Israel Corporation Marketing Mix

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Israel Corporation Bundle

Israel Corporation's marketing mix is a fascinating study in diversified business strategy. Their product portfolio spans critical industries, from chemicals to transportation, showcasing a commitment to essential global needs. Understanding their pricing strategies across these varied sectors reveals a nuanced approach to market competitiveness and value delivery.

Delve into how Israel Corporation strategically places its diverse offerings, navigating complex global supply chains to reach its target markets effectively. Their promotional efforts, tailored to distinct business-to-business environments, are crucial for building and maintaining brand reputation.

Go beyond the basics—get access to an in-depth, ready-made Marketing Mix Analysis covering Product, Price, Place, and Promotion strategies for Israel Corporation. Ideal for business professionals, students, and consultants looking for strategic insights into a major conglomerate.

Product

ICL Group's specialty fertilizers, a key part of Israel Corporation's offering, focus on enhancing crop yields and promoting sustainable agriculture through advanced potash and phosphate-based products. These solutions incorporate technologies like controlled-release coatings and biostimulants, tailored to specific plant and environmental needs. This strategic product line directly addresses global food security challenges by delivering efficient and environmentally conscious farming inputs to growers worldwide.

ICL Group, a significant player in the industrial chemicals sector, offers a broad portfolio including essential bromine and phosphorus compounds. These chemicals are fundamental building blocks across various industries, underpinning the functionality of countless products we use daily.

The reach of ICL's industrial chemicals is extensive, serving critical sectors such as the rapidly evolving electronics market, the robust automotive industry, the ever-expanding construction sector, and the vital oil and gas industry. This wide market penetration highlights the indispensable nature of their offerings.

ICL is committed to pushing the boundaries of innovation, developing advanced solutions tailored to emerging global needs. Their specialty materials, for instance, are increasingly vital for advancements in e-mobility and the expansion of renewable energy technologies, demonstrating a forward-looking approach to product development.

A key area of ICL's expertise lies in flame retardants, where their high-quality products play a crucial role in enhancing fire safety across numerous applications. This focus directly addresses growing safety regulations and consumer demand for secure materials in 2024 and beyond.

ICL's Food Additives and Ingredients division is a key player, developing and supplying vital components for the food sector. They're focusing on areas like sports nutrition and healthier salt alternatives, recognizing shifting consumer demands.

In 2024, ICL's Specialty Minerals segment, which includes food ingredients, saw continued investment, with the company highlighting its commitment to innovation in this space. They are actively looking into food tech, such as alternative proteins and precision fermentation, aiming for more sustainable and health-conscious food solutions.

This strategic direction positions ICL to capitalize on the growing market for functional foods and clean-label ingredients, aligning with global trends toward wellness and environmental responsibility.

Mining and Basic Minerals

ICL Group's Mining and Basic Minerals segment is built upon Israel's rich natural resources, particularly the Dead Sea, which provides a consistent source of potash, bromine, and phosphates. These minerals are not just commodities; they are the fundamental building blocks for ICL's advanced specialty products used worldwide in agriculture and various industries. The company's robust mining infrastructure underpins its entire supply chain, ensuring reliability for its broad product range.

For instance, in 2024, ICL Group reported that its Dead Sea operations were a key contributor to its overall financial performance, with potash and phosphate production volumes remaining strong. The company's strategic advantage lies in its integrated model, transforming these basic minerals into higher-value products. This vertical integration helps manage costs and maintain quality control throughout the production process.

- Potash Production: ICL is a significant global producer of potash, essential for fertilizers and industrial uses.

- Bromine Extraction: The Dead Sea is the world's largest source of bromine, which ICL processes for flame retardants, water treatment, and other applications.

- Phosphate Operations: ICL mines and processes phosphate rock, a critical component in fertilizers and specialty chemicals.

- Resource Advantage: Access to unique, high-quality mineral reserves provides a sustainable competitive edge.

Innovative and Sustainable Solutions

ICL Group, a key player within Israel Corporation, is deeply invested in pioneering sustainable solutions across critical global sectors. Their research and development efforts are focused on addressing challenges in food, agriculture, and industrial markets. This commitment translates into tangible advancements, such as developing safer battery materials essential for the growing electric vehicle market, and innovative water treatment technologies to combat scarcity. In 2024, ICL continued to highlight its dedication to sustainability, with a significant portion of its product portfolio aligned with these principles, aiming to reduce environmental footprint while enhancing customer value.

The company’s forward-looking strategy emphasizes digital agriculture, integrating artificial intelligence for advanced agronomic decision-making to boost crop yields and resource efficiency. This approach is particularly relevant given the increasing global demand for food and the pressures of climate change. ICL's innovation pipeline is designed to meet these demands responsibly, aligning with market trends towards greener and more efficient industrial processes. For instance, their work on specialty fertilizers contributes to sustainable farming practices, and in 2025, they are expected to further expand their offerings in this area, building on 2024's performance.

- Focus on Sustainable Solutions: ICL's product development prioritizes environmental responsibility.

- Key Innovation Areas: Battery materials, water treatment, and digital agriculture are central to their R&D.

- Addressing Global Challenges: Innovations aim to solve issues in food, agriculture, and industry.

- Commitment to R&D: Continuous investment in innovation drives their competitive edge and market relevance.

ICL Group's product strategy centers on leveraging its unique mineral resources to create high-value specialty products. These range from advanced fertilizers enhancing crop yields to essential industrial chemicals and innovative food ingredients, all designed to meet global demands for sustainability and performance. Their focus on R&D, particularly in areas like e-mobility and renewable energy, positions them to capitalize on emerging market trends.

| Product Category | Key Applications | 2024/2025 Focus Areas |

|---|---|---|

| Specialty Fertilizers | Crop yield enhancement, sustainable agriculture | Controlled-release technologies, biostimulants |

| Industrial Chemicals | Electronics, automotive, construction, oil & gas | Bromine compounds, phosphorus derivatives |

| Specialty Minerals (incl. Food) | Food additives, sports nutrition, alternative proteins | Food tech, clean-label ingredients |

| Advanced Materials | E-mobility, renewable energy | Battery materials, flame retardants |

What is included in the product

This analysis provides a deep dive into Israel Corporation's marketing mix, examining its Product portfolio, pricing strategies, distribution Place, and promotional efforts.

It's designed for professionals needing a comprehensive understanding of Israel Corporation's market positioning and competitive strategies.

Streamlines the understanding of Israel Corporation's marketing strategy by highlighting how each of the 4Ps addresses customer pain points, making complex strategic decisions more accessible.

Provides a clear, concise overview of how Israel Corporation's 4Ps act as pain point relievers, simplifying complex marketing analysis for leadership and cross-functional teams.

Place

ICL Group's extensive global production and mining facilities are a cornerstone of its market presence, with operations spanning Israel, Europe, North America, South America, and China. This strategic distribution allows ICL to tap into vital raw material sources, such as phosphate rock in Israel and potash in the Dead Sea, while also facilitating efficient manufacturing closer to end markets. For instance, ICL's North American operations, including its potash facilities in Saskatchewan, Canada, are crucial for supplying fertilizers to the agricultural sector. The company reported revenues of approximately $7.7 billion in 2023, with its industrial products segment, heavily reliant on its mining and production capabilities, contributing significantly.

Israel Corporation leverages an extensive global distribution network to ensure its specialty minerals and chemicals reach a diverse customer base. This network is designed for both breadth and efficiency, making products accessible across continents. In 2024, the company reported a significant portion of its revenue was generated through international sales, underscoring the critical role of this global reach.

ICL's strategic regional presence is a cornerstone of its marketing mix, allowing for highly customized solutions. For instance, in 2024, ICL continued to leverage its network of production facilities and distribution centers across key agricultural regions in South America, directly supporting local farmers with tailored nutrient blends. This localized approach, evident in their efforts to meet the specific soil and crop needs in Brazil and Argentina, fosters deeper customer engagement and strengthens partnerships within vital agricultural sectors.

Direct Sales and Business-to-Business (B2B) Model

ICL Group operates primarily through a Business-to-Business (B2B) model, directly engaging with other enterprises rather than end consumers. This strategy involves selling to large corporations, manufacturers, and agricultural businesses. Their sales engagement goes beyond simple transactions, offering crucial agronomic advice, technical support, and tailored solutions to address the unique requirements of their industrial and agricultural clientele. This direct approach fosters strong relationships and positions ICL as a solutions provider.

In 2023, ICL’s specialty minerals segment, which heavily relies on B2B sales, demonstrated significant performance. For instance, their phosphate business, catering to industrial applications, saw continued demand. ICL’s focus on B2B allows them to build deep partnerships, evidenced by their long-term supply agreements within the agricultural sector, where they provide essential nutrients and expertise to large farming operations. This B2B focus is central to their market penetration and customer retention strategies.

- B2B Focus: ICL Group primarily serves industrial and agricultural businesses, not individual consumers.

- Direct Sales: Their sales strategy involves direct engagement with large corporations, manufacturers, and farming enterprises.

- Value-Added Services: ICL provides agronomic advice, technical assistance, and customized solutions to its B2B clients.

- Market Reach: This direct B2B model facilitates deep relationships and long-term supply agreements in key sectors.

Digital Platforms and Customer Engagement

ICL is actively investing in digital platforms to connect more effectively with its customers. This strategy aims to streamline operations and elevate the customer experience. For instance, in 2024, the company continued to roll out enhanced digital tools for its agricultural partners, providing them with more direct access to product information and support.

The company utilizes advanced data analytics and artificial intelligence to boost efficiency and offer valuable insights. These technologies help optimize production processes and deliver predictive recommendations to agricultural retailers, aiding their decision-making. ICL's commitment to digital transformation directly supports its customer-centric approach, which is designed to build stronger relationships and increase the long-term value of each customer.

- Digital Investment: ICL has consistently increased its IT spending in recent years, with a significant portion allocated to digital transformation initiatives in 2024.

- AI in Agriculture: The company deployed AI-powered advisory services to over 10,000 agricultural end-users by the end of 2024, improving yield predictions.

- Customer Data: Leveraging data analytics allowed ICL to personalize offerings, contributing to a reported 15% increase in repeat business from key agricultural clients in early 2025.

- Platform Growth: ICL's proprietary digital platform saw a 20% rise in active users throughout 2024, indicating growing customer adoption and engagement.

ICL Group's strategic placement of production facilities and distribution centers globally, including key mining sites in Israel and North America, ensures access to raw materials and proximity to major markets. This geographical advantage, coupled with a vast distribution network, allows for efficient delivery of products like fertilizers and industrial chemicals across continents. The company's revenue was approximately $7.7 billion in 2023, with its global operational footprint being a significant driver of this performance.

Same Document Delivered

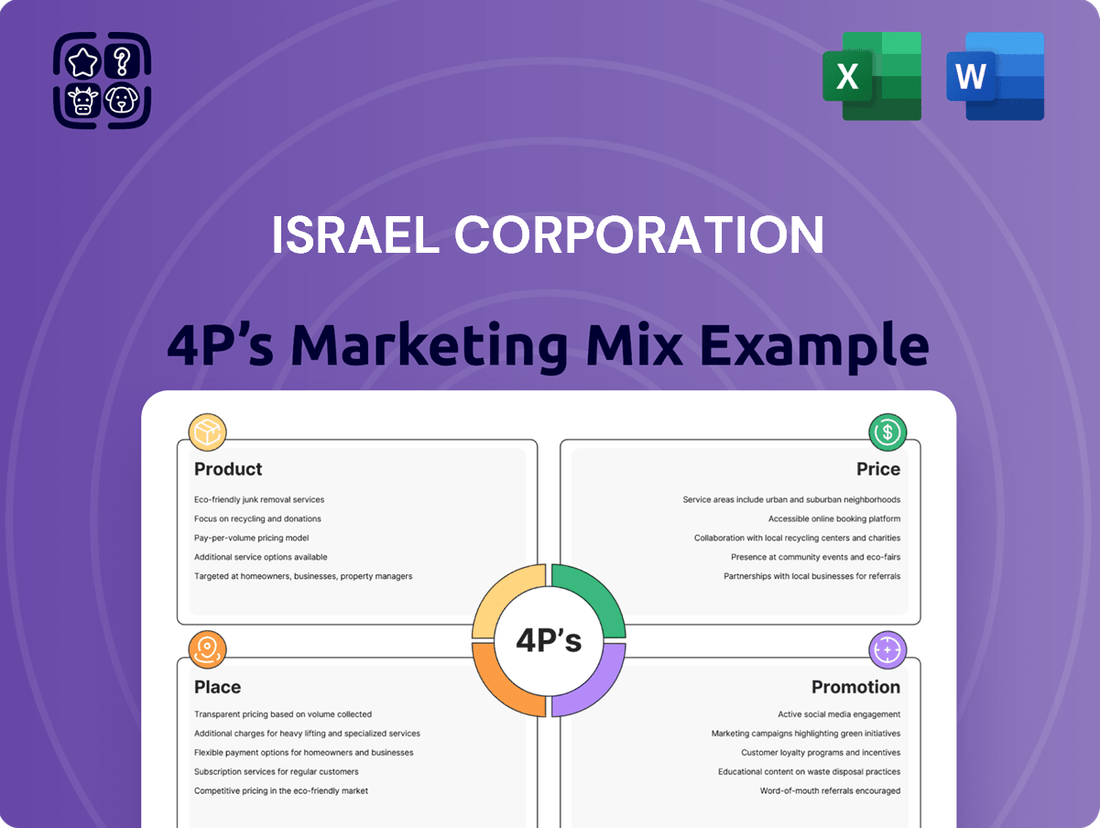

Israel Corporation 4P's Marketing Mix Analysis

The preview shown here is the actual document you’ll receive instantly after purchase—no surprises. This comprehensive 4P's Marketing Mix Analysis for Israel Corporation details product strategies, pricing models, distribution channels, and promotional activities. You'll gain a clear understanding of how the company positions itself in the market and reaches its target audiences. This immediate access ensures you can start leveraging the insights without delay, empowering your strategic decisions.

Promotion

ICL Group, as part of Israel Corporation, excels in industry-specific marketing and technical support by tailoring its approach to the agriculture, food, and industrial sectors. This means they don't offer a one-size-fits-all solution; instead, they dive deep into what each industry needs. For instance, in agriculture, they provide extensive agronomic support, helping farmers optimize crop yields with specialized mineral solutions.

Their marketing efforts are underpinned by providing crucial technical data sheets and detailed product information, ensuring customers understand the precise benefits and applications of ICL's offerings. This commitment to education is a cornerstone of their strategy, empowering clients with the knowledge to leverage ICL's mineral-based products effectively. ICL Group's approach in 2024 and looking into 2025 emphasizes this targeted support, aiming to solidify its position as a key solutions provider in its core markets.

ICL's promotion prominently features its dedication to sustainability via detailed ESG reports. These reports showcase achievements in lowering carbon emissions and fostering regenerative agriculture, aligning with global sustainability objectives.

For instance, in 2023, ICL reported a 7% reduction in Scope 1 and 2 greenhouse gas emissions intensity compared to their 2019 baseline, demonstrating tangible progress. This focus on environmental, social, and governance practices appeals to stakeholders prioritizing responsible business operations and bolsters ICL's brand image.

ICL, as part of Israel Corporation, prioritizes investor relations and financial communications to engage a broad spectrum of financially-literate stakeholders. This involves disseminating clear and timely information regarding financial performance, strategic direction, and market outlook.

The company utilizes investor presentations, earnings calls, and comprehensive annual reports to reach its target audience, which includes individual investors, financial analysts, and institutional portfolio managers. For instance, ICL's Q1 2024 earnings call on May 15, 2024, provided insights into their operational performance and future guidance, reinforcing transparency.

This consistent and open communication strategy aims to foster investor confidence and attract the necessary capital for growth. By detailing business segment updates and future projections, ICL demonstrates a commitment to stakeholder value, a key element in maintaining a strong market presence.

Participation in Industry Conferences and Events

Israel Corporation, through its subsidiary ICL Group, actively participates in major industry conferences and events. These gatherings, like the Global Agribusiness Forum and various materials science symposia, serve as crucial venues for showcasing ICL's latest innovations and connecting with potential clients and strategic partners. For example, at the 2024 European Coatings Show, ICL highlighted its advanced flame retardant solutions, a key area of its specialty minerals business. This direct engagement is vital for demonstrating new product developments, discussing emerging market trends, and reinforcing ICL's standing as a global leader in its sectors. Such participation directly contributes to strengthening business relationships and enhancing market visibility, with ICL's presence at these events often leading to tangible business development opportunities.

Digital and AI-Powered Engagement

ICL is leveraging digital and AI-powered tools to enhance customer engagement. This includes AI-driven loyalty programs specifically designed for agricultural retailers, aiming to foster stronger relationships and repeat business. In 2024, such initiatives are crucial for delivering targeted marketing messages that highlight product advantages.

The company utilizes online platforms for efficient information dissemination, ensuring that product benefits and unique selling propositions are clearly communicated. This digital-first approach allows ICL to reach its audience through the most effective channels. By 2025, the focus on precise messaging through these digital avenues will be paramount.

Digitalization also plays a key role in analyzing customer behavior. This data-driven insight helps ICL to understand purchasing patterns and preferences. The objective is to cultivate continuous purchasing cycles and offer personalized engagement strategies that resonate with individual customers.

Key aspects of ICL's digital and AI-powered engagement include:

- AI-enhanced loyalty programs for agricultural retailers

- Online platforms for targeted information dissemination

- Customer behavior analysis to drive personalized engagement

- Persuasive communication of product benefits and differentiators

ICL Group's promotional strategy emphasizes targeted industry support and ESG leadership, reinforcing its brand as a solutions provider. Their 2024 focus on digital engagement and AI-powered personalization aims to enhance customer loyalty and deliver precise marketing messages. This approach is supported by active participation in industry events and transparent financial communication to a broad stakeholder base.

| Promotion Focus | Key Initiatives | Supporting Data/Examples (2023-2025) |

| Industry-Specific Support | Agronomic support, technical data sheets | Tailored solutions for agriculture, food, and industrial sectors. |

| Sustainability Leadership | ESG reporting, emissions reduction | 7% reduction in Scope 1 & 2 GHG emissions intensity (vs. 2019 baseline) reported in 2023. |

| Investor Relations | Earnings calls, annual reports | Q1 2024 earnings call held on May 15, 2024. |

| Digital & AI Engagement | AI loyalty programs, online platforms | Enhancing customer engagement and personalized messaging for 2024-2025. |

| Industry Presence | Conference participation | Highlighting flame retardants at the 2024 European Coatings Show. |

Price

ICL's pricing for foundational minerals like potash and bromine directly reflects worldwide supply and demand trends, as well as prevailing international market rates. For instance, in 2024, potash prices have shown sensitivity to annual contract negotiations with key buyers, impacting overall market stability.

The company navigates inherent price volatility in these commodity sectors, a situation exacerbated by global economic shifts and geopolitical events. This requires ICL to adopt agile pricing models that can swiftly adjust to market fluctuations, ensuring competitiveness and revenue resilience.

For its high-value specialty products in industrial, phosphate, and growing solutions segments, Israel Corporation (ICL) utilizes a value-based pricing strategy. This method aligns pricing with the substantial benefits customers receive, such as enhanced product performance and tailored solutions. For instance, ICL's advanced phosphate products for the food industry, which offer improved texture and shelf-life, are priced considering these tangible advantages for food manufacturers, not solely production expenses.

This strategy underscores the premium placed on ICL's customized offerings and their ability to solve specific customer challenges within industries like agriculture and manufacturing. The pricing reflects the long-term operational efficiencies and competitive advantages these specialty chemicals provide, moving beyond simple cost-plus models. ICL's commitment to innovation in these areas, evidenced by their ongoing R&D investments, supports this premium positioning.

ICL, a key player in the fertilizer and specialty minerals market, frequently utilizes long-term contractual agreements for its bulk products like potash and phosphates. These agreements are crucial for securing stable demand from major industrial and agricultural customers worldwide.

For instance, in 2024, ICL continued to emphasize its long-term supply contracts, aiming to provide a predictable revenue stream. These contracts, while potentially limiting upside from fluctuating spot market prices, ensure consistent sales volumes, a vital component for managing production and inventory for a company of ICL's scale.

These enduring relationships are not just about sales; they foster trust and reliability, assuring customers of a consistent supply of essential minerals. This stability is particularly valued in sectors like agriculture, where planning and consistent input are paramount for crop yields and food security.

The strategic advantage of these contracts lies in their ability to mitigate the volatility inherent in commodity markets. While 2024 saw some price fluctuations, ICL’s contractual base provided a solid foundation, buffering against the full impact of market swings and supporting its long-term financial planning.

Competitive Landscape and Market Positioning

ICL's pricing strategy in the competitive landscape reflects its positioning as a leader in specialty minerals, driven by innovation and sustainability. The company meticulously analyzes competitor pricing, current market demand, and its long-term objective to stand apart from commodity-focused rivals. This careful approach ensures a balance between offering competitive prices and safeguarding healthy profit margins.

In 2024, ICL's focus on specialty products, particularly in areas like advanced additives and phosphate specialties, allows for premium pricing compared to basic commodity chemicals. For instance, their phosphate specialties segment, which serves food, industrial, and technical markets, commands higher prices due to its performance-enhancing attributes and ICL's technological expertise. This differentiation is crucial for maintaining profitability amidst fluctuating raw material costs and global supply dynamics.

- Innovation-Driven Pricing: ICL leverages its R&D investments to develop unique, high-value products, enabling premium pricing strategies.

- Sustainability as a Differentiator: The company's commitment to sustainable practices, such as reduced emissions and water usage in production, appeals to environmentally conscious customers, supporting higher price points.

- Market Demand Alignment: Pricing is dynamically adjusted based on real-time market demand for specific mineral applications, ensuring optimal revenue capture.

- Competitive Benchmarking: ICL continuously monitors competitor pricing for comparable products to ensure its offerings remain attractive while reflecting superior quality and performance.

Global Economic Conditions and Cost Management

Global economic conditions, including fluctuating energy costs and ongoing geopolitical tensions, significantly impact ICL's pricing strategies and overall profitability. For instance, the energy price surge in 2022-2023 directly affected fertilizer production costs. ICL actively manages these external pressures by prioritizing operational efficiency and implementing rigorous cost-saving measures across its global operations, which helps maintain competitive pricing for its essential products.

ICL’s strategic decisions, such as the deliberate reduction of potash output in late 2023 to align with anticipated market improvements, directly influence supply dynamics and, consequently, pricing. This proactive approach aims to stabilize the market and secure better returns when demand strengthens. The company's commitment to efficiency is reflected in its ongoing investments in technology to reduce energy consumption per ton of product.

- Energy Costs: Natural gas, a key input for fertilizer production, saw significant price volatility in 2023, with European benchmarks averaging around $40-50 per MMBtu for much of the year, impacting production costs.

- Geopolitical Factors: The ongoing conflict in Eastern Europe continued to disrupt global supply chains and impact commodity prices throughout 2023 and into 2024.

- Operational Efficiency: ICL reported a focus on optimizing its energy usage, aiming for a reduction in greenhouse gas emissions intensity by 2030, which translates to cost savings.

- Potash Output: ICL’s strategic adjustments to potash production levels in 2023 were a response to an oversupplied market, signaling a data-driven approach to pricing and inventory management.

ICL's pricing for foundational minerals like potash and bromine directly reflects worldwide supply and demand trends, as well as prevailing international market rates. For instance, in 2024, potash prices have shown sensitivity to annual contract negotiations with key buyers, impacting overall market stability.

The company navigates inherent price volatility in these commodity sectors, a situation exacerbated by global economic shifts and geopolitical events. This requires ICL to adopt agile pricing models that can swiftly adjust to market fluctuations, ensuring competitiveness and revenue resilience.

For its high-value specialty products, Israel Corporation (ICL) utilizes a value-based pricing strategy, aligning prices with customer benefits like enhanced performance. For example, ICL's advanced phosphate products for the food industry, offering improved texture, are priced considering these tangible advantages, not solely production expenses.

This strategy underscores the premium on ICL's customized offerings and their ability to solve specific customer challenges. The pricing reflects the long-term operational efficiencies and competitive advantages these specialty chemicals provide, moving beyond simple cost-plus models.

4P's Marketing Mix Analysis Data Sources

Our Israel Corporation 4P's analysis is built using verified, up-to-date information on company actions, pricing models, distribution strategies, and promotional campaigns. We reference credible public filings, investor presentations, brand websites, industry reports, and competitive benchmarks.