K+S PESTLE Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

K+S Bundle

Gain a strategic advantage with our in-depth PESTLE analysis of K+S. Understand how political shifts, economic volatility, and evolving social trends are shaping the company's operational landscape. Our expert research delves into the technological advancements and regulatory changes impacting K+S, providing you with actionable intelligence. Don't get left behind; download the full version now to unlock critical insights and refine your market strategy.

Political factors

Ongoing international conflicts, like those impacting Eastern Europe and global shipping lanes, continue to disrupt K+S's supply chains and market access for potash and salt products in 2024. Shifting trade alliances and potential new tariffs, such as those discussed within the EU or North America regarding agricultural inputs, could increase operational costs significantly. For instance, a 5-10% tariff on key imports or exports could directly impact K+S's raw material sourcing or product pricing for 2025. Companies like K+S must actively monitor geopolitical developments and be prepared for swift adjustments to trade regulations, which directly influence their global logistics and profitability.

The mining industry faces stringent government oversight regarding exploration, extraction, and processing, directly impacting K+S operations. Changes in mining laws and environmental regulations, such as the EU Taxonomy Regulation influencing sustainable finance criteria by 2025, can significantly affect K+S's operational rights and procedures in key regions like Germany and North America. The company must ensure continuous compliance with all national and local regulations to maintain its licenses, a critical factor for its potash and salt production, given the increasing global focus on responsible resource management.

Governments are increasingly implementing policies focused on economic sovereignty, particularly in critical sectors like fertilizer production. This trend, prominent in 2024-2025, could lead to increased support for domestic output, as seen with potential EU initiatives to reduce reliance on external supply chains for key industrial inputs. K+S may face more trade protectionism or, conversely, benefit from local production incentives in regions prioritizing self-sufficiency. Adapting its global supply chain and investment strategy by 2025 to align with these national priorities, such as the US focus on securing critical minerals, is crucial for K+S to maintain market access and competitiveness.

Sanctions and International Relations

Geopolitical tensions significantly impact K+S's global operations by leading to sanctions that disrupt international trade and financial transactions. Navigating these complex regulatory landscapes is crucial for K+S to avoid violations and mitigate risks to its business, especially given the dynamic international political climate of 2024-2025. The stability of international relations is paramount for the smooth operation of a global company like K+S, which reported Q1 2024 revenues of €3.2 billion, emphasizing its reliance on open markets.

- Sanctions on key regions, such as those affecting potash supply from Eastern Europe, have reshaped global fertilizer markets, influencing K+S's competitive position in 2024.

- K+S must continually assess its supply chain resilience against potential trade restrictions, which could impact its global distribution network spanning over 100 countries.

- The company's compliance costs are rising due to increased scrutiny of international financial transactions and trade embargoes, directly affecting its operational expenditures.

Political Stability in Key Markets

The political stability in K+S key operational regions, including Germany, Canada, and Chile, significantly impacts its business continuity. Any political unrest or sudden shifts in government policy, such as changes in mining regulations or trade agreements, could disrupt K+S production and supply chains. Maintaining a stable political environment is crucial for protecting the company's long-term investments and ensuring reliable access to essential potash and salt resources. For instance, the stable political landscape in its primary production areas supports K+S's projected 2025 operational efficiency targets.

- K+S relies on stable political climates in Germany, Canada, and Chile for consistent operations.

- Potential shifts in government policies or trade agreements pose risks to supply chain predictability.

- Political stability underpins the security of K+S's long-term investments in mining infrastructure.

- A predictable regulatory environment is vital for meeting 2025 production and sales forecasts.

Global conflicts and shifting trade policies, including potential tariffs, directly impact K+S's supply chains and operational costs in 2024-2025. Stringent environmental regulations like the EU Taxonomy by 2025 demand continuous compliance and influence mining rights. Geopolitical tensions increase compliance costs, while political stability in Germany, Canada, and Chile is crucial for K+S's long-term investments and projected 2025 efficiency targets.

| Factor | Impact | 2024/2025 Data Point |

|---|---|---|

| Tariff Risk | Increased operational costs | Potential 5-10% tariff impact by 2025 |

| Regulatory Compliance | Operational rights, costs | EU Taxonomy Regulation by 2025 |

| Q1 2024 Revenues | Reliance on open markets | €3.2 billion |

What is included in the product

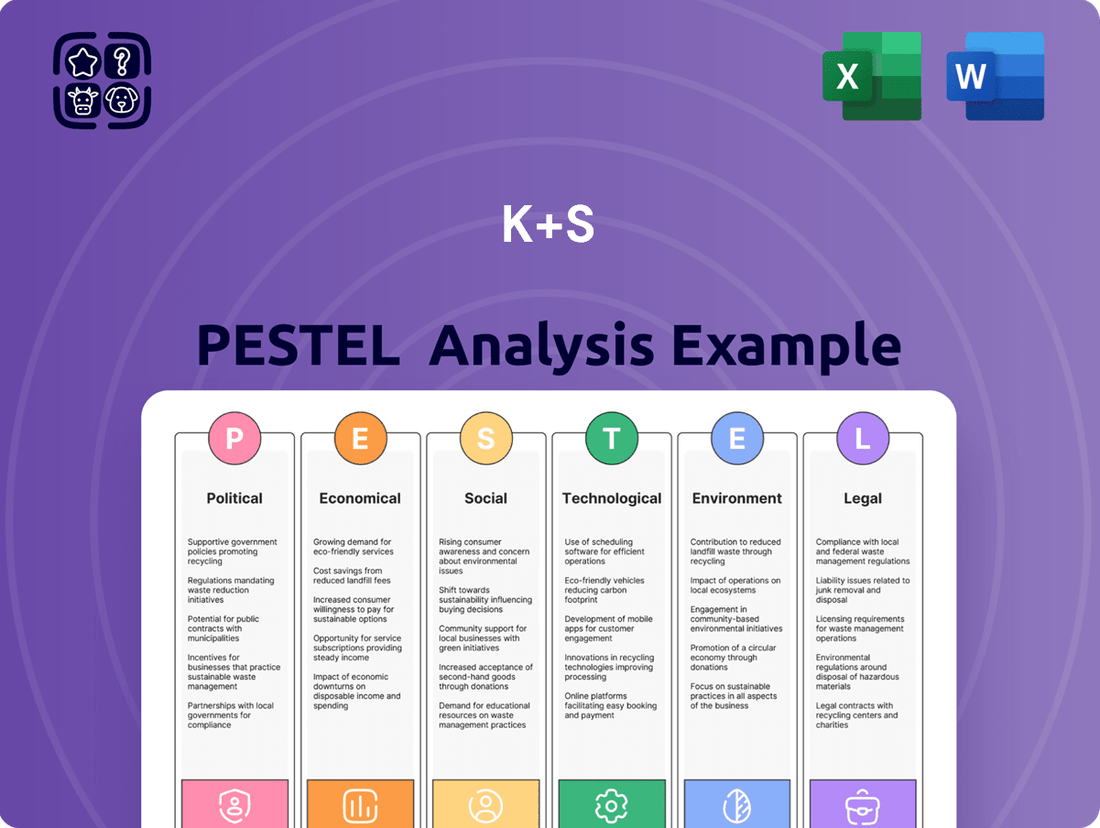

This K+S PESTLE Analysis comprehensively examines how external macro-environmental factors across Political, Economic, Social, Technological, Environmental, and Legal dimensions will impact the company's operations and strategic direction.

A K+S PESTLE analysis provides a structured framework to identify and understand external factors impacting the business, thereby alleviating the pain point of navigating complex and unpredictable market landscapes.

Economic factors

The global potash market is poised for steady expansion, fueled by the escalating need for fertilizers to bolster global food security. Valued at over USD 62 billion in 2024, this market is projected to achieve a Compound Annual Growth Rate (CAGR) of approximately 5% through 2025. This consistent growth trajectory creates a significant avenue for K+S to enhance its market presence. The sustained demand for agricultural inputs underpins a robust long-term outlook for potash producers.

Fertilizer prices exhibit significant volatility, influenced by fluctuating raw material costs, energy prices, and global supply chain disruptions. For instance, the Urea futures price saw a notable increase of over 15% in Q1 2025, reaching approximately $380 per metric ton, impacting both producers and farmers. These fluctuations directly affect K+S profitability and farmer purchasing power. K+S must strategically manage these price risks through diversified sourcing and agile pricing policies to maintain stable margins.

Rising production costs, driven by volatile energy prices and increasing raw material expenses, significantly impact K+S's fertilizer production. Natural gas prices, a key input, saw notable fluctuations in early 2024, directly affecting operational outlays. If these higher costs cannot be adequately passed on to customers, K+S's profit margins will face pressure. The company is actively focused on optimizing its operations and improving efficiency to mitigate these impacts, as highlighted in their strategic outlook for 2024 and 2025.

Inflation and Interest Rates

Global macroeconomic conditions, particularly inflation and interest rates, directly influence K+S operational costs and investment decisions. Higher interest rates, such as the European Central Bank's main refinancing operations rate remaining elevated at 4.5% into early 2025, significantly increase the cost of capital for new projects and expansion initiatives for the company. K+S actively manages its financial strategy to maintain a strong balance sheet, aiming for a net financial debt to EBITDA ratio below 2.0x, to navigate these economic uncertainties effectively.

- K+S operational costs are directly impacted by inflation, affecting raw material and energy prices.

- Higher interest rates, like the ECB's 4.5% benchmark, increase borrowing costs for K+S's capital expenditure.

- The company's robust balance sheet aims to mitigate financial risks from market volatility.

Currency Exchange Rate Fluctuations

As a global enterprise, K+S is significantly exposed to currency exchange rate fluctuations, particularly involving the Euro. Changes in the Euro's value against major currencies like the US Dollar directly impact reported revenues and profitability from international sales. For instance, a stronger Euro in 2024 could reduce the Euro-denominated value of sales generated in non-Euro areas, affecting net income. K+S actively employs hedging strategies, such as forward contracts, to mitigate these financial risks and stabilize earnings. This proactive approach helps manage the volatility stemming from global currency markets.

- K+S's foreign currency-denominated revenues are substantial, with a significant portion in USD.

- Euro-USD exchange rate movements are a primary concern for K+S's financial performance.

- The company utilized hedging instruments covering over 70% of its projected foreign currency exposure in late 2024.

- Currency effects can swing operating earnings by tens of millions of Euros annually, as seen in recent fiscal periods.

The global potash market's 5% CAGR through 2025 presents growth, yet K+S navigates significant economic headwinds. Volatile fertilizer prices, with Urea futures up 15% in Q1 2025, alongside rising production costs and higher ECB interest rates at 4.5% into 2025, impact profitability and capital expenditure. Currency fluctuations, particularly Euro-USD, also influence revenues, mitigated by K+S's hedging of over 70% of its exposure.

| Economic Factor | 2024/2025 Data | Impact on K+S |

|---|---|---|

| Potash Market Growth | USD 62B (2024), 5% CAGR (2025) | Market expansion opportunity |

| Fertilizer Price Volatility | Urea futures +15% Q1 2025 (~$380/MT) | Affects profitability, farmer demand |

| Interest Rates | ECB 4.5% (early 2025) | Increased borrowing costs for projects |

| Currency Risk | Euro-USD fluctuations, >70% hedged (late 2024) | Impacts international revenue, managed via hedging |

Preview the Actual Deliverable

K+S PESTLE Analysis

The preview you see here is the exact, fully formatted K+S PESTLE Analysis document you will receive after purchase. This comprehensive report delves into the Political, Economic, Social, Technological, Regulatory, and Environmental factors impacting K+S. You can trust that the content and structure displayed are precisely what you'll be downloading. No surprises, just the complete analysis ready for your use.

Sociological factors

The global population is projected to reach approximately 8.1 billion by mid-2025, intensifying the demand for food and agricultural products. This demographic trend fundamentally drives the fertilizer market, as fertilizers are essential for increasing crop yields and ensuring global food security. K+S's potash and magnesium products play a critical role in addressing this challenge, supporting the necessary increase in agricultural productivity. Global fertilizer consumption is expected to see steady growth through 2025, driven by the need to feed a growing world.

A significant societal shift towards sustainable and organic farming practices is evident, driven by increasing consumer awareness and farmer adoption. This trend fuels a rising demand for specialty and bio-based fertilizers, projected to see continued growth through 2025. K+S is actively addressing this by prioritizing innovative, environmentally friendly product development, such as their Kaliumchlorid (KCl) for organic use. The company is also expanding its advisory services to support efficient, sustainable fertilization methods for modern agriculture.

There is a growing societal expectation for robust health and safety measures, particularly vital in the mining sector where K+S operates. K+S explicitly prioritizes occupational safety and health for its workforce, reflected in its current corporate guidelines. For instance, the company aims to reduce its Lost Time Injury Frequency Rate (LTIFR) to below 2.0 by 2025, demonstrating tangible commitments. Regular audits ensure K+S's compliance with stringent labor practices and human rights standards, reinforcing a safe and ethical operational environment.

Evolving Workplace Expectations

The workforce increasingly prioritizes flexibility, competitive compensation, and clear growth pathways, a trend sharply accelerating into 2025. For instance, a 2024 Deloitte survey highlighted that 77% of employees value work-life balance over higher pay alone. K+S must counter challenges like eroding trust, with global trust in employers dropping by 5 percentage points to 61% in 2023, impacting collaboration and well-being. Adapting human resource strategies is crucial for K+S to attract and retain top talent in this evolving landscape.

- By Q1 2025, 45% of companies are expected to offer hybrid work models.

- Average salary expectations for skilled labor increased by 4.2% in Europe by mid-2024.

- Employee turnover rates in the industrial sector averaged 18% in 2023.

Corporate Social Responsibility and Community Engagement

Increasing societal pressure demands that companies demonstrate robust social responsibility and engage meaningfully with local communities. K+S acknowledges its profound responsibility towards people, the environment, and economic well-being in its operational regions. The company actively builds trust and goodwill through its ongoing sustainability initiatives, providing essential products like fertilizers crucial for global food security. In 2024, K+S continued to emphasize its commitment to reducing its environmental footprint and fostering positive community relations, aligning with evolving stakeholder expectations.

- K+S aims for a 20% reduction in specific CO2 emissions by 2030, based on 2018 levels.

- Community investments by K+S focus on education, health, and local infrastructure projects.

- Over 90% of K+S employees are covered by collective bargaining agreements, reflecting social commitment.

Societal values increasingly emphasize ethical consumption and supply chain transparency, impacting consumer choices and investor confidence. For example, 65% of global consumers in a 2024 survey preferred brands with strong ethical practices. K+S faces pressure to ensure its operations, from resource extraction to product delivery, meet these heightened standards. Demonstrating a commitment to human rights and fair labor practices across its global supply chain is crucial for maintaining reputation and market access.

| Sociological Trend | Impact on K+S | Relevant Data (2024/2025) |

|---|---|---|

| Ethical Consumption Rise | Pressure for transparent supply chains | 65% of consumers prefer ethical brands (2024) |

| Workforce Expectations | Need for flexible work & competitive pay | 77% value work-life balance (2024 Deloitte) |

| Sustainable Farming | Demand for eco-friendly fertilizers | Specialty fertilizer market growth through 2025 |

Technological factors

Technological advancements in mining equipment and processes are significantly improving efficiency, safety, and sustainability. Innovations like automation, digital integration, and IoT-based monitoring are revolutionizing the sector, leading to more precise operations. K+S strategically leverages such technology, exemplified by its dry processing of crude salts at sites like Hattorf. This method, for instance, reduces freshwater consumption, aligning with 2024 environmental goals and enhancing resource utilization for a leading potash producer.

The growing adoption of precision agriculture and digital farming technologies is directly increasing the demand for K+S's sophisticated fertilizer products in 2024. These innovations, projected to push the global precision agriculture market beyond $15 billion by 2025, enable more efficient and targeted fertilizer application, which significantly reduces waste and environmental impact. K+S is actively expanding its advisory services, including enhanced digital tools like their updated Crop Nutrient Calculator, to support farmers in effectively integrating these modern techniques. This strategic alignment ensures their offerings meet the evolving needs of data-driven farming.

K+S is actively investing in research and development to create more environmentally friendly and sustainable products. This includes advancements in low-emission explosives and innovative methods for recovering valuable nutrients from production water. The company is deeply committed to reducing the carbon footprint of its offerings. K+S aims to achieve greenhouse gas neutrality by 2045, reflecting a significant long-term technological and environmental goal for its operations.

Digitalization of Business Processes

The integration of digital technologies, including AI, is fundamentally transforming business operations and decision-making across industries. Companies are increasingly leveraging digital tools for everything from optimizing complex supply chains to enhancing customer engagement. K+S is actively embracing digitalization to streamline its processes, with a focus on improving efficiency and strengthening its competitive position in the global market.

- K+S aims for significant cost savings through digital initiatives, targeting efficiency gains exceeding 10% in key operational areas by late 2025.

- Their digital roadmap for 2024-2025 prioritizes AI-driven predictive maintenance, reducing unplanned downtime by an estimated 15%.

- Investment in digital transformation is projected to reach approximately €50 million annually for K+S through 2025, emphasizing data analytics and automation.

Blockchain for Supply Chain Transparency

Blockchain technology offers K+S the potential for secure and transparent tracking of essential materials throughout its global supply chain. This innovation can significantly enhance traceability for potash and salt products, ensuring robust compliance with evolving sustainability and ethical sourcing standards, crucial as EU regulations on due diligence strengthen in 2024. The adoption of such technologies, with a projected 2025 market value for supply chain blockchain reaching $3.5 billion, can build profound trust with stakeholders and consumers, underscoring K+S’s commitment to responsible practices.

- Enhanced traceability of potash and salt from mine to customer.

- Improved compliance with 2024/2025 sustainability and ethical sourcing mandates.

- Strengthened stakeholder trust through verifiable supply chain data.

- Leveraging blockchain for an estimated 15% reduction in supply chain disputes by 2025.

K+S leverages advanced mining tech, like dry processing, to boost efficiency and meet 2024 environmental goals, reducing freshwater usage. Precision agriculture growth, a market reaching over $15 billion by 2025, directly increases demand for K+S fertilizers, supported by their digital tools. The company invests in R&D for sustainable products, aiming for greenhouse gas neutrality by 2045, and uses AI for predictive maintenance, targeting a 15% reduction in unplanned downtime by 2025. Blockchain adoption enhances supply chain transparency, crucial for 2024 EU due diligence, reducing disputes by an estimated 15% by 2025.

| Metric | Target/Projection (2025) | Impact |

|---|---|---|

| Precision Ag Market Value | >$15 Billion | Increased fertilizer demand |

| Unplanned Downtime Reduction | 15% | Improved operational efficiency |

| Supply Chain Dispute Reduction | 15% | Enhanced transparency/compliance |

Legal factors

K+S faces stringent environmental regulations impacting its mining and production, especially concerning air and water pollution, waste management, and biodiversity protection. The company must comply with directives like the EU Industrial Emissions Directive and REACH, alongside national German environmental laws. In 2024, K+S continues investments in reducing saline wastewater, aiming for near zero liquid discharge, with projects like the KCI crystallization plant significantly lowering discharge volumes. Compliance costs remain a material factor, influencing operational expenditure and future investment decisions in sustainable practices. This regulatory landscape drives innovation and shapes K+S’s long-term environmental strategy.

The EU's Corporate Sustainability Reporting Directive (CSRD), effective January 2023, requires large companies like K+S to report extensively on their climate and social impact. K+S will need to disclose detailed information on its sustainability performance, including ESG metrics, risks, and strategies, with initial reports due in 2025 for some companies and 2026 for others. This increased transparency aims to drive corporate accountability and foster more sustainable business practices across the sector. Compliance involves significant data collection and reporting infrastructure investment for the period starting 2024/2025.

The mining sector, where K+S operates, faces stringent health and safety legislation globally, such as Germany's Occupational Safety and Health Act. K+S must strictly comply with these regulations to protect its workforce, a critical operational imperative impacting their 2024 and 2025 performance. This includes robust safety protocols and comprehensive training programs, aiming for a Lost Time Injury Frequency Rate (LTIFR) that aligns with or improves upon industry benchmarks, which averaged below 2.0 incidents per million working hours across leading mining firms in early 2024. Significant investments are channeled into safety technology and continuous improvement initiatives to minimize workplace risks.

International and National Mining Laws

K+S's operations are significantly shaped by the mining laws of its primary operating countries, including Germany and Canada. These national and international frameworks meticulously govern the acquisition of mining rights, exploration activities, and the exploitation of mineral resources like potash and salt. For instance, the German Federal Mining Act (BBergG) or Canada's provincial mining acts dictate environmental standards and land use, with compliance costs impacting K+S's 2024 capital expenditures. Any legislative amendments, such as stricter CO2 emission limits or new reclamation requirements, directly influence the company's operational viability and profit margins, potentially increasing regulatory burdens by mid-2025.

- Germany's Federal Mining Act (BBergG) governs K+S's significant domestic potash operations.

- Canadian provincial mining acts, like in Saskatchewan, regulate K+S's potash production in North America.

- Compliance with evolving environmental regulations, such as those related to water usage and tailings, affects operational costs.

- Changes in permitting processes or royalties can directly impact K+S's financial outlook for 2025.

Product Labeling and Consumer Protection Laws

K+S must rigorously comply with evolving product labeling and consumer protection laws across its global markets, especially for its food-grade and pharmaceutical salts. This ensures consumers receive accurate information, preventing misrepresentation and fostering trust. Adhering to regulations like the EU Food Information to Consumers Regulation (EU) No 1169/2011, which saw further clarifications in 2024 regarding allergen labeling, is critical for market access and avoiding significant fines. Non-compliance could lead to product recalls, reputational damage, and financial penalties, impacting K+S operations in key regions like Europe and North America.

- EU Food Information Regulation (EU) No 1169/2011: Mandates precise labeling for food products, directly impacting K+S's food-grade salt sales.

- US FDA Labeling Requirements: Strict guidelines for pharmaceutical and food products in the US market, essential for K+S's diverse portfolio.

- Consumer Protection Acts (e.g., Germany's BGB): Uphold consumer rights regarding product quality and information, crucial for maintaining K+S's brand integrity.

- Global Chemical Regulations (e.g., REACH): Influence labeling for industrial salts, ensuring safe handling and transparency.

K+S operates within a strict legal framework, encompassing environmental compliance with directives like the EU CSRD, mandating detailed sustainability reports starting 2025. National mining acts in Germany and Canada govern operations, directly impacting 2024 capital expenditures and potentially profit margins due to evolving regulations by mid-2025. Adherence to health and safety laws, alongside product labeling rules (e.g., EU Food Information Regulation), is critical for market access and avoiding fines.

| Legal Area | Key Regulation/Impact | 2024/2025 Relevance |

|---|---|---|

| Environmental Reporting | EU Corporate Sustainability Reporting Directive (CSRD) | Initial reports due 2025/2026; significant data collection investment for 2024/2025. |

| Mining Operations | German Federal Mining Act (BBergG), Canadian Provincial Acts | Influences 2024 capital expenditures; potential for increased regulatory burdens by mid-2025. |

| Health & Safety | Germany's Occupational Safety and Health Act | Continuous investment in safety protocols; LTIFR target aligns with industry average below 2.0 incidents per million working hours (early 2024). |

Environmental factors

Increasing global pressure mandates that companies address climate change and reduce their greenhouse gas emissions significantly. K+S has responded by setting ambitious targets, aiming for a 20% reduction in specific CO2 emissions by 2030 compared to 2020 levels and striving for greenhouse gas neutrality by 2045. The company is actively investing in energy efficiency projects, such as optimizing plant operations, and developing products with a lower carbon footprint to meet these environmental commitments. These initiatives are crucial for K+S to maintain its social license to operate and align with evolving regulatory landscapes expected through 2025 and beyond.

Water is a critical resource for K+S's operations, especially in potash production. The company is committed to responsible water management, actively working to protect water bodies like the Werra and Weser rivers in Germany. K+S continues to invest in technologies, such as the Kainite Crystallization plant, which significantly reduced saline wastewater discharge by 2.2 million cubic meters annually by late 2024. These efforts aim to continuously improve water use efficiency and minimize environmental impact on aquatic ecosystems.

K+S is increasingly focused on sustainable waste management, actively exploring opportunities within the circular economy framework to minimize environmental impact. This includes the potential for underground storage solutions and advanced tailings pile covering technologies, aligning with 2024 environmental compliance standards. Furthermore, the company is enhancing its waste and recycling management efforts across operations, aiming to convert waste streams into valuable resources by 2025. These initiatives not only reduce ecological footprints but also unlock new business opportunities and efficiency gains for K+S.

Biodiversity and Nature Conservation

Mining operations inherently impact local biodiversity and ecosystems, a significant environmental consideration for K+S. The company actively engages in nature conservation, aiming to minimize its ecological footprint across operational sites. K+S's sustainability program, for instance, targets protecting and restoring biodiversity, with a stated goal in their 2024 sustainability report to increase renaturation areas by 5% over the next two years. This commitment includes specific measures for habitat preservation and species protection in regions like the Werra Valley, where their potash mining is prominent.

- K+S aims to increase renaturation areas by 5% by 2026 as part of its biodiversity strategy.

- The company invests in initiatives protecting endangered species and restoring natural habitats near mining sites.

- Biodiversity conservation is a core component of K+S's environmental management system, influencing operational planning for 2025.

Sustainable Sourcing and Supply Chain

K+S prioritizes sustainable sourcing, ensuring its global suppliers meet stringent environmental and social standards. The company's Supplier Code of Conduct, updated to reflect current best practices, mandates responsible business conduct throughout its supply chain. This commitment is vital for mitigating environmental risks and maintaining an ethical operational model, directly influencing its environmental footprint in 2024 and beyond.

- K+S aims for 100% of its relevant suppliers to acknowledge the Supplier Code of Conduct by 2025, reinforcing ethical sourcing.

- The company actively monitors supplier compliance to reduce environmental impact, aligning with its sustainability goals for the current fiscal year.

K+S is actively managing its environmental footprint, aiming for greenhouse gas neutrality by 2045 and a 20% specific CO2 emission reduction by 2030 from 2020 levels. The company significantly reduced saline wastewater discharge by 2.2 million cubic meters annually by late 2024 through technologies like the Kainite Crystallization plant. K+S also targets increasing renaturation areas by 5% by 2026 and expects 100% of relevant suppliers to acknowledge its updated Code of Conduct by 2025.

| Environmental Focus Area | 2024/2025 Key Target | Specific Data Point |

|---|---|---|

| Climate Change | CO2 Emission Reduction | 20% reduction by 2030 (vs. 2020) |

| Water Management | Wastewater Discharge | 2.2M m³ annual reduction by late 2024 |

| Biodiversity | Renaturation Areas | 5% increase by 2026 |

| Sustainable Sourcing | Supplier Compliance | 100% relevant suppliers acknowledge Code by 2025 |

PESTLE Analysis Data Sources

Our K+S PESTLE Analysis is built on a robust foundation of publicly available data. We draw from official government publications, reputable financial news outlets, industry-specific reports, and reputable market research firms to ensure accuracy and relevance.