets, underpinning its competitive advantage in the global potash sector.

Focus on Sustainability and Innovation

K+S demonstrates a robust commitment to sustainable mining, significantly reducing its CO2 emissions by approximately 27% since 2018, targeting 30% by 2030.

The company actively develops innovative processes like dry processing of crude salts, aiming for greenhouse gas neutrality by 2050.

This focus not only minimizes environmental impact but also strengthens K+S's brand appeal, attracting the growing segment of environmentally conscious investors and customers.

- CO2 emissions reduced by 27% since 2018, targeting 30% by 2030.

- Goal of greenhouse gas neutrality by 2050.

Strong Financial Management

K+S maintains a robust financial position, characterized by a strong balance sheet and a disciplined financial policy that targets a low leverage ratio. This prudent approach, evidenced by their net financial debt to adjusted EBITDA ratio often remaining well below 2.0x, ensures significant stability. The company's robust cash management supports strategic investments, such as the ongoing optimization and expansion of the Bethune potash plant in Canada, projected to reach 4.35 million tonnes by 2025. This financial discipline provides capacity for growth and consistent shareholder distributions.

- Targeted net financial debt to adjusted EBITDA below 2.0x.

- Bethune potash plant expansion aiming for 4.35 million tonnes by 2025.

- Strong cash flow generation supports strategic capital expenditures.

K+S holds a strong global market position in potash and salt, supported by its extensive production network and long operational history, ensuring reliability through 2025.

Its diversified product portfolio, including high-purity salts, generated €1,489 million in adjusted Group EBITDA in 2023, mitigating market volatility.

The company maintains a robust financial position with a low leverage ratio, supporting strategic investments like the Bethune plant expansion to 4.35 million tonnes by 2025.

| Metric | 2023 Data | 2025 Target |

|---|---|---|

| Adj. Group EBITDA | €1,489M | N/A |

| CO2 Reduction | 27% (since 2018) | 30% (by 2030) |

| Bethune Capacity | ~4.0M Tonnes | 4.35M Tonnes |

What is included in the product

Delivers a strategic overview of K+S’s internal strengths and weaknesses alongside external market opportunities and threats.

K+S's SWOT analysis streamlines identifying and addressing market challenges, offering clarity on competitive positioning and operational weaknesses.

It provides a structured framework to proactively mitigate risks and capitalize on opportunities within the potash and salt industries.

Weaknesses

K+S revenues and profitability are highly susceptible to the volatility of global potash and salt prices, which are influenced by unpredictable supply and demand dynamics. For instance, potash prices, after peaking near $1,200 per tonne in 2022, saw significant declines in 2023, impacting K+S's earnings trajectory. A sustained downturn, such as the market stabilization around $300-400 per tonne for standard MOP in early 2024, directly compresses the company's margins. This price sensitivity poses a continuous challenge to financial stability and future investment planning for K+S.

The mining sector, inherently, involves substantial fixed costs for operating and maintaining facilities, a significant weakness for K+S. These include extensive capital expenditures, with K+S forecasting around €1.1 billion in investments for 2024 and 2025 combined to modernize and sustain operations. Such high outlays exert considerable pressure on profit margins, especially when production volumes decrease or commodity prices, like potash, experience declines, as seen in the volatile market conditions of early 2024. Effectively managing these persistent costs remains a critical and ongoing challenge for the company's financial stability and profitability.

K+S faces stringent environmental regulations, leading to significant compliance costs. The company's potash and salt operations, especially in regions like Werra, are under scrutiny for water usage and potential discharge impacts, with ongoing discussions impacting future investments through 2025. Managing these environmental liabilities and adhering to evolving standards requires continuous capital expenditure, impacting K+S's operational profitability.

Production Bottlenecks and Operational Challenges

K+S has faced ongoing production bottlenecks, often stemming from significant workforce illness rates, which directly impact sales volumes and operational efficiency. For instance, in late 2023 and early 2024, the company reported specific challenges in its potash production due to higher absenteeism. Technical issues also frequently hinder the full ramp-up of new capacities, such as those at the Bethune plant, where full operational stability for its targeted 4.3 million tonnes per annum was a multi-year effort. These operational hurdles can prevent K+S from fully capitalizing on strong market demand for fertilizers, potentially leaving revenue on the table.

- Potash production in Q1 2024 saw output fluctuations due to operational adjustments.

- Bethune plant's optimization efforts continue towards its design capacity.

- Workforce availability remains a critical factor for consistent output.

- Technical disruptions can delay new product lines or expansion projects.

Reliance on a Few Key Markets

K+S faces a notable weakness due to its heavy reliance on specific markets, primarily agriculture and de-icing salt. This concentration, with the Potash and Magnesium Products segment and the Salt segment forming the core of its business, exposes K+S to significant vulnerabilities. For instance, shifts in agricultural policies or fluctuating commodity prices, like the potash price dynamics observed in early 2024, directly impact profitability. Additionally, milder winters, as seen in some European regions during the 2023/2024 season, can reduce demand for de-icing salt, affecting the company's Salt segment's performance.

- The Potash and Magnesium Products segment contributed substantially to K+S's operating earnings in Q1 2024.

- Variability in global agricultural input demand directly correlates with a significant portion of K+S's revenue.

- Unpredictable weather patterns, particularly mild winters, can reduce de-icing salt sales, a key component of the Salt segment.

- Economic downturns impacting farming communities could constrain demand for fertilizers, affecting K+S’s agricultural sales volume.

K+S faces significant vulnerability to volatile global potash prices, which saw declines to $300-400 per tonne in early 2024, directly compressing margins. High fixed costs, with €1.1 billion in investments projected for 2024-2025, alongside stringent environmental compliance in regions like Werra, exert continuous financial pressure. Persistent production bottlenecks due to workforce issues and technical hurdles, as observed in Q1 2024, hinder output and revenue capture. Additionally, heavy reliance on agriculture and de-icing salt markets exposes the company to demand fluctuations, such as reduced de-icing sales from milder 2023/2024 winters.

| Weakness Area | Key Impact | 2024/2025 Data Point |

|---|---|---|

| Price Volatility | Margin Compression | Potash prices $300-400/tonne (early 2024) |

| High Fixed Costs | Capital Expenditure Burden | €1.1 billion investments (2024-2025) |

| Production Bottlenecks | Output & Efficiency Loss | Q1 2024 output fluctuations |

| Market Concentration | Demand Vulnerability | Milder 2023/2024 winters affecting salt sales |

What You See Is What You Get

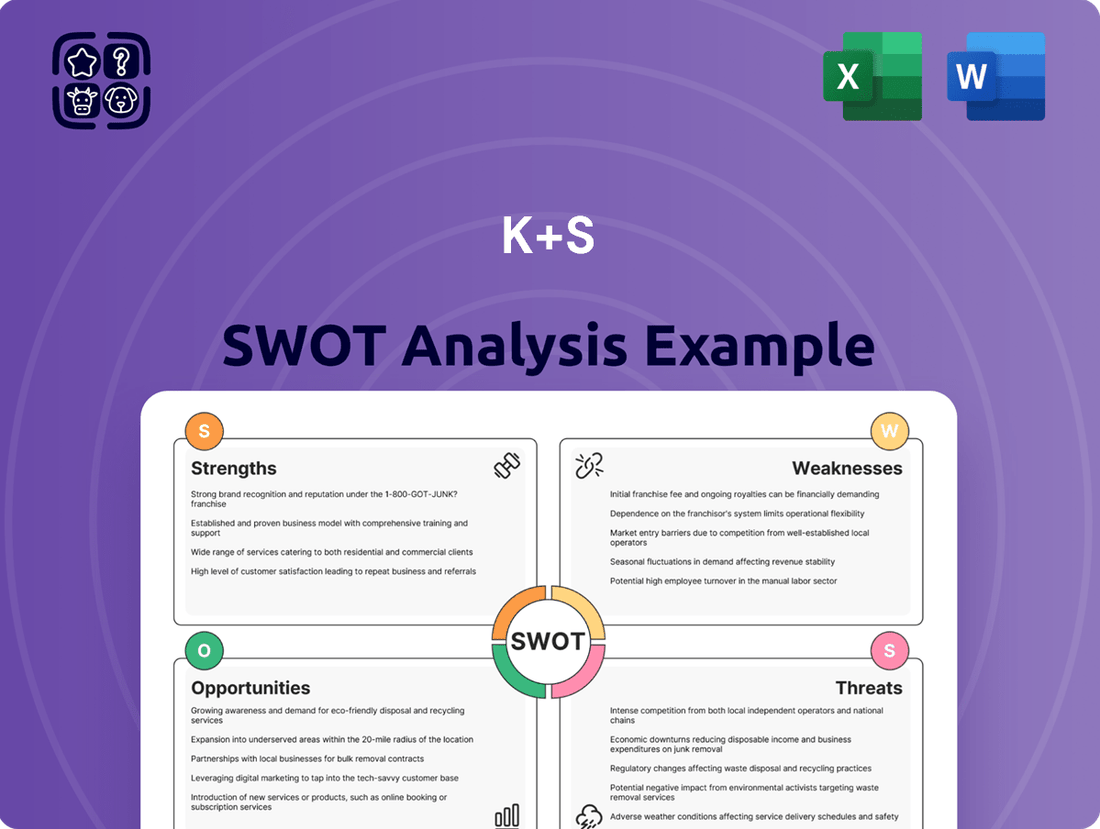

K+S SWOT Analysis

The file shown below is not a sample—it’s the real SWOT analysis you'll download post-purchase, in full detail. This comprehensive analysis for K+S covers their internal Strengths and Weaknesses, alongside external Opportunities and Threats. You'll gain a clear understanding of the company's strategic position and potential challenges. Purchasing this document unlocks the complete, in-depth report, providing valuable insights for informed decision-making.

Opportunities

Global population growth continues to drive an increasing demand for food, directly fueling the need for fertilizers like potash to maximize crop yields. K+S is strategically positioned to capitalize on this long-term trend, with the global potash market projected to grow at 2-3% annually through 2025. This sustained demand necessitates significant new production capacities, creating clear expansion opportunities for K+S to increase its output. The rising need for efficient agriculture globally underscores potash as a critical input.

The market for specialty fertilizers and high-purity salts is expanding significantly, driven by demand in sectors like pharmaceuticals, food processing, and animal nutrition, with projections indicating continued growth through 2025. K+S is positioned to capitalize on this by expanding its portfolio of these higher-margin products, moving beyond standard commodities. This strategic shift enables the company to meet specific customer requirements and achieve greater differentiation. Focusing on specialty offerings, which typically command premium pricing, can enhance K+S's overall profitability and market resilience. Such diversification strengthens its competitive standing in a dynamic global market.

Changing weather patterns, including the potential for more frequent and intense winter storms across North America and Europe in the 2024/2025 season, elevate the demand for de-icing salt. K+S, as a leading global producer, is well-positioned to capitalize on this by ensuring a robust supply chain for municipalities and road safety authorities. This trend is projected to sustain K+S’s industrial and de-icing salt segment, which contributed approximately 25% of its 2023 revenue, providing a crucial, albeit seasonal, revenue stream. Continued investment in logistics and storage capacity further strengthens their market response to these demands.

Technological Advancements and Digitalization

Adopting new technologies and digitalization significantly boosts K+S’s efficiency, cost reduction, and safety across its mining and production operations. Innovations like predictive maintenance, which can reduce unplanned downtime by up to 20%, directly improve operational stability. The growing precision agriculture market, projected to exceed USD 15 billion by 2025, creates new avenues for K+S to offer targeted fertilizer solutions, aligning with evolving farmer needs. Continued investment in research and development, particularly in digital tools for resource optimization, enhances the company's competitive edge for the 2024/2025 period.

- Digitalization can cut operational costs by an estimated 15-20% for leading industrial players.

- The global precision agriculture market is forecast to reach over USD 15 billion by 2025.

- K+S aims for continuous improvement in production efficiency through technological integration.

- Advanced analytics in mining can reduce energy consumption by up to 10-15%.

Strategic Partnerships and Acquisitions

K+S could explore strategic partnerships or acquisitions to enter new markets or expand its product offerings, especially given the global demand for fertilizers projected to grow by 1.5% annually through 2025.

Collaborating with companies in the agricultural or chemical sectors, perhaps in emerging markets like Southeast Asia, could lead to synergies and new growth avenues, potentially boosting its specialty fertilizers segment which saw strong performance in early 2024.

- Market expansion into regions with high agricultural growth potential.

- Diversification of product portfolio beyond traditional potash and magnesium.

- Access to innovative agritech solutions for sustainable farming.

K+S can capitalize on the projected 2-3% annual growth in global potash demand through 2025, driven by food security needs. The expanding specialty fertilizer market, expected to grow through 2025, offers higher-margin product diversification. Increased de-icing salt demand for the 2024/2025 winter season provides a strong revenue stream, while the precision agriculture market, exceeding USD 15 billion by 2025, opens new tech-driven solutions.

| Opportunity | Market Growth (2024/2025) | Impact for K+S |

|---|---|---|

| Potash Demand | 2-3% Annually | Increased Sales Volume |

| Specialty Products | Continued Growth | Enhanced Profit Margins |

| Precision Agriculture | >USD 15 Billion | New Tech Solutions |

Threats

The global potash and salt markets are intensely competitive, with major players like Nutrien, Mosaic, and Compass Minerals vying for market share. These strong competitors exert significant pricing pressure, potentially impacting K+S's profit margins, particularly as global potash prices have stabilized at lower levels in early 2025 compared to 2022 peaks. The re-entry and increased export volumes from Russian and Belarusian producers, such as Uralkali and Belaruskali, further intensify this competitive landscape. This heightened rivalry challenges K+S's market position and requires agile strategic responses.

Geopolitical tensions pose a significant threat to K+S, potentially disrupting global supply chains and impacting operations. Escalating conflicts, like those seen in Eastern Europe through 2023, can lead to trade barriers or tariffs, directly affecting K+S's potash and salt exports to key markets. While fertilizers have generally been exempted from recent U.S. and EU trade restrictions, the persistent risk of new protectionist measures remains a concern for K+S's international business. Such instability could reduce market access and increase logistical costs for the company's global distribution network in 2024 and 2025.

Increasingly stringent environmental regulations, particularly concerning mining, water usage, and emissions, pose a significant threat to K+S. Compliance for 2024 and 2025 is expected to drive higher operational costs, potentially increasing K+S's environmental protection expenses which were already €100 million in 2023. Meeting new standards often necessitates substantial investments in advanced technologies and processes. Non-compliance could result in hefty fines, as seen with some industry penalties exceeding €50 million in recent years, legal challenges, and severe reputational damage to the company.

Economic Downturns

A global or regional economic downturn could significantly reduce demand for K+S products. For instance, lower farm incomes, as seen with fluctuating agricultural commodity prices into early 2025, often lead farmers to cut back on fertilizer use, directly impacting K+S's agricultural segment sales volumes. Similarly, municipal budget constraints could decrease demand for de-icing salt, especially if public spending is tightened due to economic pressures. An economic slowdown therefore places considerable pressure on both sales volumes and pricing across K+S's portfolio.

- Global GDP growth projections for 2024 revised downwards to approximately 2.6% by the World Bank in June 2024, signaling potential demand headwinds.

- Agricultural commodity price volatility, particularly for grains, impacts farmer profitability and fertilizer purchasing power into mid-2025.

- Government budget deficits and inflation pressures could reduce municipal infrastructure spending on de-icing salts.

Development of Substitute Products

The emergence of alternative fertilizer products and sustainable de-icing solutions poses a long-term threat to K+S core operations. Global investments in bio-fertilizers are expanding rapidly, with the market projected to reach USD 6.5 billion by 2030, potentially reducing reliance on traditional potash. Advancements in agricultural technology, including precision farming, could further optimize nutrient use, impacting fertilizer demand. Similarly, the growing adoption of environmentally friendly de-icing alternatives could diminish K+S salt sales in the coming years.

- Global bio-fertilizer market projected to grow significantly by 2030.

- Increased focus on sustainable agricultural practices.

- Development of eco-friendly de-icing alternatives.

- Technological advancements reducing reliance on bulk commodities.

K+S faces significant threats from intense global competition, particularly with increased export volumes from Russian producers, leading to pricing pressure in early 2025. Geopolitical instability and stringent environmental regulations, driving K+S's compliance costs beyond €100 million in 2023, pose operational and financial risks. Furthermore, a potential global economic slowdown, with 2024 GDP growth revised to 2.6%, could reduce demand for their products. The rise of alternative fertilizers, like the bio-fertilizer market projected to reach USD 6.5 billion by 2030, also presents a long-term challenge.

| Threat Category | Key Impact | 2024/2025 Data Point |

|---|---|---|

| Competition | Pricing Pressure | Potash prices stabilized lower early 2025 |

| Regulations | Increased Costs | K+S environmental expenses €100M (2023) |

| Economic Downturn | Reduced Demand | Global GDP growth 2.6% (2024 revised) |

| Alternatives | Market Share Erosion | Bio-fertilizer market USD 6.5B (2030 projection) |

SWOT Analysis Data Sources

This K+S SWOT analysis is built upon a foundation of credible data, drawing from the company's official financial reports, comprehensive market research, and valuable expert industry commentary.