J. Front Retailing PESTLE Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

J. Front Retailing Bundle

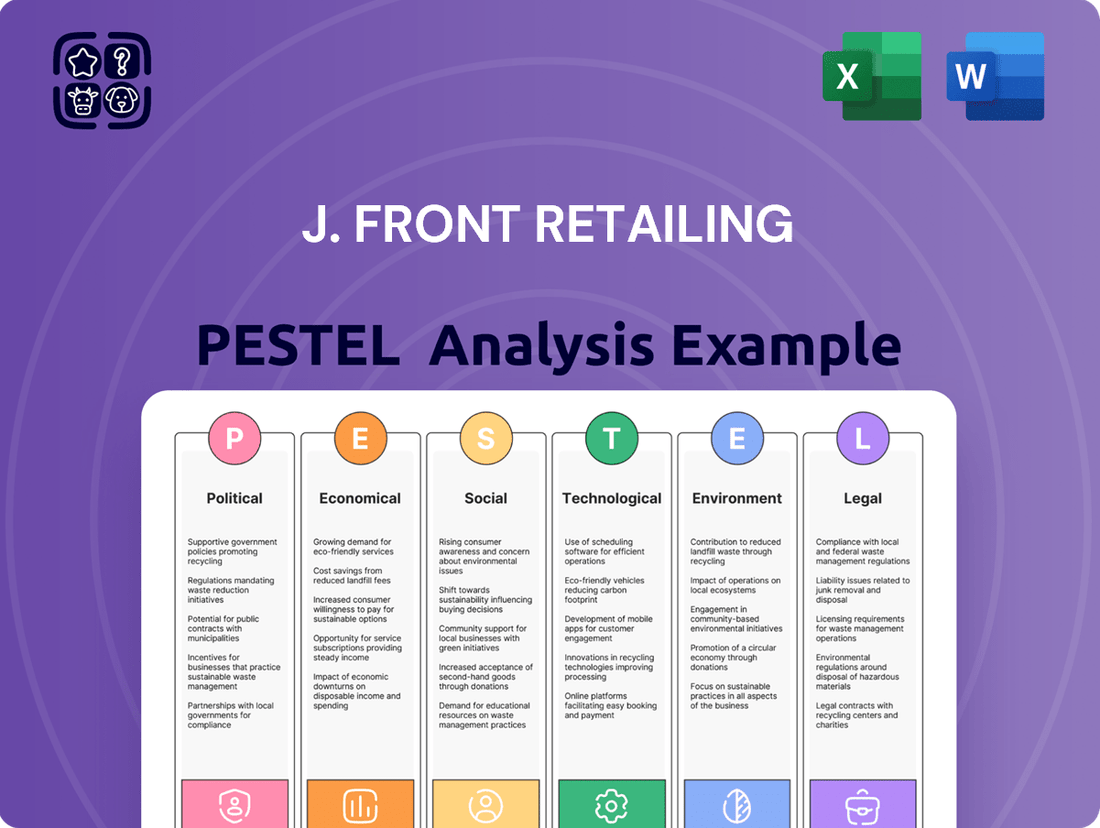

The retail landscape is constantly shifting, and understanding the external forces impacting J. Front Retailing is crucial for strategic success. Our PESTLE analysis delves into the political, economic, social, technological, legal, and environmental factors shaping the company's operations and future trajectory. Discover how evolving consumer behaviors, economic fluctuations, and technological advancements present both challenges and opportunities for J. Front Retailing.

Gain a competitive edge by leveraging our expertly crafted PESTLE analysis of J. Front Retailing. This comprehensive report provides actionable intelligence to navigate the complexities of the current market. Make informed decisions and proactively adapt to the external environment.

Unlock a deeper understanding of J. Front Retailing's strategic positioning by exploring the comprehensive PESTLE analysis. This ready-to-use resource is invaluable for investors, consultants, and business strategists seeking to identify growth avenues and mitigate risks. Download the full version now for immediate access to critical market insights.

Political factors

The Japanese government's commitment to boosting tourism is a significant tailwind for J. Front Retailing. Their ambitious goal of attracting 60 million inbound tourists by 2030 directly translates to increased foot traffic and spending in their department stores, which are popular destinations for international shoppers. In 2023, Japan saw a record 25.07 million foreign visitors, a strong indicator of this ongoing trend.

Changes to tax-free shopping, moving from immediate exemption to an airport refund system effective from 2025, could influence how tourists approach their spending. While this might slightly alter the on-the-spot purchase experience, the overall incentive to shop remains, with potential for larger purchases if the refund process is streamlined. This policy shift aims to simplify tax refunds for tourists and enhance compliance.

Further bolstering inbound tourism, Japan is expected to ease visa requirements for Chinese tourists in spring 2025. Given that Chinese visitors are a major demographic for luxury goods and high-end retail, this policy is poised to significantly benefit J. Front Retailing's premium offerings and drive substantial revenue growth in the coming years.

New amendments to Japan's four key product safety laws, expected by the end of 2025, will significantly enhance consumer protection, particularly for online purchases and children's items. These updates mandate that foreign companies selling directly to Japanese consumers must designate a local representative, a move aimed at improving accountability and recourse for buyers.

For J. Front Retailing, which offers a wide range of products including those for children, adherence to these strengthened regulations is crucial. Non-compliance could lead to penalties, impacting the company's reputation and financial standing, especially as consumer trust is paramount in the retail sector.

Japan's labor laws underwent significant revisions in 2024, with further adjustments anticipated for 2025. These updates include stricter notification requirements for employees, more precise regulations for fixed-term contracts, and modifications to the discretionary work hour system. The overarching goal is to bolster employee rights and workplace transparency.

For J. Front Retailing, a large employer, these legal shifts necessitate a review and potential overhaul of its human resource strategies to ensure full compliance. Such adaptations could influence operational expenses and how the company manages its workforce, particularly concerning scheduling and employment contracts.

The revised labor laws are designed to promote fairer employment practices, which could lead to increased labor costs for businesses if they require more extensive benefits or more structured working hours. For instance, clearer guidelines on fixed-term employment might reduce the flexibility employers previously had in managing their staff base, potentially impacting recruitment and retention strategies.

As of 2024, reports indicate a growing emphasis on work-life balance and employee well-being within Japan's corporate landscape, a trend that these legal revisions are intended to support. This environment suggests that companies like J. Front Retailing will need to proactively integrate these principles into their operational frameworks to remain competitive and compliant.

Economic Stimulus and Inflation Control

Government initiatives to stimulate the economy and manage inflation significantly impact consumer spending, a critical driver for J. Front Retailing. Despite temporary support like worker bonuses and tax cuts, real disposable income has not fully recovered to pre-pandemic figures.

The Bank of Japan's monetary policy, including the possibility of interest rate increases, will shape the broader economic landscape.

- Impact on Spending: Policies that boost disposable income, such as tax reductions or wage subsidies, can lead to increased retail sales for J. Front Retailing. Conversely, tightening monetary policy to control inflation could dampen consumer confidence and spending.

- Inflationary Pressures: Persistent inflation erodes purchasing power, forcing consumers to prioritize essential goods and potentially reduce discretionary spending on items sold by J. Front Retailing.

- Monetary Policy: The Bank of Japan's stance on interest rates directly affects borrowing costs for businesses and consumers, influencing investment and spending decisions across the economy. For instance, a shift towards tighter monetary policy in 2024 or 2025 could slow down consumer demand.

Trade Agreements and International Relations

Japan's active participation in trade agreements, such as the Comprehensive and Progressive Agreement for Trans-Pacific Partnership (CPTPP), directly impacts J. Front Retailing by potentially reducing tariffs on imported goods and opening new markets for its brands. Stable diplomatic ties foster a predictable environment for international business operations, vital for a company with global ambitions. For J. Front Retailing, aiming for a 20% revenue increase from international operations within three years, these agreements are not just beneficial, but essential for supply chain efficiency and customer acquisition abroad.

Geopolitical stability and the strength of Japan's international relations are paramount for J. Front Retailing's expansion strategy. Positive diplomatic engagement can lead to increased tourism, a significant driver for the retail sector, as seen with the continued growth in inbound tourism figures prior to any potential global disruptions. Conversely, strained relations could deter international shoppers and complicate sourcing of foreign-made merchandise, directly impacting sales and profitability.

- Trade Agreements: CPTPP membership facilitates smoother trade flows and market access for J. Front Retailing's diverse product offerings.

- International Relations: Strong diplomatic ties with key trading partners bolster consumer confidence and encourage inbound tourism, a crucial revenue stream.

- Supply Chain Resilience: Stable international relations ensure the consistent availability and competitive pricing of imported goods essential for J. Front Retailing's inventory.

- Revenue Growth: J. Front Retailing's target of a 20% revenue increase from international operations hinges on favorable trade policies and a welcoming global market environment.

Government policies promoting tourism are a significant boon for J. Front Retailing, with Japan aiming to attract 60 million inbound tourists by 2030; in 2023, the country welcomed a record 25.07 million foreign visitors, highlighting this trend. Upcoming changes to tax-free shopping, transitioning to an airport refund system from 2025, might subtly alter immediate spending habits, though the overall incentive to shop is expected to persist. Furthermore, anticipated easing of visa requirements for Chinese tourists in spring 2025 is particularly beneficial, as this demographic heavily influences luxury goods sales, a key area for J. Front Retailing.

What is included in the product

This PESTLE analysis provides a comprehensive examination of the external macro-environmental factors impacting J. Front Retailing across Political, Economic, Social, Technological, Environmental, and Legal dimensions.

It offers actionable insights for strategic decision-making by detailing how these forces create both challenges and opportunities within J. Front Retailing's operating landscape.

A clear, actionable PESTLE analysis for J. Front Retailing that highlights key external opportunities and threats, enabling proactive strategic adjustments and mitigating potential market disruptions.

Economic factors

Japanese consumer spending is showing a positive trajectory, with late 2024 witnessing growth and projections indicating a continued, albeit slow, rise through 2025, targeting a return to pre-pandemic spending levels. This recovery is a key indicator for retailers.

However, inflation is creating a dual effect on consumer behavior. While some consumers are splurging on occasional luxury goods, a significant portion is exercising greater caution with their everyday purchases. This polarization impacts different retail segments unevenly.

For J. Front Retailing, this spending pattern presents a mixed outlook. The company's luxury divisions are likely to benefit from the increased willingness to spend on higher-end items. For instance, department store sales in luxury goods have seen a notable uptick in recent quarters.

Conversely, J. Front Retailing's general merchandise and food categories may encounter more restrained consumer spending. Shoppers are prioritizing value and necessity in these areas, potentially leading to slower growth or even stagnation if price increases outpace wage growth.

Inflation remains a significant concern, with projections for 2025 indicating continued pressure on consumer purchasing power, particularly for essential, non-durable goods. While wages are anticipated to see an uptick in 2025, driven by ongoing labor shortages and robust corporate earnings, the real wage growth may still lag behind inflation, forcing consumers to be more price-sensitive.

For J. Front Retailing, this economic climate necessitates a delicate balancing act. The company must carefully calibrate its pricing strategies to remain attractive to value-conscious shoppers, a segment likely to expand as inflation bites. Simultaneously, the anticipated rise in wages, while beneficial for employees, could also translate into increased operational costs for the retailer through higher labor expenses, impacting profit margins if not managed effectively.

Inbound tourism significantly bolsters J. Front Retailing's revenue. Foreign visitor spending has seen a notable increase and is anticipated to keep rising through 2025, directly benefiting the company's department store operations.

The current economic climate, characterized by a weaker yen, positions Japan as a highly appealing destination for international tourists. This trend is particularly advantageous for J. Front Retailing, as it fuels robust sales of luxury goods at its flagship stores, Daimaru and Matsuzakaya.

For the fiscal year concluding in February 2024, J. Front Retailing reported impressive revenue growth. A substantial portion of this expansion can be attributed to heightened consumer demand for apparel and accessories, a segment strongly influenced by tourist spending.

Real Estate Market Dynamics

J. Front Retailing's involvement in real estate development means the Japanese property market's health is crucial. Property values, construction expenses, and lease income directly affect its Developer segment's profitability. For instance, the company's strategic focus on prime locations like Ginza Six underscores the importance of appreciating real estate assets.

The Japanese real estate market has shown resilience, with prime urban areas experiencing steady demand. In early 2024, Tokyo's central business districts continued to see stable rental yields, though development costs, particularly for materials and labor, remained elevated due to supply chain pressures and a tight labor market. J. Front Retailing's ability to secure favorable land acquisition and development terms will be key to its success in this environment.

- Property Values: Prime retail locations in major Japanese cities, like Tokyo and Osaka, have maintained or increased in value, driven by consistent consumer spending and inbound tourism.

- Development Costs: Construction material prices, influenced by global commodity markets and domestic supply, saw a notable uptick in late 2023 and early 2024, impacting project budgets.

- Rental Income: Occupancy rates for well-located commercial properties, especially those managed by large developers like J. Front Retailing, remained high, supporting stable rental income streams.

- Investment Trends: Foreign and domestic institutional investors continued to show interest in Japanese commercial real estate, particularly in mixed-use developments offering retail and office space.

E-commerce Growth and Digitalization Investment

E-commerce is a significant and expanding part of J. Front Retailing's business. In the fiscal year concluding in February 2024, online sales represented a substantial 25% of the company's total revenue. This highlights the increasing importance of digital channels in reaching customers.

The company is actively investing in its digital future, committing around ¥6 billion to digitalization efforts. These investments cover crucial areas like enhancing e-commerce platforms and upgrading in-store technologies. The goal is to drive a notable 30% year-on-year growth in online sales.

This strategic focus on digital transformation is essential for J. Front Retailing to keep pace with changing consumer preferences. As shoppers increasingly favor online purchasing, these investments help the company remain competitive and relevant in the evolving retail landscape.

- E-commerce Contribution: Online sales made up 25% of J. Front Retailing's total revenue in FY ending Feb 2024.

- Digitalization Investment: Approximately ¥6 billion has been invested in digital initiatives, including e-commerce and in-store tech.

- Online Sales Target: The company aims for a 30% year-on-year increase in online sales through these efforts.

- Strategic Importance: Digital transformation is key to adapting to consumer behavior and maintaining market competitiveness.

Japanese consumer spending is projected to see a modest increase through 2025, though inflation remains a concern, potentially dampening purchasing power for essential goods. While luxury segments may benefit from continued inbound tourism and a weaker yen, value-conscious consumers will likely drive demand in other categories.

The economic landscape presents a dual challenge for J. Front Retailing: capitalizing on luxury spending fueled by tourism while navigating price sensitivity in everyday items. The company's real estate segment benefits from resilient prime property values, but elevated development costs persist due to supply chain and labor market pressures.

Digitalization is a key focus, with J. Front Retailing investing ¥6 billion to enhance its e-commerce platforms and in-store technology, aiming for a 30% year-on-year growth in online sales. This strategic move is crucial for adapting to evolving consumer preferences and maintaining competitiveness in the retail sector.

| Economic Factor | Trend/Impact | Relevance to J. Front Retailing |

|---|---|---|

| Consumer Spending | Projected slow growth through 2025; polarization between luxury and value-driven purchases. | Positive for luxury divisions, potential pressure on general merchandise. |

| Inflation | Continued pressure on purchasing power for essentials; real wage growth may lag. | Requires careful pricing strategy to attract value-conscious consumers; potential for increased operational costs. |

| Inbound Tourism | Increasingly bolstering revenue, especially for luxury goods, supported by a weaker yen. | Directly benefits department store operations and luxury sales at flagship locations. |

| Real Estate Market | Resilient prime urban property values; elevated development costs for materials and labor. | Supports Developer segment profitability; strategic land acquisition is key. |

| E-commerce Growth | 25% of total revenue in FY ending Feb 2024; aiming for 30% YoY growth in online sales. | Significant investment in digital transformation to meet changing consumer behavior. |

Preview the Actual Deliverable

J. Front Retailing PESTLE Analysis

The content and structure shown in the preview is the same document you’ll download after payment. This comprehensive PESTLE analysis of J. Front Retailing covers Political, Economic, Social, Technological, Legal, and Environmental factors impacting the business. You'll find detailed insights into market trends, competitive landscapes, and strategic considerations for J. Front Retailing. This document is fully formatted and ready for immediate use upon purchase.

Sociological factors

Japanese consumer lifestyles are undergoing a significant shift, with a pronounced move towards prioritizing experiences, personal well-being, and environmental consciousness, especially within younger demographics like millennials and Gen Z. This trend directly impacts retail strategies as consumers increasingly seek value beyond mere product acquisition.

J. Front Retailing is actively responding to these evolving values by curating a diverse range of products and services designed to enhance customer lifestyles. A key focus is on catering to the growing demand for durable, long-lasting goods that offer tangible, long-term benefits, reflecting a conscious consumerism that values quality and sustainability.

For instance, in 2023, consumer spending in Japan on experiences like travel and dining saw a notable rebound. Simultaneously, surveys indicate that over 60% of Japanese consumers, particularly those under 40, consider sustainability a crucial factor in their purchasing decisions, with a willingness to pay a premium for eco-friendly products.

Japan's demographic landscape is characterized by a declining birthrate and an increasingly elderly population, a trend projected to continue through 2025. This shrinking consumer base directly affects overall demand. For instance, by 2025, it's estimated that over 30% of Japan's population will be aged 65 or older, a significant portion of which will be the 'silver market'.

While the growing 'silver market' offers potential, representing a significant spending power for healthcare, leisure, and specialized goods, younger demographics present a different challenge. Millennials and Gen Z, for example, are noted for their cautious spending, often prioritizing essential goods and demonstrating a strong preference for value-for-money propositions in 2024 and looking ahead to 2025.

Consequently, J. Front Retailing needs to strategically adapt its business model. This involves carefully curating product assortments and developing marketing campaigns that resonate with the distinct needs and financial priorities of both the expanding elderly demographic and the value-conscious younger generations.

As cities grow, department stores like Daimaru and Matsuzakaya are evolving into destinations offering more than just products. They are becoming 'experience hubs' to counter the rise of online shopping, focusing on creating memorable in-store visits for urban consumers.

This transformation means integrating sensory elements, offering outstanding customer service, and curating unique events. For instance, in 2024, J. Front Retailing's department store segment saw significant investment in store renovations aimed at enhancing customer experience, reflecting a broader trend in urban retail to foster deeper consumer engagement.

Diversity and Inclusion in Workforce

J. Front Retailing places a strong emphasis on cultivating a diverse and inclusive workforce, recognizing its strategic importance. In 2023, women held 45% of leadership positions, underscoring the company's progress towards gender parity. The organization has set a clear target to achieve 50% representation of underrepresented groups in management by 2025.

This dedication to diversity and inclusion is instrumental in driving innovation and enhancing decision-making processes. By mirroring the diversity of its customer base, J. Front Retailing can better understand and cater to varied market needs. This approach is vital for maintaining a competitive edge and fostering a dynamic organizational culture.

- Workforce Diversity: 45% of leadership roles held by women in 2023.

- Inclusion Goal: Aiming for 50% representation of underrepresented groups in management by 2025.

- Strategic Benefit: Fosters innovation and improved decision-making.

- Customer Alignment: Reflects the diversity of the customer base.

Ethical Consumption and Sustainability Awareness

Consumers today are more attuned to environmental issues and expect businesses to act responsibly. This growing awareness of ethical consumption makes sustainability a core value for companies like J. Front Retailing. For instance, by 2024, a significant portion of consumers, estimated to be over 60% in developed markets, actively seek out brands demonstrating strong environmental commitments.

J. Front Retailing's focus on reducing its carbon footprint, expanding its range of eco-friendly products, and prioritizing recycled materials directly addresses this powerful consumer trend. This strategic alignment is vital for maintaining brand loyalty and attracting new customers in the 2024-2025 period. Reports indicate that companies with robust sustainability initiatives saw, on average, a 5-10% increase in customer preference compared to their less eco-conscious competitors in the past year.

- Increased Demand for Sustainable Products: A growing segment of the consumer base, particularly millennials and Gen Z, prioritizes purchasing from brands with clear environmental and social responsibility policies.

- Corporate Social Responsibility (CSR) as a Differentiator: Companies demonstrating genuine commitment to sustainability often gain a competitive edge, fostering trust and positive brand perception.

- Supply Chain Transparency: Consumers are increasingly scrutinizing the origins of products, demanding transparency regarding ethical sourcing and manufacturing processes.

- Impact of Eco-Conscious Marketing: Marketing campaigns highlighting sustainability efforts can resonate strongly, driving sales and brand advocacy.

Sociological factors significantly shape J. Front Retailing's operating environment, driven by evolving Japanese consumer lifestyles. A notable trend is the increasing prioritization of experiences and personal well-being, particularly among younger demographics like millennials and Gen Z. This shift means consumers are seeking more than just products; they desire value that enhances their lifestyle.

Demographic changes in Japan, including an aging population and declining birthrate, present both opportunities and challenges for the retail sector. The growing 'silver market' offers considerable spending power for specialized goods and services. However, younger generations, while influential, often exhibit cautious spending habits, emphasizing value for money in their 2024-2025 purchasing decisions.

Technological factors

J. Front Retailing is heavily invested in digital transformation, with substantial investments earmarked for enhancing its e-commerce capabilities and integrating advanced in-store technologies. The company's strategic objective is to significantly boost its online sales figures, aiming for a larger share of revenue to come from digital channels in the coming years.

The company is actively pursuing an omnichannel strategy, a crucial technological factor, to create a unified and seamless customer journey that bridges both physical and online retail environments. This approach leverages technology to deliver highly personalized customer interactions, from targeted marketing to customized shopping experiences across all touchpoints.

Japanese retailers, including J. Front Retailing, are rapidly integrating AI and data analytics to understand shoppers better, fine-tune store designs, and create personalized experiences. This technological shift aims to optimize operations and enhance customer engagement across the sector.

For J. Front Retailing, these advancements offer significant opportunities. By harnessing AI for inventory management, the company can reduce waste and ensure popular items are always in stock. Data analytics can also pinpoint effective training areas for customer service staff, leading to improved in-store interactions.

Furthermore, targeted marketing campaigns powered by data insights can significantly boost sales and profitability. For instance, a 2024 report indicated that retail companies leveraging AI for personalization saw an average increase of 15% in customer conversion rates, a metric J. Front Retailing can strive to achieve.

J. Front Retailing can significantly boost its appeal by integrating advanced in-store technologies. Interactive screens, virtual try-on solutions, and streamlined smart payment systems are becoming essential for engaging Japan's increasingly tech-savvy customer base. These innovations can transform the traditional shopping journey into a more dynamic and memorable experience, differentiating J. Front Retailing from competitors.

Payment System Evolution (Cashless and Mobile Payments)

The shift towards cashless transactions in Japan presents a significant technological factor for J. Front Retailing. While cash still holds a considerable share of the market, the adoption of credit cards, prepaid cards, and mobile payment solutions like PayPay is rapidly increasing. For instance, in 2023, the cashless payment ratio in Japan reached approximately 36.7%, a notable increase from previous years, indicating a clear consumer trend towards digital payments.

To remain competitive and cater to evolving consumer preferences, J. Front Retailing must ensure its payment infrastructure is robust and adaptable to these emerging technologies. This includes seamless integration of various cashless options to provide customers with convenience and choice. The company’s ability to facilitate these payment methods directly impacts customer experience and potentially sales volume.

Key technological advancements in payment systems include:

- Growth in QR Code Payments: Services like PayPay have seen exponential growth, with millions of active users in Japan, facilitating quick and easy transactions.

- Contactless Payment Integration: The increasing use of NFC technology in credit and debit cards, as well as mobile devices, demands compatible point-of-sale systems.

- Data Security and Privacy: As more transactions become digital, ensuring the security of customer payment data is paramount, requiring investment in advanced cybersecurity measures.

Supply Chain Digitalization and Efficiency

The retail sector, including J. Front Retailing, increasingly relies on supply chain digitalization to boost efficiency and navigate complex market demands. By adopting advanced technologies, companies can gain a clearer view of their entire supply chain, from sourcing raw materials to delivering finished goods to customers, thereby enhancing operational performance.

J. Front Retailing can leverage digital tools to achieve greater visibility and centralized control over its supply chain. This allows for more effective management of inventory, reduced lead times, and improved responsiveness to market shifts. For instance, advancements in IoT sensors and blockchain technology can provide real-time tracking and verification of goods, ensuring greater traceability and accountability throughout the process.

The ongoing digital transformation in retail is directly impacting operational efficiency. Companies that embrace digitalization are better positioned to manage disruptions, optimize logistics, and reduce costs. This focus on efficiency is critical for maintaining competitiveness in the dynamic retail landscape. For example, the global retail supply chain management market was valued at approximately USD 20 billion in 2023 and is projected to grow significantly in the coming years, underscoring the importance of these technological investments.

Key technological factors enabling this shift include:

- Artificial Intelligence (AI) and Machine Learning (ML): For demand forecasting, inventory optimization, and route planning.

- Internet of Things (IoT): For real-time tracking of goods, temperature monitoring, and asset management.

- Blockchain: To enhance transparency, traceability, and security across the supply chain.

- Robotics and Automation: In warehouses and distribution centers to speed up order fulfillment and reduce labor costs.

J. Front Retailing's technological strategy focuses on enhancing customer experience through an omnichannel approach and leveraging AI for operational efficiency. The company is investing in digital transformation to boost online sales and personalize customer interactions. By integrating advanced in-store technologies like interactive screens and smart payment systems, J. Front Retailing aims to engage Japan's tech-savvy consumers and differentiate itself in the market.

Legal factors

Japan's tax-free shopping landscape is undergoing significant changes, impacting retailers like J. Front Retailing. A key reform moves from immediate tax exemption to a consumption tax-on model, where tourists pay tax at the point of sale and then seek a refund before leaving the country. This shift, intended to align with international practices, commenced with stricter regulations in April 2025, with further adjustments anticipated by November 2026.

This evolution necessitates that J. Front Retailing re-evaluate and adapt its operational procedures for international shoppers. The company will need to implement new systems to manage the upfront collection of consumption tax and facilitate the subsequent refund process for eligible tourists. These changes are crucial for maintaining a competitive edge and ensuring compliance with the updated legal framework governing tax-free shopping for visitors to Japan.

J. Front Retailing must navigate upcoming changes to product safety laws, particularly amendments to the Four Product Safety Acts set to take effect by late 2025. These revisions will significantly tighten rules for online sales and products aimed at children, mandating that foreign companies designate a local representative. This means J. Front Retailing needs to meticulously verify that all its offerings, especially those imported or intended for younger consumers, adhere to the stricter safety benchmarks and updated labeling mandates.

Recent revisions to Japanese labor laws effective in 2024, with ongoing implications through 2025, impose stricter rules on employers. These changes include more detailed notification duties for employees, clearer frameworks for managing fixed-term employment contracts, and explicit consent requirements for employees working under discretionary hour systems. J. Front Retailing must ensure its operational practices align with these updated regulations regarding work hours, rest periods, leave entitlements, and contract stipulations to maintain legal compliance and mitigate the risk of litigation.

Data Privacy and AI Regulations

Japan is actively promoting itself as an AI-friendly nation, often characterized by a more permissive regulatory environment. This approach is designed to foster innovation, particularly in areas like artificial intelligence development.

However, this doesn't mean a complete absence of oversight. There are ongoing efforts to update existing legislation, such as the Act on the Protection of Personal Information (APPI). These proposed amendments aim to streamline how personal data can be utilized for AI advancement, balancing innovation with privacy concerns.

For J. Front Retailing, as it pushes forward with its digital transformation and AI integration strategies, understanding and adhering to these evolving data privacy regulations is crucial. Navigating these changes effectively is key to safeguarding customer information and upholding public trust. For instance, companies must be prepared for potential new requirements regarding consent and data anonymization as AI applications become more sophisticated.

The company's commitment to data security will be a significant factor in its ability to leverage AI for personalized customer experiences and operational efficiencies. As of early 2024, discussions around APPI amendments are ongoing, with a focus on enabling data utilization while strengthening individual rights.

- AI-Friendly Stance: Japan's government is actively positioning the country to be a hub for AI development through supportive policies.

- APPI Amendments: Proposals are in place to modify the Act on the Protection of Personal Information to facilitate personal data usage for AI research and growth.

- Data Privacy Imperative: J. Front Retailing must ensure compliance with these evolving laws to protect customer data and maintain trust.

- Balancing Act: The regulatory landscape seeks to balance the need for data to train AI with the fundamental right to privacy.

Intellectual Property and E-commerce Laws

J. Front Retailing's e-commerce ventures in Japan navigate a landscape governed by specific legal frameworks. The Act on Specified Commercial Transactions (ASCT) and the Consumer Contract Act are crucial, targeting deceptive marketing and consumer protection. These laws mandate transparency and fairness, preventing misleading product descriptions and exploitative contract terms that could disadvantage shoppers. Failure to adhere can result in penalties and damage to brand reputation.

Compliance with intellectual property laws is equally vital for J. Front Retailing's online activities. This includes safeguarding their own trademarks, copyrights, and patents, while also respecting the intellectual property rights of others. The company must ensure that its digital storefronts and marketing materials do not infringe on existing IP, which could lead to costly litigation and operational disruptions. In 2023, Japan saw a notable increase in e-commerce related disputes, underscoring the importance of robust legal adherence.

- ASCT Compliance: Ensures fair e-commerce transactions by prohibiting unfair labeling and misleading advertising.

- Consumer Contract Act: Protects consumers from excessively disadvantageous contract terms, promoting equitable business practices.

- Intellectual Property Protection: Safeguards J. Front Retailing's brands and prevents infringement claims by respecting third-party IP rights.

- E-commerce Dispute Trends: Awareness of increasing e-commerce disputes in Japan highlights the need for strict legal compliance to mitigate risk.

Japan's recent reforms to its tax-free shopping system, effective April 2025, shift from immediate exemption to a consumption tax-on, refund-at-departure model. This necessitates J. Front Retailing to adapt its systems for handling upfront tax collection and subsequent tourist refunds, impacting operational efficiency and compliance. Furthermore, upcoming amendments to product safety laws by late 2025 will impose stricter regulations on online sales and children's products, requiring foreign companies to designate local representatives and potentially impacting J. Front Retailing's product sourcing and compliance checks.

Updated labor laws in 2024 and 2025 introduce more stringent employer notification duties and consent requirements for discretionary hour systems. J. Front Retailing must align its practices with these changes concerning work hours, rest periods, and contract terms to ensure legal compliance. The company also faces evolving data privacy regulations, particularly amendments to the Act on the Protection of Personal Information (APPI), aiming to balance AI development with privacy concerns, which requires careful adherence for data security and customer trust.

J. Front Retailing's e-commerce operations are governed by the Act on Specified Commercial Transactions and the Consumer Contract Act, demanding transparency and fair practices to avoid penalties. Ensuring compliance with intellectual property laws is also critical, as evidenced by the increase in e-commerce disputes in Japan in 2023, highlighting the need to protect the company's brands and respect third-party IP rights.

Environmental factors

J. Front Retailing is actively pursuing a robust sustainability agenda, with ambitious targets for decarbonization. The company aims to achieve net zero emissions by 2050 and has set a near-term goal of reducing emissions by 50% by 2030.

In 2023, J. Front Retailing made significant strides, cutting its carbon footprint by 15%. This achievement was supported by a notable increase in renewable energy usage, which now accounts for 30% of the company's total energy consumption.

These efforts are part of a broader strategy to enhance energy efficiency across operations and to actively promote environmentally conscious lifestyles among consumers and stakeholders.

J. Front Retailing is making significant strides in waste management, having successfully recycled 70% of its waste within its retail operations in 2023. This commitment is central to their strategy for fostering a circular economy.

Looking ahead, the company has set ambitious targets for 2025, aiming to source 100% of its paper products from recycled materials. This initiative underscores their dedication to reducing reliance on virgin resources.

Furthermore, J. Front Retailing is actively expanding its range of eco-friendly products, with a goal to increase the proportion of sustainable goods by 25% by 2025. This focus on sustainable offerings caters to a growing consumer demand for environmentally conscious options.

J. Front Retailing is actively working towards a sustainable supply chain, a key environmental consideration. A significant part of this effort involves tackling Scope 3 greenhouse gas (GHG) emissions, which often arise from activities outside the company's direct control, like those of their suppliers. By collaborating with these partners, J. Front Retailing aims to reduce its overall environmental footprint.

To achieve this, the company is focused on visualizing and centrally managing its entire supply chain. This granular oversight allows them to ensure ethical sourcing and environmental responsibility at every stage, from the very origin of raw materials right through to the finished products reaching consumers. This comprehensive approach underscores a commitment to a more responsible business model.

Resource Conservation and Energy Efficiency

J. Front Retailing is actively focusing on resource conservation beyond just carbon emissions, with a specific emphasis on water usage reduction across its operations. This commitment is a core part of their environmental strategy to lessen their overall ecological footprint.

The company is implementing energy-efficient practices throughout its numerous retail stores and property developments. This proactive approach aims to significantly minimize the energy consumed by its physical infrastructure and daily business activities.

For instance, in fiscal year 2023, J. Front Retailing reported a reduction in water consumption in some of its facilities. While specific overall figures for energy efficiency improvements are still being consolidated for 2024, the company has invested in LED lighting upgrades and more efficient HVAC systems in several key locations.

- Water Usage: Focused efforts to reduce water consumption in retail and development sites.

- Energy Efficiency: Implementation of LED lighting and upgraded HVAC systems in outlets.

- Operational Impact: Minimizing the environmental footprint through efficient resource management.

- Fiscal Year 2023: Noted reductions in water usage at specific J. Front Retailing properties.

Consumer Demand for Eco-friendly Products

Consumer demand for eco-friendly products is a significant environmental factor influencing J. Front Retailing. In Japan, there's a clear upward trend in consumer preference for sustainable and environmentally conscious options. Brands that effectively integrate these values into their offerings often experience a boost in customer loyalty and engagement. For instance, a 2024 survey indicated that over 60% of Japanese consumers consider environmental impact when making purchasing decisions, a notable increase from previous years.

J. Front Retailing is actively responding to this societal shift. Their strategic initiatives include expanding eco-friendly product lines across their department stores and fashion brands. A prime example is their 'Green Store' program, which highlights and promotes products with reduced environmental footprints. This program is designed to meet the growing demand for conscious consumerism and aligns the company with evolving consumer values.

- Growing Preference: Over 60% of Japanese consumers consider environmental impact in purchasing decisions as of 2024.

- Brand Loyalty: Companies adapting to eco-friendly demands see increased customer loyalty.

- J. Front Retailing's Response: Expansion of eco-friendly product lines is a key strategy.

- 'Green Store' Program: This initiative directly addresses and capitalizes on the conscious consumerism trend.

J. Front Retailing's environmental strategy is deeply intertwined with resource conservation, focusing on reducing water consumption and enhancing energy efficiency across its operations. The company is actively implementing upgrades like LED lighting and more efficient HVAC systems in its retail locations. In fiscal year 2023, specific J. Front Retailing properties reported reductions in water usage, reflecting a commitment to minimizing their ecological footprint.

The growing consumer demand for eco-friendly products is a significant environmental driver for J. Front Retailing. By 2024, over 60% of Japanese consumers consider environmental impact when making purchasing decisions, a trend J. Front Retailing is addressing by expanding its range of sustainable goods and promoting its 'Green Store' program.

J. Front Retailing is committed to decarbonization, aiming for net zero emissions by 2050 and a 50% reduction by 2030, having already achieved a 15% cut in its carbon footprint in 2023 through increased renewable energy use, now at 30%. Waste management is also a priority, with 70% of waste recycled in retail operations in 2023, and a target to source 100% recycled paper products by 2025.

| Environmental Focus | 2023 Achievement | 2025 Target | 2030 Goal | 2050 Goal |

|---|---|---|---|---|

| Carbon Emissions Reduction | 15% reduction | 50% reduction | Net Zero | |

| Renewable Energy Usage | 30% of total | |||

| Waste Recycling Rate | 70% in retail | |||

| Recycled Paper Products | 100% sourced | |||

| Sustainable Product Proportion | Increase by 25% |

PESTLE Analysis Data Sources

Our J. Front Retailing PESTLE analysis is constructed using a robust blend of official government publications, reputable industry research firms, and international economic databases. We meticulously gather data on political stability, economic indicators, social trends, technological advancements, environmental regulations, and legal frameworks to ensure comprehensive and accurate insights.