Sainsbury Business Model Canvas

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Sainsbury Bundle

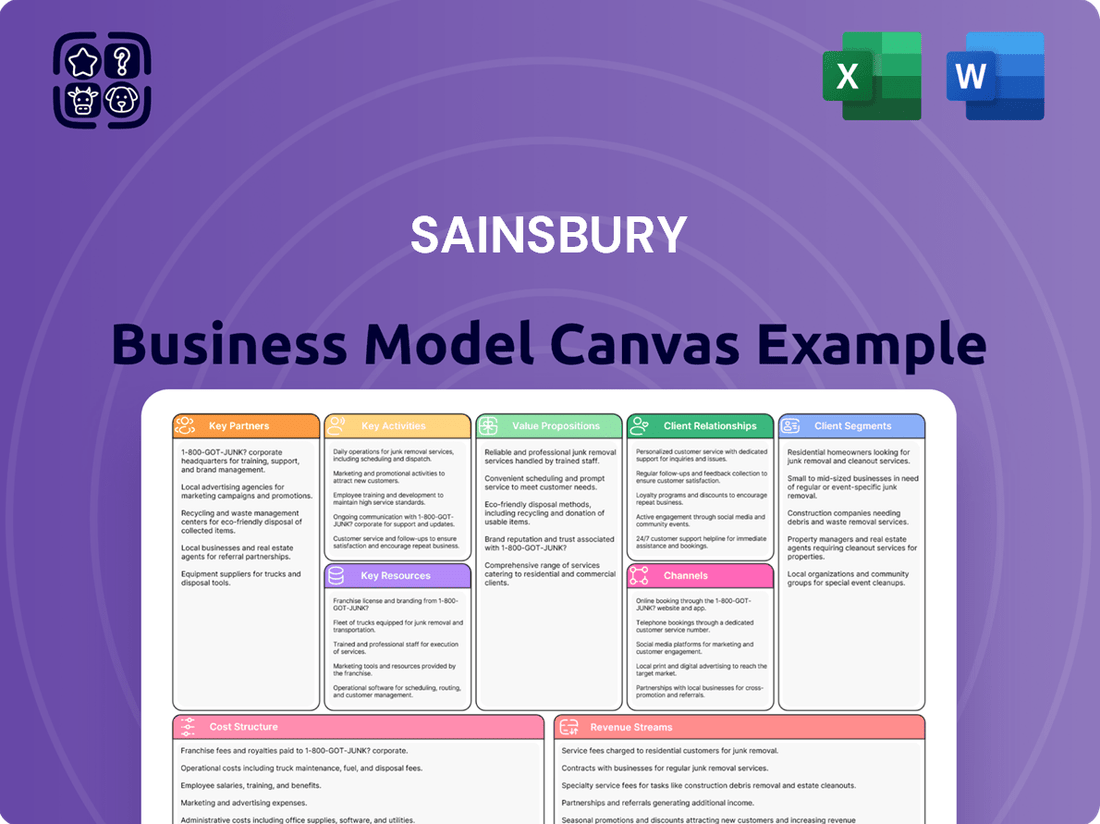

Unlock the core of Sainsbury's success with its comprehensive Business Model Canvas. This strategic framework dissects how Sainsbury effectively serves diverse customer segments, from value-conscious shoppers to those seeking premium quality. Discover their key partnerships, vital resources, and unique value propositions that drive customer loyalty and market dominance.

Delve into the operational engine of Sainsbury, understanding their cost structure and revenue streams that fuel their expansive retail empire. Analyze their key activities and how they leverage innovation to maintain a competitive edge in the fast-paced grocery sector. This canvas offers a clear, actionable blueprint for understanding retail strategy.

Ready to gain a deeper understanding of how Sainsbury thrives? Download the full Business Model Canvas to access all nine essential building blocks. This detailed, professionally analyzed document is your key to unlocking strategic insights, perfect for business students, aspiring entrepreneurs, or seasoned industry professionals looking to learn from a market leader.

Partnerships

Sainsbury's relies on strategic relationships with a vast network of local and international suppliers and farmers. These partnerships are crucial for ensuring a consistent supply of quality products, especially given the retailer's commitment to British sourcing, with over 75% of its fresh produce sourced from the UK in 2024. Effective supplier management directly impacts cost efficiency and product availability, allowing Sainsbury's to offer fresh produce and maintain its brand promise. For instance, strong ties with over 20,000 British farmers underscore their dedication to quality and sustainability. These collaborations are pivotal for Sainsbury's to meet consumer demand and uphold its market position.

Nectar 360 functions as Sainsbury's crucial data and loyalty coalition, extending its reach beyond groceries. This partnership integrates major brands like British Airways and Esso, enhancing the Nectar loyalty program's value for its 18 million active customers. By leveraging this extensive network, Sainsbury's gains richer customer data, enabling highly personalized offers and driving strategic marketing decisions. This collaborative ecosystem underpins a data-driven approach, optimizing customer engagement and business insights in 2024.

Sainsbury's relies on strategic partnerships with leading technology and cloud providers for its robust e-commerce platform and data analytics capabilities. These collaborations are essential for powering its cloud infrastructure and in-store technologies like SmartShop. Such alliances drive digital transformation, enhancing operational efficiency and the overall customer experience. In the fiscal year ending March 2024, Sainsbury's continued to prioritize digital investments, reflecting the critical role these tech partners play in its competitive retail strategy.

Logistics and Distribution Partners

While Sainsbury's operates a significant own logistics network, it strategically partners with third-party logistics providers for specialized services like international freight and last-mile delivery, enhancing supply chain resilience. These collaborations offer critical flexibility and scale, especially for high-demand periods, optimizing the flow of goods from suppliers through distribution centers to stores and customer homes. For instance, in 2024, such partnerships are crucial for managing the over 17 million customer transactions weekly. This hybrid approach ensures efficient and cost-effective distribution across its extensive retail footprint.

- Sainsbury's leverages its own vast logistics network for core operations.

- Third-party logistics (3PL) partners handle specialized tasks like international freight.

- Partnerships enhance flexibility and scalability, crucial for peak demand.

- This hybrid model optimizes supply chain efficiency from producer to consumer.

Financial Service Underwriters

Sainsbury's Bank relies on key partnerships with financial service underwriters and institutions to diversify its product portfolio, including insurance and travel money. These strategic alliances enable the bank to expand its offerings without fully absorbing the associated risks and regulatory complexities. For instance, in 2024, Sainsbury's continues to leverage its trusted brand, reaching millions of customers weekly, to offer competitive financial products through these collaborations. This model allows for efficient market penetration into adjacent financial service sectors.

- Sainsbury's Bank actively partners with third-party underwriters for its insurance products, mitigating direct underwriting risk.

- These collaborations facilitate the provision of diverse financial services, such as travel money, enhancing customer value.

- Leveraging the core Sainsbury's brand, which serves over 27 million customers weekly as of early 2024, expands the reach of these financial offerings.

- This model significantly reduces the regulatory burden and capital requirements for Sainsbury's in the financial sector.

Sainsbury's strategically partners across its value chain, from over 20,000 British farmers ensuring fresh produce, with 75% UK-sourced in 2024, to technology providers powering its digital transformation. Key alliances like Nectar 360 engage 18 million active customers, while 3PLs optimize logistics for over 17 million weekly transactions. Sainsbury's Bank also leverages financial underwriters, extending services to its 27 million weekly customers.

| Partner Type | Key Role | 2024 Data Point |

|---|---|---|

| Suppliers/Farmers | Product Sourcing | 75% UK fresh produce |

| Nectar 360 | Loyalty/Data | 18M active customers |

| Tech Providers | Digital Infrastructure | Ongoing digital investment |

| Logistics (3PL) | Supply Chain Efficiency | 17M weekly transactions |

What is included in the product

A detailed breakdown of Sainsbury's operations, mapping out its customer segments, value propositions, and revenue streams.

This model provides a structured overview of how Sainsbury's creates, delivers, and captures value across its diverse retail offerings.

Streamlines complex business thinking into a clear, actionable framework.

Provides a structured approach to identify and address potential business inefficiencies.

Activities

Retail Operations and Merchandising form Sainsbury's core activity, managing its extensive network which includes over 600 supermarkets, 800 convenience stores, and around 700 Argos outlets as of early 2024. This involves meticulous inventory management, ensuring product availability and minimizing waste across its 1,300+ grocery and general merchandise locations. Effective staffing and customer service are crucial for in-store experience, contributing to the strong brand perception. Sainsbury's focus on efficient operations helps drive profitability, with grocery sales up 6.5% in the third quarter of fiscal year 2023/24, reflecting strong in-store performance.

Sainsbury's supply chain management involves sourcing products globally and nationally, leveraging a vast network of over 20 distribution centers across the UK as of early 2024. This complex activity coordinates a large fleet of vehicles to ensure products are consistently available on supermarket shelves and for growing online orders. The focus remains on driving efficiency and cost reduction, which helped mitigate inflationary pressures on food prices for the fiscal year ending March 2024. A highly resilient and efficient supply chain provides a significant competitive advantage, crucial for maintaining product availability across their extensive store estate and online delivery network.

Digital Platform Management and E-commerce are central to Sainsbury's operations, encompassing the continuous development and maintenance of the Sainsbury's website, mobile applications, and the Argos online platform.

These activities are crucial for efficiently managing online grocery orders, coordinating delivery, and facilitating Click & Collect slots, ensuring a smooth user experience. This digital-first approach is vital for capturing the growing online market; for instance, Sainsbury's reported strong digital growth, with online grocery sales maintaining high penetration, reflecting its strategic importance.

Marketing, Branding, and Loyalty Management

Marketing, branding, and loyalty management are central to Sainsbury's strategy, encompassing promotion of its Sainsbury's, Argos, and Tu brands through diverse advertising campaigns and robust digital marketing efforts. A cornerstone is the Nectar loyalty program, boasting over 18 million active users in 2024, which enables highly personalized promotions and communications. This data-driven approach aims to significantly drive customer traffic and increase basket size. The overarching goal is to foster deep, long-term customer loyalty and enhance overall market share.

- Nectar program leverages data for over 2 billion personalized offers annually.

- Digital marketing spend increased to target online shopper growth.

- Focus on integrating Argos and Tu branding within Sainsbury's ecosystem.

- Loyalty efforts contribute to customer retention, crucial for sustained revenue.

Product Development and Quality Control

Sainsbury's prioritizes developing its extensive own-brand product range, spanning from accessible value items to premium Taste the Difference lines. This involves rigorous market research, precise product formulation, and careful supplier selection, all underpinned by robust quality assurance processes. A strong own-brand portfolio significantly enhances profit margins and offers exclusive products that differentiate Sainsbury's in the competitive retail landscape. For instance, in their recent trading updates, own-brand sales continued to show strong growth, reflecting customer trust and value perception.

- Development of diverse own-brand ranges, from value to premium.

- Rigorous market research and product formulation.

- Strict supplier selection and quality assurance protocols.

- Enhanced profit margins and competitive differentiation.

Sainsbury's key activities center on efficient retail operations across its extensive store network and robust supply chain, ensuring product availability. Strategic digital platform management drives e-commerce growth and seamless online experiences. Furthermore, targeted marketing, the Nectar loyalty program with over 18 million users in 2024, and strong own-brand product development are crucial for customer engagement and profitability.

| Activity Area | Key Metric (2024 Data) | Impact | ||

|---|---|---|---|---|

| Retail Operations | 1,300+ grocery & general merchandise locations | Extensive market reach | ||

| Supply Chain | Over 20 UK distribution centers | Efficient product flow | ||

| Customer Loyalty | 18M+ Nectar active users | Personalized engagement |

Full Version Awaits

Business Model Canvas

The Sainsbury Business Model Canvas preview you are viewing is the exact document you will receive upon purchase. This is not a mockup or a sample; it is a direct snapshot of the complete, ready-to-use file. When you complete your order, you will gain full access to this same professionally structured and formatted Business Model Canvas, allowing you to immediately leverage its insights for your strategic planning.

Resources

Sainsbury's extensive physical store network is a primary asset, encompassing over 600 supermarkets and more than 800 convenience stores, alongside its Argos network as of early 2024. This vast real estate portfolio provides wide market coverage and high brand visibility across the UK. These locations are crucial for Sainsbury's multi-channel strategy, often serving as fulfillment centers for online grocery and general merchandise orders. The significant value and strategic location of this property portfolio act as a substantial barrier to entry for competitors.

Sainsbury's relies on a sophisticated network of 17 major distribution centers across the UK, a critical resource for efficient operations.

This infrastructure, alongside its extensive delivery fleet, supports the daily distribution of over 20 million items to stores and customers.

The system is vital for ensuring consistent product availability and managing inventory effectively.

It also underpins the rapidly expanding online grocery business, which saw significant growth in 2024, facilitating millions of home delivery slots weekly.

Sainsbury's leverages its iconic brand, established over 150 years, which signifies quality and trust to millions of UK customers daily. The Argos brand, acquired in 2016, complements this with its strong association for value and wide choice in general merchandise, including a significant online presence that contributed to over 1 billion online visits in 2023. Tu, as a key clothing brand, further diversifies the portfolio, making Sainsbury's the UK's second-largest clothing retailer by volume. This robust brand equity across food, general merchandise, and clothing fosters customer loyalty and enables successful ventures into areas like financial services. These established brands collectively drive a significant portion of the company's 32.7 billion GBP revenue reported for the fiscal year ending March 2024.

Nectar Customer Data Asset

The Nectar loyalty program furnishes Sainsbury's with an exceptionally rich customer data asset, critical for understanding evolving shopping behaviors in 2024. This invaluable resource enables highly personalized marketing campaigns, optimizing promotions to individual preferences and maximizing their effectiveness. The data directly informs strategic decisions regarding product ranging and efficient store layouts, enhancing the customer experience. This extensive data asset, encompassing millions of active users, serves as a powerful and unique competitive tool in the UK retail landscape.

- Nectar boasts over 18 million active users, providing unparalleled insights into UK consumer behavior as of 2024.

- Personalized offers driven by Nectar data can increase customer basket size by up to 15% for targeted promotions.

- Data analysis helps optimize product placement, potentially boosting category sales by 5-10% in high-traffic areas.

- Strategic decisions based on Nectar analytics contribute to Sainsbury's market share stability, reported at around 15% in early 2024.

Human Capital and Expertise

Sainsbury's human capital, encompassing over 150,000 colleagues as of early 2024, is a critical key resource. Their collective expertise across retail operations, intricate supply chain management, emerging technology, and customer service drives the business forward. Strategic investment in training and retaining skilled employees ensures operational excellence and fosters innovation. This commitment to colleague development supports the delivery of a strong customer experience and efficient business processes.

- Over 150,000 colleagues contribute daily to Sainsbury's operations.

- Expertise spans retail, logistics, technology, and customer interaction.

- Training programs enhance skills in areas like digital transformation.

- Retention strategies are vital for maintaining a high-performing workforce.

Sainsbury's leverages its extensive physical store network, including over 1,400 food and Argos locations, alongside a sophisticated distribution infrastructure to ensure widespread market reach. Its powerful brand portfolio, encompassing Sainsbury's, Argos, and Tu, generated 32.7 billion GBP revenue by March 2024. The Nectar loyalty program, with over 18 million active users, provides critical customer data for personalized strategies. Furthermore, a skilled workforce of over 150,000 colleagues drives daily operations and innovation.

| Resource | Key Metric (2024) | Value/Impact |

|---|---|---|

| Physical Network | Over 1,400 stores | Extensive UK coverage |

| Brand Equity | 32.7B GBP revenue | FY ending March 2024 |

| Nectar Data | 18M+ active users | Personalized marketing insights |

| Human Capital | Over 150,000 colleagues | Operational excellence |

Value Propositions

Sainsbury's offers customers high-quality products, especially fresh food, at competitive prices, reinforced by initiatives like the Aldi Price Match, covering over 600 products in 2024. This proposition is built on a long-standing brand reputation for trust and fairness. It appeals to customers who do not want to compromise on quality but remain budget-conscious, aligning with Sainsbury's 15.1% grocery market share as of April 2024.

Sainsbury's offers unmatched convenience through its diverse shopping formats, catering to every need. Customers can conduct a full weekly shop at one of its larger supermarkets or grab essentials from over 800 Sainsbury's Local convenience stores. The company also streamlines shopping with its online grocery delivery, where digital sales accounted for a substantial portion of overall grocery sales in 2024. Furthermore, the integration of Argos within over 460 Sainsbury's stores provides a seamless one-stop solution for general merchandise, saving valuable customer time.

Sainsbury's offers a compelling value proposition by seamlessly integrating its grocery operations with general merchandise from Argos, allowing customers to conveniently purchase a wide array of non-food items alongside their groceries.

This creates a highly differentiated retail experience, leveraging Argos's significant contribution to the broader group, which saw general merchandise sales grow 1.2% in the financial year ending March 2024.

The integrated model enhances customer convenience and boosts average basket spend, as shoppers are encouraged to fulfil diverse needs in one visit.

This strategic synergy attracts a broader customer base, combining the strengths of a leading UK grocer with a prominent general merchandise retailer.

Personalized Rewards through Nectar

The Nectar loyalty program offers Sainsbury customers personalized discounts and targeted offers based on their shopping history, creating a strong sense of individual value. This approach significantly encourages repeat business and deepens customer loyalty. As of 2024, Nectar has over 18 million active customers, benefiting from tailored promotions. The Nectar Prices initiative, launched in 2023, saved customers over £1 billion by March 2024, enhancing perceived value. The ability to earn and spend points across a wide network of partners further solidifies this proposition.

- Nectar boasts over 18 million active customers as of 2024.

- Nectar Prices, introduced in 2023, saved customers over £1 billion by March 2024.

Accessible Financial Services

Sainsbury's Bank leverages the highly trusted master brand to offer accessible financial products, including credit cards, loans, and insurance, seamlessly integrating services for customers. This convenience strengthens the customer relationship while diversifying Sainsbury's revenue streams. For instance, in their 2024 fiscal update, financial services contributed to the broader group performance, indicating its strategic importance.

- Offers convenient financial services under a familiar retail brand.

- Includes credit cards, personal loans, and various insurance products.

- Strengthens customer loyalty by providing integrated financial solutions.

- Contributes to diversified revenue for the Sainsbury's Group.

Sainsbury's provides high-quality groceries at competitive prices, reinforced by initiatives like the Aldi Price Match across over 600 products in 2024. Convenience is key, with diverse formats from large supermarkets to over 800 Local stores and robust online delivery, alongside Argos integration in over 460 stores. The Nectar loyalty program, with over 18 million active customers in 2024, delivers personalized savings, including over £1 billion saved by March 2024 through Nectar Prices. Sainsbury's Bank further adds value with accessible financial products.

| Value Proposition | Key Feature | 2024 Data Point |

|---|---|---|

| Quality & Value | Aldi Price Match | 600+ products |

| Convenience | Argos Integration | 460+ stores |

| Loyalty & Savings | Nectar Active Customers | 18M+ customers |

Customer Relationships

The Nectar loyalty program is central to Sainsbury's customer relationship strategy, shifting from mere transactions to a deeply personalized engagement model. It fosters loyalty through a robust rewards system, allowing customers to collect points on purchases both in-store and online. This enables highly data-driven communication, with personalized offers and discounts delivered via the Nectar app and email, ensuring relevance. For instance, Nectar has over 18 million active members, with Sainsbury's leveraging data to provide tailored promotions, making customers feel valued and understood as of 2024. This personalization strengthens customer affinity and encourages repeat business.

Sainsbury’s maintains customer relationships through diverse channels, ensuring accessibility for all shoppers. In 2024, in-store colleagues remain crucial, offering direct face-to-face assistance. This is complemented by dedicated call centers and comprehensive online support via help pages and social media platforms. Such a multi-channel approach allows customers to resolve issues through their preferred method, fostering trust and loyalty. Providing consistent, high-quality service across all touchpoints is a core focus for customer satisfaction.

Sainsbury's increasingly manages customer relationships through self-service technologies like their widespread self-checkouts and the SmartShop app. This approach caters to customers prioritizing speed and efficiency, empowering them to scan items as they shop. For instance, in 2024, the SmartShop app continued to drive digital engagement, contributing significantly to Sainsbury's online sales. This automated relationship is built on offering convenience and ease of use, enhancing the overall shopping journey.

Digital Engagement and Community

Sainsbury's cultivates strong customer relationships through extensive digital engagement, leveraging its website, mobile app, and social media platforms. This strategy includes sharing engaging content like recipes and sustainability news, alongside promotional offers, fostering a vibrant online community. The objective is to ensure the brand remains top-of-mind and to build an emotional connection that extends beyond simple transactions.

- Sainsbury's mobile app saw significant usage growth, with digital sales continuing their strong trajectory into 2024.

- Their Nectar loyalty program, integrated digitally, reached over 18 million active users in 2024, enhancing personalized offers.

- Social media channels actively share content, with their main Facebook page having over 1.5 million followers.

- The digital focus aims to increase customer lifetime value and brand loyalty through seamless online experiences.

In-Store Human Interaction

Despite the rise of digital channels, Sainsbury’s continues to prioritize direct, personal interaction with customers in-store. Friendly and helpful colleagues on the shop floor, at checkouts, and service desks significantly enhance the customer experience, fostering loyalty. This human touch builds rapport and allows for immediate resolution of customer needs, which remains crucial for many shoppers. Sainsbury’s invests in colleague training, recognizing that human interaction drives satisfaction, with recent surveys indicating high importance placed on staff helpfulness.

- In 2024, customer service remains a key differentiator in retail, with 70% of consumers valuing helpful staff.

- Sainsbury’s reported colleague availability and helpfulness as top drivers for in-store satisfaction.

- Effective in-store interactions can reduce customer complaints by up to 25%.

- Personalized service in physical stores can increase repeat visits by 15-20%.

Sainsbury's prioritizes customer relationships via its Nectar loyalty program, engaging over 18 million members with personalized 2024 offers. A multi-channel approach blends digital tools like the SmartShop app with crucial in-store colleague interactions. This strategy ensures convenience and builds loyalty through both digital engagement and human touch.

| Metric | 2024 Data | Impact |

|---|---|---|

| Nectar Members | 18M+ Active | Personalized Loyalty |

| SmartShop Usage | Significant Growth | Digital Convenience |

| Colleague Helpfulness | High Customer Value | In-Store Satisfaction |

Channels

Sainsbury's large-format supermarkets are the cornerstone of its physical retail channels, offering a comprehensive range of groceries, clothing, and general merchandise. These stores serve as key destinations for customers undertaking their main weekly shops, anchoring the brand's presence within communities across the UK. Increasingly, these locations function as crucial hubs for efficient online order fulfillment and convenient Click & Collect services, reflecting the evolving retail landscape. As of March 2024, Sainsbury's operated around 590 supermarkets, integrating their physical reach with digital convenience.

Sainsbury's Local convenience stores serve as a vital channel, capturing high-frequency, top-up shopping missions. With over 800 stores as of early 2024, these outlets are strategically located in urban centers, transport hubs, and residential areas. They offer a curated selection of products for immediate consumption and essential items. This extensive network is crucial for driving growth and increasing market share within the competitive convenience retail sector.

The Sainsbury's website and mobile app serve as the primary digital channel for e-commerce, allowing customers to seamlessly browse the extensive product range and place orders for convenient home delivery or Click & Collect. This channel also empowers customers to manage their Nectar loyalty accounts directly. It is crucial for serving time-poor customers and competing effectively within the expanding online grocery market, which saw Sainsbury's online grocery sales grow by 11.4% in the fourth quarter of fiscal year 2023/24, highlighting its strategic importance.

Argos Stores and Website

Argos functions as a distinct retail channel for Sainsbury's, leveraging its own website and a network of over 400 standalone stores, complemented by more than 450 Argos stores located within Sainsbury's supermarkets as of early 2024. This model is crucial for general merchandise, electronics, and toys, utilizing its unique catalogue and collection system. The integration allows customers to collect Argos orders while grocery shopping, enhancing convenience and driving footfall across both brands. This synergy contributes significantly to Sainsbury's broader retail strategy, expanding its non-food offering.

- Over 450 Argos stores operate within Sainsbury's supermarkets by 2024.

- Argos is the primary channel for Sainsbury's general merchandise and electronics sales.

- The catalogue and collection model remains central to Argos's operations.

Sainsbury's Bank

Sainsbury's Bank primarily utilizes online and mobile banking platforms as its main channels for delivering financial services. This digital-first approach is complemented by a physical presence through in-store travel money bureaus across Sainsbury's supermarkets, leveraging the extensive retail footprint. Telephone banking services also provide direct customer support. As of early 2024, Sainsbury's announced a strategic phased withdrawal from core banking products like loans and credit cards, aiming to simplify its business and focus on Argos Financial Services and travel money.

- Online and mobile platforms serve as primary digital channels.

- In-store travel money bureaus utilize the supermarket network.

- Telephone banking provides direct customer service support.

- Strategic shift in 2024 focuses on Argos Financial Services and travel money.

Sainsbury's utilizes a comprehensive multi-channel approach, centered on its extensive physical footprint of around 590 supermarkets and over 800 Local convenience stores for grocery and general merchandise. A robust digital channel through its website and mobile app supports e-commerce, driving online grocery sales growth of 11.4% in Q4 FY23/24. Additionally, Argos serves as a distinct channel with over 400 standalone stores and more than 450 within Sainsbury's, while Sainsbury's Bank focuses on digital platforms and in-store travel money services. This integrated network maximizes customer reach and convenience across various shopping missions.

| Channel Type | Key Channel | 2024 Data |

|---|---|---|

| Physical Retail | Supermarkets | Approx. 590 stores (March 2024) |

| Physical Retail | Local Convenience | Over 800 stores (early 2024) |

| Digital & Integrated | Online Grocery | 11.4% sales growth (Q4 FY23/24) |

Customer Segments

Main-Shop Families represent Sainsbury's core customer base, primarily conducting their extensive weekly grocery shopping in larger supermarket formats. This segment prioritizes a balanced offering of quality products, competitive value, a wide range of goods, and overall shopping convenience. As of early 2024, Sainsbury's continues to see strong engagement from these households, with millions actively using the Nectar loyalty program to maximize savings and personalize offers. Their consistent patronage drives significant sales volume across the company's extensive store network, which includes over 600 supermarkets across the UK as of March 2024.

Convenience-driven consumers, including busy professionals and city-dwellers, prioritize quick and easy shopping experiences. They frequently utilize Sainsbury's Local stores for food-to-go items and essential top-up purchases due to their accessible locations. This segment also heavily uses the online channel for home delivery, valuing time-saving solutions. Sainsbury's has seen continued growth in its online sales, with digital channels being key for this demographic in 2024. Their purchasing decisions are primarily influenced by store proximity and efficient service, reflecting a demand for seamless transactions.

Sainsbury's addresses value-seeking shoppers who prioritize budget without significantly compromising product quality. The retailer employs its Aldi Price Match on over 400 everyday items as of early 2024, ensuring competitive pricing. Own-brand value ranges and personalized Nectar promotions, which saw 10 billion Nectar points redeemed in 2023-2024, further appeal to this cost-conscious segment. This strategic focus helps maximize their budget effectively.

Digital-Native Shoppers

Digital-native shoppers represent a crucial and expanding segment for Sainsbury’s, preferring engagement primarily through digital channels. These customers extensively use the Sainsbury’s website and app for their grocery needs, leveraging features like SmartShop in-store for a quicker checkout experience. They are highly responsive to personalized digital Nectar offers, which are tailored based on their purchasing history. This segment values a seamless, technologically advanced, and customized shopping journey.

- Sainsbury's online grocery sales continued to perform strongly into 2024, reflecting this segment's preference.

- SmartShop usage has seen consistent growth, indicating high adoption among tech-savvy shoppers.

- Digital Nectar engagement remains a key driver for personalized promotions.

- This segment seeks efficiency and tailored experiences across all digital touchpoints.

General Merchandise and Seasonal Buyers

This customer segment, primarily targeted by the Argos integration, includes individuals seeking electronics, toys, home goods, and various non-food items. They are drawn to Sainsbury's by the wide product range, competitive value, and the convenience of the Click & Collect model. These buyers often make significant purchases around key seasonal events, such as Christmas and Black Friday. Sainsbury's general merchandise sales saw growth in 2024, reflecting the success of this strategy.

- Argos reported strong digital sales, with over 70% of its total sales originating online as of early 2024.

- Click & Collect continues to be a crucial driver, with over 90% of Argos sales now collected from Sainsbury's and Argos stores.

- Sainsbury's highlighted general merchandise growth in its Q4 2023/24 trading update, indicating continued strength in non-food categories.

Sainsbury's caters to diverse customer segments, including core main-shop families seeking value and range, alongside convenience-driven shoppers utilizing local stores and online channels. Value-conscious consumers are supported by competitive pricing and Nectar offers, while digital-native shoppers prioritize seamless tech-enabled experiences. Additionally, non-food buyers, leveraging the Argos integration, value wide product selection and efficient Click & Collect options.

| Customer Segment Focus | 2024 Key Metric/Insight | Value Proposition |

|---|---|---|

| Main-Shop Families | Millions actively using Nectar program | Quality, range, value, convenience |

| Convenience-Driven | Continued growth in online sales channels | Quick access, time-saving solutions |

| Value-Seeking | Aldi Price Match on over 400 items | Budget-friendly, smart savings |

| Digital-Native | SmartShop usage increasing | Seamless, personalized digital experience |

| Non-Food/Argos Buyers | Over 70% Argos sales online; 90% Click & Collect | Wide selection, convenient fulfillment |

Cost Structure

The Cost of Goods Sold represents Sainsbury's single largest cost component, covering the direct expenses of purchasing all products for its Sainsbury's and Argos stores. For the fiscal year ending March 2024, Sainsbury's reported a cost of sales of approximately £29.86 billion, underscoring its significant impact on profitability. Effectively managing this through robust supplier negotiations and efficient sourcing strategies is crucial for maintaining a healthy gross margin. Reducing waste across the supply chain also directly impacts this cost. In the low-margin retail industry, optimizing COGS remains a primary focus area for the business.

Staff costs and benefits represent a substantial portion of Sainsbury's operational expenses, encompassing salaries, wages, bonuses, and pension contributions for its extensive workforce. As of March 2024, the company employed over 100,000 colleagues across its stores, distribution centers, and corporate functions. Labour costs are critical, influencing profitability and requiring a delicate balance between competitive colleague pay and training initiatives. Sainsbury's reported an underlying profit before tax of £701 million for the year ending March 2024, highlighting the need for efficient management of these significant human capital investments to drive productivity and customer service.

Property and occupancy costs represent a significant expense for Sainsbury’s, covering the vast network of physical stores and logistical infrastructure. These include essential outlays like rent for numerous leased properties across the UK, alongside substantial business rates or property taxes. Furthermore, utilities such as energy and water, vital for daily operations, contribute heavily to this category, with recent market volatility seeing energy prices remain elevated. Effective management of this large, relatively fixed-cost base is crucial for maintaining profitability, especially as these expenses continue to climb in the current economic climate.

Logistics and Supply Chain Costs

Logistics and supply chain costs are pivotal for Sainsbury, encompassing warehousing, transportation, fuel, and vehicle maintenance for its extensive delivery fleet. These expenses are particularly significant for the online grocery business, where last-mile delivery remains a costly component. Sainsbury continues to invest in optimizing route planning and fulfillment efficiency to mitigate these operational expenditures, especially given ongoing inflationary pressures on fuel and labor in 2024. Controlling these costs is crucial for maintaining competitive pricing and profitability.

- Warehousing and distribution network management.

- Transportation, including fuel and fleet maintenance.

- Significant last-mile delivery costs for online orders.

- Investment in route optimization and automation to enhance efficiency.

Marketing and Technology Expenses

Sainsbury's dedicates substantial resources to marketing and technology, crucial for engaging customers and driving sales. This includes all spending on advertising, brand campaigns, and the operational costs of the Nectar loyalty program, which remains central to customer retention. Significant ongoing investment in technology covers maintaining robust e-commerce platforms, developing intuitive mobile applications, and upgrading in-store systems to enhance the shopping experience. These strategic expenditures are essential for fostering growth and ensuring competitiveness in the dynamic retail market as of 2024.

- For the fiscal year ending March 2024, Sainsbury's capital expenditure, which heavily includes technology, was approximately £830 million.

- Sainsbury's continues to leverage its Nectar loyalty program, with over 18 million active users, to personalize offers and drive engagement.

- Digital sales, supported by robust e-commerce platforms and mobile apps, represent a significant portion of total revenue, underscoring technology investment importance.

- Ongoing tech upgrades are critical for efficiency and customer satisfaction, reflecting a sustained focus on digital transformation post-2024.

Sainsbury's cost structure is heavily influenced by its Cost of Goods Sold, totaling £29.86 billion in 2024, alongside substantial staff costs for over 100,000 colleagues. Significant outlays also arise from property and occupancy expenses, encompassing rent and utilities. Logistics, including last-mile delivery, and strategic investments in marketing and technology, with £830 million in capital expenditure for 2024, are also critical cost drivers.

| Cost Category | Key Expense | 2024 Data |

|---|---|---|

| Cost of Goods Sold | Product Purchases | £29.86 Billion |

| Staff Costs | Salaries, Benefits | Over 100,000 Employees |

| Capital Expenditure | Technology, Infrastructure | £830 Million |

Revenue Streams

In-store retail sales represent Sainsbury's primary revenue stream, generated directly from the extensive network of its physical supermarkets and convenience stores across the UK. This encompasses all three core product categories: groceries, general merchandise, and the popular Tu clothing line. For the fiscal year ending March 2024, Sainsbury's reported strong grocery sales growth, with like-for-like sales excluding fuel up by 9.4%, driven significantly by these physical retail channels. Maximizing sales per square foot and enhancing footfall remain central to the business, ensuring these stores continue to be key drivers of profitability.

Online sales and delivery fees are a rapidly growing and strategically vital revenue stream for Sainsbury's, derived from grocery and general merchandise orders placed via the Sainsbury's and Argos websites and mobile apps. This includes the value of goods sold and associated charges for home delivery or fulfillment. In its Q4 2023/24 results, Sainsbury's reported online grocery sales growth of 11.7%, highlighting its increasing importance. This expansion, including services like Chop Chop, underscores the priority placed on digital growth. Overall online penetration for groceries reached approximately 17% in the period.

Argos revenue represents a significant stream from the sale of general merchandise, electronics, and other non-food items. This includes sales from standalone Argos stores, digital channels via the Argos website, and Argos concessions integrated within Sainsbury's supermarkets. This diversification is crucial, especially given the low-margin nature of the core grocery market. For the full year 2023/24, Sainsbury's general merchandise sales, which predominantly include Argos, increased by 1.1%, highlighting its ongoing contribution to the group's overall financial performance.

Financial Services Income

Sainsbury's Bank generates significant revenue through its diverse portfolio of financial products, leveraging its extensive customer base. This includes net interest income derived from loans and credit cards, a core component of its profitability. The bank also earns commission income from the sale of various insurance products, enhancing its financial services offering. Additionally, fees from services like ATM usage and travel money contribute to this income stream, making it a profitable, brand-aligned extension of the retail business.

- Net interest income from lending activities.

- Commission from insurance product sales.

- Fees generated by ATM and travel money services.

- Leveraging 27.8 million customer transactions weekly in 2024.

Ancillary Revenue

Ancillary revenue for Sainsbury’s represents a diversified income stream from activities beyond core grocery retail. This includes significant contributions from fuel sales at its petrol filling stations, income generated by in-store pharmacies and cafes, and rental income from letting excess space to concession partners within its larger stores. While these non-core activities are smaller individually, they enhance the one-stop-shop appeal for customers, contributing to overall group profitability. For the fiscal year ending March 2024, fuel sales continued to be a notable component of total group sales.

- Fuel sales contribute significantly to total group revenue.

- In-store pharmacies and cafes offer additional convenience and income.

- Rental income from concessions utilizes excess retail space efficiently.

- These streams boost profitability and customer convenience.

Sainsbury's generates revenue primarily from diverse retail sales, including in-store groceries and online channels, with like-for-like grocery sales up 9.4% in 2024 and online growth at 11.7%. Additional significant streams come from Argos general merchandise, which grew by 1.1% in 2023/24, and Sainsbury's Bank, leveraging 27.8 million weekly customer transactions. Ancillary income from fuel sales and concessions further diversifies their financial base.

| Revenue Stream | Key Contributor | 2024 Performance Highlight | ||

|---|---|---|---|---|

| In-store Retail | Groceries, Tu Clothing | Like-for-like grocery sales +9.4% | ||

| Online Sales | Grocery, General Merchandise | Online grocery sales +11.7% | ||

| Argos & Bank | General Merchandise, Financial Services | General merchandise sales +1.1%, 27.8M weekly bank transactions |

Business Model Canvas Data Sources

The Sainsbury Business Model Canvas is meticulously constructed using a blend of internal financial disclosures, extensive market research on consumer behaviour and competitor analysis, and strategic insights derived from operational performance data. These diverse data streams ensure a comprehensive and accurate representation of Sainsbury's current and future business strategy.