Israel Corporation Boston Consulting Group Matrix

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Israel Corporation Bundle

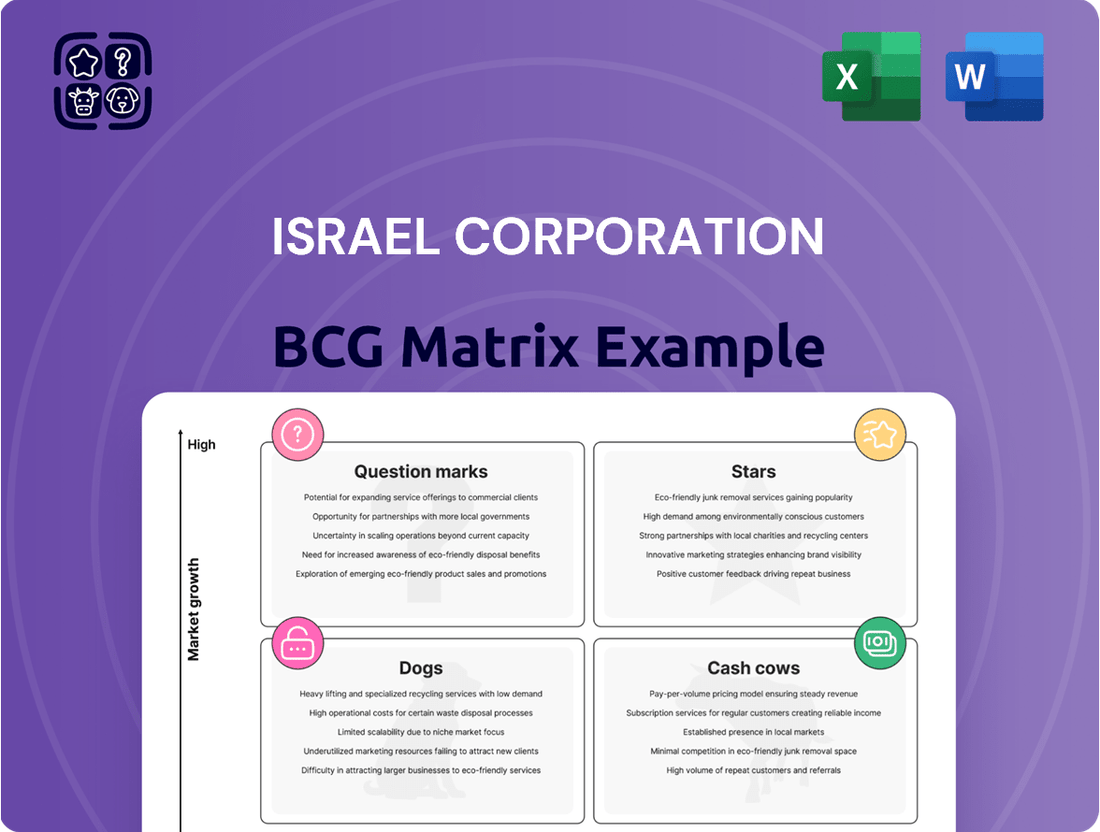

Uncover the strategic positioning of Israel Corporation's diverse portfolio through its BCG Matrix. This analysis highlights which ventures are current market leaders (Stars), which are generating stable profits (Cash Cows), which are lagging behind (Dogs), and which hold potential for future growth but require significant investment (Question Marks).

Understanding these placements is crucial for informed decision-making. Are you ready to see exactly where Israel Corporation's key businesses fall within this powerful strategic framework?

Dive deeper into this company’s BCG Matrix and gain a clear view of where its products stand—Stars, Cash Cows, Dogs, or Question Marks. Purchase the full version for a complete breakdown and strategic insights you can act on.

Stars

ICL's Growing Solutions segment, focusing on specialty plant nutrition, fits the profile of a Star in the BCG matrix. This includes products like controlled-release fertilizers and specialized nutrients for professional turf, ornamentals, and horticulture. These markets are experiencing robust growth due to the increasing global demand for sustainable and high-efficiency agricultural inputs.

The market for specialty fertilizers is a key driver for this segment. Projections indicate significant expansion, fueled by the necessity to boost crop yields to feed a growing global population. For instance, the global specialty fertilizer market was valued at approximately $27.8 billion in 2023 and is anticipated to reach around $44.3 billion by 2028, showcasing a compound annual growth rate of about 9.7%.

ICL stands as a dominant force in the bromine market, holding the top spot for flame retardant solutions vital for electronics and the burgeoning electric vehicle (EV) sector. Their extensive bromine capacity directly fuels innovation in these high-demand industries.

The global demand for bromine is surging, largely propelled by the exponential growth in energy storage and electric vehicle manufacturing. This makes ICL's position in this segment particularly strong, as they are a primary supplier for these critical components.

In 2024, the electric vehicle market alone is projected to reach over 17 million units sold globally, a significant driver for the need for advanced flame retardants. ICL's #1 market share in this niche ensures they are at the forefront of supplying these essential materials.

ICL's Phosphate Solutions segment is making significant strides into the burgeoning battery materials market, a sector fueled by the accelerating adoption of electric vehicles and renewable energy storage. This strategic pivot is well-timed, capitalizing on a high-growth industry.

Within ICL's broader phosphate specialties business, the battery materials component is distinctly positioned as a Star in the BCG Matrix. This designation reflects both the segment's exceptional market growth potential and ICL's substantial, targeted investments aimed at capturing a leading share.

For instance, ICL announced in early 2024 its plans to invest significantly in expanding its lithium iron phosphate (LFP) cathode materials production capacity, anticipating robust demand. By 2023, the global market for battery materials was valued at tens of billions of dollars and is projected to grow at a compound annual growth rate exceeding 20% through 2030.

Digital Agriculture Platforms

ICL's focus on digital agriculture platforms positions it within a rapidly expanding sector. These platforms provide farmers with data-driven tools to optimize crop yields and profitability. For instance, the global precision agriculture market was valued at approximately USD 7.8 billion in 2023 and is projected to reach USD 15.2 billion by 2028, growing at a CAGR of 14.3%.

ICL's investment in these technologies, even if currently holding a nascent market share, signifies a strategic move into a high-growth area. This aligns with the characteristics of a Star in the BCG matrix, representing significant future potential.

- Market Growth: The precision agriculture market is experiencing robust expansion.

- ICL's Strategy: ICL is investing in digital solutions for farmers.

- Potential: These initiatives are positioned as future Stars due to high market growth.

- Data-Driven Approach: Platforms leverage data for yield and profitability improvements.

Advanced Food Additives and Ingredients

ICL Group's Advanced Food Additives and Ingredients segment is positioned as a potential Star in the BCG Matrix. This is driven by its role as a leading global provider of functional plant-based ingredients and shelf-life extension solutions for the food industry.

The food-tech sector, especially alternative proteins and sustainable nutrition, is experiencing significant expansion. ICL's innovative food additive offerings align perfectly with these growth trends, catering to increasing consumer preferences for healthier and more sustainable food options. For instance, the global market for food additives was projected to reach over $63 billion by 2024, with plant-based ingredients showing particularly strong growth.

- High Growth Market: The food-tech industry, particularly alternative proteins and sustainable nutrition, is a rapidly expanding sector.

- ICL's Strong Position: ICL is a key player, offering functional plant-based ingredients and shelf-life solutions that meet evolving consumer demands.

- Innovation Focus: The company's commitment to innovation in food additives addresses critical sustainability challenges in the food supply chain.

- Projected Market Growth: The global food additives market is expected to continue its upward trajectory, creating a favorable environment for ICL's segment.

ICL's specialty plant nutrition, particularly its controlled-release fertilizers and specialized nutrients for professional horticulture, aligns perfectly with the Star quadrant of the BCG matrix. The demand for efficient and sustainable agricultural inputs is escalating globally, driving significant growth in this segment.

The global specialty fertilizer market, valued at approximately $27.8 billion in 2023, is projected to reach $44.3 billion by 2028, demonstrating a compound annual growth rate of about 9.7%. This robust market expansion, coupled with ICL's strong presence, solidifies its position as a Star.

| ICL Segment | BCG Quadrant | Key Growth Drivers | Market Data (2023-2028) |

| Specialty Plant Nutrition | Star | Demand for sustainable agriculture, increased crop yields | Specialty fertilizer market: $27.8B (2023) to $44.3B (2028), CAGR 9.7% |

What is included in the product

This BCG Matrix overview offers strategic insights into Israel Corporation's business units, guiding investment decisions.

A clear BCG Matrix overview for Israel Corp. clarifies strategic focus, alleviating the pain of resource allocation uncertainty.

Cash Cows

ICL's potash production, a significant part of Israel Corporation's portfolio, stands as a prime example of a Cash Cow in the BCG matrix. The company is a global leader, securing about 7% of the world's potash market. This robust market position allows for substantial and consistent cash generation, even within a mature industry.

Despite the potash market being mature, its essential role in agriculture ensures steady demand, which ICL effectively leverages. The company's strategic approach to managing production aligns output with market needs, contributing to price stability and predictable cash flows. This makes potash a reliable engine for ICL's financial performance.

ICL's industrial bromine business, excluding advanced flame retardants, functions as a classic Cash Cow within the BCG Matrix. This segment, a cornerstone of ICL's operations, benefits from its established global leadership in bromine production capacity, ensuring a consistent and reliable stream of revenue.

The primary driver for this segment's Cash Cow status is its stable demand from essential industrial applications, such as clear brine fluids crucial for the oil and gas sector. Despite experiencing some volatility in market prices, the sheer volume and established market share allow ICL to generate substantial and predictable cash flows.

In 2023, ICL's Bromine segment, which encompasses these industrial applications, reported revenues of $1.1 billion. This highlights the segment's significant contribution to the company's overall financial health, underscoring its maturity and strong cash-generating ability.

ICL's Phosphate Solutions division, a key component of Israel Corporation's operations, functions as a classic Cash Cow within the BCG Matrix. This segment focuses on producing and selling fundamental phosphate commodity products, such as sulphuric and green phosphoric acid. These materials are essential for a range of established industrial uses, providing a consistent demand base.

While these commodity products are indeed vulnerable to the inherent volatility of market prices, ICL's well-established production infrastructure and strong market position provide a reliable stream of cash. For instance, in 2024, ICL reported that its Phosphate Solutions segment continued to be a significant contributor to its overall financial performance, demonstrating stable cash generation despite the cyclical nature of commodity markets.

Standard Fertilizers (non-specialty)

ICL's traditional fertilizer business, focusing on standard potash and phosphate fertilizers, operates within a large but mature agricultural market. This segment acts as a reliable cash generator, underpinning the company's broader strategic investments in more specialized products.

Despite a strategic pivot towards specialty fertilizers, these foundational commodity products continue to offer a stable revenue stream. For instance, in 2024, ICL's potash segment, a key component of its standard fertilizer offerings, is expected to maintain robust demand, driven by global food security concerns.

These cash cows are critical for funding research and development into higher-margin specialty fertilizers, showcasing their essential role in ICL's portfolio.

- Stable Revenue: Standard fertilizers provide a consistent income source for ICL.

- Market Maturity: The agricultural market for these products is large but well-established.

- Cash Generation: Significant cash flow is generated to support other business units.

- Strategic Support: Funds innovation and expansion into specialty products.

Magnesium and Magnesia Products

ICL's magnesium and magnesia products, including various grades of magnesium, magnesium chloride, and magnesia, are firmly positioned as cash cows within its BCG matrix. These established products cater to mature industries like de-icing, ceramics, and pharmaceuticals, generating stable and reliable revenue streams. In 2024, ICL's Specialty Minerals segment, which includes these products, continued to be a significant contributor to the company's robust cash flow, demonstrating the maturity and consistent demand for these essential materials.

The consistent performance of these products underscores their role in funding other business units or strategic investments. For instance, the global market for magnesium compounds is projected to see steady, albeit modest, growth, reflecting the ongoing demand in core applications. ICL's ability to leverage its established production capabilities and market presence ensures these offerings remain vital to its financial health.

- Established Market Presence: ICL's magnesium and magnesia products serve vital roles in sectors like de-icing, ceramics, and pharmaceuticals, indicating consistent market demand.

- Stable Revenue Generation: These products are recognized for their ability to provide predictable and reliable cash flow, acting as a foundational element of ICL's financial stability.

- Contribution to Cash Flow: In 2024, ICL's Specialty Minerals segment, housing these cash cows, reported strong performance, highlighting their crucial role in the company's overall financial health and ability to fund growth initiatives.

- Low Growth, High Share: Positioned in mature markets, these products represent high market share with low growth potential, a classic characteristic of cash cow businesses.

ICL's established fertilizer business, primarily standard potash and phosphate fertilizers, functions as a crucial Cash Cow. Despite the agricultural market's maturity, these products offer a stable revenue stream, underpinning the company's investment in specialty products. In 2024, ICL's potash segment, a key part of this business, continued to experience strong demand driven by global food security needs.

ICL's industrial bromine segment, excluding advanced flame retardants, also operates as a Cash Cow. Its global leadership in bromine production capacity ensures a consistent revenue stream from essential industrial uses. The segment's 2023 revenue of $1.1 billion underscores its significant, stable cash-generating ability despite some market price fluctuations.

The Phosphate Solutions division, focusing on commodity products like sulphuric and green phosphoric acid, is another key Cash Cow. Its well-established production infrastructure and market position provide reliable cash flow, as demonstrated by its continued significant contribution to ICL's financial performance in 2024.

These segments provide the financial backbone for ICL, generating consistent cash flow that can be reinvested into growth areas or used for strategic initiatives.

| Business Segment | BCG Category | Key Products | 2023/2024 Data Point | Significance |

| Potash Fertilizers | Cash Cow | Standard Potash | Strong demand in 2024 due to food security | Stable revenue, funds innovation |

| Industrial Bromine | Cash Cow | Bromine | $1.1 billion revenue in 2023 | Consistent cash generation |

| Phosphate Solutions | Cash Cow | Sulphuric acid, Green Phosphoric acid | Significant contributor to financial performance in 2024 | Reliable cash flow from established markets |

What You See Is What You Get

Israel Corporation BCG Matrix

The BCG Matrix preview you are viewing accurately represents the complete document you will receive upon purchase, ensuring no discrepancies in content or formatting. This means the strategic insights and analysis pertaining to Israel Corporation's business units are precisely as you see them now, ready for immediate application. You can confidently expect the same high-quality, professionally designed report, free from any watermarks or demo limitations, allowing you to leverage its full potential for your business planning. This preview is your direct glimpse into the finalized BCG Matrix analysis, providing transparency and assurance of the valuable strategic tool you are acquiring.

Dogs

Within Israel Corporation's portfolio, certain regional potash operations, like those at ICL Dead Sea and ICL Iberia, are currently considered question marks in the BCG matrix. While the broader potash market is generally a cash cow, these specific sites have experienced production hurdles and decreased output.

These operational inefficiencies directly impact their profitability, causing them to consume cash without generating substantial returns or commanding a high market share within their respective operational spheres. For instance, ICL Group reported lower potash volumes in Q1 2024 compared to the previous year, directly impacting revenue from these segments.

Within Israel Corporation's broader portfolio, certain legacy phosphate specialties, like purified phosphoric acid (TPA and WPA), are currently facing significant pricing pressure. This is largely due to persistent market overcapacity. In 2024, global phosphate rock production, a key input, remained robust, contributing to this supply-side imbalance.

This overcapacity situation places these phosphate specialties in a position that resembles a 'cash cow' or potentially a 'dog' in the BCG Matrix, depending on their market share and profitability trends. While ICL may possess strong products in these areas, the intense competition and market saturation limit growth prospects and compress profit margins.

Within Israel Corporation's portfolio, certain niche specialty minerals are showing signs of declining demand, placing them in the "Dogs" category of the BCG Matrix. For instance, the demand for specific magnesia applications used in the pharmaceutical and food industries has seen a reduction. This segment of the business is likely underperforming due to shifting market needs or increased competition.

Furthermore, solid magnesium chloride (MgCl2), primarily used for de-icing, experienced a moderate dip in demand. This decline is attributed to milder winter conditions in key markets, a factor outside the company's direct control. Such products, with reduced market attractiveness and potential for low growth, represent areas where resources might be better allocated.

These smaller, niche product lines are contributing minimally to overall profitability and could potentially tie up valuable resources that could be reinvested in more promising areas of Israel Corporation's business. Their position as "Dogs" suggests a need for careful evaluation, potentially leading to divestment or a strategic repositioning if market conditions do not improve.

Divested Lavie Bio Assets

The divestiture of Lavie Bio's majority of assets and operations by Evogene to ICL Group Ltd. in 2024 strongly suggests these assets were classified as 'Dogs' within Evogene's portfolio, according to the BCG Matrix.

This move indicates that Lavie Bio likely exhibited low market share and low market growth, making it a poor performer and a candidate for divestment to free up resources for more promising ventures.

- Low Market Share: Lavie Bio's products may not have captured a significant portion of the ag-biologicals market.

- Low Market Growth: The overall ag-biologicals market segment Lavie Bio operated in might have experienced slow growth, limiting its potential.

- Strategic Reallocation: Divesting 'Dogs' allows companies to focus capital and management attention on 'Stars' or 'Question Marks' with higher growth potential.

- Financial Impact: While specific financial details of the divestiture for Evogene were not publicly detailed beyond the transaction itself, such sales often aim to improve overall profitability by shedding underperforming units.

Segments Heavily Reliant on Outdated Technologies

While ICL Group actively pursues innovation, certain segments might still rely on older technologies. These could represent potential "Dogs" in a BCG analysis if they haven't fully embraced newer, more efficient, and sustainable processes. For instance, production facilities or product lines that haven't undergone significant upgrades could fall into this category.

The company's strategic investments in natural gas conversion for its plants highlight a push towards cost reduction and lower emissions. This initiative suggests that older, more energy-intensive operations, if they exist and haven't been modernized, would likely be less competitive. In 2023, ICL continued its capital expenditure, with a significant portion allocated to projects aimed at improving efficiency and sustainability across its operations.

- Legacy Production Facilities: Segments with manufacturing processes not yet optimized with current technology.

- Outdated Energy Infrastructure: Plants still dependent on less efficient energy sources than the company's newer natural gas conversions.

- Lower Efficiency Output: Product lines or operations that consume more resources per unit of output compared to modern alternatives.

- Potential for Divestment or Modernization: These segments may require significant investment to become competitive or could be considered for divestment.

Within Israel Corporation's diverse holdings, some niche specialty minerals and older production technologies are exhibiting characteristics of "Dogs" in the BCG Matrix. These segments often face declining demand, market saturation, or reliance on less efficient processes, leading to low market share and limited growth potential.

For example, specific magnesia applications and legacy phosphate specialties like purified phosphoric acid are pressured by overcapacity and shifting market needs. Products such as solid magnesium chloride, used for de-icing, have also seen demand dips due to milder winters, underscoring their vulnerability to external factors.

The divestiture of Lavie Bio's assets by Evogene in 2024 is a clear indication of classifying underperforming units as Dogs, freeing up capital for more promising ventures. These "Dog" segments, while potentially minor contributors, require careful strategic evaluation, often leading to divestment or significant modernization efforts to improve competitiveness.

| Category | Examples within Israel Corp. | BCG Matrix Classification | Key Characteristics |

| Niche Specialty Minerals | Certain magnesia applications | Dogs | Declining demand, shifting market needs |

| Legacy Phosphate Specialties | Purified phosphoric acid (TPA, WPA) | Dogs (potential) | Pricing pressure, market overcapacity |

| Seasonal Products | Solid magnesium chloride (de-icing) | Dogs | Vulnerable to external factors (e.g., weather), moderate demand dips |

| Outdated Production | Older, less energy-efficient facilities | Dogs (potential) | Lower efficiency, higher operating costs |

Question Marks

ICL's foray into advanced biostimulants and organic fertilizers positions it within a rapidly expanding segment of the agricultural market. This move aligns with the global trend toward sustainable and organic farming practices, a key driver for this sector's growth. By investing in this area, ICL is targeting a market characterized by both significant potential and intense competition.

The company's strategic acquisitions, such as Custom Ag Formulators and GreenBest, alongside the recent purchase of Lavie Bio's ag-biologicals assets, underscore a deliberate strategy to build its presence in this niche. These moves suggest that while ICL's current market share in advanced biostimulants and organic fertilizers might be relatively low, its aggressive investment signals a strong belief in the high growth potential of this category, placing it in a "question mark" position on the BCG matrix.

ICL's foray into emerging food-tech, especially alternative proteins and precision fermentation, positions them in a high-growth, albeit early-stage, market. Through ventures like the Planet Startup Hub, ICL is actively nurturing innovation in these nascent sectors. While the potential is substantial, their direct market share in these developing product categories is currently minimal, reflecting the significant investment needed to build a strong presence.

ICL Group is actively innovating in the flame retardant sector to meet new regulatory demands, particularly those arising from the burgeoning electric vehicle (EV) market, increased automation, and the push for energy-efficient construction. This strategic focus positions ICL to capitalize on a high-growth market for compliant materials, as evidenced by the growing demand for advanced safety solutions in these rapidly expanding industries.

While ICL's new flame retardant formulations represent a forward-looking approach, their market penetration is still in its early stages. The company is working to establish these advanced products and gain market share against established or alternative flame retardant technologies, a common challenge for new entrants in specialized chemical markets. For instance, the global flame retardants market was valued at approximately $7.5 billion in 2023 and is projected to reach over $10 billion by 2030, with specialty chemicals like those ICL is developing seeing significant growth.

Strategic Expansion in Emerging Agricultural Economies

ICL's strategic expansion into emerging agricultural economies like China and South America positions its advanced agricultural solutions as potential stars in its BCG matrix. These regions represent significant growth opportunities for agricultural inputs, with China's agricultural market alone valued in the hundreds of billions of dollars annually. ICL's efforts to increase its presence and market share in these high-growth areas are crucial for leveraging these emerging markets.

This geographical expansion is a strategic move to capture nascent demand and build a strong foundation for future growth. For instance, by 2024, the agricultural sector in many South American countries is expected to see continued expansion driven by global food demand. ICL's focus on partnerships allows it to navigate local market complexities and accelerate market penetration.

- ICL's focus on China and South America targets high-growth agricultural input markets.

- The company aims to increase market share in these emerging economies through strategic partnerships.

- These expansions are critical for ICL's long-term growth strategy and portfolio diversification.

- By 2024, ICL anticipates significant contributions from these emerging markets to its overall revenue.

AI-driven Agricultural Solutions (e.g., MicroBoost AI)

ICL's acquisition of Lavie Bio's MicroBoost AI platform for its AI-driven agricultural solutions marks a strategic entry into a high-growth sector. This move aims to speed up the development of microbial products and refine agricultural decision-making.

While the broader AI in agriculture market is expanding rapidly, ICL's position within this specific technological niche is nascent. Significant investment will be crucial for ICL to capture a meaningful share and unlock the full potential of this AI-driven approach.

- Market Growth: The global AI in agriculture market was valued at approximately $1.8 billion in 2023 and is projected to reach over $5.2 billion by 2028, demonstrating substantial growth potential.

- Strategic Investment: ICL's investment in MicroBoost AI is a forward-looking move to capitalize on this trend, requiring continued R&D and market penetration efforts.

- Niche Development: The company's market share in advanced AI microbial solutions is still being established, indicating a need for focused development and customer acquisition.

- Competitive Landscape: While specific data on ICL's market share in AI-driven microbial solutions is not readily available, the broader ag-tech landscape is becoming increasingly competitive, with both established players and startups investing heavily in AI.

ICL's ventures into advanced biostimulants, organic fertilizers, and AI-driven agricultural solutions place them in the "question mark" category of the BCG matrix. These are high-growth potential markets where the company is still establishing its market share. Significant investment and strategic acquisitions are being made to build a strong presence in these nascent but promising sectors.

The company's focus on emerging food technologies, such as alternative proteins and precision fermentation, also fits the question mark profile. While these areas offer substantial long-term growth prospects, ICL's current market penetration is minimal, necessitating continued innovation and market development.

ICL's strategic positioning in new flame retardant formulations, particularly for the electric vehicle market, also represents a question mark. The company is developing advanced, compliant materials for a rapidly growing sector, but gaining market share against established technologies requires sustained effort and market penetration.

| ICL's Question Mark Segments | Market Growth Potential | ICL's Current Market Share | Strategic Focus | Key Investments/Acquisitions |

|---|---|---|---|---|

| Advanced Biostimulants & Organic Fertilizers | High | Low/Nascent | Sustainable agriculture, market penetration | Custom Ag Formulators, GreenBest, Lavie Bio assets |

| AI in Agriculture (Microbial Solutions) | High | Nascent | R&D, market adoption | Lavie Bio's MicroBoost AI platform |

| Emerging Food Technologies (Alt Proteins, Precision Fermentation) | High | Minimal | Innovation, venture incubation | Planet Startup Hub |

| Specialty Flame Retardants (for EVs, etc.) | High | Early Stage | Regulatory compliance, market acceptance | New product development |

BCG Matrix Data Sources

Our BCG Matrix for Israel Corporation is built on a foundation of official company filings, comprehensive market research, and industry-specific growth projections.