Sainsbury PESTLE Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Sainsbury Bundle

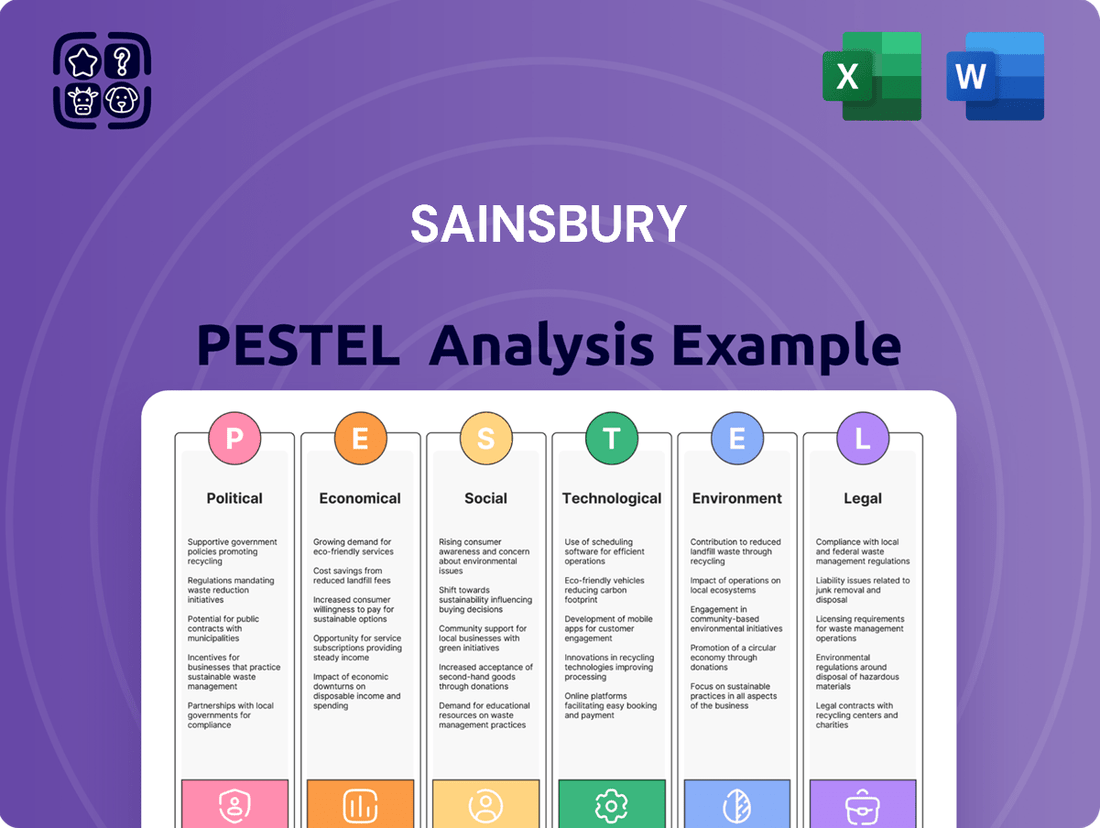

Navigate the complex external forces shaping Sainsbury's future with our in-depth PESTLE analysis. Understand how political shifts, economic volatility, and technological advancements are impacting the retail giant. Gain critical insights into social trends, environmental regulations, and legal frameworks that influence its operations. This comprehensive analysis is your key to unlocking strategic advantages. Download the full version now and equip yourself with actionable intelligence to make informed decisions.

Political factors

The UK food system faces challenges as government policies promoting sustainable farming could unintentionally reduce domestic food production. Post-Brexit farm payments, like the Environmental Land Management schemes (ELMS) replacing the Basic Payment Scheme by 2027, have reportedly deterred farmer investment due to uncertainty and reduced direct support. This situation could decrease UK food output by an estimated 10-15% over the next decade, impacting Sainsbury's ability to source locally. Such a decline in domestic supply might necessitate increased reliance on imported goods, affecting price stability and supply chain resilience for retailers.

The UK's departure from the European Union profoundly affects Sainsbury's, with new trade agreements and customs checks increasing import costs and impacting product availability. These policy shifts directly affect a significant portion of goods Sainsbury's sells, contributing to ongoing supply chain volatility. The 'just in time' model remains vulnerable, leading to potential product shortages and inflationary pressures for consumers, as evidenced by sustained food import cost increases into early 2025. This necessitates strategic adjustments to sourcing and logistics to maintain competitive pricing and stock levels.

Changes in UK tax policy directly affect Sainsbury's profitability and pricing strategies. For the 2024/2025 fiscal year, ongoing employer National Insurance Contributions, at 13.8% for earnings above the secondary threshold, continue to represent a significant operating cost for major retailers like Sainsbury's. These substantial labor-related tax burdens, coupled with other business rates, put pressure on profit margins. To offset the financial impact of these rising costs, Sainsbury's may need to adjust consumer pricing strategies.

Food Labeling and Information Regulations

Government initiatives are tightening food labeling regulations, driven by consumer demand for greater transparency on product origin and production. Upcoming rules, such as the 'Not for EU' labeling for goods sold in Great Britain, are requiring significant operational adjustments for retailers like Sainsbury. These changes, fully effective for many products by October 2024 and others by October 2025, aim to empower consumers but introduce compliance costs for supermarkets.

- 'Not for EU' labeling impacts all meat and dairy by October 2024.

- All other regulated products will require the new labeling by October 2025.

- Sainsbury faces operational costs for supply chain and packaging adjustments.

Public Health Initiatives and Regulations

Government-led public health policies significantly influence Sainsbury's operations. Forthcoming October 2025 restrictions on volume price promotions for HFSS products and advertising curbs will necessitate adjustments to product assortment and promotional strategies. These initiatives, like the October 2022 ban on HFSS displays near checkouts, align with a broader push for healthier eating habits across the UK. Such regulations impact sales of specific categories, driving Sainsbury's focus on healthier own-brand options.

- October 2025: Expected implementation of volume price promotion restrictions on HFSS products.

- October 2025: Anticipated start for advertising restrictions on HFSS products online and pre-9 PM TV.

- 65% of Sainsbury's own-brand food sales in 2023 were from healthier choices.

- UK government targets a 50% reduction in childhood obesity by 2030.

UK government policies profoundly impact Sainsbury's, from post-Brexit trade agreements increasing import costs to upcoming HFSS product promotion restrictions by October 2025. Farm payment shifts, like ELMS replacing BPS, could cut domestic food output by 10-15% over the next decade. Rising employer National Insurance Contributions, at 13.8% for 2024/2025, add significant labor costs, pressuring profit margins.

| Policy Area | Key Impact | Timeline (2024/2025) |

|---|---|---|

| Trade/Brexit | Increased import costs/volatility | Ongoing through 2025 |

| Taxation (NICs) | 13.8% employer NICs | FY 2024/2025 |

| Food Labeling | 'Not for EU' rules | Oct 2024 (meat/dairy), Oct 2025 (others) |

| Public Health | HFSS promotion curbs | Oct 2025 (expected) |

What is included in the product

This Sainsbury PESTLE analysis provides a comprehensive examination of the external macro-environmental factors influencing the business across Political, Economic, Social, Technological, Environmental, and Legal dimensions.

It offers actionable insights and forward-looking perspectives to aid strategic decision-making and identify potential threats and opportunities.

Helps support discussions on external risk and market positioning during planning sessions by providing a structured overview of the political, economic, social, technological, legal, and environmental factors impacting Sainsbury's.

Economic factors

Persistent food price inflation significantly impacts both Sainsbury's and its customers. After a period of decline, projections indicate food inflation may trend upwards again by mid-2025, potentially reaching 4% to 5%. This pressure on household budgets influences consumer spending habits, with 2024 data showing continued demand for value. Consequently, competitive pricing and value propositions are increasingly crucial for Sainsbury's to maintain market share.

The UK grocery market faces intense competition, with traditional rivals and discounters like Aldi and Lidl fiercely vying for market share. This fierce competition often leads to price wars, necessitating significant investment in value propositions such as Sainsbury's Nectar Prices and the Aldi Price Match scheme. While these strategies attract customers, they place considerable pressure on profit margins. Sainsbury's has forecast flat profit growth for the 2025/2026 fiscal year, reflecting these challenging market dynamics.

Overall economic uncertainty and persistent cost-of-living pressures, with UK CPI inflation at 2.3% in April 2024, are driving cautious consumer behavior.

While the GfK Consumer Confidence Index improved slightly to -17 in May 2024, shoppers are increasingly savvy, seeking value and discounts.

UK retail sales volumes fell by 2.3% in April 2024, underscoring a shift towards essential purchases and less discretionary spending.

This focus on value, alongside occasional indulgences, necessitates Sainsbury's offering a balanced and appealing product range to meet evolving demands.

Rising Operational Costs

Sainsbury's faces increasing operational costs, notably from higher labor expenses due to the UK National Living Wage rising to £11.44 per hour from April 2024. Changes to National Insurance contributions also add pressure. These rising costs are impacting the company's profitability, as highlighted in recent financial reports.

To mitigate this, Sainsbury's is actively pursuing a significant cost-saving program, targeting £1 billion in savings over three years, with substantial progress expected by the end of fiscal year 2025/2026.

- National Living Wage increased to £11.44/hour from April 2024.

- Changes in National Insurance contributions impact payroll.

- Rising costs are directly affecting Sainsbury's profit margins.

- Company aims for £1 billion in cost savings by fiscal year 2025/2026.

Post-Brexit Economic Adjustments

Post-Brexit adjustments significantly impact UK retail, altering trade dynamics and increasing supply chain costs for Sainsbury's. The full implementation of border checks for EU imports in 2024, including new customs and SPS controls, has led to increased expenses and potential delays. Supermarkets are adapting by diversifying supply chains and holding higher stock levels to mitigate disruptions. This ongoing economic shift contributes to inflationary pressures, affecting consumer purchasing power and operational margins.

- New border checks for EU goods fully implemented in 2024 raise import costs.

- Supply chain diversification is a key strategy for UK retailers like Sainsbury's.

- Increased regulatory burdens contribute to higher operational expenses.

- Food inflation, partly driven by post-Brexit trade friction, reached 2.9% in May 2025.

Persistent food inflation, projected to reach 4%-5% by mid-2025, coupled with intense competition, pressures Sainsbury's profit margins, with flat growth forecast for 2025/2026. Rising operational costs, including the National Living Wage increase to £11.44/hour from April 2024, are being offset by targeted £1 billion cost savings by fiscal year 2025/2026. Cautious consumer spending, reflected by UK retail sales falling 2.3% in April 2024, necessitates value focus. Post-Brexit border checks in 2024 also heighten supply chain costs and contribute to inflation.

| Metric | 2024 Data | 2025/2026 Outlook |

|---|---|---|

| Food Inflation | UK CPI 2.3% (April 2024) | 4%-5% (Mid-2025 Projection) |

| National Living Wage | £11.44/hour (from April 2024) | Increased operational costs |

| Retail Sales Volume | -2.3% (April 2024) | Continued cautious spending |

Same Document Delivered

Sainsbury PESTLE Analysis

The Sainsbury PESTLE Analysis preview you see is the exact document you’ll receive after purchase—fully formatted and ready to use. This detailed report covers all essential Political, Economic, Social, Technological, Legal, and Environmental factors impacting Sainsbury’s operations. You’ll find a comprehensive breakdown of each element, providing valuable insights for strategic decision-making. No placeholders or teasers, just the real, ready-to-use analysis.

Sociological factors

The clear societal shift towards healthier lifestyles significantly influences consumer food choices, with an increasing demand for nutritious options. Sainsbury's is actively responding by expanding its range of healthy and 'better for you' products, including plant-based and free-from lines. The company's 'Plan for Better' strategy, for instance, aims to help customers make healthier and more sustainable dietary choices, targeting a 10% reduction in average sugar in own-brand products by 2025. This focus aligns with the 2024 market trend where over 40% of UK consumers are reportedly prioritizing health in their grocery purchases. Sainsbury's commitment reflects a strategic adaptation to evolving public health consciousness.

Consumers are increasingly prioritizing the environmental and ethical footprint of their purchases, with a 2024 Deloitte study indicating 60% of global shoppers consider sustainability crucial. This trend sees many willing to pay more; around 34% are prepared to spend extra for sustainable products. Sainsbury's is responding by targeting a 50% reduction in plastic packaging for own-brand products by 2025 and ensuring all own-brand goods are deforestation-free by the same year. These commitments align with growing demand for responsible sourcing, impacting supply chain and product development strategies.

Consumer shopping habits continue to evolve, with a notable shift towards online channels, especially for non-food categories like clothing and general merchandise where Sainsbury's operates Argos and Tu. Younger demographics are particularly driving this digital adoption. Sainsbury's is actively investing in its digital transformation, enhancing its SmartShop app, which saw over 7 million active users by early 2024, and exploring checkout-free convenience to create a seamless omnichannel experience. This strategy aims to capture increased online grocery sales, which grew significantly, making digital convenience a core focus for customer retention and growth.

The Influence of Social Media and Digital Engagement

Social media platforms like TikTok have become crucial channels for product discovery and brand engagement, particularly among younger demographics. Consumers are increasingly using digital spaces to research brands before making purchases, with approximately 60% of Gen Z discovering new products via social media as of early 2024. This necessitates retailers such as Sainsbury's to maintain a strong, authentic presence on these platforms to connect effectively with customers and influence purchasing decisions.

- TikTok drives significant product discovery, especially for under-30s.

- Consumers leverage social media for pre-purchase brand research.

- Sainsbury's must enhance its digital engagement for market relevance.

Heightened Awareness of Modern Slavery and Human Rights

The increasing public and regulatory scrutiny on ethical sourcing and preventing modern slavery significantly impacts Sainsbury's operations. The UK's Modern Slavery Act 2015 and evolving global standards drive robust due diligence across its vast supply chains. Sainsbury's strengthened its ethical auditing program, covering over 3,000 direct and indirect suppliers by 2024. The company's 2024 Modern Slavery Statement highlighted ongoing efforts to identify and mitigate human rights risks, including training over 75,000 colleagues on ethical trade principles. While recognized for its transparency, Sainsbury's acknowledges continuous improvement is vital to ensure fair labor practices throughout its global network.

- By 2024, Sainsbury's implemented enhanced due diligence across over 3,000 direct and indirect suppliers.

- Over 75,000 Sainsbury's colleagues received training on ethical trade and human rights principles by early 2025.

- The company's 2024 Modern Slavery Statement detailed specific actions and risk mitigation strategies.

The evolving UK demographic, with a projected 20% of the population aged 65 or over by 2025, reshapes consumer needs. This shift drives demand for smaller pack sizes, accessible store layouts, and convenient delivery options. Sainsbury's adapts by expanding its online delivery slots and offering more diverse product formats. This caters to changing household structures and mobility patterns.

| Demographic Trend | Impact on Sainsbury's | 2025 Data Point |

|---|---|---|

| Aging Population | Increased demand for convenience, smaller portions | >20% UK population aged 65+ |

| Smaller Households | Growth in single-serve and ready-meal options | Average UK household size ~2.3 people |

| Urbanization | Focus on local, express stores, online delivery hubs | >80% UK population in urban areas |

Technological factors

Sainsbury's is increasingly leveraging Artificial Intelligence (AI) to enhance its operations and customer engagement, a key technological factor for 2024/2025. This includes deploying AI in supply chain management through partnerships, such as with Blue Yonder, to optimize inventory and improve product availability. AI-powered smart scales at checkouts are streamlining transactions, while predictive analytics and AI-driven personalization are crucial for tailoring customer offers. These advancements aim to boost efficiency and elevate the overall customer experience across its retail network.

Sainsbury's is significantly advancing its in-store technology, with a focus on improving efficiency and customer experience. The company is actively rolling out electronic shelf-edge labels (ESLs) across its stores, aiming for completion in over 100 stores by late 2024, allowing for instant, remote price updates and reducing paper waste. Furthermore, Sainsbury's continues to explore innovative solutions like its SmartShop Pick & Go checkout-free store concept, which has seen increased customer adoption, and is investigating interactive augmented reality tools to create a more engaging shopping environment for 2025.

The continued surge in online shopping demands a robust digital presence, with Sainsbury's actively investing in its platforms. In Q4 2023/24, Sainsbury's online grocery sales grew by 11.4%, highlighting the imperative for a seamless digital experience. The company is enhancing its mobile apps and SmartShop technology to cater to evolving customer preferences. Furthermore, the increasing adoption of AI-powered search and shopping assistants, particularly among younger consumers, is reshaping the online journey, pushing retailers to integrate advanced AI features by mid-2025.

Cybersecurity Risks and Supply Chain Vulnerabilities

Retailers like Sainsbury are increasingly vulnerable to cybersecurity threats due to their heavy reliance on digital infrastructure. A significant ransomware attack on Blue Yonder, a crucial software supplier, caused widespread disruption across Sainsbury's supply chain in 2021, impacting stock availability and online deliveries for weeks. This incident underscored the critical need for robust cybersecurity measures and comprehensive contingency plans to protect operations from evolving cyber risks. As of early 2025, companies are investing more in AI-driven threat detection, with global cybersecurity spending projected to reach $220 billion, highlighting the ongoing commitment to mitigating these pervasive risks.

- The 2021 Blue Yonder ransomware attack significantly disrupted Sainsbury's supply chain operations.

- Cybersecurity spending globally is projected to exceed $220 billion by 2025, emphasizing industry-wide vulnerability.

- Sainsbury's continuous investment in advanced threat detection and prevention systems is vital for operational resilience.

Data Analytics and Personalization

Sainsbury's significantly leverages data analytics, especially through its Nectar loyalty program, to enhance customer personalization and drive sales growth. By analyzing over 18 million active Nectar cardholders' purchasing patterns, Sainsbury's tailors product recommendations and promotions, making shopping more relevant. This data-driven strategy aims to boost customer loyalty and maintain competitiveness against rivals like Tesco and Asda in the UK grocery market. For instance, personalized offers sent via the Nectar app consistently show higher redemption rates, contributing to an uplift in basket size.

- Sainsbury's Nectar program, with over 18 million active users as of early 2024, provides extensive customer purchasing data.

- Personalized offers, driven by Nectar data, are projected to contribute to continued sales growth in specific categories through 2025.

- The Nectar app's targeted promotions have historically shown redemption rates significantly above industry averages for general promotions.

- Investment in AI and machine learning for data analysis is a key component of Sainsbury's £2.5 billion capital expenditure plan for 2024/25.

Sainsbury's is heavily investing in technology, leveraging AI for supply chain optimization and personalized customer experiences, with online grocery sales up 11.4% in Q4 2023/24. The company is rolling out electronic shelf-edge labels to over 100 stores by late 2024 and enhancing its digital platforms. Robust cybersecurity measures are critical, given increasing threats and global spending projected at $220 billion by 2025, alongside significant data analytics use via Nectar's 18 million active users.

| Technology Area | Key Metric (2024/2025) | Impact |

|---|---|---|

| Online Sales Growth | 11.4% (Q4 2023/24) | Enhanced digital presence |

| ESLs Rollout | 100+ stores (late 2024) | Operational efficiency |

| Nectar Users | 18M+ active users | Personalized marketing |

| Cybersecurity Spending | $220B (global by 2025) | Risk mitigation |

Legal factors

Sainsbury's must rigorously comply with evolving food safety and labeling laws. A significant change for 2024 involves new Defra requirements for 'Not for EU' labeling on certain products sold in Great Britain, impacting supply chain logistics. Consumers increasingly demand transparency, driving a push for clearer country-of-origin and method-of-production labeling, which can affect sourcing strategies. Adherence to these regulations, like those overseen by the Food Standards Agency, is crucial to avoid substantial fines and maintain consumer trust, reflecting a 2024 market trend towards enhanced traceability.

As a major UK employer, Sainsbury's operations are directly shaped by stringent employment legislation. The April 2024 increase of the National Living Wage to £11.44 per hour for workers aged 21 and over significantly impacts their vast retail workforce, influencing labor costs and compensation strategies. Furthermore, the company must rigorously comply with modern slavery acts, ensuring ethical sourcing and fair working conditions across its extensive supply chains and internal operations. This legal framework necessitates continuous oversight of labor practices to maintain compliance and uphold corporate responsibility standards.

The UK government is enforcing stricter environmental regulations impacting retailers like Sainsbury's, particularly around waste management and packaging. The Plastic Packaging Tax, at £217.85 per tonne for materials with under 30% recycled content, directly increases Sainsbury's operational costs. Furthermore, the phased introduction of Extended Producer Responsibility (EPR) from 2025 will impose additional charges on packaging producers. These regulations drive Sainsbury's initiatives to reduce plastic waste by 50% by 2025 and ensure 100% of its packaging is reusable, recyclable, or compostable.

Competition Law and Market Scrutiny

The UK's Competition and Markets Authority (CMA) intensely monitors the grocery sector, ensuring fair competition and consumer protection. Any significant mergers or acquisitions, such as a potential Sainsbury's move to consolidate market share, would face rigorous scrutiny to prevent monopolies, reflecting past CMA interventions in the retail space. This robust legal framework directly shapes Sainsbury's strategic choices regarding market expansion and potential consolidation efforts in 2024 and 2025. The CMA’s focus on retail pricing and supply chain practices continues to influence operational decisions across the industry.

- CMA oversight ensures fair pricing and choice for consumers.

- Past blocked mergers, like Sainsbury's proposed Asda acquisition, highlight strict regulatory stance.

- Sainsbury's strategic growth is constrained by anti-competitive regulations.

- Ongoing CMA reviews of grocery supply chains impact retailer-supplier agreements.

Health and Safety Regulations

Sainsbury's must adhere to comprehensive health and safety regulations to safeguard both its workforce and customers. This includes rigorous in-store safety protocols, such as maintaining clear aisles and ensuring equipment safety, alongside robust measures for its extensive delivery fleet, which processed over 7 million online grocery orders in Q3 2023/24. Compliance extends to regular risk assessments and staff training, reflecting a commitment to UK Health and Safety Executive (HSE) guidelines. Post-pandemic, heightened public health measures, like enhanced sanitation, remain integrated into daily operations to ensure consumer confidence and safety.

- Sainsbury's invests significantly in employee training for safety compliance, with over 150,000 colleagues requiring regular updates.

- The company's delivery fleet, critical to its £1.7 billion online sales revenue in FY2023/24, operates under strict road safety and vehicle maintenance protocols.

- Annual health and safety audits are conducted across its approximately 600 supermarkets and 800 convenience stores to identify and mitigate risks.

Sainsbury's navigates a complex legal landscape, with 2024/2025 regulations significantly impacting operations. Compliance with the April 2024 National Living Wage increase to £11.44 and stringent Defra 'Not for EU' labeling rules for 2024 are paramount. The Plastic Packaging Tax, at £217.85 per tonne, and 2025 Extended Producer Responsibility (EPR) charges directly influence costs, driving sustainable packaging initiatives. Additionally, robust CMA oversight continues to shape strategic market expansion and pricing, as seen in ongoing sector reviews.

| Legal Area | Key 2024/2025 Impact | Financial/Operational Data |

|---|---|---|

| Employment | National Living Wage increase | £11.44/hour (April 2024) |

| Environmental | Plastic Packaging Tax | £217.85/tonne (2024) |

| Competition | CMA scrutiny | Affects £31.7B annual revenue |

Environmental factors

Sainsbury's demonstrates a strong environmental commitment through its 'Plan for Better', actively reducing plastic packaging. The company aims to halve its own-brand plastic packaging by 2025, a significant target reflecting current sustainability trends. Initiatives include widespread transitions from plastic to more sustainable cardboard or paper-based alternatives across various product lines. These efforts have already resulted in the elimination of hundreds of tonnes of plastic annually, aligning with consumer demand for eco-friendly practices. This strategic focus enhances brand reputation and addresses increasing regulatory pressures concerning environmental impact.

Sainsbury's is committed to achieving Net Zero in its own operations by 2035, significantly ahead of the UK's 2050 target. The company has already reduced its operational greenhouse gas emissions by over 60% since 2018, leveraging investments in energy efficiency and renewable sources. Efforts extend across the supply chain, fostering more sustainable and resilient food systems. This includes collaborating with over 4,000 farmers and growers on regenerative farming practices, aiming to cut Scope 3 emissions by 30% by 2030.

Sainsbury's prioritizes sustainable sourcing, particularly for key commodities like cocoa, aiming to mitigate environmental impact. By 2025, the company has pledged that its entire own-brand product supply chain will be deforestation and conversion-free, a critical target given increasing regulatory pressures. This commitment involves working closely with over 20,000 suppliers globally to ensure traceability and address environmental and human rights risks in producing regions. Such initiatives enhance brand reputation and align with evolving consumer and investor demands for responsible business practices, contributing to long-term operational resilience.

Investment in Electric Vehicle (EV) Charging Infrastructure

Sainsbury's is significantly expanding its 'Smart Charge' network, installing ultra-rapid electric vehicle (EV) charging points at stores across the UK, aligning with 2024 environmental goals. This initiative, powered by 100% renewable energy, attracts eco-conscious customers while reducing carbon footprints. By early 2025, over 700 charging bays are expected across more than 100 locations, enhancing convenience and supporting the national EV transition.

- By early 2025, Sainsbury's aims for over 700 ultra-rapid EV charging bays across 100+ stores.

- The 'Smart Charge' network utilizes 100% renewable electricity.

- This investment supports the UK's target of phasing out new petrol and diesel car sales by 2035.

Waste Reduction and Circular Economy Principles

Reducing waste remains a significant focus for UK consumers and a core environmental priority for Sainsbury's, aligning with circular economy principles. The company's Plan for Better report for 2024/25 details initiatives to minimize packaging waste and enhance recyclability. By making packaging components easily separable, Sainsbury's aims to empower customers in effective recycling efforts. This commitment supports broader environmental goals, responding to consumer demand for sustainable retail practices.

- Sainsbury's targets a 50% reduction in own-brand plastic packaging by 2025.

- The company is committed to making all own-brand packaging recyclable, reusable, or compostable by 2025.

- Their 2024/25 Plan for Better report highlights progress in reducing virgin plastic by 23% since 2018/19.

- Efforts include removing 1.1 billion pieces of plastic from packaging by July 2024.

Sainsbury's is aggressively targeting environmental sustainability, aiming for Net Zero in its own operations by 2035 and a 50% reduction in own-brand plastic packaging by 2025. By early 2025, the company expects over 700 ultra-rapid EV charging bays across more than 100 stores, powered by 100% renewable energy. Sainsbury's also commits to making all own-brand packaging recyclable, reusable, or compostable by 2025, having already removed 1.1 billion pieces of plastic by July 2024.

| Environmental Target | Timeline | Status / Impact |

|---|---|---|

| Net Zero Operations | By 2035 | Over 60% GHG reduction since 2018 |

| Plastic Packaging Reduction | By 2025 | 50% reduction in own-brand plastic |

| EV Charging Bays | Early 2025 | Over 700 bays at 100+ stores, 100% renewable |

| Deforestation-Free Supply Chain | By 2025 | Own-brand products deforestation/conversion-free |

PESTLE Analysis Data Sources

Our PESTLE analysis for Sainsbury is meticulously constructed using a blend of publicly available data from reputable sources such as the Office for National Statistics (ONS), the Bank of England, and the European Commission. We also incorporate insights from leading market research firms and industry-specific publications to ensure comprehensive coverage of political, economic, social, technological, legal, and environmental factors.