K+S Boston Consulting Group Matrix

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

K+S Bundle

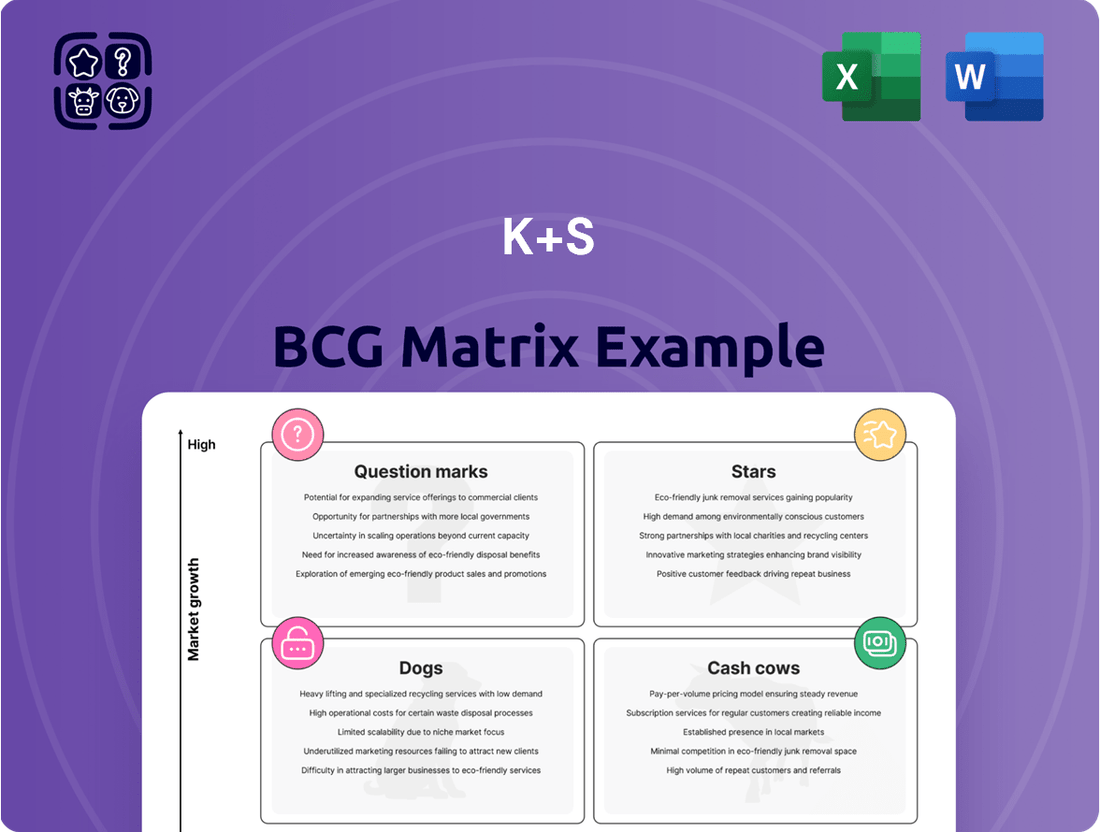

The K+S BCG Matrix classifies their products based on market share and growth. "Stars" shine bright, while "Cash Cows" generate steady revenue. "Dogs" struggle, and "Question Marks" need careful management. This initial look scratches the surface.

The full BCG Matrix report offers detailed product placements across quadrants. It includes strategic recommendations for optimal resource allocation and growth. Gain a complete picture with expert analysis. Purchase now for a ready-to-use strategic tool.

Stars

K+S's potash for agriculture can be a "star" in regions with high agricultural growth. The Asia Pacific region shows strong demand. The global potash market is projected to increase due to the need for higher crop yields. In 2024, global potash consumption reached approximately 70 million tonnes.

K+S's specialty fertilizers could be 'Stars' if they lead high-growth areas in agriculture, where K+S holds a strong market position. Their 'SOP Max' strategy, focused on Sulfate of Potash (SOP) production, supports this. In 2024, the specialty fertilizer market grew, with SOP demand increasing. K+S's strategic focus aims to capitalize on these trends.

The Bethune potash plant's production increase positions it as a 'Star' within K+S's portfolio, boosting market share in a growing potash market. In 2024, the plant is expected to produce around 2.5 million tonnes of potash annually. This expansion is crucial, given the rising global demand for fertilizers. This strategic move strengthens K+S's competitive edge.

Specific Industrial Minerals

Specific industrial minerals could be "Stars" if K+S holds a strong market share in high-growth segments. For instance, K+S produces minerals used in pharmaceuticals, a sector that saw global revenue of approximately $1.48 trillion in 2023. These minerals, vital for specialized applications, could be "Stars" if K+S dominates their market. This status is supported by K+S's focus on specialty products and its strategic acquisitions.

- Pharmaceuticals: A $1.48 trillion global market in 2023.

- K+S focus: Specialty mineral products.

- Strategic Acquisitions: Boosting market share.

Innovative or Low-Carbon Footprint Products

If K+S launches innovative, low-carbon products that capture substantial market share within expanding markets, these offerings could evolve into Stars. Consider the increasing demand for sustainable agricultural practices. K+S's focus on eco-friendly potash production and specialty fertilizers aligns with this trend. In 2024, the global market for sustainable agriculture is estimated at $350 billion. This positions K+S favorably if they innovate successfully.

- Market growth: The sustainable agriculture market is projected to reach $450 billion by 2027.

- Competitive advantage: Low-carbon products may provide a significant edge.

- Financial impact: Successful products can drive revenue and profitability.

- Strategic alignment: Innovation fits K+S's sustainability goals.

K+S's potash for agriculture, particularly in high-growth regions like Asia Pacific, functions as a Star, with 2024 global consumption reaching 70 million tonnes. Specialty fertilizers, including SOP Max, also hold Star potential in expanding agricultural segments. The Bethune plant's 2.5 million tonnes annual potash output in 2024 further strengthens K+S's Star presence. Additionally, industrial minerals for sectors like pharmaceuticals, a $1.48 trillion market in 2023, and innovative low-carbon products targeting the $350 billion sustainable agriculture market in 2024, represent emerging Stars for the company.

| Product/Segment | 2024 Market Data | K+S Position | ||

|---|---|---|---|---|

| Potash for Agriculture | 70 million tonnes consumed | Strong in high-growth regions | ||

| Specialty Fertilizers | Market growth, SOP demand up | Strong market leadership | ||

| Bethune Potash Plant | 2.5 million tonnes production | Increasing market share | ||

| Industrial Minerals | Pharmaceuticals: $1.48 trillion (2023) | Dominant in niche applications | ||

| Low-Carbon Products | Sustainable agriculture: $350 billion | Aligns with market demand |

What is included in the product

Clear descriptions and strategic insights for Stars, Cash Cows, Question Marks, and Dogs

Printable summary optimized for A4 and mobile PDFs, saving time and hassle.

Cash Cows

In mature agricultural markets, K+S's potash business functions as a 'Cash Cow.' It boasts high market share but faces slower growth. This segment generates consistent revenue with reduced investment needs. For example, in 2024, the global potash market was valued at approximately $20 billion.

K+S is a key de-icing salt provider, especially in Europe. The de-icing salt market shows stability, driven by winter weather needs. Consistent demand in winter supports 'Cash Cow' status. In 2023, K+S reported strong salt sales, reflecting the market's reliability.

Standard-grade potash, a staple in mature markets, generates consistent revenue for K+S, acting as a reliable cash source. In 2024, the global potash market was valued at approximately $20 billion, with steady demand. K+S holds a significant market share in these established areas, ensuring stable cash flow. This stability supports further investments and strategic initiatives.

Established Industrial Minerals

Established industrial minerals, crucial in stable and mature industries, are where K+S has a solid market presence, generating reliable revenue. The company's focus on potash and salt, vital in agriculture and various industrial applications, supports this. In 2024, K+S reported €4.3 billion in revenue, with a stable outlook. This segment is a cash cow, contributing significantly to overall financial stability.

- Steady Demand: Consistent demand from agriculture, food, and industry.

- Strong Market Position: K+S holds a significant market share in potash and salt.

- Consistent Revenue: Reliable income stream, contributing to financial stability.

- Mature Industries: Operates within established and predictable markets.

Products with Optimized Production

Products that have seen gains from K+S's optimization efforts, especially at its German locations, fit the "Cash Cows" profile. These products benefit from enhanced efficiency and robust cash flow. For instance, in 2024, K+S reported a significant reduction in production costs at its German facilities. This cost reduction directly boosts profitability, classifying these products as cash cows.

- Cost savings at German sites boosted profitability.

- Improved operational efficiency.

- Enhanced cash flow generation.

K+S's potash and salt segments, particularly in agriculture and de-icing, function as 'Cash Cows.' They boast high market share in mature markets, generating consistent revenue with reduced investment needs. For 2024, K+S projects stable revenue, reinforced by cost optimization at German facilities.

| Segment | Status | 2024 Outlook |

|---|---|---|

| Potash | Cash Cow | Stable Demand |

| Salt | Cash Cow | Consistent Revenue |

Delivered as Shown

K+S BCG Matrix

The BCG Matrix you see is the actual document you'll receive after purchase, fully editable and ready to analyze. No hidden extras or watermarks—just a professional, strategic planning tool at your fingertips.

Dogs

In the K+S BCG Matrix, "Dogs" represent products or segments with low market share in low-growth markets. These offerings typically produce minimal cash flow, potentially becoming a drain on resources. For instance, in 2024, K+S might consider divesting such segments to free up capital. The company's strategic focus will be on high-growth areas.

Underperforming mines or production sites, especially those with high operating costs and low output, can indeed be classified as "Dogs." For instance, a K+S potash mine in a region with falling potash prices might fit this description. Data from 2024 showed that certain older K+S facilities struggled to compete with newer, more efficient operations. These sites potentially consume resources without generating substantial returns, impacting overall profitability.

K+S is decreasing its trade goods business. This decision suggests these goods may have been underperforming or misaligned with the company's strategy. In 2024, K+S's revenue from trade goods was approximately €100 million, a decrease from €120 million in 2023. This could indicate a 'Dog' status in the BCG matrix.

Specific Geographies with Weak Performance

In the K+S BCG matrix, "Dogs" are regions with low market share and growth. These areas often underperform. For example, regions where K+S struggles to gain traction. This can lead to reduced profitability.

- Examples include areas with tough competition.

- Weak demand or high operational costs.

- Financial data in 2024 shows lower revenues.

- These challenges affect overall company performance.

Outdated Production Methods or Products

Dogs in the K+S BCG Matrix represent products or processes losing their market edge. These offerings struggle to compete and rarely boost profitability. For instance, Kodak's shift from film to digital, failing to adapt, led to significant losses. Consider Blockbuster, which didn't embrace streaming, resulting in its decline.

- Outdated products face shrinking market shares.

- Inefficient production methods increase costs.

- Low profitability and cash generation are typical.

- Divestment or liquidation is often the best strategy.

K+S Dogs represent segments with low market share in low-growth markets, typically generating minimal cash flow. For example, K+S's trade goods business, with 2024 revenue at €100 million, down from €120 million in 2023, exemplifies a 'Dog' status. These underperforming assets, including older mines, often drain resources without substantial returns. Divestment is a key strategy to free up capital.

| Segment | 2023 Revenue (€M) | 2024 Revenue (€M) |

|---|---|---|

| Trade Goods | 120 | 100 |

Question Marks

New product development by K+S focuses on minerals for growing markets, where its current market share is low. These initiatives necessitate significant investment to capture a larger share. For example, K+S invested over €200 million in 2024 in new projects. These projects are expected to yield higher returns. The company aims to strengthen its market position through these strategic investments.

Expansion into new geographic markets, where K+S lacks a significant presence, would be a question mark. This strategy involves investment to build market share and infrastructure. For instance, K+S's revenue in North America could grow significantly. In 2024, the global fertilizer market, relevant to K+S, was valued at approximately $190 billion.

Investments in new, sustainable mining technologies or environmentally conscious products are question marks. Their success and market adoption are not yet guaranteed, requiring significant investment for potential future growth. K+S invested EUR 130 million in sustainable projects in 2024. The market for sustainable mining is projected to reach $27.8 billion by 2029.

Projects like 'Werra 2060'

Projects such as 'Werra 2060' are crucial for K+S's long-term strategy. These initiatives involve large investments with delayed returns. For instance, K+S invested significantly in its Werra site, aiming for operational efficiency. This aligns with the BCG Matrix, where such projects initially resemble 'Question Marks'.

- Werra 2060 aims for sustainable production, crucial for future market positioning.

- Upfront costs are substantial, impacting short-term profitability.

- Success hinges on efficient execution and market acceptance.

- These projects transform into 'Stars' if successful, boosting market share.

Diversification into Related Industries

K+S might consider diversifying into related sectors, such as specialty fertilizers or agricultural chemicals, to tap into growth opportunities. These moves would require significant investment and carry higher risk due to K+S's limited experience and market share in these areas. Careful analysis, including market research and financial projections, is crucial before committing capital.

- 2024: K+S's revenue in the fertilizer segment was approximately €4.6 billion.

- 2024: The global fertilizer market is projected to reach $200 billion.

- Strategic Framework: SWOT analysis is essential to assess the feasibility of diversification.

K+S's Question Marks encompass new product developments and market expansions, requiring significant investment without guaranteed high market share. For example, the company invested over €200 million in new projects in 2024. These initiatives, like sustainable mining technologies, aim for future growth but currently hold low relative market share in high-growth areas. Success hinges on substantial capital commitment and effective execution to potentially become Stars.

| Area | 2024 Investment (€) | Market Size ($B) |

|---|---|---|

| New Projects | 200M+ | — |

| Sustainable Projects | 130M | 27.8 (by 2029) |

| Global Fertilizer Market | — | 190-200 |

BCG Matrix Data Sources

Our K+S BCG Matrix leverages robust data: financial statements, market research, and competitor analyses, for insightful, data-driven strategies.