J. Front Retailing SWOT Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

J. Front Retailing Bundle

J. Front Retailing's impressive brand portfolio and established customer loyalty form a solid foundation of strengths. However, the competitive retail landscape presents significant threats, while evolving consumer preferences pose challenges to their traditional model. Understanding these dynamics is crucial for navigating the future.

Want the full story behind J. Front Retailing's strengths, risks, and growth drivers? Purchase the complete SWOT analysis to gain access to a professionally written, fully editable report designed to support planning, pitches, and research.

Strengths

J. Front Retailing's diversified business portfolio is a key strength, encompassing core department stores like Daimaru and Matsuzakaya, along with shopping centers such as PARCO, real estate development, and credit finance. This broad operational scope significantly reduces its dependency on any single market segment, fostering greater financial resilience. For example, the Developer Business has demonstrated robust growth, positively impacting the company's overall revenue streams.

J. Front Retailing enjoys significant strength from its deeply ingrained brand recognition and rich heritage, particularly through its flagship department stores, Daimaru and Matsuzakaya. These names are synonymous with quality and prestige in Japan, boasting a history that spans centuries.

This long-standing reputation cultivates a loyal customer base, especially among affluent domestic shoppers and international tourists seeking premium retail experiences. For instance, in the fiscal year ending February 2024, Daimaru and Matsuzakaya department stores contributed substantially to J. Front Retailing's overall sales, underscoring their enduring appeal.

J. Front Retailing benefits from its considerable real estate holdings and strong development capabilities. This dual advantage allows the company not only to manage and operate its properties but also to undertake significant urban development initiatives.

These capabilities are evident in projects like the Tenjin-2-chome South Block development, showcasing their capacity for strategic urban revitalization. The Landmark Nagoya Sakae project further exemplifies their ability to create value through integrated property management and development.

By leveraging these assets, J. Front Retailing can generate new revenue streams and enhance the overall value of its property portfolio, moving beyond traditional retail operations.

Beneficiary of Inbound Tourism Surge

J. Front Retailing is a significant beneficiary of the robust inbound tourism trend, particularly evident in Japan during 2024 and extending into early 2025. This surge in international visitors has directly translated into increased sales for the company's department store segment. The 'bakugai' or spending craze, fueled by record visitor numbers and higher per-capita spending, has been a key driver of this performance.

Key impacts include:

- Increased Foot Traffic and Sales: Department stores like Daimaru and Matsuzakaya have seen a substantial rise in customers, especially those from overseas, leading to higher transaction volumes.

- Higher Average Spending: Tourists are demonstrating a propensity for purchasing higher-value items, including luxury goods, cosmetics, and watches, which are core offerings in J. Front Retailing's stores.

- Revenue Growth: The tourism boom has contributed directly to revenue growth, enhancing the company's overall financial performance in the recent periods.

- Market Share Gains: By effectively catering to the needs of inbound tourists, J. Front Retailing is likely solidifying or expanding its market share within the competitive retail landscape.

Commitment to Digitalization and Omnichannel Strategy

J. Front Retailing is demonstrating a strong commitment to digitalization, investing heavily in its e-commerce platforms and upgrading in-store technology. This focus aims to provide customers with the seamless shopping experiences they now expect, blending online and offline interactions. For instance, the Ashita Kenzei outlet within Daimaru Matsuzakaya exemplifies this, enabling customers to interact with products in person and then conveniently order them online using QR codes, showcasing an agile response to contemporary retail demands.

This omnichannel strategy is crucial for staying competitive. In fiscal year 2023, J. Front Retailing reported a significant increase in online sales, contributing to overall revenue growth. The company's continued investment in digital infrastructure, including data analytics and personalized marketing, is expected to further enhance customer engagement and drive sales in the coming years, solidifying its position in the evolving retail landscape.

- Digital Investment: J. Front Retailing is prioritizing digital transformation initiatives.

- Omnichannel Approach: Integrating online and offline channels for a unified customer journey.

- Customer Experience Focus: Enhancing convenience and personalization through technology.

- Sales Growth: Online sales saw a notable uptick in fiscal year 2023, supporting overall performance.

J. Front Retailing's diversified business structure, spanning department stores, shopping centers, real estate, and credit finance, provides significant stability. This broad operational base shields the company from over-reliance on any single sector, contributing to its financial resilience.

The company commands strong brand equity through its heritage department stores, Daimaru and Matsuzakaya. These established names resonate with quality and tradition, fostering a loyal customer following among both domestic and international shoppers seeking premium experiences.

J. Front Retailing possesses valuable real estate assets and robust development capabilities, enabling strategic urban projects and the creation of new revenue streams beyond traditional retail. The company's effective leveraging of these assets enhances its property portfolio's overall value.

The significant inbound tourism trend, particularly strong through 2024 and into early 2025, has directly boosted sales in J. Front Retailing's department stores. This surge in international visitors, driven by record numbers and increased per-capita spending, has been a key contributor to recent financial performance.

J. Front Retailing's commitment to digitalization, including investments in e-commerce and in-store technology, is crucial for meeting evolving customer expectations. This omnichannel strategy, evidenced by initiatives like the Ashita Kenzei outlet, aims to create seamless shopping experiences and drive future sales growth.

What is included in the product

Explores the strategic advantages and threats impacting J. Front Retailing’s success by detailing its internal strengths and weaknesses alongside external opportunities and threats.

Offers a clear, actionable roadmap by highlighting J. Front Retailing's competitive advantages and areas for improvement.

Weaknesses

J. Front Retailing's significant reliance on its department store segment, despite efforts at diversification, presents a notable weakness. This traditional model faces inherent challenges in today's rapidly evolving retail environment.

Department store sales have generally lagged behind the growth of other retail categories, such as supermarkets, convenience stores, and especially e-commerce, over the past decade. For instance, while department store sales saw a recovery post-pandemic, the overall growth trajectory for the sector has been more subdued compared to faster-growing segments.

J. Front Retailing's robust performance, particularly from inbound tourism, is quite sensitive to currency shifts. When the yen strengthens, as it did around mid-2025, it makes Japan less affordable for international travelers, directly impacting spending, especially in luxury segments.

This yen appreciation began to curb Japan's price advantage for foreign visitors. For instance, a stronger yen can mean that goods previously seen as bargains become more expensive, potentially leading to a slowdown in the growth of luxury brands and a deceleration in tax-free sales within department stores like those operated by J. Front Retailing.

The volatility of exchange rates presents a clear risk, as it directly influences the discretionary spending power of tourists. For example, if the yen continues to strengthen significantly against major currencies like the US dollar or the Euro, it could lead to a noticeable dip in inbound tourist expenditures, impacting J. Front Retailing's revenue streams.

J. Front Retailing operates in Japan's fiercely competitive retail landscape, where e-commerce giants like Amazon and Rakuten are steadily gaining market share. This online surge, coupled with the enduring strength of convenience stores and supermarkets, puts traditional department store models under pressure. By the end of fiscal year 2024, Japan's e-commerce sales were projected to exceed ¥22 trillion, a significant portion of total retail sales, directly impacting brick-and-mortar establishments.

Furthermore, the rise of domestic private-label brands, known for their attractive price points and quality, presents another formidable challenge. These brands can often capture consumer attention and loyalty by offering compelling value propositions that may divert spending away from J. Front Retailing's offerings. This intensifies the need for differentiation and customer retention strategies in an increasingly crowded marketplace.

Declining Profitability in Payment and Finance Segment

J. Front Retailing's Payment and Finance Business segment experienced a noticeable downturn. For the three months concluding May 31, 2025, both business profit and operating profit within this segment saw a decline. This suggests that the operations related to credit card issuance and administration are facing headwinds, potentially due to rising costs or increased competition, which impacts the group's overall financial performance.

- Declining Segment Profits: Business profit and operating profit in the Payment and Finance segment decreased for the quarter ending May 31, 2025.

- Operational Challenges: This decline points to potential issues in credit card issuance and administration.

- Impact on Group Performance: The segment's struggles could negatively affect J. Front Retailing's consolidated profitability.

Aging Domestic Population and Shifting Consumer Preferences

Japan's rapidly aging population presents a significant challenge, as it can lead to shifts in consumer spending patterns. Older demographics may reduce their spending on discretionary items typically found in department stores, potentially impacting sales volumes. For instance, in 2023, the proportion of individuals aged 65 and over in Japan reached approximately 29.9%, a figure projected to climb higher, indicating a shrinking core customer base for traditional retail formats.

Concurrently, there's a pronounced shift towards digital engagement and online shopping, particularly among younger consumers. This evolving preference demands substantial and ongoing investment in developing robust omnichannel strategies and e-commerce platforms. J. Front Retailing, like its peers, faces the challenge of adapting its business model to meet these digital expectations, which could strain financial resources as it invests in technology and logistics.

- Declining Birthrate Impact: Japan's birthrate continues to fall, exacerbating the aging population trend and potentially leading to a long-term reduction in overall consumer demand for non-essential goods.

- Evolving Retail Expectations: Younger generations prioritize convenience, personalization, and seamless integration between online and physical stores, requiring significant capital expenditure for modernization.

- Digital Transformation Costs: Investing in advanced e-commerce infrastructure, data analytics, and customer relationship management systems to compete in the digital space can be a considerable financial burden.

- Competition from Online Pure-Plays: Traditional retailers like J. Front Retailing must contend with agile online competitors who have lower overheads and are often more adept at catering to digital-native consumers.

J. Front Retailing's reliance on department stores, a sector facing secular decline, remains a key vulnerability. This is compounded by the intensifying competition from e-commerce platforms and nimble private-label brands, which offer compelling value propositions that divert consumer spending. The company's Payment and Finance Business also showed weakness, with declining profits in the quarter ending May 31, 2025, indicating operational headwinds in credit card services.

Furthermore, the company's revenue is highly susceptible to currency fluctuations, particularly the strengthening yen, which dampens inbound tourism spending. Japan's demographic shifts, including an aging population and declining birthrate, pose long-term challenges, potentially shrinking the core customer base for traditional retail formats and overall consumer demand.

The imperative to invest heavily in digital transformation and omnichannel capabilities to meet evolving consumer expectations, especially among younger demographics, presents a significant financial burden and operational challenge.

These factors collectively highlight the need for J. Front Retailing to accelerate its diversification and digital adaptation strategies to mitigate these inherent weaknesses.

Preview the Actual Deliverable

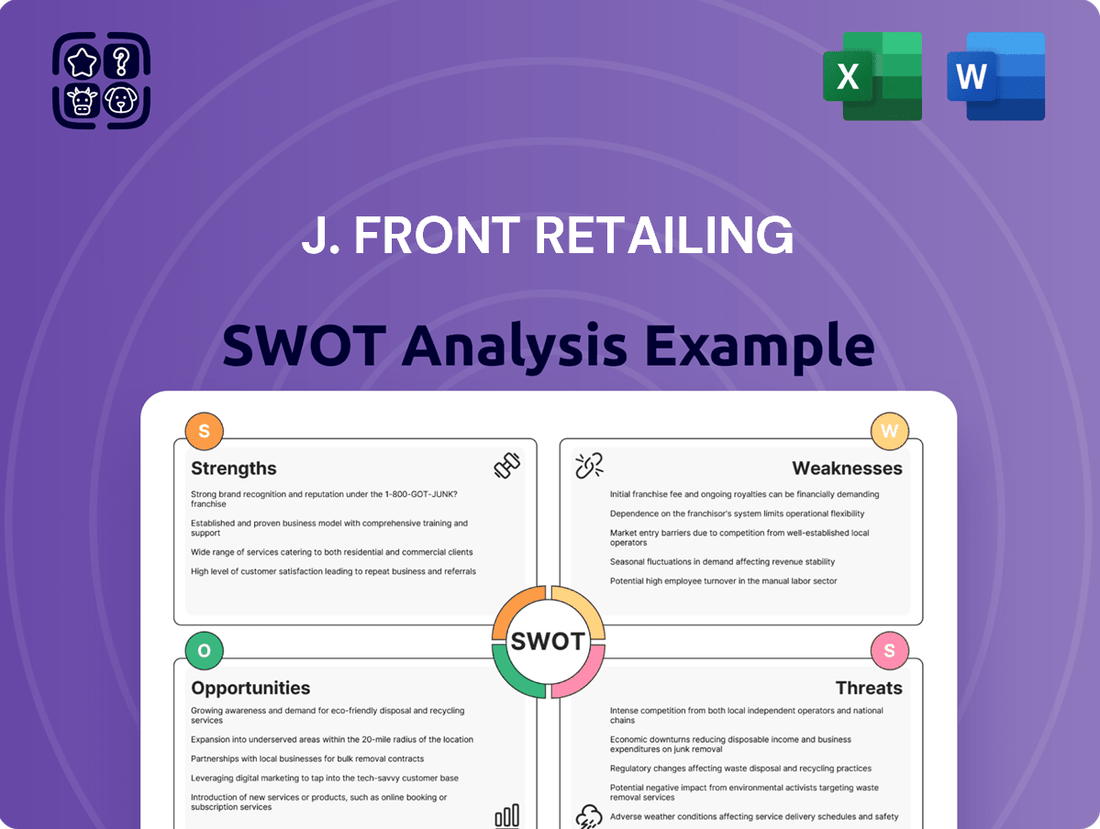

J. Front Retailing SWOT Analysis

The file shown below is not a sample—it’s the real J. Front Retailing SWOT analysis you'll download post-purchase, in full detail. You'll gain a comprehensive understanding of the company's internal Strengths and Weaknesses, alongside external Opportunities and Threats. This allows for informed strategic planning.

Opportunities

Japan's ambitious target of 60 million annual inbound tourists by 2030, even with recent yen fluctuations, signals a significant long-term growth avenue for J. Front Retailing. This presents a prime opportunity to expand their reach and revenue streams within the hospitality and retail sectors.

By refining the duty-free shopping experience, J. Front Retailing can attract more international shoppers. This includes optimizing store layouts, improving multilingual customer service, and streamlining the tax-refund process, making it seamless for tourists.

Expanding services specifically for international visitors, such as personalized shopping assistance, curated local experiences, and exclusive brand partnerships, will enhance their overall customer journey. This tailored approach can drive higher spending and customer loyalty.

Strategically promoting high-value luxury goods and unique Japanese artisanal products can capitalize on tourist spending habits. For instance, highlighting traditional crafts or exclusive collaborations can appeal to visitors seeking authentic and premium souvenirs, further boosting sales for J. Front Retailing.

J. Front Retailing can capitalize on Japan's growing preference for seamless online and offline shopping by broadening its digital footprint. This includes enhancing its e-commerce platforms and exploring new digital retail innovations to meet evolving consumer expectations.

Investing in cutting-edge AI for inventory management presents a significant opportunity to streamline operations and reduce costs. This technology can predict demand more accurately, leading to optimized stock levels and improved efficiency across J. Front Retailing's diverse store formats.

Augmented reality (AR) shopping experiences offer a novel way to engage customers, allowing them to virtually try on clothes or visualize products in their homes. This digital enhancement can drive sales and create a more immersive and memorable shopping journey, potentially boosting customer loyalty and conversion rates.

For the fiscal year ending February 2024, J. Front Retailing reported online sales contributing 11.5% of total revenue, a figure poised for growth as they expand these omnichannel capabilities.

J. Front Retailing can significantly expand its Developer Business by focusing on mixed-use urban development, blending retail with entertainment and residential components. This strategy taps into growing consumer demand for integrated living and leisure spaces.

The company's success in projects like the Shinsaibashi Project demonstrates its capability to create attractive urban landmarks. These developments not only generate immediate revenue but also foster long-term, stable income streams through property management and leasing.

Collaborations with international real estate firms can bring in crucial expertise and capital, enhancing the scale and sophistication of development projects. Such partnerships are vital for navigating complex urban planning and construction processes, as seen in major global city developments.

By revitalizing urban areas, J. Front Retailing can create significant value, not just financially but also for the communities it serves. This approach aligns with broader trends in sustainable urban planning and economic regeneration, potentially attracting further investment and government support.

Premiumization of Private Label Products

J. Front Retailing can capitalize on the growing consumer demand for premium private label products. As consumers increasingly seek quality and value, elevating in-house brands presents a significant opportunity. This trend is supported by data showing a rise in private label sales, with some categories seeing double-digit growth in recent years. For instance, in 2023, private label penetration in the grocery sector reached new highs, indicating a broader consumer acceptance across retail segments.

By focusing on premiumization, J. Front Retailing can differentiate itself from competitors and capture higher profit margins. This strategy aligns with evolving consumer preferences for organic, plant-based, and specialty diet options, which are often associated with higher price points and greater consumer loyalty. This move can provide a competitive edge, particularly against general retailers who may not offer the same curated or quality-focused private label assortments.

- Opportunity: Elevate private label offerings to premium status.

- Consumer Trend: Growing demand for high-quality, specialized products (organic, plant-based).

- Financial Benefit: Potential for higher profit margins and increased business stability.

- Competitive Advantage: Differentiation against general retailers lacking curated private labels.

Mergers, Acquisitions, and Strategic Partnerships

The Japanese retail sector is experiencing a notable trend of consolidation, creating fertile ground for J. Front Retailing to pursue strategic mergers and acquisitions. This consolidation presents a clear opportunity for the company to enhance its scale, operational efficiency, and overall market resilience amidst increasing competition. For instance, in fiscal year 2023, the Japanese retail market saw a number of significant M&A activities, with companies seeking to bolster their market share and competitive edge. J. Front Retailing can capitalize on this by targeting smaller, specialized retailers that offer complementary product lines or unique customer experiences, thereby diversifying its portfolio.

Forming strategic partnerships is another avenue for growth and market expansion. By collaborating with other retailers or even companies in related industries, J. Front Retailing can broaden its customer reach and introduce innovative offerings. This could involve joint ventures for e-commerce platforms or co-branded store concepts. The benefits are amplified by the potential to share resources and mitigate risks. For example, a partnership could provide access to new geographic markets or customer demographics that would be costly to penetrate independently.

- Acquire specialty retailers to broaden product assortment and customer base.

- Form strategic alliances to expand market reach and distribution channels.

- Leverage consolidation trends to achieve economies of scale and operational efficiencies.

- Diversify offerings through partnerships to cater to evolving consumer demands.

Japan's target of 60 million inbound tourists by 2030 presents a substantial opportunity for J. Front Retailing to enhance its retail and hospitality services, particularly through optimized duty-free shopping and curated experiences for international visitors. By leveraging digital advancements, including AI for inventory management and AR for immersive shopping, the company can improve operational efficiency and customer engagement, with online sales already representing 11.5% of total revenue in FY2024. Furthermore, strategic expansion of its Developer Business into mixed-use urban developments, like the successful Shinsaibashi Project, can create long-term, stable income streams and community value. The company can also capitalize on market consolidation by acquiring specialty retailers and forming strategic partnerships to expand its reach and diversify its offerings, thereby strengthening its competitive position.

Threats

The escalating competition within Japan's e-commerce sector presents a considerable threat to J. Front Retailing. With the Japanese e-commerce market anticipated to hit $206.8 billion by 2025, the shift towards online purchasing, driven by convenience and better pricing, is undeniable. This trend directly challenges traditional brick-and-mortar retail models.

The increasing presence of global e-commerce giants, such as Alibaba's 'TAO' platform, further amplifies this competitive pressure. These international players often possess vast resources and established logistics networks, allowing them to offer aggressive pricing and a wider product selection. This can lead to a significant erosion of J. Front Retailing's market share if the company cannot effectively adapt its strategies to compete in the digital space.

Despite some signs of economic recovery, persistent uncertainties in Japan, such as ongoing inflationary pressures and a dip in real wages, pose a significant threat to J. Front Retailing. These factors could curb domestic consumer spending, directly impacting sales, especially for discretionary and luxury goods typically found in department stores.

For instance, if consumer confidence wavers due to these economic headwinds, it could lead to a slowdown in the overall retail sector, affecting J. Front Retailing's top-line growth. Data from the Japanese government in early 2024 indicated that while nominal wages saw some increases, real wages continued to struggle, suggesting less disposable income for many households.

While J. Front Retailing benefits from robust tourism, the rise of overtourism presents a significant threat. This situation can create negative sentiment among local communities and has led authorities in popular destinations to consider or implement stricter regulations. For instance, cities like Venice have introduced visitor taxes, and some natural attractions are capping daily entries. Such measures could indirectly reduce the overall flow of tourists into retail centers, potentially impacting J. Front Retailing's sales volumes.

Supply Chain Disruptions and Rising Operational Costs

Global economic uncertainty, including the impact of tariffs and ongoing inflation, presents a significant threat by increasing the cost of goods and potentially disrupting J. Front Retailing's supply chain. This makes it harder to predict and manage inventory.

In Japan specifically, a tightening labor market is driving up wages. This directly impacts operational costs for large retailers like J. Front Retailing, putting pressure on their profit margins.

- Rising Labor Costs: J. Front Retailing faces increased expenses due to wage hikes in Japan's tight labor market.

- Supply Chain Volatility: Global tariffs and inflation contribute to higher sourcing costs and potential disruptions.

- Margin Squeeze: The combination of increased costs and competitive pricing pressures threatens retail profitability.

Shifting Retail Landscape and Consumer Loyalty

The retail sector in Japan is undergoing a significant transformation, with consumers placing a premium on integrated online and offline shopping journeys. J. Front Retailing, like other traditional department stores, faces the challenge of adapting its offerings to meet these evolving demands. Failure to provide a truly seamless omnichannel experience, coupled with a keen consumer focus on price and value, could lead to a dilution of customer loyalty.

Consumers are increasingly drawn to specialized retailers and robust online marketplaces that can offer convenience and competitive pricing. For instance, the e-commerce market in Japan saw substantial growth, with total retail e-commerce sales reaching an estimated ¥20.1 trillion (approximately $135 billion USD) in 2024, a figure projected to continue climbing. This shift presents a direct threat as department stores may lose market share if they cannot effectively compete with the agility and targeted offerings of online platforms and discount chains.

- Omnichannel Expectations: Japanese shoppers are actively seeking integrated experiences across physical stores and digital channels.

- Price Sensitivity: Consumers remain highly attuned to value, making price competitiveness a crucial factor in purchasing decisions.

- Competition from Specialists: Niche retailers and online platforms offer tailored selections that can outmaneuver broad-appeal department stores.

- E-commerce Dominance: The continued expansion of online retail channels poses a persistent challenge to traditional brick-and-mortar models.

The intensifying competition from domestic and international e-commerce platforms poses a significant threat, especially as Japan's online retail market is projected to reach $206.8 billion by 2025. Global players like Alibaba's 'TAO' platform bring vast resources, potentially eroding J. Front Retailing's market share. Additionally, persistent economic uncertainties, including inflation and stagnant real wages, could dampen consumer spending, impacting sales of discretionary items. For example, while nominal wages increased in early 2024, real wages lagged, indicating less disposable income.

Overtourism, while beneficial, also presents a risk. As destinations implement stricter regulations, such as visitor caps or taxes, tourist flows into retail hubs could decrease, affecting sales. Global economic volatility, including tariffs and inflation, further increases the cost of goods and risks supply chain disruptions, squeezing profit margins. A tightening labor market in Japan is also driving up wages, directly increasing operational costs and impacting profitability.

| Threat Category | Specific Threat | Impact on J. Front Retailing | Supporting Data/Trend |

|---|---|---|---|

| Competition | E-commerce Growth | Market share erosion, pressure on pricing | Japan's e-commerce market to reach $206.8B by 2025 |

| Economic Factors | Inflation & Wage Stagnation | Reduced consumer spending, lower sales | Real wages struggled in early 2024 despite nominal wage increases |

| Operational Costs | Rising Labor Costs | Increased operational expenses, margin pressure | Tight labor market in Japan driving wage hikes |

| Consumer Behavior | Demand for Omnichannel & Value | Risk of customer loyalty dilution if experience is not seamless | Consumers seek integrated online/offline journeys and competitive pricing |

SWOT Analysis Data Sources

This SWOT analysis leverages a comprehensive blend of data sources, including J. Front Retailing's official financial reports, detailed market research on the retail sector, and insights from industry experts to provide a robust strategic overview.