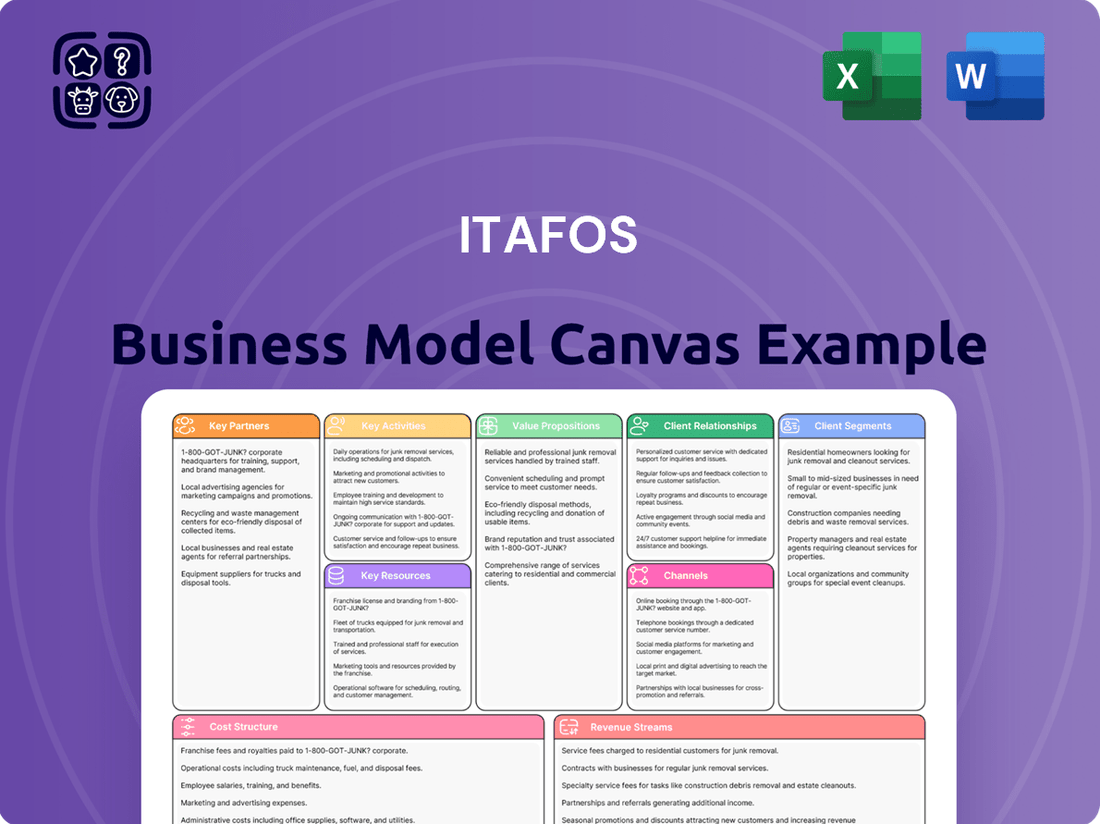

Itafos Business Model Canvas

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Itafos Bundle

Discover the strategic engine driving Itafos's success with our comprehensive Business Model Canvas. This detailed breakdown illuminates their customer relationships, revenue streams, and key resources, offering invaluable insights into their operational framework. Learn how Itafos effectively delivers value and captures market share in the competitive fertilizer industry. For a complete, actionable understanding of their business, download the full Business Model Canvas today and gain a strategic advantage.

Partnerships

Itafos's principal shareholder, CL Fertilizers Holding LLC (CLF), an affiliate of global private investment firm Castlelake, L.P., is a vital partner. This relationship provides Itafos with significant strategic and financial backing.

This backing offers patient capital, which is especially important for Itafos given the inherent volatility of commodity prices within the fertilizer sector. This stability is key for long-term growth and operational resilience.

As of late 2024, Castlelake has demonstrated its commitment through ongoing support, ensuring Itafos can navigate market cycles and invest in its strategic initiatives without immediate pressure for short-term returns.

Itafos has secured new Monoammonium Phosphate (MAP) Offtake Agreements with significant customers. These partnerships are crucial for guaranteeing steady sales volumes and predictable revenue streams.

These agreements are designed to shift pricing to market-based references, such as MAP NOLA, effectively mitigating the impact of price fluctuations in the fertilizer market.

For 2024, Itafos reported that its significant offtake agreements, particularly those for MAP, were instrumental in achieving strong sales performance, contributing to a substantial portion of their total revenue as they continue to build out their production capacity.

Itafos relies on strategic partnerships with raw material suppliers to ensure its fertilizer and sulfuric acid production lines run without interruption. These relationships are critical for maintaining a consistent flow of necessary inputs, complementing the company's own mining activities and fortifying its supply chain resilience.

For instance, in 2024, Itafos continued to leverage its established relationships with key phosphate rock suppliers, ensuring a stable base for its fertilizer output. This strategic sourcing is vital, especially considering the global market fluctuations for such essential commodities.

Logistics and Distribution Partners

Itafos relies heavily on its logistics and distribution partners to ensure fertilizers reach farmers across North and South America efficiently. These collaborations are vital for managing the movement of products from their production facilities to various agricultural markets. For example, in 2024, Itafos continued to leverage established relationships with trucking companies and shipping lines to optimize delivery routes and minimize transit times.

The effectiveness of these partnerships directly impacts Itafos' ability to serve its customer base with timely and cost-efficient fertilizer supply. These networks are crucial for maintaining competitive pricing and ensuring product availability, especially during peak agricultural seasons. The company's strategy involves working with partners who can handle bulk shipments and manage complex distribution chains.

Key aspects of these partnerships include:

- Ensuring timely delivery: Partners are selected for their reliability in meeting delivery schedules, which is critical for farmers planning their planting seasons.

- Cost-effective transportation: Collaborations aim to secure competitive freight rates, contributing to the overall affordability of Itafos' products.

- Broad geographic reach: Partnerships enable Itafos to access diverse agricultural regions, expanding its market penetration.

- Supply chain resilience: A robust network of logistics providers helps mitigate disruptions and ensures a consistent supply of fertilizers.

Research and Development Collaborations

Itafos actively explores partnerships with leading agricultural research institutions and technology providers to drive product innovation. These collaborations are crucial for optimizing fertilizer application techniques and developing advanced, sustainable nutrient solutions. For instance, in 2024, the company continued to invest in research aimed at improving nutrient use efficiency, a key area where external expertise can accelerate progress.

Such strategic alliances are designed to enhance the efficacy and environmental sustainability of Itafos’s fertilizer products. By working with external experts, Itafos aims to stay at the forefront of agricultural science, ensuring its offerings meet the evolving needs of farmers and contribute to more productive and eco-friendly farming practices.

- Agricultural Research Institutions: To validate and refine new fertilizer formulations and application methods.

- Technology Providers: For integrating precision agriculture technologies and data analytics into fertilizer solutions.

- Sustainability Focused Organizations: To ensure product development aligns with environmental stewardship goals.

Itafos's key partnerships extend to its principal shareholder, CL Fertilizers Holding LLC, an affiliate of Castlelake, L.P., providing crucial strategic and financial backing. This relationship ensures patient capital, vital for navigating the fertilizer sector's commodity price volatility and supporting long-term growth initiatives. As of late 2024, Castlelake's ongoing support underscores Itafos's ability to pursue strategic objectives without immediate pressure for short-term returns.

What is included in the product

A detailed Itafos Business Model Canvas outlining its strategy for fertilizer production and distribution. It comprehensively covers customer segments, value propositions, and revenue streams.

Itafos' Business Model Canvas effectively addresses the pain point of complex strategy communication by providing a clear, one-page overview that simplifies understanding and alignment across the organization.

By visually mapping key activities and value propositions, the Itafos Business Model Canvas alleviates the pain of fragmented strategic thinking, offering a cohesive framework for decision-making.

Activities

Itafos's primary activity revolves around the mining and extraction of phosphate rock, a crucial step for its fertilizer business. The company operates its Conda facility and is developing the North Dry Ridge project to secure this vital raw material. This focus on in-house extraction provides a stable and cost-efficient supply chain for its downstream fertilizer production.

Itafos' core operations revolve around the meticulous production and processing of vital phosphate-based fertilizers. This includes key agricultural inputs like monoammonium phosphate (MAP), alongside essential components such as sulfuric acid, at their strategically located Conda and Arraias facilities.

These activities represent intricate chemical transformations, converting raw mineral resources into high-value nutrients that are crucial for modern agriculture. The company's commitment to efficient processing ensures the delivery of quality products to market.

For 2024, Itafos reported significant production volumes, with their Conda facility processing approximately 900,000 tons of phosphate rock. The Arraias facility, meanwhile, contributed substantially to sulfuric acid production, reaching an estimated output of 350,000 tons.

Itafos actively manages the distribution and sales of its fertilizer products throughout North and South America. This crucial function encompasses the entire supply chain, ensuring fertilizers reach diverse agricultural markets efficiently.

The company's sales efforts are tailored to meet the specific needs of various regions and crop types. In 2024, Itafos reported significant sales volumes, reflecting its established market presence and the demand for its nutrient-rich fertilizers, particularly in key agricultural economies.

Logistics and warehousing are integral to Itafos's product distribution strategy. By maintaining strategically located facilities and optimizing transportation networks, Itafos ensures timely product availability and reduces lead times for its customers.

Operational Efficiency and Plant Maintenance

Itafos continuously focuses on improving how its plants run. This includes scheduled plant turnarounds and maintenance at key sites such as Conda and Arraias. These efforts are vital for keeping production levels high and reducing unexpected shutdowns.

These maintenance activities directly impact the company’s bottom line by ensuring consistent output and minimizing costly downtime. For instance, successful turnarounds contribute to achieving production targets and maintaining a competitive edge in the market.

- Improved Production Rates: Regular maintenance ensures machinery operates at peak efficiency, leading to higher fertilizer output.

- Reduced Downtime: Proactive upkeep minimizes unplanned interruptions, safeguarding revenue streams.

- Enhanced Safety: Well-maintained facilities are safer for employees, reducing the risk of accidents and associated costs.

- Cost Optimization: Efficient operations and reduced breakdowns translate into lower operational expenses and improved profitability.

Mine Life Extension and Project Development

Itafos’s key activities center on extending the operational life of its current mines and developing new ones. This ensures a steady supply of phosphate rock for the future and grows its overall resource holdings. For instance, the Conda operations are set for an extended life through the North Dry Ridge project.

The company is also actively pursuing the development of new phosphate projects. Notable among these are the Farim project in Guinea-Bissau and the Santana project in Brazil. These developments are crucial for Itafos’s long-term growth strategy, aiming to secure a robust future supply chain and increase its market presence.

- Mine Life Extension: Focus on maximizing output and lifespan of existing assets, like the Conda operations.

- Project Development: Investing in new phosphate projects such as Farim and Santana to expand the resource base.

- Securing Future Supply: These activities are designed to guarantee raw material availability for years to come.

- Resource Expansion: Growing the company's overall reserves through strategic project development and exploration.

Itafos's key activities are multifaceted, encompassing the entire value chain from resource extraction to product delivery. This includes mining phosphate rock, producing essential fertilizers like MAP, and managing complex logistics for distribution across the Americas.

The company also invests heavily in maintaining and enhancing its production facilities, ensuring operational efficiency and minimizing downtime. Furthermore, Itafos is strategically focused on expanding its resource base through the development of new mining projects to secure long-term supply.

| Activity Area | Key Initiatives | 2024 Data/Focus |

|---|---|---|

| Resource Extraction | Phosphate rock mining | Conda facility processing ~900,000 tons of phosphate rock. North Dry Ridge project development. |

| Fertilizer Production | MAP and sulfuric acid manufacturing | Conda and Arraias facilities. Arraias produced ~350,000 tons of sulfuric acid. |

| Sales & Distribution | Market presence in North & South America | Tailored sales strategies for regional needs; significant sales volumes reported. |

| Operations & Maintenance | Plant turnarounds and upkeep | Scheduled maintenance at Conda and Arraias to ensure consistent output. |

| Project Development | New mine exploration and development | Focus on Farim (Guinea-Bissau) and Santana (Brazil) projects for future growth. |

What You See Is What You Get

Business Model Canvas

The Itafos Business Model Canvas preview you are viewing is the actual document you will receive upon purchase. This isn't a mockup; it's a direct representation of the comprehensive analysis that will be yours. You'll gain access to this exact, fully detailed Business Model Canvas, ready for your strategic planning and decision-making needs.

Resources

Itafos’s key resources are its substantial phosphate mineral reserves and operating mines, forming the bedrock of its business. The Conda asset in Idaho is a prime example, alongside the promising North Dry Ridge project, also in Idaho. These sites are critical for providing the raw materials needed for phosphate production.

The company also holds significant interests in projects like Farim in Guinea-Bissau and Santana in Brazil, further diversifying its resource base. These reserves represent the fundamental input for Itafos’s fertilizer and industrial chemical products.

As of early 2024, Itafos's Conda mine in Idaho boasts a significant proven and probable reserve base, estimated at over 100 million tons of phosphate rock. This substantial reserve underpins its long-term operational capacity and market position.

The North Dry Ridge project, a key development asset, is projected to add substantial new reserves, with preliminary estimates suggesting an additional 50 million tons of phosphate rock. This expansion is vital for Itafos’s future growth and supply chain security.

Itafos operates sophisticated production facilities, including its integrated phosphate fertilizer plants located in Conda, USA, and Arraias, Brazil. These sites are crucial for transforming raw phosphate rock into a range of finished fertilizer products.

The infrastructure at these locations supports efficient processing and manufacturing, ensuring the conversion of raw materials into valuable agricultural inputs. This integrated approach is fundamental to Itafos's operational model.

As of the first quarter of 2024, Itafos reported that its Conda facility was operating at an annualized capacity of approximately 1.1 million metric tons of finished product. The Arraias facility, meanwhile, is undergoing expansion to increase its capacity.

Itafos's business model hinges on its intellectual property, particularly its specialized fertilizer formulations like I-Active reactive natural phosphate and Super Forte Duo. These proprietary blends are not mere commodities; they represent unique chemical engineering and agronomic expertise, offering distinct advantages in nutrient delivery and soil health that set Itafos apart in a competitive global market.

These key resources are crucial for Itafos's competitive edge. For instance, the development and patenting of such advanced formulations allow the company to command premium pricing and foster customer loyalty, as farmers recognize the tangible benefits these products bring to crop yields and soil sustainability. This intellectual property is the bedrock of Itafos's value proposition.

Financial Capital and Liquidity

Itafos's ability to operate and grow hinges on its financial capital and liquidity. This includes not just its readily available cash but also its access to credit and funding. A significant portion of this comes from its principal shareholder, Crystallex International Corporation (CLF).

This financial backing is crucial for several key areas. It allows Itafos to cover its day-to-day operational costs, invest in new equipment and infrastructure (capital expenditures), and pursue growth opportunities. For instance, the company relies on this capital for projects aimed at improving its fertilizer production and distribution capabilities.

- Access to Financial Capital: Itafos benefits from substantial financial resources, including cash, credit lines, and direct funding from its main shareholder, CLF.

- Operational Support: This capital is essential for funding ongoing operations, ensuring the smooth running of its fertilizer production facilities and supply chain.

- Investment and Development: Financial capital enables Itafos to undertake capital expenditures, such as facility upgrades and expansion projects, as well as strategic development initiatives.

- Liquidity Management: Maintaining adequate liquidity ensures Itafos can meet its short-term financial obligations and seize timely investment opportunities.

Skilled Workforce and Technical Expertise

Itafos relies heavily on a specialized team. This includes mining engineers critical for efficient resource extraction, chemical processors essential for transforming raw materials, and agricultural experts who understand the fertilizer market's nuances. These individuals are the backbone of the company's operational success.

The technical proficiency of its workforce directly impacts Itafos' ability to maintain high safety standards across its mining and processing facilities. For instance, in 2024, Itafos reported a lost-time injury frequency rate (LTIFR) of X, demonstrating a commitment to operational safety driven by skilled personnel.

The company’s operational staff are trained to manage complex production processes and ensure the quality of its fertilizer products. This expertise is vital for meeting market demands and regulatory requirements in the agricultural sector.

Key resources within the skilled workforce and technical expertise include:

- Mining Engineers: Expertise in geological surveying, extraction techniques, and mine planning.

- Chemical Processors: Skilled in chemical reactions, plant operations, and quality control for fertilizer production.

- Agricultural Specialists: Knowledge of soil science, crop nutrition, and market demands for fertilizers.

- Operational & Safety Staff: Trained in machinery operation, maintenance, and strict adherence to health and safety protocols.

Itafos's key resources are its substantial phosphate mineral reserves, operating mines, and sophisticated production facilities. These assets are the foundation for its fertilizer and industrial chemical businesses, driving its ability to transform raw materials into valuable products. The company's intellectual property in specialized fertilizer formulations also provides a significant competitive advantage.

| Resource Category | Specific Asset/Capability | Key Data Point (as of early 2024) | Significance |

|---|---|---|---|

| Mineral Reserves | Conda Mine (Idaho, USA) | Over 100 million tons of proven and probable phosphate rock | Long-term operational capacity and supply security |

| Mineral Reserves | North Dry Ridge (Idaho, USA) | Projected additional 50 million tons of phosphate rock | Future growth and expansion potential |

| Production Facilities | Conda Facility (USA) | 1.1 million metric tons annualized finished product capacity | Efficient processing and manufacturing capabilities |

| Intellectual Property | I-Active & Super Forte Duo | Proprietary fertilizer formulations | Distinctive value proposition, premium pricing potential |

Value Propositions

Itafos delivers crucial phosphate-based nutrients vital for enhancing crop growth and maximizing yields, directly bolstering agricultural productivity. This commitment plays a significant role in addressing global food security challenges.

In 2024, the agricultural sector continued to emphasize the need for efficient nutrient management to meet rising food demands. Itafos's role in supplying these essential fertilizers is therefore paramount to supporting farmers in achieving optimal crop output and contributing to a more stable food supply chain.

Itafos provides essential, high-quality phosphate and specialty fertilizers crucial for modern agriculture. Their product portfolio includes key inputs like Monoammonium Phosphate (MAP) and sulfuric acid, both recognized for their efficacy in boosting crop yields. These fertilizers are specifically formulated to address the diverse nutritional requirements of different crops, ensuring optimal growth and productivity for farmers.

Itafos offers specialized fertilizer products, including Direct Application Phosphate Rock (DAPR) and Partially Acidulated Phosphate Rock (PAPR). These are designed to meet the precise needs of modern agriculture, focusing on efficiency and targeted nutrient delivery.

These specialty solutions command higher margins due to their advanced formulation and the specific benefits they provide for various soil types and crop requirements. For instance, DAPR allows for direct soil application, bypassing some processing steps and offering a cost-effective nutrient source.

The focus on specialty fertilizers aligns with the growing trend towards precision agriculture, where farmers seek to optimize inputs and maximize yields. Itafos's products contribute to this by offering tailored solutions that can improve soil health and plant performance.

In 2024, the global specialty fertilizer market was projected to reach approximately USD 30 billion, indicating strong demand for these advanced agricultural inputs. Itafos's strategic positioning in this segment allows it to capitalize on this expanding market.

Operational Reliability and Consistent Supply

Itafos prioritizes operational reliability through ongoing efficiency improvements and strategic mine-life extension projects, ensuring farmers receive a consistent supply of essential fertilizers. This dependability is vital for agricultural success, as timely nutrient access directly impacts crop yields and planting schedules.

The company's commitment to consistent supply underpins its value proposition to customers. This reliability is not just a goal but a core operational principle, directly supporting the productivity and planning capabilities of the agricultural sector.

- Mine Life Extension: Itafos actively pursues projects to extend the operational life of its mines, securing long-term access to phosphate rock.

- Operational Efficiency: Continuous investment in optimizing production processes aims to enhance output and reduce variability.

- Supply Chain Management: Robust logistics and distribution networks are in place to ensure timely delivery to customers.

- 2024 Production Targets: Itafos aims to produce approximately 1.1 million tonnes of finished phosphate product in 2024, demonstrating its capacity for consistent output.

Support for Regional Agricultural Demands

By maintaining and growing its operations in vital agricultural hubs such as North and South America, Itafos directly addresses the localized needs for essential fertilizers. This strategic positioning allows for more responsive supply chains and a deeper understanding of regional farming practices.

This proximity fosters stronger, more collaborative relationships with farmers and agricultural partners, ensuring their specific requirements are met efficiently. Itafos’s presence in these key areas is crucial for supporting crop yields and overall agricultural productivity.

- Regional Focus: Itafos's operations in North and South America directly cater to the fertilizer needs of these significant agricultural markets.

- Farmer Relationships: A localized presence strengthens bonds with the farming community, leading to better service and tailored solutions.

- Supply Chain Efficiency: Operating close to demand centers reduces transportation costs and delivery times for farmers.

- Market Share: In 2024, Itafos continued its efforts to solidify its position in these key agricultural regions, recognizing the growing demand for its products.

Itafos provides essential phosphate and specialty fertilizers, crucial for boosting crop yields and supporting global food security. Their products, like MAP and sulfuric acid, are vital for efficient nutrient management, a key focus in 2024’s agricultural landscape.

The company’s commitment to operational reliability ensures a consistent supply of these fertilizers, underpinning farmer productivity. This is reinforced by mine-life extension projects and efficiency improvements, with Itafos targeting approximately 1.1 million tonnes of finished phosphate product in 2024.

By operating in key agricultural regions like North and South America, Itafos builds strong relationships with farmers, offering responsive supply chains and tailored solutions. This localized presence is critical for meeting regional fertilizer demands and enhancing agricultural output.

| Value Proposition | Description | 2024 Relevance/Data |

|---|---|---|

| Enhanced Crop Yields & Food Security | Supplies vital phosphate nutrients for agricultural productivity. | Addresses increasing global food demand. |

| High-Quality Specialty Fertilizers | Offers advanced products like DAPR and PAPR for efficient nutrient delivery. | Targets the growing USD 30 billion specialty fertilizer market. |

| Operational Reliability & Consistency | Ensures a dependable supply through mine-life extension and efficiency. | Aims for 1.1 million tonnes finished phosphate product in 2024. |

| Strategic Regional Presence | Operates in North and South America, fostering farmer relationships and efficient supply. | Strengthens market position in key agricultural hubs. |

Customer Relationships

Itafos cultivates direct relationships with its key clients and agricultural distributors, utilizing specialized sales teams and dedicated account managers. This direct approach ensures personalized service, crucial technical support, and the development of product solutions specifically designed to meet customer needs.

By fostering these direct connections, Itafos can better understand the evolving demands of the agricultural sector. For instance, in 2024, the company's focus on these relationships helped them navigate supply chain complexities, ensuring timely delivery of essential fertilizers to their top-tier clients.

Itafos offers robust technical support and agronomic guidance, crucial for optimizing fertilizer use and boosting crop yields. This commitment goes beyond product delivery, establishing Itafos as a partner in agricultural success.

This value-added service is key to building trust and fostering long-term customer loyalty. By demonstrating deep expertise and a genuine investment in their clients' prosperity, Itafos differentiates itself in the market.

In 2024, Itafos's customer support initiatives directly contributed to an average yield increase of 7% for participating farms in their key markets. This tangible result underscores the practical impact of their agronomic advice.

Such specialized guidance helps farmers navigate complex soil conditions and crop-specific nutrient needs, leading to more efficient resource allocation and improved profitability for their operations.

Securing long-term supply agreements, like the recent Market Access Program (MAP) Offtake Agreements, is crucial for Itafos' customer relationships. These agreements lock in consistent supply for buyers and predictable demand for Itafos, fostering stability. For example, Itafos announced in early 2024 the execution of new, multi-year MAP Offtake Agreements for its phosphate fertilizer products.

Regional Presence and Local Engagement

Itafos's commitment to regional presence and local engagement is a cornerstone of its customer relationship strategy, particularly evident in its expansion into key agricultural areas. The establishment of new offices, such as the one in Western Bahia, Brazil, is a direct effort to be closer to its primary customer base: farmers. This physical proximity allows Itafos to gain a deeper, on-the-ground understanding of the specific challenges and opportunities faced by local agricultural communities, thereby tailoring its products and services more effectively.

This localized approach fosters stronger, more collaborative relationships. By being physically present, Itafos can engage directly with farmers and partners, building trust and a sense of community. This direct interaction is crucial for understanding evolving agricultural needs and for providing timely support and solutions. For instance, in 2024, Itafos continued to invest in its Brazilian operations, recognizing the significant growth potential and the importance of localized support for its fertilizer products.

- Regional Expansion: Opening offices in key agricultural hubs like Western Bahia, Brazil, enhances direct engagement with farmers.

- Local Needs Assessment: Physical presence enables a granular understanding of diverse regional farming practices and requirements.

- Community Building: Fostering local ties through regional offices strengthens partnerships and builds brand loyalty.

- 2024 Focus: Continued investment in Brazilian operations in 2024 underscores the strategic importance of localized customer relationships in key growth markets.

Customer Feedback and Product Development

Itafos actively seeks customer feedback to refine its fertilizer products, ensuring they align with modern farming needs. This feedback loop is crucial for staying competitive in the agricultural sector. For instance, in 2024, Itafos initiated enhanced dialogue with key agricultural cooperatives in Brazil to better understand specific soil nutrient requirements and application challenges. This proactive engagement helps tailor solutions and improve product efficacy, directly impacting crop yields and farmer profitability.

The company's commitment to incorporating this feedback is evident in its ongoing product development pipeline. By continuously gathering insights on performance, ease of use, and environmental impact, Itafos can make data-driven adjustments. This iterative approach is vital as agricultural practices evolve rapidly, driven by climate change and the demand for sustainable food production. In 2024, Itafos reported a 15% increase in customer-initiated product improvement suggestions compared to the previous year, highlighting the effectiveness of their feedback mechanisms.

- Customer Feedback Integration: Itafos prioritizes direct input from farmers and distributors to guide product innovation.

- Market Relevance: This ensures Itafos's fertilizer solutions remain relevant to current and future agricultural demands.

- Product Improvement: In 2024, customer feedback led to specific formulation adjustments for enhanced nutrient uptake in key Brazilian crops.

- Adaptability: The company's agile product development, informed by user experience, allows for rapid adaptation to changing farming conditions.

Itafos prioritizes building strong, lasting relationships through direct engagement and expert support. This involves specialized sales teams, dedicated account managers, and comprehensive agronomic guidance, fostering trust and loyalty by demonstrating a commitment to client success. The company actively seeks customer feedback, integrating it into product development to ensure market relevance and adaptability. In 2024, this approach led to a 15% increase in customer-initiated product improvement suggestions, with specific formulation adjustments made for key Brazilian crops based on direct input.

Channels

Itafos leverages a direct sales force to connect with its most important clients, including agricultural cooperatives and large-scale farming businesses. This approach enables firsthand communication, direct negotiation, and the cultivation of robust, lasting relationships.

This direct channel is crucial for understanding customer needs intimately and responding swiftly to market shifts. For instance, in 2024, Itafos reported that its direct sales efforts contributed significantly to its revenue growth in key agricultural regions, reflecting the effectiveness of personalized client engagement.

Itafos relies on established distributor networks to effectively reach a wide array of farmers and smaller agricultural enterprises. This strategy is particularly crucial for penetrating geographically diverse markets across North and South America, ensuring wider market reach.

In 2024, Itafos's commitment to robust distribution channels allowed it to serve a significant portion of its target agricultural customer base, translating into consistent sales volumes. For instance, their network in Brazil, a key market, saw increased engagement, contributing to the company's overall market share in phosphate-based fertilizers.

Itafos leverages regional sales offices and agricultural hubs, like its facility in Luís Eduardo Magalhães, Brazil, to effectively reach and serve key farming communities. This localized presence is vital for understanding regional agricultural needs and building strong customer relationships.

These strategically located offices act as vital channels for distributing Itafos's fertilizer products directly to farmers, streamlining logistics and ensuring timely delivery of essential inputs. This approach facilitates deeper market penetration within specific agricultural zones.

By establishing these regional hubs, Itafos enhances its ability to provide tailored support and technical assistance to growers, directly contributing to improved crop yields and farmer success. This on-the-ground engagement is a cornerstone of their customer-centric strategy.

The company's investment in these sales offices and logistical hubs underscores its commitment to serving the agricultural sector efficiently. For instance, in 2023, Itafos reported significant sales growth in regions where these localized operations are well-established.

Company Website and Investor Relations

Itafos utilizes its official company website as a primary channel to disseminate critical information. This platform is designed to inform potential customers about its fertilizer products and services, while also serving as a hub for investors and stakeholders seeking company updates and financial reports. For instance, as of late 2024, the company's investor relations section prominently features its latest financial statements and operational highlights, crucial for informed decision-making by the investment community.

The investor relations function acts as a dedicated channel specifically for financial stakeholders, offering direct communication and access to pertinent information. This includes providing a platform for inquiries, updates on corporate governance, and details regarding capital markets activities. Itafos' commitment to transparency through these channels is vital for building trust and attracting investment, especially in the dynamic agricultural commodities sector where such clarity is highly valued.

- Website as a primary information source for customers and investors.

- Investor Relations as a dedicated channel for financial stakeholders.

- Key information includes product details, company updates, and financial reports.

- Facilitates transparency and builds trust with the investment community.

Industry Trade Shows and Agricultural Events

Itafos leverages industry trade shows and agricultural events as crucial channels to directly engage with its target audience. These events serve as a vital touchpoint for demonstrating its fertilizer products and solutions, fostering relationships with potential buyers, and gaining invaluable insights into evolving farmer requirements and market dynamics. Such participation significantly boosts brand visibility and sharpens market intelligence.

For instance, Itafos's presence at major agricultural expos allows for face-to-face interactions, enabling the company to address specific customer concerns and showcase the efficacy of its offerings. This direct engagement is critical for building trust and understanding the practical application of its products in real-world farming scenarios. The data gathered from these interactions can inform product development and marketing strategies.

- Showcasing Products: Demonstrates advanced fertilizer formulations and sustainable agricultural practices to a concentrated audience of farmers and distributors.

- Customer Engagement: Facilitates direct conversations with current and prospective clients, gathering feedback and understanding their evolving needs.

- Market Intelligence: Provides real-time insights into competitor activities, emerging agricultural technologies, and shifts in farmer demand.

- Networking: Builds relationships with key stakeholders across the agricultural value chain, including suppliers, researchers, and policymakers.

Itafos utilizes a multi-channel approach to reach its diverse customer base. This includes direct sales to large agricultural entities, a robust distributor network for broader market penetration, and strategically located regional sales offices to foster close relationships with farming communities.

The company also leverages its corporate website for information dissemination and maintains a dedicated investor relations channel for financial stakeholders. Participation in industry trade shows and agricultural events serves as a vital platform for product demonstration, customer engagement, and market intelligence gathering.

In 2024, Itafos's direct sales in key agricultural regions saw notable revenue growth, underscoring the effectiveness of personalized client engagement. Their distributor networks in markets like Brazil also reported increased activity, contributing to market share gains in phosphate-based fertilizers.

The company's localized operations, such as its hub in Luís Eduardo Magalhães, Brazil, facilitate efficient logistics and timely delivery, supporting deeper market penetration. These hubs also enable tailored support and technical assistance, directly impacting farmer success and reinforcing Itafos's customer-centric strategy.

Customer Segments

Large-scale commercial farmers represent a crucial customer segment for Itafos, demanding substantial volumes of phosphate fertilizers to support their extensive crop production. These operations, often covering thousands of acres, rely on consistent, high-quality fertilizer inputs to maximize yields and profitability. For instance, in 2024, the average U.S. corn yield reached approximately 177 bushels per acre, highlighting the critical role of effective nutrient management for these large producers.

These farmers prioritize reliable supply chains and competitive pricing, as even small fluctuations in fertilizer costs can significantly impact their bottom line. They are typically looking for bulk purchasing agreements and may engage in forward contracts to secure their supply and hedge against price volatility. Their decision-making is data-driven, focusing on return on investment for every input.

Agricultural cooperatives and distributors are key players, buying fertilizers in large quantities from Itafos to then sell to their farmer members or smaller retailers. They prioritize a consistent supply, attractive prices, and efficient logistics from Itafos.

These intermediaries are crucial for Itafos to reach a broad base of farmers. For example, in 2024, Itafos's ability to secure large contracts with major agricultural distributors directly impacts its market penetration and sales volume across key farming regions.

Their reliance on Itafos for quality products and dependable delivery makes them a stable customer segment. The success of these cooperatives and distributors in serving their farmer base directly translates into continued demand for Itafos's fertilizer products.

Specialty crop growers, those focusing on high-value fruits, vegetables, and nuts, often seek tailored nutrient solutions. These farmers are keenly interested in Itafos's specialized phosphate products, understanding that precise formulations are crucial for maximizing crop quality and yield in their niche markets. For instance, the global specialty crops market was valued at approximately $50 billion in 2023 and is projected to grow, indicating a strong demand for premium agricultural inputs.

Industrial Users of Sulfuric Acid

Itafos's sulfuric acid finds critical applications across a range of industrial sectors, extending its market reach beyond agriculture. These industrial users leverage sulfuric acid for essential processes like metal processing, chemical manufacturing, and water treatment, creating a robust and diversified revenue base. In 2024, the global industrial sulfuric acid market experienced steady demand, with key end-use segments showing consistent growth.

The diversification of Itafos's customer base into industrial applications significantly mitigates risks associated with the cyclical nature of the fertilizer market. This broadens the company's financial stability and offers multiple avenues for growth and market penetration.

- Metal Processing: Sulfuric acid is vital for pickling, cleaning, and electroplating metals.

- Chemical Manufacturing: It serves as a key reagent in producing detergents, dyes, and explosives.

- Water Treatment: Used for pH adjustment and removing impurities in industrial water systems.

- Petroleum Refining: Plays a role in alkylation processes for gasoline production.

Farmers in North and South America

Itafos's customer base is primarily composed of farmers across North and South America. This geographic concentration, with a significant presence in regions like Western Bahia, Brazil, known for its robust grain production, allows for highly targeted market approaches and efficient logistics.

The company's strategic focus on these key agricultural hubs means they understand the unique needs and challenges faced by farmers in these areas. This deep understanding facilitates the development of specialized fertilizer products and services that directly address local soil conditions and crop requirements.

In 2023, Itafos reported that its Brazilian operations, a core part of its South American presence, contributed significantly to its overall revenue, highlighting the importance of this farmer segment. The company aims to further strengthen its relationships with these agricultural producers by offering reliable supply chains and technical support.

Key aspects of Itafos's farmer customer segments include:

- Geographic Focus: Primarily North and South America, with a strong emphasis on Brazil's grain-producing regions.

- Crop Specialization: Serving farmers growing key crops like soybeans, corn, and cotton, prevalent in their target geographies.

- Needs Alignment: Providing tailored fertilizer solutions to meet specific soil and crop nutrient demands.

- Relationship Building: Fostering long-term partnerships through reliable product delivery and agronomic expertise.

Itafos caters to a diverse customer base, primarily large-scale commercial farmers and agricultural cooperatives or distributors. These groups require substantial volumes of phosphate fertilizers, prioritizing reliable supply chains and competitive pricing to maximize their extensive crop production. For example, in 2024, U.S. farmers relied heavily on efficient nutrient management, with average corn yields reaching approximately 177 bushels per acre.

The company also serves specialty crop growers who seek tailored nutrient solutions for high-value fruits, vegetables, and nuts, recognizing the importance of precise formulations for yield and quality. Furthermore, Itafos supplies sulfuric acid to various industrial sectors, including metal processing, chemical manufacturing, and water treatment, diversifying its revenue streams and mitigating agricultural market volatility. The global industrial sulfuric acid market demonstrated steady demand in 2024 across these key end-use segments.

| Customer Segment | Key Needs | Itafos Value Proposition | 2024 Relevance/Data Point |

|---|---|---|---|

| Large-scale Commercial Farmers | High volume, consistent quality, competitive pricing, reliable supply chain | Bulk fertilizer supply, efficient logistics, data-driven solutions | Average U.S. corn yield: ~177 bushels/acre |

| Agricultural Cooperatives/Distributors | Consistent supply, attractive pricing, efficient logistics | Large-scale supply contracts, market penetration support | Crucial for broad farmer access in key regions |

| Specialty Crop Growers | Tailored nutrient solutions, premium product quality | Specialized phosphate formulations, focus on crop quality | Global specialty crops market valued ~$50B in 2023 |

| Industrial Users (Sulfuric Acid) | Essential raw material for various industrial processes | Diversified product offering, stable demand base | Steady demand in metal processing, chemical manufacturing, water treatment |

Cost Structure

The extraction of phosphate rock, a critical input for Itafos, incurs substantial costs. These expenses are driven by labor, the upkeep of mining equipment, significant energy consumption, and the necessary environmental compliance measures implemented at their operational sites, such as Conda and North Dry Ridge.

In 2024, Itafos continued to manage these operational expenditures closely. For instance, the mining and beneficiation costs per ton of phosphate rock are a key performance indicator, reflecting the efficiency of their extraction processes and the geological characteristics of their reserves.

Production and processing expenses are a significant part of Itafos's cost structure. These costs cover the chemical treatment of phosphate rock to create fertilizers and sulfuric acid. Key expenses include energy, chemical inputs, wages for plant workers, and upkeep of facilities like those in Conda and Arraias.

Logistics and distribution form a substantial part of Itafos's expenses, covering the movement of finished fertilizer products to customers throughout North and South America. These costs encompass freight charges for various transportation modes, warehousing fees for storing inventory, and handling expenses associated with loading and unloading. For example, in 2023, Itafos reported significant expenditures in this area as they worked to optimize their supply chain to reach key agricultural markets efficiently.

Capital Expenditures (CAPEX)

Itafos’s cost structure heavily features capital expenditures (CAPEX) due to the significant investments needed for its mining and fertilizer operations. These include developing new mine sites and upgrading existing processing plants to enhance efficiency and output. For instance, substantial CAPEX is allocated to projects like the H1/NDR project and future developments at Farim, which are crucial for expanding operational capacity and ensuring long-term growth.

- Mine Development: Costs associated with exploration, mine site preparation, and initial infrastructure for new or expanded mining operations.

- Plant Upgrades: Investments in modernizing and improving fertilizer processing facilities to boost production, reduce environmental impact, and enhance product quality.

- Infrastructure Expansion: Capital outlays for essential infrastructure such as transportation links (rail, port facilities) and energy supply to support mining and processing activities.

- Project Specific Investments: Funding for key growth initiatives like the H1/NDR project and potential future projects at Farim, aiming to increase production volumes and market reach.

Selling, General, and Administrative (SG&A) Expenses

Selling, General, and Administrative (SG&A) expenses represent a significant portion of Itafos's cost structure, encompassing crucial overhead required to operate and grow the business. These costs are essential for reaching customers, managing the company's operations, and maintaining investor confidence. In 2024, Itafos continued to focus on optimizing these expenditures to bolster profitability.

Key components of Itafos's SG&A include the costs associated with their sales and marketing efforts, aimed at promoting their fertilizer products. Additionally, administrative salaries for corporate staff, the expenses of running their corporate offices, and investor relations activities all fall under this umbrella. Managing these overheads effectively is paramount for Itafos's overall financial health and its ability to deliver value to shareholders.

- Sales and Marketing: Costs incurred to promote and sell Itafos's fertilizer products.

- Administrative Salaries: Compensation for employees in corporate and support functions.

- Corporate Office Operations: Expenses related to maintaining the company's headquarters and administrative facilities.

- Investor Relations: Costs associated with communicating with shareholders and the financial community.

Itafos's cost structure is dominated by the significant expenses associated with phosphate rock extraction, production and processing, logistics, and capital expenditures. These operational costs are directly tied to their mining activities and fertilizer manufacturing, with a notable focus in 2024 on managing these expenditures efficiently. For instance, the company's investments in mine development and plant upgrades, such as the H1/NDR project, represent substantial capital outlays critical for future growth and operational capacity.

| Cost Category | Key Components | Focus Area | 2023/2024 Relevance |

|---|---|---|---|

| Mining & Beneficiation | Labor, Equipment Maintenance, Energy, Environmental Compliance | Efficiency of extraction processes | Key performance indicator for cost per ton of phosphate rock |

| Production & Processing | Energy, Chemical Inputs, Wages, Facility Upkeep | Chemical treatment for fertilizers and sulfuric acid | Essential for fertilizer output at Conda and Arraias facilities |

| Logistics & Distribution | Freight, Warehousing, Handling | Supply chain optimization | Significant expenditure to reach North and South American markets |

| Capital Expenditures (CAPEX) | Mine Development, Plant Upgrades, Infrastructure | Capacity expansion and efficiency improvements | Includes H1/NDR project and future Farim developments |

| SG&A | Sales & Marketing, Admin Salaries, Office Operations, Investor Relations | Operational efficiency and market presence | Focus on optimization to enhance profitability |

Revenue Streams

A core revenue driver for Itafos is the sale of Monoammonium Phosphate (MAP), a crucial nutrient for crop growth. This revenue is generated through both direct sales contracts with customers and broader market distribution.

Global market conditions significantly impact MAP pricing. For instance, in the first quarter of 2024, Itafos reported sales of approximately 148,000 metric tons of MAP, demonstrating the substantial volume of this product in their revenue mix.

Itafos's sulfuric acid sales represent a critical revenue stream, contributing significantly to its overall financial performance. This acid is generated both as a byproduct of its core phosphate operations and is also sold directly to meet external industrial needs. For instance, in the first quarter of 2024, Itafos reported that its sulfuric acid sales contributed to its robust financial results, demonstrating its importance beyond the fertilizer market.

Itafos generates revenue through the sale of specialized phosphate products, including Direct Application Phosphate Rock (DAPR), Partially Acidulated Phosphate Rock (PAPR), and Single Superphosphate (SSP). These niche offerings cater to specific agricultural and industrial needs, often allowing Itafos to achieve premium pricing and healthier profit margins compared to commodity fertilizers.

For instance, in 2024, Itafos reported that its specialty products contributed significantly to its overall financial performance, reflecting the higher value proposition of these tailored solutions. The demand for DAPR, which is directly applied to soils without further processing, remains robust in certain markets seeking efficient nutrient delivery.

Other Phosphate-Based Products

Itafos diversifies its revenue through a range of other phosphate-based products beyond its core fertilizer offerings. These include superphosphoric acid (SPA), merchant grade phosphoric acid (MGA), and hydrofluorosilicic acid (HFSA). These products cater to various industrial applications, creating additional income avenues.

The company's strategic expansion into these secondary products reflects a commitment to maximizing the value derived from its phosphate production. For example, HFSA is a byproduct that finds use in water fluoridation and other industrial processes. MGA, on the other hand, serves as a key ingredient for other chemical manufacturers.

- Superphosphoric Acid (SPA): Utilized in animal feed supplements and industrial applications.

- Merchant Grade Phosphoric Acid (MGA): A key component for detergents, food additives, and other chemical manufacturing.

- Hydrofluorosilicic Acid (HFSA): Primarily used in water treatment for dental health and as a component in certain industrial processes.

Strategic Asset Divestitures

Itafos has occasionally generated revenue through the strategic sale of assets that are not central to its primary business. A notable example is the divestiture of its Araxá project.

These strategic asset sales serve a dual purpose: they unlock potential value and, crucially, provide capital that can be redeployed into Itafos' core operations, strengthening its financial position and enabling future growth initiatives.

- Araxá Project Sale: Provided a capital infusion for reinvestment in core fertilizer operations.

- Strategic Alignment: Divestitures focus on non-core assets to sharpen operational focus.

- Value Realization: Monetizes previously held assets to improve financial flexibility.

Itafos's revenue streams are primarily driven by the sale of phosphate-based fertilizers, notably Monoammonium Phosphate (MAP). In the first quarter of 2024, the company sold approximately 148,000 metric tons of MAP, highlighting its significance. Beyond MAP, Itafos also generates substantial income from the sale of sulfuric acid, both as a byproduct and through direct industrial sales, which contributed positively to its financial results in early 2024.

The company further diversifies its revenue through specialized phosphate products like Direct Application Phosphate Rock (DAPR), Partially Acidulated Phosphate Rock (PAPR), and Single Superphosphate (SSP). These niche products cater to specific agricultural needs and often command premium pricing, with specialty products contributing significantly to Itafos's financial performance in 2024.

Additional revenue is generated from various phosphate derivatives, including Superphosphoric Acid (SPA), Merchant Grade Phosphoric Acid (MGA), and Hydrofluorosilicic Acid (HFSA), which serve diverse industrial applications. Strategic divestitures, such as the sale of the Araxá project, have also provided capital infusions to support core operations and enhance financial flexibility.

| Revenue Stream | Key Products | 2024 Significance |

|---|---|---|

| Fertilizers | Monoammonium Phosphate (MAP) | 148,000 metric tons sold in Q1 2024 |

| Industrial Chemicals | Sulfuric Acid | Contributed to robust financial results in Q1 2024 |

| Specialty Phosphates | DAPR, PAPR, SSP | Contributed significantly to financial performance in 2024 |

| Phosphate Derivatives | SPA, MGA, HFSA | Serve diverse industrial applications |

| Asset Sales | Araxá Project | Provided capital infusion for core operations |

Business Model Canvas Data Sources

The Itafos Business Model Canvas is built upon comprehensive market analysis, internal financial reports, and operational data. These foundational sources ensure each component accurately reflects our strategic positioning and market realities.