J. Front Retailing Business Model Canvas

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

J. Front Retailing Bundle

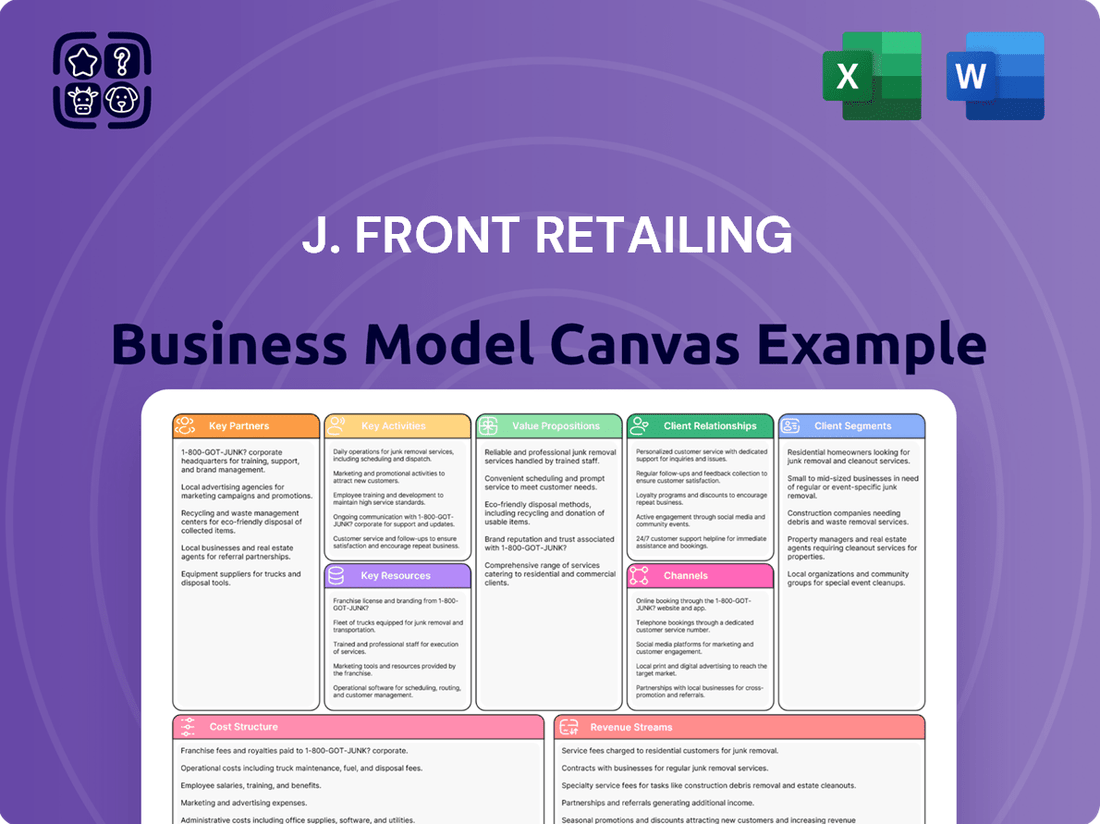

Uncover the intricate workings of J. Front Retailing's success with our comprehensive Business Model Canvas. This detailed breakdown illuminates their customer relationships, key resources, and revenue streams, offering a clear view of their strategic advantages. It’s a must-have for anyone seeking to understand retail innovation and competitive strategy.

Dive into the core of J. Front Retailing's operational framework with the full Business Model Canvas. This professionally crafted document provides a granular look at their value propositions and cost structures, essential for strategic analysis and benchmarking. Acquire the complete canvas to gain a competitive edge.

Partnerships

J. Front Retailing actively cultivates partnerships with a curated selection of luxury brands and renowned fashion houses. This strategic alliance is fundamental to their business model, enabling the exclusive offering of sought-after products and limited-edition collections across their prestigious Daimaru and Matsuzakaya department stores. For instance, in fiscal year 2023, J. Front Retailing reported a significant portion of its revenue derived from its department store segment, where these luxury brand collaborations play a pivotal role in attracting high-net-worth individuals.

These collaborations are not merely about product availability; they are instrumental in solidifying J. Front Retailing's premium brand positioning and attracting a discerning, affluent customer base. By aligning with globally recognized luxury names, the company reinforces its image as a destination for quality and exclusivity, thereby driving foot traffic and sales. The consistent success of these partnerships is reflected in the overall customer loyalty and spending patterns observed within their flagship stores.

The inclusion of exclusive merchandise from these esteemed partners directly contributes to a differentiated and elevated shopping experience. This strategy ensures that J. Front Retailing’s stores remain attractive to consumers seeking unique items and the prestige associated with high-end fashion, ultimately enhancing customer satisfaction and encouraging repeat business. The company's commitment to these partnerships underscores its dedication to providing a superior retail environment.

J. Front Retailing's strategic alliances with real estate developers and property owners are foundational to its expansion, particularly within its real estate segment. These collaborations are crucial for securing and developing high-value locations for its retail and mixed-use properties, exemplified by projects like the Landmark Nagoya Sakae.

These partnerships enable J. Front Retailing to access prime real estate opportunities, which is vital for growing its shopping center portfolio, including iconic brands like PARCO. By teaming up with developers, the company can efficiently acquire and develop sites, thereby strengthening its physical presence in key urban areas.

The company's involvement in projects such as the Shinsaibashi Project underscores the importance of these relationships in creating integrated urban environments. These developments often blend retail spaces with other functionalities, enhancing their attractiveness and revenue potential.

For instance, in fiscal year 2024, J. Front Retailing continued to invest in and develop its properties, leveraging these partnerships to ensure optimal site selection and construction. This strategic approach allows for the seamless integration of retail operations with broader urban development goals.

J. Front Retailing actively collaborates with major financial institutions and credit card companies. This strategic alliance is crucial for managing its proprietary credit card offerings, such as the PARCO CARD and the JFR Card. These partnerships are foundational to the company's payment and finance division, enabling seamless transactions and rewarding customer loyalty.

These collaborations are designed to bolster customer engagement and unlock new revenue streams through financial services. For instance, by facilitating credit and payment solutions, J. Front Retailing enhances the overall shopping experience, encouraging repeat business and deeper customer relationships. This strategic alignment with financial partners is a cornerstone of their customer value proposition.

Technology and Digital Solution Providers

J. Front Retailing actively cultivates partnerships with technology and digital solution providers, recognizing their pivotal role in advancing its digital transformation and omnichannel ambitions. These collaborations are instrumental in deploying cutting-edge solutions across its retail operations.

Key collaborations focus on enhancing customer experiences through sophisticated digital tools. For instance, investments in e-commerce platforms and AI-driven inventory management systems are designed to streamline operations and personalize customer interactions.

The company also leverages partnerships to develop multilingual applications, aiming to broaden its customer reach and improve accessibility. These technological integrations are vital for driving innovation and operational efficiency throughout J. Front Retailing's varied business segments.

- E-commerce Platform Enhancement: Collaborations to build and refine robust online sales channels.

- AI-Powered Inventory Management: Partnerships for implementing intelligent systems to optimize stock levels and reduce waste.

- Multilingual App Development: Joint efforts to create user-friendly mobile applications that cater to a diverse customer base.

- Data Analytics and Personalization: Working with providers to leverage data for personalized marketing and product recommendations.

Local Businesses and Cultural Organizations

J. Front Retailing actively cultivates relationships with local businesses and cultural institutions to foster community vibrancy and deliver distinctive customer experiences. These collaborations are instrumental in showcasing and distributing regional products, thereby supporting local economies.

Through joint events and initiatives, J. Front Retailing strengthens its connection with the community, offering unique, localized value propositions that resonate with its diverse customer base. For instance, in 2024, the company continued its efforts to highlight artisanal crafts and regional specialties, contributing to the economic well-being of the areas in which it operates.

- Community Engagement: Partnerships with cultural organizations enhance J. Front Retailing's role as a community hub.

- Product Diversification: Collaborations with local businesses introduce unique, regionally sourced products to customers.

- Economic Impact: Supporting local producers and artisans contributes to local economic development.

- Customer Experience: Offering exclusive local goods and culturally relevant events differentiates J. Front Retailing's offerings.

J. Front Retailing's key partnerships are multifaceted, extending from luxury brand collaborations that drive its department store segment to strategic alliances with real estate developers crucial for its property ventures. Financial institutions and technology providers are also vital partners, supporting payment systems and digital transformation initiatives.

These collaborations are essential for product sourcing, market positioning, and operational efficiency. For example, in the fiscal year ending February 2024, J. Front Retailing's department store revenue remained a significant contributor, underscoring the importance of its brand partnerships in attracting and retaining customers. The company's ongoing investment in its real estate segment, including the development of properties like PARCO, further highlights the reliance on developer partnerships.

| Partner Type | Purpose | Impact Example (FY24) |

|---|---|---|

| Luxury Brands | Exclusive product offerings, brand prestige | Drove significant sales in Daimaru/Matsuzakaya, attracting affluent clientele. |

| Real Estate Developers | Property acquisition and development | Facilitated expansion and modernization of retail spaces, including PARCO properties. |

| Financial Institutions | Payment processing, loyalty programs | Supported proprietary card services (e.g., PARCO CARD), enhancing customer engagement. |

| Technology Providers | Digital transformation, e-commerce | Enabled improvements in online sales channels and customer data analytics. |

What is included in the product

A comprehensive business model canvas detailing J. Front Retailing's strategy, covering its diverse customer segments, multi-channel approach, and value propositions across its department store and specialty store businesses.

Reflects J. Front Retailing's real-world operations by outlining key partners, activities, resources, cost structures, and revenue streams within its retail ecosystem.

Simplifies understanding complex retail operations by visually mapping J. Front Retailing's value proposition and customer segments.

Offers a clear framework to identify and address challenges within J. Front Retailing's diverse customer relationships and revenue streams.

Activities

Operating department stores, primarily Daimaru and Matsuzakaya, is J. Front Retailing's central activity. This encompasses managing a diverse product range, from fashion and beauty to home goods and food, ensuring effective merchandising and stock control. Customer experience is paramount, with a focus on high-quality in-store service.

Strategic efforts are invested in store renovations and curating appealing product assortments. This approach aims to draw in both local shoppers and international tourists. For example, J. Front Retailing reported net sales of ¥726.9 billion for the fiscal year ending February 2024, with department store operations forming the backbone of this revenue.

J. Front Retailing's core activity involves developing and managing shopping centers, with the PARCO brand being a prime example. This encompasses securing tenants, managing leases, and curating appealing retail spaces designed to draw in a wide range of shoppers. The company's strategy actively aims to rejuvenate urban districts, a significant driver for increasing foot traffic and consumer engagement.

A key element of this is attracting diverse customer segments, with a particular emphasis on inbound tourists, reflecting a broader trend in retail strategy. For instance, in fiscal year 2023, PARCO's revenue saw a notable increase, driven by robust performance across its retail properties, signaling successful engagement with its target demographics. This development and management function is crucial for creating vibrant commercial hubs.

J. Front Retailing's key activities center on its robust real estate development and leasing operations. This involves not only leasing out its extensive property portfolio but also actively developing new mixed-use buildings. These ventures are supported by specialized subsidiaries, J. Front Design & Construction and J. Front City Development, which handle interior design and construction services.

This strategic diversification is a major driver for J. Front Retailing, allowing it to maximize the value of its considerable real estate assets. By developing and managing these properties, the company secures a consistent stream of rental income, contributing significantly to its overall financial stability and profitability.

Credit Finance and Payment Services

J. Front Retailing's credit finance and payment services are central to its customer loyalty and revenue generation. The company issues and manages its own credit cards, like the JFR Card and PARCO Card, which are instrumental in driving sales within its department stores and affiliated businesses.

These services go beyond simple transactions. They encompass robust loyalty programs that incentivize repeat purchases and build lasting customer relationships. By offering financial convenience and tailored rewards, J. Front Retailing aims to increase customer lifetime value and secure a steady stream of revenue from interest and transaction fees.

In fiscal year 2023, J. Front Retailing reported that its credit card business, which includes the aforementioned services, played a significant role in its overall financial performance, contributing to both sales growth and profitability. The ongoing development of these payment solutions is a strategic imperative to maintain competitiveness and adapt to evolving consumer spending habits.

- Credit Card Operations J. Front Retailing actively manages credit card issuance and processing, fostering customer engagement through proprietary cards like the JFR Card and PARCO Card.

- Loyalty Program Integration These payment services are deeply integrated with loyalty programs, rewarding customers and encouraging sustained patronage across the group's retail outlets.

- Revenue Contribution The credit finance segment is a key contributor to J. Front Retailing's overall revenue, generating income from interest, fees, and increased sales driven by card usage.

- Customer Relationship Management By offering convenient payment options and valuable rewards, the company strengthens its connection with customers, enhancing retention and brand loyalty.

Digital Transformation and Omnichannel Integration

J. Front Retailing is heavily invested in digital transformation, a key activity that underpins its business model. This involves building robust e-commerce platforms and leveraging advanced data analytics to understand customer behavior across all touchpoints.

The company is actively upgrading in-store technology to ensure a consistent and seamless omnichannel experience. This integration aims to bridge the gap between online browsing and physical purchasing, making it easier for customers to interact with the brand.

These efforts are designed to boost customer satisfaction by offering convenience and personalization. For example, J. Front Retailing has seen positive results from its digital initiatives, with online sales contributing a growing portion of revenue. In fiscal year 2023, the company reported increased online sales, reflecting the success of its digital transformation strategy.

- E-commerce Platform Enhancement: Continuous improvement of online shopping interfaces for better user experience.

- Data Analytics Implementation: Utilizing customer data to personalize offers and optimize marketing efforts.

- In-Store Technology Integration: Deploying tools like digital signage and improved POS systems to connect online and offline channels.

- Omnichannel Strategy: Creating a unified brand experience that allows customers to shop seamlessly across all platforms.

J. Front Retailing's key activities revolve around the strategic development and leasing of retail properties, notably under the PARCO brand. This involves managing tenant relationships, curating appealing retail environments, and revitalizing urban areas to drive foot traffic. The company actively targets diverse customer segments, including inbound tourists, to enhance engagement and sales performance. For example, PARCO's robust performance in fiscal year 2023 demonstrated the effectiveness of its property management and tenant mix strategies.

Furthermore, the company's department store operations, primarily Daimaru and Matsuzakaya, remain a cornerstone. This includes meticulous merchandising, inventory management, and a strong emphasis on high-quality in-store customer service. Strategic investments in store renovations and product assortment curation are ongoing to attract a broad customer base. In the fiscal year ending February 2024, department store sales contributed significantly to the ¥726.9 billion in net sales, underscoring their central role.

Digital transformation is another critical activity, focusing on enhancing e-commerce platforms and implementing advanced data analytics. The company is also upgrading in-store technology to create a seamless omnichannel experience, bridging online and offline interactions. These initiatives aim to improve customer satisfaction through personalization and convenience, with online sales showing a notable increase in fiscal year 2023, validating the digital strategy.

Finally, J. Front Retailing actively manages credit finance and payment services, including proprietary credit cards like the JFR Card and PARCO Card. These services are integrated with loyalty programs to encourage repeat business and build customer relationships. This segment is a significant revenue driver, generating income from fees and increased sales, and was highlighted as a key contributor to financial performance in fiscal year 2023.

Full Version Awaits

Business Model Canvas

The J. Front Retailing Business Model Canvas preview you see is the actual document you will receive upon purchase. This isn't a sample or a mockup; it's a direct representation of the complete file. You'll gain immediate access to this same professionally structured and formatted Business Model Canvas, ensuring exactly what you preview is what you'll get.

Resources

J. Front Retailing's brand portfolio, featuring Daimaru, Matsuzakaya, and PARCO, is a cornerstone of its business model, embodying significant heritage and consumer trust. These brands are not just names; they represent a long-standing commitment to quality and luxury, which is a powerful draw for both domestic and international shoppers.

The established recognition and prestige of Daimaru, Matsuzakaya, and PARCO create a substantial competitive advantage. This strong brand equity translates directly into customer loyalty and a consistent ability to attract shoppers, underpinning J. Front Retailing's market position and revenue generation.

In fiscal year 2023, J. Front Retailing reported net sales of ¥774.2 billion. This performance is significantly influenced by the enduring appeal and reputation of its core brands, which continue to command premium positioning in the retail landscape.

J. Front Retailing boasts a significant physical presence, operating numerous department stores and shopping centers strategically situated in prime urban areas throughout Japan. This extensive retail and real estate footprint is a cornerstone of their business model.

As of fiscal year 2023, J. Front Retailing managed a portfolio of 19 department stores and several large-scale shopping complexes. These prime locations are crucial for attracting high foot traffic and ensuring broad customer accessibility.

The company's real estate assets, comprising both owned and managed properties, offer a stable foundation and present ongoing opportunities for value creation through redevelopment and expansion initiatives.

J. Front Retailing recognizes that its people are a cornerstone of its success. This includes a highly skilled team, from seasoned retail associates and specialized luxury sales experts to adept real estate development professionals and astute financial service advisors.

To ensure exceptional customer experiences and drive innovation, J. Front Retailing invests significantly in employee development. For instance, in fiscal year 2024, the company continued its commitment to training programs aimed at enhancing service quality and fostering new ideas across all its diverse business units.

Financial Capital and Investment Capacity

J. Front Retailing's substantial financial capital is a cornerstone of its business model, enabling ambitious real estate developments and significant technology investments. This financial muscle allows the company to effectively manage its varied operational portfolio, ensuring resources are available for critical growth initiatives.

The company's robust financial standing directly fuels its capacity for strategic acquisitions, crucial renovations, and vital sustainability projects. These investments are designed to bolster long-term growth trajectories and maintain operational stability across its business segments.

- Real Estate Development: J. Front Retailing leverages its financial capital for large-scale projects, such as the redevelopment of its flagship Daimaru Shinsaibashi store.

- Technology Investment: Significant financial resources are allocated to digital transformation, enhancing customer experience and operational efficiency.

- Strategic Acquisitions: The company's financial strength supports opportunistic acquisitions to expand its market presence and service offerings.

- Sustainability Initiatives: Financial capital is directed towards environmental, social, and governance (ESG) improvements, aligning with long-term business resilience.

Advanced Technology and Data Infrastructure

J. Front Retailing's investment in advanced technology and data infrastructure is fundamental to its business model. This includes significant capital allocated to robust digital platforms, sophisticated inventory management systems, and cutting-edge customer data analytics tools. These technological assets are vital for integrating their retail, real estate, and finance operations, enabling a seamless omnichannel experience for customers.

The company leverages this infrastructure to drive efficiency and informed decision-making. For instance, their customer data analytics tools allow for personalized marketing and product recommendations, enhancing customer engagement and loyalty. This data-driven approach supports strategic planning across all business segments.

Key technological resources at J. Front Retailing include:

- Digital Platforms: Enabling online sales and customer interaction.

- Inventory Management Systems: Ensuring efficient stock control and availability.

- Customer Data Analytics: Providing insights for personalized marketing and service.

- Omnichannel Solutions: Integrating online and offline retail experiences.

In fiscal year 2023, J. Front Retailing continued to prioritize digital transformation, with efforts focused on enhancing their e-commerce capabilities and data utilization to better understand and serve their customer base across all its diverse business units.

J. Front Retailing's brand portfolio, including Daimaru, Matsuzakaya, and PARCO, is a critical asset. These well-established names carry significant heritage and customer trust, forming the bedrock of its retail operations. The prestige associated with these brands directly contributes to customer loyalty and attracts a broad customer base, reinforcing the company's market standing.

The company's extensive real estate holdings, comprising numerous department stores and shopping centers in prime urban locations across Japan, are a significant resource. As of fiscal year 2023, J. Front Retailing operated 19 department stores and several large shopping complexes, capitalizing on high foot traffic and accessibility to drive sales. These properties not only generate rental income but also provide opportunities for future development and value enhancement.

J. Front Retailing's human capital, encompassing skilled retail staff, luxury sales experts, real estate developers, and financial advisors, is a key resource. The company's commitment to employee development, evident in its ongoing training programs in fiscal year 2024, ensures high service quality and fosters innovation across its diverse business units.

The company's financial strength enables strategic investments in real estate development, such as the redevelopment of its Daimaru Shinsaibashi store, and crucial technology upgrades. This robust financial backing supports acquisitions, renovations, and sustainability projects, underpinning long-term growth and operational stability across all segments.

Advanced technology and data infrastructure are fundamental to J. Front Retailing's business model, supporting digital platforms, inventory management, and customer analytics. In fiscal year 2023, the company continued its digital transformation efforts, enhancing e-commerce capabilities and data utilization to better understand and serve its customer base.

| Key Resource | Description | Fiscal Year 2023 Impact |

| Brand Portfolio | Daimaru, Matsuzakaya, PARCO - heritage, trust, prestige | ¥774.2 billion net sales |

| Real Estate Footprint | 19 department stores, multiple shopping complexes in prime locations | High foot traffic and accessibility |

| Human Capital | Skilled employees across retail, real estate, finance | Ongoing investment in training (FY2024) for service quality |

| Financial Capital | Enables development, technology, acquisitions, sustainability | Supports strategic growth and operational stability |

| Technology & Data Infrastructure | Digital platforms, inventory systems, customer analytics | Enhanced e-commerce and data utilization |

Value Propositions

J. Front Retailing distinguishes itself by offering a carefully chosen range of premium and luxury goods, prominently featured in its flagship Daimaru and Matsuzakaya department stores. This curated selection encompasses high-end fashion, sought-after cosmetics, and gourmet food products, catering to a discerning clientele.

This value proposition directly targets consumers who prioritize exclusivity, authenticity, and brand prestige in their purchases. The emphasis on these luxury segments has proven to be a significant driver of revenue, particularly from international visitors.

For instance, during the fiscal year ending February 2024, J. Front Retailing reported robust sales, with luxury goods playing a key role in attracting high-spending customers. Inbound tourist spending, a major contributor, saw a notable increase, reflecting the appeal of their curated luxury offerings.

J. Front Retailing excels at weaving together shopping with a vibrant tapestry of dining, entertainment, and cultural happenings. This approach transforms its retail spaces, like PARCO, into dynamic lifestyle hubs, featuring unique attractions such as character cafes that draw in specific fan bases.

The company's strategy focuses on enriching customer lives by offering a spectrum of engaging activities and appealing environments. This moves beyond mere transactions to create memorable experiences that resonate with a broader audience.

By curating these integrated lifestyle experiences, J. Front Retailing cultivates destinations that naturally encourage visitors to stay longer and return more often. For instance, PARCO’s continued success in urban centers demonstrates the appeal of this multifaceted approach.

This integrated model drives customer loyalty and fosters a deeper connection with the brand. It’s about building a lifestyle proposition, not just selling products.

J. Front Retailing's department stores and shopping centers are positioned as convenient urban anchors, offering shoppers easy access and a variety of amenities. These prime locations often integrate services such as ample parking, diverse dining options, and crucial tax-exemption counters specifically catering to international visitors. This comprehensive approach significantly boosts customer convenience and encourages longer, more engaging shopping experiences.

For instance, Daimaru Umeda, a key J. Front Retailing property, is directly connected to Osaka Station, a major transportation nexus. In the fiscal year ending February 2024, J. Front Retailing reported consolidated net sales of ¥779.5 billion, demonstrating the significant foot traffic and commercial activity these urban hubs generate.

Personalized Services and Customer Loyalty Programs

J. Front Retailing cultivates deep customer loyalty through highly personalized services. Their 'gaisho' or personal shopper service caters specifically to high-net-worth individuals, offering tailored shopping experiences that foster strong relationships. This bespoke approach significantly enhances customer satisfaction and encourages repeat patronage.

Loyalty programs, primarily driven by their credit card offerings, further incentivize and reward customers. These programs provide tangible benefits, making customers feel valued and more inclined to continue their spending with the company. By focusing on individual needs and offering exclusive rewards, J. Front Retailing effectively builds lasting customer connections.

For instance, in fiscal year 2023, J. Front Retailing reported robust performance, with total sales reaching ¥390.4 billion. Their strategic emphasis on personalized services and loyalty programs is a key driver in maintaining a strong customer base, which is crucial for sustained growth in the competitive retail landscape.

- Personalized 'Gaisho' Service: Tailored shopping assistance for high-net-worth clientele.

- Credit Card Loyalty Programs: Rewards and benefits designed to retain and attract repeat customers.

- Customer Relationship Building: Focus on individual needs to enhance satisfaction and loyalty.

Sustainable and Responsible Retail Practices

J. Front Retailing is deeply committed to embedding sustainability across its retail operations, actively incorporating eco-friendly materials and championing product lines that resonate with environmentally aware shoppers. This focus directly addresses a significant market trend, as consumers increasingly seek out businesses demonstrating strong corporate social responsibility. In 2024, the company reported a reduction in its Scope 1 and 2 greenhouse gas emissions by 15% compared to its 2020 baseline, a tangible step towards its climate goals.

The company's dedication to reducing its environmental footprint is not just an ethical stance but a strategic business advantage. By prioritizing waste reduction and the use of sustainable resources, J. Front Retailing aligns itself with the escalating consumer demand for ethical and environmentally conscious purchasing choices. This commitment is further solidified by their ongoing investment in supply chain transparency, ensuring that the journey of their products from source to consumer adheres to high sustainability standards.

Here's a look at key aspects of their sustainable practices:

- Eco-friendly Materials: Increased utilization of recycled polyester and organic cotton in apparel lines, contributing to a more circular economy.

- Waste Reduction Initiatives: Implemented comprehensive in-store recycling programs and reduced packaging materials, aiming for a 20% decrease in operational waste by 2025.

- Sustainable Product Promotion: Dedicated marketing campaigns highlighting products with certified sustainability credentials, driving consumer awareness and preference.

- Carbon Emission Targets: Actively working towards achieving carbon neutrality in its direct operations by 2030, evidenced by ongoing energy efficiency upgrades in stores and distribution centers.

J. Front Retailing's core value lies in its curated selection of premium and luxury goods, predominantly found in its prestigious Daimaru and Matsuzakaya department stores. This refined assortment, featuring high-fashion apparel, sought-after cosmetics, and gourmet food items, is designed to appeal to a sophisticated customer base that values exclusivity and brand prestige.

The company further enhances its appeal by transforming its retail environments, such as PARCO, into dynamic lifestyle destinations. These spaces integrate shopping with diverse dining, entertainment, and cultural experiences, creating engaging hubs that encourage longer visits and repeat patronage.

J. Front Retailing also emphasizes convenience and accessibility, positioning its stores as prime urban anchors with excellent transportation links and comprehensive amenities. For instance, Daimaru Umeda's direct connection to Osaka Station facilitates high foot traffic, contributing to the company's ¥779.5 billion in consolidated net sales for the fiscal year ending February 2024.

Personalized customer service is another key value proposition, with initiatives like the 'gaisho' or personal shopper service catering to high-net-worth individuals. Loyalty programs, particularly through their credit card offerings, further incentivize repeat business, reinforcing customer relationships and driving sales, as seen in the ¥390.4 billion total sales reported for fiscal year 2023.

Sustainability is increasingly central, with J. Front Retailing integrating eco-friendly practices and promoting ethically sourced products. In 2024, the company achieved a 15% reduction in Scope 1 and 2 greenhouse gas emissions against its 2020 baseline, aligning with growing consumer demand for responsible retail.

| Value Proposition | Description | Supporting Data/Examples |

|---|---|---|

| Curated Luxury Goods | Offering a premium selection of fashion, cosmetics, and gourmet food in flagship stores. | Daimaru and Matsuzakaya department stores are key venues. |

| Integrated Lifestyle Hubs | Transforming retail spaces into destinations with dining, entertainment, and cultural attractions. | PARCO stores serve as examples of these dynamic hubs. |

| Urban Convenience & Accessibility | Providing prime locations with easy access, parking, and amenities for shoppers. | Daimaru Umeda's connection to Osaka Station. |

| Personalized Customer Service & Loyalty | Offering bespoke services like 'gaisho' and rewarding customers through loyalty programs. | Focus on high-net-worth clients and credit card rewards. |

| Commitment to Sustainability | Incorporating eco-friendly materials and promoting ethical products. | 15% reduction in GHG emissions (Scope 1 & 2) by 2024 vs. 2020 baseline. |

Customer Relationships

J. Front Retailing prioritizes deep customer connections, especially with affluent clients, through its distinctive 'gaisho' personal shopper service. This tailored approach provides a highly curated shopping journey, including access to special merchandise and private events.

The company is actively focusing on re-engaging dormant high-net-worth accounts, aiming to reactivate their spending and loyalty. This strategy underscores a commitment to nurturing long-term relationships within its most valuable customer base.

J. Front Retailing nurtures customer loyalty through its JFR Card and PARCO Card programs, offering tangible benefits like points accumulation and exclusive discounts. These initiatives are designed to encourage sustained engagement and provide crucial insights into shopper behavior. For instance, during the fiscal year ended February 2024, J. Front Retailing reported that its loyalty programs continued to be a significant driver of repeat business across its department store and specialty store segments.

J. Front Retailing cultivates customer relationships through a robust omnichannel strategy, blending physical store experiences with digital touchpoints. This ensures customers can engage with the brand seamlessly, whether browsing in a Daimaru or Matsuzakaya department store, shopping on their e-commerce sites, or utilizing their mobile applications.

The company's commitment to a connected customer journey is exemplified by initiatives like the multilingual Daimaru Matsuzakaya app. This platform is designed to foster ongoing communication and elevate the experience specifically for international visitors, demonstrating a proactive approach to catering to diverse customer needs.

This integrated approach to engagement is crucial in today's retail landscape. For J. Front Retailing, it means providing consistent, accessible, and personalized support across all interaction points, strengthening brand loyalty and driving repeat business in a competitive market.

In-store Events and Experiential Marketing

J. Front Retailing cultivates customer loyalty through engaging in-store events and experiential marketing. These initiatives go beyond typical retail, offering unique pop-up promotions and cultural exhibitions that provide memorable experiences. For instance, hosting art exhibitions or themed cafes transforms shopping into a cultural immersion, fostering a deeper connection with customers.

These events are crucial for building community and enhancing the perceived value of their department stores and shopping centers. By offering these experiences, J. Front Retailing differentiates itself in a competitive market, encouraging repeat visits and strengthening brand affinity.

- Experiential Value: Events like art exhibitions and themed cafes offer unique experiences beyond product purchase.

- Community Building: These activities foster a sense of belonging and connection around J. Front Retailing's properties.

- Brand Differentiation: Experiential marketing sets J. Front Retailing apart from competitors by offering unique customer engagement.

- Customer Loyalty: Memorable experiences contribute to increased customer retention and repeat business.

Direct Marketing and Targeted Communications

J. Front Retailing excels at direct marketing and targeted communications, leveraging customer data to personalize outreach. This ensures that promotions and product launches are highly relevant, fostering stronger customer connections. For instance, by analyzing purchase history, they can send tailored offers for new arrivals in a customer's preferred brand or category, driving repeat business.

This data-driven approach is crucial for maintaining customer engagement and boosting sales conversions. In 2024, J. Front Retailing continued to refine its segmentation strategies, aiming to maximize the impact of its marketing spend. Their efforts focus on delivering timely and pertinent information, which is key to building loyalty in a competitive retail landscape.

- Personalized Offers: J. Front Retailing uses customer data to send specific promotions, enhancing relevance.

- Data-Driven Approach: Analysis of purchase behavior informs targeted communication strategies.

- Customer Engagement: Effective communication maintains interest and encourages repeat purchases.

- Sales Impact: Tailored marketing directly contributes to driving sales performance.

J. Front Retailing cultivates deeply personal relationships, notably through its exclusive 'gaisho' personal shopper service for affluent clients, offering curated experiences and access to special items. Loyalty is further cemented via the JFR and PARCO Card programs, which provide tangible benefits like points and discounts, driving repeat business as evidenced by their continued role in fiscal year 2024 performance. These initiatives, combined with a strong omnichannel strategy and engaging in-store events, foster community and brand differentiation.

| Customer Relationship Strategy | Key Initiatives | Impact/Focus (2024) |

|---|---|---|

| Personalized Service | Gaisho (Personal Shopper) | Targeted engagement with high-net-worth individuals. |

| Loyalty Programs | JFR Card, PARCO Card | Driving repeat purchases and gathering shopper insights. |

| Omnichannel Engagement | In-store, E-commerce, Mobile Apps | Seamless customer journey across all touchpoints. |

| Experiential Marketing | In-store events, Cultural exhibitions | Building community, brand differentiation, and loyalty. |

| Direct & Targeted Marketing | Data-driven personalized outreach | Refining segmentation for marketing effectiveness and sales impact. |

Channels

The core distribution channel for J. Front Retailing remains its flagship Daimaru and Matsuzakaya department stores. These physical locations, situated in prime urban centers across Japan, are the primary touchpoints for customers, offering a curated selection of goods and a high-quality retail environment.

These iconic department stores are integral to J. Front Retailing's brand, embodying a commitment to premium products and customer service. They act as significant anchors for the company's revenue generation and brand visibility, fostering direct customer engagement.

As of fiscal year 2023, J. Front Retailing reported net sales of ¥764.8 billion, with its department store segment being the largest contributor. This highlights the continued importance of these physical channels in the company's overall business model, despite evolving retail landscapes.

PARCO shopping centers serve as a key physical channel for J. Front Retailing, emphasizing fashion, entertainment, and lifestyle. These venues are particularly successful in drawing younger consumers and international tourists, offering unique retail and leisure opportunities that differ from traditional department stores.

In 2023, PARCO Co., Ltd. reported net sales of ¥227.8 billion, highlighting the significant contribution of these specialized centers to the group's overall performance. This channel effectively diversifies J. Front Retailing's physical footprint, catering to evolving consumer preferences for experiential retail.

J. Front Retailing leverages e-commerce platforms and its own online stores to serve customers beyond its brick-and-mortar footprint. This digital presence ensures broader accessibility and convenience, a key component of its omnichannel approach.

The company has experienced substantial growth in its digital sales channels. For instance, in fiscal year 2024, J. Front Retailing reported that its online sales continued to be a significant contributor to overall revenue, demonstrating the success of its digital investments.

These online channels facilitate direct sales of merchandise and also act as crucial touchpoints for digital customer engagement. They allow for interactive experiences and personalized recommendations, further strengthening customer relationships.

The investment in these digital sales channels is central to J. Front Retailing's strategy of creating a seamless shopping experience across both physical and online environments. This integrated approach aims to capture a larger share of the evolving retail market.

Proprietary Credit Cards (JFR Card, PARCO Card)

J. Front Retailing's proprietary credit cards, specifically the JFR Card and PARCO Card, serve as crucial customer engagement and loyalty channels. These cards are more than just payment instruments; they actively foster deeper relationships by offering loyalty points and exclusive benefits, encouraging repeat business and enhancing the customer experience within the retail ecosystem.

These credit card operations are a core component of the company's payment and finance segment, directly facilitating transactions and capturing valuable customer data. For instance, JFR Card members can earn points on purchases, redeemable for discounts or special offers, thereby driving increased spending. Similarly, the PARCO Card provides targeted promotions and financing options, catering to the specific customer base of PARCO stores.

- JFR Card & PARCO Card: Direct customer engagement and loyalty building tools.

- Transaction Facilitation: Key to the payment and finance segment.

- Loyalty Programs: Points systems and exclusive benefits drive repeat purchases.

- Customer Data: Insights gathered inform marketing and product development.

Real Estate Sales and Leasing Offices

J. Front Retailing’s Developer Business relies on specialized real estate sales and leasing offices. These offices are crucial for handling property sales, managing tenant relationships, and overseeing the development lifecycle of their commercial and mixed-use projects.

These dedicated channels allow J. Front Retailing to maintain direct engagement with both property buyers and tenants, fostering strong relationships and ensuring efficient project execution. This direct interaction is key to understanding market needs and delivering successful developments.

- Facilitation of Property Transactions: These offices manage the entire sales process, from initial inquiries to closing deals, ensuring a smooth experience for buyers.

- Tenant Services and Management: They provide ongoing support to commercial tenants, handling lease renewals, addressing concerns, and maintaining tenant satisfaction within the developments.

- Project Management Oversight: The teams within these offices play a vital role in the day-to-day management of development projects, coordinating with various stakeholders to keep projects on track and within budget.

- Direct Client and Partner Interaction: By operating these offices, J. Front Retailing ensures personalized service and builds trust with clients and business partners involved in their real estate ventures.

J. Front Retailing's channels extend beyond its core department stores and PARCO centers to include robust e-commerce platforms and proprietary credit card services. These digital and financial channels are vital for customer engagement, loyalty, and transaction facilitation, supporting the company's omnichannel strategy. The company's developer business also utilizes dedicated sales and leasing offices to manage real estate transactions and tenant relationships.

| Channel Type | Key Function | 2023/2024 Data Point |

| Department Stores (Daimaru, Matsuzakaya) | Primary retail touchpoint, premium product offering | Contributed to the majority of ¥764.8 billion in net sales (FY2023) |

| PARCO Shopping Centers | Fashion, entertainment, lifestyle focus, targets younger consumers | PARCO Co., Ltd. reported ¥227.8 billion in net sales (2023) |

| E-commerce Platforms | Broad accessibility, convenience, digital customer engagement | Online sales continued to be a significant revenue contributor (FY2024) |

| JFR Card & PARCO Card | Customer loyalty, transaction facilitation, data gathering | Drive repeat purchases through loyalty points and exclusive benefits |

| Real Estate Sales & Leasing Offices | Property transactions, tenant management, project oversight | Facilitate direct engagement with buyers and tenants for development projects |

Customer Segments

Affluent domestic consumers in Japan, a core customer segment, represent high-net-worth individuals who actively seek luxury goods, exclusive brands, and highly personalized services. These discerning shoppers often engage with department store offerings through specialized channels like ‘gaisho’ services, which facilitate high-value transactions and bespoke experiences. In 2024, department stores continue to rely on this demographic for a significant portion of their high-ticket sales, underscoring the enduring appeal of prestige and curated shopping environments for this group.

International tourists represent a vital customer segment for J. Front Retailing, particularly those drawn to Japan for luxury goods, cosmetics, and distinctive Japanese artisanal products. This group is actively courted through specialized services like tax-free shopping assistance and the provision of multilingual staff, ensuring a welcoming and convenient experience.

The company's focus on inbound shoppers has yielded significant returns, with sales to this demographic demonstrating robust and ongoing growth. For instance, in the fiscal year ending February 2024, J. Front Retailing reported a notable increase in sales driven by foreign visitors, underscoring the segment's importance to their overall performance.

J. Front Retailing's PARCO shopping centers specifically cater to fashion-conscious youth and urban millennials. This demographic actively seeks out the latest trends in fashion, as well as unique pop culture merchandise and engaging entertainment experiences. In 2024, PARCO continued to leverage digital platforms and host limited-time events to attract these customers, contributing to a significant portion of their non-traditional retail revenue.

Families and Lifestyle-Oriented Consumers

J. Front Retailing understands that families and lifestyle-oriented consumers are looking for more than just apparel. They seek a one-stop shop for food, everyday household items, and a range of services that enhance their daily lives. This segment prioritizes convenience, a wide selection to meet varied needs, and an enjoyable shopping atmosphere.

The company's strategy to provide lifestyle enrichment deeply appeals to these customers. For instance, in fiscal year 2023, J. Front Retailing reported robust sales in its department store segment, which includes offerings that cater directly to these lifestyle needs, demonstrating a strong market connection.

- Broad Product Assortment: Offering everything from groceries and home goods to fashion and services.

- Convenience Focus: Streamlining the shopping experience to cater to busy family schedules.

- Lifestyle Enrichment: Providing products and services that enhance the quality of life and daily routines.

- Targeted Promotions: Tailoring offers to family needs and seasonal lifestyle events.

Corporate Clients and Real Estate Tenants

J. Front Retailing's Developer Business specifically targets corporate clients who require commercial spaces for lease, encompassing a wide array of business needs. This includes retail tenants looking to establish a presence within their shopping centers, as well as companies seeking dedicated office or event venues.

Furthermore, J. Front Retailing caters to businesses that need specialized interior construction and design services to create functional and aesthetically pleasing environments. This dual focus allows them to capture a significant portion of the commercial real estate and fit-out market.

In 2024, the demand for flexible and well-located commercial spaces remained robust, particularly in urban centers where J. Front Retailing's properties are situated.

- Diverse Tenant Base: From flagship retail stores to boutique shops and corporate offices, J. Front Retailing accommodates a broad spectrum of commercial tenants.

- Interior Services Demand: Businesses increasingly outsource interior construction and design to specialized firms, a service J. Front Retailing provides.

- Strategic Locations: Properties are often located in prime areas, attracting businesses seeking visibility and accessibility for their operations.

- Lease Agreements: The core offering is the leasing of commercial space, with terms and conditions tailored to the needs of corporate clients.

J. Front Retailing serves a diverse customer base that extends beyond individual shoppers. This includes corporate clients seeking commercial leasing opportunities, from retail outlets to office spaces, within their strategically located properties. Additionally, the company engages with businesses requiring specialized interior construction and design services, catering to the demand for tailored commercial environments.

For fiscal year 2024, the company's developer business segment continues to see strong interest in its prime real estate offerings, reflecting the ongoing need for well-positioned commercial venues across Japan.

The company’s customer segments are primarily individual consumers, encompassing affluent domestic shoppers, international tourists, and younger, fashion-forward demographics like millennials and Gen Z who frequent PARCO stores. It also targets families and lifestyle-oriented consumers seeking a broad range of goods and services, from groceries to household items, for enhanced daily living.

Beyond individual consumers, J. Front Retailing also serves a business-to-business (B2B) clientele through its developer arm, providing commercial real estate leases and interior construction services to various companies.

| Customer Segment | Key Characteristics | 2024 Focus/Activity |

|---|---|---|

| Affluent Domestic Consumers | High-net-worth individuals, seek luxury, exclusivity, personalized service. | Continued reliance for high-ticket sales, engagement via specialized services. |

| International Tourists | Seek luxury goods, cosmetics, Japanese artisanal products. | Supported by tax-free shopping, multilingual staff; robust sales growth observed. |

| Fashion-Conscious Youth & Millennials (PARCO) | Seek latest trends, pop culture, entertainment. | Leverage digital platforms, limited-time events for engagement. |

| Families & Lifestyle Consumers | Seek convenience, broad assortment (food, home goods), services. | Catered to via department store offerings enhancing daily life; strong sales reported in FY2023. |

| Corporate Clients (Developer Business) | Require commercial spaces (retail, office), interior construction/design. | Strong demand for flexible, well-located commercial spaces and specialized fit-out services. |

Cost Structure

The cost of goods sold (COGS) is a significant element in J. Front Retailing's cost structure, stemming directly from acquiring merchandise for its department stores and specialty outlets. For the fiscal year ending February 2024, J. Front Retailing reported a COGS of ¥380.4 billion, representing a substantial portion of their revenue.

Effective inventory management is paramount to controlling these costs. J. Front Retailing leverages strategies, including the integration of AI-powered systems, to optimize stock levels. This focus aims to reduce holding expenses and mitigate the risk of inventory becoming outdated or unsaleable, thereby preserving profitability.

J. Front Retailing's cost structure is significantly impacted by personnel expenses and labor costs. These encompass salaries, benefits, and ongoing training for a diverse workforce, from sales associates on the front lines to administrative staff and specialized real estate management teams supporting their extensive retail operations.

A notable portion of these costs is directly tied to employee development, which J. Front Retailing identifies as a key strategic priority. Investing in training and skill enhancement for their personnel across all business segments naturally contributes to higher labor expenditures but is seen as crucial for maintaining service quality and operational efficiency.

For the fiscal year ending February 2024, J. Front Retailing reported total personnel expenses amounting to approximately ¥125.6 billion. This figure highlights the substantial investment in their human capital, reflecting the large number of employees required to manage their department stores, specialty stores, and e-commerce platforms effectively.

J. Front Retailing's cost structure is significantly impacted by property lease and maintenance expenses. Operating a vast network of department stores and shopping centers, particularly in prime urban areas, necessitates substantial outlays for rent and ongoing facility upkeep. These fixed costs are a considerable component of their operational budget.

For instance, in fiscal year 2023, J. Front Retailing reported significant expenses related to their store operations, including rent and facility management. While specific figures for just property lease and maintenance are not itemized separately in all public disclosures, the overall selling, general, and administrative expenses, which heavily feature these costs, represent a substantial portion of their total revenue, underscoring their importance.

Marketing, Advertising, and Promotion Costs

J. Front Retailing dedicates substantial resources to marketing, advertising, and promotional activities. These efforts are crucial for building brand awareness, attracting customers to its diverse retail formats like department stores and PARCO, and boosting sales, particularly through initiatives like credit card promotions. In the fiscal year ending February 2024, the company's selling, general, and administrative expenses, which encompass these marketing outlays, were ¥192.9 billion.

The company strategically allocates its marketing budget across various channels to reach its target demographics effectively. This includes digital advertising, in-store promotions, and collaborations, all aimed at enhancing customer engagement and loyalty. For instance, campaigns often highlight new collections, seasonal sales, and special events to drive foot traffic and online purchases.

- Brand Building: Significant investment in advertising campaigns to strengthen the image of department stores and PARCO.

- Customer Acquisition: Promotions and loyalty programs designed to attract new customers and retain existing ones, especially via credit card services.

- Sales Generation: Targeted advertising for specific product categories and seasonal sales events to directly impact revenue.

- Digital Presence: Increased spending on online advertising and social media marketing to reach a wider audience.

Technology Infrastructure and Digital Investment Costs

J. Front Retailing invests significantly in its technology infrastructure to power its e-commerce operations and enhance in-store experiences. These costs cover the development, ongoing maintenance, and crucial upgrades to their digital platforms. For example, in fiscal year 2023, the company continued to push forward with its digital transformation initiatives, which inherently involve substantial technology outlays to ensure a seamless customer journey across all touchpoints.

These investments are not one-off; they are continuous efforts to stay competitive and improve operational efficiency. This includes expenditures on advanced data analytics tools to better understand consumer behavior and personalize offerings, as well as modernizing in-store technologies like POS systems and inventory management solutions. The commitment to digital transformation reflects a strategic imperative to boost both sales and customer satisfaction in an increasingly online retail landscape.

- E-commerce Platform Development & Maintenance: Costs associated with building, hosting, and updating online stores and mobile applications.

- Data Analytics & CRM Tools: Investment in software and services for customer data management, insight generation, and personalized marketing.

- In-store Technology Upgrades: Capital expenditures for modernizing point-of-sale systems, digital signage, and other in-store digital solutions.

- Cloud Services & Cybersecurity: Ongoing expenses for secure cloud hosting and robust cybersecurity measures to protect data and operations.

J. Front Retailing's cost structure includes significant investments in marketing and advertising to maintain brand visibility and drive sales across its department stores and PARCO. For the fiscal year ending February 2024, selling, general, and administrative expenses, which encompass these marketing outlays, totaled ¥192.9 billion. These costs are allocated across digital channels, in-store promotions, and collaborations to enhance customer engagement and loyalty. For example, campaigns often highlight new collections and seasonal sales events to boost both foot traffic and online purchases.

| Cost Component | FY2024 Figures (¥ billion) | Key Activities |

| Cost of Goods Sold (COGS) | 380.4 | Merchandise acquisition for department stores and specialty outlets. |

| Personnel Expenses | 125.6 | Salaries, benefits, and training for diverse workforce. |

| Selling, General & Administrative Expenses | 192.9 | Marketing, advertising, promotions, and operational overhead. |

Revenue Streams

J. Front Retailing's primary revenue stream originates from the direct sale of a wide array of products. This includes clothing, beauty items, food, and various general merchandise sold through its well-known department store brands, Daimaru and Matsuzakaya, as well as its specialty retail chain, PARCO.

This direct selling of goods forms the bedrock of the company's retail operations. In the fiscal year concluding in February 2024, J. Front Retailing achieved a remarkable ¥1.25 trillion in revenue, underscoring the significance of these sales channels.

Within this core business, apparel and accessories stand out as particularly strong revenue generators. The consistent performance of these categories is crucial to the company's overall financial health and market position.

Revenue is primarily generated through leasing commercial spaces within its prominent shopping centers, such as PARCO, and other real estate ventures. This stream offers a consistent and predictable income, acting as a stabilizing force against the fluctuations often seen in retail sales. J. Front City Development reported robust and steady rental income throughout fiscal year 2024, underscoring the reliability of this revenue source.

J. Front Retailing generates significant revenue from its Payment and Finance Business. This segment primarily earns income through fees associated with the issuance and ongoing usage of its proprietary credit cards, specifically the JFR Card and PARCO Card. These fees, along with revenue from other financial services offered, play a crucial role in the company's overall profitability.

Transaction fees, stemming from every purchase made using these cards, contribute directly to the bottom line. Furthermore, interest income earned on outstanding balances further bolsters this revenue stream. For instance, in fiscal year 2024, the Payment and Finance segment demonstrated robust performance, reflecting the continued reliance on credit and payment services within the retail landscape.

Developer Business Income (Construction, Interior Design)

J. Front Retailing's developer business income is a significant revenue contributor, encompassing construction contracting and interior decoration services. This segment benefits from the expertise of subsidiaries such as J. Front Design & Construction, which manages property development and related projects.

This diversified income stream reflects the company's integrated approach to real estate, extending beyond retail operations. In fiscal year 2023, J. Front Retailing reported a consolidated revenue of ¥465.3 billion, with the developer segment playing a key role in this overall financial performance.

- Construction Contracting Revenue: Income generated from undertaking building and construction projects for various clients.

- Interior Decoration Services: Earnings from providing design and execution services for interior spaces, enhancing property value.

- Related Service Fees: Revenue from other ancillary services associated with property development and management.

- Subsidiary Contribution: The financial impact of J. Front Design & Construction and similar entities within the group.

Other Diversified Services and Ventures

J. Front Retailing diversifies its income beyond core retail through several other ventures. These include wholesale trade activities, which tap into different market segments. The company also generates revenue from parking lot operations, leveraging its existing real estate.

Furthermore, merchandise inspection services contribute to its varied income streams. J. Front Retailing actively pursues new growth avenues through its corporate venture funds, investing in emerging businesses. For instance, J. Front Retailing's wholesale segment, including businesses like J. Front Link, reported sales of ¥144.5 billion in fiscal year 2023, showcasing the significance of these diversified operations.

- Wholesale Trade: Generating revenue through B2B transactions and distribution.

- Parking Lot Operations: Monetizing underutilized parking facilities.

- Merchandise Inspection: Offering quality control services to partners.

- Corporate Venture Funds: Investing in and fostering new business opportunities.

J. Front Retailing's revenue streams are notably diverse, extending well beyond direct product sales. The company leverages its extensive real estate holdings through rental income from commercial spaces, providing a stable financial base. Additionally, its Payment and Finance Business, driven by credit card operations, generates consistent income from fees and interest, contributing significantly to overall profitability.

| Revenue Stream | Description | Fiscal Year 2023 (¥ Billion) |

| Direct Product Sales | Sales from department stores (Daimaru, Matsuzakaya) and specialty retail (PARCO). | 1,174.7 |

| Real Estate (Leasing) | Rental income from commercial spaces and property development. | 150.1 |

| Payment and Finance | Fees and interest from credit cards (JFR Card, PARCO Card) and financial services. | 112.5 |

| Developer Business | Income from construction contracting and interior decoration services. | 465.3 (Consolidated Revenue - Developer Segment Impact) |

| Other Ventures | Includes wholesale trade, parking operations, and merchandise inspection services. | 144.5 (Wholesale Sales) |

Business Model Canvas Data Sources

The J. Front Retailing Business Model Canvas is built upon a foundation of internal financial disclosures, comprehensive market research reports, and strategic insights derived from industry trend analysis. These data sources ensure each component of the canvas is grounded in J. Front Retailing's operational realities and its competitive landscape.