Sainsbury Boston Consulting Group Matrix

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Sainsbury Bundle

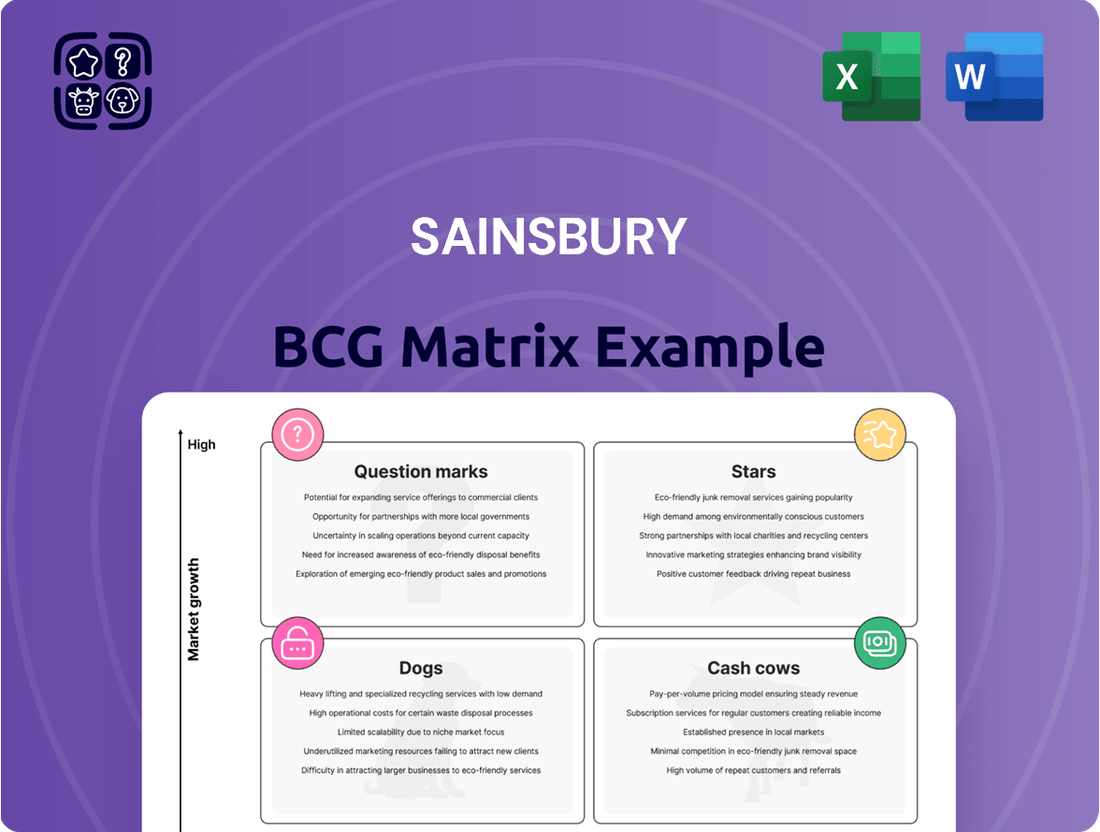

Explore Sainsbury's portfolio using the BCG Matrix to understand its product strengths. Identify Stars, Cash Cows, Dogs, and Question Marks within their offerings. This strategic tool analyzes market growth & relative market share.

See how Sainsbury's allocates resources across its diverse product lines. Understand which products are poised for growth and which may need rethinking. This overview provides a glimpse into their strategic positioning. Purchase the full BCG Matrix for actionable insights & detailed strategic plans.

Stars

Sainsbury's grocery business is a "Star" in the BCG Matrix, holding a significant market share in the expanding UK grocery sector. Sainsbury's reported a 0.6% increase in grocery sales, with a 15.6% market share in Q1 2024. This growth is fueled by strong performance in premium products and strategic customer acquisition. The UK grocery market is projected to grow, solidifying its "Star" status.

Sainsbury's "Taste the Difference" range is a Star. It shows strong sales growth, indicating a high market share in the premium grocery segment. This market is growing as consumers look for affordable luxuries. In 2024, Sainsbury's reported strong sales growth for this range, with a 7.9% increase in the latest quarter.

Online grocery is a star for Sainsbury's, with sales up. This sector is experiencing strong growth, driven by changing consumer behavior. Sainsbury's digital improvements boost this growth. In 2024, online grocery sales accounted for 18% of total sales.

Convenience Stores

Sainsbury's convenience stores are thriving, showcasing robust sales growth and enhanced customer satisfaction. The company is strategically increasing its convenience store presence, improving product offerings in these smaller formats. This directly responds to rising consumer demand for convenient food choices. In 2024, Sainsbury's saw a 7.5% increase in convenience store sales.

- Sales Growth: 7.5% increase in 2024.

- Expansion: Actively increasing store numbers.

- Customer Satisfaction: Improved ratings.

- Product Range: Enhancing offerings.

Aldi Price Match and Nectar Prices

Sainsbury's value initiatives, like Aldi Price Match and Nectar Prices, are crucial for growth. These strategies boost market share and enhance customer value perception. They are significant in a competitive market. Sainsbury's aims to increase its market share from 15.6% in 2024.

- Market share gains through value strategies.

- Customer satisfaction improvements.

- Competitive advantage in the grocery sector.

- Focus on value and customer loyalty.

Sainsbury's core grocery, premium Taste the Difference, and online offerings are key Stars, demonstrating strong market share and growth. Online sales made up 18% of total sales in 2024, while convenience stores grew 7.5%. These segments, alongside value initiatives, solidify Sainsbury's competitive position and market share of 15.6% in 2024.

| Category | 2024 Sales Growth | 2024 Market Share/Contribution |

|---|---|---|

| Grocery Business | 0.6% | 15.6% (Q1 2024) |

| Taste the Difference | 7.9% | High in Premium Segment |

| Online Grocery | Significant Growth | 18% of Total Sales |

| Convenience Stores | 7.5% | Expanding Footprint |

What is included in the product

Analysis of Sainsbury's product portfolio using the BCG Matrix, revealing strategic investment and divestment opportunities.

Printable summary optimized for A4 and mobile PDFs, enabling quick stakeholder review and decision-making.

Cash Cows

Sainsbury's large supermarket network holds a significant market share in the mature grocery sector. These established stores, especially in traditional areas, likely produce substantial cash flow. Although the overall market grows, these formats experience slower growth compared to online sales. Sainsbury's reported a revenue of £34.9 billion in FY2023/24. These stores benefit from loyal customers and operational efficiency.

Sainsbury's core grocery offerings, such as staples, hold a substantial market share. These items experience steady demand in a low-growth market, ensuring a consistent revenue stream. For example, in 2024, essential food sales accounted for approximately 60% of Sainsbury's total grocery revenue. This stability reduces the need for heavy promotional spending. This category generates robust cash flow due to consistent consumer purchases.

Following restructuring, Sainsbury's financial services likely operates as a cash cow. The UK financial services market, though evolving, sees Sainsbury's focus on mature, cash-generating services. In 2024, the financial services sector in the UK showed moderate growth, with specific segments experiencing shifts. Sainsbury's reduced scope suggests a stable, income-focused approach. This positioning aims at steady returns rather than rapid expansion.

Established Own Brand Products (excluding premium)

Sainsbury's established own-brand products, excluding premium lines, are cash cows. These products have a strong market share in the stable grocery sector. They generate consistent cash flow due to customer loyalty. Investment needs are lower compared to premium or new products.

- Own-brand sales in 2023 were a significant portion of total sales.

- These products have high brand recognition.

- They require minimal marketing compared to new products.

- They contribute positively to Sainsbury's overall profitability.

Habitat General Merchandise (integrated within stores)

Habitat, integrated into Sainsbury's and Argos stores, functions as a Cash Cow. Its home and furniture lines generate consistent cash flow, utilizing existing retail space and customer footfall. This segment focuses on steady performance rather than rapid growth, aligning with a Cash Cow strategy. This integration allows Sainsbury's to leverage Habitat's brand recognition and product range.

- Habitat's integration leverages Sainsbury's existing retail infrastructure.

- Focus is on steady cash generation rather than aggressive expansion.

- Product lines include home goods and furniture.

- Sainsbury's reported a total revenue of £36.3 billion in FY24.

Sainsbury's core supermarket network and essential grocery offerings consistently generate robust cash flow due to high market share and stable demand. Own-brand products and integrated segments like Habitat also act as cash cows, requiring minimal investment for steady returns. These segments underpin Sainsbury's financial stability, contributing significantly to its overall revenue of £36.3 billion in FY2024.

| Segment | Contribution | Growth Rate |

|---|---|---|

| Grocery Network | High Cash Flow | Low |

| Essential Food Sales | ~60% Grocery Revenue (2024) | Stable |

| Own-Brand Products | Consistent Profitability | Low |

Preview = Final Product

Sainsbury BCG Matrix

This Sainsbury BCG Matrix preview is identical to the purchased document. Receive a complete, ready-to-use analysis, offering insights for strategic planning and investment decisions.

Dogs

Argos, a "dog" in Sainsbury's BCG matrix, struggles with declining sales amid tough market conditions. The division's market share is low in a potentially declining market. Its performance has been below expectations. In 2024, Argos' sales decreased, affecting overall group profitability.

Argos's traditional catalogue sales, a "Dog" in Sainsbury's BCG matrix, face decline. With low market share, this segment struggles in the digital age. Sales from physical catalogues are minimal, unlike online. In 2024, this model is likely a small percentage of overall revenue, continuing its downturn.

Certain general merchandise categories, especially big-ticket items at Argos, are underperforming. These categories have low market share and face a challenging market environment. For example, in 2024, general merchandise sales at Sainsbury's saw a decrease, reflecting weaker demand. This decline highlights the pressure on discretionary spending.

Underperforming Standalone Argos Stores

Sainsbury's is actively restructuring its Argos operations, closing standalone stores and incorporating them into existing supermarkets. This strategic shift suggests that standalone Argos stores have been underperforming. The move aims to improve efficiency and capitalize on the foot traffic within Sainsbury's supermarkets. In 2024, Sainsbury's reported a 4.6% increase in like-for-like sales, showing the impact of these changes.

- Store closures are a direct response to low growth.

- Integration is aimed to increase market share.

- Sainsbury's is shifting towards more efficient formats.

- The strategy is reflected in recent sales data.

Non-core or Divested Financial Services

The sale of parts of Sainsbury's Bank, classified as "Dogs" in the BCG matrix, indicates these segments were underperforming or misaligned with the core business. These divestitures likely aimed to streamline operations and focus on more profitable ventures. This strategic shift helps Sainsbury's concentrate resources on high-growth areas. These moves often reflect the company's efforts to optimize resource allocation for better financial outcomes.

- Sainsbury's Bank made a £100 million loss in 2023.

- Sainsbury's sold its mortgage portfolio to NatWest in 2024.

- The bank has been reducing its banking services since 2020.

Sainsbury's Dogs primarily comprise underperforming Argos general merchandise, particularly traditional catalogue sales, which faced declining demand in 2024. Strategic integration of Argos stores into supermarkets aims to improve efficiency and boost overall like-for-like sales, which increased by 4.6%. Additionally, segments of Sainsbury's Bank, like its mortgage portfolio sold in 2024 following a £100 million loss in 2023, were divested to streamline operations and focus resources on core profitable ventures. These moves reflect a clear strategy to shed low-growth assets.

| Segment | Status | 2024 Action/Impact |

|---|---|---|

| Argos General Merchandise | Underperforming Dog | Sales decrease in 2024 |

| Argos Standalone Stores | Restructuring Dog | Integration into supermarkets, aiding 4.6% like-for-like sales rise |

| Sainsbury's Bank Mortgages | Divested Dog | Portfolio sold to NatWest in 2024 after £100M loss (2023) |

Question Marks

New Sainsbury's convenience store locations, while part of the overall Star category, face initial challenges. These stores, especially in new areas, often start with a low market share. However, they operate in a growing market, presenting significant potential. For instance, in 2024, Sainsbury's planned to open 100 new convenience stores. This strategic expansion aims to boost market share.

Sainsbury's is actively growing its grocery presence geographically. A prime example is the recent launch in Felixstowe. These new ventures are considered "Stars" in the BCG Matrix, representing high-growth potential. They require significant investment to capture market share. Sainsbury's reported a revenue increase of 3.5% for Q1 2024, showing positive growth.

Sainsbury's is heavily investing in digital services, aiming to boost its online presence. This includes exploring new retail media platforms, a move into a high-growth sector. Such ventures require substantial funding and effective implementation to gain market share. In 2024, Sainsbury's online sales showed growth, but digital investments continue.

Introduction of Highly Innovative or Niche Food Products

Introducing highly innovative or niche food products within Sainsbury's grocery range can be viewed as a question mark in the BCG matrix. These products operate in the growing food market but still need to gain significant market share and customer acceptance. Success hinges on substantial investment in product development, marketing, and distribution strategies. The goal is to turn these question marks into stars.

- Sainsbury's reported a 10.3% increase in underlying profit before tax for the fiscal year 2023-2024, showing financial capacity for investment.

- The UK's online grocery market grew by 7.6% in 2024, indicating a growing channel for new product introductions.

- Product innovation spending by major UK supermarkets increased by an average of 8% in 2024, highlighting the importance of new product development.

- Niche food product sales in the UK saw a 12% rise in 2024, showing potential market growth.

Exploration of Emerging Retail Technologies (e.g., AI in finance)

Although not specifically outlined for Sainsbury's, the retail and financial sectors widely embrace AI. This includes AI-driven fraud detection and personalized customer experiences. Investments in these technologies could offer high growth. However, market share and returns are likely low and uncertain initially.

- Retail AI spending is projected to reach $20.7 billion by 2027.

- AI-powered personalization can boost sales by 10-15%.

- Fraud losses in the finance sector totaled $40 billion in 2023.

Sainsbury's innovative food products and AI investments are Question Marks. These ventures operate in growing markets, like the UK's online grocery market which grew 7.6% in 2024, but currently hold low market share. They require significant investment, as product innovation spending increased 8% in 2024, to potentially become Stars. The goal is to maximize their uncertain returns.

| Area | Market Growth (2024) | Investment Trend (2024) |

|---|---|---|

| Niche Food Products | 12% rise in sales | 8% increase in innovation spending |

| Online Grocery Market | 7.6% growth | Continued digital investments |

| AI Technologies | Projected $20.7B by 2027 | Significant, for personalization |

BCG Matrix Data Sources

Sainsbury's BCG Matrix leverages annual reports, market analysis, competitor data, and industry publications for strategic accuracy.