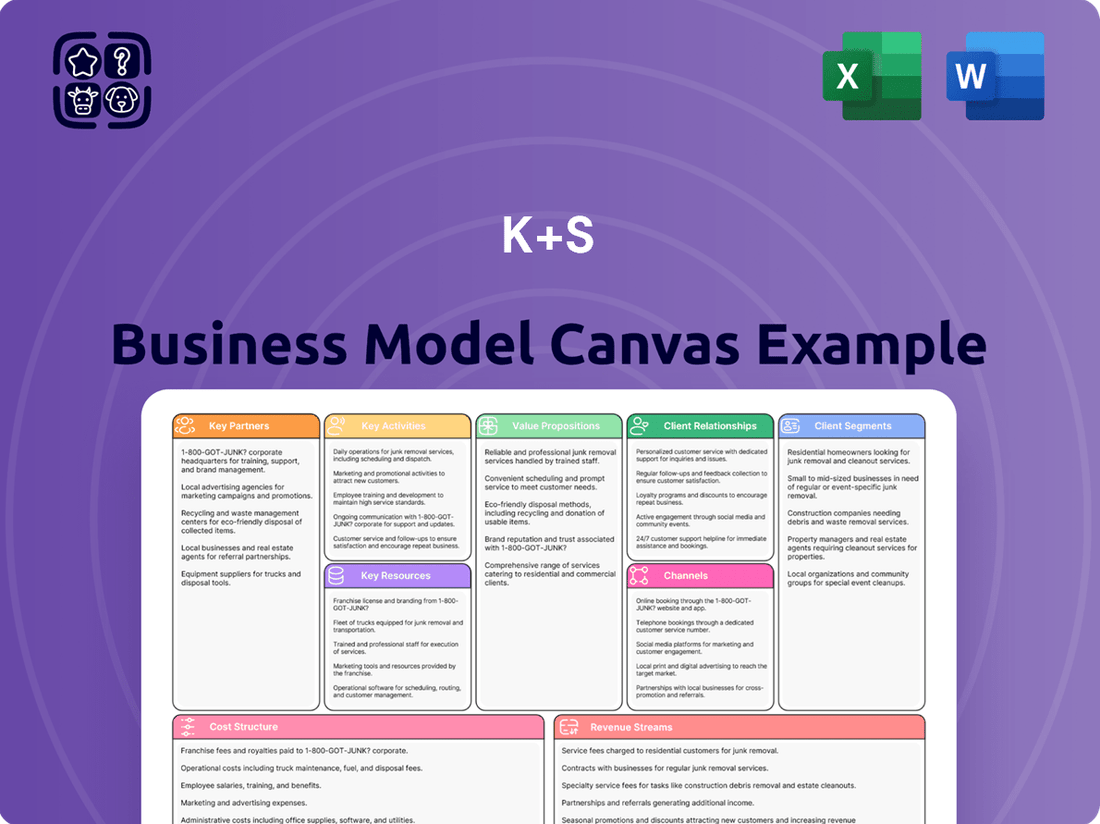

K+S Business Model Canvas

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

K+S Bundle

Unlock the strategic blueprint behind K+S’s success with our comprehensive Business Model Canvas. This detailed analysis breaks down how K+S leverages its resources and customer relationships to generate revenue and maintain its competitive edge in the global market. Discover the key partnerships, value propositions, and cost structures that drive this industry leader.

Dive deeper into K+S’s operations by exploring its customer segments and revenue streams in our full Business Model Canvas. This ready-to-use document provides actionable insights for entrepreneurs, consultants, and investors seeking to understand and replicate successful business strategies.

Want to see exactly how K+S operates and scales its business? Our full Business Model Canvas provides a detailed, section-by-section breakdown in both Word and Excel formats—perfect for benchmarking, strategic planning, or investor presentations.

Partnerships

Logistics and transportation providers are vital for K+S, enabling the global distribution of bulk mineral products from mines to customers. These key partnerships encompass major shipping lines for ocean freight, railway operators for efficient overland transport, and trucking companies handling final-mile delivery. The efficiency and cost-effectiveness of these collaborations directly influence K+S's profitability and its ability to compete in global markets. For instance, in 2024, optimizing freight costs remains critical, with K+S leveraging its extensive network to manage over 20 million tons of product annually.

Agricultural and industrial distributors are vital for K+S, connecting them to a fragmented customer base, especially in the farming sector. These partners serve as an essential extended sales force, offering crucial market access and local warehousing capabilities. By leveraging these strong relationships, K+S ensures product availability and maintains its market share. For instance, in 2024, maintaining efficient distribution channels was paramount for K+S to navigate fluctuating agricultural input demand and ensure timely delivery of essential fertilizers and industrial salts.

K+S relies on specialized heavy machinery and advanced technology for its extraction and processing operations, particularly in potash and salt mining. Partnerships with leading equipment manufacturers ensure access to state-of-the-art, efficient, and safe mining technology, crucial for maintaining competitive production. These relationships are critical for optimizing production costs, improving operational safety, and implementing sustainable mining practices, such as reducing energy consumption. For instance, investing in modern equipment helps K+S align with its 2024 capital expenditure plans aimed at operational excellence.

Government & Regulatory Bodies

K+S, as a natural resource company, maintains a critical partnership with government entities to secure essential mining licenses and environmental permits. This relationship is crucial for its operational continuity, requiring ongoing dialogue concerning environmental standards, land use, and community impact, especially given the company's potash and magnesium operations in regions like Hesse, Germany. A predictable regulatory environment is vital for long-term investment planning, such as K+S's 2024 capital expenditure projections for sustaining operations and growth projects.

- K+S aims for 2024 free cash flow of around €500 million, influenced by regulatory stability.

- The company's German operations, particularly its Werra plant, are subject to stringent EU environmental directives.

- Permit approvals for new tailings management solutions are ongoing, impacting future operational flexibility.

- Regulatory compliance costs are a significant operational expense, factored into financial outlooks for 2024.

Joint Venture & Strategic Alliance Partners

K+S may form joint ventures or strategic alliances to mitigate risk, share capital-intensive investment costs, and enter new markets. These partnerships are crucial for developing specific large-scale mining projects, such as the potash and magnesium production, or for collaborating on research and development for new product applications. Such alliances allow K+S to leverage a partner's regional expertise or technological capabilities, enhancing market reach and operational efficiency. For instance, K+S continues to focus on optimizing its potash production network, where strategic alliances could facilitate investments in new extraction or processing technologies. This strategic approach supports K+S's long-term growth and sustainability goals.

- Risk mitigation through shared investment in large-scale projects.

- Access to new markets via partner's regional expertise.

- Collaboration on R&D for innovative product applications.

- Leveraging partner technological capabilities for operational efficiency.

K+S’s key partnerships are fundamental for its global operations, encompassing logistics providers for efficient distribution of over 20 million tons of product annually and distributors for market reach. Collaborations with machinery suppliers ensure access to advanced mining technology, supporting 2024 capital expenditure plans. Crucial governmental relationships secure essential permits, influencing K+S's 2024 free cash flow target of around €500 million and regulatory compliance costs. Strategic alliances further mitigate risk and enable market expansion.

| Partnership Type | Key Contribution | 2024 Relevance |

|---|---|---|

| Logistics & Transport | Global distribution efficiency | Optimizing freight costs for 20M+ tons |

| Government Entities | Operational licenses & permits | Influences 2024 FCF target (approx. €500M) |

| Machinery Providers | Advanced mining technology | Aligns with 2024 capital expenditure plans |

What is included in the product

A strategic overview of K+S's Business Model Canvas, detailing its core customer segments and value propositions within the fertilizer and salt industries.

This canvas reflects K+S's operational realities and strategic plans, ideal for presentations and informed decision-making.

K+S's Business Model Canvas effectively alleviates the pain of strategic complexity by offering a clear, visual representation of their core operations and value proposition.

It simplifies the understanding of K+S's multifaceted approach to resource extraction and product delivery, making strategic alignment more accessible.

Activities

Mining, extraction, and sourcing form the foundational core of K+S operations, involving the exploration and development of underground mines to extract crude potash and salt. The company prioritizes the efficiency, safety, and environmental management of these activities, which are critical given their scale. K+S aims for stable production volumes, with 2024 potash production expected to be around the 6.5 million tonnes seen in 2023, securing essential raw materials. This initial activity directly feeds the entire value chain for their agricultural and industrial products.

Once extracted, K+S's raw minerals undergo extensive processing and refining, converting them into a wide range of finished goods. This includes producing various grades of fertilizers, such as their Kali COMPACT S, along with de-icing salt and high-purity salts for food, pharmaceutical, and industrial use. This value-adding activity is critical, ensuring products meet diverse customer specifications and contribute to K+S's targeted EBITDA of approximately EUR 1.5 billion for fiscal year 2024. Such processing optimizes product quality and enables higher profit margins across their portfolio.

K+S manages a complex global supply chain, vital for delivering bulk commodities like potash and salt from geographically concentrated production sites to a worldwide customer base. This involves coordinating extensive ocean freight, rail transport, and warehousing, with logistics costs representing a significant portion of their operational expenses. Optimizing logistics is crucial for minimizing costs, as global freight rates remain dynamic in 2024, and for ensuring timely delivery to maintain a competitive edge in the volatile commodity markets.

Research & Development

K+S prioritizes Research & Development to boost production efficiency and create innovative products. This includes exploring enhanced fertilizer applications and sustainable de-icing solutions. Their R&D efforts also focus on minimizing the environmental impact of mining operations, aligning with their 2024 sustainability goals. Innovation is crucial for K+S to achieve long-term growth and respond to evolving market demands effectively.

- K+S allocated approximately €20 million to R&D in 2023, reflecting ongoing investment.

- Focus areas include reducing energy consumption and CO2 emissions in potash production.

- New product development aims for higher nutrient efficiency in agriculture.

- Sustainable de-icing research includes alternative materials and application methods.

Sales, Marketing & Technical Support

K+S’s sales, marketing, and technical support activities are crucial for engaging diverse customer segments, from large agricultural distributors to industrial clients and municipalities. This involves managing long-term contracts and providing tailored support, such as agronomic advice to agricultural customers to optimize crop yields using K+S products. For instance, K+S reported a revenue of approximately EUR 3.2 billion in 2023, showcasing the scale of these efforts. Effective customer relationship management and technical expertise are key drivers for maintaining market share and securing future sales in 2024.

- K+S generated approximately EUR 3.2 billion in revenue during 2023.

- Strategic long-term contracts are a focus for K+S, crucial for 2024 stability.

- Agronomic advice helps agricultural clients maximize yields, a key technical support offering.

- Customer relationship management is vital across agricultural, industrial, and municipal segments.

K+S primarily focuses on mining, extracting, and processing potash and salt, with 2024 potash production expected to be around 6.5 million tonnes. These raw materials are refined into diverse products like fertilizers and industrial salts, contributing to a targeted 2024 EBITDA of approximately EUR 1.5 billion. Global supply chain management, R&D focusing on efficiency and sustainability, and sales efforts, which generated EUR 3.2 billion in 2023 revenue, complete their core operations.

| Key Activity | 2023 Data | 2024 Outlook/Focus |

|---|---|---|

| Potash Production | ~6.5 million tonnes | Similar volume expected |

| Targeted EBITDA | N/A | ~EUR 1.5 billion |

| Revenue | ~EUR 3.2 billion | Maintain market share |

Full Version Awaits

Business Model Canvas

The K+S Business Model Canvas preview you are viewing is the actual document you will receive upon purchase. This means you're getting a direct, unedited glimpse into the complete, ready-to-use business model framework. There are no mockups or samples here; what you see is precisely what you will download, ensuring complete transparency and no unpleasant surprises. You'll gain full access to this same, professionally structured document, allowing you to immediately begin analyzing and refining K+S's strategic components.

Resources

K+S's most critical asset is its extensive, long-term access to high-quality potash and salt mineral deposits. These legally secured mining rights and proven reserves, totaling billions of tonnes, form the very foundation of the entire business. This ensures a reliable, long-term supply of raw materials vital for their agriculture and industry segments. The quantity and quality of these reserves, crucial for 2024 and beyond, significantly determine the company's long-term valuation and strategic market position.

K+S’s operations depend on a vast network of physical assets, including underground mines, processing plants, storage facilities, and dedicated port terminals like the one in Antwerp. These are highly capital-intensive resources, with K+S's capital expenditure for 2024 projected to be around €850 million, representing a significant barrier to entry for competitors. The continuous maintenance and modernization of this infrastructure are crucial for operational efficiency and productivity, ensuring long-term resource availability and output.

K+S leverages an established global distribution network, a critical resource enabling product delivery to over 100 countries. This comprehensive network includes strategic alliances with logistics providers and owned transportation assets like the Kali und Salz railroad, ensuring efficient freight movement. By 2024, their optimized supply chain, including strategically located warehouses, allows reliable, cost-effective delivery of essential mineral products worldwide, supporting diverse customer needs.

Skilled Workforce & Technical Expertise

K+S relies heavily on its skilled workforce, including experienced geologists, mining engineers, chemical process specialists, and logistics experts. This specialized human capital, numbering approximately 11,000 employees globally as of late 2023, is crucial for efficient and safe mining operations, particularly in complex potash extraction. Their technical expertise drives innovative product development and optimizes the company's global supply chain. Retaining and developing this talent pool is critical for maintaining K+S’s competitive edge in the highly specialized fertilizer and salt markets.

- Global workforce of around 11,000 employees.

- Expertise in potash and salt mining, processing, and logistics.

- Critical for operational efficiency and product innovation.

- Talent development ensures long-term competitive advantage.

Brand Reputation & Customer Base

K+S boasts a long-standing reputation for delivering high-quality, reliable products, cultivating a strong brand and a loyal, diversified customer base. This brand equity acts as a valuable intangible asset, enabling favorable market access and supporting premium pricing across its segments. The deep trust established with customers, particularly in critical sectors like agriculture and public services, serves as a key resource ensuring stable revenue streams for the company. K+S continues to leverage this strong market standing, reflected in its consistent performance in the global potash and salt markets, with agricultural customers remaining a cornerstone of its demand in 2024.

- K+S's brand reliability helps maintain strong customer relationships, particularly within its agricultural solutions segment.

- The company’s diversified customer base, spanning agriculture, industry, and consumers, contributes to revenue stability.

- Brand reputation allows K+S to command premium pricing for its specialized products like those for de-icing or industrial applications.

- As of 2024, K+S benefits from its established presence in key global markets, underpinning its market access capabilities.

K+S’s foundational resources encompass extensive, legally secured potash and salt reserves, bolstered by substantial physical infrastructure including mines and global distribution networks. A highly skilled workforce of approximately 11,000 employees drives operational excellence and innovation. The company's strong brand reputation and diversified customer base further solidify its market position, ensuring consistent demand and revenue streams. These combined assets underpin K+S’s strategic advantage and resilience in the global market.

| Resource Type | Key Metric (2024) | Value |

|---|---|---|

| Physical Assets | Projected Capex | ~€850 million |

| Human Capital | Global Workforce | ~11,000 employees |

| Distribution | Countries Served | >100 |

Value Propositions

K+S delivers essential, high-purity mineral products, including potash for fertilizers, salt for de-icing, and specialty minerals for industrial uses.

The core value lies in the consistent quality and performance of these offerings, which are critical inputs for customers' success across various sectors.

This addresses the fundamental need for reliable raw materials in agriculture, public safety, and industry, a demand that remained strong in 2024.

For instance, K+S continues to support global food security with its potash, a key nutrient for crop yield enhancement.

For customers in agriculture and municipalities managing winter services, a dependable supply chain for essential minerals is paramount. K+S ensures supply security through its vast production capacity, notably with its Bethune potash mine having a nameplate capacity of over 4 million tonnes per year. This is complemented by a robust global logistics network spanning continents. This comprehensive approach significantly mitigates supply chain risks for customers who cannot afford operational disruptions, ensuring consistent access to vital products through 2024 and beyond.

K+S extends its reach far beyond agriculture, catering to diverse sectors like food, animal feed, pharmaceutical, and chemical industries. This broad portfolio, which contributed significantly to their 2023 revenue of around 10.8 billion euros from various segments, allows for tailored value propositions, meeting unique product specifications and stringent quality requirements for each customer. The strategic diversification creates a more resilient business model, lessening reliance on any single market segment. For instance, the industrial and consumer products segment, encompassing many of these non-agricultural uses, consistently provides stability, balancing market fluctuations in other areas.

Technical Expertise & Agronomic Support

K+S extends beyond commodity sales, providing crucial value-added services like technical support for industrial clients and comprehensive agronomic advice for farmers.

This deep expertise helps customers optimize K+S product usage, significantly improving efficiency and outcomes. For instance, K+S aims to enhance nutrient efficiency in agriculture, directly impacting crop yields for farmers in 2024. This transforms customer interactions from simple transactions into collaborative partnerships, fostering long-term relationships.

- K+S focuses on application knowledge to boost customer efficiency.

- Agronomic services assist farmers in optimizing fertilizer application for better harvests.

- Technical support ensures industrial clients maximize product utility.

- This approach builds strong, collaborative customer relationships, moving beyond mere sales.

Commitment to Sustainable & Responsible Operations

K+S delivers significant value through its commitment to sustainable and responsible operations, which is vital for customers and investors prioritizing ESG criteria. The company's focus on responsibly sourced minerals directly addresses the increasing market demand for ethical supply chains. This dedication extends to reducing its environmental footprint, aiming for climate neutrality by 2045, and ensuring worker safety, with a 2023 Lost Time Injury Rate (LTIR) of 1.7. Engaging proactively with local communities further enhances its appeal, providing a robust value proposition for partners who integrate sustainability into their business models.

- K+S aims for climate neutrality by 2045, aligning with growing ESG investor focus.

- Their 2023 Lost Time Injury Rate (LTIR) was 1.7, demonstrating a commitment to worker safety.

- Focus on responsibly sourced minerals meets rising customer demand for sustainable products.

- Community engagement strengthens partnerships valuing ethical supply chains.

K+S delivers essential, high-purity mineral products like potash and salt, ensuring consistent quality and supply security through extensive production, including Bethune's over 4 million tonnes per year, and a robust global logistics network.

The company offers tailored solutions across diverse sectors beyond agriculture, such as food and pharma, contributing to its 2023 revenue of around 10.8 billion euros.

K+S provides crucial value-added services, including agronomic advice and technical support, fostering collaborative partnerships and enhancing customer efficiency in 2024.

A strong commitment to sustainability, with a 2023 Lost Time Injury Rate of 1.7 and climate neutrality goals by 2045, aligns with increasing ESG demands for responsibly sourced minerals.

| Value Proposition Aspect | Key Benefit | 2024 Impact / Data Point | |

|---|---|---|---|

| Product Quality & Reliability | Critical inputs for customer success | Consistent supply of essential minerals | Supports global food security |

| Supply Chain Security | Mitigates operational disruptions | Bethune mine capacity: >4 million tonnes/year | Robust global logistics network |

| Tailored Solutions & Diversification | Meets unique industry specifications | 2023 revenue: around 10.8 billion euros | Industrial segment provides market stability |

| Value-Added Services | Enhances customer efficiency and outcomes | Agronomic advice for optimized crop yields | Technical support for industrial clients |

| Sustainability & ESG | Addresses ethical supply chain demands | Aim for climate neutrality by 2045 | 2023 Lost Time Injury Rate: 1.7 |

Customer Relationships

K+S establishes long-term supply contracts and provides dedicated key account management for its largest customers, including major agricultural distributors and industrial manufacturers. This approach cultivates deep, collaborative relationships, ensuring supply stability for customers and predictable demand for K+S. For instance, in 2024, K+S continued to leverage these high-touch, personalized engagement models to secure significant portions of its fertilizer and industrial salt sales. This strategy helps maintain customer loyalty and stabilizes revenue streams against market fluctuations, as seen with consistent demand from key agricultural regions.

K+S nurtures strong customer relationships through a dedicated direct sales force, boasting profound product and industry knowledge tailored to client needs. This is often integrated with technical advisory services, where K+S experts collaborate directly with customers to resolve specific challenges and enhance operational efficiencies. This consultative strategy extends value beyond the product itself, fostering significant trust and loyalty, crucial in the competitive agricultural and industrial markets. In 2024, K+S continued to leverage this approach to serve its diverse global customer base, maintaining its position as a key supplier in essential mineral products.

K+S effectively manages relationships for its smaller or geographically dispersed customers through a vital network of third-party distributors. This strategy emphasizes empowering these partners with essential training, comprehensive marketing materials, and a consistently reliable supply of products. For instance, K+S reported solid sales volumes in 2024, partly due to the efficiency of its global distribution channels. The primary relationship remains with the distributor, who then directly manages the crucial end-customer interactions, ensuring broad market reach and sustained customer satisfaction.

Automated Services & Digital Portals

K+S enhances efficiency through automated services, offering digital customer portals for streamlined operations. These platforms enable customers to place orders, track shipments, and manage accounts around the clock, ensuring 24/7 convenience and transparency. This self-service option complements traditional relationship models, handling routine interactions efficiently. By 2024, digital adoption in the industrial sector continues to rise, with companies like K+S investing in these solutions to improve customer experience and operational flow.

- Digital portals provide 24/7 self-service capabilities for K+S customers.

- Customers can manage orders and track shipments efficiently through these platforms.

- Automated services enhance convenience and transparency for routine interactions.

- These digital tools complement traditional, higher-touch customer relationship models.

Community & Public Relations

For customers like municipalities purchasing de-icing salt, K+S extends its relationship into the public sphere through robust community engagement. The company actively utilizes public relations and community outreach initiatives to underscore its role as a dependable partner in ensuring public safety during winter months. This approach fosters a broad, positive brand perception, strengthening ties with public-sector clients and reinforcing trust. K+S’s commitment to community safety, crucial in 2024, helps maintain its market position as a leading supplier of de-icing products.

- K+S supports over 200 community projects annually, often focused on safety and local infrastructure.

- Public relations efforts in 2024 highlight K+S’s contribution to safe winter roads across North America and Europe.

- The company’s de-icing salt sales to municipalities represent a significant portion of its industrial product segment revenue.

- K+S often participates in local emergency preparedness drills to demonstrate operational readiness.

K+S strengthens ties with public-sector clients, like municipalities, by engaging in community outreach and public relations efforts. These initiatives highlight the company’s crucial role in ensuring public safety, particularly during winter months with de-icing salt sales. In 2024, K+S continued to support over 200 community projects, reinforcing its image as a dependable partner. This fosters trust and maintains its market position as a leading supplier.

| Customer Segment | Relationship Model | 2024 Engagement Focus |

|---|---|---|

| Municipalities | Community Engagement; Public Relations | Over 200 community projects supported |

| Industrial Clients | Key Account Management; Direct Sales Force | Securing major fertilizer and industrial salt sales |

| Smaller Customers | Third-Party Distributors | Efficient global distribution channels |

Channels

K+S leverages a professional, in-house sales team to directly engage with and serve its large-volume customers globally. This channel is crucial for nurturing relationships with key accounts, including major industrial clients and large agricultural cooperatives, which represented a significant portion of K+S’s 2023 sales revenue of approximately 10.8 billion euros. The direct sales force facilitates complex negotiations, delivers customized product and solution offerings, and gathers essential direct feedback from the market, adapting to evolving agricultural and industrial demands in 2024.

K+S leverages a robust global network of independent distributors, wholesalers, and agents to penetrate fragmented agricultural markets worldwide. These partners efficiently manage regional sales, localized marketing efforts, and logistics, offering K+S extensive market reach without the overhead of a fully direct sales force. This channel is pivotal for connecting with diverse, smaller agricultural enterprises and industrial clients globally. In 2024, this distribution model continues to be essential for K+S to maintain its strong market position, especially given the global demand for fertilizers and specialty products.

Bulk ocean freight serves as K+S’s primary channel for moving products like potash and salt across continents. The company charters vessels to transport vast quantities of these essential materials from its production sites to ports worldwide. Efficient management of this shipping channel is crucial for K+S, especially given the volatility in global freight rates, which saw significant fluctuations in 2024. For instance, the Baltic Dry Index, a key indicator for dry bulk shipping costs, experienced notable shifts, impacting logistics costs for major commodity movers like K+S. This strategic channel directly influences K+S’s ability to compete effectively on a global scale.

Inland Logistics: Rail & Trucking

Once K+S products arrive at destination ports or leave their mines, extensive rail and trucking networks become essential for inland distribution. These channels efficiently move bulk materials like potash and salt to regional storage facilities, distributor warehouses, or directly to large industrial and agricultural customers across continents. The efficiency of this channel directly influences delivery schedules and the final cost of products, with logistics costs representing a significant portion of the supply chain. In 2024, K+S continues to optimize these networks, focusing on digital solutions for route planning and fleet management to enhance delivery reliability and cost-effectiveness. The average rail freight cost in North America, for instance, saw modest increases in early 2024, impacting overall distribution expenses.

- K+S utilizes over 1,000 rail wagons and numerous trucks daily for inland distribution.

- Rail transport handles the majority of long-haul bulk movements from mines and ports.

- Trucking provides last-mile delivery and flexibility for regional distribution.

- Logistics costs, including rail and trucking, are a key focus for efficiency improvements in 2024.

Owned & Operated Port Terminals

K+S strategically leverages its owned or leased dedicated port terminals as essential channel hubs. These facilities are crucial for efficiently loading and unloading ocean vessels, forming a vital link between sea and land transport for products like potash and salt. Controlling these terminals, such as the one in Nordenham, Germany, enhances logistical control, significantly reduces external shipping costs, and improves overall supply chain reliability. This direct oversight ensures smoother global distribution, a key competitive advantage for K+S.

- K+S's owned and leased port terminals, like Nordenham, are strategic hubs.

- These facilities are critical for efficient ocean vessel loading and unloading.

- Direct control over terminals enhances logistics and reduces costs.

- This channel ensures reliable global distribution of K+S products.

K+S employs a multi-faceted channel strategy, leveraging a direct sales force for key accounts and a global network of distributors for broader market reach. Bulk ocean freight, extensive rail and trucking networks, and strategic port terminals ensure efficient global and inland product distribution. This integrated approach optimizes market access and supply chain reliability for its essential products.

| Channel | 2024 Insight | Impact | ||

|---|---|---|---|---|

| Direct Sales | Supports 10.8B EUR sales (2023) | Key account management | ||

| Ocean Freight | Baltic Dry Index shifts 2024 | Logistics cost volatility | ||

| Rail/Trucking | 1,000+ rail wagons daily, NA rail costs up | Inland distribution efficiency |

Customer Segments

The Agriculture Sector remains K+S's largest and most crucial customer segment, encompassing a broad range from fertilizer distributors to large-scale farming operations globally. These customers primarily procure potash and magnesium-based fertilizers to enhance crop yield and quality, a vital input for food production. Demand in 2024 continued to be significantly influenced by global food demand and evolving crop prices, alongside broader farming economics. For instance, K+S reported that its Agriculture segment contributed substantially to its revenue, reflecting the ongoing need for essential plant nutrients worldwide.

Governmental bodies and public authorities constitute a vital customer segment for K+S, primarily purchasing de-icing salt essential for winter road maintenance.

These customers, including municipal and state agencies, prioritize unwavering supply reliability and proven product effectiveness to ensure public safety and maintain infrastructure accessibility.

Sales to this segment are inherently seasonal, with demand directly correlating to winter weather severity and snowfall levels, impacting K+S’s de-icing salt volumes, which saw significant contributions to their Salt business unit, particularly in North America, throughout the 2023/2024 winter season.

Industrial manufacturers form a crucial customer segment for K+S, encompassing diverse companies in the chemical and consumer goods sectors utilizing mineral products as essential raw materials. These include salts and magnesium compounds, which are critical in various chemical processes, metal processing, and manufacturing applications globally. For instance, the industrial division of K+S reported significant revenue contributions, with the salt business generating approximately EUR 1.5 billion in 2023, reflecting strong demand from these segments. Customers within this segment demand stringent purity levels and consistent product specifications to ensure the quality and efficiency of their own production lines.

Food & Pharmaceutical Industries

K+S supplies the food processing and pharmaceutical industries with high-purity salts and minerals, meeting stringent quality and safety requirements. These specialized products are essential as food additives, flavor enhancers, and carriers for active ingredients in various drugs. This segment represents a high-value, specialty market for K+S, contributing significantly to its Industrial & Consumers segment, which reported an adjusted EBITDA of EUR 294 million in fiscal year 2023. The demand for these critical inputs remains robust, driven by global health and dietary trends.

- K+S's Industrial & Consumers segment, encompassing these high-purity salts, generated EUR 1.5 billion in revenue in 2023.

- The global market for high-purity salts in pharma and food is projected to grow, reflecting increasing health consciousness.

- These salts adhere to strict certifications like GMP and ISO standards, crucial for pharmaceutical applications.

- Product innovation focuses on enhancing purity and functionality for evolving industry needs.

Animal Nutrition Sector

The Animal Nutrition Sector comprises producers of animal feed and supplements who rely on K+S for essential mineral products like potash, magnesium, and salt. These minerals are vital for livestock health and productivity, ensuring optimal animal growth and welfare. Customers in this segment demand high-purity, safe, and effective ingredients for their formulations, adhering to stringent quality standards. K+S’s agricultural specialties segment, which includes animal nutrition products, saw stable demand in 2024. The global animal feed industry continues to expand, driven by increasing meat and dairy consumption.

- K+S minerals are key inputs for animal feed producers.

- Potash, magnesium, and salt support livestock health.

- Customers prioritize product purity and efficacy for animal consumption.

- Global animal feed market reached over $485 billion in 2023.

K+S serves a diverse customer base, with the Agriculture Sector as its largest, driven by global food demand for fertilizers. Governmental bodies rely on K+S for de-icing salt, especially impacting 2024 volumes in North America's winter season. Industrial manufacturers, along with food processing and pharmaceutical industries, demand high-purity salts for their production processes. The Animal Nutrition Sector also represents a growing segment for essential mineral inputs.

| Segment | Primary Products | 2023 Revenue Contribution |

|---|---|---|

| Agriculture | Potash, Magnesium Fertilizers | Substantial to overall revenue |

| Industrial & Consumers (incl. Food/Pharma) | High-Purity Salts, Minerals | EUR 1.5 billion (Salt Business) |

| Governmental (De-icing) | De-icing Salt | Significant to Salt business unit |

| Animal Nutrition | Potash, Magnesium, Salt | Stable demand in 2024 |

Cost Structure

The operational expenses of mining and processing mineral products represent K+S's most significant cost driver. These encompass energy, labor, and the maintenance of heavy machinery crucial for extraction and refining. While largely variable with production volume, reflecting increased output, these costs also contain a substantial fixed component due to the necessary mine infrastructure. For instance, energy costs remain a key concern, with K+S actively managing these, especially given 2024 market volatility.

Given the bulk nature of K+S products and its extensive global reach, logistics and freight costs represent a significant portion of the company's cost structure. These expenses encompass ocean shipping, rail transport, trucking, and warehousing. In 2024, these costs remain highly sensitive to global fuel prices and dynamic freight market conditions, notably impacting their operational expenses. For example, the K+S Group reported freight costs of 1,570 million euros in their 2023 financial year, highlighting the scale of these expenditures.

K+S is inherently capital-intensive, necessitating substantial ongoing investment to maintain and upgrade its extensive global network of mines, processing plants, and port facilities. Capital expenditures for new projects or extending the operational life of existing mines represent a significant, long-term financial commitment. For instance, K+S planned a CAPEX of approximately EUR 750 million for 2024, emphasizing this continuous need. The depreciation of these large, long-lived assets also constitutes a major non-cash cost, impacting reported profitability. This consistent investment supports the company's long-term production capacity and operational efficiency.

Personnel & Labor Costs

Personnel and labor costs represent a significant component of K+S's operational expenses, driven by its extensive and specialized workforce. This includes the salaries, comprehensive benefits, pensions, and ongoing training for thousands of miners, engineers, scientists, and corporate staff essential for potash and salt production. Labor relations and collective bargaining agreements, particularly in Germany where K+S is headquartered, critically influence these expenses and are subject to regular negotiations. For instance, K+S reported approximately 11,000 employees globally as of December 2023, reflecting a substantial human capital investment.

- K+S employed around 11,000 people globally as of late 2023.

- Labor costs encompass salaries, benefits, and pension provisions.

- Training and development expenses contribute to the overall personnel budget.

- Collective bargaining agreements significantly impact wage structures for 2024.

Environmental Compliance & Remediation Costs

Operating within the natural resources sector, K+S faces substantial environmental compliance and remediation costs, essential for its operational license. These include significant expenditures for water management and stringent emissions control measures. Provisions for the eventual closure and reclamation of mining sites represent a considerable long-term financial commitment, ensuring environmental restoration. In 2024, K+S continues to allocate substantial capital towards these critical environmental initiatives, reflecting ongoing regulatory demands and sustainable practices.

- K+S's environmental provisions for mine closure and reclamation were significant, impacting its balance sheet.

- The company invests in advanced water treatment and emissions reduction technologies.

- Regulatory compliance costs are a non-negotiable component of their operating expenses.

- Ongoing environmental projects ensure adherence to evolving 2024 standards.

K+S's cost structure is dominated by operational expenses like energy, labor for its 11,000 global employees, and machinery maintenance. Significant logistics and freight costs, totaling EUR 1,570 million in 2023, are sensitive to 2024 fuel prices. Capital expenditures, approximately EUR 750 million for 2024, are continuous for mine infrastructure. Environmental compliance and provisions for mine reclamation also represent substantial ongoing costs.

| Cost Category | 2023/2024 Data Point | Impact |

|---|---|---|

| Logistics & Freight | EUR 1,570 million (2023) | Sensitive to 2024 fuel prices |

| Capital Expenditures | Approx. EUR 750 million (2024) | Ongoing investment in infrastructure |

| Personnel | Approx. 11,000 employees (Dec 2023) | Significant labor costs, 2024 negotiations |

Revenue Streams

K+S generates its primary revenue from selling potash and magnesium-based fertilizers to the global agriculture industry. In 2023, their Agriculture segment, which includes fertilizers, contributed significantly, with revenue reaching approximately 3.2 billion euros. Revenue is directly tied to the volume of products sold, with prices influenced by global supply and demand dynamics, crop prices, and competitor strategies. This revenue stream is foundational, shaping the company's financial performance and strategic outlook for 2024.

Sales of de-icing salt represent a significant revenue stream for K+S, primarily serving public and private entities for winter road maintenance. This highly seasonal income is concentrated during the Northern Hemisphere's winter months. Demand is directly correlated with the severity and duration of winter weather, impacting sales volumes. For instance, milder winters in 2023/2024 could influence de-icing salt sales, as seen in past years where K+S's salt business segment reported varying revenues based on weather patterns.

K+S generates significant revenue by selling a diverse range of mineral products to various industrial customers. This includes high-purity salts essential for chemical processing, alongside potassium and magnesium compounds vital for applications in pharmaceuticals, food, and other manufacturing sectors. This industrial segment serves as a crucial diversification strategy for K+S, helping to balance revenue streams and reduce reliance on the inherent cyclicality of the agricultural market. For instance, in 2024, K+S continued to see stable demand from industrial clients, contributing substantially to overall Group revenue.

Sales to Food, Pharma & Animal Feed Sectors

K+S generates significant revenue from selling high-purity, specialty-grade mineral products to the food, pharmaceutical, and animal nutrition sectors. These specific products, like high-quality potassium chloride for food processing or magnesium for pharmaceuticals, typically command higher prices and margins compared to bulk agricultural commodities. This stream represents a crucial value-added segment for K+S, contributing to diversified earnings. The company's focus on these premium segments enhances its market position and profitability, leveraging specialized production capabilities.

- In 2024, K+S aims to maintain a strong market share in specialty products.

- High-purity potassium chloride and magnesium compounds are key offerings.

- These products cater to strict quality standards in regulated industries.

- The specialty business contributes significantly to the company's overall EBITDA margin.

Licensing & Royalty Income

K+S could generate revenue through licensing its specialized technologies, particularly in extraction or processing, or via royalty agreements tied to its extensive mineral rights. This stream, while a smaller component of overall revenue, leverages the company's significant intangible assets and valuable mineral deposits. For instance, partnerships might involve other entities extracting minerals from K+S-owned sites in exchange for a royalty fee. This approach diversifies revenue streams beyond direct sales of products like potash and magnesium products.

- Leverages K+S's proprietary mineral processing technologies.

- Enables income from strategic partnerships for mineral extraction.

- Complements primary revenue from potash and salt sales, as seen in K+S's 2024 strategic outlook.

- Monetizes vast mineral reserves without direct operational involvement.

K+S generates revenue primarily from fertilizers for agriculture, with this segment contributing significantly to 2023's 3.2 billion euro revenue. De-icing salt provides seasonal income, while industrial mineral products and high-purity specialty products offer crucial diversification and higher margins. The company also leverages its mineral rights through licensing and royalty agreements, complementing its core sales for 2024.

| Segment | 2023 Revenue (EUR bn) | 2024 Outlook |

|---|---|---|

| Agriculture | 3.2 | Foundational |

| Industrial | N/A (stable) | Stable demand |

| Specialty | N/A (higher margins) | Strong market share |

Business Model Canvas Data Sources

The K+S Business Model Canvas is informed by a robust blend of internal financial data, comprehensive market analysis, and operational insights. These sources ensure each component, from key resources to cost structure, is grounded in empirical evidence and strategic understanding.