Itafos SWOT Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Itafos Bundle

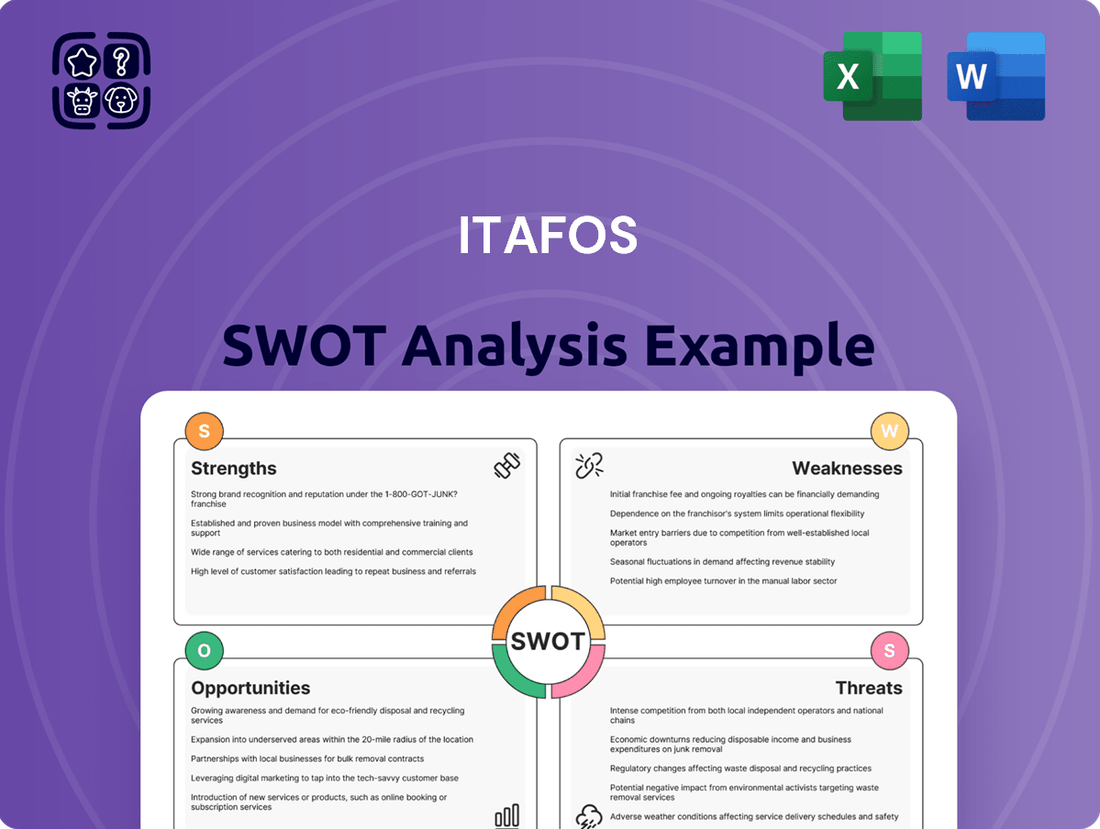

Itafos, a key player in the phosphate industry, boasts significant strengths in its integrated operations and access to high-quality mineral reserves. However, understanding the nuances of its market position, potential threats, and strategic opportunities requires a deeper dive. Our comprehensive SWOT analysis unpacks these crucial elements, offering a clearer picture of Itafos's competitive landscape.

Ready to move beyond the highlights and gain a strategic advantage? Purchase the full Itafos SWOT analysis to unlock detailed insights, expert commentary, and an editable report perfect for investors, analysts, and strategic planners. Get the actionable intelligence you need to make informed decisions.

Strengths

Itafos showcased remarkable operational strength throughout 2024, highlighted by record-breaking production at its Conda facility. In Q4 2024 alone, Conda achieved its best-ever monthly and quarterly front-end production figures, underscoring the company's ability to maximize output efficiently. This consistent performance is a significant advantage in the competitive fertilizer sector.

Beyond sheer volume, Itafos maintained a steadfast commitment to safety, achieving its operational goals in 2024 with an exceptional safety record. This dual focus on production excellence and employee well-being reinforces its reputation as a reliable and responsible operator in the industry.

Itafos boasts a robust and varied product range centered on phosphate. This includes essential fertilizers like monoammonium phosphate (MAP) and super phosphoric acid (SPA), alongside merchant grade phosphoric acid (MGA) and single superphosphate (SSP). This breadth allows the company to serve diverse agricultural needs.

The company's strategic emphasis on specialty fertilizers, such as ammonium polyphosphate (APP), direct application phosphate rock (DAPR), and partially acidulated phosphate rock (PAPR), is a significant strength. These products are crucial for precision agriculture, enabling Itafos to tap into high-value, niche markets. This focus on specialized offerings provides an avenue for potentially higher profit margins compared to producers solely focused on commodity fertilizers.

Itafos boasts a strong strategic asset base, with vertically integrated phosphate fertilizer operations in Conda, Idaho, USA, and Arraias, Brazil. These established facilities provide a solid foundation for production and market access.

The company is proactively extending its mine life, a crucial element for sustained operations. The North Dry Ridge (H1/NDR) project at its Conda site is a prime example, with first ore shipments anticipated in the latter half of 2025. This initiative is designed to secure long-term raw material availability, bolstering operational continuity.

Beyond its current operational hubs, Itafos holds promising projects in Guinea-Bissau and Pará, Brazil. These ventures represent future growth opportunities and diversification of its resource portfolio, further strengthening its strategic positioning in the global fertilizer market.

Improved Financial Performance and Liquidity

Itafos demonstrated a significant uplift in its financial performance throughout 2024. The company reported robust increases in key metrics such as revenue, adjusted EBITDA, net income, and free cash flow when contrasted with the prior year. This surge in profitability and operational efficiency underscores a strengthening financial foundation.

The company's liquidity position as of March 31, 2025, was notably strong, standing at $180.3 million. This figure encompasses both readily available cash and available borrowing capacity, providing a solid cushion for operational needs and strategic initiatives. Itafos has effectively managed its debt, achieving a negative net debt balance, a clear indicator of its enhanced financial health and reduced leverage.

- Revenue Growth: Itafos experienced a notable increase in revenue in Q4 and full-year 2024.

- Profitability Boost: Adjusted EBITDA, net income, and free cash flow all saw substantial improvements year-over-year.

- Liquidity Strength: As of March 31, 2025, the company maintained $180.3 million in liquidity.

- Debt Reduction: Itafos successfully reduced its net debt to a negative balance, signifying a strong financial standing.

Commitment to ESG and Operational Safety

Itafos’ dedication to Environmental, Social, and Governance (ESG) principles is a significant strength, clearly outlined in their April 2024 ESG report. This commitment is further evidenced by their operational performance.

The company achieved an outstanding safety record throughout 2024, boasting a very low Total Recordable Incident Frequency Rate (TRIFR). This focus on safety extended into early 2025, with Itafos reporting no environmental releases or recordable incidents in the first quarter.

Itafos actively integrates its ESG objectives directly into its daily business activities, demonstrating a proactive approach to sustainability and responsible operations. This integration ensures that their commitment to ESG is not just a statement but a core part of their business model.

- Strong ESG Reporting: April 2024 ESG report highlights commitment.

- Exceptional Safety Record: Low TRIFR in 2024.

- Zero Incidents in Q1 2025: No environmental releases or recordable incidents.

- Operational Integration: ESG goals are embedded within daily operations.

Itafos possesses a diversified product portfolio with a strong emphasis on phosphate-based fertilizers, including MAP, SPA, MGA, and SSP, catering to a wide array of agricultural demands. Their strategic focus on high-value specialty fertilizers like APP, DAPR, and PAPR positions them advantageously in niche markets, potentially leading to improved profit margins.

The company benefits from a robust, vertically integrated operational structure, particularly at its Conda, Idaho, USA, and Arraias, Brazil facilities. Furthermore, Itafos is actively extending its mine life through projects like North Dry Ridge (H1/NDR) at Conda, with initial ore shipments expected in the latter half of 2025, securing long-term raw material supply.

Itafos demonstrated significant financial improvement in 2024, with notable year-over-year increases in revenue, adjusted EBITDA, net income, and free cash flow. As of March 31, 2025, the company maintained strong liquidity of $180.3 million and achieved a negative net debt balance, indicating enhanced financial health and reduced leverage.

The company's commitment to ESG principles is a core strength, as highlighted in its April 2024 report, reinforced by an exceptional safety record in 2024 and zero environmental releases or recordable incidents in Q1 2025. This dedication is integrated into daily operations, underscoring responsible business practices.

What is included in the product

Analyzes Itafos’s competitive position through key internal and external factors, identifying its strengths, weaknesses, opportunities, and threats.

Offers a clear, actionable framework to identify and address Itafos' strategic challenges, turning potential weaknesses into opportunities.

Weaknesses

Itafos's financial health is directly tied to the unpredictable swings in phosphate and other essential raw material prices, like sulfur. For instance, while the price of monoammonium phosphate (MAP) experienced a boost in the fourth quarter of 2024, the forecast for phosphate pricing throughout 2025 suggests a period of little to no growth.

Adding to this challenge, the first quarter of 2025 saw an increase in sulfur costs, which has put pressure on Itafos's profit margins. This sensitivity to commodity prices means that any significant downturn in these markets can directly impact the company's profitability and overall financial performance.

Itafos' operational strength is significantly tied to its Conda facility in Idaho and the Arraias facility in Brazil, creating a notable geographic concentration. This reliance means a major setback at either location, whether from operational hiccups, new regulations, or unforeseen environmental issues, could disproportionately affect the company's entire output and earnings.

Itafos faces execution risks with its mine-life extension projects, such as H1/NDR, and efforts to boost production at Arraias. These development endeavors, while crucial for future growth, are susceptible to delays in obtaining permits, construction setbacks, or challenges in scaling new operations.

Such execution challenges can directly translate into increased project costs and push back the timeline for realizing expected financial benefits. For instance, if the Arraias expansion, targeting increased phosphate production, encounters permitting delays in 2024, it could impact the planned output ramp-up and associated revenue projections.

Cost overruns are a significant concern, potentially eroding the profitability of these strategic investments. For example, unexpected increases in raw material prices or labor shortages during the construction phase of the H1/NDR project could inflate capital expenditures beyond initial estimates.

Ultimately, these execution risks can directly affect Itafos's future profitability by deferring anticipated revenue streams and increasing the overall investment required to achieve operational goals. The company's ability to navigate these complexities efficiently will be critical to unlocking the full value of its development pipeline.

Market Competition and Pricing Pressures

The global fertilizer market, while fragmented, is dominated by large-scale producers, creating a challenging environment for Itafos. For instance, in 2024, the top five global fertilizer companies by revenue accounted for a significant portion of the market, exerting considerable influence on pricing dynamics. This intense competition can erode Itafos' pricing power, particularly if larger entities shift their strategies to target the specialty fertilizer segments Itafos prioritizes.

Furthermore, shifts in global production capacity can lead to oversupply, intensifying price pressures. If overall fertilizer output, especially for key nutrients like phosphate and nitrogen, outpaces demand in 2024-2025, Itafos could see its margins squeezed even for its differentiated products. This is a persistent risk in the commodity-driven fertilizer sector.

- Intense competition from established global players.

- Risk of larger competitors entering niche specialty markets.

- Potential for price erosion due to oversupply.

- Limited ability to dictate pricing in a supply-heavy market.

Potential for Trade Policy and Geopolitical Disruptions

Global trade policies and geopolitical tensions represent a significant weakness for Itafos, potentially disrupting its operations and market access. For instance, China's historical export restrictions on raw materials, like phosphates, could directly impact Itafos's ability to secure necessary inputs or face increased competition. The evolving landscape of international trade, marked by protectionist measures and trade disputes, creates an unpredictable environment for export-oriented businesses like Itafos. These disruptions can lead to volatility in pricing for its products, such as DAP and MAP fertilizers, and create uncertainty around international sales volumes. For example, if new tariffs were imposed on fertilizer imports in key markets, Itafos's market share and profitability could be negatively affected.

Broader geopolitical conflicts also pose a substantial risk. Events such as the ongoing conflict in Eastern Europe, which has impacted global energy and fertilizer markets, illustrate how international instability can spill over into commodity sectors. These conflicts can lead to:

- Disruptions in shipping routes and increased freight costs.

- Sanctions or trade embargoes affecting key customer nations.

- Volatile energy prices, impacting production costs for Itafos.

- Shifts in global demand patterns as countries reassess supply chain security.

Itafos's reliance on commodity prices, particularly for phosphate and sulfur, presents a significant vulnerability. For instance, while 2024 saw some phosphate price recovery, forecasts for 2025 indicate a plateauing, with increased sulfur costs in Q1 2025 directly impacting margins.

Geographic concentration in Idaho and Brazil means operational issues at either facility, such as regulatory changes or environmental concerns, could disproportionately affect overall production. This limited geographic diversification amplifies the impact of localized challenges.

Execution risks associated with mine-life extensions and production ramp-ups, like at the Arraias facility, are substantial. Delays in permitting, construction setbacks, or scaling difficulties for projects such as H1/NDR could lead to cost overruns and deferred revenue realization, impacting future profitability.

The company also faces intense competition from larger global fertilizer producers. This competitive landscape, where top players held significant market share in 2024, can limit Itafos's pricing power, especially if oversupply situations emerge in the 2024-2025 period.

Same Document Delivered

Itafos SWOT Analysis

The preview you see is the same document the customer will receive after purchasing. This means you're getting a genuine, unedited look at the Itafos SWOT analysis. No hidden sections or altered information—just the complete, professional report. Purchase unlocks the full, in-depth version for your strategic planning needs.

Opportunities

The global fertilizer market is on a strong upward trajectory, with projections indicating significant growth through 2025 and beyond. This expansion is fundamentally fueled by a burgeoning global population, which necessitates increased agricultural output to ensure food security for billions. For companies like Itafos, specializing in phosphate fertilizers, this translates into a robust and sustained demand for their products.

By 2025, the global fertilizer market is expected to reach a valuation of over $200 billion, showcasing the sheer scale of this industry. This consistent demand for enhanced crop production directly supports the business model of phosphate fertilizer producers. Itafos is well-positioned to capitalize on this trend, as phosphate is a critical nutrient for plant growth and yield improvement.

Itafos' existing focus on specialty fertilizers such as DAPR and PAPR is a significant strength. This positions the company to take advantage of the increasing demand for specialized nutrient solutions that typically come with higher profit margins. By continuing to innovate and grow within this segment, Itafos can set its products apart and secure more value in the market.

Itafos is strategically positioned for growth in South America, particularly in Brazil, which is a major driver of fertilizer demand. The company's existing operations and its plans for granulated dry fertilizer production in Brazil align perfectly with this burgeoning market. Brazil's agricultural sector is experiencing robust growth, making it a prime location for Itafos to capitalize on increasing fertilizer consumption. In 2023, Brazil's soybean production alone was projected to reach a record 150 million metric tons, underscoring the need for enhanced agricultural inputs.

The expansion of Itafos's Brazilian footprint, including the establishment of new offices and ambitious sales volume targets, offers a clear pathway to capture a larger share of this expanding market. This strategic move allows Itafos to directly address local demand and solidify its presence in one of the world's most significant agricultural economies. By deepening its engagement in Brazil, Itafos can leverage its production capabilities to meet the needs of a growing agricultural base, aiming to significantly boost its market share in the region.

Leveraging ESG for Competitive Advantage and Investment

Itafos' dedication to Environmental, Social, and Governance (ESG) principles offers a distinct competitive edge. Their proactive stance on ESG reporting, with measurable advancements in sustainability, safety, and emission reductions, sets them apart. For instance, Itafos reported a reduction in Scope 1 and Scope 2 GHG emissions intensity by 12.5% in 2023 compared to their 2020 baseline, demonstrating tangible progress. This commitment is likely to attract investment from ESG-focused funds and resonate with environmentally aware consumers.

This focus on ESG can unlock significant financial benefits. By appealing to a growing pool of investors prioritizing sustainability, Itafos can expect improved access to capital, potentially at more favorable terms. Furthermore, a strong ESG profile enhances brand reputation, a critical asset in a market where consumers and stakeholders increasingly demand corporate responsibility. In 2024, the global sustainable investment market is projected to exceed $50 trillion, highlighting the substantial financial implications of robust ESG strategies.

- Attracting ESG Capital: Itafos' ESG performance can draw in specialized investment funds, increasing capital availability.

- Enhanced Brand Image: A strong sustainability record boosts reputation, attracting environmentally conscious customers.

- Reduced Operational Risk: Proactive environmental management can mitigate regulatory and operational risks.

- Market Differentiation: Measurable ESG progress provides a clear advantage over less sustainable competitors.

Technological Advancements in Agriculture

The agricultural sector is rapidly embracing technological innovation, presenting significant avenues for growth. Precision agriculture, which leverages data and technology to optimize farming practices, is seeing increased adoption globally. For instance, the global precision agriculture market was valued at approximately USD 8.5 billion in 2023 and is projected to reach USD 21.4 billion by 2030, growing at a CAGR of 14.1%. This trend fuels demand for advanced fertilizers that can be precisely applied, maximizing efficiency and minimizing environmental impact.

There's a growing market for high-efficiency fertilizers, including liquid and bio-based alternatives, driven by a focus on sustainable farming and improved crop yields. Biofertilizers, for example, are gaining traction as they enhance nutrient availability and soil health. Itafos can capitalize on this by innovating its product portfolio to include these advanced fertilizer types and developing smart application technologies. Strategic investments or partnerships in companies at the forefront of these agricultural tech advancements, particularly those enhancing nutrient delivery and reducing waste, can significantly bolster Itafos's market position and align with the growing demand for sustainable agricultural solutions.

- Growing Precision Agriculture Market: The global precision agriculture market is expected to reach USD 21.4 billion by 2030.

- Demand for Efficient Fertilizers: Increased consumer and regulatory pressure for sustainable farming practices drives demand for liquid and bio-based fertilizers.

- Innovation Opportunities: Itafos can develop new fertilizer formulations and application technologies to meet these evolving market needs.

- Strategic Partnerships: Collaborating with ag-tech companies can accelerate innovation in nutrient delivery and yield optimization.

Itafos's strategic focus on specialty fertilizers, like DAPR and PAPR, positions it to capture higher profit margins amid increasing demand for tailored crop nutrition. The company's expansion into Brazil, a key agricultural hub, offers significant growth potential, especially with Brazil's projected record crop production in 2023, reaching 150 million metric tons of soybeans alone. Furthermore, Itafos's commitment to ESG principles, evidenced by a 12.5% reduction in GHG emissions intensity in 2023, attracts sustainability-focused investors and enhances its brand reputation in a market where ESG investments are projected to exceed $50 trillion by 2024.

Threats

Global phosphate prices are projected to remain relatively stable in 2025, a positive sign for companies like Itafos. However, this stability is not guaranteed. Factors such as unexpected shifts in supply and demand, geopolitical tensions impacting trade routes, and fluctuating energy costs, particularly natural gas which is a key input for fertilizer production, could lead to significant price swings.

A prolonged downturn in fertilizer prices, driven by these volatilities, poses a direct threat to Itafos' financial performance. Lower prices can directly translate into reduced revenues and squeezed profit margins, impacting the company's ability to invest in future growth and meet its financial obligations.

The cost of essential raw materials, particularly sulfur, a vital component in phosphate fertilizer manufacturing, has been on an upward trend. This increase directly impacts Itafos' production expenses, potentially squeezing profit margins.

For instance, sulfur prices saw a notable increase in late 2023 and early 2024, driven by global supply chain dynamics and demand from various industries. While Itafos has demonstrated strong operational efficiency, these persistent cost escalations pose a significant challenge.

If Itafos cannot fully pass these higher input costs onto customers through pricing adjustments or effectively mitigate them through hedging strategies, its profitability could be significantly eroded in the coming quarters.

Itafos faces growing pressure from intensifying environmental regulations, particularly concerning emissions and waste management within the fertilizer sector. For instance, by 2024, many jurisdictions are implementing stricter carbon pricing mechanisms that directly impact energy-intensive fertilizer production, potentially increasing operational costs for Itafos.

Failure to adapt to these evolving standards, such as those related to nutrient runoff or water usage, could result in substantial penalties. Reports from 2024 indicate a rise in environmental fines for industrial operations globally, a trend likely to continue impacting companies like Itafos.

Any environmental misstep at its mining or production sites could trigger significant operational halts and damage its carefully constructed sustainability image, especially as investors increasingly prioritize ESG performance. For example, a hypothetical incident could lead to immediate production stoppages, costing millions in lost revenue and remediation efforts.

Geopolitical Instability and Trade Barriers

Geopolitical instability poses a significant threat to Itafos. Ongoing global conflicts and shifting trade policies, such as new import tariffs or the relaxation of export restrictions by major economies like China, can disrupt international trade. For instance, disruptions in key shipping lanes, like those experienced in the Red Sea in late 2023 and early 2024, led to increased freight costs and delivery delays for many industries, a risk Itafos must navigate.

These trade barriers and conflicts directly impact Itafos' operational efficiency and market access. The company's ability to export its products, secure essential raw materials, and maintain stable pricing in its target markets can be severely hampered. For example, if a major phosphate-producing nation were to impose export restrictions, it could directly affect Itafos' supply chain and cost structure.

The risk of sanctions against certain countries or entities involved in Itafos' supply chain or customer base adds another layer of complexity. Such measures can freeze assets, restrict transactions, and force companies to find alternative suppliers or markets, potentially at a higher cost or with reduced efficiency. This volatility necessitates robust risk management strategies to mitigate the impact of external geopolitical events on Itafos' business.

- Disrupted Supply Chains: Conflicts and trade disputes can interrupt the flow of critical raw materials, impacting production schedules and costs for Itafos.

- Market Volatility: Changes in tariffs or export policies by countries like China can lead to unpredictable price fluctuations for fertilizers and related commodities.

- Increased Operational Costs: Geopolitical tensions can drive up shipping insurance, freight rates, and the cost of sourcing alternative materials, directly affecting Itafos' profitability.

- Reduced Market Access: Sanctions or political instability in key customer regions could limit Itafos' ability to sell its products, impacting revenue streams.

Competition from Alternative Fertilizers and Farming Practices

The agricultural sector's increasing embrace of organic and bio-based fertilizers presents a significant challenge. For instance, the global bio-fertilizer market was valued at approximately USD 2.4 billion in 2023 and is projected to grow substantially. This trend could gradually diminish the demand for conventional phosphate fertilizers, which form a part of Itafos's product mix.

Furthermore, innovations in nutrient management and sustainable farming practices, such as precision agriculture and cover cropping, are enhancing crop yields without relying heavily on synthetic inputs. These advancements, while beneficial for the environment, could also reduce the overall need for traditional fertilizers.

The potential shift in consumer preference towards organically certified produce further fuels the adoption of alternative fertilization methods. While Itafos focuses on specialty phosphate products, a broad market movement away from conventional chemical fertilizers could impact its market share over the long term.

Key areas of concern include:

- Growing demand for organic and bio-fertilizers: This could displace traditional chemical fertilizer usage.

- Advancements in nutrient efficiency: Precision farming techniques aim to maximize nutrient uptake, reducing reliance on bulk fertilizers.

- Consumer preference shifts: Increased demand for organic food products may indirectly reduce the market for conventional agricultural inputs.

- Regulatory pressures: Potential future regulations favoring more sustainable agricultural inputs could impact the competitive landscape.

Itafos faces significant threats from volatile global phosphate and sulfur prices, with sulfur costs notably rising in late 2023 and early 2024 due to supply chain issues. Increasingly stringent environmental regulations, including carbon pricing mechanisms implemented by 2024, also pose a risk of higher operational costs and potential penalties.

Geopolitical instability, evidenced by disruptions in shipping lanes like the Red Sea in late 2023 and early 2024, increases freight costs and delivery times. Furthermore, the growing demand for organic and bio-fertilizers, with the bio-fertilizer market valued at approximately USD 2.4 billion in 2023, could gradually reduce the market share for conventional phosphate fertilizers like those produced by Itafos.

| Threat Category | Specific Risk | Impact on Itafos | 2024/2025 Relevance |

| Price Volatility | Fluctuating sulfur prices | Increased production costs, squeezed margins | Sulfur prices saw a notable increase in late 2023/early 2024. |

| Regulatory Environment | Stricter environmental standards, carbon pricing | Higher operational costs, potential fines | Carbon pricing mechanisms impacting energy-intensive production by 2024. |

| Market Trends | Rise of organic/bio-fertilizers | Potential reduction in demand for conventional products | Global bio-fertilizer market was approx. USD 2.4 billion in 2023. |

| Geopolitical Factors | Supply chain disruptions, trade policy changes | Increased logistics costs, market access issues | Red Sea shipping disruptions in late 2023/early 2024. |

SWOT Analysis Data Sources

This analysis is built upon comprehensive data, including Itafos's official financial filings, extensive market research reports, and expert industry commentary to provide a robust and insightful SWOT assessment.