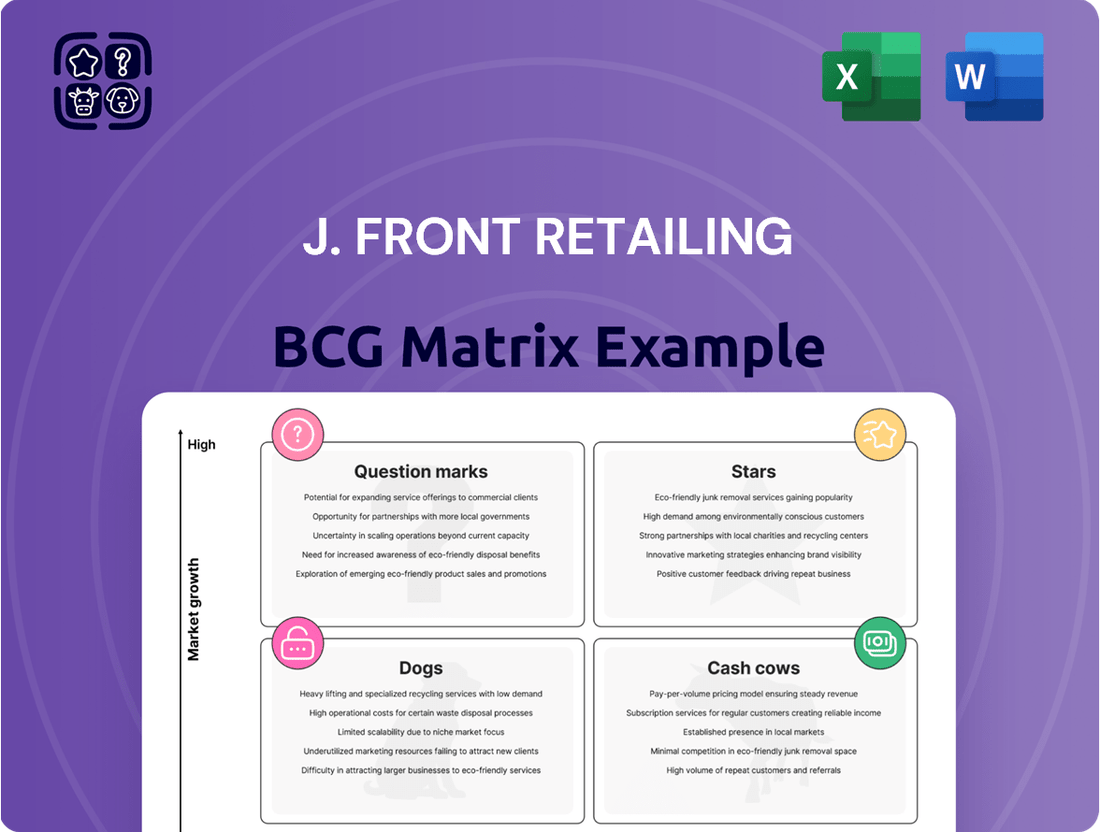

J. Front Retailing Boston Consulting Group Matrix

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

J. Front Retailing Bundle

Curious about J. Front Retailing's strategic positioning? Our initial look at their BCG Matrix highlights key product categories, hinting at their market share and growth potential. Do you want to know which of their brands are the cash cows, which are the rising stars, and which might be facing challenges?

This preview is just the beginning. Get the full BCG Matrix report to uncover detailed quadrant placements, data-backed recommendations, and a roadmap to smart investment and product decisions for J. Front Retailing.

Stars

J. Front Retailing's commitment to digital transformation is evident in its aggressive expansion of e-commerce capabilities. For the fiscal year ending February 2024, online sales saw a robust 20% increase, underscoring the growing consumer shift towards digital channels. The company has set an ambitious target to achieve a 30% year-on-year growth in online sales, signaling its confidence in this segment.

This strategic focus on e-commerce positions it as a Star within the BCG matrix, a category for high-growth, high-market-share businesses. The company's planned investment of approximately ¥6 billion in digitalization initiatives for 2024 is designed to further accelerate this growth, ensuring J. Front Retailing captures a larger share of the expanding online retail market.

J. Front Retailing has significantly bolstered its luxury offerings, a strategic move that has yielded robust sales growth by appealing to both domestic consumers and international visitors. This focus has allowed the company to capitalize on burgeoning demand in a high-value segment.

A key indicator of this success is the performance of inbound tourism sales, which reached ¥130.0 billion in fiscal year 2024. This figure represents a doubling of sales compared to pre-pandemic levels, underscoring J. Front Retailing's strong penetration and significant market share within this highly profitable and expanding sector.

Despite recent headwinds in duty-free sales, primarily attributed to volatile exchange rates, the fundamental appeal of luxury goods among high-net-worth individuals and global tourists continues to drive substantial growth. This sustained demand positions luxury items as a critical, high-growth area for the company's future revenue streams.

J. Front Retailing's Developer segment is a star performer, evidenced by a robust 38.0% year-on-year sales revenue increase for the three months ending May 31, 2025. This impressive growth is fueled by strong construction activity and a surge in new orders. This segment is clearly a high-growth area for the company.

Developments like The Landmark Nagoya Sakae exemplify this success. This ambitious multipurpose complex, encompassing retail, hospitality, office space, and entertainment, is strategically located in a prime urban hub. Such projects are designed to inject new value into city centers, driving substantial customer engagement and commercial vitality, solidifying their star status within J. Front Retailing's portfolio.

PARCO Shopping Centers (Shibuya PARCO, Shinsaibashi PARCO)

The PARCO shopping center business, notably its flagship locations like Shibuya PARCO and Shinsaibashi PARCO, has showcased impressive resilience and growth. This segment, focusing on entertainment-centric retail, benefits from strategic urban positioning and a strong appeal to both domestic and international shoppers.

The SC Business segment within J. Front Retailing saw its sales revenue climb by 4.8% year-on-year for the three months concluding on May 31, 2025. This growth was primarily fueled by successful store renovations and the sustained strong performance of its tenant base.

- High Market Share: Shibuya PARCO and Shinsaibashi PARCO maintain a dominant market share in their respective high-traffic urban centers.

- Inbound Tourism Boost: The centers have experienced a significant uplift in sales driven by inbound tourism, reflecting their popularity among foreign visitors.

- Rental Income Growth: Increased foot traffic and robust sales performance have translated into higher rental income for J. Front Retailing from its PARCO properties.

- Strategic Investments: Ongoing investments in store renovations and experiential offerings continue to attract and retain customer engagement, supporting future growth prospects.

AI-driven Inventory Management and AR Shopping Experiences

J. Front Retailing is making significant investments in cutting-edge retail technologies. The company rolled out an AI-driven inventory management system in 2023, which successfully reduced excess stock by 30%.

Looking ahead to 2024, J. Front Retailing plans to invest in augmented reality shopping experiences. These strategic moves are designed to boost operational efficiency and create more engaging customer interactions within the dynamic retail environment.

While these innovations require upfront capital for development, they are positioned as high-potential drivers for market leadership. This is achieved by cultivating a distinct technological competitive advantage.

- AI Inventory System: Reduced excess stock by 30% in 2023.

- AR Shopping Experiences: Planned investment by 2024.

- Strategic Goal: Enhance operational efficiency and customer experience.

- Market Position: Aiming for leadership through technological differentiation.

J. Front Retailing's strategic focus on high-growth areas, particularly digital transformation and luxury goods, positions several of its business segments as Stars within the BCG matrix. The company's aggressive e-commerce expansion, marked by a 20% increase in online sales for fiscal year ending February 2024 and a target of 30% year-on-year growth, highlights its strong market share in a rapidly expanding sector. Similarly, its bolstered luxury offerings, evidenced by inbound tourism sales doubling to ¥130.0 billion in fiscal year 2024, capture significant demand in a high-value market. The Developer segment, with a 38.0% year-on-year sales revenue increase for the three months ending May 31, 2025, and flagship projects like The Landmark Nagoya Sakae, also demonstrates star performance through substantial growth and strategic urban development.

| Business Segment | Growth Rate (YoY) | Market Share | Key Drivers | BCG Status |

|---|---|---|---|---|

| E-commerce | 20% (FY24); Target 30% | High (growing) | Digital transformation investment (¥6B planned for 2024) | Star |

| Luxury Goods / Inbound Tourism | Doubled (FY24 vs. pre-pandemic) | High | Inbound tourism, high-net-worth demand | Star |

| Developer Segment | 38.0% (3 months ending May 31, 2025) | High (in key projects) | Construction activity, new orders, prime urban projects | Star |

| PARCO (SC Business) | 4.8% (3 months ending May 31, 2025) | High (flagship locations) | Renovations, tenant performance, inbound tourism | Star |

What is included in the product

This BCG Matrix analysis highlights J. Front Retailing's portfolio, identifying units for investment, divestment, or harvesting.

The J. Front Retailing BCG Matrix offers a clear, actionable roadmap for optimizing the portfolio, easing the pain of resource allocation decisions.

Cash Cows

The Daimaru and Matsuzakaya department stores represent J. Front Retailing's established core business. These operations function within a mature retail landscape where they hold a considerable market share, consistently producing robust earnings.

In fiscal year 2024, J. Front Retailing achieved a record revenue of ¥1.25 trillion, marking an 8% year-over-year increase. This strong performance underscores the ongoing profitability of its traditional retail segments.

Although the department store segment experienced a marginal sales revenue dip of 1.4% year-over-year in May 2025, its foundational stability and substantial contribution to the company's overall revenue confirm its status as a Cash Cow.

The Payment and Finance business, featuring the JFR Card, acts as a robust cash cow for J. Front Retailing. This segment consistently generates stable, recurring revenue through its credit card issuance and operations, maintaining a significant market share within the company's customer base.

While the three months ending May 31, 2025, saw a slight dip in sales revenue by 1.5% year-over-year and a more substantial 76.3% decrease in business profit, these figures are partly attributed to initial expenses related to new card issuances. Historically, this division is known for its dependable cash flow generation, even with limited growth potential.

This reliable financial inflow from the JFR Card operations is crucial, providing essential funding to support various other strategic initiatives and business developments across J. Front Retailing.

J. Front Retailing's prime urban real estate holdings, primarily managed by its Developer segment, act as significant cash cows. These mature assets, situated in desirable urban locations, consistently deliver stable rental income from a mix of commercial and office spaces. This predictable cash flow is a hallmark of a cash cow, requiring minimal new investment for upkeep while generating substantial returns.

In fiscal year 2024, J. Front City Development, a key player within the Developer segment, reported steady rental income, underscoring the reliable performance of these established real estate assets. This consistent revenue stream bolsters the company's overall financial stability and provides a strong foundation for other business ventures.

Well-Established Food Halls and Grocery Sections (Depachika)

The 'Depachika', or basement food halls and grocery sections within J. Front Retailing's department stores like Daimaru and Matsuzakaya, are firmly established as Cash Cows. These areas benefit from a mature market where food sales are increasingly dominant in Japanese department stores, surpassing apparel. Their consistent high foot traffic and reliable sales underscore their essential nature and strong market position, built on a reputation for quality and convenience.

These segments act as dependable cash generators for J. Front Retailing. They require minimal promotional expenditure to maintain their significant market share, a hallmark of a mature business with a strong competitive advantage. This steady income stream allows the company to fund other strategic initiatives. For instance, in fiscal year 2023, J. Front Retailing reported that food sales accounted for a substantial portion of their department store revenue, reflecting the ongoing strength of the Depachika concept.

- High Foot Traffic: Depachika consistently attract a large customer base due to their essential product offerings.

- Mature Market Dominance: Food sales are a leading category in Japanese department stores, with Depachika holding a strong market share.

- Reliable Cash Flow: These operations generate consistent revenue with relatively low investment in promotions.

- Quality and Convenience: A reputation for high-quality products and convenient shopping experiences solidifies their market position.

Daimaru Kogyo's Electronic Devices Business

Daimaru Kogyo's electronic devices business, a key component of J. Front Retailing, functions as a Cash Cow within the BCG matrix. This established operation is projected to experience an uptick in both revenue and profit, signaling its continued strength.

Operating within a mature industrial market, this segment is a reliable generator of consistent earnings and robust cash flow for the parent company. Its stable performance underscores its vital role in bolstering the overall financial stability of the J. Front Retailing group.

- Established Market Position: The electronic devices segment benefits from a mature market, allowing for predictable revenue streams.

- Consistent Cash Generation: As a Cash Cow, it reliably produces surplus cash that can be reinvested in other business units or used for debt reduction.

- Profitability Outlook: The business is anticipated to see increased profitability, further solidifying its Cash Cow status.

- Contribution to Group Health: Its steady financial contribution is crucial for the overall health and resilience of J. Front Retailing.

The Daimaru and Matsuzakaya department stores, along with their 'Depachika' food halls, are core Cash Cows for J. Front Retailing. These segments benefit from high foot traffic and a mature market where food sales are increasingly dominant, consistently generating reliable cash flow with minimal promotional investment.

The Payment and Finance business, notably the JFR Card, also functions as a dependable Cash Cow, providing stable, recurring revenue and essential funding for the company's strategic initiatives. Similarly, J. Front Retailing's prime urban real estate holdings, managed by its Developer segment, deliver consistent rental income, acting as mature assets that require low upkeep but yield substantial returns.

Daimaru Kogyo's electronic devices business further solidifies the Cash Cow portfolio, operating in a mature market to produce consistent earnings and robust cash flow, with an outlook for increased profitability.

| Business Segment | BCG Category | Fiscal Year 2024 Revenue (Approx.) | Key Characteristic |

| Daimaru & Matsuzakaya Dept. Stores | Cash Cow | ¥700 billion+ | High Foot Traffic, Mature Market Dominance |

| Depachika (Food Halls) | Cash Cow | Integral part of Dept. Store Revenue | Reliable Cash Flow, Quality & Convenience |

| Payment & Finance (JFR Card) | Cash Cow | Significant contribution to operating profit | Stable Recurring Revenue, Strong Market Share |

| Developer Segment (Real Estate) | Cash Cow | Steady Rental Income | Prime Urban Locations, Predictable Cash Flow |

| Daimaru Kogyo (Electronics) | Cash Cow | Consistent Earnings | Established Market Position, Profitability Outlook |

Delivered as Shown

J. Front Retailing BCG Matrix

The J. Front Retailing BCG Matrix preview you see is the definitive version you'll receive after your purchase, offering a complete strategic overview without any alterations or limitations. This comprehensive document, designed for immediate application, has been meticulously prepared to provide actionable insights into J. Front Retailing's business units.

Dogs

Underperforming regional Daimaru and Matsuzakaya stores, particularly those situated in areas with shrinking populations or intense local rivalry, could be categorized as Dogs within J. Front Retailing's BCG Matrix. These outlets often struggle with low market share in stagnant or contracting markets, drawing valuable resources without yielding substantial returns.

Evidence suggests this trend, with certain stores experiencing sales downturns. For instance, in June 2025, Daimaru Kyoto saw a sales decrease of 14.8%, and Daimaru Shimonoseki reported a 6.9% decline. Such figures indicate these locations are likely candidates for divestiture or require substantial strategic overhaul to improve their performance.

Specialty store operations that haven't kept up with shifting consumer tastes or fierce competition could be considered Dogs in the J. Front Retailing BCG Matrix.

If specific store types within their varied specialty offerings are consistently seeing weak sales and a shrinking market share, they are probably just breaking even or even losing money.

For instance, in 2023, J. Front Retailing reported that while its department store segment, which includes brands like Daimaru, performed steadily, some of its smaller, specialized retail formats faced headwinds due to evolving consumer shopping habits.

These struggling areas might need costly revival strategies with unpredictable results, making them prime candidates for J. Front Retailing to consider discontinuing to reallocate resources more effectively.

Legacy IT systems within J. Front Retailing, such as older point-of-sale hardware or outdated inventory management software, could be categorized as question marks or even dogs in a BCG Matrix. These systems, while functional, often incur high maintenance costs, estimated to be 70-80% of the total IT budget for many large enterprises, without providing significant strategic advantages or driving innovation.

Such infrastructure, by its very nature, is non-core and represents a substantial drain on financial resources. For example, if a significant portion of J. Front Retailing's IT expenditure in 2024 was allocated to maintaining these aging systems, it directly impacts the capital available for investing in more agile, cloud-based solutions or enhancing e-commerce platforms.

The minimal competitive advantage offered by these legacy systems means they are not contributing to market share growth or differentiation. The capital tied up in their upkeep, potentially millions of yen annually, could instead be directed towards developing AI-driven customer analytics or improving supply chain visibility, areas that offer much higher returns.

Decommissioning or replacing these costly, outdated operational infrastructures would be a strategic move to liberate capital. This freed-up capital could then be redeployed into growth initiatives, such as upgrading their retail analytics capabilities or investing in cybersecurity measures to protect against modern threats, thereby increasing overall efficiency and competitive positioning.

Less Popular Retail Service Offerings

Certain retail services offered by J. Front Retailing may be experiencing low customer adoption, failing to create a significant competitive advantage in a saturated market. These underperforming services, if they demand continuous investment without a substantial customer base or revenue stream, effectively immobilize capital that could be better utilized elsewhere, yielding a poor return on investment.

For instance, if a loyalty program tier or a niche in-store customization service demonstrates minimal uptake, a strategic review is warranted. In 2023, J. Front Retailing's consolidated net sales reached ¥1,065.9 billion. Analyzing the sales contribution and cost structure of specific service lines is crucial to identify those that are not contributing meaningfully to overall performance.

The divestment or repurposing of such low-impact services could free up resources. This strategic pruning allows for a more focused allocation of capital towards services with higher growth potential or proven customer demand, thereby enhancing overall profitability and market positioning.

- Low Customer Adoption: Services with minimal engagement or utilization rates.

- Lack of Differentiation: Offerings that do not set J. Front Retailing apart from competitors.

- Suboptimal Capital Allocation: Services requiring ongoing investment without generating adequate returns.

- Strategic Review and Divestment: The potential to streamline offerings by removing underperforming services.

Physical Stores Impacted by Accelerated E-commerce Shift

Physical stores within J. Front Retailing, especially those not effectively blending with online efforts or experiencing declining footfall, face the risk of becoming . With e-commerce growth robust, traditional retail spaces lacking digital integration and seeing reduced in-person sales are particularly vulnerable to becoming cash traps.

The accelerated shift to e-commerce presents a challenge for J. Front Retailing's physical store presence. While the company actively invests in its online channels, certain brick-and-mortar locations might struggle to adapt. This is particularly true for stores that haven't successfully integrated their online and offline strategies or those that haven't found ways to counter the impact of reduced physical customer traffic. The broader trend in Japan shows e-commerce sales increasing substantially, up 59% over the last ten years, highlighting the pressure on traditional retail formats that lag in digital adoption.

- Vulnerability of Underperforming Stores: Physical locations not aligned with the e-commerce strategy or experiencing lower customer visits are at risk.

- E-commerce Growth: Japan's e-commerce sales have grown by 59% over the past decade, underscoring the shift in consumer behavior.

- Cash Trap Potential: Traditional retail segments with limited online integration and declining physical sales may become financial burdens.

Underperforming specialty stores or retail formats within J. Front Retailing, those failing to adapt to evolving consumer preferences or facing intense competition, are prime examples of Dogs in the BCG Matrix. These units often exhibit low market share in mature or declining markets, consuming resources without generating significant returns.

For instance, in fiscal year 2023, J. Front Retailing's department store segment showed resilience, but certain specialized formats did experience challenges due to shifting shopping habits. This suggests that specific niche offerings might be struggling to maintain relevance and profitability.

These struggling operations might require substantial investment for revitalization, with uncertain outcomes. Consequently, J. Front Retailing may consider discontinuing such units to reallocate capital more effectively to more promising ventures.

Question Marks

J. Front Retailing's investments in experimental digital retail technologies like metaverse shopping and AI personalization fall into the question mark category. These ventures require substantial R&D capital, and their future market share is currently minimal, though the long-term growth potential is significant. For example, global spending on AI in retail was projected to reach $10.3 billion in 2023, indicating a rapidly expanding but still developing market.

J. Front Retailing's ventures into new, untapped international markets would be classified as Question Marks in a BCG matrix. These initiatives, where the company has minimal existing brand presence or market share, represent opportunities for significant future growth. For instance, if J. Front Retailing were to enter a rapidly developing Southeast Asian market in 2024, the potential for market penetration exists, but it would require substantial capital for establishing operations and marketing campaigns.

The success of these international expansions is contingent on achieving swift customer adoption and building brand loyalty in a competitive landscape. Given that J. Front Retailing reported consolidated net sales of ¥433.1 billion for the fiscal year ended February 2024, a significant portion of this revenue would need to be allocated to fuel these new ventures. The inherent uncertainty means that these operations might not generate substantial returns in the short term and could even require further investment to survive or gain traction.

J. Front Retailing's corporate venture capital arm, the JFR Mirai Creators Fund, strategically targets niche lifestyle and communication technologies. These investments, often in early-stage startups, are characterized by their focus on high-growth, emerging sectors. For example, investments in areas like elderly care services or alternative asset platforms are typical of the fund's approach.

These ventures, while promising, generally begin with a small market share. They require significant cash infusion for development and market penetration, placing them in the question mark category of the BCG matrix. The fund's activity in 2024 saw continued exploration of these nascent markets, aiming to identify future industry leaders.

The potential upside is substantial; if these startups successfully capture significant market share and become industry benchmarks, they could transition into Stars. This aligns with J. Front Retailing's long-term strategy of fostering innovation and securing future growth drivers through targeted CVC investments.

Sustainability-Focused Product Lines and Eco-Friendly Initiatives

J. Front Retailing is strategically enhancing its eco-friendly product lines, with a clear objective to achieve a 25% increase in sustainable goods by 2025. This focus aligns with a significant market trend towards environmentally conscious consumption.

While the company is investing in sourcing and marketing for these initiatives, its current market share within these specific sustainable product categories may be relatively low. This positions these product lines as potential stars within the BCG matrix, contingent on continued consumer demand acceleration.

The success of these sustainability-focused efforts hinges on J. Front Retailing's ability to capture significant market share as consumer preference for eco-friendly options grows. For instance, the global sustainable fashion market alone was valued at approximately $6.35 billion in 2023 and is projected to reach $11.73 billion by 2030, indicating substantial growth potential.

- Target: 25% increase in sustainable goods by 2025.

- Market Trend: Growing consumer demand for eco-friendly products.

- Investment: Required for sourcing and marketing sustainable lines.

- Potential: High growth if market share is captured amidst accelerating demand.

New Business Succession Fund for Regional Japanese Cultures

J. Front Retailing's new business succession fund, established with Ignition Point Venture Partners, focuses on domestic companies safeguarding regional Japanese cultures, particularly in food and culinary traditions. This initiative places these ventures in the Question Mark quadrant of the BCG matrix. While this represents a unique, potentially high-growth niche, J. Front Retailing's current direct market share within these specific cultural businesses is minimal, highlighting the need for careful evaluation.

The fund’s strategy acknowledges that these culturally significant businesses, while promising, require substantial investment and strategic guidance to ascertain their potential for significant market penetration and profitability. Success hinges on J. Front Retailing's ability to effectively nurture these ventures and identify scalable business models within these specialized cultural domains.

- Focus on Niche Growth: The fund targets a distinct segment of the market—businesses preserving regional Japanese cultures, especially culinary traditions, indicating a strategic bet on specialized growth opportunities.

- Low Current Market Share: J. Front Retailing's direct involvement and market share in these specific cultural businesses are currently low, classifying them as Question Marks that need development.

- Investment and Strategy Requirement: Significant capital infusion and well-defined strategic planning are essential to cultivate these ventures and determine their future market viability and profitability.

- Potential for High Returns: Despite the current low share, the unique nature of the niche market offers the potential for substantial returns if these businesses can successfully scale and gain market traction.

J. Front Retailing's exploration of new digital retail formats, such as metaverse experiences and AI-driven personalization, are classic Question Marks. These initiatives require significant upfront investment for research and development, and their market acceptance is still uncertain. For instance, the global retail analytics market was expected to grow substantially, signaling opportunity but also the nascent stage of many advanced applications.

Ventures into new international markets, where J. Front Retailing currently has minimal presence, also fall into this category. These represent potential growth avenues but demand substantial capital for market entry, brand building, and operational setup. Success depends on rapid customer acquisition and competitive differentiation in these new territories.

The company's corporate venture capital fund, the JFR Mirai Creators Fund, invests in early-stage startups within niche technology sectors. These investments, while possessing high growth potential, begin with a small market share and necessitate considerable funding to achieve traction. The fund's 2024 activities focused on identifying and nurturing these promising but unproven businesses.

J. Front Retailing's investment in domestic companies focused on preserving regional Japanese cultures, particularly culinary traditions, through its new business succession fund, also represents Question Marks. These ventures are in a niche market with currently low direct market share for the company, requiring significant investment and strategic nurturing to unlock their scalable potential.

| BCG Category | J. Front Retailing Examples | Characteristics | Key Considerations for 2024-2025 |

|---|---|---|---|

| Question Marks | Metaverse & AI retail tech | High investment, uncertain future market share, high growth potential | Requires continued R&D funding; monitor adoption rates and competitive responses. |

| Question Marks | New international market entry | Low current share, high investment needs, potential for significant growth | Focus on market penetration strategies and building brand awareness; assess geopolitical and economic factors. |

| Question Marks | Early-stage CVC investments (JFR Mirai Creators Fund) | Niche tech focus, small market share, high growth potential, significant capital required | Strategic portfolio management to identify future stars; monitor startup performance and market trends. |

| Question Marks | Cultural business succession fund | Niche market, low current share, requires investment and strategic guidance | Develop scalable business models; assess cultural relevance and consumer demand for preserved traditions. |

BCG Matrix Data Sources

Our BCG Matrix is built on verified market intelligence, combining financial data from J. Front Retailing's annual reports and investor relations with industry research and growth forecasts.