Itafos Boston Consulting Group Matrix

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Itafos Bundle

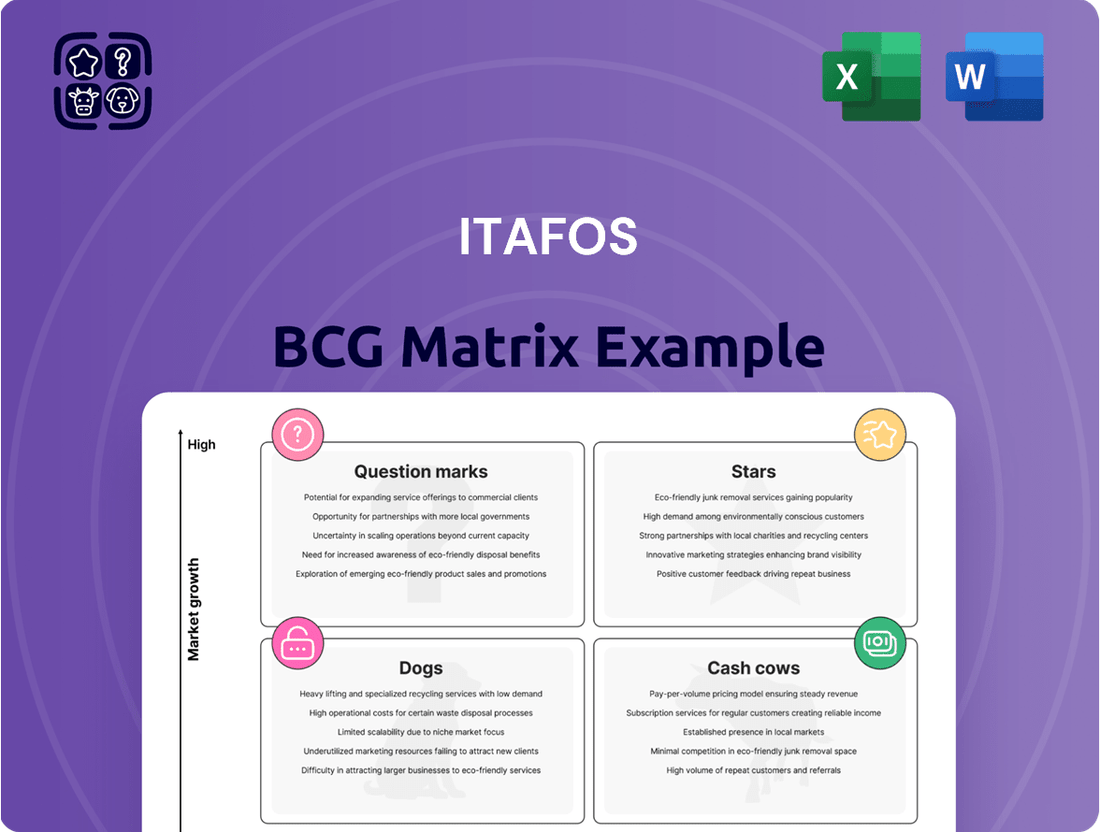

Curious about Itafos's strategic product positioning? This glimpse into their BCG Matrix reveals the potential for growth and stability within their portfolio. Understand which segments are driving revenue and which might require a closer look. Don't miss out on the comprehensive analysis that unlocks the full picture of Itafos's market performance. Purchase the complete BCG Matrix to gain actionable insights into their Stars, Cash Cows, Dogs, and Question Marks, and equip yourself with the knowledge to make informed strategic decisions for your own business.

Stars

Itafos's Conda facility, its key operation in Idaho, has demonstrated exceptional performance, reaching record production for both monoammonium phosphate (MAP) and sulfuric acid during the fourth quarter of 2024 and the entirety of fiscal year 2024. This operational success, combined with higher MAP prices, suggests a leading position in a growing market segment, classifying it as a Star within the BCG matrix.

The sustained high output at Conda is further bolstered by the successful mine-life extension, ensuring continued strong production capabilities for the foreseeable future. This strategic advantage solidifies the facility's status as a Star, benefiting from both increased demand and enhanced operational longevity.

The production of Itafos's newly introduced dry products at its Arraias facility in Brazil experienced a dramatic surge in 2024, more than tripling its output from the prior year. This substantial increase points to robust market acceptance and suggests these products are entering a high-growth phase.

This rapid acceleration in production, while the products' market share is still establishing itself, strongly positions them within the Star quadrant of the BCG matrix. The impressive growth trajectory indicates significant potential for further market expansion and solidifies their status as a key growth driver for Itafos.

Itafos's Super Forte Duo fertilizer represents a strategic entry into Brazil's acidified fertilizer market, specifically targeting the unique needs of cerrado vegetation with its immediate plant absorption technology. This move positions Itafos to capitalize on a region with significant agricultural growth potential.

The Brazilian fertilizer market is substantial, with domestic demand projected to grow. In 2024, Brazil remains a global powerhouse in agriculture, heavily reliant on fertilizer imports to support its vast crop production, particularly soybeans and corn, which thrive in cerrado conditions.

If Super Forte Duo achieves strong market penetration and customer adoption, its contribution to Itafos’s Brazilian operations could elevate it to a Star performer within the company's BCG matrix analysis. Success here hinges on demonstrating clear yield improvements and cost-effectiveness for Brazilian farmers.

Expansion in Western Bahia, Brazil

Itafos's strategic push into Western Bahia, Brazil, marks a significant Star initiative within its BCG matrix. The opening of a new office in October 2024 signals a commitment to capturing a larger share of this burgeoning agricultural market.

The company has set an ambitious goal to increase its market share in Western Bahia from the current 20% to 30% by the close of 2025. This aggressive expansion is fueled by the region's robust grain production, positioning it as a high-growth area where Itafos aims to solidify its leadership.

- Market Share Target: 30% in Western Bahia by end of 2025.

- Current Market Share: 20% in Western Bahia.

- Expansion Driver: Substantial grain production in the region.

- Strategic Classification: Star (high growth, high market share potential).

High-Efficiency Specialty Fertilizers

The agricultural sector's increasing adoption of precision agriculture fuels demand for high-efficiency specialty fertilizers. Products like diammonium phosphate (DAP) and monoammonium phosphate (MAP) are key components in this shift, offering targeted nutrient delivery. Itafos's strategic investment in expanding its production capacity for these specialized fertilizers, notably tripling output at its Arraias facility, underscores its commitment to this high-growth market segment.

This focus on specialty fertilizers positions Itafos to potentially achieve higher profit margins compared to commodity fertilizers. By concentrating on products that enhance crop yields and reduce environmental impact, Itafos aims to capture a leading share in the evolving agricultural solutions market. This strategic direction suggests that Itafos's specialty fertilizer business could be classified as a Star within the BCG matrix, characterized by high growth and a strong market position.

- Market Growth: The global specialty fertilizer market is projected to grow significantly, driven by precision agriculture and the need for enhanced crop nutrition. For instance, the market size was valued at approximately USD 25.4 billion in 2023 and is expected to reach over USD 40 billion by 2030, indicating a compound annual growth rate (CAGR) of around 6.5%.

- Itafos's Position: Itafos's increased production capacity at Arraias, aiming for 1.2 million metric tons of DAP and MAP annually, directly addresses this growing demand. This expansion is critical for securing a larger market share in the specialty fertilizer segment.

- Margin Potential: Specialty fertilizers typically command higher prices and offer better margins than standard fertilizers due to their advanced formulations and performance benefits. This allows companies like Itafos to achieve greater profitability.

- Strategic Alignment: The emphasis on high-efficiency products aligns with global agricultural trends towards sustainability and yield optimization, reinforcing Itafos's potential as a Star.

The Conda facility's record production in Q4 2024 and FY 2024, coupled with higher MAP prices, firmly places it as a Star. Its extended mine life ensures continued strong output, a key indicator of its leading market position in a growing segment.

Itafos's new dry products at Arraias are rapidly growing, more than tripling output in 2024. This surge, despite a still-developing market share, signals a Star performer with significant expansion potential.

The strategic focus on Western Bahia, with a goal to reach 30% market share by end of 2025 from 20%, highlights this region as a Star. The growth is driven by substantial grain production, a key factor for Itafos's expansion.

The company's increased capacity for specialty fertilizers like DAP and MAP, with Arraias targeting 1.2 million metric tons annually, positions these products as Stars. This aligns with the growing demand for high-efficiency fertilizers driven by precision agriculture, a market expected to exceed $40 billion by 2030.

| Facility/Product | BCG Classification | Key Supporting Data |

| Conda Facility (MAP & Sulfuric Acid) | Star | Record production FY 2024, extended mine life. |

| Arraias Dry Products | Star | Output more than tripled in 2024, high growth trajectory. |

| Western Bahia Operations | Star | Targeting 30% market share by end of 2025 (from 20%), strong regional grain production. |

| Specialty Fertilizers (DAP/MAP) | Star | Capacity expansion at Arraias, addressing high-growth specialty fertilizer market ($25.4B in 2023, projected $40B+ by 2030). |

What is included in the product

The Itafos BCG Matrix offers a strategic framework for analyzing its business units based on market growth and share.

It highlights which units to invest in, hold, or divest to optimize Itafos's portfolio.

Provides a clear, visual overview of Itafos' business units, reducing complexity.

Simplifies strategic decision-making by categorizing units, alleviating analytical overload.

Cash Cows

Itafos's core Monoammonium Phosphate (MAP) production at its Conda facility stands as a robust cash cow. This operation consistently delivers high-volume output, demonstrating resilience even through planned maintenance in 2024. The facility benefits from strong realized prices, indicating a significant market share within the mature fertilizer sector.

The Conda MAP production is a prime example of a cash cow due to its established market position and consistent demand. It requires minimal new investment for growth, instead focusing on optimizing existing operations to generate substantial and reliable cash flow. This stability makes it a cornerstone of Itafos's financial strategy.

Sulfuric acid production at Itafos' Arraias facility is a solid Cash Cow. Its distribution volume ranked third in Brazil in 2023, demonstrating a significant market presence. The facility saw a notable increase in production in 2024, further solidifying its reliable cash-generating capabilities.

This essential industrial product serves a dual purpose, supporting Itafos' internal operations while also meeting external customer needs. Operating within a mature, low-growth market, sulfuric acid's consistent demand ensures a steady stream of income for the company.

Itafos' established phosphate-based products in North America are prime examples of Cash Cows within their business portfolio. This region represents a mature yet stable market for phosphate fertilizers, consistently supported by ongoing agricultural demand. By 2024, Itafos' deep roots and extensive distribution channels in North America position them to command significant market share for these foundational products.

Legacy Superphosphate (SSP) Production (Arraias)

The Arraias facility is a significant player in Single Superphosphate (SSP) production, boasting substantial installed annual capacity. SSP, a fundamental phosphate fertilizer, operates in a market that may be mature with limited growth prospects.

Despite the market's maturity, Itafos's continued operations and established capacity at Arraias suggest a strong regional market share. This sustained production likely translates into a reliable source of cash flow for the company, characteristic of a cash cow business.

- Arraias SSP Capacity: The facility possesses a notable annual installed capacity for SSP, a key phosphate fertilizer.

- Market Position: Despite market maturity, Itafos's established capacity implies a strong regional market share for SSP.

- Cash Flow Contribution: Continued production signifies a consistent and reliable generation of cash flow for Itafos.

Existing Long-Term Offtake Agreements

Itafos leverages its existing long-term offtake agreements as significant cash cows. A prime example is the recent MAP Offtake Agreement at its Conda facility, which shifted to a more advantageous pricing structure. This ensures a steady flow of revenue, underpinning the predictable demand for Itafos’ high-volume fertilizer products.

These agreements are crucial for consistent cash generation, solidifying Itafos' established market presence. The predictability offered by these contracts allows for reliable financial planning and operational efficiency. Itafos’ strategy relies heavily on these established relationships to maximize returns from its mature product lines.

- Stable Revenue Streams: Long-term agreements provide a predictable income base, reducing financial volatility.

- Predictable Demand: Offtake contracts guarantee a market for high-volume products, ensuring consistent sales.

- Favorable Pricing Models: Agreements like the Conda MAP deal offer improved pricing, boosting profitability.

- Market Position Reinforcement: These contracts validate and strengthen Itafos' standing in established markets.

Itafos's established phosphate-based products in North America are prime examples of Cash Cows. This region represents a mature yet stable market for phosphate fertilizers, consistently supported by ongoing agricultural demand. By 2024, Itafos' deep roots and extensive distribution channels in North America position them to command significant market share for these foundational products.

The Conda MAP production is a prime example of a cash cow due to its established market position and consistent demand. It requires minimal new investment for growth, instead focusing on optimizing existing operations to generate substantial and reliable cash flow. This stability makes it a cornerstone of Itafos's financial strategy.

Sulfuric acid production at Itafos' Arraias facility is a solid Cash Cow. Its distribution volume ranked third in Brazil in 2023, demonstrating a significant market presence. The facility saw a notable increase in production in 2024, further solidifying its reliable cash-generating capabilities.

Itafos's long-term offtake agreements, such as the recent MAP Offtake Agreement at its Conda facility with its advantageous pricing structure, act as significant cash cows. These agreements ensure a steady flow of revenue, underpinning the predictable demand for Itafos’ high-volume fertilizer products and reinforcing its market position.

| Product/Segment | Region | 2023 Distribution Volume Rank (Brazil for Sulfuric Acid) | 2024 Production Trend | Strategic Role |

|---|---|---|---|---|

| Monoammonium Phosphate (MAP) | North America (Conda Facility) | N/A | Resilient through maintenance, strong realized prices | Core Cash Cow |

| Sulfuric Acid | Brazil (Arraias Facility) | 3rd | Notable increase | Solid Cash Cow |

| Phosphate-based Products | North America | N/A | Established market, deep roots, extensive distribution | Prime Cash Cows |

| Single Superphosphate (SSP) | Brazil (Arraias Facility) | N/A | Continued operations, substantial installed capacity | Cash Cow |

| Long-term Offtake Agreements | Various (e.g., Conda MAP) | N/A | Shifted to advantageous pricing | Stable Revenue Streams |

Preview = Final Product

Itafos BCG Matrix

The preview you see of the Itafos BCG Matrix is the complete, unwatermarked document you will receive immediately after your purchase. This means you'll be acquiring the exact same professionally formatted analysis, ready for strategic deployment without any additional steps or hidden content. It's designed to offer immediate value for your business planning and decision-making processes.

Dogs

Underperforming regional niche products within Itafos's portfolio would be classified in the 'Dogs' quadrant of the BCG Matrix. These are products with low market share in a low-growth market, characterized by limited adoption and specific regional demand. For Itafos, this could represent specialized fertilizer formulations catering to very particular soil conditions or crop types in a limited geographic area.

Products in this category typically generate minimal revenue, often failing to cover their operational and marketing costs. The investment required to boost adoption or expand the market for these niche products is unlikely to yield significant returns, making them a drain on resources. In 2024, for example, a hypothetical niche product with only 2% regional market share and facing a declining 1% annual market growth would exemplify this scenario.

Itafos's older production lines, if they exist and are less efficient, represent potential "Dogs" in the BCG Matrix. These facilities might be costly to maintain and operate, especially when compared to newer, more advanced technologies. For instance, if Itafos still utilizes production methods that require significantly more energy or labor per ton of output than current industry standards, they would fall into this category.

These obsolete lines likely produce products facing declining market demand or are being outcompeted on price by more modern facilities. In 2024, with global fertilizer markets increasingly sensitive to production costs and environmental impact, such older lines would struggle to remain competitive. They represent a drain on resources and capital that could be better allocated to growth areas.

The divestiture of Itafos's Araxá project, a significant rare earth element and niobium mine, clearly signals a strategic move away from non-core assets. For Itafos, this project, while possessing intrinsic value, was likely categorized as a Dog or a Question Mark within their business portfolio. This classification stems from its potential misalignment with the company's core strategic focus on phosphate and specialty fertilizers, or perhaps due to its underperformance relative to other assets.

Products with Declining Market Share in Mature Segments

Itafos's standard phosphate products, if facing a consistent decline in market share within mature segments, would be categorized as Dogs in their BCG Matrix. This situation arises from factors like intensifying competition or shifts in agricultural practices, leading to diminished demand for these established offerings. These products exhibit limited growth potential and struggle to retain their previous market standing.

For instance, if a particular granular phosphate product saw its market share drop from 15% to 10% in a mature agricultural region between 2023 and 2024, it could be considered a Dog. This decline might be attributed to the introduction of new, more efficient fertilizers by competitors, or a regional shift towards different crop types that require alternative nutrient blends. The overall phosphate market in that region might only be growing at 1-2% annually, further highlighting the weak growth prospects for such a product.

Products in this category often require careful management to minimize losses or might be candidates for divestment. Analyzing specific product lines within Itafos's portfolio, such as their conventional diammonium phosphate (DAP) offerings in regions with established, high-yield farming techniques, could reveal such characteristics. If these products are seeing a negative growth rate in market share, while the overall market is stagnant or only slightly growing, they fit the Dog profile.

Key indicators for Itafos's "Dog" products would include:

- Declining Revenue Contribution: A steady decrease in the revenue generated by specific phosphate products year-over-year. For example, a 5% year-on-year revenue decline for a standard phosphate blend.

- Market Share Erosion: A consistent loss of market share in key geographic segments, potentially dropping below a benchmark like 8% in a competitive market.

- Low or Negative Market Growth: The mature market segment for these products experiences minimal annual growth, perhaps in the 0-2% range, making it difficult to gain traction.

- Increased Competitive Pressure: Competitors introducing innovative or lower-cost alternatives that directly impact the sales volume of Itafos's standard phosphate products.

Inefficient Legacy Mining Operations

While Itafos's Conda operation is a prime example of a Star in the BCG matrix, the company also manages less efficient legacy mining sites. These operations, characterized by lower-grade phosphate yields and higher extraction costs compared to current market prices, fall into the category of Dogs. They represent a drain on resources, offering minimal returns and strategic advantage.

These legacy sites often struggle with aging infrastructure and less advanced extraction technologies, making it difficult to compete profitably. For instance, if a particular legacy mine in 2024 had an average phosphate grade of 25% and extraction costs of $60 per ton, while the market price for comparable grades hovered around $50 per ton, it would clearly be operating at a loss.

- Low-Grade Phosphate Yields: Legacy operations may extract ore with significantly lower concentrations of valuable phosphate, requiring more material to be processed for the same output.

- High Extraction Costs: Older equipment, inefficient processes, and the need to access deeper or more challenging ore bodies can drive up the cost per ton of extracted phosphate.

- Unfavorable Market Dynamics: When the cost of production for these legacy mines exceeds prevailing market prices for their output, they become cash drains.

- Limited Strategic Value: These operations typically contribute little to Itafos's overall market share growth or competitive positioning, acting more as liabilities than assets.

Itafos's "Dogs" are products or operations with a low market share in a low-growth market. These often include older, less efficient production lines or niche fertilizer formulations with limited regional demand. They typically generate minimal revenue and can be a drain on resources, with little prospect for significant returns on investment. For example, a legacy mining site with high extraction costs compared to market prices would fit this description.

These underperforming assets require careful management to minimize losses, and divestiture is often a strategic consideration. In 2024, Itafos's strategic move to divest its Araxá project suggests a focus on shedding assets that may have been classified as Dogs or Question Marks due to a misalignment with core business strategies or underperformance relative to other holdings.

Key indicators for Itafos's "Dog" products include declining revenue contribution, market share erosion, and operating in mature markets with minimal growth, often facing increased competitive pressure from newer alternatives. Conventional diammonium phosphate (DAP) offerings in regions with stagnant or declining demand could exemplify this category.

Legacy mining operations, such as certain less efficient sites, also fall into the Dog quadrant. These are characterized by low-grade phosphate yields and high extraction costs, making them unprofitable when compared to prevailing market prices. For instance, a mine with extraction costs exceeding market prices per ton would be a clear example of a Dog in 2024.

Question Marks

The Farim phosphate mine project in Guinea-Bissau is a prime example of a Question Mark in the BCG matrix. It boasts significant potential due to its substantial high-grade phosphate reserves, estimated at 153 million tonnes at a promising grade of 38% P2O5 as of recent reports.

However, its current market share is negligible because it remains a development-stage project, not yet in commercial production. This lack of operational status, combined with its high-growth potential in the phosphate market, firmly places it in the Question Mark quadrant.

Bringing the Farim mine to fruition requires substantial capital. Initial estimates for development and construction were in the hundreds of millions of dollars, a significant investment needed to overcome the inherent risks and unlock its value. This capital requirement is a defining characteristic of a Question Mark, as it necessitates strategic decisions about future funding.

The project's future success hinges on securing this necessary investment and navigating the evolving global phosphate market once it becomes operational. The phosphate industry, while essential for agriculture, can be subject to price volatility and supply-demand dynamics, adding another layer of uncertainty to its progression from a Question Mark to a Star or potentially a Dog.

The Santana Mine and Fertilizer Plant Project in Pará, Brazil, represents Itafos' ambitious move into a vertically integrated, high-grade phosphate operation. This project is firmly in the Question Mark quadrant of the BCG Matrix. Brazil's agricultural sector offers substantial growth potential, a key factor for any Question Mark, but Santana currently has no established market share.

Santana requires significant capital infusion to move from development to full production, a hallmark of Question Marks. In 2024, Itafos continued to focus on advancing the project, with significant progress reported on its development. The success of this project hinges on Itafos' ability to execute its development plan and capture market share, otherwise, it risks becoming a Dog.

While Itafos's Conda operations are a cash cow, the North Dry Ridge mine-life extension project, slated for initial mining operations in 2025 with first ore shipments anticipated in the second half of 2025, represents a significant investment in future growth. These types of initiatives are classified as Stars in the BCG matrix, demanding substantial upfront capital for development and operational ramp-up. Their success hinges on effectively securing future supply chains and integrating seamlessly into Itafos's existing market presence to bolster market share.

Exploration of Nearfield Opportunities in Southeast Idaho

Itafos is focused on nearfield exploration in Southeast Idaho, aiming to expand its existing phosphate mining operations. These opportunities are characterized by substantial phosphate reserves, indicating a strong potential for future growth and resource extraction. The company views these as strategic investments, acknowledging the significant capital and successful development required to bring them to fruition.

These nearfield exploration efforts are classified as question marks within the BCG matrix. This means they possess high growth potential, reflecting the untapped value of the phosphate resources. However, they currently hold a low market share in terms of active extraction, necessitating considerable investment to realize their full economic benefit.

For instance, Itafos's 2024 exploration budget allocated a significant portion to these Southeast Idaho projects, underscoring the company's commitment. The success of these ventures hinges on overcoming the inherent risks associated with early-stage resource development, including geological uncertainties and the need for advanced extraction technologies.

- High Growth Potential: Southeast Idaho's phosphate deposits offer considerable upside for future production.

- Low Market Share: Current extraction from these specific nearfield areas is minimal, indicating a nascent stage.

- Substantial Investment Required: Bringing these resources online will demand significant capital expenditure for exploration and development.

- Strategic Importance: Extending mining life in a key operational region aligns with Itafos's long-term resource strategy.

Future Granulated Dry Fertilizer Product in Brazil (Arraias)

Itafos's plan to introduce a granulated dry fertilizer in Brazil, specifically utilizing the Arraias facility in 2025, positions this venture as a Question Mark within the BCG matrix. This is because it represents a new product in a defined market, requiring significant investment to gain traction and market share. The company aims to boost its profit margins and cater to the growing local demand for such fertilizers.

The Brazilian fertilizer market is substantial, with domestic demand projected to continue its upward trend. In 2024, Brazil remained a leading global consumer of fertilizers, importing a significant portion of its needs. By developing a granulated dry fertilizer product, Itafos is entering a segment that requires substantial market development.

- New Product Offering: Granulated dry fertilizer is a new product line for Itafos in the Brazilian market.

- Market Potential: Brazil's agricultural sector shows strong and consistent demand for fertilizers.

- Strategic Goal: The initiative aims to increase Itafos's profit margins and serve local demand.

- BCG Classification: Classified as a Question Mark due to its newness and need for market share growth.

Question Marks represent business units or projects with high growth potential but low market share. For Itafos, these are ventures that require significant investment to capture market share and could potentially become Stars or Dogs. The company's strategic focus often involves carefully evaluating these opportunities to determine their future direction.

Itafos's nearfield exploration in Southeast Idaho and the Santana Mine project in Brazil are prime examples. Both show promise in terms of resource potential and market growth, but they are in early development stages with minimal current market share. Significant capital is needed to develop these assets and achieve commercial production.

The success of these Question Marks is critical for Itafos's long-term growth strategy. The company must secure the necessary funding and execute development plans effectively to convert these high-potential ventures into profitable operations.

The introduction of a granulated dry fertilizer in Brazil also falls into this category, requiring investment to build market presence. Itafos is actively managing these Question Marks, aiming to capitalize on market growth and expand its operational footprint.

| Project/Venture | BCG Quadrant | Growth Potential | Market Share | Investment Needs (Illustrative) |

|---|---|---|---|---|

| Farim Phosphate Mine (Guinea-Bissau) | Question Mark | High (Phosphate reserves) | Negligible (Development stage) | Hundreds of millions USD |

| Santana Mine & Fertilizer Plant (Brazil) | Question Mark | High (Brazilian agriculture) | Negligible (Development stage) | Significant capital infusion |

| Southeast Idaho Nearfield Exploration | Question Mark | High (Phosphate resources) | Low (Early stage extraction) | Significant portion of 2024 exploration budget |

| Granulated Dry Fertilizer (Brazil) | Question Mark | High (Brazilian fertilizer demand) | Low (New product offering) | Substantial market development investment |

BCG Matrix Data Sources

Our Itafos BCG Matrix is constructed using robust data from Itafos's financial disclosures, including annual and quarterly reports, complemented by industry-wide market research and growth projections.