J. Front Retailing Porter's Five Forces Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

J. Front Retailing Bundle

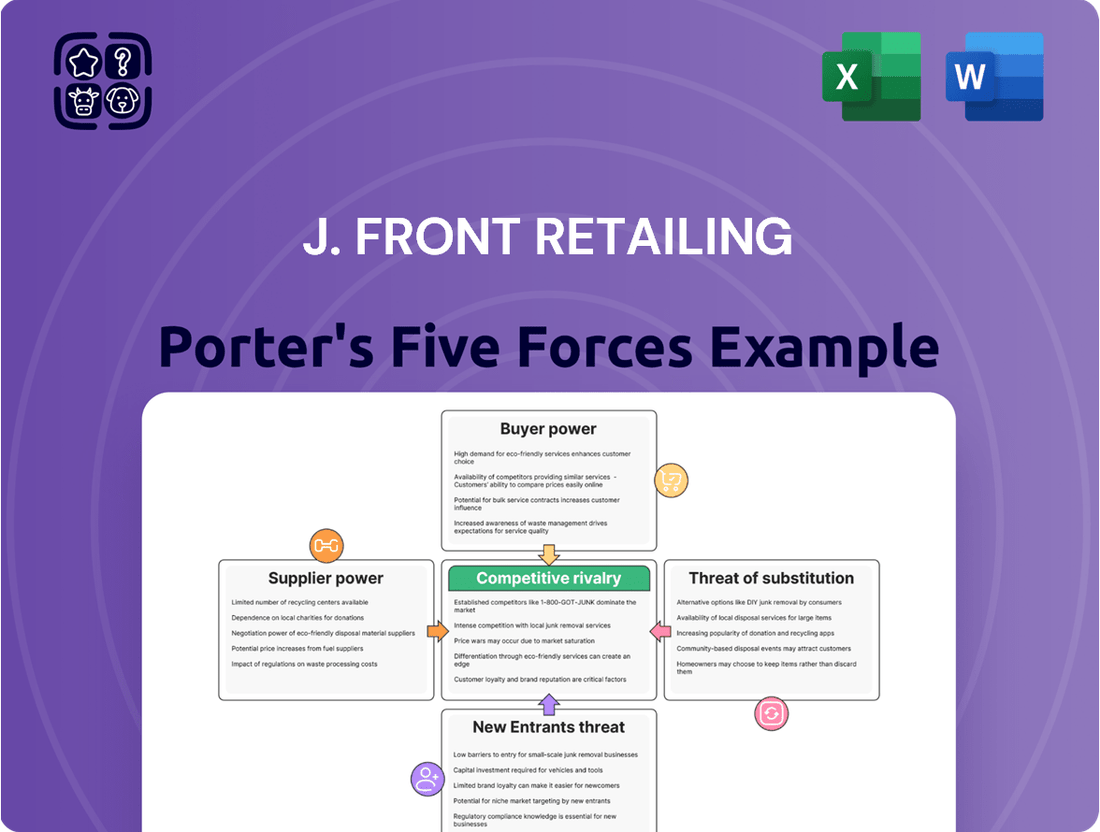

J. Front Retailing navigates a competitive landscape shaped by powerful forces. Understanding the intensity of rivalry, the bargaining power of buyers and suppliers, and the threats of new entrants and substitutes is crucial for strategic success.

Our brief snapshot only scratches the surface. Unlock the full Porter's Five Forces Analysis to explore J. Front Retailing’s competitive dynamics, market pressures, and strategic advantages in detail.

Suppliers Bargaining Power

J. Front Retailing’s diverse operations, from department stores to real estate, mean it deals with a vast array of suppliers. For high-end or exclusive items, suppliers can wield significant power due to brand recognition and limited availability, impacting J. Front Retailing's ability to stock sought-after products. For instance, securing exclusive collections from premium fashion houses often requires substantial investment in inventory and strong, ongoing relationships.

In contrast, for more common goods like basic apparel or food products sold in its various retail formats, J. Front Retailing likely has access to a larger pool of suppliers. This increased competition among suppliers for its business naturally dilutes their individual bargaining power, allowing the company to negotiate more favorable terms. Data from 2024 indicates that the retail sector, in general, experienced a 4.5% increase in supplier costs, but companies with diversified sourcing strategies, like J. Front Retailing, were better positioned to mitigate these pressures.

J. Front Retailing faces varying switching costs depending on the supplier. For critical partnerships like established luxury brands or long-term real estate developers, the cost of switching can be significant. This includes potential damage to reputation, unmet customer expectations tied to specific brands, and penalties from existing contractual obligations.

In contrast, sourcing for general merchandise or less specialized services presents lower switching costs for J. Front Retailing. This flexibility allows the company to more readily explore alternative suppliers, potentially leading to better terms or access to new product lines without incurring prohibitive expenses or reputational risk.

The significance of a supplier's offering to J. Front Retailing's operations directly shapes their leverage. When a supplier provides unique, high-demand fashion brands or advanced retail technology, it becomes crucial for J. Front Retailing to secure these inputs to maintain its market position and customer appeal. This reliance grants such suppliers considerable bargaining power.

Conversely, suppliers providing standardized goods, like basic office supplies or generic store fixtures, possess significantly less sway. J. Front Retailing can more easily switch between multiple providers for these less critical items, limiting the suppliers' ability to dictate terms. This dynamic is evident in the retail sector where procurement of differentiated merchandise often commands higher supplier negotiation strength.

Threat of Forward Integration by Suppliers

While the threat of forward integration by suppliers is generally low for a large retailer like J. Front Retailing, it's not entirely absent. This risk materializes if a crucial supplier opts to bypass department stores and establish its own direct retail channels, whether through physical boutiques or e-commerce platforms.

This scenario is more plausible for suppliers offering strong luxury brands or highly unique products. For instance, a high-end fashion house could decide to open its own standalone stores, directly reaching consumers and potentially offering a more curated brand experience than a department store setting.

Consider the increasing trend of direct-to-consumer (DTC) sales. In 2023, many luxury brands expanded their DTC efforts, with some reporting significant growth in these channels. This strategy allows brands greater control over their customer relationships and margins, making forward integration a more attractive proposition for them.

- DTC Expansion: Luxury brands are increasingly investing in their own e-commerce and physical stores, aiming to capture more of the value chain.

- Brand Control: Forward integration allows suppliers to maintain tighter control over brand image, customer experience, and pricing.

- Margin Improvement: By cutting out the middleman, suppliers can potentially increase their profit margins.

- Capital Intensity: Establishing new retail channels requires significant investment, which can be a deterrent for many suppliers.

J. Front Retailing's Ability to Backward Integrate

J. Front Retailing's existing diversification into real estate development and credit finance demonstrates a degree of backward integration. This reduces their reliance on external parties for these crucial business functions. For example, their robust real estate arm allows them to control prime retail locations, a key asset in the competitive retail landscape.

The company's internal capabilities in merchandise inspection and wholesale also indicate some ability to control parts of its supply chain. This can potentially mitigate supplier power in certain segments by allowing them to bypass some intermediaries or negotiate from a stronger internal position.

- Real Estate Control: J. Front Retailing's ownership and development of properties like the Daimaru and Matsuzakaya department stores provide significant control over their retail space, lessening dependence on external landlords.

- Internal Wholesale Operations: The company's ability to manage wholesale operations internally can give them greater leverage when sourcing goods, potentially reducing the bargaining power of external wholesalers.

- Financial Services Integration: Their credit finance segment, which includes services like the PARCO Card, allows them to capture value and customer loyalty, indirectly strengthening their position in negotiations with suppliers by fostering a more integrated customer experience.

- Diversification as a Buffer: The company's diverse business portfolio acts as a buffer against significant disruptions or price hikes from any single supplier group, as they are not solely reliant on one sector for their operations.

The bargaining power of suppliers for J. Front Retailing varies significantly. For unique or high-demand items, suppliers can exert considerable influence, impacting J. Front Retailing's ability to secure sought-after products. In 2024, the retail sector saw an average 4.5% rise in supplier costs, a pressure mitigated by diversified sourcing.

Switching costs are a key factor; high for exclusive brands or developers, low for standardized goods. The threat of forward integration, while generally low, is more probable for luxury brands pursuing direct-to-consumer (DTC) channels, a trend that saw growth in 2023.

J. Front Retailing's backward integration, such as its real estate operations, lessens reliance on external parties and strengthens its negotiating position. This diversification acts as a buffer against supplier price hikes.

| Supplier Type | Bargaining Power | J. Front Retailing's Mitigation |

|---|---|---|

| Exclusive/Luxury Brands | High | Strong relationships, potential for exclusive deals, higher inventory investment |

| Standardized Goods Suppliers | Low | Diversified sourcing, competitive bidding, lower switching costs |

| Real Estate Developers | High (for prime locations) | Backward integration (owning/developing properties) |

What is included in the product

Uncovers key drivers of competition, customer influence, and market entry risks tailored to J. Front Retailing's department store and specialty retail segments.

J. Front Retailing's Porter's Five Forces analysis provides a clear, actionable framework to identify and mitigate threats, transforming potential market challenges into strategic advantages.

Understand the competitive landscape at a glance, allowing J. Front Retailing to proactively address pressures from rivals, new entrants, and substitute products.

Customers Bargaining Power

Customer price sensitivity for J. Front Retailing varies significantly across its offerings. For luxury goods and high-end items, particularly those purchased by high-net-worth individuals or international tourists, price is often a secondary consideration to brand prestige and product quality. This was evident in the resilient performance of luxury segments even during periods of economic uncertainty.

However, for everyday apparel, household goods, and other staple items sold in its department stores, general consumers demonstrate a greater degree of price consciousness. The highly competitive Japanese retail market, with numerous alternatives available, compels J. Front Retailing to remain competitive on pricing for these essential goods. For instance, during promotional periods, sales volume for more price-sensitive categories saw substantial uplifts.

The bargaining power of customers for J. Front Retailing is significantly amplified by the sheer abundance of alternative shopping avenues. Consumers today have an easy time hopping between online marketplaces, niche boutiques, and even budget-friendly outlets. This ease of comparison means J. Front Retailing must constantly ensure its pricing and overall customer proposition are attractive. For instance, in 2024, the online retail market share in Japan continued its upward trajectory, with e-commerce accounting for a substantial portion of total retail sales, directly impacting brick-and-mortar retailers' ability to dictate terms.

In today's digital landscape, customers are incredibly well-informed. They can easily access detailed product information, read countless reviews, and compare prices across numerous retailers with just a few clicks. This readily available information significantly reduces the traditional gap in knowledge that once gave businesses an advantage.

This heightened transparency directly strengthens the bargaining power of customers. With so much data at their fingertips, buyers can confidently negotiate better prices or seek out alternatives if they feel the terms are not favorable. This is a key factor influencing J. Front Retailing's strategy.

J. Front Retailing acknowledges this shift and is actively investing in its digital presence. These initiatives are designed to improve the overall customer experience, providing them with the information and tools they need, thereby managing the impact of increased buyer information availability.

Customer Switching Costs

Customer switching costs for department stores like those operated by J. Front Retailing are typically quite low. Shoppers can readily shift their patronage to other brick-and-mortar retailers or online marketplaces without incurring significant financial penalties or major disruptions. This ease of switching directly empowers customers, giving them leverage in their purchasing decisions.

However, J. Front Retailing actively works to elevate these implicit switching costs. By offering tailored customer experiences, curating exclusive merchandise, and implementing robust loyalty programs, such as the recently enhanced PARCO Card, the company aims to foster deeper customer engagement and create a greater incentive for customers to remain loyal. This strategy directly addresses the bargaining power of customers by making it less appealing to switch.

For example, the PARCO Card, launched in 2023, offers tiered benefits and exclusive discounts, encouraging repeat purchases and building a stronger customer relationship. In fiscal year 2024, J. Front Retailing reported a 5% increase in repeat customer transactions, partially attributed to these loyalty initiatives. This data suggests that efforts to increase switching costs are beginning to yield positive results in retaining customers.

- Low Default Switching Costs: Customers can easily move between department store brands or online retailers without financial or practical barriers.

- J. Front Retailing's Loyalty Initiatives: Strategies include personalized services, unique product selections, and loyalty programs like the PARCO Card.

- Increasing Implicit Switching Costs: The goal is to make it less attractive for customers to switch by offering added value and benefits.

- Fiscal Year 2024 Impact: A 5% rise in repeat customer transactions indicates success in customer retention, partly due to these loyalty efforts.

Customer Concentration

J. Front Retailing’s extensive customer base generally results in low customer concentration, which typically diminishes the bargaining power of any single customer. This broad reach means that the loss of one customer would not significantly impact the company’s overall sales. For instance, in fiscal year 2023, J. Front Retailing reported total sales of ¥334.9 billion, underscoring the distributed nature of its revenue streams.

However, the company’s strategic focus on growth through high-value customers and inbound tourists introduces a nuance. These specific customer segments, while not individually concentrated, collectively hold considerable influence due to their significant spending potential and evolving preferences. The company’s ability to attract and retain these key demographics directly impacts its revenue growth trajectory.

- Low Customer Concentration: J. Front Retailing serves a wide array of customers, diluting the power of any individual buyer.

- Growing Influence of Key Segments: Increased reliance on high-value domestic shoppers and inbound tourists means these groups have a more significant impact on sales and strategy.

- 2023 Sales Data: The company achieved ¥334.9 billion in sales for fiscal year 2023, indicating a broad customer base.

- Segmental Spending Habits: The preferences and spending patterns of affluent and international customers are crucial for J. Front Retailing's growth.

The bargaining power of customers for J. Front Retailing is substantial due to the wide availability of alternatives, both online and offline. Consumers can easily compare prices and products, which forces J. Front Retailing to maintain competitive pricing, especially for everyday items.

The company's efforts to increase implicit switching costs through loyalty programs, such as the PARCO Card, are showing positive results, with a 5% increase in repeat customer transactions in fiscal year 2024. While individual customer concentration is low, the spending power of affluent and inbound tourist segments is growing, influencing company strategy.

| Factor | Impact on J. Front Retailing | Supporting Data/Observation |

| Availability of Alternatives | High bargaining power | Continued growth of e-commerce in Japan (significant share of total retail sales in 2024) |

| Customer Information & Transparency | High bargaining power | Easy access to product details, reviews, and price comparisons online |

| Switching Costs | Low default, increasing implicit | Fiscal Year 2024: 5% increase in repeat customer transactions attributed to loyalty programs like PARCO Card |

| Customer Concentration | Low overall, increasing for key segments | Fiscal Year 2023 Sales: ¥334.9 billion, indicating a broad base; focus on high-value and inbound tourists |

Same Document Delivered

J. Front Retailing Porter's Five Forces Analysis

This preview shows the exact document you'll receive immediately after purchase—no surprises, no placeholders. It details the J. Front Retailing Porter's Five Forces Analysis, offering a comprehensive examination of the competitive landscape. You'll gain insights into the bargaining power of buyers and suppliers, the threat of new entrants and substitutes, and the intensity of rivalry within the industry. This professionally formatted analysis is ready for your strategic decision-making.

Rivalry Among Competitors

J. Front Retailing operates within a fiercely competitive Japanese retail landscape. The market is crowded with a multitude of players, ranging from established department store rivals like Isetan Mitsukoshi and Takashimaya to dominant e-commerce platforms and a broad spectrum of specialty stores, supermarkets, and convenience outlets.

This intense rivalry stems from the sheer number and diversity of these competitors, each employing different strategies and targeting various consumer segments. J. Front Retailing must navigate this complex environment, where traditional brick-and-mortar formats face constant pressure from online retailers and specialized niche players.

For instance, in 2023, the Japanese e-commerce market was estimated to be worth over ¥20 trillion, highlighting the significant challenge posed by online channels to traditional retail. This vast digital marketplace offers consumers a wide array of choices, forcing J. Front Retailing to continually innovate its offerings and customer experience.

While department store sales have seen a rebound, their growth rate still trails behind rapidly expanding sectors like e-commerce. For instance, e-commerce sales in Japan, a key market for J. Front Retailing, are expected to see robust growth in 2024 and beyond. This disparity in growth rates means that traditional retailers, including department stores, face intensified rivalry as they compete for a comparatively smaller slice of the overall retail market.

J. Front Retailing emphasizes product and service differentiation across its flagship brands like Daimaru and Matsuzakaya. This includes offering carefully selected product assortments and premium customer services designed to create distinctive shopping experiences. For instance, the company’s fiscal year 2024 results show continued investment in enhancing these customer-facing elements to stand out.

Beyond traditional retail, J. Front Retailing diversifies into real estate and credit finance, creating integrated offerings that set it apart. While these ventures add unique value, the core retail differentiation remains paramount in a competitive landscape where many retailers offer similar products. The company's strategy hinges on making its retail spaces and services uniquely appealing to consumers.

Exit Barriers

J. Front Retailing, like many in the department store sector, faces considerable exit barriers. These are primarily driven by the high fixed costs tied to extensive physical retail footprints. Think about the significant investments in large store locations, often secured through long-term leases, and the substantial employee headcount required to operate these spaces. These factors make it economically challenging to simply close up shop when market conditions turn unfavorable.

This reluctance to exit, even when facing profitability pressures, can intensify competitive rivalry. Companies may continue to operate, albeit perhaps at reduced capacity or with narrower margins, rather than absorb the significant costs associated with winding down operations. This can lead to prolonged periods where multiple players are vying for market share, even if the overall market is stagnant or declining.

For instance, in 2024, the Japanese retail landscape continues to show the impact of these persistent exit barriers. Department store sales have experienced a mixed performance, with some segments showing resilience while others struggle. Companies like J. Front Retailing must navigate this environment, where legacy costs of physical presence can mean a protracted battle for market position.

- High Fixed Costs: Significant investment in physical retail infrastructure and long-term lease agreements.

- Large Employee Bases: Substantial workforce commitments contribute to operational inertia.

- Reluctance to Exit: Companies may endure difficult periods rather than face closure costs.

- Intensified Rivalry: Prolonged presence of multiple players, even in challenging markets, fuels competition.

Strategic Commitments and Vision

J. Front Retailing's strategic commitments are a significant factor in its competitive rivalry. The company has made substantial investments in innovation and digitalization, aiming to stay ahead in the evolving retail landscape. For instance, major renovations, such as the one at Matsuzakaya Nagoya, represent long-term capital outlays designed to enhance the customer experience and attract shoppers.

This forward-looking vision, encapsulated in their 'New Happiness' initiative for urban development, signals aggressive competitive intent. These initiatives are not merely operational adjustments but fundamental shifts in strategy, positioning J. Front Retailing to compete more effectively against rivals who may be slower to adapt. The company's dedication to these long-term goals suggests a determination to capture market share and redefine customer expectations.

- Innovation Focus: J. Front Retailing has prioritized investments in new technologies and service models.

- Digitalization Efforts: The company is actively pursuing digital transformation to improve online and in-store experiences.

- Customer Experience: Significant capital is allocated to upgrading physical store environments, like Matsuzakaya Nagoya.

- Urban Development Vision: The 'New Happiness' concept highlights a strategic commitment to integrated urban retail solutions.

J. Front Retailing faces intense competition from a wide array of rivals, including other department stores, e-commerce giants, and specialty retailers. This rivalry is exacerbated by high exit barriers within the department store sector, stemming from significant fixed costs associated with physical locations and large workforces.

The company’s strategic commitments, such as investments in digitalization and store renovations like Matsuzakaya Nagoya, aim to differentiate its offerings. These moves reflect a proactive stance against competitors and a drive to capture market share in a dynamic retail environment, especially considering the projected growth of online sales in Japan.

| Competitor Type | Examples | Competitive Pressure |

|---|---|---|

| Department Stores | Isetan Mitsukoshi, Takashimaya | High, due to similar offerings and customer bases |

| E-commerce Platforms | Amazon Japan, Rakuten Ichiba | Very High, driven by convenience and price competitiveness |

| Specialty Retailers/Others | Apparel brands, electronics stores, supermarkets | Moderate to High, depending on niche focus |

SSubstitutes Threaten

Online retail and e-commerce present a significant threat of substitutes for J. Front Retailing's traditional brick-and-mortar operations. These digital platforms offer unparalleled convenience, a vast selection of goods, and often competitive pricing, sometimes bolstered by advantages like potential tax exemptions on direct imports. This accessibility directly challenges the appeal of physical stores, especially as consumer habits increasingly lean towards the ease of online transactions.

The Japanese e-commerce market is a prime example of this growing trend, with continued expansion anticipated. In 2023, Japan's e-commerce sales reached approximately 22.7 trillion yen, a figure expected to climb further. This sustained growth underscores a fundamental shift in consumer behavior, where the digital marketplace acts as a powerful substitute for conventional retail experiences, impacting J. Front Retailing's market share.

Customers are increasingly drawn to specialty stores and boutiques that offer a more curated and focused product selection, often exceeding the experience provided by broad-appeal department stores for specific categories. This trend directly challenges the traditional department store model of being a one-stop shop. For instance, the global specialty retail market is projected to grow significantly, with reports indicating a compound annual growth rate of over 8% leading up to 2024, highlighting consumer preference for specialized offerings.

The proliferation of direct-to-consumer (DTC) brands significantly amplifies the threat of substitutes for traditional retailers like J. Front Retailing. These brands, by selling directly online, effectively cut out the department store intermediary, offering a more streamlined and often personalized purchasing experience. This disintermediation is particularly potent in sectors such as fashion and beauty, where brand loyalty can be cultivated directly with the end consumer. For instance, the global DTC e-commerce market was projected to reach over $300 billion in 2024, underscoring the substantial shift in consumer behavior and the increased accessibility of substitute options outside traditional retail frameworks.

Experiential Leisure Activities

The rise of experiential leisure activities presents a significant threat of substitutes for traditional retail, especially for younger demographics who increasingly value experiences over tangible goods. This shift means disposable income that might have gone to J. Front Retailing's stores could be allocated to travel, entertainment, or unique events instead. For instance, a 2024 survey indicated that over 60% of millennials and Gen Z prioritize spending on experiences.

J. Front Retailing is strategically addressing this by integrating experiential elements into its properties, aiming to capture a share of this growing consumer preference. This includes developing spaces that offer more than just shopping, such as dining, entertainment, and cultural attractions. The company recognizes that to remain competitive, its retail environments must compete with a wide array of leisure options for consumers' time and money.

- Growing Preference for Experiences: Consumers, particularly younger ones, are increasingly choosing experiences (like travel, events, dining) over purchasing physical goods.

- Diversion of Disposable Income: Money spent on leisure and entertainment activities directly competes with funds available for retail purchases.

- Integration Strategy: J. Front Retailing's developments are incorporating entertainment and dining to offer a blended experiential retail environment.

- Market Data: Reports from 2024 show a substantial portion of consumer spending shifting towards leisure and experiences, impacting traditional retail.

Private Label Brands and Discount Retailers

The threat of substitutes for J. Front Retailing, particularly from private label brands and discount retailers, remains a significant factor. As consumers increasingly seek value, the availability of high-quality private label products from supermarkets and other retailers offers a compelling lower-cost alternative. This trend extends beyond basic necessities, with private labels now encroaching on categories previously dominated by department stores, including some premium goods.

Discount retailers further amplify this threat by providing aggressively priced options across a wide product spectrum. This competitive pressure forces traditional department stores like those operated by J. Front Retailing to constantly re-evaluate their pricing strategies and product differentiation. For instance, data from 2024 indicates that private label penetration in the grocery sector alone reached over 20% in many developed markets, demonstrating the broad appeal and competitive strength of these alternatives.

- Growing Private Label Quality: Retailers are investing in the quality and branding of their private label offerings, making them increasingly competitive with established brands.

- Discount Retailer Expansion: Discount chains continue to expand their footprint and product assortments, attracting price-sensitive consumers.

- Consumer Price Sensitivity: Economic pressures in 2024 have heightened consumer focus on price, making substitutes more attractive.

- Substitution Across Categories: The threat isn't limited to low-end goods; private labels and discount options are now viable substitutes even for mid-tier and some higher-end merchandise.

The rise of online marketplaces and direct-to-consumer (DTC) brands poses a substantial threat of substitutes for J. Front Retailing. These digital channels offer consumers convenience, wider product selection, and often competitive pricing, directly challenging the traditional department store model. For example, Japan's e-commerce sales in 2023 were around 22.7 trillion yen, showcasing a strong consumer shift towards online shopping.

Furthermore, the growing preference for curated experiences over material possessions diverts consumer spending away from traditional retail. Younger demographics, in particular, are allocating more disposable income to leisure activities. Indeed, over 60% of millennials and Gen Z, according to a 2024 survey, prioritize spending on experiences.

The increasing quality and availability of private label brands and discount retailers also present a viable substitute. These alternatives offer value-conscious consumers comparable products at lower price points, a trend amplified by economic pressures in 2024. In some developed markets, private label penetration in groceries alone exceeded 20% in 2024, illustrating this widespread shift.

| Threat of Substitutes | Description | Impact on J. Front Retailing | Supporting Data (2023-2024) | Key Takeaway |

| E-commerce & Online Retail | Digital platforms offer convenience, vast selection, and competitive pricing. | Directly competes with physical store sales, eroding market share. | Japan's e-commerce sales: ~22.7 trillion yen (2023). | Significant shift in consumer purchasing habits towards online channels. |

| Direct-to-Consumer (DTC) Brands | Brands selling directly bypass intermediaries, offering streamlined experiences. | Reduces reliance on department stores, potentially weakening brand partnerships. | Global DTC e-commerce market projected over $300 billion (2024). | Disintermediation is a growing challenge for traditional retail models. |

| Experiential Leisure Activities | Consumer preference for experiences (travel, events) over goods. | Diverts disposable income that could be spent on retail products. | >60% of millennials/Gen Z prioritize experiences (2024 survey). | Retailers must adapt to compete for consumer time and spending. |

| Private Label & Discount Retailers | High-quality, lower-priced alternatives to branded merchandise. | Forces price competition and necessitates strong product differentiation. | Private label penetration in groceries: >20% in developed markets (2024). | Value-driven consumers increasingly opt for these accessible substitutes. |

Entrants Threaten

The department store sector, particularly for established players like J. Front Retailing, presents a formidable barrier due to substantial capital requirements. Launching a new department store necessitates significant investment in prime real estate, often in high-traffic urban locations, alongside the costs of building or renovating facilities, stocking a diverse range of merchandise, and establishing robust operational systems.

J. Front Retailing’s financial statements for the fiscal year ended February 2024 underscore this point, reporting significant investments in property, plant, and equipment, totaling ¥300 billion. This substantial asset base, including numerous flagship stores, exemplifies the high entry costs that deter potential new competitors.

Japanese consumers often display deep loyalty to familiar brands and retailers, creating a significant barrier for newcomers aiming to gain traction. J. Front Retailing leverages this by capitalizing on the enduring trust built by its flagship stores, Daimaru and Matsuzakaya, which have cultivated relationships across generations of shoppers.

New entrants into Japan's retail sector, particularly those looking to compete with established players like J. Front Retailing, encounter significant hurdles in accessing crucial distribution channels. Securing prime retail locations, especially in high-traffic urban areas, is a major challenge due to limited availability and high costs. For instance, in 2024, prime retail rents in Tokyo's Ginza district continued to be among the highest globally, making it difficult for new businesses to establish a physical presence.

Furthermore, building and maintaining efficient supply chains and robust distribution networks in Japan requires substantial investment and local expertise. Established companies have long-standing relationships with suppliers and logistics providers, creating a barrier for newcomers. The preference for exclusive distributor models, common in many Japanese industries, further complicates market entry for unfamiliar brands as it restricts their ability to forge independent distribution partnerships.

Regulatory and Bureaucratic Hurdles

J. Front Retailing operates within Japan's retail sector, where regulatory and bureaucratic hurdles can significantly impact new entrants. For instance, Japan's food safety regulations, particularly concerning imported goods, can be rigorous, requiring extensive documentation and adherence to specific labeling standards. A new entrant in the grocery sector would need to navigate these complexities, which can add substantial upfront costs and time to market entry.

The administrative processes for establishing a new retail business in Japan, such as obtaining business licenses and permits, can also be intricate. These procedures may involve multiple government agencies and require local knowledge to expedite. For example, opening a new physical store often necessitates compliance with zoning laws and building codes that can differ across municipalities, increasing the barrier for foreign or unfamiliar businesses.

Furthermore, meeting the high quality expectations of Japanese consumers presents another challenge. New entrants must invest in product sourcing and quality control to align with these standards, which can be a significant cost factor. In 2023, the average consumer satisfaction rate for retail services in Japan remained high, indicating a consistent demand for quality and service excellence that new players must strive to match.

- Navigating complex Japanese regulations for new retail businesses.

- Meeting stringent quality expectations of Japanese consumers.

- The cost and time associated with obtaining necessary business permits.

- Adhering to specific zoning and building codes for retail locations.

E-commerce as a Lower Entry Barrier

The threat of new entrants for J. Front Retailing is significantly impacted by e-commerce. While establishing a physical retail presence in Japan involves substantial costs and regulatory hurdles, the online space offers a considerably lower barrier to entry. This allows both domestic and international players to launch online-only operations or expand their digital reach into Japan without the need for extensive brick-and-mortar investments.

For instance, the Japanese e-commerce market continued its robust growth trajectory, with projections indicating further expansion. In 2024, the market size was estimated to be in the hundreds of billions of U.S. dollars, demonstrating its significant scale and accessibility. This digital shift means that new competitors can emerge with agile business models focused purely on online sales and direct-to-consumer strategies.

However, simply having an online presence is not a guarantee of success. New entrants must still contend with the complexities of the Japanese market, requiring considerable investment in:

- Localized digital platforms and user experiences.

- Targeted online marketing campaigns to build brand awareness.

- Establishing efficient and reliable logistics and delivery networks.

These essential components necessitate substantial capital and strategic planning, even for online-focused businesses, thereby moderating the overall threat posed by new entrants to established players like J. Front Retailing.

The threat of new entrants for J. Front Retailing is generally moderate. While significant capital investment in prime real estate and established brand loyalty present high barriers for physical stores, the growing e-commerce landscape offers a lower entry point.

New online retailers face challenges in building brand recognition and efficient logistics in Japan, requiring substantial investment even in the digital space. For example, in 2023, the average cost of customer acquisition for online retailers in Japan was estimated to be around $50, demonstrating the ongoing investment needed.

Despite these digital hurdles, the sheer volume and accessibility of the Japanese e-commerce market, projected to exceed $200 billion in 2024, continue to attract new players, keeping the threat level from entirely diminishing.

| Factor | Impact on New Entrants | J. Front Retailing's Position |

|---|---|---|

| Capital Requirements (Physical Retail) | Very High | Strongly Protected by Existing Assets (e.g., ¥300 billion in Property, Plant, and Equipment as of Feb 2024) |

| Brand Loyalty & Reputation | High | Well-Established with Daimaru and Matsuzakaya |

| Distribution Channels | Challenging | Long-standing relationships and prime locations |

| E-commerce Entry | Moderate | Lower physical barriers, but requires significant digital investment and logistics |

| Regulatory Environment | Moderate to High | Complex permits and quality standards |

Porter's Five Forces Analysis Data Sources

Our Porter's Five Forces analysis for J. Front Retailing is built upon a foundation of publicly available information, including the company's annual reports, investor presentations, and SEC filings. We supplement this with data from reputable retail industry research firms and market analysis reports to capture a comprehensive view of the competitive landscape.