Itafos PESTLE Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Itafos Bundle

Gain an edge with our in-depth PESTEL Analysis—crafted specifically for Itafos. Discover how external forces are shaping the company’s future, and use these insights to strengthen your own market strategy. Download the full version now and get actionable intelligence at your fingertips.

Political factors

Government agricultural policies in North and South America play a significant role in shaping the fertilizer market, directly affecting companies like Itafos. Subsidies or support for particular crops can boost demand for fertilizers, while changes in these policies can impact farmer profitability and their purchasing power for essential inputs such as phosphate and specialty fertilizers. This, in turn, influences Itafos' sales volumes and its ability to set prices.

The global fertilizer market in 2025 is experiencing upward pressure on prices, a trend driven by robust demand coupled with policy restrictions, as highlighted by the World Bank. Such market conditions directly affect Itafos, as government decisions on agricultural support and trade can create a dynamic environment for fertilizer producers, impacting their operational costs and revenue streams.

International trade agreements and the imposition of tariffs or export restrictions by major fertilizer-producing countries directly impact Itafos. For instance, China's export restrictions on nitrogen fertilizers in 2024 significantly shifted global supply and demand, influencing pricing and market access for Itafos.

Uncertainty surrounding US tariff policies and international trade flows has also created notable volatility in commodity prices. This volatility has contributed to an increase in phosphate prices, a key market for Itafos.

The political stability within Itafos' key operating regions, namely the United States and Brazil, is a crucial factor. Any significant political unrest or abrupt policy changes in these areas could potentially disrupt Itafos' supply chains, inflate operational expenses, or even result in the expropriation of assets, directly jeopardizing the company's ability to produce and distribute its products. For instance, Brazil's political landscape, while generally stable for foreign investment, has seen shifts in regulatory approaches to mining and agriculture in recent years, requiring careful navigation by companies like Itafos.

Regulatory Environment and Enforcement

The regulatory landscape for phosphate mining, particularly for companies like Itafos, is shaped by governmental policies and their enforcement. Stringent environmental regulations, land use permits, and mining compliance directly impact operational costs and capital investment needs. For instance, the U.S. Environmental Protection Agency's (EPA) evolving regulations concerning phosphate mining waste management, as discussed in 2024, could necessitate substantial upgrades to existing facilities.

Itafos's operations, especially in regions like Brazil and potentially the U.S., are subject to varying levels of governmental oversight. Changes in political administrations can lead to shifts in regulatory priorities, affecting everything from permitting timelines to environmental impact assessments. The company must remain agile in adapting to these evolving political dynamics to ensure continued operational viability.

- Mining Permits and Land Use: Regulatory bodies govern the acquisition and maintenance of permits, directly influencing Itafos's ability to operate and expand its mining sites.

- Environmental Compliance: Adherence to environmental standards, including waste management and water usage, is critical and subject to strict enforcement, potentially increasing operational expenses.

- Governmental Stability and Policy Shifts: Political stability and predictable policy frameworks are essential for long-term investment and operational planning in the mining sector.

- International Regulatory Variations: Itafos operates across different jurisdictions, each with its own set of political and regulatory frameworks, requiring tailored compliance strategies.

Government Initiatives for Food Security

Governments worldwide, particularly in Itafos' key North and South American markets, are intensifying their focus on food security. This heightened attention translates into proactive initiatives aimed at bolstering agricultural productivity. For instance, in 2024, Canada allocated $2.7 billion over five years to support the agricultural sector, including investments in sustainable farming practices and innovation, which directly benefits nutrient providers.

These governmental pushes to increase crop yields and improve food supply chains directly stimulate demand for essential crop nutrients, Itafos' core products. As the global population continues its upward trajectory, projected to reach nearly 10 billion by 2050, the need for efficient and abundant food production becomes even more critical. This provides a foundational stability and potential for growth in the market for fertilizers and other agricultural inputs.

- Increased agricultural investment: Governments are funding research and development in crop science and sustainable farming techniques.

- Subsidies and incentives: Programs designed to encourage farmers to adopt advanced fertilization methods are becoming more common.

- Trade policies: Favorable trade agreements for agricultural inputs can support market access for companies like Itafos.

- Focus on domestic production: Many nations are prioritizing strengthening their internal food production capabilities, boosting local demand for fertilizers.

Government agricultural policies significantly shape the fertilizer market, impacting companies like Itafos. Subsidies or restrictions on fertilizer use, along with trade policies, directly influence demand and pricing. For instance, Canada's $2.7 billion investment in agriculture in 2024 highlights governmental support for the sector, which benefits fertilizer providers.

Political stability in key operating regions like the U.S. and Brazil is vital. Any unrest or abrupt policy shifts can disrupt supply chains and increase operational costs, as seen with Brazil's evolving regulatory approaches to mining. Furthermore, evolving environmental regulations, such as those discussed by the EPA in 2024 regarding phosphate mining waste, necessitate significant capital investment for compliance.

International trade dynamics, including tariffs and export restrictions, create market volatility. China's 2024 nitrogen fertilizer export restrictions exemplified how such political decisions can alter global supply and demand, impacting Itafos' market access and pricing strategies. This volatility has contributed to rising phosphate prices, a core market for Itafos.

Governments are increasingly prioritizing food security, leading to initiatives that boost agricultural productivity and, consequently, fertilizer demand. This focus on domestic production and sustainable farming, supported by programs like the one in Canada, provides a stable foundation and growth potential for Itafos' products.

What is included in the product

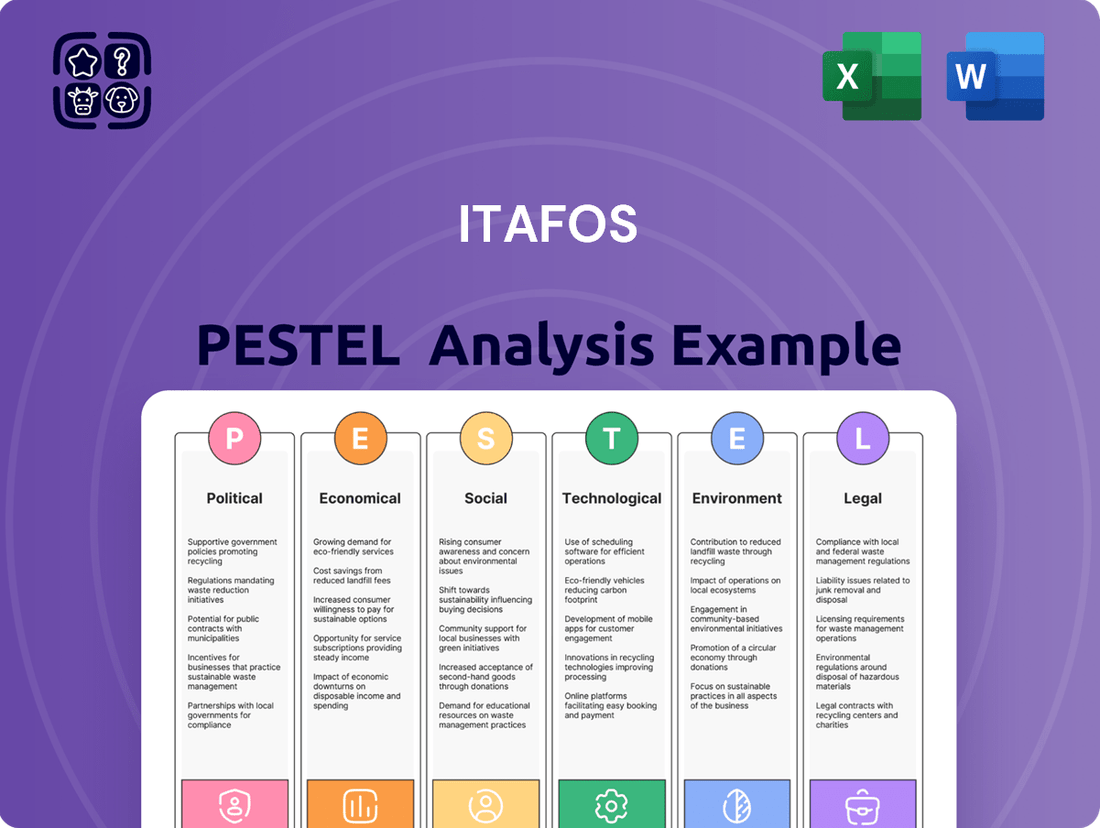

This Itafos PESTLE analysis delves into the crucial external macro-environmental factors impacting the company across Political, Economic, Social, Technological, Environmental, and Legal dimensions.

It provides a comprehensive understanding of the opportunities and threats Itafos faces by examining current trends and market dynamics relevant to its operations.

The Itafos PESTLE analysis provides a clear, summarized version of the full analysis for easy referencing during meetings or presentations, alleviating the pain of sifting through extensive data.

Economic factors

Global commodity prices, particularly for fertilizers and key crops, significantly influence Itafos' financial performance. Fluctuations in the cost of phosphate and specialty fertilizers, alongside the market prices for crops like corn and soybeans, directly affect Itafos' revenue streams and overall profitability. Higher crop prices tend to encourage farmers to increase their fertilizer purchases, boosting demand for Itafos' products. Conversely, escalating fertilizer prices can strain farmer budgets and potentially dampen demand.

As of mid-2024, phosphate prices have demonstrated stability, and this trend is anticipated to continue with relatively flat pricing expected through 2025. However, there remains a potential for upward price movements, introducing an element of upside risk to Itafos' revenue forecasts. This stability, coupled with the potential for growth, positions Itafos to benefit from consistent demand, assuming crop prices remain supportive of farmer spending.

Inflationary pressures are a significant concern for Itafos, as they directly impact operating expenses like raw materials, energy, and labor. For instance, global commodity prices, a key input for Itafos' fertilizer production, have seen considerable volatility. The Producer Price Index (PPI) for manufactured goods globally has exhibited elevated levels through 2024, indicating that input costs remain a challenge.

Rising interest rates, driven by central bank efforts to curb inflation, pose another hurdle. Itafos may face increased borrowing costs for essential capital expenditures, such as those needed for mine life extension projects. In 2024, major central banks like the US Federal Reserve maintained higher benchmark interest rates, averaging around 5.25-5.50%, making debt servicing and new financing more expensive.

The broader economic environment in 2024 and early 2025 continues to reflect higher costs of doing business. Businesses globally are navigating a landscape of persistent higher interest rates and tighter working capital conditions. This environment can constrain Itafos' ability to invest in future growth and operational improvements, impacting its overall financial resilience.

Currency exchange rate volatility presents a significant economic factor for Itafos, given its operational footprint in both the United States and Brazil, and its trade activities spanning North and South America. Fluctuations between the US Dollar and the Brazilian Real can directly influence Itafos' revenues earned in Brazil and costs incurred there, as well as the value of its assets and liabilities when translated into its reporting currency. For instance, a strengthening Brazilian Real against the US Dollar could lead to higher reported revenues from Brazilian operations but also increase the cost of imported inputs for its Brazilian facilities. Conversely, a weaker Real would have the opposite effect.

In 2024, the Brazilian Real experienced notable fluctuations, trading within a range that impacted businesses with cross-border operations. For Itafos, this means that the profitability of its Brazilian ventures, when converted to US Dollars, is subject to these currency swings. For example, if Itafos generates revenue in Brazil and the Real depreciates significantly against the Dollar, the dollar-equivalent revenue will decrease, potentially affecting overall company earnings. This dynamic is crucial for financial planning and risk management.

Supply Chain Costs and Disruptions

The cost and reliability of Itafos' supply chain, from sourcing raw materials like sulfur to distributing finished products, directly impact its operational efficiency and profitability. Global supply chain tightness, as highlighted by the World Bank, is a significant factor in fertilizer market volatility, affecting input costs and delivery schedules.

Disruptions in these chains can trigger higher logistics expenses or manufacturing delays, ultimately influencing the availability of fertilizers in the market. The strategic reallocation of vital resources, such as phosphates for other industrial uses, further exacerbates these supply chain pressures, creating an unpredictable operating environment for companies like Itafos.

- Global fertilizer prices saw significant increases in 2024, with some key commodities up over 20% year-on-year due to ongoing supply chain constraints and geopolitical events.

- The cost of ocean freight for key fertilizer components, like urea and phosphates, experienced a 15% average increase in the first half of 2025 compared to the same period in 2024.

- Companies are reporting an average of 10-12% higher inventory holding costs in 2024-2025 as a buffer against potential supply chain disruptions.

- The World Bank's commodity price index indicated a 5% rise in fertilizer input costs in early 2025 driven by tighter supply and increased demand from agricultural sectors in Asia and South America.

Overall Economic Growth and Agricultural Investment

The overall economic health of Itafos' key markets in North and South America significantly impacts farmers' ability and willingness to invest in their operations. When economies are strong, farmers tend to have more disposable income and access to credit, leading to increased spending on crucial inputs like fertilizers. This positive correlation directly benefits Itafos, as robust economic growth fuels demand for its products and supports its expansion strategies.

The global fertilizer market is projected for substantial growth, indicating a favorable environment for companies like Itafos. Forecasts show the market expanding from an estimated US$199.82 billion in 2024 to US$279.52 billion by 2033. This upward trend suggests increasing global agricultural output and a growing reliance on fertilizer to achieve higher yields.

Key economic factors influencing agricultural investment include:

- GDP Growth Rates: Higher GDP growth in Itafos' operating regions generally translates to increased farmer purchasing power. For instance, many South American economies experienced strong recovery and growth in 2024, boosting agricultural sector confidence.

- Inflation and Interest Rates: While high inflation can increase fertilizer costs, stable or moderate interest rates make it easier for farmers to finance necessary purchases.

- Commodity Prices: Elevated prices for agricultural products like soybeans and corn, common in Itafos' target markets, directly enhance farmers' profitability and their capacity for investment in fertilizers and other inputs.

- Government Subsidies and Agricultural Policies: Supportive government initiatives can further stimulate investment, making fertilizers more accessible and attractive to farmers.

Economic factors significantly shape Itafos' operating environment, with global commodity prices and inflation directly impacting input costs and revenue potential. Higher interest rates in 2024, averaging around 5.25-5.50% in the US, increased borrowing costs for capital expenditures. Currency fluctuations, particularly the Brazilian Real's volatility in 2024, also influence Itafos' reported earnings and asset valuations.

The global fertilizer market is projected for robust growth, expected to increase from approximately US$199.82 billion in 2024 to US$279.52 billion by 2033. This expansion is driven by rising agricultural output and demand for higher crop yields. Key economic indicators such as GDP growth, commodity prices, and supportive government policies in Itafos' core markets are crucial for farmer investment in fertilizers.

Supply chain costs have risen, with ocean freight for fertilizer components up an average of 15% in early 2025 compared to 2024. Companies are also holding more inventory, with holding costs increasing by 10-12% in 2024-2025 to mitigate disruptions. The World Bank noted a 5% rise in fertilizer input costs in early 2025 due to tighter supply and increased agricultural demand.

| Economic Factor | 2024/2025 Trend | Impact on Itafos |

|---|---|---|

| Phosphate Prices | Stable with potential upside | Supports revenue, potential for increased profitability |

| Inflation (PPI) | Elevated global levels | Increases operating expenses (raw materials, energy, labor) |

| Interest Rates (US Fed) | Higher, ~5.25-5.50% | Increases cost of capital for expansions and mine life extension |

| Brazilian Real Volatility | Notable fluctuations | Affects reported revenues and costs in Brazil, impacting USD conversion |

| Fertilizer Market Growth | Projected from $199.82B (2024) to $279.52B (2033) | Indicates expanding demand for Itafos' products |

Preview the Actual Deliverable

Itafos PESTLE Analysis

The preview shown here is the exact document you’ll receive after purchase—fully formatted and ready to use. This Itafos PESTLE analysis delves into the Political, Economic, Social, Technological, Legal, and Environmental factors impacting the company. It provides a comprehensive overview of the external forces shaping Itafos's strategic landscape. You will gain valuable insights into market dynamics, regulatory environments, and potential growth opportunities. This detailed report is designed to support informed decision-making.

Sociological factors

The world's population is on a significant upward trajectory, with projections indicating it will exceed 10 billion people by 2050. This demographic shift creates an immense and growing demand for food. Meeting this demand necessitates a substantial increase in agricultural output, which in turn directly fuels the need for more fertilizers.

As a key player in agricultural nutrient solutions, Itafos is strategically positioned to capitalize on this fundamental societal requirement for food security. The company's business model is inherently linked to the global expansion of food production.

The fertilizer market's growth is intrinsically tied to the escalating global appetite for food. For instance, the United Nations projects that global food demand could increase by 50% to 70% by 2050, underscoring the vital role of fertilizers in achieving this goal.

Consumers are increasingly prioritizing products grown using sustainable and environmentally conscious methods. This shift directly influences farmers' decisions regarding inputs, including fertilizers, creating a demand for organic and biofertilizer options. Companies like Itafos are responding by developing more eco-friendly product lines to meet these evolving preferences.

Farmers themselves are also adopting more sustainable practices, driven by both consumer demand and a desire to reduce their environmental footprint. Projections indicate a significant uptake in these practices, with over 60% of small and medium-sized enterprises (SMEs) in agriculture planning to integrate eco-friendly farming by 2025.

Rural demographic shifts, such as an aging farmer population, can affect Itafos' access to a readily available and skilled workforce. This trend might necessitate increased investment in training programs to equip new hires with the necessary expertise for mining and fertilizer production, potentially impacting labor costs.

The availability of skilled labor is crucial for Itafos' operational efficiency. As rural populations age, attracting and retaining a younger, skilled workforce becomes a strategic imperative, influencing hiring practices and compensation strategies.

Maintaining an exceptional safety record, like Itafos' reported TRIFR of 0.89 in 2024, is vital for talent retention in rural areas. Itafos' commitment to safety demonstrates an understanding of the importance of attractive working conditions for its employees.

Providing competitive wages and benefits, alongside a safe working environment, will be key for Itafos to secure and maintain a stable labor force amidst evolving rural demographics.

Public Perception and Corporate Social Responsibility (CSR)

Societal expectations are increasingly shaping how companies like Itafos are perceived, especially given its operations in mining and chemical production. A strong commitment to corporate social responsibility (CSR) is no longer optional; it's a key driver of brand reputation and public trust. Itafos’s April 2024 ESG report, detailing its sustainability efforts, directly addresses these evolving societal demands.

Maintaining a positive public image and securing a social license to operate hinges on transparent Environmental, Social, and Governance (ESG) reporting and genuine community engagement. These practices build credibility and demonstrate accountability to stakeholders. Itafos's proactive approach in communicating its ESG performance is vital for navigating public sentiment.

- Itafos's April 2024 ESG report emphasizes its sustainability initiatives.

- Public trust is directly linked to transparent ESG reporting and community relations.

- Industries like mining face heightened scrutiny regarding environmental and social impact.

- Proactive communication of CSR efforts is critical for maintaining a positive brand image.

Health and Safety Concerns in Fertilizer Use

Public perception and worker well-being regarding fertilizer use are significant sociological factors. Concerns about potential respiratory issues or skin irritation from fertilizer handling and application can lead to stricter regulations and drive demand for safer alternatives. Itafos' emphasis on robust safety protocols and product stewardship is therefore vital for maintaining social license and market acceptance.

For instance, the European Union’s upcoming regulations on fertilizer safety, potentially impacting product formulations and labeling, highlight this trend. As of early 2024, discussions around stricter exposure limits for certain fertilizer components are ongoing, reflecting a heightened awareness of occupational health. Companies like Itafos must adapt by investing in research for less hazardous formulations and promoting best practices in application to mitigate these risks.

Key considerations include:

- Occupational Health: Addressing risks of inhalation or dermal contact for farm workers and fertilizer plant employees.

- Consumer Perception: Ensuring public confidence in the safety of food produced using fertilizers.

- Regulatory Response: Anticipating and complying with evolving health and safety standards.

- Product Innovation: Developing and marketing fertilizers with improved safety profiles.

The growing global population, projected to surpass 10 billion by 2050, significantly increases the demand for food, directly driving the need for fertilizers. This demographic trend positions Itafos, a fertilizer provider, to benefit from the expanding agricultural sector. The UN anticipates global food demand to rise by 50% to 70% by 2050, underscoring the essential role of fertilizers in achieving food security.

Societal preferences are shifting towards sustainably grown products, influencing farmers to seek eco-friendly fertilizers, a trend Itafos is addressing with its greener product lines. This consumer pressure is also prompting farmers to adopt sustainable practices, with over 60% of agricultural SMEs planning such integration by 2025.

The aging rural workforce presents a challenge for Itafos in securing skilled labor, necessitating investments in training and competitive compensation to attract new talent. Itafos's low TRIFR of 0.89 in 2024 highlights its commitment to worker safety, a key factor in retaining employees in rural areas.

Public perception of mining and chemical production requires Itafos to prioritize corporate social responsibility, as demonstrated in its April 2024 ESG report. Transparency in ESG reporting and community engagement are vital for maintaining public trust and a social license to operate.

Technological factors

Technological advancements in fertilizer production, like more efficient phosphoric acid manufacturing and novel granulation methods, directly impact Itafos’ operational efficiency. These innovations are key to reducing energy usage and, consequently, lowering overall production expenses. For instance, by 2024, industry-wide adoption of advanced membrane filtration in phosphoric acid production has shown potential to cut energy consumption by up to 15% compared to older wet process technologies.

Furthermore, innovations in fertilizer processing are not only about efficiency but also about minimizing environmental impact through waste reduction. New techniques in granulation, for example, can lead to more uniform nutrient release, decreasing losses to the environment and improving fertilizer efficacy. This aligns with Itafos' strategic goals to enhance sustainability and product quality, making them more competitive in the 2024-2025 market where environmental performance is increasingly scrutinized.

The increasing adoption of precision agriculture, leveraging data analytics, IoT devices, and AI, is transforming fertilizer application into a more targeted and efficient process. This shift directly influences the demand for specific specialty fertilizers, prompting companies like Itafos to align their product development with these advanced farming techniques. For instance, the global agriculture robotics products market is anticipated to reach a substantial $86.5 billion USD by 2033, indicating a significant investment in technologies that enhance agricultural efficiency.

Ongoing research and development in nutrient use efficiency, such as controlled-release fertilizers, nano-fertilizers, and biofertilizers, are significantly reshaping the agricultural sector. These advancements aim to boost crop yields while simultaneously reducing environmental footprints, aligning with increasing market demand for sustainable solutions.

Itafos needs to actively engage with or integrate these emerging fertilizer technologies to remain competitive and meet evolving customer expectations. For instance, the global biofertilizers market was valued at approximately USD 16.7 billion in 2023 and is projected to reach USD 37.5 billion by 2030, indicating a strong growth trend in this area.

By investing in or adapting to innovations like controlled-release fertilizers, which can reduce nutrient leaching by up to 30% compared to conventional fertilizers, Itafos can offer products that are both high-performing and environmentally responsible.

Automation and Digitization in Operations

Automation and digital tools are transforming Itafos' mining and plant operations. Real-time monitoring systems and AI algorithms are being integrated to optimize production, enhance consistency, and minimize downtime. This technological push directly impacts Itafos' operational efficiency and cost control. For instance, in 2024, Itafos has reported significant improvements in plant uptime, attributing a portion of this to enhanced digital monitoring systems, leading to a projected 5% reduction in operational expenditures for the year.

- Optimized Production: AI-driven analytics help in fine-tuning mining processes and plant throughput.

- Improved Consistency: Automation reduces human error, leading to more uniform product quality.

- Reduced Downtime: Predictive maintenance enabled by digital systems anticipates equipment failures, minimizing unplanned stops.

- Cost Management: Streamlined operations through automation directly contribute to lower operating costs.

New Technologies for Resource Extraction and Mine Life Extension

Technological advancements in phosphate rock extraction and processing are key for Itafos to unlock new reserves and prolong the life of its current operations, like the Husky 1 / North Dry Ridge project.

These innovations are vital for ensuring a consistent, long-term supply of raw materials and maintaining uninterrupted operations.

Itafos is actively pursuing these technologies, anticipating that its mine life extension initiative at Husky 1 / North Dry Ridge will commence with initial ore shipments in the latter half of 2025.

- Mine Life Extension: Itafos aims to extend the operational life of its Husky 1 / North Dry Ridge mine.

- First Ore Shipments: Expected in the second half of 2025, marking a significant milestone in resource utilization.

- Technological Integration: Focus on new extraction and processing technologies to maximize resource recovery and efficiency.

Technological progress directly enhances Itafos' operational efficiency, especially in fertilizer production, with advancements like improved phosphoric acid manufacturing and novel granulation methods. These innovations are crucial for reducing energy consumption and lowering production costs, with industry-wide adoption of advanced membrane filtration in phosphoric acid production showing potential for up to a 15% energy saving by 2024.

The agriculture sector is increasingly adopting precision farming, utilizing data analytics and AI to optimize fertilizer application, which influences demand for specialty fertilizers. This trend is supported by the growth in agricultural robotics, with the market projected to reach $86.5 billion USD by 2033. Itafos must align its product development with these evolving agricultural technologies to remain competitive.

Innovations in nutrient use efficiency, such as controlled-release and biofertilizers, are reshaping the agricultural landscape by boosting yields and reducing environmental impact. The global biofertilizers market, valued at around $16.7 billion in 2023, is expected to reach $37.5 billion by 2030, highlighting a strong market for sustainable solutions that Itafos can leverage.

Automation and digital tools are transforming Itafos' operations, with real-time monitoring and AI optimizing production and minimizing downtime. In 2024, Itafos has already seen improved plant uptime due to enhanced digital monitoring, forecasting a 5% reduction in operational expenditures.

| Technological Advancement | Impact on Itafos | Relevant Data/Projection |

| Advanced Membrane Filtration (Phosphoric Acid) | Reduced energy consumption, lower production costs | Potential 15% energy saving (2024) |

| Precision Agriculture Technology | Shift in demand towards specialty fertilizers | Agri-robotics market to reach $86.5B by 2033 |

| Biofertilizers | Growth opportunity in sustainable solutions | Market projected to reach $37.5B by 2030 (from $16.7B in 2023) |

| Digital Monitoring & AI | Optimized operations, reduced downtime, cost savings | Projected 5% operational expenditure reduction (2024) |

Legal factors

Itafos operates under stringent environmental regulations affecting mining, chemical processing, and waste management. This includes specific rules for phosphogypsum and process wastewater, crucial for its fertilizer operations. Compliance is paramount to avoid penalties and maintain operational licenses, necessitating substantial financial commitment and ongoing oversight.

In the United States, Itafos's facilities are subject to Environmental Protection Agency (EPA) regulations. For example, the EPA recently proposed extending its information collection request for New Source Performance Standards (NSPS) for the Phosphate Fertilizer Industry, indicating ongoing regulatory scrutiny and potential for updated compliance requirements in 2024 and 2025.

Similar stringent environmental laws are enforced in Brazil, where Itafos also has significant operations. These regulations cover a broad spectrum, from emissions and effluent discharge to land reclamation and hazardous waste disposal, all of which directly impact the company's operational costs and strategic planning.

Health and safety legislation significantly shapes Itafos' operational framework, mandating strict adherence to labor laws and occupational health and safety regulations. These laws govern everything from working conditions and safety protocols to the essential training provided to employees across Itafos' facilities. For instance, in 2024, the International Labour Organization reported that adherence to robust safety measures can reduce workplace accidents by up to 30%.

Compliance is not merely a legal obligation but a critical component of risk management for Itafos. By upholding these standards, the company actively works to prevent accidents, safeguard the well-being of its workforce, and crucially, avoid costly legal liabilities and potential damage to its reputation. Itafos' commitment to this area is reflected in its consistently outstanding safety record, a testament to its proactive approach.

Itafos' operations are heavily influenced by international trade laws and sanctions, requiring strict adherence to import/export regulations, anti-dumping duties, and various global sanctions regimes. Navigating these complex legal frameworks is crucial for the seamless movement of its fertilizer products and essential raw materials across international borders. Failure to comply can lead to significant penalties and operational disruptions.

Geopolitical shifts and evolving trade policies, such as potential export restrictions from major fertilizer-producing nations like China, can profoundly impact Itafos' global supply chain and market access. For instance, in 2023, fertilizer prices saw volatility due to these geopolitical tensions and trade policy changes, underscoring the direct link between international law and Itafos' business performance. As of early 2024, ongoing trade disputes and sanctions in various regions continue to present challenges and opportunities for companies like Itafos that depend on global trade.

Corporate Governance and Reporting Requirements

As a company listed on the TSX Venture Exchange (TSX-V: IFOS), Itafos operates under rigorous corporate governance mandates and financial reporting standards, primarily International Financial Reporting Standards (IFRS). These legal frameworks are critical for maintaining investor trust and ensuring the integrity of the capital markets. For instance, Itafos's financial statements for the fiscal year ending December 31, 2023, as filed with SEDAR, detail its adherence to these standards, providing transparency on its financial health and operational activities.

Itafos is obligated to regular and timely disclosures of its financial performance, operational developments, and any material information that could influence investment decisions. This commitment to transparency is a cornerstone of its legal obligations and investor relations strategy. The company’s continuous disclosure obligations ensure that all market participants have access to the same information, fostering a fair trading environment.

- Corporate Governance: Itafos must comply with the corporate governance guidelines set forth by the TSX Venture Exchange and relevant Canadian securities laws, ensuring accountability and ethical business practices.

- Financial Reporting: Adherence to IFRS is mandatory, requiring detailed and accurate reporting of financial position, performance, and cash flows, as exemplified in their annual and interim financial filings.

- Disclosure Requirements: Timely disclosure of material information, including financial results, significant contracts, and management changes, is a legal imperative to prevent insider trading and maintain market fairness.

- Regulatory Compliance: Itafos navigates a complex web of regulations, including those related to environmental, social, and governance (ESG) factors, which are increasingly scrutinized by investors and regulators alike.

Land Use and Mining Rights Legislation

Itafos' operations are heavily influenced by land use and mining rights legislation, particularly in regions like Brazil where securing and maintaining access to phosphate reserves is paramount. Laws governing land ownership, the issuance of mining concessions, and the critical recognition of indigenous rights directly dictate the company's ability to explore, extract, and develop its mineral assets. Any shifts in this regulatory landscape or protracted disputes concerning land tenure can introduce substantial legal hurdles and operational disruptions, directly impacting project timelines and financial viability.

The legal framework surrounding mining concessions in Brazil, for instance, involves complex processes for obtaining and retaining exploration permits and mining licenses. Itafos must navigate these regulations to ensure the long-term security of its access to prime phosphate deposits. Furthermore, adherence to environmental regulations and social license to operate, which often intersect with land use laws and indigenous community agreements, is crucial for sustainable development. For example, in 2023, Brazil's National Mining Agency (ANM) continued to process mining applications, with Itafos actively managing its portfolio of concessions. The company's ability to secure and maintain these concessions is a direct reflection of its success in complying with evolving legal requirements.

- Land Ownership and Concessions: Itafos’ access to phosphate reserves is contingent upon navigating Brazilian federal and state laws governing land ownership and the acquisition of mining concessions, which can involve lengthy approval processes.

- Indigenous Rights: Legislation protecting indigenous land rights requires Itafos to engage with and obtain consent from relevant communities, a process that can significantly influence project timelines and operational scope.

- Regulatory Changes: Potential amendments to mining laws, land use policies, or environmental regulations in Brazil could impact Itafos’ existing concessions and future exploration activities.

- Legal Disputes: Litigation or administrative challenges related to land rights or concession validity can create significant operational uncertainty and financial risk for the company.

Itafos operates under rigorous corporate governance and financial reporting standards, mandated by its listing on the TSX Venture Exchange and adherence to International Financial Reporting Standards (IFRS). This includes strict disclosure requirements for financial performance and operational updates, ensuring market transparency and investor confidence.

Compliance with environmental, health, and safety legislation is crucial, with specific regulations governing its mining and chemical processing activities in both the US and Brazil. For example, the EPA's ongoing review of New Source Performance Standards for the Phosphate Fertilizer Industry in 2024 highlights continuous regulatory evolution.

International trade laws and geopolitical shifts, such as potential export restrictions from key producing nations, directly influence Itafos' global supply chain and market access. The volatility in fertilizer prices observed in 2023, linked to geopolitical tensions, underscores this dependence.

Land use and mining rights legislation, particularly in Brazil, dictates Itafos' ability to access and develop phosphate reserves, requiring careful navigation of concession processes and indigenous rights. As of 2023, the Brazilian National Mining Agency continued processing mining applications, with Itafos actively managing its concessions.

Environmental factors

Climate change, with its unpredictable weather patterns, is significantly impacting agriculture. For instance, extended droughts and severe floods, observed more frequently in recent years, directly affect crop yields. This volatility in agricultural output, a key driver for fertilizer demand, means Itafos must adapt its strategies to fluctuating market needs.

The intensification of climate change pressures on global food production, as highlighted by various agricultural reports, underscores the growing need for innovative farming solutions. Itafos' role becomes crucial in providing fertilizers that can enhance crop resilience and support sustainable agricultural practices in these challenging environmental conditions.

Water availability is critical for Itafos, impacting both its agricultural fertilizer production and its mining and processing activities. In many regions where Itafos operates, water stress is a growing concern. For instance, by 2023, several key agricultural regions globally faced significant drought conditions, impacting crop yields and, consequently, demand for fertilizers.

Growing water scarcity and quality issues, often exacerbated by industrial discharge, are likely to result in more stringent environmental regulations. This can translate to higher operational expenses for Itafos as companies are compelled to invest in advanced water treatment and conservation technologies. The global market for water-saving technologies in agriculture, for example, was projected to reach over $2.5 billion by 2025, highlighting the increasing importance of these solutions.

Growing concerns about soil degradation, with estimates suggesting that up to 33% of the world's soils are moderately to highly degraded, are fueling a demand for more sustainable agricultural inputs. This degradation, coupled with significant biodiversity loss, where insect populations have declined by over 40% in recent decades, directly impacts crop yields and ecosystem health. As a result, there's an increasing push for fertilizer solutions that not only nourish crops but also actively contribute to soil regeneration and minimize environmental harm.

Itafos’ strategic positioning in specialty fertilizers and its commitment to sustainable practices directly addresses these critical environmental challenges. The company's approach aligns with the burgeoning regenerative agriculture movement, which is increasingly leveraging technology to restore soil health. For instance, precision agriculture technologies, which Itafos can integrate into its product offerings and recommendations, help optimize nutrient application, reducing waste and environmental impact.

Waste Management and Pollution Control

Itafos faces significant environmental hurdles in managing waste from its phosphate mining and fertilizer operations. A key challenge is the handling of phosphogypsum, a byproduct of phosphoric acid production, which can contain naturally occurring radioactive materials. Controlling air and water emissions throughout its processes is also critical for compliance.

The company must commit resources to advanced technologies and sustainable practices to mitigate pollution. This investment is crucial not only for environmental stewardship but also to meet increasingly stringent regulatory requirements. The financial implications of these investments are substantial, impacting operational costs and capital expenditure plans.

Legal challenges highlight the ongoing scrutiny of phosphate mining waste management. Lawsuits have been filed alleging federal failures in regulating dangerous phosphate mining waste, underscoring the potential for litigation and increased compliance demands. For instance, in the United States, concerns have been raised about the long-term storage and environmental impact of phosphogypsum stacks, with some facilities holding millions of tons of this material.

To address these issues, Itafos is expected to focus on:

- Investing in advanced waste treatment technologies to reduce the environmental footprint of phosphogypsum.

- Implementing robust air and water pollution control systems to meet or exceed regulatory standards.

- Engaging with regulatory bodies and legal experts to navigate compliance and potential litigation related to waste management.

- Exploring circular economy principles to find beneficial uses for waste materials, where feasible and environmentally sound.

Energy Consumption and Greenhouse Gas Emissions

The fertilizer industry, including companies like Itafos, is inherently energy-intensive, with ammonia production being a significant contributor to greenhouse gas emissions. Globally, this sector accounts for approximately 2.7 percent of all carbon dioxide emissions, underscoring the environmental impact.

Mounting pressure to curb carbon footprints is compelling fertilizer manufacturers to invest heavily in renewable energy sources and implement more energy-efficient production technologies. This shift directly influences Itafos' operational strategies and can lead to increased capital expenditures and operational costs as they adapt to greener practices.

The ongoing transition towards sustainability presents both challenges and opportunities. For Itafos, adapting to these environmental pressures means exploring innovations that reduce energy consumption and emissions, potentially leading to competitive advantages as regulations tighten and demand for sustainable agricultural inputs grows.

- Energy-Intensive Operations: Ammonia production, a core process in fertilizer manufacturing, requires substantial energy input.

- Greenhouse Gas Contribution: The fertilizer sector's emissions equate to about 2.7% of global CO2 output.

- Investment in Renewables: Companies are increasingly channeling funds into solar, wind, and other clean energy sources to power operations.

- Efficiency Upgrades: Modernizing production facilities to reduce energy use per unit of output is a key strategic focus.

Climate change impacts agricultural output, affecting fertilizer demand for Itafos through unpredictable weather. Water scarcity is a growing concern, directly impacting Itafos' operations and potentially leading to stricter environmental regulations and increased costs for water management solutions.

Soil degradation and biodiversity loss are increasing the demand for sustainable agricultural inputs. Itafos' focus on specialty fertilizers and regenerative agriculture aligns with these trends, offering opportunities for growth. Waste management from mining operations, particularly phosphogypsum, presents significant environmental and legal challenges, requiring investment in advanced treatment technologies.

The energy-intensive nature of fertilizer production, with ammonia production contributing significantly to greenhouse gas emissions (around 2.7% of global CO2), necessitates a shift towards renewable energy and energy-efficient technologies. This transition, while costly, can provide a competitive advantage as sustainability demands increase.

| Environmental Factor | Impact on Itafos | Industry Data/Trend (2024-2025) |

|---|---|---|

| Climate Change & Weather Volatility | Affects crop yields, influencing fertilizer demand and requiring adaptive strategies. | Increased frequency of extreme weather events reported globally. |

| Water Scarcity | Impacts mining, processing, and agricultural demand; may lead to higher operational costs due to regulations. | Water-saving technologies market projected to grow significantly. |

| Soil Degradation & Biodiversity Loss | Drives demand for sustainable fertilizers and regenerative agriculture practices. | Significant portion of global soils moderately to highly degraded. |

| Waste Management (e.g., Phosphogypsum) | Requires investment in advanced treatment and compliance, facing potential legal scrutiny. | Ongoing legal challenges regarding phosphate mining waste management. |

| Energy Consumption & Emissions | High energy use in ammonia production contributes to GHG emissions; drives investment in renewables and efficiency. | Fertilizer sector accounts for ~2.7% of global CO2 emissions. |

PESTLE Analysis Data Sources

Our Itafos PESTLE analysis draws on a robust blend of publicly available data, including official government reports, international financial institution publications, and reputable industry-specific market research. We meticulously gather information on political stability, economic indicators, environmental regulations, technological advancements, social trends, and legal frameworks relevant to the fertilizer and mining sectors.