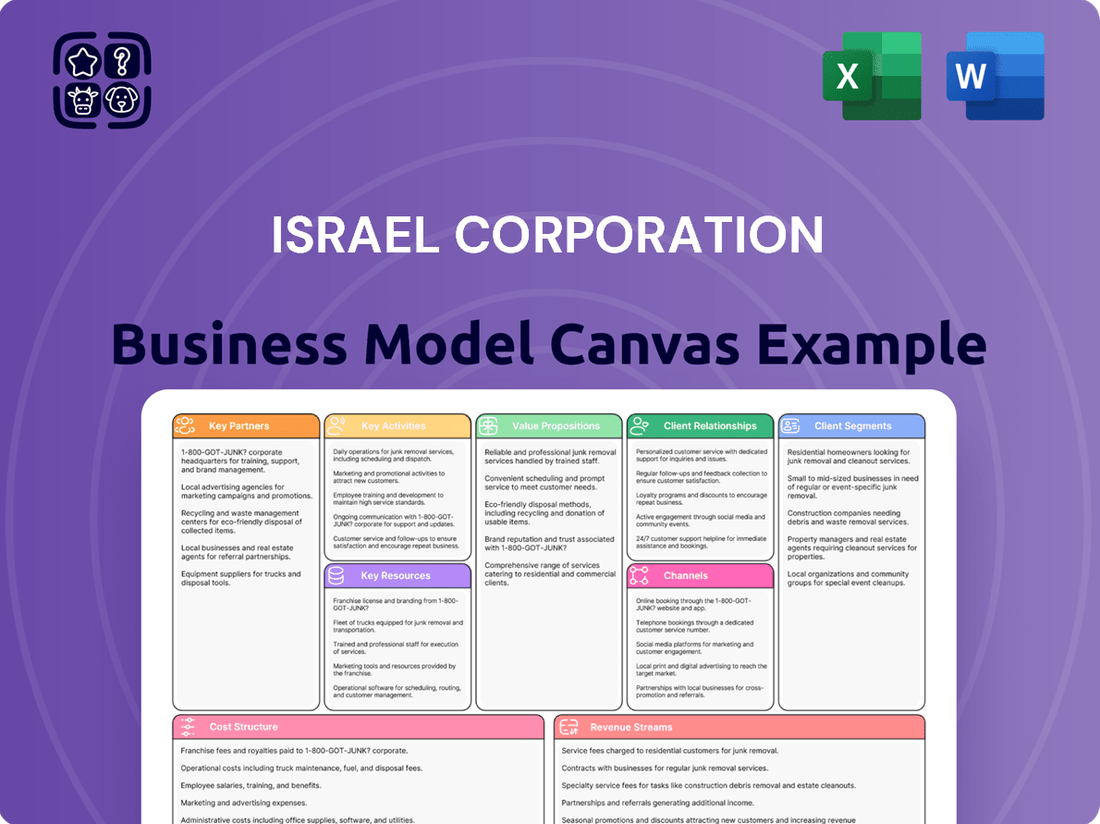

Israel Corporation Business Model Canvas

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Israel Corporation Bundle

Unlock the full strategic blueprint behind Israel Corporation's business model. This in-depth Business Model Canvas reveals how the company drives value across its diverse portfolio, from chemicals to infrastructure. Understand their key partnerships and revenue streams that fuel their growth. Ideal for entrepreneurs, investors, and strategists seeking actionable insights into a global conglomerate.

Partnerships

ICL Group actively cultivates strategic alliances with agricultural technology companies, notably through its ICL Planet Startup Hub. This initiative is designed to foster innovation by providing promising AgTech startups with essential incubation, crucial funding, and dedicated R&D support. These partnerships are vital for ICL's business model, enabling them to stay at the forefront of agricultural advancements.

These collaborations are instrumental in accelerating the development and implementation of cutting-edge solutions across key areas such as advanced crop nutrition, enhanced soil health, and the burgeoning field of digital farming. For instance, ICL's engagement supports the creation of AI-driven agronomic insights that optimize farming practices, as well as the development of novel biostimulants that improve plant resilience and yield. The company reported a significant increase in its innovation pipeline through such partnerships by early 2024.

ICL Group actively collaborates with leading universities and research institutions, including the Hebrew University of Jerusalem and the Technion – Israel Institute of Technology. These partnerships are crucial for driving innovation in advanced fertilizers, novel materials, and sustainable technologies. In 2024, ICL continued to leverage these collaborations to accelerate its research and development pipeline, focusing on solutions for food security and environmental challenges.

Israel Corporation, through its subsidiary ICL Group, leverages a comprehensive network of global distribution and logistics partners to ensure its specialty minerals and chemicals reach customers worldwide. These collaborations are fundamental to ICL's strategy, facilitating the efficient movement of products from production sites to diverse end markets across continents.

In 2024, ICL's extensive supply chain relied on a robust infrastructure involving shipping lines, freight forwarders, and warehousing facilities. This network is critical for managing the complexities of international trade, including customs, regulations, and timely delivery, thereby supporting ICL's commitment to consistent product availability for its global clientele.

Technology and Innovation Ecosystems

ICL is deeply embedded in technology and innovation ecosystems, actively seeking out and partnering with startups. Their focus areas are strategically expanding beyond core agriculture into exciting new sectors like food tech and e-mobility. This forward-thinking approach allows ICL to leverage cutting-edge advancements and diversify its business interests.

A prime example of this is ICL's investment in Aleph Farms, a leader in the alternative protein space. This collaboration highlights ICL's commitment to exploring sustainable food solutions. Furthermore, they are forging partnerships aimed at developing safer battery materials, signaling a significant move into the rapidly growing electric vehicle market.

- Food Tech Ventures: Investments in companies like Aleph Farms demonstrate a commitment to the alternative protein market, a sector projected for substantial growth.

- E-Mobility Partnerships: Collaborations focused on safer battery materials position ICL to capitalize on the expanding electric vehicle industry.

- Industrial Solutions: Engagement with innovation ecosystems for industrial applications broadens ICL's market reach and technological capabilities.

Key Customers and Industry Collaborators

Israel Corporation, through its subsidiaries like ICL Group, cultivates deep, long-standing relationships with major agricultural players. These collaborations are crucial for innovation and market penetration, ensuring ICL's offerings align with evolving agricultural demands. For instance, partnerships with large agricultural holdings like Kernel UA go beyond simple transactions, involving active joint crop trials and co-development of new products. This collaborative approach is fundamental to ICL's strategy of providing solutions that directly address specific customer needs and promote sustainable farming methods.

These strategic alliances are not just about product testing; they are vital for understanding the practical application of ICL's fertilizers and specialty chemicals in diverse farming environments. By working closely with entities such as Kernel UA, ICL gains invaluable on-the-ground insights, which are then used to refine existing products and pioneer new ones. This feedback loop is essential for maintaining a competitive edge and for ensuring that ICL remains at the forefront of agricultural technology. The success of these partnerships is reflected in the continued growth and market share of ICL's agricultural solutions.

The benefits extend to fostering sustainable agricultural practices. Through these collaborations, ICL and its partners aim to optimize resource utilization, reduce environmental impact, and enhance crop yields. This shared commitment to sustainability strengthens the partnerships and positions both ICL and its collaborators as leaders in responsible agriculture.

- Kernel UA Partnership: Joint crop trials and product development with a major agricultural holding.

- Customer-Centric Solutions: Tailoring ICL's products to meet specific needs of large agricultural enterprises.

- Sustainable Farming Focus: Collaborating to promote and implement environmentally friendly agricultural practices.

- Market Insight Generation: Leveraging partnerships to gain real-world data for product refinement and innovation.

ICL Group strategically partners with technology startups through its ICL Planet Startup Hub, providing funding and R&D support. These alliances are critical for developing advanced agricultural solutions, including AI-driven agronomic insights and novel biostimulants, enhancing ICL's innovation pipeline by early 2024.

Collaborations with leading universities like the Hebrew University of Jerusalem and the Technion – Israel Institute of Technology drive innovation in fertilizers and sustainable technologies. In 2024, ICL leveraged these partnerships to accelerate its R&D efforts, focusing on food security and environmental solutions.

ICL also engages with the food tech sector, exemplified by its investment in Aleph Farms, and explores e-mobility through partnerships focused on safer battery materials, expanding its market reach into growth sectors.

What is included in the product

This Business Model Canvas provides a strategic overview of Israel Corporation's diversified operations, detailing its customer segments, revenue streams, and key resources across its various industrial holdings.

Provides a structured framework to dissect complex business operations, alleviating the pain of disorganized strategic planning.

Offers a clear, visual representation of Israel Corporation's strategic elements, simplifying the identification of synergistic opportunities and potential weaknesses.

Activities

ICL's core business centers on extracting vital minerals, including potash, bromine, and phosphates, leveraging its exclusive access to resources like the Dead Sea. This foundational step is crucial for its operations.

The extracted raw materials undergo sophisticated industrial processing. This transforms them into specialized, high-value products catering to diverse global markets and applications.

In 2023, ICL Group reported total revenues of approximately $7.7 billion, with its essential minerals segment forming a significant portion of this figure, underscoring the scale of its extraction and processing activities.

The company's commitment to sustainability is integrated into its extraction and processing, aiming for efficient resource utilization and minimal environmental impact, a key consideration in its business model.

Israel Corporation heavily invests in Research and Development as a core activity, driving innovation across its diverse business segments. This focus spans the creation of advanced crop nutrition solutions, including specialized fertilizers and biostimulants, to enhance agricultural yields and sustainability.

The company also dedicates significant resources to developing novel industrial and performance products. This involves creating innovative food additives and high-performance materials, often leveraging cutting-edge technologies like artificial intelligence and biotechnology to ensure future market relevance and competitive advantage.

ICL's core manufacturing and production activities involve transforming extracted minerals into a wide array of valuable products. This global network of facilities produces essential items like specialty fertilizers crucial for agriculture, flame retardants for safety applications, and vital food ingredients. In 2023, ICL's Industrial Products segment, which includes flame retardants and other industrial chemicals, generated approximately $2.3 billion in revenue, highlighting the significance of these production lines.

Optimizing these production processes is paramount to ICL's success, focusing on efficiency and cost-effectiveness. Simultaneously, stringent quality assurance measures are implemented at every stage to guarantee the integrity and performance of the finished goods. This commitment to quality is vital for maintaining customer trust and meeting regulatory standards across diverse markets.

Global Sales, Marketing, and Distribution

ICL's global sales, marketing, and distribution are critical for connecting with its broad customer base spanning agriculture, food, and industrial sectors worldwide. This encompasses managing international sales forces, cultivating robust distribution networks, and tailoring marketing approaches to meet the unique demands of various regional markets.

In 2023, ICL's Specialty Minerals segment, a significant part of its global reach, reported revenues of $1.5 billion, underscoring the importance of its worldwide sales and distribution capabilities. The company actively participates in global trade shows and digital marketing campaigns to enhance brand visibility and product awareness among its diverse clientele.

- Global Sales Management: Overseeing international sales teams to drive revenue growth across different geographical regions.

- Distribution Network Development: Establishing and maintaining efficient channels to deliver products to customers globally.

- Market Adaptation: Customizing sales and marketing strategies to suit local economic conditions, consumer preferences, and regulatory environments.

- Customer Engagement: Building relationships with key accounts and distributors through consistent communication and support.

Sustainability and Environmental Management

ICL's key activities in sustainability and environmental management focus on embedding eco-friendly practices throughout its operations. This includes actively pursuing carbon reduction targets, optimizing resource utilization, and undertaking robust environmental protection measures. For instance, ICL has set ambitious goals to reduce its greenhouse gas emissions, aiming for significant cuts by 2030 as detailed in its sustainability reports.

The company's dedication to Environmental, Social, and Governance (ESG) principles is a cornerstone of its business model. ICL publicly reports on its ESG performance, demonstrating accountability and a commitment to long-term value creation. This transparency is evident in their annual corporate responsibility reports, which detail progress on key sustainability metrics.

- Carbon Reduction: Implementing technologies and processes to lower greenhouse gas emissions across all facilities.

- Resource Stewardship: Focusing on efficient water usage and responsible management of raw materials.

- Environmental Protection: Investing in pollution control and biodiversity conservation initiatives.

- ESG Integration: Embedding ESG considerations into strategic decision-making and operational planning.

ICL's key activities revolve around the extraction and processing of essential minerals like potash, bromine, and phosphates, leveraging unique resources such as the Dead Sea. This is followed by transforming these raw materials into high-value specialized products for global markets. In 2023, ICL Group's revenue was approximately $7.7 billion, with its mineral segment being a substantial contributor.

The company also heavily invests in Research and Development to innovate in crop nutrition, developing advanced fertilizers and biostimulants to boost agricultural productivity and sustainability. Furthermore, ICL focuses on creating novel industrial and performance products, including food additives and advanced materials, often utilizing technologies like AI and biotechnology.

Core manufacturing and production activities involve converting minerals into a wide range of products such as specialty fertilizers, flame retardants, and food ingredients. In 2023, ICL's Industrial Products segment alone generated about $2.3 billion in revenue. These production processes are optimized for efficiency and cost-effectiveness, with stringent quality assurance measures in place.

Global sales, marketing, and distribution are crucial for reaching customers in agriculture, food, and industrial sectors worldwide, involving international sales teams and robust distribution networks. ICL's Specialty Minerals segment, for instance, reported $1.5 billion in revenues in 2023, highlighting the importance of its global reach and market adaptation strategies.

| Key Activity | Description | 2023 Segment Revenue (Approx.) |

|---|---|---|

| Mineral Extraction & Processing | Leveraging Dead Sea resources for potash, bromine, phosphates. | Significant portion of $7.7B total revenue |

| R&D and Innovation | Developing advanced fertilizers, biostimulants, industrial materials. | N/A (Investment) |

| Manufacturing & Production | Producing fertilizers, flame retardants, food ingredients. | Industrial Products: $2.3B |

| Global Sales & Distribution | Connecting with diverse global customers across sectors. | Specialty Minerals: $1.5B |

Full Version Awaits

Business Model Canvas

The Business Model Canvas you're previewing for Israel Corporation is the actual document you will receive upon purchase. This is not a sample or a mockup; it's a direct, unedited snapshot of the complete file. When you complete your order, you'll gain full access to this same professionally structured and informative Business Model Canvas, ready for your strategic analysis and application.

Resources

ICL Group's most vital resource is its unparalleled access to extensive and unique mineral reserves, especially potash, bromine, and phosphates. These are predominantly sourced from the Dead Sea, a key geographical advantage. These raw materials are the bedrock of ICL's diverse product offerings and a significant driver of its competitive edge in the global market.

In 2024, ICL continued to leverage these reserves, which are among the world's largest and most accessible for these specific minerals. For instance, the Dead Sea provides an exceptionally rich source of potash, essential for fertilizers. This access translates directly into a cost advantage and supply chain security for ICL.

Israel Corporation's advanced production facilities and infrastructure are a cornerstone of its operations. This includes a global network of modern mining, processing, and manufacturing plants, crucial for large-scale output and efficiency.

These facilities are vital for the extraction of key minerals like potash and the production of bromine and specialty chemicals. For instance, their Dead Sea Works operation is one of the world's largest producers of potash, a critical component in fertilizers.

In 2024, the company continued to invest in upgrading these assets to maintain a competitive edge. Their infrastructure supports a vertically integrated model, ensuring control over the supply chain from raw material extraction to finished product.

The operational efficiency derived from these advanced facilities directly impacts cost-effectiveness and the ability to meet global demand for their diverse product portfolio.

ICL's strength lies in its robust intellectual property, boasting a significant patent portfolio and proprietary processes in specialty minerals and chemicals. This intellectual capital is a cornerstone of their innovation strategy, fueling advancements in product development and manufacturing efficiency.

Their R&D expertise is particularly evident in creating sustainable solutions, which actively differentiates ICL's offerings in a competitive global market. This focus on innovation not only enhances their product line but also contributes to operational efficiencies, a key aspect of their business model.

Skilled Workforce and Human Capital

Israel Corporation, now operating as ICL Group, leverages a global professional workforce exceeding 12,000 individuals. This diverse talent pool includes scientists, engineers, agronomists, and sales professionals, forming a critical human capital asset. Their collective expertise spans research and development, intricate logistics, and dedicated customer service, all vital for ICL's operational success and the achievement of its strategic goals.

The company's commitment to its workforce is evident in its investment in human capital. In 2024, ICL continued to focus on attracting and retaining top talent, recognizing that skilled employees are the engine of innovation and growth. The breadth of their expertise ensures that ICL can effectively navigate complex global markets and maintain its competitive edge in the specialty minerals and chemicals sector.

- Global Reach: Over 12,000 skilled employees worldwide.

- Expertise Spectrum: Scientists, engineers, agronomists, sales professionals, and more.

- Operational Integration: Expertise crucial across R&D, logistics, and customer service.

- Strategic Importance: Human capital directly supports ICL's strategic objectives and market position.

Financial Capital and Market Access

Israel Corporation's robust financial standing, demonstrated by its substantial revenue streams and significant market capitalization, acts as a vital source of financial capital. This financial strength fuels critical investments in research and development, strategic acquisitions, and necessary operational enhancements across its diverse portfolio companies.

The company's dual listing on both the New York Stock Exchange (NYSE) and the Tel Aviv Stock Exchange (TASE) significantly broadens its access to global capital markets. This strategic positioning allows Israel Corporation to tap into a wider pool of investors, facilitating easier and more cost-effective fundraising for its ongoing growth initiatives.

- Financial Health: As of the first quarter of 2024, Israel Corporation reported revenues of approximately $1.7 billion, underscoring its strong operational performance and financial stability.

- Market Capitalization: The company's market capitalization, hovering around $3.5 billion in mid-2024, provides a solid foundation for accessing equity financing.

- Global Capital Access: The NYSE listing, in particular, grants access to a vast international investor base, crucial for funding large-scale projects and maintaining competitive operations.

- Investment Capacity: This financial leverage directly supports strategic investments in innovation and expansion, enabling companies like Tower Semiconductor (a former Israel Corp. subsidiary) to undertake significant capital expenditures for advanced manufacturing capabilities.

ICL Group's proprietary technologies and extensive patent portfolio are critical intellectual resources. These innovations drive product differentiation and enhance manufacturing efficiency, particularly in specialty minerals and fertilizers.

Their R&D focus in 2024 continued to yield advancements in areas like controlled-release fertilizers and bromine-based flame retardants, solidifying their market leadership.

ICL's global brand reputation and established customer relationships are invaluable intangible assets. These foster trust and loyalty, facilitating market penetration and sustained demand for their diverse chemical and mineral products.

The company's commitment to sustainability and responsible resource management further strengthens its brand image, a key differentiator in today's market.

ICL Group's access to unique mineral reserves, primarily potash and bromine from the Dead Sea, remains its most significant physical resource. This provides a substantial cost advantage and ensures supply chain stability.

In 2024, ICL continued to maximize the value of these reserves, which are among the world's largest and most accessible, particularly for potash, a key component in global agriculture.

The company's advanced production facilities and global logistics network are essential physical assets. These enable efficient extraction, processing, and distribution of its wide range of products.

In 2024, investments were made to upgrade these facilities, ensuring operational efficiency and maintaining a competitive edge in global markets.

| Resource Type | Description | 2024 Impact/Data |

| Intellectual Property | Patents, proprietary processes, R&D expertise | Continued innovation in specialty minerals and fertilizers; focus on sustainable solutions. |

| Brand Reputation | Established customer trust, sustainability commitment | Facilitates market access and demand for ICL products globally. |

| Mineral Reserves | Potash, bromine, phosphates from the Dead Sea | World's largest and most accessible reserves, providing cost advantage and supply security. |

| Production Facilities & Logistics | Global network of modern mining, processing, and distribution infrastructure | Supports vertical integration and efficient global supply chain operations. |

Value Propositions

ICL, as part of Israel Corporation, delivers innovative solutions addressing fundamental human needs in agriculture and industry. Their advanced fertilizers, for instance, are crucial for boosting crop yields to feed a growing global population. In 2024, the demand for sustainable agricultural inputs remained exceptionally high, directly benefiting ICL's offerings.

Beyond food security, ICL's product portfolio extends to critical industrial applications. Their flame retardants, vital for enhancing product safety across various sectors, experienced robust demand throughout 2024 due to heightened safety regulations. Furthermore, ICL's food additives contribute to developing healthier and more appealing food products, aligning with consumer preferences observed in 2024.

ICL Group’s commitment to sustainable and responsible mineral sourcing is a cornerstone of its business model, reflecting a deep dedication to environmental stewardship and ethical practices. This focus is not just about compliance but about creating long-term value by minimizing ecological impact and contributing positively to global sustainability efforts. For instance, ICL’s 2023 ESG report detailed a 22% reduction in Scope 1 and 2 greenhouse gas emissions compared to their 2019 baseline, demonstrating tangible progress toward their climate goals.

The company actively aligns its operations with the United Nations Sustainable Development Goals (UN SDGs), particularly those related to responsible consumption and production, climate action, and life on land. Their investments in regenerative agriculture initiatives, such as improving soil health and water efficiency, further underscore this commitment. In 2024, ICL announced a multi-year partnership aimed at advancing sustainable mining practices in the Dead Sea region, emphasizing biodiversity protection and community engagement.

This dedication to sustainability resonates strongly with a growing segment of environmentally conscious stakeholders, including investors, customers, and employees. ICL's transparency in its ESG reporting, which includes specific data on water usage reduction—achieving a 10% decrease in water intensity across its operations in 2023—builds trust and reinforces its reputation as a responsible corporate citizen. Such efforts are crucial for maintaining social license to operate and securing a competitive advantage in an increasingly sustainability-focused market.

ICL's business model is strengthened by its high-quality, diversified product portfolio, encompassing specialty minerals and chemicals. This broad offering, which includes essential nutrients for agriculture and advanced materials for various industries, significantly reduces dependency on any single market or product. For instance, in 2024, ICL's fertilizers segment, a core part of its agricultural solutions, continued to be a major revenue driver, alongside its growing industrial products division which serves sectors like food, electronics, and automotive.

Reliable Global Supply Chain

Leveraging its integrated business model and extensive global presence, ICL, as part of Israel Corporation, ensures a dependable and consistent supply of vital minerals and products across the globe. This inherent operational strength is crucial for mitigating disruptions and offering stability, especially for customers in essential sectors such as agriculture.

ICL's commitment to a reliable global supply chain is underscored by its strategic asset base and logistical capabilities. For example, in 2024, the company continued to optimize its production and distribution networks, aiming to maintain high levels of product availability even amidst fluctuating market conditions. This focus on resilience directly benefits customers who depend on ICL for critical inputs.

- Global Reach: ICL operates production facilities and distribution networks across multiple continents, ensuring proximity to key markets and customers.

- Integrated Operations: The company's control over its value chain, from raw material extraction to finished product delivery, enhances supply chain predictability.

- Customer Stability: This reliability is particularly vital for agricultural customers who require consistent access to fertilizers and crop nutrition solutions to ensure food security.

- Risk Mitigation: ICL's diversified sourcing and multiple production sites help to buffer against localized supply chain risks, providing a more secure supply for its partners.

Technical Expertise and Customer Support

ICL provides customers with extensive technical know-how and thorough agronomic assistance, enabling them to refine product use and attain superior outcomes. This commitment to value-added support fosters robust client connections and amplifies the efficacy of ICL's offerings.

For instance, ICL's specialty fertilizer segment, which heavily relies on this expertise, saw revenue growth. In 2023, ICL reported total revenue of approximately $7.7 billion, with specialty solutions playing a crucial role in driving this performance.

- Deep Agronomic Knowledge: ICL’s teams possess specialized understanding of soil science, crop physiology, and nutrient management.

- Optimized Product Application: Customers receive guidance on the most effective ways to use ICL’s products for maximum yield and quality.

- Enhanced Crop Performance: This support directly contributes to customers achieving better agricultural results, reinforcing the value of ICL’s solutions.

- Customer Loyalty: By providing this comprehensive assistance, ICL builds trust and long-term relationships with its client base.

ICL's value proposition centers on providing essential minerals and innovative solutions that address fundamental global needs in agriculture and industry. They offer advanced fertilizers crucial for food security, with demand remaining high in 2024. Additionally, their industrial products, like flame retardants and food additives, cater to safety and consumer preference trends observed in 2024.

The company's commitment to sustainability, demonstrated by a 22% reduction in Scope 1 and 2 greenhouse gas emissions by 2023 and a 10% decrease in water intensity in the same year, appeals to environmentally conscious stakeholders. This focus on responsible practices, including regenerative agriculture initiatives and partnerships for sustainable mining, strengthens their market position.

ICL leverages its diversified, high-quality product portfolio, including specialty minerals and chemicals, to mitigate market-specific risks. For example, in 2024, their fertilizers continued to be a strong revenue driver, complementing growth in their industrial products division serving sectors like food and automotive.

Their integrated operations and global presence ensure a reliable supply chain for critical minerals and products, particularly vital for agricultural customers. This operational strength, coupled with extensive technical and agronomic support, fosters customer loyalty and optimizes product application, as seen in the revenue growth of their specialty fertilizer segment.

Customer Relationships

ICL cultivates strong customer connections through specialized sales and technical support. These teams offer expert guidance, assist with product modifications, and resolve issues, delivering personalized solutions that foster lasting satisfaction.

For instance, in 2024, ICL's commitment to customer service was evident in their proactive engagement with major agricultural clients, providing on-site expertise to optimize fertilizer application and improve crop yields, a key differentiator in a competitive market.

Israel Corporation, through its subsidiary ICL Group, heavily relies on long-term supply contracts with major agricultural and industrial clients. These agreements are fundamental to its customer relationship strategy, offering predictable revenue streams and market stability. For instance, ICL's contracts for potash and phosphate products often span several years, securing consistent demand for its output.

These enduring partnerships cultivate a sense of reliability and mutual dependence. By locking in supply, ICL ensures consistent operational capacity utilization, while its clients benefit from assured access to essential raw materials. This fosters a strong foundation of trust and shared commitment, crucial for sustained business growth in the chemical and fertilizer sectors.

ICL actively partners with key customers on joint research and development projects. This strategy ensures their innovations are precisely tailored to solve real-world customer problems and meet evolving market demands.

In 2023, ICL reported significant investment in R&D, with a focus on developing specialized fertilizers and flame retardants. Their collaborative efforts led to the launch of several enhanced product lines, directly responding to feedback from agricultural and industrial partners.

Digital Platforms and Agronomic Insights

ICL, through its innovative digital platforms like GROWERS and Agmatix, is revolutionizing how it engages with its farmer customer base. These platforms provide AI-driven agronomic insights, offering a powerful tool for farmers to make more informed decisions about their crop management. This direct digital connection enhances customer relationships by delivering tangible value through data and optimized practices.

These digital channels are crucial for ICL's customer relationship strategy, fostering deeper engagement by providing farmers with actionable data and expertise. The aim is to empower growers with the information needed to improve yields and efficiency. For instance, Agmatix’s data analytics can help identify optimal fertilization schedules, directly impacting crop health and farmer profitability.

- Digital Engagement: Platforms like GROWERS and Agmatix offer direct digital channels for farmer interaction.

- AI-Powered Insights: These platforms deliver AI-driven agronomic recommendations to optimize farming practices.

- Data-Driven Value: Farmers receive valuable data for improved decision-making and crop management.

- Enhanced Efficiency: The goal is to streamline operations and boost farmer profitability through technological solutions.

Sustainability Partnerships and ESG Reporting

ICL (Israel Corporation) cultivates robust customer and stakeholder relationships by prioritizing sustainability and transparent Environmental, Social, and Governance (ESG) reporting. This focus is central to its business model, fostering trust and meeting the increasing market demand for environmentally conscious products and practices.

Through active collaboration on sustainable initiatives, ICL demonstrates its commitment to shared environmental goals. This partnership approach extends to sharing progress and data, reinforcing credibility and aligning with customer values.

- Sustainability Collaboration: ICL engages customers and stakeholders in joint sustainability projects, enhancing mutual understanding and shared responsibility.

- Transparent ESG Reporting: The company provides detailed ESG reports, offering clear insights into its environmental impact, social contributions, and governance practices. For instance, in 2023, ICL reported a 15% reduction in greenhouse gas emissions intensity compared to its 2019 baseline, a key metric for its sustainability partnerships.

- Meeting Market Demands: By actively pursuing and communicating its sustainability efforts, ICL positions itself as a preferred partner for businesses and investors seeking to align with responsible supply chains and investment criteria.

ICL's customer relationships are built on a foundation of long-term supply agreements, specialized technical support, and collaborative innovation. They leverage digital platforms to provide data-driven insights, enhancing farmer decision-making and efficiency.

Sustainability and transparent ESG reporting are also key pillars, fostering trust and aligning with customer values. For example, in 2023, ICL reported a 15% reduction in greenhouse gas emissions intensity from its 2019 baseline, a critical factor in many customer relationships.

This multifaceted approach ensures customer loyalty and positions ICL as a reliable partner in both agricultural and industrial sectors.

| Customer Relationship Aspect | Description | Key Initiatives/Data (2023-2024) |

|---|---|---|

| Long-Term Contracts | Securing predictable revenue through multi-year supply agreements for key products. | Potash and phosphate contracts often span several years, ensuring consistent demand. |

| Specialized Support | Providing expert sales and technical assistance for product optimization and issue resolution. | Proactive engagement with major agricultural clients in 2024 for on-site fertilizer optimization. |

| Joint R&D | Collaborating with key customers to develop tailored solutions and innovations. | Significant R&D investment in 2023 for specialized fertilizers and flame retardants, leading to enhanced product lines. |

| Digital Engagement | Utilizing platforms like GROWERS and Agmatix for direct customer interaction and data-driven insights. | Agmatix data analytics offer optimal fertilization schedules for improved crop health and farmer profitability. |

| Sustainability Focus | Prioritizing ESG reporting and collaborating on sustainable initiatives. | Reported 15% reduction in greenhouse gas emissions intensity (vs. 2019 baseline) in 2023. |

Channels

ICL's direct sales force and key account managers are crucial for nurturing relationships with its most significant industrial and agricultural clients worldwide. This approach enables deep understanding of customer needs, facilitating the development of tailored solutions and fostering robust, long-term partnerships.

In 2024, this direct engagement model proved vital for ICL's specialty minerals segment, which reported strong performance, particularly in advanced additives for food and industrial applications. The ability to provide bespoke technical support and product development directly to major customers was a key differentiator.

Israel Corporation leverages a robust global distribution network, supported by numerous local offices, to ensure its products reach diverse markets effectively. This infrastructure is crucial for its expansive operations, particularly in the specialty minerals and chemicals sectors.

These local presences are not just about sales; they are vital for efficient logistics, understanding nuanced regional demands, and facilitating market penetration. For instance, ICL Group's presence in over 100 countries means tailored approaches to distribution are essential for its fertilizers, industrial products, and innovative food ingredients.

In 2024, ICL continued to optimize its supply chain, reporting significant investments in logistics and warehousing to enhance its reach. The company's strategy emphasizes localized support, allowing for quicker responses to customer needs and market shifts, a key differentiator in competitive global markets.

This extensive network allows ICL to manage inventory effectively across continents, reducing lead times and ensuring product availability. Their commitment to a strong local footprint directly translates into better customer relationships and a deeper understanding of end-user requirements, a core component of their business model.

ICL actively utilizes digital platforms to share crucial information and offer technical assistance, exploring e-commerce opportunities for specific product ranges. This digital presence is key to their customer engagement strategy.

Through initiatives like the ICL Planet Startup Hub, they foster connections with innovators, driving forward new solutions. This hub acts as a crucial bridge for collaboration and idea generation within the industry.

Agmatix, another digital tool, exemplifies ICL's commitment to data-driven insights, providing valuable information to users and enhancing decision-making processes. The platform's analytical capabilities support better outcomes.

These digital avenues are integral to ICL's business model, enabling broader reach and more efficient interaction with stakeholders. In 2023, ICL reported significant investments in digital transformation initiatives, aiming to further enhance these channels.

Industry Conferences, Trade Shows, and Webinars

Israel Corporation, through its subsidiary ICL Group, actively participates in key industry gatherings. These events are vital for demonstrating innovative solutions like advanced fertilizers and specialty chemicals. For instance, ICL's presence at events like the International Fertilizer Association (IFA) Annual Conference and the International Production & Processing Expo (IPPE) allows them to engage directly with agricultural leaders and potential clients.

These platforms are instrumental in ICL's strategy to disseminate technical knowledge and foster business relationships. By hosting webinars on topics such as sustainable agriculture practices or the benefits of their specialized chemical products, ICL can reach a broader, geographically diverse audience. This direct engagement helps in understanding market needs and positioning their offerings effectively.

- Product Showcase: ICL uses these channels to unveil new product lines, such as their innovative controlled-release fertilizers, which aim to improve nutrient efficiency and reduce environmental impact.

- Expertise Sharing: The company leverages these events to present research findings and technical insights from their R&D efforts, reinforcing their position as an industry leader.

- Customer Engagement: Direct interaction at trade shows and Q&A sessions during webinars facilitate feedback loops with existing and prospective customers, fostering stronger partnerships.

- Market Intelligence: Participation provides valuable insights into market trends, competitor activities, and emerging customer demands, informing future product development and strategic decisions.

Company Website and Investor Relations Portals

ICL's official website and investor relations portals are key communication hubs, offering crucial financial reports, press releases, and sustainability updates. These digital platforms ensure transparency and provide timely information to stakeholders, including investors and analysts, fostering an informed market.

These channels are vital for ICL's engagement strategy, delivering comprehensive data and insights directly to the investment community. For instance, ICL's 2024 investor relations section would detail performance metrics and strategic outlooks, reinforcing its commitment to open communication.

- Direct Access to Financials: The website provides easy access to quarterly and annual financial statements, enabling detailed analysis.

- Corporate Governance Information: Key details on board structure, executive compensation, and compliance are readily available.

- Sustainability Reporting: Comprehensive reports on Environmental, Social, and Governance (ESG) initiatives highlight ICL's commitment to responsible operations.

- Investor Presentations and Webcasts: Live and archived presentations offer direct insights into company strategy and performance from management.

ICL utilizes a multifaceted approach to its channels, blending direct sales, a global distribution network, and robust digital platforms. This strategy ensures deep customer engagement, efficient market penetration, and transparent communication with stakeholders.

In 2024, ICL's direct sales force, comprising key account managers, was instrumental in strengthening relationships with major industrial and agricultural clients. This personal engagement facilitated the development of tailored solutions, particularly boosting the specialty minerals segment with its advanced additives for food and industrial uses. The company’s expansive global distribution network, supported by numerous local offices across over 100 countries, ensures effective product delivery and market penetration for its diverse portfolio, including fertilizers and food ingredients.

ICL also actively leverages digital channels, including its website and investor relations portals, for information sharing and customer assistance. Initiatives like the ICL Planet Startup Hub and the data-driven Agmatix platform exemplify their commitment to innovation and informed decision-making, enhancing stakeholder interaction and expanding their market reach. Their participation in industry events further solidifies their market presence and facilitates knowledge exchange.

Customer Segments

Israel Corporation's agricultural business segment serves large-scale farmers, cooperatives, and agro-holdings worldwide. These entities depend on a reliable supply of premium fertilizers, advanced crop nutrition solutions, and effective biostimulants to boost their harvests and contribute to global food security. For instance, in 2023, the global fertilizer market was valued at approximately $257 billion, with a projected compound annual growth rate of 3.5% through 2030, underscoring the significant demand from this sector.

Food and beverage manufacturers are a key customer segment for Israel Corporation's specialty ingredients. These companies rely on ICL's phosphates and other additives to enhance food products, improve texture, and act as leavening agents. The growing demand for healthier and more sustainable food options directly drives their need for these specialized ingredients.

In 2024, ICL's Food Specialties segment has seen continued strength, with a particular focus on functional ingredients that support the clean label and plant-based protein trends. For example, their phosphate-based solutions are crucial for texture and stability in meat alternatives, a rapidly expanding market.

The beverage industry also represents a significant portion of this customer base. Manufacturers utilize ICL's ingredients for everything from pH control and shelf-life extension in soft drinks to mineral fortification in functional beverages. This diverse application highlights the broad reach of ICL's offerings within the food and beverage sector.

Industrial Chemical Producers represent a crucial customer segment for Israel Corporation, particularly those in manufacturing sectors that depend on bromine-based compounds for flame retardants and specialty phosphates for detergents. These businesses are looking for high-performance and safety-critical materials to ensure the quality and reliability of their own products.

For example, in 2024, the demand for flame retardants, a significant application for bromine derivatives, remained robust across industries like electronics and construction, driven by increasingly stringent safety regulations. ICL's ability to supply these specialized chemicals positions them as a vital partner for these industrial clients.

Furthermore, the global market for detergents, which utilizes specialty phosphates, continued to grow in 2024, influenced by rising hygiene awareness and population growth. Industrial chemical producers serving this sector rely on consistent, high-quality phosphate supplies, a core offering from ICL.

Water Treatment and Pharmaceutical Industries

Water treatment and pharmaceutical companies represent key customer segments for Israel Corporation's mineral-based products. These industries rely heavily on the high purity and specific chemical functionalities that ICL’s offerings provide for critical processes and final product integrity.

For instance, in water treatment, ICL's phosphates and other mineral derivatives are essential for purification, scale inhibition, and corrosion control in both municipal and industrial water systems. Pharmaceutical manufacturers utilize ICL’s highly purified chemicals as excipients, active pharmaceutical ingredients (APIs), or for synthesis in drug production, where stringent quality standards are paramount.

- Water Treatment Applications: ICL’s specialty phosphates are used in potable water treatment to prevent lead and copper leaching and in industrial water systems for scale and corrosion control.

- Pharmaceutical Applications: High-purity lithium carbonate from ICL is utilized in the production of mood-stabilizing medications.

- Purity Demands: Both sectors require products that meet rigorous regulatory standards, such as those set by the FDA or EPA, ensuring safety and efficacy.

- Growth Drivers: Increasing global demand for clean water and advanced pharmaceuticals directly fuels the need for ICL’s specialized mineral solutions.

Battery Materials and E-mobility Sector

Israel Corporation is increasingly targeting companies within the burgeoning battery materials and e-mobility sectors. This represents a forward-thinking strategy to capitalize on the global shift towards sustainable energy.

A key focus for ICL, a significant entity within Israel Corporation's portfolio, is the expansion into producing lithium iron phosphate (LFP) cathode active materials. LFP is a critical component in the next generation of electric vehicle batteries, offering advantages in cost and safety.

- LFP Production Expansion: ICL is investing heavily in its LFP capabilities, aiming to become a major supplier in the rapidly growing electric vehicle battery market.

- Strategic Importance: E-mobility and battery materials are considered strategically vital for both environmental sustainability and future economic growth, aligning with global decarbonization efforts.

- Market Growth Projections: The global electric vehicle market is projected to reach over $800 billion by 2025, driving significant demand for battery materials.

Israel Corporation’s customer base is diverse, spanning agriculture, food and beverage, industrial chemicals, water treatment, pharmaceuticals, and the rapidly growing e-mobility sector. These segments are united by their need for specialized chemical solutions that enhance product performance, ensure safety, and support sustainable practices.

For instance, the agricultural sector relies on ICL's fertilizers and crop nutrition, while food manufacturers use their phosphates for texture and preservation. Industrial clients depend on bromine for flame retardants and phosphates for detergents, highlighting the broad industrial applications.

The company is also a key supplier to water treatment and pharmaceutical industries, providing high-purity minerals for purification and drug production. Its strategic focus on battery materials, particularly LFP for electric vehicles, positions it for significant growth in the e-mobility market.

| Customer Segment | Key Needs | 2024/2025 Relevance |

| Agriculture | Fertilizers, Crop Nutrition | Global food security demands reliable supply; fertilizer market projected strong growth. |

| Food & Beverage | Specialty Phosphates, Functional Ingredients | Clean label and plant-based trends drive demand for texture and stability solutions. |

| Industrial Chemicals | Bromine-based Flame Retardants, Specialty Phosphates | Stringent safety regulations and hygiene awareness fuel demand for performance materials. |

| Water Treatment & Pharma | High-Purity Minerals, Specialty Phosphates | Essential for purification, scale control, and drug synthesis where quality is paramount. |

| E-Mobility & Batteries | Lithium Iron Phosphate (LFP) | Crucial for next-gen EV batteries; market growth projected to exceed $800 billion by 2025. |

Cost Structure

Israel Corporation's (now ICL Group) cost structure heavily relies on the extraction of raw minerals, with significant operational expenses tied to mining, drilling, and the initial processing of potash, bromine, and phosphates. These fundamental costs are directly impacted by the inherent geological complexities of resource deposits and the fluctuating prices of energy required for these intensive operations.

For context, ICL reported total cost of sales of approximately $5.1 billion in 2023. A substantial portion of this figure is directly attributable to the upstream extraction and initial processing activities, reflecting the capital and operational intensity of accessing and preparing these vital raw materials for further use.

Israel Corporation's manufacturing and processing expenses are significant, driven by the complex operations involved in producing specialty minerals and chemicals. These costs encompass substantial energy consumption for chemical processing and refining, alongside expenditures for skilled labor and the ongoing maintenance of sophisticated equipment.

Across its global network of facilities, plant depreciation also forms a considerable part of the cost structure. For instance, in 2023, Israel Corporation's consolidated operating expenses, which include these manufacturing and processing costs, amounted to approximately $3.2 billion.

Israel Corporation's commitment to innovation is reflected in its substantial and recurring Research and Development (R&D) investment. This is a crucial cost driver for maintaining its competitive edge across various sectors. These expenses encompass salaries for scientific and engineering talent, cutting-edge laboratory equipment, and the operational costs of pilot plants to test new concepts.

The company allocates significant resources to intellectual property development, securing patents and licenses for novel products and sustainable technologies. For instance, in 2023, Israel Corporation, through its subsidiaries like IDE Technologies and OPAL Fuels, continued to pour resources into advancing desalination, water treatment, and alternative fuels, with R&D being a core component of their strategic growth.

Logistics, Distribution, and Transportation Costs

Logistics, distribution, and transportation are significant cost drivers for ICL, given its extensive global operations. These costs encompass the movement of raw materials to production sites and the shipment of finished products to customers across numerous international markets. In 2023, ICL reported that its selling, general, and administrative expenses, which include many of these logistical components, amounted to approximately $1.6 billion.

Managing this complex international supply chain involves substantial expenditure on freight, warehousing, and customs. These outlays are essential for maintaining ICL's market presence and ensuring timely delivery of its diverse product portfolio, ranging from fertilizers to specialty chemicals.

- Freight Costs: Expenses associated with sea, rail, and road transportation of raw materials and finished goods globally.

- Warehousing and Storage: Costs incurred for storing materials and products at various points in the supply chain.

- Supply Chain Management: Investments in technology and personnel to optimize the efficiency and cost-effectiveness of international distribution.

- Distribution Network: Maintaining and operating a network of distribution centers and partners worldwide.

Sales, Marketing, and Administrative Expenses

Israel Corporation's cost structure significantly includes expenses tied to its global sales operations and extensive marketing initiatives. These encompass salaries and commissions for international sales teams, the development and execution of diverse marketing campaigns across various platforms, and the ongoing costs associated with robust customer relationship management systems.

Further contributing to these costs are the essential corporate administrative functions. This segment of the expense base covers vital activities such as ensuring regulatory compliance across all operating regions, legal counsel and services for contracts and disputes, and the crucial investor relations efforts needed to maintain strong relationships with shareholders and the financial community.

- Global Sales & Marketing: Costs for international sales teams and marketing campaigns.

- Customer Relationship Management: Investment in systems and personnel to manage customer interactions.

- Corporate Administration: Expenses for compliance, legal, and investor relations.

Israel Corporation's cost structure is dominated by the significant expenses associated with extracting and processing its core mineral assets, potash, bromine, and phosphates. These upstream activities, including mining and initial treatment, are capital-intensive and sensitive to energy price fluctuations. In 2023, the company's cost of sales reached approximately $5.1 billion, with a large portion directly linked to these foundational resource acquisition efforts.

Manufacturing and chemical processing represent another major cost area, driven by complex refining operations, substantial energy consumption, and the need for skilled labor and equipment maintenance. These operational expenditures, alongside depreciation across its global facilities, contributed significantly to its 2023 operating expenses, which totaled around $3.2 billion.

Furthermore, substantial investments in Research and Development (R&D) are critical for innovation and maintaining a competitive edge, as seen in 2023's ongoing advancements in desalination and alternative fuels. Logistics and distribution costs, encompassing global freight, warehousing, and supply chain management, also form a considerable part of its overall expense base, with selling, general, and administrative expenses amounting to approximately $1.6 billion in 2023.

| Cost Component | Approximate 2023 Impact | Key Drivers |

| Cost of Sales (Extraction & Processing) | ~$5.1 Billion (Total) | Mining, drilling, energy, raw material processing |

| Manufacturing & Operations | Included in ~$3.2 Billion Operating Expenses | Chemical processing, energy, labor, equipment maintenance, depreciation |

| Research & Development | Significant & Recurring Investment | Talent, equipment, pilot plants, intellectual property |

| Logistics & Distribution | Included in ~$1.6 Billion SG&A | Freight, warehousing, supply chain management, global network |

| Sales, Marketing & Administration | ~$1.6 Billion (SG&A) | Sales teams, marketing campaigns, CRM, compliance, legal, investor relations |

Revenue Streams

Israel Corporation's primary revenue generator is the sale of potash and a diverse array of specialty fertilizers. This includes advanced products like controlled-release and water-soluble fertilizers, essential for boosting agricultural yields worldwide.

These vital agricultural inputs are distributed to farmers and large-scale agricultural operations across the globe. For instance, in 2024, the global fertilizer market was valued at approximately $240 billion, underscoring the significant demand for these products.

Israel Corporation generates significant revenue through the sale of key industrial products. These include bromine and its various compounds, widely used as flame retardants and in pharmaceuticals, as well as phosphate-based chemicals essential for fertilizers and detergents. The company also profits from magnesium compounds, vital for industries like automotive and aerospace.

In 2024, the global demand for bromine derivatives remained robust, driven by stricter fire safety regulations across electronics and construction sectors. Israel Corporation's specialized bromine compounds are well-positioned to capitalize on this trend. Furthermore, the ongoing need for agricultural productivity worldwide continues to support strong sales of phosphate-based fertilizers, a core offering.

Israel Corporation's performance products and food additives segment is a key revenue generator. This includes sales of specialized items like food additives and phosphoric acid, which are vital components for various industries.

These products serve essential roles in sectors such as food and beverages, pharmaceuticals, and water treatment, demonstrating their broad market applicability. For instance, in 2024, the demand for high-purity phosphoric acid in food applications saw a steady increase, reflecting its importance in product formulation.

The company's strategic focus on these specialty chemicals allows it to capture value across multiple high-growth markets. Its commitment to quality ensures these additives meet stringent industry standards, fostering repeat business and strengthening market position.

Innovative AgTech and FoodTech Solutions

As ICL deepens its involvement in AgTech and FoodTech, revenue is shifting towards advanced digital offerings. This includes income from AI-powered agronomic platforms designed to optimize crop yields and resource management.

Beyond software, ICL is generating revenue through its innovative biostimulants, which enhance plant growth and resilience. These products represent a growing segment of their specialized agricultural solutions.

The company is also exploring licensing opportunities for its proprietary technologies developed within its AgTech and FoodTech divisions. This strategy allows ICL to monetize its research and development efforts across the industry.

- Software Solutions: Revenue from AI-driven agronomic platforms and digital farming tools.

- Biostimulants: Sales of products that naturally improve plant health and productivity.

- Technology Licensing: Potential income from granting access to ICL's unique AgTech and FoodTech innovations.

Battery Materials Sales

Israel Corporation (ICL) is tapping into the burgeoning electric vehicle and energy storage sectors through the sales of advanced battery materials. This emerging revenue stream focuses on key components like lithium iron phosphate (LFP) cathode active materials, a critical element in many modern battery chemistries.

ICL's strategic expansion into this market leverages its existing expertise in specialty minerals and chemical processing. The company aims to capture a significant share of the growing demand for these high-performance materials, driven by global trends towards electrification.

By 2024, the global battery materials market is projected to see substantial growth, with LFP materials playing an increasingly important role due to their cost-effectiveness and safety profile. ICL's involvement positions it to benefit directly from this expansion.

- Focus on LFP Cathode Active Materials: ICL's battery materials sales primarily involve LFP, a widely adopted cathode technology.

- E-mobility and Energy Storage Markets: These sales are strategically targeted at the rapidly expanding electric vehicle and grid-scale energy storage industries.

- Strategic Expansion: This revenue stream represents a deliberate move by ICL to diversify and capitalize on future growth trends in sustainable technologies.

- Leveraging Chemical Expertise: ICL's established capabilities in chemical production and material science underpin its entry into this advanced materials market.

Israel Corporation's revenue streams are diverse, spanning essential agricultural inputs, industrial chemicals, performance products, and emerging advanced materials. The company generates substantial income from potash and specialty fertilizers, critical for global food production. In 2024, the company reported significant sales in its bromine and phosphate segments, driven by demand in sectors ranging from flame retardants to agriculture.

Furthermore, ICL is increasingly deriving revenue from its AgTech and FoodTech innovations, including AI-powered platforms and biostimulants, reflecting a strategic shift towards digital solutions and sustainable agriculture. This segment also includes revenue from licensing proprietary technologies. The company's entry into the battery materials market, particularly LFP cathode active materials, is a key growth area, capitalizing on the booming electric vehicle and energy storage industries.

| Revenue Stream | Key Products/Services | Market Drivers (2024 Focus) | 2024 Market Context (Approx.) |

|---|---|---|---|

| Agricultural Solutions | Potash, Specialty Fertilizers, Biostimulants | Global food security, precision agriculture | Global fertilizer market: ~$240 billion |

| Industrial Products | Bromine compounds, Phosphates, Magnesium compounds | Fire safety regulations, industrial processes, agriculture | Robust demand for bromine derivatives |

| Performance Products & Food Additives | Food additives, Phosphoric acid | Food & beverage industry growth, water treatment | Steady increase in demand for high-purity phosphoric acid |

| AgTech & FoodTech | AI Agronomic Platforms, Technology Licensing | Digital transformation in agriculture, R&D monetization | Growing investment in AgTech solutions |

| Battery Materials | LFP Cathode Active Materials | E-mobility, energy storage expansion | Significant growth projected for battery materials market |

Business Model Canvas Data Sources

The Israel Corporation Business Model Canvas is informed by a comprehensive review of its annual reports, investor presentations, and segment-specific financial disclosures. This data provides a granular understanding of its diverse business units, revenue streams, and cost structures.