Israel Corporation PESTLE Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Israel Corporation Bundle

Gain an edge with our in-depth PESTEL Analysis—crafted specifically for Israel Corporation. Discover how political stability, economic growth, and technological advancements are shaping the company’s future. Uncover vital social trends and environmental considerations that could impact operations. Download the full version now and get actionable intelligence to strengthen your market strategy.

Political factors

Geopolitical instability in the Middle East, including ongoing conflicts, presents substantial risks for ICL Group. These tensions can disrupt critical supply chains and shipping routes, essential for ICL's global operations. For instance, the period following October 2023 saw increased maritime security concerns in the Red Sea, a key transit area for many global trade routes, including those impacting fertilizer and chemical shipments.

Military mobilization and reserve duty requirements in Israel can lead to temporary personnel shortages, affecting production and operational capacity. This was a notable concern during periods of heightened conflict, impacting various sectors within Israel's economy, including those reliant on skilled labor.

Furthermore, regional conflicts can foster a reluctance among international partners to engage in new contractual agreements with Israeli-based companies. This reluctance can manifest as trade limitations or outright bans, potentially impacting ICL's market access and partnership opportunities in specific regions.

ICL Group's ability to maintain business continuity amidst this volatile environment hinges on its sophisticated risk management strategies and its capacity for rapid adaptation to evolving security and political landscapes.

The Israeli government is considering significant changes to Dead Sea mineral extraction policies, which could directly affect Israel Corporation's (ICL) key business segments. Proposals include reducing the land available for future mineral concessions by half, simplifying royalty calculations, and potentially increasing these royalties based on profitability. These changes, expected to be implemented in the coming years, aim to modernize resource management and ensure fairer revenue sharing.

Furthermore, new regulations may require the designated franchisee to actively manage evaporation pool water levels, adding an operational requirement. ICL's historical exemptions from certain planning, building, water usage, and environmental protection laws are also being reviewed. This suggests a trend towards increased regulatory oversight and potentially higher compliance costs for ICL's extensive Dead Sea operations.

International trade agreements and tariffs significantly impact ICL's operations, particularly its substantial export business. For instance, ongoing trade discussions and potential shifts in tariff structures could directly influence the volume and pricing of ICL's products sold to major markets such as China and India. These nations are critical for ICL, holding significant long-term contracts for its fertilizers and specialty chemicals. In 2023, ICL's sales to Asia Pacific represented approximately 30% of its total revenue, underscoring the sensitivity to trade policy changes in the region.

ICL's global footprint and diversified operational structure are strategic assets designed to buffer against such geopolitical and trade-related uncertainties. However, the company's ability to forecast and plan for future growth hinges on achieving greater clarity regarding evolving international trade policies. The competitiveness of ICL's offerings in the global arena is intrinsically linked to these fluctuating trade dynamics, making proactive monitoring and adaptation essential for sustained market presence and profitability.

Government Support and Subsidies for Agriculture

Government support and subsidies for agriculture significantly impact the demand for ICL's fertilizer and specialty mineral products across its operating regions. In 2024, many nations continued to allocate substantial funds towards agricultural development, with the EU's Common Agricultural Policy (CAP) alone representing a significant portion of the EU budget, influencing fertilizer usage and demand. Policies that encourage sustainable practices or favor certain crops directly shape market opportunities for ICL.

ICL's strategic focus on sustainable solutions and regenerative agriculture aligns well with evolving global agricultural policies, positioning the company to potentially benefit from increased government incentives and supportive initiatives. For instance, programs in North America promoting soil health and reduced chemical inputs could drive demand for ICL's advanced nutrient management products. By 2025, we anticipate continued policy shifts favoring environmentally conscious farming, which is a positive indicator for ICL's product portfolio.

- Government agricultural budgets globally are expected to remain robust through 2025, supporting demand for fertilizers.

- The EU's Farm to Fork strategy, aiming for more sustainable food systems, could boost demand for ICL's specialty fertilizers.

- In 2024, initiatives in countries like Brazil focused on precision agriculture are likely to increase the adoption of advanced fertilizer technologies.

- ICL's investment in R&D for bio-stimulants and slow-release fertilizers positions it to capitalize on government grants for sustainable farming solutions.

Regulatory Environment and Corporate Governance

Israel's regulatory landscape, overseen by bodies like the Israel Securities Authority (ISA) and the Ministry of Environmental Protection (MOEP), is increasingly focused on corporate responsibility and the disclosure of environmental risks. While a unified ESG regulator is absent, current legislation addresses corporate governance and the environmental and social dimensions of business. For instance, in 2024, the ISA continued to enhance its disclosure requirements for public companies, pushing for greater transparency on climate-related risks, a trend expected to strengthen through 2025.

ICL, a key player in the Israeli market, actively collaborates with these authorities, ensuring compliance with new permits and regulations. This proactive approach is crucial for maintaining operational integrity and adhering to evolving environmental standards. In 2023, ICL reported significant investments in environmental compliance, aligning with new water use permits issued by the MOEP, reflecting the ongoing regulatory push for sustainable practices.

- Strengthened Disclosure: Expect continued emphasis on ESG and climate risk reporting by the ISA, impacting corporate governance practices.

- Environmental Compliance: Ongoing adherence to MOEP permits and stipulations is vital for ICL's operational continuity and sustainability initiatives.

- Evolving Regulations: The absence of a single ESG regulator means companies must navigate a complex web of existing environmental, social, and governance laws.

Geopolitical tensions in the Middle East create supply chain and trade route risks for ICL Group, particularly impacting fertilizer and chemical shipments. Military mobilization can lead to personnel shortages affecting production, and regional conflicts may deter international partnerships, limiting market access.

The Israeli government is reviewing Dead Sea mineral extraction policies, potentially reducing concessions, simplifying royalties, and increasing them based on profitability. New regulations might require active management of evaporation pools, and ICL's exemptions from certain laws are under scrutiny, indicating increased regulatory oversight.

International trade agreements and tariffs significantly influence ICL's substantial export business, with China and India being critical markets. In 2023, the Asia Pacific region accounted for approximately 30% of ICL's revenue, highlighting sensitivity to trade policy shifts.

What is included in the product

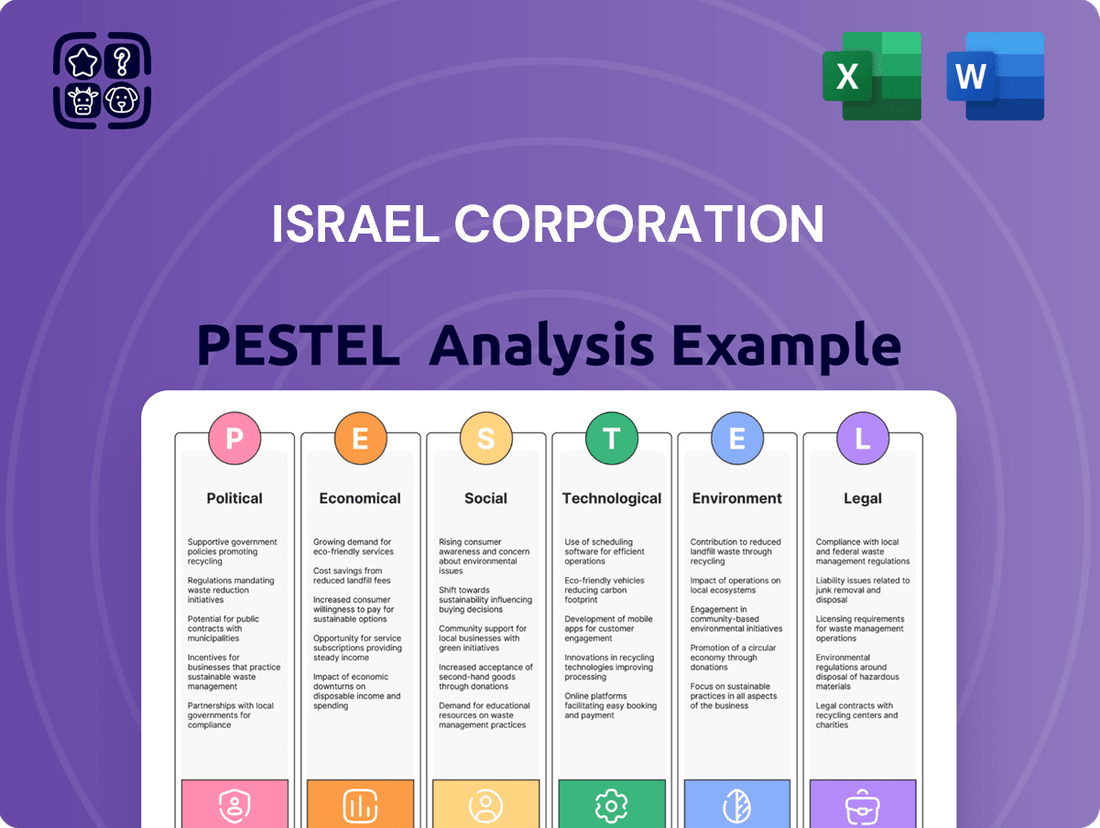

This PESTLE analysis offers a comprehensive examination of the external macro-environmental factors influencing the Israel Corporation across Political, Economic, Social, Technological, Environmental, and Legal dimensions.

It provides actionable insights for strategic decision-making, highlighting opportunities and threats shaped by current trends and market dynamics.

Our PESTLE analysis for Israel Corporation acts as a pain point reliever by offering a concise, easily digestible overview of external factors. This allows leadership to quickly grasp potential challenges and opportunities, streamlining strategic decision-making and reducing the burden of sifting through extensive data.

Economic factors

Global commodity prices for potash, bromine, and phosphorus are pivotal to Israel Corporation's (ICL) financial health. These are the bedrock of ICL's core products. For instance, in 2024, a notable dip in potash prices, especially from key markets like China and India, directly weighed on ICL's revenue and EBITDA, despite growth in its specialty segments.

These price swings aren't just minor blips; they have a direct and significant impact on ICL's profitability and how the market values the company. Effectively managing these price fluctuations and broadening its product range are crucial strategies for ICL to maintain its financial footing and market position.

Stabilization in global inflation and interest rates offers a more predictable landscape for ICL Group. For instance, as of Q1 2024, global inflation figures have shown signs of moderation, though remaining above historical averages in many developed economies. This stability can lead to more consistent borrowing costs for ICL, positively influencing its capital structure and the feasibility of new investment projects.

Conversely, periods of high inflation, as experienced through much of 2022 and 2023, directly impacted ICL by increasing the cost of essential raw materials like potash and phosphate. Interest rate hikes during this period also raised the cost of capital, making financing for expansion initiatives, such as those in its specialty minerals segment, more expensive.

Monitoring these macroeconomic indicators is paramount for ICL's financial health. For example, a 1% increase in interest rates could add millions to the company's annual financing costs, depending on its debt levels. The company's ability to manage its debt and operational expenses in line with inflation trends is a key determinant of its profitability and ability to fund future growth opportunities.

Global economic growth is a critical driver for ICL, impacting demand across its core sectors of agriculture, food, and industrial applications. While ICL reported a dip in overall annual sales for 2024, its specialties-focused segments showed robust growth, highlighting resilience. This suggests that even amidst broader economic headwinds, specific high-value product lines are performing well.

Looking ahead, the persistent rise in global population and the increasing need for food security are strong tailwinds for the specialty fertilizers market. This trend is anticipated to fuel sustained growth for ICL's agricultural solutions, offering a positive long-term demand outlook for these essential products.

Currency Exchange Rate Fluctuations

Currency exchange rate fluctuations present a significant economic factor for ICL Group, a global enterprise with extensive international operations. As ICL converts revenues and costs from various foreign currencies into its reporting currency, shifts in exchange rates directly affect its financial performance. For instance, a stronger Israeli Shekel (ILS) against major trading currencies like the US Dollar (USD) or Euro (EUR) could reduce the reported value of its foreign earnings and sales.

This exposure necessitates robust financial strategies. ICL actively manages its international cash flows and employs hedging instruments to mitigate the risks associated with currency volatility. For example, in 2024, ICL's financial reports highlighted the impact of currency movements on its profitability, with specific mentions of how USD/ILS and EUR/ILS rates influenced its reported results, underscoring the importance of these financial management tools.

- Global Exposure: ICL's worldwide operations mean it deals with numerous currencies, increasing its susceptibility to exchange rate swings.

- Impact on Financials: Fluctuations can alter reported revenues, expenses, and overall profit margins when transactions are translated.

- Hedging Necessity: The company relies on financial hedging strategies and careful management of its international cash to offset these currency risks.

- 2024 Performance Link: Currency impacts were noted in ICL's 2024 financial disclosures, directly influencing reported profitability.

Supply Chain and Logistics Disruptions

Supply chain and logistics disruptions, particularly those stemming from geopolitical events like the ongoing tensions in the Red Sea, pose significant challenges for Israel Corporation (ICL). These disruptions directly translate into higher freight rates and increased operational complexities for the company. For instance, shipping costs on key routes have seen substantial spikes, with some reports indicating increases of over 100% on certain East-West lanes in early 2024 due to rerouting around the Cape of Good Hope.

These logistical hurdles can impede the timely arrival of essential raw materials and the dispatch of finished goods, thereby escalating production costs and potentially constraining sales volumes. ICL's effectiveness in managing these volatile conditions is paramount for sustaining operational efficiency and its competitive standing in the global market. The company's reliance on international shipping means that even minor disruptions can have a cascading effect on its bottom line.

- Increased Freight Costs: Red Sea disruptions have led to a significant rise in shipping expenses, impacting ICL's cost of goods sold.

- Delivery Delays: Rerouting and port congestion contribute to longer lead times for both inbound raw materials and outbound finished products.

- Operational Complexity: Managing alternative routes and potential inventory buffers adds layers of complexity to ICL's logistics operations.

- Market Competitiveness: The ability to mitigate these disruptions efficiently will directly influence ICL's cost competitiveness and market responsiveness.

Global economic growth directly influences demand for ICL's products, especially in agriculture and industrial sectors. While 2024 saw some economic headwinds, ICL's specialty segments demonstrated resilience, with robust growth in areas like advanced agriculture solutions. This highlights the company's ability to navigate varied economic conditions by focusing on higher-value offerings.

The persistent need for food security globally is a significant long-term driver for ICL's agricultural solutions. This trend is expected to sustain demand for its specialty fertilizers, providing a positive outlook for this crucial segment. For instance, the global population is projected to reach 8.5 billion by 2030, increasing the pressure on agricultural output.

Currency fluctuations significantly impact ICL's international operations, as revenues and costs are converted into its reporting currency. A stronger Israeli Shekel in 2024, for example, could decrease the reported value of foreign earnings. ICL actively manages these risks through hedging strategies, as noted in its 2024 financial disclosures, to mitigate the impact of USD/ILS and EUR/ILS rate movements.

| Economic Factor | Impact on ICL | 2024/2025 Data/Trend |

|---|---|---|

| Global Economic Growth | Drives demand for agricultural and industrial products. | Mixed global growth in 2024, with resilience in specialty segments. |

| Food Security Needs | Boosts demand for specialty fertilizers and agricultural solutions. | Continued population growth (projected 8.5 billion by 2030) supports long-term demand. |

| Currency Exchange Rates | Affects reported financial performance due to international operations. | Fluctuations in USD/ILS and EUR/ILS impacted 2024 results; hedging is key. |

Preview Before You Purchase

Israel Corporation PESTLE Analysis

The preview shown here is the exact document you’ll receive after purchase—fully formatted and ready to use. This comprehensive PESTLE analysis of Israel Corporation delves into Political, Economic, Social, Technological, Legal, and Environmental factors impacting the company. Understand the critical external forces shaping its strategic landscape, from government regulations and economic trends to societal shifts and technological advancements. This detailed report provides actionable insights for informed decision-making.

Sociological factors

Global population growth, projected to reach approximately 9.7 billion by 2050 according to UN estimates, is a significant driver for increased food demand. This escalating need places immense pressure on agricultural systems worldwide, highlighting the critical importance of efficient crop nutrition. ICL, as a leading specialty minerals company, directly addresses this challenge by supplying essential fertilizers and agricultural solutions that enhance crop yields and quality.

ICL's strategic focus on sustainable agriculture is paramount in meeting this growing food security imperative. For instance, the company's investments in advanced fertilizer technologies aim to optimize nutrient delivery, reducing waste and environmental impact. This commitment not only bolsters ICL's market position but also contributes tangibly to global efforts in ensuring sufficient food availability for a burgeoning population.

Societal shifts are heavily influencing what consumers want, especially regarding environmental impact. There's a noticeable upswing in demand for food produced through sustainable methods, like organic farming, and a general preference for products that are kind to the planet.

This means companies are under pressure to be more open about their practices and to offer solutions that genuinely support sustainability. In 2023, for example, global consumer spending on sustainable products saw a significant rise, with many shoppers willing to pay a premium for eco-friendly options.

ICL's strategic moves, such as promoting Polysulphate for its reduced carbon footprint and advancing phosphorus recycling with Puraloop, directly address these evolving consumer desires. This proactive approach not only strengthens ICL's standing but also makes its offerings more attractive in the marketplace.

ICL's operational stability hinges significantly on its labor relations, especially given its workforce of over 12,000 individuals globally. A key challenge for the company, particularly in Israel, involves managing personnel shortages that can arise due to mandatory reserve duty. Successfully navigating these situations ensures continuity in production and service delivery.

The company places a strong emphasis on diversity and inclusion, fostering a positive and equitable workplace culture. This commitment is not just about social responsibility; it directly impacts talent acquisition and retention. By creating an environment where all employees feel valued, ICL can better attract and keep skilled workers.

ICL's recognition as a top workplace in several regions underscores its dedication to employee well-being and engagement. Such accolades are tangible proof of effective human resource strategies, contributing to higher employee morale, increased productivity, and a stronger employer brand. This focus on its people is a vital component of its long-term success and resilience.

Community Engagement and Social License to Operate

ICL places significant emphasis on community engagement across its operational sites. In 2023, the company reported investing over $10 million globally in community development programs, focusing on education, environmental sustainability, and local economic growth. This proactive approach is crucial for maintaining its social license to operate, particularly in regions like the Negev Desert in Israel where its mining activities are concentrated.

These engagements are designed to build trust and foster shared value. For instance, ICL's support for educational initiatives in the Negev in 2024 included funding for STEM programs in local schools, aiming to improve scientific literacy and future employment opportunities. Such efforts directly contribute to a positive perception and acceptance of the company's presence and operations by the local population.

The company's commitment extends to environmental stewardship, often involving collaborative projects with local communities. In 2024, ICL initiated several tree-planting campaigns in the vicinity of its Dead Sea facilities, engaging local residents and environmental groups. These actions help to offset potential environmental impacts and demonstrate a commitment to the well-being of the surrounding areas.

- Community Investment: In 2023, ICL allocated over $10 million globally to community development projects.

- Educational Support: In 2024, significant investment was directed towards STEM education in Israeli schools within its operational areas.

- Environmental Collaboration: Tree-planting initiatives in 2024 involved local communities near the Dead Sea facilities.

- Social License: Strong community relations are identified as a key factor in mitigating operational risks and fostering positive stakeholder relationships.

Public Perception of Mining and Chemical Industries

Public perception of the mining and chemical sectors, including those operated by Israel Corporation, is often influenced by concerns over environmental stewardship and social responsibility. ICL's commitment to transparency in its Environmental, Social, and Governance (ESG) performance, as detailed in its 2024 ESG Report, directly addresses these public concerns. This report highlights ICL's alignment with the United Nations Sustainable Development Goals, aiming to foster public trust.

Proactive communication regarding sustainability initiatives is crucial for shaping a positive public image. ICL's efforts to communicate its progress in areas like water conservation and emissions reduction are vital for managing stakeholder expectations and building confidence in its operations.

- Environmental Impact: Public opinion often centers on the environmental footprint of mining and chemical processes.

- Social License to Operate: Gaining and maintaining public acceptance is essential for long-term operational viability.

- Transparency in Reporting: ICL's 2024 ESG Report, detailing its progress on UN SDGs, is a key tool for building this trust.

- Stakeholder Engagement: Open dialogue about sustainability efforts helps mitigate negative perceptions and address community concerns.

Societal attitudes toward environmental responsibility are increasingly shaping consumer and investor preferences, pushing companies like ICL to prioritize sustainable practices. This shift is evident in the growing demand for eco-friendly products and transparent operational reporting. ICL's investments in areas like phosphorus recycling, exemplified by its Puraloop technology, and its promotion of products with lower carbon footprints, such as Polysulphate, directly align with these evolving societal expectations, reinforcing its market relevance and appeal.

Technological factors

Continuous advancements in mining and extraction technologies are paramount for ICL, a global specialty minerals company, to boost operational efficiency and lower costs. For instance, in 2023, ICL invested $265 million in research and development, a significant portion of which targets innovative extraction methods for its potash and phosphate operations. These technological leaps also play a crucial role in reducing the environmental footprint associated with resource extraction.

Innovations in areas like in-situ recovery and advanced flotation techniques can significantly improve the yield from existing mineral reserves, making operations more sustainable. ICL's commitment to R&D, evident in its ongoing projects like the development of more energy-efficient evaporation ponds for potash production, is key to capitalizing on these technological advancements.

ICL's commitment to research and development is a cornerstone of its strategy, focusing on specialty minerals and fertilizers to address global needs in agriculture, clean energy, and sustainability. The company is actively expanding its Ag Biologicals offerings and developing products with a reduced environmental impact, such as its low-carbon Polysulphate fertilizer.

A key area of innovation for ICL is nutrient recycling, exemplified by its Puraloop technology, which aims to create a more circular economy for essential resources. These R&D initiatives are crucial for differentiating ICL's product portfolio and maintaining its competitive edge in the market.

ICL's commitment to automation and digitalization is a significant technological factor. The company is actively integrating technologies like the Internet of Things (IoT) sensors and artificial intelligence (AI) for data analysis. For instance, these advancements are particularly impactful in optimizing water management processes across its global operations.

These technological investments are designed to achieve tangible benefits. By enabling real-time optimization of resource utilization, ICL can significantly improve its overall operational efficiency. Furthermore, enhanced data management through AI-driven analytics leads to more informed and strategic decision-making, directly impacting productivity and sustainability efforts.

The widespread digitalization across ICL's diverse global activities is a key driver of enhanced performance. This digital transformation not only boosts productivity but also plays a crucial role in the company's ongoing pursuit of greater sustainability. For example, in 2024, ICL reported a 15% increase in water use efficiency in its mining operations due to advanced sensor deployment and AI-driven process control.

Development of Sustainable Production Methods

ICL Group is actively advancing sustainable production methods, a key technological factor influencing its operations. This includes a strong commitment to circular economy principles, aiming to minimize waste and maximize resource utilization. For instance, in 2023, ICL reported a significant reduction in hazardous waste generation across its facilities, a testament to its ongoing technological investments in cleaner processes.

The company is also prioritizing the adoption of renewable energy sources to power its production. This strategic shift not only lowers its carbon footprint but also enhances energy security. ICL's investments in solar and wind power projects are projected to contribute substantially to its energy mix by 2025, aligning with global trends towards decarbonization.

These technological advancements are designed to foster long-term operational resilience and achieve cost efficiencies. By processing non-hazardous waste for recycling or energy recovery, ICL is creating value from byproducts, thereby reducing reliance on virgin materials and mitigating price volatility. This approach is crucial for maintaining competitiveness in a market increasingly focused on environmental, social, and governance (ESG) performance.

- Circular Economy Integration: ICL is implementing technologies that enable the recycling and reuse of materials within its production cycles.

- Renewable Energy Investment: The company is channeling capital into clean energy solutions to power its manufacturing plants, aiming for increased reliance on renewables by 2025.

- Waste Reduction Technologies: Investments are focused on processes that minimize hazardous waste and maximize the recovery of value from non-hazardous waste streams.

- Operational Efficiency Gains: Sustainable production methods are yielding tangible benefits through reduced input costs and improved resource management.

Innovation in Battery Materials and Energy Transition

Israel Corporation is actively participating in the global energy transition by expanding into battery materials. A key focus is supplying phosphorus trichloride, a critical component for lithium-ion batteries. This move leverages ICL's existing mineral expertise to tap into the burgeoning energy storage market.

The company is also establishing facilities for LFP cathode materials, further solidifying its position in the clean energy supply chain. This strategic diversification is directly aligned with the increasing global demand for sustainable energy solutions. In 2024, the global battery market was valued at over $100 billion, with significant growth projected for energy storage applications.

To support these advancements, ICL is investing in new innovation centers. These centers are crucial for developing next-generation battery technologies and optimizing material production processes. By fostering innovation, ICL aims to maintain a competitive edge in this rapidly evolving sector.

- Phosphorus trichloride supply for lithium-ion batteries

- Investment in LFP cathode material production facilities

- Leveraging core mineral resources for energy storage

- Establishment of new innovation centers to drive battery technology

Technological advancements are a critical driver for ICL Group, particularly in enhancing operational efficiency and sustainability across its mining and specialty minerals businesses. The company's significant investment in R&D, reaching $265 million in 2023, directly fuels innovation in extraction techniques and product development. These efforts are geared towards improving mineral yields and reducing environmental impact.

ICL's strategic focus on digitalization and automation, including the use of IoT sensors and AI, is yielding measurable results in optimizing processes like water management. For example, in 2024, ICL reported a 15% increase in water use efficiency in its mining operations due to advanced sensor deployment and AI-driven process control, underscoring the tangible benefits of these technological integrations.

Furthermore, ICL is actively expanding its role in the clean energy sector by supplying essential battery materials like phosphorus trichloride and investing in LFP cathode material production. This strategic move into energy storage is supported by investments in new innovation centers aimed at developing next-generation battery technologies, positioning ICL to capitalize on the rapidly growing global battery market, valued at over $100 billion in 2024.

| Key Technological Focus | 2023 R&D Investment | Key 2024 Efficiency Improvement | Strategic Market Expansion |

| Mining & Extraction Innovation | $265 million | 15% increase in water use efficiency (mining) | Battery Materials (Phosphorus trichloride, LFP cathode) |

| Digitalization & Automation (IoT, AI) | Optimized water management, enhanced data analysis | Energy Storage Supply Chain | |

| Circular Economy & Waste Reduction | Reduced hazardous waste generation | Next-gen Battery Technology Development | |

| Renewable Energy Integration | Increased reliance on solar and wind power projected by 2025 | Global Battery Market (>$100 billion in 2024) |

Legal factors

ICL faces significant environmental regulations across its global operations, impacting everything from emissions and waste disposal to water consumption. For instance, in Israel, the company is working closely with the Ministry of Environmental Protection to meet new emission permit requirements, a common trend as environmental standards tighten.

Compliance with these rules, like adherence to the Israeli Clean Air Act, is paramount. Failure to comply can result in hefty fines, operational disruptions, and even the loss of operating licenses, directly affecting ICL's ability to conduct business and maintain its reputation.

The company's proactive engagement in discussions with regulatory bodies underscores the importance of staying ahead of evolving environmental laws. This includes managing the environmental impact of its Dead Sea operations, a particularly sensitive ecosystem.

For 2024-2025, ICL continues to invest in technologies and processes to meet and exceed these environmental mandates. For example, its efforts to reduce greenhouse gas emissions are a key focus, aligning with global climate change initiatives and national targets set by Israel and other operating countries.

ICL Group's mining operations, especially at the Dead Sea Works, are significantly influenced by government regulations concerning permits and concessions. The existing concession is set to expire in 2030, creating a critical window for renegotiation.

Proposed legislative changes could impose more stringent requirements, such as limitations on land use and increased financial responsibilities for environmental remediation efforts. These potential shifts highlight the need for ICL to actively engage in securing favorable terms for future concessions to ensure continued access to vital mineral resources.

International trade laws present a significant legal factor for ICL, a global enterprise. Navigating diverse import/export regulations, tariffs, and compliance requirements across its many operating regions is a constant challenge. For instance, in 2023, the World Trade Organization (WTO) reported that global trade in goods saw a slowdown, underscoring the complexities companies like ICL face in market access.

Potential sanctions imposed on Israel or specific Israeli-related entities pose a direct legal risk. Such measures could restrict ICL's ability to export its products, particularly fertilizers and specialty chemicals, to key international markets. This necessitates a proactive approach to trade strategy, ensuring adherence to evolving international legal frameworks and sanctions regimes, which are often influenced by geopolitical developments.

Labor Laws and Workforce Regulations

ICL, operating globally, must navigate a complex web of labor laws and workforce regulations across all its jurisdictions. These regulations dictate essential aspects like working conditions, minimum wages, and fundamental employee rights, ensuring fair treatment and safety. For instance, in Israel, the Wages Protection Law mandates timely salary payments, while general labor laws cover aspects like annual leave and sick pay. Globally, ICL adheres to standards set by organizations like the International Labour Organization (ILO), which influence national labor policies and corporate responsibility. The company's stated commitment to fair employment, diversity, and inclusion reflects an understanding that robust compliance is not just a legal necessity but a strategic imperative.

Maintaining a stable and motivated workforce hinges on strict adherence to these labor mandates. Non-compliance can lead to significant legal challenges, reputational damage, and operational disruptions. For example, a 2023 report indicated that labor disputes in the technology sector in Israel, while not directly ICL, often stem from disagreements over working hours and compensation, highlighting the sensitivity of these matters. ICL's approach emphasizes proactive compliance and fostering positive employee relations to mitigate these risks.

- Global Operations Compliance: ICL must adhere to labor laws covering working conditions, wages, and employee rights in Israel, the EU, North America, South America, and Asia, reflecting diverse regulatory landscapes.

- Fair Employment Practices: The company's alignment with global labor standards, including diversity and inclusion initiatives, is key to attracting and retaining talent, particularly in competitive markets.

- Risk Mitigation: Robust compliance with labor laws is essential for preventing costly legal disputes and maintaining operational continuity, safeguarding against strikes or work stoppages.

- Workforce Stability: Adherence to regulations fosters a stable workforce, contributing to productivity and employee morale, which is critical for ICL's ongoing business success.

Corporate Governance and Reporting Standards

ICL Group maintains strong corporate governance, adhering to the stringent listing requirements of both the New York Stock Exchange (NYSE) and the Tel Aviv Stock Exchange (TASE). This dual listing necessitates compliance with diverse regulatory frameworks, ensuring a high level of transparency and accountability in its operations and financial reporting. The company's commitment to these standards is further underscored by its alignment with leading global Environmental, Social, and Governance (ESG) reporting frameworks, including the Task Force on Climate-related Financial Disclosures (TCFD), Sustainability Accounting Standards Board (SASB), and Global Reporting Initiative (GRI).

ICL's dedication to transparency is evident in its published reports. For instance, the company's 2024 ESG Report and its annual financial statements provide detailed insights into its performance and strategic direction. These documents are crucial for stakeholders to assess the company's adherence to legal and ethical standards, as well as its long-term sustainability. Compliance with these evolving reporting standards is paramount for fostering investor confidence and navigating the complexities of regulatory scrutiny in the global financial landscape.

The company's adherence to these comprehensive reporting standards is not merely a matter of compliance but a strategic imperative. It directly impacts ICL's ability to attract and retain capital, as investors increasingly prioritize companies with robust governance and transparent ESG practices. This focus on good governance and clear reporting supports ICL's operational resilience and its reputation within the international business community.

- NYSE and TASE Listing Requirements: ICL operates under the regulatory oversight of two major stock exchanges, demanding adherence to distinct but often overlapping governance and disclosure rules.

- Global ESG Framework Alignment: The company actively reports in accordance with TCFD, SASB, and GRI guidelines, demonstrating a commitment to standardized and comparable ESG disclosures.

- Transparency through Reporting: ICL's 2024 ESG Report and annual financial reports serve as key documents for stakeholders, detailing performance and adherence to corporate responsibility.

- Investor Confidence and Regulatory Scrutiny: Compliance with these legal and reporting standards is vital for maintaining investor trust and managing regulatory expectations.

ICL's legal standing is significantly shaped by its concessions, particularly for Dead Sea operations, with the current one expiring in 2030, necessitating proactive renegotiation to secure future resource access and manage potential increased environmental remediation costs.

International trade laws and potential sanctions against Israel pose risks to ICL's global exports, requiring diligent navigation of import/export regulations and adherence to evolving international legal frameworks to maintain market access.

The company's compliance with diverse labor laws across its global operations, from Israeli wage protection to international ILO standards, is crucial for workforce stability, preventing legal disputes, and upholding its commitment to fair employment practices.

ICL's dual listing on the NYSE and TASE mandates adherence to stringent corporate governance and transparency requirements, further reinforced by its alignment with global ESG reporting frameworks like TCFD and SASB, vital for investor confidence.

Environmental factors

Israel Corporation, through its subsidiary ICL Group, is actively addressing climate change. ICL has committed to a substantial 30% reduction in its Scope 1 and 2 greenhouse gas (GHG) emissions by 2030, using 2018 as its baseline. This initiative is a key step towards their ultimate goal of achieving net-zero emissions by 2050.

To achieve these ambitious targets, ICL is implementing a multi-faceted strategy. This includes a significant shift towards renewable energy sources to power its operations and a strong focus on enhancing energy efficiency across its facilities. Furthermore, the company is investing in the development of products designed to have a lower carbon footprint, aligning with global sustainability trends.

The direct impacts of climate change on agricultural stability and the availability of critical resources pose significant risks. For ICL, whose core business is deeply intertwined with agriculture through its fertilizer and specialty mineral products, these environmental shifts make its mitigation efforts not just a corporate responsibility but a necessity for long-term business viability and resilience.

Water scarcity is a significant environmental factor for Israel Corporation (ICL), particularly impacting its operations in arid regions like the Negev Desert and the Dead Sea area, where water is a vital input. ICL is actively pursuing strategies to enhance water efficiency and responsible sourcing, aiming to reduce its reliance on freshwater and increase the utilization of alternative sources.

In 2023, ICL reported progress in its water conservation efforts, with a focus on optimizing its water footprint across its production sites. The company's commitment extends to improving water management through advanced data systems and AI, which are crucial for real-time optimization and ensuring sustainable water use in its operations, especially given the growing global concern over water stress.

ICL Group is acutely aware of its responsibility to safeguard biodiversity within its operational spheres, particularly in Israel's unique arid and semi-arid ecosystems. The company's environmental stewardship includes proactive measures for ecosystem restoration and minimizing the footprint of its mining and manufacturing activities.

This commitment is a cornerstone of ICL's broader sustainability agenda, directly supporting international targets like the UN Sustainable Development Goal 15 (Life on Land). In 2023, ICL reported investing $21 million in environmental protection and rehabilitation initiatives, a testament to their dedication to responsible resource management.

Waste Management and Circular Economy Practices

ICL is actively transforming waste management by integrating circular economy principles, aiming to significantly cut down waste and boost resource efficiency. A key achievement is reducing hazardous waste and processing over 50% of its non-hazardous waste for recycling, reuse, or energy recovery, showcasing a commitment to sustainability.

The company is at the forefront of developing innovative solutions, such as Puraloop, a pioneering technology designed to recycle phosphorus from sewage sludge. This initiative highlights ICL's dedication to converting waste streams into valuable resources, thereby lessening its dependence on primary raw materials.

These efforts align with growing global trends and regulatory pressures encouraging businesses to adopt more sustainable waste management strategies. ICL's proactive approach positions it favorably in an evolving environmental landscape.

- Hazardous Waste Reduction: ICL is implementing strategies to minimize hazardous waste generation across its operations.

- Non-Hazardous Waste Processing: Over 50% of non-hazardous waste is directed towards recycling, reuse, or energy recovery.

- Puraloop Initiative: Recycling phosphorus from sewage sludge, turning waste into valuable nutrients.

- Resource Efficiency: Maximizing the use of resources and reducing reliance on virgin materials.

Environmental Impact of Mining Operations

The environmental footprint of mining is a critical concern for ICL (Israel Corporation), encompassing land use, pollution risks, and waste management. The company operates in regions where environmental regulations are tightening, necessitating proactive measures to address its impact.

ICL is under increased scrutiny regarding its environmental performance, particularly in areas with historical ecological challenges. This includes the responsibility for remediating past environmental damage, such as legacy industrial waste disposal and the repurposing of disused quarry sites. For instance, ICL has been involved in efforts to clean up sites like the Zin Valley, addressing concerns related to water quality and land restoration.

Meeting growing regulatory and public expectations for responsible mining practices is paramount. This translates into ongoing investment in rehabilitation projects to minimize the impact of current operations and prevent future environmental degradation. These efforts are essential for maintaining social license to operate and ensuring long-term sustainability.

- Land Use: Mining activities inherently alter landscapes, requiring careful planning for land restoration post-operation.

- Pollution Potential: Risks include water contamination from runoff and air pollution from dust, necessitating robust control measures.

- Waste Generation: Managing tailings and other mining byproducts is a significant environmental challenge, with increasing focus on circular economy principles.

- Regulatory Compliance: Adherence to evolving environmental standards and remediation obligations is a key operational factor for ICL.

ICL Group continues to drive substantial investment in environmental protection and rehabilitation. In 2023, the company allocated $21 million to these initiatives, underscoring a strong commitment to mitigating its operational footprint and fostering ecosystem restoration.

The company's strategy to combat climate change involves a significant push towards renewable energy sources and enhanced energy efficiency. These efforts are crucial for ICL to meet its target of a 30% reduction in Scope 1 and 2 greenhouse gas emissions by 2030, based on a 2018 baseline.

Water scarcity remains a critical environmental factor, prompting ICL to focus on water efficiency and alternative sourcing. By 2023, the company reported progress in optimizing its water footprint, utilizing advanced data systems and AI to ensure sustainable water management.

ICL is actively integrating circular economy principles into its waste management. In 2023, over 50% of its non-hazardous waste was processed for recycling, reuse, or energy recovery, demonstrating a clear move towards resource efficiency.

PESTLE Analysis Data Sources

Our PESTLE Analysis for Israel Corporation is meticulously constructed using data from official Israeli government publications, reports from international financial institutions like the IMF and World Bank, and reputable industry-specific market research. This comprehensive approach ensures that political stability, economic indicators, technological advancements, and social trends are accurately reflected.