Sainsbury Marketing Mix

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Sainsbury Bundle

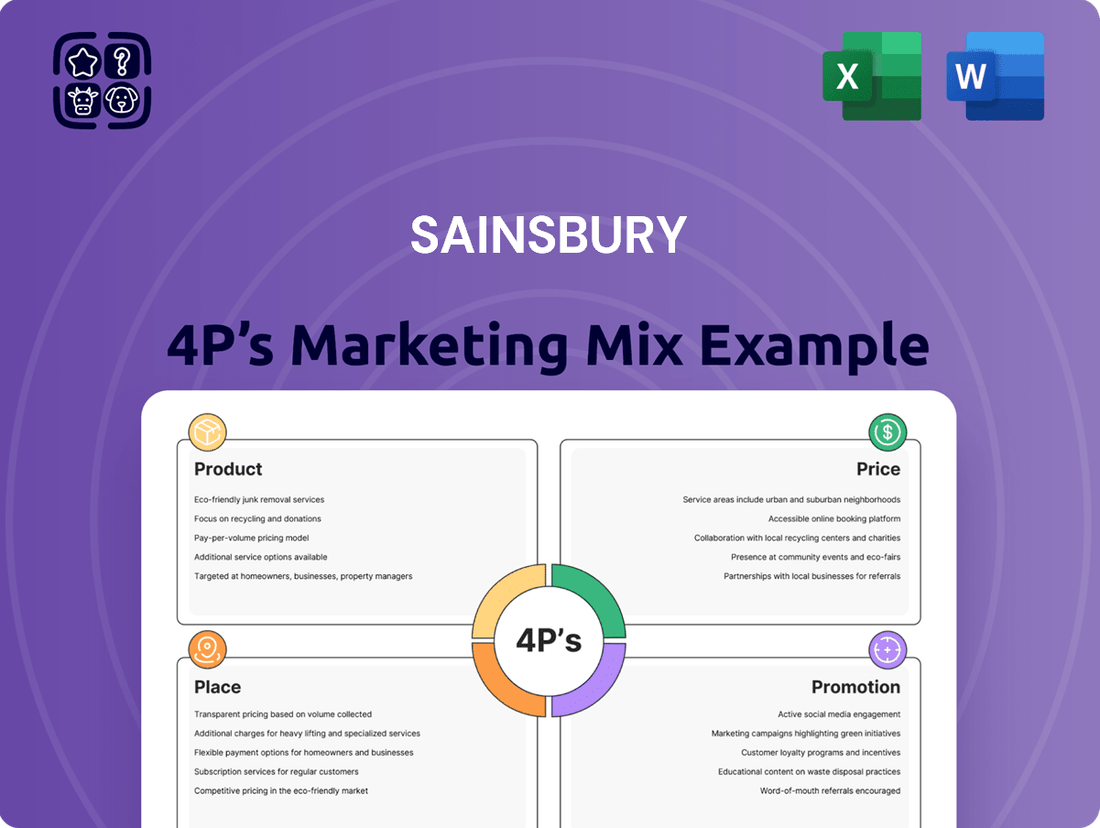

Sainsbury's masterful execution of the 4Ps—Product, Price, Place, and Promotion—is a key driver of its enduring success in the competitive UK grocery market.

Their product strategy, encompassing own-brand innovation and quality, coupled with competitive pricing, creates significant customer value.

Explore how Sainsbury's extensive store network and online presence (Place) ensure accessibility, while their targeted promotions and advertising (Promotion) build strong brand loyalty.

This deep dive into Sainsbury's marketing mix offers actionable insights for any business aiming to understand and replicate strategic marketing excellence.

Go beyond this overview and gain access to an in-depth, ready-made Marketing Mix Analysis covering Product, Price, Place, and Promotion strategies. Ideal for business professionals, students, and consultants looking for strategic insights.

Save hours of research and analysis. This pre-written Marketing Mix report provides actionable insights, examples, and structured thinking—perfect for reports, benchmarking, or business planning.

Product

Sainsbury's core product strategy focuses on a vast, diversified range, featuring over 30,000 product lines available online as of early 2025. This extensive selection includes fresh food, essential pantry items, and convenient ready-to-eat meals, catering to daily grocery needs. Beyond food, the integration of Argos contributes general merchandise, while the Tu brand provides clothing, making Sainsbury's a comprehensive one-stop shop. This broad offering aims to capture a larger share of consumer spending by addressing diverse shopping requirements in a single transaction, enhancing customer convenience and loyalty.

Sainsbury's strategically prioritizes its own-brand portfolio, which constitutes a substantial portion of its product offerings. This multi-tiered approach includes value options alongside the highly successful premium 'Taste the Difference' range. In its 2024 financial reporting, Sainsbury's highlighted strong own-brand sales growth, with 'Taste the Difference' particularly outperforming. This strategy allows Sainsbury's to cater to diverse customer segments, from budget-conscious shoppers to those seeking premium, innovative products. Ultimately, this focus strengthens brand loyalty and enhances margin potential across its product lines.

Sainsbury's 'Next Level Sainsbury's' strategy, building on the 'Food First' initiative, prioritizes the grocery business as its central pillar. This involves significant investment in product innovation, with over 540 new products launched in the first half of 2024 alone. The focus remains on enhancing quality, taste, and value for consumers. The goal is to establish Sainsbury's as the primary choice for food shopping by ensuring a superior and consistently available food range, driving customer loyalty and market share into 2025.

Integration of Financial and Other Services

While Sainsbury's recently divested its core banking operations to NatWest for a reported £250 million in March 2024, it maintains a curated selection of financial services. These include general insurance, travel money, and the Argos credit card, now offered through strategic partnerships to enhance customer loyalty. This capital-light approach supports the core retail business rather than operating as a standalone financial entity. The focus is on convenience, ensuring customers can access essential services within the Sainsbury's ecosystem.

- Divestment to NatWest completed March 2024, valued at £250 million.

- Continued offering includes insurance, travel money, and Argos credit card.

- Strategy shifts to capital-light partnerships supporting core retail.

Sustainability and Ethical Sourcing

Sainsbury's deeply embeds sustainability within its product strategy, actively reducing plastic packaging and championing ethically sourced goods. Their 'Good to Know' campaign highlights these commitments, such as using 100% pole and line-caught tuna for all own-label products, appealing to a growing segment of environmentally conscious consumers. By late 2023, Sainsbury's had removed over 1.2 billion plastic bags from circulation and reduced own-brand plastic packaging by over 12% since 2018, reinforcing brand trust and a positive corporate image as they target Net Zero by 2040.

- Plastic Reduction: Over 1.2 billion plastic bags removed by late 2023.

- Packaging Reduction: Own-brand plastic packaging reduced by over 12% since 2018.

- Ethical Sourcing: 100% pole and line-caught tuna in own-label products.

- Net Zero Target: Aiming for Net Zero emissions by 2040.

Sainsbury's product strategy centers on a vast, diversified range of over 30,000 product lines, including groceries, general merchandise via Argos, and Tu clothing, aiming for a comprehensive offering by early 2025. This includes a strong emphasis on own-brand portfolios, with 'Taste the Difference' showing significant growth in 2024. The 'Food First' strategy drove over 540 new product launches in H1 2024, focusing on quality and value. Additionally, Sainsbury's integrates sustainability, having removed 1.2 billion plastic bags by late 2023.

| Category | Metric | 2024/2025 Data | Impact |

|---|---|---|---|

| Product Range | Total Product Lines | 30,000+ (early 2025) | Comprehensive one-stop shop |

| Own-Brand | 'Taste the Difference' Growth | Outperforming (2024 reporting) | Enhanced margins, loyalty |

| Innovation | New Products Launched (H1 2024) | 540+ | Increased market share |

What is included in the product

This analysis provides a comprehensive examination of Sainsbury's 4Ps, detailing its Product, Price, Place, and Promotion strategies within its competitive landscape.

It's designed for professionals seeking an in-depth understanding of Sainsbury's marketing approach, offering actionable insights and real-world examples.

Simplifies the complex Sainsbury 4Ps analysis into a clear, actionable framework for strategic decision-making.

Provides immediate clarity on Sainsbury's marketing strategy, alleviating the pain of information overload for busy executives.

Place

Sainsbury's leverages a comprehensive physical network of over 1,400 locations, encompassing large supermarkets and compact Sainsbury's Local convenience stores. This dual-format strategy effectively caters to diverse shopping needs, from extensive weekly grocery runs to quick, localized purchases. Such an approach guarantees broad demographic and geographic market penetration across the UK. As part of its Next Level strategy, the company plans to expand its convenience presence significantly, aiming to add approximately 75 new Local stores by 2027.

Sainsbury's place strategy heavily features the integrated Argos store-in-store model within its supermarkets. This plan aims to accelerate the rollout, targeting approximately 430 Argos stores inside Sainsbury's by March 2024, with a goal for nearly all supermarkets to host an Argos presence. This strategic co-location drives significant footfall, enhancing the one-stop-shop appeal for customers. It consolidates retail space, with around 400 standalone Argos stores closed by March 2024, optimizing operational efficiency. This integration boosts sales potential for both brands, leveraging shared physical space for increased market reach.

Sainsbury's maintains a robust online presence through its grocery delivery service and the Argos website, which remains one of the UK's most visited retail sites. The company reported that online grocery sales continued strong growth, contributing significantly to overall revenue, with digital channels accounting for approximately 18% of total retail sales in the fiscal year ending March 2024. Investment continues in enhancing the digital experience, including the website and app, to boost customer engagement and online transaction frequency. This focus aims to further integrate loyalty programs like Nectar within the digital ecosystem for improved personalization by late 2024.

Strategic Store Expansion and Modernization

Sainsbury's is undertaking its most substantial investment in new supermarket space, acquiring 14 sites for conversion to bolster its full food range accessibility. This strategic expansion, integral to the 'Next Level' plan, focuses on modernizing and expanding offerings in around 180 of its highest-potential stores by 2025. The aim is to enhance the overall customer shopping experience and market reach.

- 14 new sites acquired for conversion.

- Investment targets 180 high-potential stores for modernization.

- Focus on expanding the full food range accessibility.

- Part of the 'Next Level' strategic growth plan for 2024-2025.

Click & Collect and Convenience Hubs

Sainsbury's leverages its extensive store network as a crucial element of its Place strategy, facilitating robust Click & Collect services. This omnichannel approach integrates online shopping convenience with physical pickup immediacy, optimizing supply chains and meeting evolving consumer demands for flexibility. A prime example is Argos, where around 70% of sales are collected in-store, underscoring the success of this model. Sainsbury's is actively expanding this reach, projecting an addition of 150 to 200 more Argos collection points within its supermarkets and convenience stores by 2025.

- 70% of Argos sales are collected in-store.

- Sainsbury's plans to add 150-200 new Argos collection points by 2025.

Sainsbury's Place strategy effectively blends an extensive physical network of over 1,400 stores with a robust digital presence. This includes expanding convenience formats and integrating Argos shop-in-shops, targeting 430 by March 2024. Online channels are crucial, contributing 18% of retail sales by March 2024, supported by strong Click & Collect services. Strategic investments involve acquiring 14 new sites and modernizing 180 high-potential stores by 2025 to enhance market reach.

| Metric | 2024 Data | 2025 Target |

|---|---|---|

| Total Physical Stores | Over 1,400 | Expanding |

| Argos Store-in-shops | 430 (by Mar 2024) | Nearly All Supermarkets |

| Online Retail Sales Share | 18% (by Mar 2024) | Continued Growth |

| New Sites Acquired | 14 | N/A |

| High-Potential Stores Modernized | N/A | 180 |

What You Preview Is What You Download

Sainsbury 4P's Marketing Mix Analysis

The preview shown above is identical to the final version you'll download. Buy with full confidence. This comprehensive Sainsbury 4P's Marketing Mix Analysis covers Product, Price, Place, and Promotion in detail. You'll gain valuable insights into Sainsbury's strategic approach. Understand how each element contributes to their overall market success.

Promotion

The integrated Nectar loyalty program is central to Sainsbury's promotional strategy, offering personalized discounts and rewards across its ecosystem, including Argos. The Nectar Prices initiative, launched in 2023, significantly boosted value perception and customer engagement, with over 18 million Nectar members benefiting from exclusive offers. This focus on a world-leading loyalty platform aims to drive retention and leverage data for highly targeted marketing efforts. Sainsbury's reported strong Nectar uptake, contributing to a 9.3% increase in grocery sales for the 16 weeks to January 2024.

Sainsbury's employs a multi-channel advertising strategy, utilizing traditional platforms like television and radio alongside significant digital presence on social media and online video. Their 2024 Christmas campaign, for example, aimed to build emotional connections and reinforce brand identity, emphasizing the 'Good Food for All of Us' platform. Digital ad spend is projected to increase by approximately 9% in 2025, targeting enhanced online engagement and broader customer reach. This integrated approach ensures consistent messaging across diverse touchpoints, supporting their market position.

Sainsbury's employs value-oriented pricing, notably through initiatives like the Aldi Price Match on hundreds of essential products and its Low Everyday Prices campaign. This strategy directly responds to intense competitive pressure from discounter supermarkets and the ongoing cost-of-living crisis impacting consumer spending into 2025. By actively matching prices, Sainsbury's aims to shift customer perception, demonstrating its commitment to affordability. This approach is crucial for retaining market share against competitors, especially as grocery inflation remains a key consideration for UK households. Their Q1 2024/25 results highlighted strong sales in food, partly driven by these value propositions.

Digital and In-Store Marketing

Sainsbury's effectively integrates digital and in-store marketing to drive promotions. Its official website showcases product information and current offers, complementing in-store point-of-sale materials, like the 'Good to Know' campaign highlighting sustainability. Furthermore, the Nectar360 platform leverages extensive customer data to deliver highly targeted retail media opportunities for partner brands, generating a new revenue stream. This strategic approach strengthens customer engagement and maximizes promotional impact across channels.

- Nectar360's retail media revenue grew by 20% in FY2023/24, reaching £100 million.

- Sainsbury's digital sales accounted for approximately 17% of total retail sales in Q4 2023/24.

- Over 18 million active Nectar cardholders provide data for personalized offers.

- Investment in digital transformation projects for 2024/25 targets enhanced online user experience.

Strategic Partnerships and Sponsorships

Sainsbury's leverages strategic partnerships to amplify its promotional reach and customer value. The Nectar program, with over 18 million active users as of early 2024, remains central, offering targeted rewards and fostering loyalty across its ecosystem. A significant collaboration with NewDay, operational from Q1 2024, now manages Argos financial services, expanding credit offerings to millions of customers. Furthermore, Sainsbury's promotes its Smart Charge EV network, aiming for 750 rapid charging bays by late 2024, by offering Nectar point incentives, rewarding engagement with new services.

- Nectar program: Over 18 million active users as of early 2024.

- NewDay partnership: Operational from Q1 2024 for Argos financial services.

- Smart Charge EV network: Targeting 750 rapid charging bays by late 2024.

Sainsbury's robust promotional strategy centers on its Nectar loyalty program, leveraging over 18 million active members for personalized offers like Nectar Prices, which boosted grocery sales by 9.3% to January 2024. A multi-channel advertising approach, including a projected 9% increase in digital ad spend for 2025, ensures broad reach. The Nectar360 platform further amplifies promotional impact, generating £100 million in retail media revenue in FY2023/24 through data-driven campaigns. Strategic partnerships, such as with NewDay from Q1 2024 and Nectar incentives for Smart Charge EV bays, extend promotional reach and customer value.

| Promotional Aspect | Key Metric | 2024/2025 Data |

|---|---|---|

| Nectar Loyalty Program | Active Members | Over 18 million (early 2024) |

| Nectar Prices Impact | Grocery Sales Growth | +9.3% (16 weeks to Jan 2024) |

| Nectar360 Platform | Retail Media Revenue | £100 million (FY2023/24) |

| Digital Advertising | Projected Spend Increase | ~9% (2025) |

| Digital Sales Share | Total Retail Sales | ~17% (Q4 2023/24) |

Price

Sainsbury's employs a competitive pricing strategy, most notably through its Aldi Price Match initiative, to compete directly with discounters on essential items. This approach is a core component of its value proposition, aiming to reassure customers they are receiving fair prices on their everyday shopping. The company has invested over £780 million in lowering prices over the last three years, up to early 2025, to reset its competitive position. This significant investment underscores their commitment to offering compelling value across their product range.

Sainsbury's pricing strategy prioritizes value for money, balancing product quality with competitive costs rather than engaging in aggressive price wars. This stable structure reflects the perceived value, crucial for retaining customers who expect quality without an excessive premium. The Nectar Prices scheme, expanded in 2024, offers significant savings, reinforcing this value proposition. For instance, Nectar cardholders can access lower prices on thousands of items, strengthening customer loyalty and perceived affordability.

Sainsbury's employs a tiered pricing strategy for its own-brand products to cater to diverse market segments. Premium lines, such as the 'Taste the Difference' range, command higher prices, reflecting their perceived superior quality and contributing to higher average basket values in early 2025. Conversely, everyday essential items and value brands are priced affordably to ensure accessibility for a broader customer base. This differentiated approach, evolving from lines like 'Sainsbury's Basics' to 'Stamford Street Co.' by 2024, allows for effective market segmentation and optimized revenue across its extensive portfolio.

Dynamic and Loyalty-Based Pricing

Sainsbury's leverages dynamic pricing effectively through its Nectar loyalty program, offering personalized discounts and exclusive Nectar Prices to members. This strategy not only rewards loyal customers but also drives significant adoption of the Nectar platform, facilitating data-driven price adjustments and targeted promotions. As of early 2025, Nectar's active user base continues to grow, boosting sales and enhancing value perception among its most engaged shoppers, contributing to Sainsbury's resilient market position.

- Nectar Prices typically offer up to 25% savings on selected items for cardholders.

- Over 18 million active Nectar accounts drive substantial customer engagement and data insights.

- Personalized offers have shown to increase basket size by an average of 10-15% for targeted shoppers.

Strategic Withdrawal from -Led Banking

Sainsbury's strategic decision to sell its core banking business reflects a shift away from capital-intensive, price-competitive financial products. This move, announced in 2024, allows the company to reduce its financial risk exposure and streamline operations. The new model focuses on offering financial services through partnerships, ensuring that pricing decisions across the broader retail business, especially in grocery and general merchandise, are more directly aligned with driving core growth.

- The divestment frees capital, supporting a focus on value-led grocery pricing.

- It reduces exposure to volatile banking markets, enhancing financial stability.

- Sainsbury's aims to grow retail profit by at least 500 million pounds over three years from 2024/25.

- This strategic re-focus underpins a more unified and competitive pricing approach across its primary retail offerings.

Sainsbury's employs a multifaceted pricing strategy, combining competitive matching on essential goods with a strong focus on value for money. The Nectar Prices scheme, expanded in 2024, significantly enhances customer loyalty by offering up to 25% savings on thousands of items. A tiered approach to own-brand products, from premium 'Taste the Difference' to value lines like 'Stamford Street Co.' (2024), caters to diverse segments. This strategy, backed by over £780 million in price investments up to early 2025, aligns with their goal to grow retail profit by at least £500 million from 2024/25.

| Pricing Initiative | Key Feature | Impact/Data (2024/2025) |

|---|---|---|

| Aldi Price Match | Competitive pricing on essentials | Over £780 million invested in price reductions |

| Nectar Prices | Personalized discounts for members | Up to 25% savings, over 18 million active accounts |

| Tiered Own Brands | Segmented pricing for product lines | 'Taste the Difference' for premium, 'Stamford Street Co.' for value |

| Strategic Focus | Divestment of banking arm | Targeting £500 million retail profit growth from 2024/25 |

4P's Marketing Mix Analysis Data Sources

Our Sainsbury's 4P's Marketing Mix Analysis is grounded in a robust blend of official company disclosures, including annual reports and investor briefings, alongside detailed market research and competitor benchmarking. We meticulously examine their product range, pricing strategies, distribution network, and promotional activities to provide a comprehensive overview.